0000813672false00008136722024-07-222024-07-22

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT PURSUANT TO

SECTION 13 OR 15(d) OF THE

SECURITIES EXCHANGE ACT OF 1934

Date of report (Date of earliest event reported): July 22, 2024

CADENCE DESIGN SYSTEMS, INC.

(Exact Name of Registrant as Specified in its Charter) | | | | | | | | | | | | | | |

| | | | |

| Delaware | | 000-15867 | | 00-0000000 |

(State or Other Jurisdiction

of Incorporation) | | (Commission File Number) | | (I.R.S. Employer

Identification No.) |

2655 Seely Avenue, San Jose, California 95134

(Address of Principal Executive Offices) (Zip Code)

(408) 943-1234

(Registrant’s telephone number, including area code) Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions: | | | | | |

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act: | | | | | | | | | | | | | | |

| Title of each class | | Trading Symbol(s) | | Name of each exchange on which registered |

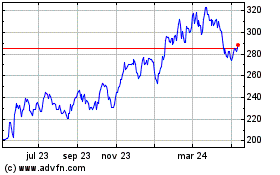

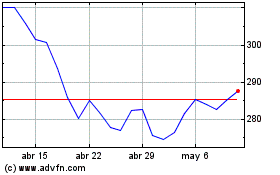

| Common Stock, $0.01 par value per share | | CDNS | | Nasdaq Global Select Market |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.02. Results of Operations and Financial Condition.

On July 22, 2024, Cadence Design Systems, Inc. ("Cadence") issued a press release announcing its financial results for the quarter ended June 30, 2024.

A copy of the press release is attached hereto as Exhibit 99.01 and a copy of the commentary by the Chief Financial Officer of Cadence regarding Cadence's financial results for the quarter ended June 30, 2024 is attached hereto as Exhibit 99.02, and the press release and the commentary are incorporated herein by reference.

The information contained in this Current Report shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or incorporated by reference in any filing under the Securities Act of 1933, as amended, or the Exchange Act, except as shall be expressly set forth by specific reference in such a filing.

Item 9.01. Financial Statements and Exhibits.

(d)Exhibits | | | | | | | | |

| Exhibit No. | | Description |

| |

| | |

| | |

| 104 | | Cover Page Interactive Data File (embedded within the Inline XBRL document). |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

Dated: July 22, 2024 | | | | | | | | |

| CADENCE DESIGN SYSTEMS, INC. |

| |

| By: | | /s/ John M. Wall |

| | John M. Wall |

| | Senior Vice President and Chief Financial Officer |

Exhibit 99.01

Cadence Reports Second Quarter 2024 Financial Results

Second Quarter Backlog of $6.0 Billion

Updating 2024 Revenue Outlook to 13% YoY Growth

SAN JOSE, Calif. — July 22, 2024 — Cadence Design Systems, Inc. (Nasdaq: CDNS) today announced results for the second quarter of 2024.

Second Quarter 2024 Financial Results

•Revenue of $1.061 billion, compared to revenue of $977 million in Q2 2023

•GAAP operating margin of 28%, compared to 31% in Q2 2023

•Non-GAAP operating margin of 40%, compared to 42% in Q2 2023

•GAAP diluted net income per share of $0.84, compared to $0.81 in Q2 2023

•Non-GAAP diluted net income per share of $1.28, compared to $1.22 in Q2 2023

•Quarter-end backlog was $6.0 billion and current remaining performance obligations ("cRPO"), contract revenue expected to be recognized as revenue in the next 12 months, was $3.1 billion.

“Cadence delivered strong results for the second quarter of 2024, with robust demand for our cutting-edge technologies from AI, hyperscale, and automotive customers,” said Anirudh Devgan, president and chief executive officer. “I'm pleased with the strong momentum of our Cadence.AI portfolio and our next generation Z3 / X3 hardware systems, and am excited about the growing demand for our industry leading products from an expanding foundry ecosystem.”

“I am pleased with our strong Q2 results. We exceeded our outlook on all key financial metrics, closing Q2 with backlog of approximately $6 billion,” said John Wall, senior vice president and chief financial officer. “A good finish to the first half of the year, combined with ongoing demand for our solutions, sets us up for strong growth in the second half of 2024.”

CFO Commentary

Commentary on the second quarter of 2024 financial results by John Wall, senior vice president and chief financial officer, is available at www.cadence.com/cadence/investor_relations.

Business Outlook

For fiscal year 2024, the company expects:

•Revenue in the range of $4.60 billion to $4.66 billion

•GAAP operating margin in the range of 29.7% to 31.3%

•Non-GAAP operating margin in the range of 41.7% to 43.3%

•GAAP diluted net income per share in the range of $3.82 to $4.02

•Non-GAAP diluted net income per share in the range of $5.77 to $5.97

For the third quarter of 2024, the company expects:

•Revenue in the range of $1.165 billion to $1.195 billion

•GAAP operating margin in the range of 27.7% to 29.3%

•Non-GAAP operating margin in the range of 40.7% to 42.3%

•GAAP diluted net income per share in the range of $0.83 to $0.93

•Non-GAAP diluted net income per share in the range of $1.39 to $1.49

The company utilizes a long-term projected non-GAAP tax rate, which reflects currently available information, as well as other factors and assumptions. The non-GAAP tax rate is subject to change for a variety of reasons, including the rapidly evolving global tax environment, significant changes in the company’s geographic earnings mix, or other changes to the company’s strategy or business operations. The company expects to use the current

normalized non-GAAP tax rate through fiscal 2025 but will re-evaluate this rate periodically for significant items that may materially affect its projections.

Reconciliations of the financial results and business outlook from GAAP operating margin, GAAP net income and GAAP diluted net income per share to non-GAAP operating margin, non-GAAP net income and non-GAAP diluted net income per share, respectively, are included in this press release.

Business Highlights

•Cadence.AI portfolio continues to gain momentum, offering unparalleled chip-to-systems design capabilities that empower our customers to achieve exceptional quality of results and productivity benefits

•IP business continued its strong momentum with AI, 3D-IC and HPC applications fueling demand for our IP titles at the most advanced nodes

•Major long-term development partner broadly deployed Palladium Z3 to deliver to its next generation AI product roadmap, further solidifying Cadence’s leadership in verification

•Closed BETA CAE acquisition and we now offer a comprehensive multiphysics platform covering electromagnetics, electrothermal, CFD and structural analysis solutions

Audio Webcast Scheduled

Anirudh Devgan, president and chief executive officer, and John Wall, senior vice president and chief financial officer, will host the second quarter 2024 financial results audio webcast today, July 22, 2024, at 2 p.m. (Pacific) / 5 p.m. (Eastern). Attendees are asked to register at the website at least 10 minutes prior to the scheduled webcast. An archive of the webcast will be available starting July 22, 2024 at 5 p.m. (Pacific) and ending September 16, 2024 at 5 p.m. (Pacific). Webcast access is available at www.cadence.com/cadence/investor_relations.

About Cadence

Cadence is a pivotal leader in electronic systems design, building upon more than 30 years of computational software expertise. The company applies its underlying Intelligent System Design strategy to deliver software, hardware and IP that turn design concepts into reality. Cadence customers are the world’s most innovative companies, delivering extraordinary electronic products from chips to boards to complete systems for the most dynamic market applications, including hyperscale computing, 5G communications, automotive, mobile, aerospace, consumer, industrial and healthcare. For 10 years in a row, Fortune magazine has named Cadence one of the 100 Best Companies to Work For. Learn more at www.cadence.com.

© 2024 Cadence Design Systems, Inc. All rights reserved worldwide. Cadence, the Cadence logo and the other Cadence marks found at www.cadence.com/go/trademarks are trademarks or registered trademarks of Cadence Design Systems, Inc. All other trademarks are the property of their respective owners.

This press release contains forward-looking statements, including Cadence's outlook on future operating results, financial condition, strategic objectives, business prospects, technology and product developments, industry trends and other statements using words such as “anticipates,” “believes,” “expects,” “intends,” “plans,” “will,” and words of similar import and the negatives thereof. Forward-looking statements are subject to a number of risks, uncertainties and other factors, many of which are outside Cadence’s control, and which may cause actual results to differ materially from expectations expressed or implied in the forward-looking statements, including, among others: (i) Cadence’s ability to compete successfully in the highly competitive industries in which it operates and realize the benefits of its investments in research and development, including opportunities presented by AI; (ii) the success of Cadence’s efforts to maintain and improve operational efficiency and growth; (iii) the mix of products and services sold, the timing of orders and deliveries and the ability to develop, install or deliver Cadence’s products or services; (iv) change in customer demands or supply constraints that could result in delays in purchases, development, installations or deliveries of Cadence’s products or services, including those resulting from consolidation, restructurings and other operational efficiency improvements of Cadence’s customers; (v) economic, geopolitical and industry conditions, including that of the semiconductor and electronics industries, government regulations and trade restrictions, and rising tensions and conflicts around the world such as in the Middle East and with respect to Taiwan; (vi) capital expenditure requirements, legislative or regulatory requirements, changes in tax laws, interest rates, currency exchange rate fluctuations, inflation rates, Cadence’s upcoming debt maturities and Cadence’s ability to access capital and debt markets; (vii) Cadence’s acquisition of other companies, businesses or technologies or the failure to successfully integrate and operate them; (viii) potential harm caused by compromises in cybersecurity and cybersecurity attacks; (ix) events that affect cash flow, liquidity, or reserves, or settlement assumptions Cadence may take from time to time with respect to accounts receivable, taxes and tax examinations, litigation, regulatory or other matters; (x) the effects of any litigation, regulatory, tax or other proceedings to which Cadence is or may become a party or to which Cadence or its products, services, technologies or properties are subject; and (xi) Cadence’s ability to successfully meet corporate governance, environmental and social targets and strategies. In addition, the timing and amount of Cadence’s repurchases of its common stock are subject to business and market conditions, corporate and regulatory requirements, stock price, acquisition opportunities and other factors.

For a detailed discussion of these and other cautionary statements related to Cadence’s business, please refer to Cadence’s filings with the U.S. Securities and Exchange Commission, including its most recent report on Form 10-K, subsequent reports on Form 10-Q and future filings.

All forward-looking statements in this press release are based on management's expectations as of the date of this press release and, except as required by law, Cadence disclaims any obligation to update these forward-looking statements to reflect future events or circumstances.

GAAP to Non-GAAP Reconciliation

Non-GAAP financial measures should not be considered as a substitute for or superior to measures of financial performance prepared in accordance with generally accepted accounting principles, or GAAP. Investors are encouraged to review the reconciliation of non-GAAP measures contained within this press release with their most directly comparable GAAP results. Investors are also encouraged to look at the GAAP results as the best measure of financial performance.

To supplement Cadence’s financial results presented on a GAAP basis, Cadence management uses non-GAAP measures that it believes are helpful in understanding Cadence’s performance. One such measure is non-GAAP net income, which is a financial measure not calculated under GAAP. Non-GAAP net income is calculated by Cadence management by taking GAAP net income and excluding, as applicable, amortization of intangible assets, stock-based compensation expense, acquisition and integration-related costs including retention expenses, investment gains or losses, income or expenses related to Cadence’s non-qualified deferred compensation plan, restructuring and other significant items not directly related to Cadence’s core business operations, and the income tax effect of non-GAAP pre-tax adjustments.

Cadence management uses non-GAAP net income because it excludes items that are generally not directly related to the performance of Cadence’s core business operations and therefore provides supplemental information to Cadence management and investors regarding the performance of the business operations, facilitates comparisons to the historical operating results and allows the review of Cadence's business from the same perspective as Cadence management, including forecasting and budgeting.

The following tables reconcile the specific items excluded from GAAP operating margin, GAAP net income and GAAP net income per diluted share in the calculation of non-GAAP operating margin, non-GAAP net income and non-GAAP net income per diluted share for the periods shown below:

| | | | | | | | | | | | | | |

| Operating Margin Reconciliation | | Three Months Ended |

| | June 30, 2024 | | June 30, 2023 |

| | | (unaudited) |

| GAAP operating margin as a percent of total revenue | | 28% | | 31% |

| Reconciling items to non-GAAP operating margin as a percent of total revenue: | | | | |

| Stock-based compensation expense | | 8% | | 8% |

| Amortization of acquired intangibles | | 2% | | 2% |

| Acquisition and integration-related costs | | 2% | | 1% |

| Restructuring | | 0% | | 0% |

Non-qualified deferred compensation expenses | | 0% | | 0% |

Special charges | | 0% | | 0% |

| Non-GAAP operating margin as a percent of total revenue | | 40% | | 42% |

| | | | | | | | | | | | | | |

| Net Income Reconciliation | | Three Months Ended |

| | June 30, 2024 | | June 30, 2023 |

| (in thousands) | | (unaudited) |

| Net income on a GAAP basis | | $ | 229,520 | | | $ | 221,120 | |

| Stock-based compensation expense | | 87,569 | | | 76,608 | |

| Amortization of acquired intangibles | | 20,155 | | | 14,920 | |

| Acquisition and integration-related costs | | 20,715 | | | 13,946 | |

| Restructuring | | (33) | | | — | |

Non-qualified deferred compensation expenses | | 1,697 | | | 3,155 | |

Special charges | | 1,233 | | | — | |

| Other income or expense related to investments and non-qualified deferred compensation plan assets* | | (27,048) | | | (2,508) | |

| Income tax effect of non-GAAP adjustments | | 16,890 | | | 6,509 | |

| Net income on a non-GAAP basis | | $ | 350,698 | | | $ | 333,750 | |

| | | | | |

| * | Includes, as applicable, equity in losses or income from investments, write-down of investments, gains or losses on investments and gains or losses on non-qualified deferred compensation plan assets recorded in other income or expense. |

| | | | | | | | | | | | | | |

| Diluted Net Income Per Share Reconciliation | | Three Months Ended |

| | June 30, 2024 | | June 30, 2023 |

| (in thousands, except per share data) | | (unaudited) |

| Diluted net income per share on a GAAP basis | | $ | 0.84 | | | $ | 0.81 | |

| Stock-based compensation expense | | 0.32 | | | 0.28 | |

| Amortization of acquired intangibles | | 0.07 | | | 0.06 | |

| Acquisition and integration-related costs | | 0.08 | | | 0.05 | |

| Restructuring | | — | | | — | |

Non-qualified deferred compensation expenses | | 0.01 | | | 0.01 | |

Special charges | | — | | | — | |

| Other income or expense related to investments and non-qualified deferred compensation plan assets* | | (0.10) | | | (0.01) | |

| Income tax effect of non-GAAP adjustments | | 0.06 | | | 0.02 | |

| Diluted net income per share on a non-GAAP basis | | $ | 1.28 | | | $ | 1.22 | |

| Shares used in calculation of diluted net income per share | | 273,520 | | | 272,996 | |

| | | | |

| | | | | |

| * | Includes, as applicable, equity in losses or income from investments, write-down of investments, gains or losses on investments and gains or losses on non-qualified deferred compensation plan assets recorded in other income or expense. |

For more information, please contact:

Cadence Investor Relations

408-944-7100

investor_relations@cadence.com

Cadence Newsroom

408-944-7039

newsroom@cadence.com

Cadence Design Systems, Inc.

Condensed Consolidated Balance Sheets

June 30, 2024 and December 31, 2023

(In thousands)

(Unaudited)

| | | | | | | | | | | | | | |

| | June 30, 2024 | | December 31, 2023 |

| Current assets: | | | | |

| Cash and cash equivalents | | $ | 1,058,955 | | | $ | 1,008,152 | |

| Receivables, net | | 564,851 | | | 489,224 | |

| Inventories | | 171,508 | | | 181,661 | |

| Prepaid expenses and other | | 401,074 | | | 297,180 | |

| Total current assets | | 2,196,388 | | | 1,976,217 | |

| Property, plant and equipment, net | | 449,422 | | | 403,213 | |

| Goodwill | | 2,417,747 | | | 1,535,845 | |

| Acquired intangibles, net | | 664,038 | | | 336,843 | |

| Deferred taxes | | 892,963 | | | 880,001 | |

| Other assets | | 605,183 | | | 537,372 | |

| Total assets | | $ | 7,225,741 | | | $ | 5,669,491 | |

| Current liabilities: | | | | |

| | | | |

Current portion of long-term debt | | $ | 349,732 | | | $ | 349,285 | |

| Accounts payable and accrued liabilities | | 505,392 | | | 576,558 | |

| Current portion of deferred revenue | | 678,598 | | | 665,024 | |

| Total current liabilities | | 1,533,722 | | | 1,590,867 | |

| Long-term liabilities: | | | | |

| Long-term portion of deferred revenue | | 88,823 | | | 98,931 | |

| Long-term debt | | 998,935 | | | 299,771 | |

| Other long-term liabilities | | 343,369 | | | 275,651 | |

| Total long-term liabilities | | 1,431,127 | | | 674,353 | |

| Stockholders’ equity | | 4,260,892 | | | 3,404,271 | |

| Total liabilities and stockholders’ equity | | $ | 7,225,741 | | | $ | 5,669,491 | |

Cadence Design Systems, Inc.

Condensed Consolidated Income Statements

For the Three and Six Months Ended June 30, 2024 and June 30, 2023

(In thousands, except per share amounts)

(Unaudited)

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | Three Months Ended | | Six Months Ended |

| | | June 30, 2024 | | June 30, 2023 | | June 30, 2024 | | June 30, 2023 |

| Revenue: | | | | | | | | |

| Product and maintenance | | $ | 960,457 | | | $ | 922,790 | | | $ | 1,873,842 | | | $ | 1,886,532 | |

| Services | | 100,224 | | | 53,789 | | | 195,942 | | | 111,737 | |

| Total revenue | | 1,060,681 | | | 976,579 | | | 2,069,784 | | | 1,998,269 | |

| Costs and expenses: | | | | | | | | |

| Cost of product and maintenance | | 94,363 | | | 74,218 | | | 169,758 | | | 174,456 | |

| Cost of services | | 44,907 | | | 22,640 | | | 94,709 | | | 46,874 | |

| Marketing and sales | | 186,725 | | | 167,070 | | | 367,314 | | | 333,736 | |

| Research and development | | 370,740 | | | 354,416 | | | 749,698 | | | 704,711 | |

| General and administrative | | 63,436 | | | 54,605 | | | 132,152 | | | 108,132 | |

| Amortization of acquired intangibles | | 6,667 | | | 4,302 | | | 12,074 | | | 8,569 | |

| Restructuring | | (33) | | | — | | | 247 | | | — | |

| Total costs and expenses | | 766,805 | | | 677,251 | | | 1,525,952 | | | 1,376,478 | |

| Income from operations | | 293,876 | | | 299,328 | | | 543,832 | | | 621,791 | |

| Interest expense | | (12,905) | | | (8,877) | | | (21,597) | | | (18,137) | |

Other income, net | | 34,739 | | | 7,973 | | | 103,518 | | | 16,257 | |

Income before provision for income taxes | | 315,710 | | | 298,424 | | | 625,753 | | | 619,911 | |

Provision for income taxes | | 86,190 | | | 77,304 | | | 148,590 | | | 156,987 | |

| Net income | | $ | 229,520 | | | $ | 221,120 | | | $ | 477,163 | | | $ | 462,924 | |

| Net income per share - basic | | $ | 0.85 | | | $ | 0.82 | | | $ | 1.77 | | | $ | 1.72 | |

| Net income per share - diluted | | $ | 0.84 | | | $ | 0.81 | | | $ | 1.74 | | | $ | 1.70 | |

| Weighted average common shares outstanding - basic | | 270,912 | | | 269,714 | | | 270,259 | | | 269,607 | |

| Weighted average common shares outstanding - diluted | | 273,520 | | | 272,996 | | | 273,532 | | | 273,078 | |

Cadence Design Systems, Inc.

Condensed Consolidated Statements of Cash Flows

For the Six Months Ended June 30, 2024 and June 30, 2023

(In thousands)

(Unaudited) | | | | | | | | | | | |

| Six Months Ended |

| | June 30, 2024 | | June 30, 2023 |

Cash and cash equivalents at beginning of period | $ | 1,008,152 | | | $ | 882,325 | |

| Cash flows from operating activities: | | | |

| Net income | 477,163 | | | 462,924 | |

| Adjustments to reconcile net income to net cash provided by operating activities: | | | |

| Depreciation and amortization | 87,202 | | | 70,432 | |

| Amortization of debt discount and fees | 684 | | | 626 | |

| Stock-based compensation | 175,698 | | | 150,896 | |

(Gain) loss on investments, net | (80,599) | | | 554 | |

| Deferred income taxes | (9,506) | | | (20,171) | |

| Provisions for losses on receivables | 614 | | | 720 | |

| ROU asset amortization and change in operating lease liabilities | (1,410) | | | (3,543) | |

| Other non-cash items | 212 | | | 1,834 | |

| Changes in operating assets and liabilities, net of effect of acquired businesses: | | | |

| Receivables | (49,384) | | | 41,208 | |

| Inventories | (15,978) | | | (16,981) | |

| Prepaid expenses and other | (39,868) | | | 50,793 | |

| Other assets | (38,967) | | | (31,838) | |

| Accounts payable and accrued liabilities | (93,078) | | | (37,049) | |

| Deferred revenue | (18,599) | | | 1,269 | |

| Other long-term liabilities | 15,013 | | | 9,497 | |

| Net cash provided by operating activities | 409,197 | | | 681,171 | |

| Cash flows from investing activities: | | | |

| | | |

| | | |

| Purchases of investments | (2,095) | | | (29,212) | |

| Proceeds from the sale and maturity of investments | 43,864 | | | 1,505 | |

| Purchases of property, plant and equipment | (78,800) | | | (46,655) | |

| | | |

| Cash paid in business combinations, net of cash acquired | (720,821) | | | (55,379) | |

| Net cash used for investing activities | (757,852) | | | (129,741) | |

| Cash flows from financing activities: | | | |

Proceeds from revolving credit facility | — | | | 50,000 | |

Payments on revolving credit facility | — | | | (150,000) | |

| Proceeds from term loan | 700,000 | | | — | |

| Payment of debt issuance costs | (944) | | | — | |

| Proceeds from issuance of common stock | 133,272 | | | 77,502 | |

| Stock received for payment of employee taxes on vesting of restricted stock | (166,903) | | | (78,988) | |

| Payments for repurchases of common stock | (250,010) | | | (450,119) | |

Net cash provided by (used for) financing activities | 415,415 | | | (551,605) | |

| Effect of exchange rate changes on cash and cash equivalents | (15,957) | | | (8,225) | |

Increase (decrease) in cash and cash equivalents | 50,803 | | | (8,400) | |

Cash and cash equivalents at end of period | $ | 1,058,955 | | | $ | 873,925 | |

Cadence Design Systems, Inc.

(Unaudited)

Revenue Mix by Geography (% of Total Revenue)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | 2023 | | 2024 |

| GEOGRAPHY | Q1 | | Q2 | | Q3 | | Q4 | | Year | | Q1 | | Q2 | | | | | | |

| Americas | 44 | % | | 41 | % | | 43 | % | | 44 | % | | 43 | % | | 46 | % | | 49 | % | | | | | | |

| China | 17 | % | | 18 | % | | 17 | % | | 15 | % | | 17 | % | | 12 | % | | 12 | % | | | | | | |

| Other Asia | 18 | % | | 18 | % | | 19 | % | | 19 | % | | 19 | % | | 20 | % | | 19 | % | | | | | | |

| Europe, Middle East and Africa | 15 | % | | 17 | % | | 15 | % | | 16 | % | | 16 | % | | 17 | % | | 14 | % | | | | | | |

| Japan | 6 | % | | 6 | % | | 6 | % | | 6 | % | | 5 | % | | 5 | % | | 6 | % | | | | | | |

| Total | 100 | % | | 100 | % | | 100 | % | | 100 | % | | 100 | % | | 100 | % | | 100 | % | | | | | | |

Revenue Mix by Product Category (% of Total Revenue)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | 2023 | | 2024 |

| PRODUCT CATEGORY | Q1 | | Q2 | | Q3 | | Q4 | | Year | | Q1 | | Q2 | | | | | | |

| Custom IC Design and Simulation | 20 | % | | 22 | % | | 22 | % | | 22 | % | | 22 | % | | 22 | % | | 21 | % | | | | | | |

| Digital IC Design and Signoff | 25 | % | | 27 | % | | 28 | % | | 29 | % | | 27 | % | | 29 | % | | 27 | % | | | | | | |

| Functional Verification, including Emulation and Prototyping Hardware | 32 | % | | 27 | % | | 26 | % | | 24 | % | | 27 | % | | 25 | % | | 25 | % | | | | | | |

| IP | 11 | % | | 11 | % | | 11 | % | | 13 | % | | 12 | % | | 12 | % | | 13 | % | | | | | | |

| System Design and Analysis | 12 | % | | 13 | % | | 13 | % | | 12 | % | | 12 | % | | 12 | % | | 14 | % | | | | | | |

| Total | 100 | % | | 100 | % | | 100 | % | | 100 | % | | 100 | % | | 100 | % | | 100 | % | | | | | | |

Cadence Design Systems, Inc.

Impact of Non-GAAP Adjustments on Forward Looking Operating Margin

As of July 22, 2024

(Unaudited)

| | | | | | | | | | | | | | | | |

| | Three Months Ending September 30, 2024 | | Year Ending December 31, 2024 | | |

| | | Forecast | | Forecast | | |

| GAAP operating margin as a percent of total revenue | | 27.7% - 29.3% | | 29.7% - 31.3% | | |

| Reconciling items to non-GAAP operating margin as a percent of total revenue: | | | | | | |

| Stock-based compensation expense | | 9% | | 8% | | |

| Amortization of acquired intangibles | | 2% | | 2% | | |

| Acquisition and integration-related costs | | 2% | | 2% | | |

| | | | | | |

| Non-qualified deferred compensation expenses | | 0% | | 0% | | |

| | | | | | |

| Non-GAAP operating margin as a percent of total revenue† | | 40.7% - 42.3% | | 41.7% - 43.3% | | |

| | | | | |

| † | The non-GAAP measures presented in the table above should not be considered a substitute for financial results and measures determined or calculated in accordance with GAAP. |

Cadence Design Systems, Inc.

Impact of Non-GAAP Adjustments on Forward Looking Diluted Net Income Per Share

As of July 22, 2024

(Unaudited)

| | | | | | | | | | | | | | | | |

| | Three Months Ending September 30, 2024 | | Year Ending December 31, 2024 | | |

| | | Forecast | | Forecast | | |

| Diluted net income per share on a GAAP basis | | $0.83 to $0.93 | | $3.82 to $4.02 | | |

| Stock-based compensation expense | | 0.38 | | 1.43 | | |

| Amortization of acquired intangibles | | 0.10 | | 0.33 | | |

| Acquisition and integration-related costs | | 0.10 | | 0.34 | | |

| | | | | | |

| Non-qualified deferred compensation expenses | | — | | 0.02 | | |

Special charges | | — | | — | | |

| Other income or expense related to investments and non-qualified deferred compensation plan assets* | | — | | (0.32) | | |

| Income tax effect of non-GAAP adjustments | | (0.02) | | 0.15 | | |

| Diluted net income per share on a non-GAAP basis† | | $1.39 to $1.49 | | $5.77 to $5.97 | | |

| | | | | |

†

| The non-GAAP measures presented in the table above should not be considered a substitute for financial results and measures determined or calculated in accordance with GAAP. |

| | | | | |

* | Includes, as applicable, equity in losses or income from investments, write-down of investments, gains or losses on investments and gains or losses on non-qualified deferred compensation plan assets recorded in other income or expense. |

Cadence Design Systems, Inc.

Impact of Non-GAAP Adjustments on Forward Looking Net Income

As of July 22, 2024

(Unaudited)

| | | | | | | | | | | | | | | | |

| | Three Months Ending September 30, 2024 | | Year Ending December 31, 2024 | | |

| ($ in millions) | | Forecast | | Forecast | | |

| Net income on a GAAP basis | | $228 to $256 | | $1,049 to $1,103 | | |

| Stock-based compensation expense | | 106 | | 391 | | |

| Amortization of acquired intangibles | | 26 | | 90 | | |

| Acquisition and integration-related costs | | 27 | | 93 | | |

| | | | | | |

| Non-qualified deferred compensation expenses | | — | | 6 | | |

Special charges | | — | | 1 | | |

| Other income or expense related to investments and non-qualified deferred compensation plan assets* | | — | | (87) | | |

| Income tax effect of non-GAAP adjustments | | (5) | | 41 | | |

| Net income on a non-GAAP basis† | | $382 to $410 | | $1,584 to $1,638 | | |

| | | | | |

†

| The non-GAAP measures presented in the table above should not be considered a substitute for financial results and measures determined or calculated in accordance with GAAP. |

| | | | | |

* | Includes, as applicable, equity in losses or income from investments, write-down of investments, gains or losses on investments and gains or losses on non-qualified deferred compensation plan assets recorded in other income or expense. |

| | | | | | | | |

CADENCE REPORTS SECOND QUARTER

2024 |

| CADENCE DESIGN SYSTEMS, INC. |

| | |

| | |

CFO COMMENTARY | | |

Key Takeaways • Annual revenue growth outlook is now 13%, including $40 million from BETA CAE at the midpoint • Annual non-GAAP operating margin outlook remains 42.5% • Q2 ending backlog remains ~$6.0B

| Q3 2024 Outlook • Revenue: $1.165 billion - $1.195 billion • GAAP operating margin: 27.7% - 29.3% • Non-GAAP operating margin: 40.7% - 42.3% • GAAP EPS: $0.83 - $0.93 • Non-GAAP EPS: $1.39 - $1.49 • Expect to use approximately $150 million to repurchase Cadence shares in Q3 | Q2 2024 KEY METRICS |

• Revenue: $1.061 billion • GAAP operating margin: 28% • Non-GAAP operating margin: 40% • GAAP EPS: $0.84 • Non-GAAP EPS: $1.28 • Operating cash flow: $156 million

|

|

|

|

|

|

|

FY 2024 Outlook • Revenue: $4.60 billion - $4.66 billion • GAAP operating margin: 29.7% - 31.3% • Non-GAAP operating margin: 41.7% - 43.3% • GAAP EPS: $3.82 - $4.02 • Non-GAAP EPS: $5.77 - $5.97 • Operating cash flow: $1.0 billion - $1.2 billion • Expect to use approximately 50% of free cash flow to repurchase Cadence shares for the year | Financial Results Webcast | |

Our Q2 2024 financial results webcast will begin July 22, 2024 at 2:00 p.m. (Pacific). The webcast may be accessed at www.cadence.com/cadence/investor_relations. An archive of the webcast will be available on July 22, 2024 until 5:00 p.m. (Pacific) on September 16, 2024. | |

|

|

|

|

|

|

| | | | | | | | |

| | |

| July 22, 2024 | Cadence Q2 2024 Financial Results | 1 |

| | | | | | | | |

| Cadence Design Systems, Inc. |

|

Financial Metrics | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| (In Millions, except per share data) | 2018 | | 2019 | | 2020* | | 2021 | | 2022 | | 2023* | | | 2024E | |

| | | | | | | | | | | | | | | |

| Revenue | $ | 2,138 | | | $ | 2,336 | | | $ | 2,683 | | | $ | 2,988 | | | $ | 3,562 | | | $ | 4,090 | | | | $4,600- $4,660 | |

| Revenue growth* | 10% | | 9% | | 15% | | 11% | | 19% | | 15% | | | 12% - 14% | |

| 3-year CAGR | 8% | | 9% | | 11% | | 12% | | 15% | | 15% | | | ~16% | |

| 3-year CAGR without 53rd week impact | | | | | 11% | | | | | | 16% | | | | |

| | | | | | | | | | | | | | | |

| GAAP operating expenses | $ | 1,742 | | | $ | 1,845 | | | $ | 2,037 | | | $ | 2,209 | | | $ | 2,488 | | | $ | 2,839 | | | | ~$3,244 | |

| GAAP operating expense growth | 8% | | 6% | | 10% | | 8% | | 13% | | 14% | | | ~14% | |

| | | | | | | | | | | | | | | |

| Non-GAAP operating expenses | $ | 1,491 | | | $ | 1,587 | | | $ | 1,739 | | | $ | 1,877 | | | $ | 2,125 | | | $ | 2,373 | | | | ~$2,663 | |

| Non-GAAP operating expense growth | 6% | | 6% | | 10% | | 8% | | 13% | | 12% | | | ~12% | |

| | | | | | | | | | | | | | | |

| GAAP operating margin** | 19% | | 21% | | 24% | | 26% | | 30% | | 31% | | | 30.5 | % | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| Non-GAAP operating margin** | 30% | | 32% | | 35% | | 37% | | 40% | | 42% | | | 42.5 | % | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| GAAP earnings per share | $ | 1.23 | | | $ | 3.53 | | | $ | 2.11 | | | $ | 2.50 | | | $ | 3.09 | | | $ | 3.82 | | | | $3.82 - $4.02 | |

| | | | | | | | | | | | | | | |

| Non-GAAP earning per share | $ | 1.87 | | | $ | 2.20 | | | $ | 2.80 | | | $ | 3.29 | | | $ | 4.27 | | | $ | 5.15 | | | | $5.77 - $5.97 | |

| Non-GAAP EPS growth** | 34% | | 18% | | 27% | | 18% | | 30% | | 21% | | | 14 | % | |

| 3-year Non-GAAP EPS CAGR** | 20% | | 22% | | 26% | | 21% | | 25% | | 23% | | | 21 | % | |

| | | | | | | | | | | | | | | |

| Weighted average shares diluted outstanding | 281.1 | | 280.5 | | 279.6 | | 278.9 | | 275.0 | | 272.7 | | | 273.5 - 275.5 | |

| | | | | | | | | | | | | | | |

| Cash flow from operations | 605 | | 730 | | 905 | | 1,101 | | 1,242 | | 1,349 | | | $1,000 - $1,200 | |

| | | | | | | | | | | | | | | |

| Capital expenditures | 62 | | 75 | | 95 | | 65 | | 123 | | 102 | | | ~$130 | |

| | | | | | | | | | | | | | | |

* Fiscal 2020 was a 53-week year, compared to all other years which were 52 week years. 2020 (which impacts the 3 year CAGR in 2023) included approximately $45 million revenue impact for the extra week.

** At midpoint of guidance.

Profitability Trends | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| (In Millions) | 2018 | | 2019 | | 2020 | | 2021 | | 2022 | | 2023 | | | 2024E* | |

| | | | | | | | | | | | | | | |

| Revenue | $ | 2,138 | | | $ | 2,336 | | | $ | 2,683 | | | $ | 2,988 | | | $ | 3,562 | | | $ | 4,090 | | | | $ | 4,630 | | |

| Revenue Growth | 10% | | 9% | | 15% | | 11% | | 19% | | 15% | | | 13% | |

| 3-Year Revenue Growth CAGR | 8% | | 9% | | 11% | | 12% | | 15% | | 15% | | | 16% | |

| GAAP operating margin | 19% | | 21% | | 24% | | 26% | | 30% | | 31% | | | 30.5% | |

| | | | | | | | | | | | | | | |

| Non-GAAP operating margin | 30.2% | | 32.1% | | 35.2% | | 37.2% | | 40.3% | | 42.0% | | | 42.5% | |

| Stock-based compensation | (7.8)% | | (7.8)% | | (7.4)% | | (7.0)% | | (7.6)% | | (8.0)% | | | (8.4)% | |

| Non-GAAP operating margin adjusted for stock-based compensation | 22.4% | | 24.3% | | 27.8% | | 30.2% | | 32.7% | | 34.0% | | | 34.1% | |

| | | | | | | | | | | | | | | |

| GAAP operating income | $ | 396 | | | $ | 492 | | | $ | 646 | | | $ | 779 | | | $ | 1,074 | | | $ | 1,251 | | | | $ | 1,386 | | |

| | | | | | | | | | | | | | | |

| Non-GAAP operating income | $ | 647 | | | $ | 749 | | | $ | 944 | | | $ | 1,111 | | | $ | 1,436 | | | $ | 1,717 | | | | $ | 1,967 | | |

| | | | | | | | | | | | | | | |

| Non-GAAP operating income adjusted for stock-based compensation | $ | 479 | | | $ | 567 | | | $ | 747 | | | $ | 901 | | | $ | 1,166 | | | $ | 1,391 | | | | $ | 1,576 | | |

| | | | | | | | | | | | | | | |

* At midpoint of guidance. | | | | | | | | |

| July 22, 2024 | Cadence Q2 2024 Financial Results | 2 |

| | | | | | | | |

| Cadence Design Systems, Inc. |

|

Third Quarter 2024 Financial Outlook | | | | | | | | | | | | | | | | | | | | | | | |

| Q3 2023 | | Q2 2024 | | | Q3 2024E | |

| | | | | | | |

| Total Revenue ($ Millions) | $ | 1,023 | | | $ | 1,061 | | | | $1,165 - $1,195 | |

| Q/Q Growth | | | 5% | | | 10% - 13% | |

| Y/Y Growth | | | 9% | | | 14% - 17% | |

| | | | | | | |

| GAAP Operating Margin | 29% | | 28% | | | 27.7% - 29.3% | |

| | | | | | | |

| Non-GAAP Operating Margin | 41% | | 40% | | | 40.7% - 42.3% | |

| | | | | | | |

| GAAP EPS | $ | 0.93 | | | $ | 0.84 | | | | $0.83 - $0.93 | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| Non-GAAP EPS | $ | 1.26 | | | $ | 1.28 | | | | $1.39 - $1.49 | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

Fiscal Year 2024 Financial Outlook | | | | | | | | | | | | | | | | | | | | | | | |

| | | Previous | | | Current | |

| FY 2023 | | FY 2024E | | | FY 2024E | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| Recurring Revenue | 84% | | 80% - 85% | | | 80% - 85% | |

| | | | | | | |

| Total Revenue ($ Millions) | $ | 4,090 | | | $4,560 - $4,620 | | | $4,600 - $4,660 | |

| Y/Y Growth | 15% | | 11% - 13% | | | 12% - 14% | |

| | | | | | | |

| Revenue from Beginning Backlog | ~75% | | ~70% | | | ~70% | |

| | | | | | | |

| GAAP Operating Margin | 30.6% | | 31% - 32% | | | 29.7% - 31.3% | |

| | | | | | | |

| Non-GAAP Operating Margin | 42.0% | | 42% - 43% | | | 41.7% - 43.3% | |

| | | | | | | |

| GAAP Other Income & Expense ($ Millions) | $ | 31 | | | $49 - $55 | | | $42 - $56 | |

| | | | | | | |

| Non-GAAP Other Income & Expense ($ Millions) | $ | (15) | | | $(5) - $(11) | | | $(31) - $(45) | |

| | | | | | | |

| GAAP Tax Rate | 19% | | ~25% | | | ~25% | |

| | | | | | | |

| Non-GAAP Tax Rate | 17.5% | | 16.5% | | | 16.5% | |

| | | | | | | |

| Weighted Average Diluted Shares Outstanding (Millions) | 272.7 | | 272.5 - 274.5 | | | 273.5 - 275.5 | |

| | | | | | | |

| GAAP EPS | $ | 3.82 | | | $4.04 - $4.14 | | | $3.82 - $4.02 | |

| Y/Y Growth | 24% | | 6% - 8% | | | 0% - 5% | |

| | | | | | | |

| Non-GAAP EPS | $ | 5.15 | | | $5.88 - $5.98 | | | $5.77 - $5.97 | |

| Y/Y Growth | 21% | | 14% - 16% | | | 12% - 16% | |

| | | | | | | |

| Cash Flow from Operations ($ Millions) | $ | 1,349 | | | $1,350 - $1,450 | | | $1,000 - $1,200 | |

| | | | | | | |

| DSO | 43 | | ~45 | | | ~45 | |

| | | | | | | |

| Capital Expenditures ($ Millions) | $ | 102 | | | ~$120 | | | ~$130 | |

| | | | | | | |

| | | | | | | | |

| July 22, 2024 | Cadence Q2 2024 Financial Results | 3 |

| | | | | | | | |

| Cadence Design Systems, Inc. |

|

Second Quarter Financial Results

Backlog | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| (In Billions) | 2020 | | 2021 | | 2022 | | 2023 | | | Q2 2024 | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| Backlog | $ | 3.9 | | | $ | 4.4 | | | $ | 5.8 | | | $ | 6.0 | | | | $ | 6.0 | | |

| | | | | | | | | | | |

Revenue | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| (In Millions) | Q2 2023 | | Q3 2023 | | Q4 2023 | | Q1 2024 | | | Q2 2024 | |

| | | | | | | | | | | |

| Product and Maintenance | $ | 923 | | | $ | 966 | | | $ | 982 | | | $ | 913 | | | | $ | 961 | | |

| Services | 54 | | | 57 | | | 87 | | | 96 | | | | 100 | | |

| Total Revenue | $ | 977 | | | $ | 1,023 | | | $ | 1,069 | | | $ | 1,009 | | | | $ | 1,061 | | |

| | | | | | | | | | | |

Recurring and Up-Front Revenue | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Q2 2023 | | Q3 2023 | | Q4 2023 | | Q1 2024 | | | Q2 2024 | |

| | | | | | | | | | | |

| Revenue recognized over time | 82 | % | | 83 | % | | 85 | % | | 87 | % | | | 85 | % | |

| Revenue from arrangements with non-cancelable commitments | 3 | % | | 2 | % | | 2 | % | | 3 | % | | | 3 | % | |

| Recurring Revenue | 85 | % | | 85 | % | | 87 | % | | 90 | % | | | 88 | % | |

| Up-Front Revenue | 15 | % | | 15 | % | | 13 | % | | 10 | % | | | 12 | % | |

| Total | 100 | % | | 100 | % | | 100 | % | | 100 | % | | | 100 | % | |

| | | | | | | | | | | |

Trailing Twelve Months Recurring and Up-Front Revenue | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Trailing Twelve Months Ended |

| Q2 2023 | | Q3 2023 | | Q4 2023 | | Q1 2024 | | | Q2 2024 | |

| | | | | | | | | | | |

| Recurring Revenue | 84 | % | | 84 | % | | 84 | % | | 87 | % | | | 87 | % | |

| Up-Front Revenue | 16 | % | | 16 | % | | 16 | % | | 13 | % | | | 13 | % | |

| Total | 100 | % | | 100 | % | | 100 | % | | 100 | % | | | 100 | % | |

| | | | | | | | | | | |

Revenue Mix by Geography | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| (% of Total Revenue) | Q2 2023 | | Q3 2023 | | Q4 2023 | | Q1 2024 | | | Q2 2024 | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| Americas | 41 | % | | 43 | % | | 44 | % | | 46 | % | | | 49 | % | |

| China | 18 | % | | 17 | % | | 15 | % | | 12 | % | | | 12 | % | |

| Other Asia | 18 | % | | 19 | % | | 19 | % | | 20 | % | | | 19 | % | |

| Europe, Middle East and Africa | 17 | % | | 15 | % | | 16 | % | | 17 | % | | | 14 | % | |

| Japan | 6 | % | | 6 | % | | 6 | % | | 5 | % | | | 6 | % | |

| Total | 100 | % | | 100 | % | | 100 | % | | 100 | % | | | 100 | % | |

Revenue Mix by Product Category | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| (% of Total Revenue) | Q2 2023 | | Q3 2023 | | Q4 2023 | | Q1 2024 | | | Q2 2024 | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| Custom IC Design and Simulation | 22 | % | | 22 | % | | 22 | % | | 22 | % | | | 21 | % | |

| Digital IC Design and Signoff | 27 | % | | 28 | % | | 29 | % | | 29 | % | | | 27 | % | |

| Functional Verification | 27 | % | | 26 | % | | 24 | % | | 25 | % | | | 25 | % | |

| IP | 11 | % | | 11 | % | | 13 | % | | 12 | % | | | 13 | % | |

| System Design and Analysis | 13 | % | | 13 | % | | 12 | % | | 12 | % | | | 14 | % | |

| Total | 100 | % | | 100 | % | | 100 | % | | 100 | % | | | 100 | % | |

| | | | | | | | |

| July 22, 2024 | Cadence Q2 2024 Financial Results | 4 |

| | | | | | | | |

| Cadence Design Systems, Inc. |

|

Gross Margin | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Q2 2023 | | Q3 2023 | | Q4 2023 | | Q1 2024 | | | Q2 2024 | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| GAAP Gross Margin | 90.1 | % | | 89.3 | % | | 90.3 | % | | 87.6 | % | | | 86.9 | % | |

| Non-GAAP Gross Margin | 91.4 | % | | 90.6 | % | | 91.7 | % | | 89.1 | % | | | 88.5 | % | |

| | | | | | | | | | | |

Total Costs and Expenses | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| (In Millions) | Q2 2023 | | Q3 2023 | | Q4 2023 | | Q1 2024 | | | Q2 2024 | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| Total GAAP Costs and Expenses | $ | 677 | | | $ | 730 | | | $ | 732 | | | $ | 759 | | | | $ | 767 | | |

| | | | | | | | | | | |

| Total Non-GAAP Costs and Expenses | $ | 569 | | | $ | 603 | | | $ | 610 | | | $ | 627 | | | | $ | 635 | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

Operating Margin | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Q2 2023 | | Q3 2023 | | Q4 2023 | | Q1 2024 | | | Q2 2024 | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| GAAP Operating Margin | 30.7 | % | | 28.6 | % | | 31.5 | % | | 24.8 | % | | | 27.7 | % | |

| Non-GAAP Operating Margin | 41.8 | % | | 41.1 | % | | 42.9 | % | | 37.8 | % | | | 40.1 | % | |

| | | | | | | | | | | |

Net Income Per Share | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Q2 2023 | | Q3 2023 | | Q4 2023 | | Q1 2024 | | | Q2 2024 | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| GAAP Net Income Per Share | $ | 0.81 | | | $ | 0.93 | | | $ | 1.19 | | | $ | 0.91 | | | | $ | 0.84 | | |

| | | | | | | | | | | |

| Non-GAAP Net Income Per Share | $ | 1.22 | | | $ | 1.26 | | | $ | 1.38 | | | $ | 1.17 | | | | $ | 1.28 | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

Total DSO | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Q2 2023 | | Q3 2023 | | Q4 2023 | | Q1 2024 | | | Q2 2024 | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| DSO | 42 | | 39 | | 43 | | 36 | | | 49 | |

| | | | | | | | | | | |

Balance Sheet and Cash Review

Free Cash Flow | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| (In Millions) | Q2 2023 | | Q3 2023 | | Q4 2023 | | Q1 2024 | | | Q2 2024 | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| Net Cash from Operating Activities | $ | 414 | | | $ | 396 | | | $ | 272 | | | $ | 253 | | | | $ | 156 | | |

| Capital Expenditures | 20 | | | 22 | | | 34 | | | 49 | | | | 29 | | |

| Free Cash Flow | $ | 394 | | | $ | 374 | | | $ | 238 | | | $ | 204 | | | | $ | 127 | | |

| | | | | | | | | | | |

Cash and Cash Equivalents | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| (In Millions) | Q2 2023 | | Q3 2023 | | Q4 2023 | | Q1 2024 | | | Q2 2024 | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| Cash and Cash Equivalents | $ | 874 | | | $ | 962 | | | $ | 1,008 | | | $ | 1,012 | | | | $ | 1,059 | | |

| | | | | | | | | | | |

•Approximately 26 percent of our cash and cash equivalents were in the U.S. at quarter-end.

Share Repurchase | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| (In Millions) | Q2 2023 | | Q3 2023 | | Q4 2023 | | Q1 2024 | | | Q2 2024 | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| Share Repurchase | $ | 265 | | | $ | 185 | | | $ | 125 | | | $ | 125 | | | | $ | 125 | | |

| Number of Shares | 1.178 | | | 0.811 | | | 0.488 | | | 0.425 | | | | 0.423 | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

•Q3 2023 includes 276,330 shares and $60 million equity forward contract from Q2 2023 ASR settled in Q3 2023.

Employees | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Q2 2023 | | Q3 2023 | | Q4 2023 | | Q1 2024 | | | Q2 2024 | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| Headcount | 10,832 | | | 11,139 | | | 11,226 | | | 11,753 | | | | 12,665 | | |

| | | | | | | | | | | |

| | | | | | | | |

| July 22, 2024 | Cadence Q2 2024 Financial Results | 5 |

| | | | | | | | |

| Cadence Design Systems, Inc. |

|

Forward Looking Statements

This CFO Commentary contains forward-looking statements, including Cadence's outlook on future operating results, financial condition, strategic objectives, business prospects, technology and product developments, industry trends and other statements using words such as “anticipates,” “believes,” “expects,” “intends,” “plans,” “will,” and words of similar import and the negatives thereof. Forward-looking statements are subject to a number of risks, uncertainties and other factors, many of which are outside Cadence’s control and which may cause actual results to differ materially from expectations expressed or implied in the forward-looking statements, including, among others: (i) Cadence’s ability to compete successfully in the highly competitive industries in which it operates and realize the benefits of its investments in research and development, including opportunities presented by AI; (ii) the success of Cadence’s efforts to maintain and improve operational efficiency and growth; (iii) the mix of products and services sold, the timing of orders and deliveries and the ability to develop, install or deliver Cadence’s products or services; (iv) change in customer demands or supply constraints that could result in delays in purchases, development, installations or deliveries of Cadence’s products or services, including those resulting from consolidation, restructurings and other operational efficiency improvements of Cadence’s customers; (v) economic, geopolitical and industry conditions, including that of the semiconductor and electronics industries, government regulations and trade restrictions, and rising tensions and conflicts around the world such as in the Middle East and with respect to Taiwan; (vi) capital expenditure requirements, legislative or regulatory requirements, changes in tax laws, interest rates, currency exchange rate fluctuations, inflation rates, Cadence's upcoming debt maturities and Cadence’s ability to access capital and debt markets; (vii) Cadence’s acquisition of other companies, businesses or technologies or the failure to successfully integrate and operate them; (viii) potential harm caused by compromises in cybersecurity and cybersecurity attacks; (ix) events that affect cash flow, liquidity, or reserves, or settlement assumptions Cadence may take from time to time with respect to accounts receivable, taxes and tax examinations, litigation, regulatory or other matters; (x) the effects of any litigation, regulatory, tax or other proceedings to which Cadence is or may become a party or to which Cadence or its products, services, technologies or properties are subject; and (xi) Cadence’s ability to successfully meet corporate governance, environmental and social targets and strategies. In addition, the timing and amount of Cadence’s repurchases of its common stock are subject to business and market conditions, corporate and regulatory requirements, stock price, acquisition opportunities and other factors.

For a detailed discussion of these and other cautionary statements related to Cadence’s business, please refer to Cadence’s filings with the U.S. Securities and Exchange Commission, including its most recent report on Form 10-K, subsequent reports on Form 10-Q and future filings.

All forward-looking statements in this document are based on management's expectations as of the date of this document and, except as required by law, Cadence disclaims any obligation to update these forward-looking statements to reflect future events or circumstances.

GAAP to Non-GAAP Reconciliation

Non-GAAP financial measures should not be considered as a substitute for or superior to measures of financial performance prepared in accordance with GAAP. Investors are encouraged to review the reconciliation of non-GAAP financial measures contained within this CFO Commentary with their most directly comparable GAAP financial results. Investors are also encouraged to look at the GAAP results as the best measure of financial performance. See our earnings press release issued today for further discussion of our non-GAAP financial measures, as well as the reconciliation provided in the Appendix to this CFO Commentary.

Cadence’s management uses non-GAAP net income because it excludes items that are generally not directly related to the performance of the company’s core business operations and therefore provides supplemental information to Cadence’s management and investors regarding the performance of the business operations, facilitates comparisons to the historical operating results and allows the review of Cadence’s business from the same perspective as Cadence’s management, including forecasting and budgeting.

© 2024 Cadence Design Systems, Inc. All rights reserved worldwide. Cadence, the Cadence logo and the other Cadence marks found at www.cadence.com/go/trademarks are trademarks or registered trademarks of Cadence Design Systems, Inc. All other trademarks are the property of their respective owners.

| | | | | | | | |

| July 22, 2024 | Cadence Q2 2024 Financial Results | 6 |

| | | | | | | | |

| Cadence Design Systems, Inc. |

|

APPENDIX I

Reconciliation of GAAP to Non-GAAP Financial Measures (Unaudited)

Reconciliation of GAAP Total Expenses to Non-GAAP Total Expenses | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| (In Millions) | Q2 2023 | | Q3 2023 | | Q4 2023 | | Q1 2024 | | | Q2 2024 | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| GAAP total costs and expenses | $ | 677 | | | $ | 730 | | | $ | 732 | | | $ | 759 | | | | $ | 767 | | |

| | | | | | | | | | | |

| Reconciling items to non-GAAP total costs and expenses | | | | | | | | | | | |

| Stock-based compensation expense | (76) | | | (88) | | | (87) | | | (88) | | | | (88) | | |

| Amortization of acquired intangibles | (15) | | | (15) | | | (17) | | | (17) | | | | (20) | | |

| Acquisition and integration-related costs | (14) | | | (14) | | | (13) | | | (22) | | | | (21) | | |

| Restructuring | — | | | (12) | | | 1 | | | — | | | | — | | |

| Non-qualified deferred compensation (expenses) credits | (3) | | | 2 | | | (6) | | | (5) | | | | (2) | | |

Special charges | — | | | — | | | — | | | — | | | | (1) | | |

| Non-GAAP total costs and expenses* | $ | 569 | | | $ | 603 | | | $ | 610 | | | $ | 627 | | | | $ | 635 | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | |

| * | The non-GAAP measures presented in the table above should not be considered a substitute for financial results and measures determined or calculated in accordance with GAAP. |

Reconciliation of GAAP Total Expenses to Non-GAAP Total Expenses | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| (In Millions) | 2018 | | 2019 | | 2020* | | 2021 | | 2022 | | 2023 | | | 2024E | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| GAAP total costs and expenses | $ | 1,742 | | | $ | 1,845 | | | $ | 2,037 | | | $ | 2,209 | | | $ | 2,488 | | | $ | 2,839 | | | | $ | 3,244 | | |

| | | | | | | | | | | | | | | |

| Reconciling items to non-GAAP total costs and expenses | | | | | | | | | | | | | | | |

| Stock-based compensation expense | (168) | | | (182) | | | (197) | | | (210) | | | (270) | | | (326) | | | | (391) | | |

| Amortization of acquired intangibles | (53) | | | (53) | | | (64) | | | (67) | | | (60) | | | (62) | | | | (90) | | |

| Acquisition and integration-related costs | (20) | | | (8) | | | (23) | | | (23) | | | (41) | | | (56) | | | | (93) | | |

| Restructuring | (11) | | | (9) | | | (9) | | | 1 | | | — | | | (11) | | | | — | | |

| Non-qualified deferred compensation (expenses) credits | 1 | | | (5) | | | (5) | | | (6) | | | 8 | | | (11) | | | | (6) | | |

| Special charges** | — | | | (1) | | | — | | | (27) | | | — | | | — | | | | (1) | | |

| Non-GAAP total costs and expenses*** | $ | 1,491 | | | $ | 1,587 | | | $ | 1,739 | | | $ | 1,877 | | | $ | 2,125 | | | $ | 2,373 | | | | $ | 2,663 | | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| | | | | |

| * | Fiscal 2020 was a 53-week year. |

| ** | 2021 includes costs related to a voluntary retirement program. |

| *** | The non-GAAP measures presented in the table above should not be considered a substitute for financial results and measures determined or calculated in accordance with GAAP. |

| | | | | | | | |

| July 22, 2024 | Cadence Q2 2024 Financial Results | 7 |

| | | | | | | | |

| Cadence Design Systems, Inc. |

|

Reconciliation of GAAP Operating Income to Non-GAAP Operating Income and Non-GAAP Operating Income Adjusted for Stock-based Compensation | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| (In Millions) | 2018 | | 2019 | | 2020* | | 2021 | | 2022 | | 2023 | | | 2024E | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

GAAP operating income | $ | 396 | | | $ | 492 | | | $ | 646 | | | $ | 779 | | | $ | 1,074 | | | $ | 1,251 | | | | $ | 1,386 | | |

| | | | | | | | | | | | | | | |

Reconciling items to non-GAAP operating income | | | | | | | | | | | | | | | |

| Stock-based compensation expense | 168 | | | 182 | | | 197 | | | 210 | | | 270 | | | 326 | | | | 391 | | |

| Amortization of acquired intangibles | 53 | | | 53 | | | 64 | | | 67 | | | 60 | | | 62 | | | | 90 | | |

| Acquisition and integration-related costs | 20 | | | 8 | | | 23 | | | 23 | | | 41 | | | 56 | | | | 93 | | |

| Restructuring | 11 | | | 9 | | | 9 | | | (1) | | | — | | | 11 | | | | — | | |

Non-qualified deferred compensation expenses (credits) | (1) | | | 5 | | | 5 | | | 6 | | | (8) | | | 11 | | | | 6 | | |

| Special charges** | — | | | 1 | | | — | | | 27 | | | — | | | — | | | | 1 | | |

Non-GAAP operating income*** | $ | 647 | | | $ | 749 | | | $ | 944 | | | $ | 1,111 | | | $ | 1,436 | | | $ | 1,717 | | | | $ | 1,967 | | |

| Stock-based compensation expense | (168) | | | (182) | | | (197) | | | (210) | | | (270) | | | (326) | | | | $ | (391) | | |

Non-GAAP operating income adjusted for stock-based compensation*** | $ | 479 | | | $ | 567 | | | $ | 747 | | | $ | 901 | | | $ | 1,166 | | | $ | 1,391 | | | | $ | 1,576 | | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

Table may not foot due to rounding

| | | | | |

| * | Fiscal 2020 was a 53-week year. |

| ** | 2021 includes costs related to a voluntary retirement program. |

| *** | The non-GAAP measures presented in the table above should not be considered a substitute for financial results and measures determined or calculated in accordance with GAAP. |

| | | | | | | | |

| July 22, 2024 | Cadence Q2 2024 Financial Results | 8 |

| | | | | | | | |

| Cadence Design Systems, Inc. |

|

Reconciliation of GAAP Gross Margin as a Percent of Total Revenue to Non-GAAP Gross Margin as a Percent of Total Revenue | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Q2 2023 | | Q3 2023 | | Q4 2023 | | Q1 2024 | | | Q2 2024 | | | | |

| | | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

| GAAP gross margin as a percent of total revenue | 90.1% | | 89.3% | | 90.3% | | 87.6% | | | 86.9% | | | | |

| | | | | | | | | | | | | | |

| Reconciling items to non-GAAP gross margin as a percent of total revenue | | | | | | | | | | | | | | |

| Stock-based compensation expense | 0.2% | | 0.2% | | 0.3% | | 0.3% | | | 0.3% | | | | |

| Amortization of acquired intangibles | 1.1% | | 1.1% | | 1.1% | | 1.1% | | | 1.2% | | | | |

| Non-qualified deferred compensation expenses (credits) | 0.0% | | 0.0% | | 0.0% | | 0.0% | | | 0.0% | | | | |

| Acquisition and integration-related costs | 0.0% | | 0.0% | | 0.0% | | 0.1% | | | 0.1% | | | | |

| Non-GAAP gross margin as a percent of total revenue* | 91.4% | | 90.6% | | 91.7% | | 89.1% | | | 88.5% | | | | |

| | | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

| | | | | |

| * | The non-GAAP measures presented in the table above should not be considered a substitute for financial results and measures determined or calculated in accordance with GAAP. |

| | | | | | | | |

| July 22, 2024 | Cadence Q2 2024 Financial Results | 9 |

| | | | | | | | |

| Cadence Design Systems, Inc. |

|

Reconciliation of GAAP Operating Margin as a Percent of Total Revenue to Non-GAAP Operating Margin as a Percent of Total Revenue | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Q2 2023 | | Q3 2023 | | Q4 2023 | | Q1 2024 | | | Q2 2024 | | | Q3 2024E | |

| | | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

| GAAP operating margin as a percent of total revenue | 31% | | 29% | | 31% | | 25% | | | 28% | | | 27.7% - 29.3% | |

| | | | | | | | | | | | | | |

| Reconciling items to non-GAAP operating margin as a percent of total revenue | | | | | | | | | | | | | | |

| Stock-based compensation expense | 8% | | 9% | | 8% | | 9% | | | 8% | | | 9% | |

| Amortization of acquired intangibles | 2% | | 1% | | 2% | | 2% | | | 2% | | | 2% | |

| Acquisition and integration-related costs | 1% | | 1% | | 1% | | 2% | | | 2% | | | 2% | |

| Restructuring | 0% | | 1% | | 0% | | 0% | | | 0% | | | 0% | |

| Non-qualified deferred compensation expenses (credits) | 0% | | 0% | | 1% | | 0% | | | 0% | | | 0% | |

Special charges | 0% | | 0% | | 0% | | 0% | | | 0% | | | 0% | |

| Non-GAAP operating margin as a percent of total revenue* | 42% | | 41% | | 43% | | 38% | | | 40% | | | 40.7% - 42.3% | |

| | | | | | | | | | | | | | |

| | | | | |

| * | The non-GAAP measures presented in the table above should not be considered a substitute for financial results and measures determined or calculated in accordance with GAAP. |

Reconciliation of GAAP Operating Margin as a Percent of Total Revenue to Non-GAAP Operating Margin as a Percent of Total Revenue

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | 2018 | | 2019 | | 2020 | | 2021 | | 2022 | | 2023 | | | 2024E | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

| GAAP operating margin as a percent of total revenue | | 19% | | 21% | | 24% | | 26% | | 30% | | 31% | | | 29.7% - 31.3% | |

| | | | | | | | | | | | | | | | |

| Reconciling items to non-GAAP operating margin as a percent of total revenue | | | | | | | | | | | | | | | | |

| Stock-based compensation expense | | 8% | | 8% | | 7% | | 7% | | 8% | | 8% | | | 8% | |

| Amortization of acquired intangibles | | 2% | | 2% | | 3% | | 2% | | 2% | | 2% | | | 2% | |

| Acquisition and integration-related costs | | 1% | | 0% | | 1% | | 1% | | 1% | | 1% | | | 2% | |

| Restructuring | | 0% | | 1% | | 0% | | 0% | | 0% | | 0% | | | 0% | |

| Non-qualified deferred compensation expenses (credits) | | 0% | | 0% | | 0% | | 0% | | (1)% | | 0% | | | 0% | |

| Special charges * | | 0% | | 0% | | 0% | | 1% | | 0% | | 0% | | | 0% | |

| Non-GAAP operating margin as a percent of total revenue** | | 30% | | 32% | | 35% | | 37% | | 40% | | 42% | | | 41.7% - 43.3% | |

| | | | | | | | | | | | | | | | |

| | | | | |

| * | 2021 includes costs related to a voluntary retirement program. |

| ** | The non-GAAP measures presented in the table above should not be considered a substitute for financial results and measures determined or calculated in accordance with GAAP. |

| | | | | | | | |

| July 22, 2024 | Cadence Q2 2024 Financial Results | 10 |

| | | | | | | | |

| Cadence Design Systems, Inc. |

|

Reconciliation of GAAP Diluted Net Income Per Share to Non-GAAP Diluted Net Income Per Share | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| (In Thousands, Except Per Share Data) | Q2 2023 | | Q3 2023 | | Q4 2023 | | Q1 2024 | | | Q2 2024 | | | Q3 2024E | |

| | | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

| Diluted net income per share on a GAAP basis | $ | 0.81 | | | $ | 0.93 | | | $ | 1.19 | | | $ | 0.91 | | | | $ | 0.84 | | | | $0.83 - $0.93 | |

| Stock-based compensation expense | 0.28 | | | 0.32 | | | 0.32 | | | 0.32 | | | | 0.32 | | | | 0.38 | | |

| Amortization of acquired intangibles | 0.06 | | | 0.06 | | | 0.06 | | | 0.06 | | | | 0.07 | | | | 0.10 | | |

| Acquisition and integration-related costs | 0.05 | | | 0.05 | | | 0.04 | | | 0.08 | | | | 0.08 | | | | 0.10 | | |

| Restructuring | — | | | 0.04 | | | — | | | — | | | | — | | | | — | | |

| Non-qualified deferred compensation expenses (credits) | 0.01 | | | — | | | 0.02 | | | 0.02 | | | | 0.01 | | | | — | | |

Special charges | — | | | — | | | — | | | — | | | | — | | | | — | | |

| Other income or expense related to investments and non-qualified deferred compensation plan assets** | (0.01) | | | (0.04) | | | (0.10) | | | (0.22) | | | | (0.10) | | | | — | | |

| | | | | | | | | | | | | | |

| Income tax effect of non-GAAP adjustments | 0.02 | | | (0.10) | | | (0.15) | | | — | | | | 0.06 | | | | (0.02) | | |

| Diluted net income per share on a non-GAAP basis* | $ | 1.22 | | | $ | 1.26 | | | $ | 1.38 | | | $ | 1.17 | | | | $ | 1.28 | | | | $1.39 - $1.49 | |

| | | | | | | | | | | | | | |

| Shares used in calculation of diluted net income per share | 272,996 | | | 272,427 | | | 272,419 | | | 273,544 | | | | 273,520 | | | | | |

| | | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

| | | | | |

| * | The non-GAAP measures presented in the table above should not be considered a substitute for financial results and measures determined or calculated in accordance with GAAP. |

| ** | Includes, as applicable, equity in losses or income from investments, write-down of investments, gains or losses on investments and gains or losses on non-qualified deferred compensation plan assets recorded in other income or expense. |

| | | | | | | | |

| July 22, 2024 | Cadence Q2 2024 Financial Results | 11 |

| | | | | | | | |

| Cadence Design Systems, Inc. |

|

Reconciliation of GAAP Diluted Net Income Per Share to Non-GAAP Diluted Net Income Per Share | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| (In Thousands, Except Per Share Data) | 2018 | | 2019 | | 2020 | | 2021 | | 2022 | | 2023 | | | 2024E | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| Diluted net income per share on a GAAP basis | $ | 1.23 | | | $ | 3.53 | | | $ | 2.11 | | | $ | 2.50 | | | $ | 3.09 | | | $ | 3.82 | | | | $3.82 - $4.02 | |

| Stock-based compensation expense | 0.60 | | | 0.65 | | | 0.71 | | | 0.75 | | | 0.98 | | | 1.19 | | | | 1.43 | | |

| Amortization of acquired intangibles | 0.19 | | | 0.19 | | | 0.23 | | | 0.24 | | | 0.22 | | | 0.23 | | | | 0.33 | | |

| Acquisition and integration-related costs | 0.07 | | | 0.03 | | | 0.08 | | | 0.08 | | | 0.15 | | | 0.21 | | | | 0.34 | | |

| Restructuring | 0.04 | | | 0.03 | | | 0.03 | | | — | | | — | | | 0.04 | | | | — | | |

| Non-qualified deferred compensation expenses (credits) | (0.01) | | | 0.02 | | | 0.02 | | | 0.02 | | | (0.03) | | | 0.04 | | | | 0.02 | | |

| Special charges** | — | | | — | | | — | | | 0.10 | | | — | | | — | | | | — | | |

| Other income or expense related to investments and non-qualified deferred compensation plan assets*** | — | | | (0.01) | | | — | | | (0.03) | | | 0.05 | | | (0.17) | | | | (0.32) | | |

| Income tax benefit related to intercompany transfers of certain intellectual property rights | — | | | (2.05) | | | — | | | — | | | — | | | — | | | | — | | |

| Income tax effect of non-GAAP adjustments | (0.25) | | | (0.19) | | | (0.38) | | | (0.37) | | | (0.19) | | | (0.21) | | | | 0.15 | | |

| Diluted net income per share on a non-GAAP basis* | $ | 1.87 | | | $ | 2.20 | | | $ | 2.80 | | | $ | 3.29 | | | $ | 4.27 | | | $ | 5.15 | | | | $5.77 - $5.97 | |

| | | | | | | | | | | | | | | |

| Shares used in calculation of diluted net income per share | 281,144 | | | 280,515 | | | 279,641 | | | 278,858 | | | 275,011 | | | 272,748 | | | | 273.5 - 275.5M | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| | | | | |

| * | The non-GAAP measures presented in the table above should not be considered a substitute for financial results and measures determined or calculated in accordance with GAAP. |

| ** | 2021 includes costs related to a voluntary retirement program. |

| *** | Includes, as applicable, equity in losses or income from investments, write-down of investments, gains or losses on investments and gains or losses on non-qualified deferred compensation plan assets recorded in other income or expense. |

| | | | | | | | |

| July 22, 2024 | Cadence Q2 2024 Financial Results | 12 |

| | | | | | | | |

| Cadence Design Systems, Inc. |

|

Reconciliation of GAAP Total Other Income and Expense to Non-GAAP Total Other Income and Expense | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | |

| (In Millions) | | | | FY 2022 | | | FY 2023 | | | FY 2024E | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| GAAP total other income and expense | | | | $ | (28) | | | | $ | 31 | | | | $42 - $56 | |

| | | | | | | | | | | |

| Reconciling items to non-GAAP total income and expense | | | | | | | | | | | |

| Other income or expense related to investments and non-qualified deferred compensation plan assets** | | | | 14 | | | | (46) | | | | (87) | | |

| Non-GAAP total other income and expense* | | | | $ | (14) | | | | $ | (15) | | | | $(31) - $(45) | |

| | | | | | | | | | | |

| | | | | |

| * | The non-GAAP measures presented in the table above should not be considered a substitute for financial results and measures determined or calculated in accordance with GAAP. |

| ** | Includes, as applicable, equity in losses or income from investments, write-down of investments, gains or losses on investments and gains or losses on non-qualified deferred compensation plan assets recorded in other income or expense. |

| | | | | | | | |

| July 22, 2024 | Cadence Q2 2024 Financial Results | 13 |

Document and Entity Information

|

Jul. 22, 2024 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Document Period End Date |

Jul. 22, 2024

|

| Entity Registrant Name |

CADENCE DESIGN SYSTEMS, INC.

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity File Number |

000-15867

|

| Entity Tax Identification Number |

00-0000000

|

| Entity Address, Address Line One |

2655 Seely Avenue,

|

| Entity Address, City or Town |

San Jose,

|

| Entity Address, State or Province |

CA

|

| Entity Address, Postal Zip Code |

95134

|

| City Area Code |

(408)

|

| Local Phone Number |

943-1234

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common Stock, $0.01 par value per share

|

| Trading Symbol |

CDNS

|

| Security Exchange Name |

NASDAQ

|

| Entity Emerging Growth Company |

false

|

| Entity Central Index Key |

0000813672

|

| Amendment Flag |

false

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |