CoStar Group, Inc. (NASDAQ: CSGP), a leading provider of online

real estate marketplaces, information and analytics in the property

markets, announced today that revenue for the quarter ended June

30, 2024 was $678 million, up 12% over revenue of $606 million for

the quarter ended June 30, 2023. Net income was $19 million in the

second quarter of 2024 and net income per diluted share was

$0.05.

“We achieved another strong quarter of results in terms of

revenue, sales and traffic to our websites,” said Andy Florance,

Founder and CEO of CoStar Group. “Overall revenue grew 12%

year-over-year, and our two billion-dollar run rate businesses

continue to deliver double-digit revenue growth with Apartments.com

growing at 18% and CoStar at 10% over the second quarter of last

year. Our commercial information and marketplace businesses

continue to perform and delivered 41% profit margins in the second

quarter of 2024,” continued Florance.

“Homes.com net new bookings through June reached over $55

million, a significant milestone as it took Apartments.com two

years to achieve those results. Our Homes.com Network had 148

million monthly average unique visitors in the second quarter,

according to Google Analytics, maintaining our position as one of

the top two most heavily trafficked residential property

marketplaces in the U.S.” continued Florance. “Our unaided brand

awareness continues to climb and reached 27% in June 2024 as a

result of our aggressive brand marketing campaign."

Year 2023-2024 Quarterly

Results - Unaudited

(in millions, except per share

data)

2023

2024

Q1

Q2

Q3

Q4

Q1

Q2

Revenues

$584

$606

$625

$640

$656

$678

Net income

87

101

91

96

7

19

Net income per share - diluted

0.21

0.25

0.22

0.24

0.02

0.05

Weighted average outstanding shares -

diluted

406

407

407

408

407

407

EBITDA

98

105

89

98

(13)

12

Adjusted EBITDA

123

127

112

130

12

41

Non-GAAP net income

118

127

120

133

42

61

Non-GAAP net income per share -

diluted

0.29

0.31

0.30

0.33

0.10

0.15

2024 Outlook

“This quarter’s results demonstrate the strength of our core

commercial business and the continued progress of our Homes.com

strategy,” said Chris Lown, CFO of CoStar Group. The Company now

expects revenue in the range of $2.735 billion to $2.745 billion

for the full year of 2024, representing revenue growth of

approximately 12% year-over-year at the midpoint of the range. The

Company expects revenue for the third quarter of 2024 in the range

of $692 million to $697 million, representing revenue growth of

approximately 11% year-over-year at the midpoint of the range.

“We now expect adjusted EBITDA for the full year of 2024 in the

range of $195 million to $205 million, an increase of $5 million at

the midpoint of the range from our previous guidance. For the third

quarter of 2024, we expect adjusted EBITDA in the range of $47

million to $52 million.”

The Company expects full year 2024 non-GAAP net income per

diluted share in a range of $0.64 to $0.66 based on 408 million

shares. For the third quarter of 2024, the Company expects non-GAAP

net income per diluted share in a range of $0.15 to $0.16 based on

408 million shares. These ranges include an estimated non-GAAP tax

rate of 26% for the full year and the third quarter of 2024.

The preceding forward-looking statements reflect CoStar Group’s

expectations as of July 23, 2024, including forward-looking

non-GAAP financial measures on a consolidated basis, based on

current estimates, expectations, observations, and trends. Given

the risk factors, rapidly evolving economic environment, and

uncertainties and assumptions discussed in this release and in our

quarterly reports on Form 10-Q and annual reports on Form 10-K,

actual results may differ materially. Other than in publicly

available statements, the Company does not intend to update its

forward-looking statements until its next quarterly results

announcement.

Reconciliations of EBITDA, adjusted EBITDA, non-GAAP net income,

and non-GAAP net income per diluted share to the most directly

comparable GAAP measures are shown in detail below, along with

definitions for those terms. A reconciliation of forward-looking

non-GAAP guidance to the most directly comparable GAAP measure, net

income, can be found within the tables included in this

release.

Non-GAAP Financial Measures

For information regarding the purpose for which management uses

the non-GAAP financial measures disclosed in this release and why

management believes they provide useful information to investors

regarding the Company’s financial condition and results of

operations, please refer to the Company’s latest periodic

report.

EBITDA is a non-GAAP financial measure that represents GAAP net

income attributable to CoStar Group before interest income or

expense, net and other income or expense, net; loss on debt

extinguishment; income taxes and depreciation and amortization

expense.

Adjusted EBITDA is a non-GAAP financial measure that represents

EBITDA before stock-based compensation expense, acquisition- and

integration-related costs, restructuring costs, and settlements and

impairments incurred outside the Company’s ordinary course of

business. Adjusted EBITDA margin represents adjusted EBITDA divided

by revenues for the period.

Non-GAAP net income is a non-GAAP financial measure determined

by adjusting GAAP net income attributable to CoStar Group for

stock-based compensation expense, acquisition- and

integration-related costs, restructuring costs, settlement and

impairment costs incurred outside the Company's ordinary course of

business and loss on debt extinguishment, as well as amortization

of acquired intangible assets and other related costs, and then

subtracting an assumed provision for income taxes. In 2024, the

Company is assuming a 26% tax rate in order to approximate its

statutory corporate tax rate excluding the impact of discrete

items.

Non-GAAP net income per diluted share is a non-GAAP financial

measure that represents non-GAAP net income divided by the number

of diluted shares outstanding for the period used in the

calculation of GAAP net income per diluted share. For periods with

GAAP net losses and non-GAAP net income, the weighted average

outstanding shares used to calculate non-GAAP net income per share

includes potentially dilutive securities that were excluded from

the calculation of GAAP net income per share as the effect was

anti-dilutive.

Operating Metrics

Net new bookings is calculated based on the annualized amount of

change in the Company's sales bookings resulting from new

subscription-based contracts, changes to existing

subscription-based contracts and cancellations of

subscription-based contracts for the period reported. Information

regarding net new bookings is not comparable to, nor should it be

substituted for, an analysis of the Company's revenues over

time.

Earnings Conference Call

Management will conduct a conference call to discuss the second

quarter 2024 results and the Company’s outlook at 5:00 PM ET on

Tuesday, July 23, 2024. A live audio webcast of the conference will

be available in listen-only mode through the Investors section of

the CoStar Group website: https://investors.costargroup.com. A

replay of the webcast audio will also be available in the Investors

section of our website for a period of time following the call.

CoStar Group, Inc.

Condensed Consolidated

Statements of Operations - Unaudited

(in millions, except per share

data)

Three Months Ended June

30,

Six Months Ended June

30,

2024

2023

2024

2023

Revenues

$

677.8

$

605.9

$

1,334.2

$

1,190.3

Cost of revenues

135.8

112.4

277.0

231.6

Gross profit

542.0

493.5

1,057.2

958.7

Operating expenses:

Selling and marketing (excluding customer

base amortization)

358.4

250.0

724.5

476.2

Software development

79.6

63.4

162.0

130.0

General and administrative

109.9

90.6

208.4

180.1

Customer base amortization

10.2

10.4

21.2

21.0

558.1

414.4

1,116.1

807.3

(Loss) income from operations

(16.1

)

79.1

(58.9

)

151.4

Interest income, net

53.5

51.9

109.7

95.4

Other (expense) income, net

(1.5

)

0.6

(3.4

)

1.2

Income before income taxes

35.9

131.6

47.4

248.0

Income tax expense

16.7

31.1

21.5

60.3

Net income

$

19.2

$

100.5

$

25.9

$

187.7

Net income per share - basic

$

0.05

$

0.25

$

0.06

$

0.46

Net income per share - diluted

$

0.05

$

0.25

$

0.06

$

0.46

Weighted-average outstanding shares -

basic

406.0

405.4

405.8

405.0

Weighted-average outstanding shares -

diluted

407.4

406.7

407.3

406.5

CoStar Group, Inc.

Reconciliation of Non-GAAP

Financial Measures - Unaudited

(in millions, except per share

data)

Reconciliation of Net Income

to Non-GAAP Net Income

Three Months Ended June

30,

Six Months Ended June

30,

2024

2023

2024

2023

Net income

$

19.2

$

100.5

$

25.9

$

187.7

Income tax expense

16.7

31.1

21.5

60.3

Income before income taxes

35.9

131.6

47.4

248.0

Amortization of acquired intangible

assets

18.1

18.0

37.9

35.7

Stock-based compensation expense

22.7

21.8

45.5

41.9

Acquisition and integration related

costs

6.0

(0.2

)

8.3

1.5

Restructuring and related costs

—

(0.1

)

—

3.3

Settlements and impairments

—

—

—

(0.1

)

Non-GAAP income before income taxes

82.7

171.1

139.1

330.3

Assumed rate for income tax expense(1)

26.0

%

26.0

%

26.0

%

26.0

%

Assumed provision for income tax

expense

(21.5

)

(44.5

)

(36.2

)

(85.9

)

Non-GAAP net income

$

61.2

$

126.6

$

102.9

$

244.4

Net income per share - diluted

$

0.05

$

0.25

$

0.06

$

0.46

Non-GAAP net income per share -

diluted

$

0.15

$

0.31

$

0.25

$

0.60

Weighted average outstanding shares -

basic

406.0

405.4

405.8

405.0

Weighted average outstanding shares -

diluted

407.4

406.7

407.3

406.5

__________________________

(1) The assumed tax rate approximates our

statutory federal and state corporate tax rate for the applicable

period.

Reconciliation of Net Income

to EBITDA and Adjusted EBITDA

Three Months Ended June

30,

Six Months Ended June

30,

2024

2023

2024

2023

Net income

$

19.2

$

100.5

$

25.9

$

187.7

Amortization of acquired intangible assets

in cost of revenues

7.9

7.5

16.7

14.6

Amortization of acquired intangible assets

in operating expenses

10.2

10.5

21.2

21.1

Depreciation and other amortization

10.1

8.1

20.4

16.0

Interest income, net

(53.5

)

(51.9

)

(109.7

)

(95.4

)

Other expense (income), net1

1.5

(0.6

)

3.4

(1.2

)

Income tax expense

16.7

31.1

21.5

60.3

EBITDA

$

12.1

$

105.2

$

(0.6

)

$

203.1

Stock-based compensation expense

22.7

21.8

45.5

41.9

Acquisition and integration related

costs

6.0

(0.2

)

8.3

1.5

Restructuring and related costs

—

(0.1

)

—

3.3

Settlements and impairments

—

—

—

(0.1

)

Adjusted EBITDA

$

40.8

$

126.7

$

53.2

$

249.7

__________________________

1 Includes $5.3 million and $8.9 million

of amortization and depreciation expense associated with lessor

income for the three and six months ended June 30, 2024,

respectively.

CoStar Group, Inc.

Condensed Consolidated Balance

Sheets - Unaudited

(in millions)

June 30, 2024

December 31,

2023

ASSETS

Current assets:

Cash and cash equivalents

$

4,919.5

$

5,215.9

Accounts receivable

226.2

213.2

Less: Allowance for credit losses

(22.4

)

(23.2

)

Accounts receivable, net

203.8

190.0

Prepaid expenses and other current

assets

83.9

70.2

Total current assets

5,207.2

5,476.1

Deferred income taxes, net

4.3

4.3

Property and equipment, net

853.2

472.2

Lease right-of-use assets

69.3

79.8

Goodwill

2,383.6

2,386.2

Intangible assets, net

342.5

313.7

Deferred commission costs, net

178.9

167.7

Deposits and other assets

26.3

17.7

Income tax receivable

2.0

2.0

Total assets

$

9,067.3

$

8,919.7

LIABILITIES AND STOCKHOLDERS'

EQUITY

Current liabilities:

Accounts payable

$

101.0

$

23.1

Accrued wages and commissions

110.2

117.8

Accrued expenses and other current

liabilities

186.3

163.0

Income taxes payable

0.1

7.7

Lease liabilities

41.2

40.0

Deferred revenue

122.9

104.2

Total current liabilities

561.7

455.8

Long-term debt, net

991.2

990.5

Deferred income taxes, net

30.3

36.7

Income taxes payable

18.8

18.2

Lease and other long-term liabilities

69.6

79.9

Total liabilities

$

1,671.6

$

1,581.1

Total stockholders' equity

7,395.7

7,338.6

Total liabilities and stockholders'

equity

$

9,067.3

$

8,919.7

CoStar Group, Inc.

Condensed Consolidated

Statements of Cash Flows - Unaudited

(in millions)

Six Months Ended June

30,

2024

2023

Operating activities:

Net income

$

25.9

$

187.7

Adjustments to reconcile net income to net

cash provided by operating activities:

Depreciation and amortization

72.1

51.7

Amortization of deferred commissions

costs

56.3

45.3

Amortization of Senior Notes discount and

issuance costs

1.7

1.2

Non-cash lease expense

12.9

14.1

Stock-based compensation expense

45.5

41.9

Deferred income taxes, net

(6.4

)

(7.0

)

Credit loss expense

17.0

13.9

Other operating activities, net

0.1

0.5

Changes in operating assets and

liabilities, net of acquisitions:

Accounts receivable

(31.1

)

(40.6

)

Prepaid expenses and other current

assets

(13.8

)

(4.2

)

Deferred commissions

(67.6

)

(65.0

)

Accounts payable and other liabilities

82.9

54.4

Lease liabilities

(14.8

)

(16.6

)

Income taxes payable, net

(7.0

)

12.9

Deferred revenue

19.0

8.9

Other assets

(3.5

)

(0.7

)

Net cash provided by operating

activities

189.2

298.4

Investing activities:

Purchases of property, equipment and other

assets for new campuses

(449.5

)

(45.6

)

Purchases of property and equipment and

other assets

(23.0

)

(8.8

)

Net cash used in investing activities

(472.5

)

(54.4

)

Financing activities:

Repurchase of restricted stock to satisfy

tax withholding obligations

(26.9

)

(22.5

)

Proceeds from exercise of stock options

and employee stock purchase plan

17.2

16.2

Principal repayments of finance lease

obligations

(2.2

)

—

Net cash used in financing activities

(11.9

)

(6.3

)

Effect of foreign currency exchange rates

on cash and cash equivalents

(1.2

)

(0.4

)

Net (decrease) increase in cash and cash

equivalents

(296.4

)

237.3

Cash and cash equivalents at the beginning

of period

5,215.9

4,968.0

Cash and cash equivalents at the end of

period

$

4,919.5

$

5,205.3

CoStar Group, Inc.

Disaggregated Revenues -

Unaudited

(in millions)

Three Months Ended June

30,

2024

2023

North America

International

Total

North America

International

Total

CoStar

$

237.1

$

15.9

$

253.0

$

219.6

$

9.6

$

229.2

Information Services

27.9

5.5

33.4

32.2

9.7

41.9

Multifamily

264.2

—

264.2

224.3

—

224.3

LoopNet

67.2

2.6

69.8

63.2

2.3

65.5

Residential

16.2

10.0

26.2

12.7

—

12.7

Other Marketplaces

31.2

—

31.2

32.3

—

32.3

Total revenues

$

643.8

$

34.0

$

677.8

$

584.3

$

21.6

$

605.9

Six Months Ended June

30,

2024

2023

North America

International

Total

North America

International

Total

CoStar

$

472.8

$

30.5

$

503.3

$

435.4

$

18.8

$

454.2

Information Services

55.3

11.1

66.4

64.3

19.2

83.5

Multifamily

519.0

—

519.0

435.0

—

435.0

LoopNet

133.6

5.3

138.9

124.4

4.4

128.8

Residential

24.6

20.2

44.8

25.9

—

25.9

Other Marketplaces

61.8

—

61.8

62.9

—

62.9

Total revenues

$

1,267.1

$

67.1

$

1,334.2

$

1,147.9

$

42.4

$

1,190.3

CoStar Group, Inc.

Results of Segments -

Unaudited

(in millions)

Three Months Ended June

30,

Six Months Ended June

30,

2024

2023

2024

2023

EBITDA

North America

$

30.8

$

104.6

$

34.0

$

201.3

International

(18.7

)

0.6

(34.6

)

1.8

Total EBITDA

$

12.1

$

105.2

$

(0.6

)

$

203.1

CoStar Group, Inc.

Reconciliation of Non-GAAP

Financial Measures with Quarterly Results - Unaudited

(in millions, except per share

data)

Reconciliation of Net Income

to Non-GAAP Net Income

2023

2024

Q1

Q2

Q3

Q4

Q1

Q2

Net income

$87.1

$100.5

$90.6

$96.4

$6.7

$19.2

Income tax expense

29.2

31.1

29.9

36.3

4.8

16.7

Income before income taxes

116.4

131.7

120.5

132.7

11.5

35.9

Amortization of acquired intangible

assets

17.7

18.0

18.7

19.3

19.8

18.1

Stock-based compensation expense

20.0

21.8

21.9

21.2

22.8

22.7

Acquisition and integration related

costs

1.7

(0.2)

0.8

10.7

2.3

6.0

Restructuring and related costs

3.4

(0.1)

0.5

0.2

—

—

Settlements and impairments

(0.1)

—

—

—

—

—

Other income, net

—

—

—

(3.8)

—

—

Non-GAAP income before income taxes(1)

159.1

171.2

162.4

180.3

56.4

82.7

Assumed rate for income tax expense(2)

26%

26%

26%

26%

26%

26%

Assumed provision for income tax

expense

(41.4)

(44.5)

(42.2)

(46.9)

(14.7)

(21.5)

Non-GAAP net income(1)

$117.7

$126.7

$120.2

$133.4

$41.7

$61.2

Non-GAAP net income per share -

diluted

$0.29

$0.31

$0.30

$0.33

$0.10

$0.15

Weighted average outstanding shares -

basic

404.5

405.4

405.6

405.8

405.6

406.0

Weighted average outstanding shares -

diluted

406.2

406.8

407.2

407.5

407.3

407.4

__________________________

(1) Totals may not foot due to

rounding.

(2) The assumed tax rate approximates our

statutory federal and state corporate tax rate for the applicable

period.

Reconciliation of Net Income

to EBITDA and Adjusted EBITDA

2023

2024

Q1

Q2

Q3

Q4

Q1

Q2

Net income

$87.1

$100.5

$90.6

$96.4

$6.7

$19.2

Amortization of acquired intangible

assets

17.7

18.0

18.7

19.3

19.8

18.1

Depreciation and other amortization

7.9

8.1

8.4

9.4

10.3

10.1

Interest income, net

(43.5)

(51.9)

(58.4)

(59.7)

(56.2)

(53.5)

Other (income) expense, net(1)

(0.6)

(0.6)

(0.5)

(3.7)

1.9

1.5

Income tax expense

29.2

31.1

29.9

36.3

4.8

16.7

EBITDA(2)

$97.8

$105.2

$88.7

$98.0

$(12.7)

$12.1

Stock-based compensation expense

20.0

21.8

21.9

21.2

22.8

22.7

Acquisition and integration related

costs

1.7

(0.2)

0.8

10.7

2.3

6.0

Restructuring and related costs

3.4

(0.1)

0.5

0.2

—

—

Settlements and impairments

(0.1)

—

—

—

—

—

Adjusted EBITDA(2)

$122.9

$126.8

$111.9

$130.1

$12.4

$40.8

__________________________

(1) Includes $5.3 million and $8.9 million

of amortization and depreciation expense associated with lessor

income for the three and six months ended June 30, 2024,

respectively.

(2) Totals may not foot due to

rounding.

CoStar Group, Inc.

Reconciliation of

Forward-Looking Guidance - Unaudited

(in millions, except per share

data)

Reconciliation of

Forward-Looking Guidance, Net Income to Non-GAAP Net Income

Guidance Range

Guidance Range

For the Three Months

For the Year Ending

Ending September 30,

2024

December 31, 2024

Low

High

Low

High

Net income

$

22

$

26

$

107

$

114

Income tax expense

13

14

57

60

Income before income taxes

35

40

164

174

Amortization of acquired intangible

assets

17

17

72

72

Stock-based compensation expense

25

25

95

95

Acquisition and integration related

costs

8

8

24

24

Non-GAAP income before income taxes

85

90

355

365

Assumed rate for income tax expense(1)

26

%

26

%

26

%

26

%

Assumed provision for income tax

expense

(22

)

(23

)

(92

)

(95

)

Non-GAAP net income

63

67

263

270

Net income per share - diluted

$

0.05

$

0.06

$

0.26

$

0.28

Non-GAAP net income per share -

diluted

$

0.15

$

0.16

$

0.64

$

0.66

Weighted average outstanding shares -

diluted

408.0

408.0

407.8

407.8

__________________________

(1) The assumed tax rate approximates our

statutory federal and state corporate tax rate for the applicable

period.

Reconciliation of

Forward-Looking Guidance, Net Income to Adjusted EBITDA

Guidance Range

Guidance Range

For the Three Months

For the Year Ending

Ending September 30,

2024

December 31, 2024

Low

High

Low

High

Net income

$

22

$

26

$

107

$

114

Amortization of acquired intangible

assets

17

17

72

72

Depreciation and other amortization

10

10

41

41

Interest income, net

(50

)

(50

)

(208

)

(208

)

Other (income) expense, net

2

2

7

7

Income tax expense

13

14

57

60

Stock-based compensation expense

25

25

95

95

Acquisition and integration related

costs

8

8

24

24

Adjusted EBITDA

$

47

$

52

$

195

$

205

About CoStar Group

CoStar Group (NASDAQ: CSGP) is a leading provider of online real

estate marketplaces, information, and analytics in the property

markets. Founded in 1987, CoStar Group conducts expansive, ongoing

research to produce and maintain the largest and most comprehensive

database of real estate information. CoStar is the global leader in

commercial real estate information, analytics, and news, enabling

clients to analyze, interpret and gain unmatched insight on

property values, market conditions and availabilities.

Apartments.com is the leading online marketplace for renters

seeking great apartment homes, providing property managers and

owners a proven platform for marketing their properties. LoopNet is

the most heavily trafficked online commercial real estate

marketplace with over twelve million monthly global unique

visitors. STR provides premium data benchmarking, analytics, and

marketplace insights for the global hospitality industry. Ten-X

offers a leading platform for conducting commercial real estate

online auctions and negotiated bids. Homes.com is the fastest

growing online residential marketplace that connects agents,

buyers, and sellers. OnTheMarket is a leading residential property

portal in the United Kingdom. BureauxLocaux is one of the largest

specialized property portals for buying and leasing commercial real

estate in France. Business Immo is France’s leading commercial real

estate news service. Thomas Daily is Germany’s largest online data

pool in the real estate industry. Belbex is the premier source of

commercial space available to let and for sale in Spain. CoStar

Group’s websites attracted over 183 million monthly average unique

visitors in the second quarter of 2024. Headquartered in

Washington, DC, CoStar Group maintains offices throughout the U.S.,

Europe, Canada, and Asia. From time to time, we plan to utilize our

corporate website, CoStarGroup.com, as a channel of distribution

for material company information. For more information, visit

CoStarGroup.com.

This news release and the Company’s earnings conference call

contain “forward-looking statements” within the meaning of the

Private Securities Litigation Reform Act of 1995. Such statements

include, but are not limited to, statements about CoStar Group's

plans, objectives, expectations, beliefs and intentions and other

statements including words such as “hope,” “anticipate,” “may,”

“believe,” “expect,” “intend,” “will,” “should,” “plan,”

“estimate,” “predict,” “continue” and “potential” or the negative

of these terms or other comparable terminology. Such statements are

based upon the current beliefs and expectations of management of

CoStar Group and are subject to many risks and uncertainties.

Actual results may differ materially from the results anticipated

in the forward-looking statements and the assumptions and estimates

used as a basis for the forward-looking statements. The following

factors, among others, could cause or contribute to such

differences: risks associated with the ability to consummate the

proposed transaction with Matterport, Inc. ("Matterport") and the

timing of the closing of the proposed transaction; the ability to

successfully integrate operations and employees; the ability to

realize anticipated benefits and synergies of the proposed mergers

as rapidly or to the extent anticipated by financial analysts or

investors; the potential impact of announcement of the proposed

mergers or consummation of the proposed Matterport transaction on

business relationships, including with employees, customers,

suppliers and competitors; unfavorable outcomes of any legal

proceedings that have been or may be instituted against CoStar or

Matterport; the ability to retain key personnel; costs, fees,

expenses and charges related to the proposed Matterport

transaction; the risk that the trends stated or implied by this

release or in the earnings conference call cannot or will not be

sustained at the current pace or may increase or decrease,

including trends and expectations related to revenue, revenue

growth, net income, non-GAAP net income, EBITDA, adjusted EBITDA,

adjusted EBITDA margin, sales, net new bookings, site traffic and

visitors, leads, and renewal rates; the risk that the Company is

unable to sustain current Company-wide or Homes.com net new

bookings; the risk that revenues for the third quarter and full

year 2024 will not be as stated in this press release; the risk

that net income for the third quarter and full year 2024 will not

be as stated in this press release; the risk that EBITDA for the

third quarter and full year 2024 will not be as stated in this

press release; the risk that adjusted EBITDA for the third quarter

and full year 2024 will not be as stated in this press release; the

risk that non-GAAP net income and non-GAAP net income per diluted

share for the third quarter and full year 2024 will not be as

stated in this press release; the risk that we may not successfully

integrate acquired businesses or assets and may not achieve

anticipated benefits of an acquisition, including expected

synergies; the risk that the tax rate estimates stated in this

press release may change and the risk that we may experience

declines in our revenues, revenue growth rates and profitability

due to the impact of economic conditions on the real estate

industry and our core customer base. More information about

potential factors that could cause results to differ materially

from those anticipated in the forward-looking statements include,

but are not limited to, those stated in CoStar Group’s filings from

time to time with the Securities and Exchange Commission (the

"SEC"), including in CoStar Group’s Annual Report on Form 10-K for

the year ended December 31, 2023 and Quarterly Report for the

quarterly period ended March 31, 2024, each of which is filed with

the SEC, including in the “Risk Factors” section of those filings,

as well as CoStar Group’s other filings with the SEC (including

Current Reports on Form 8-K) available at the SEC’s website

(www.sec.gov). All forward-looking statements are based on

information available to CoStar Group on the date hereof, and

CoStar Group assumes no obligation to update or revise any

forward-looking statements, whether as a result of new information,

future events or otherwise.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240723117420/en/

Investor Relations: Cyndi Eakin Senior Vice President

CoStar Group Investor Relations (202) 346-6784 ceakin@costar.com

News Media: Matthew Blocher Vice President CoStar Group

Corporate Marketing & Communications (202) 346-6775

mblocher@costar.com

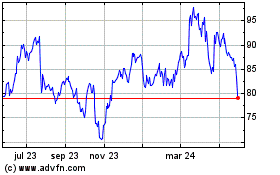

CoStar (NASDAQ:CSGP)

Gráfica de Acción Histórica

De Dic 2024 a Ene 2025

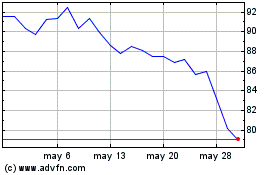

CoStar (NASDAQ:CSGP)

Gráfica de Acción Histórica

De Ene 2024 a Ene 2025