false

0001805521

0001805521

2024-07-31

2024-07-31

0001805521

FFIE:ClassCommonStockParValue0.0001PerShareMember

2024-07-31

2024-07-31

0001805521

FFIE:RedeemableWarrantsExercisableForSharesOfClassCommonStockAtExercisePriceOf11.50PerShareMember

2024-07-31

2024-07-31

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d) OF THE

SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event reported):

July 31, 2024

Faraday Future Intelligent Electric Inc.

(Exact name of registrant as specified in its charter)

| Delaware |

|

001-39395 |

|

84-4720320 |

| (State or other jurisdiction |

|

(Commission File Number) |

|

(I.R.S. Employer |

| of incorporation) |

|

|

|

Identification No.) |

| 18455 S. Figueroa Street |

|

|

| Gardena, CA |

|

90248 |

| (Address of principal executive offices) |

|

(Zip Code) |

(424) 276-7616

(Registrant’s telephone number, including

area code)

Not Applicable

(Former name or former address, if changed since

last report)

Check the appropriate box below if the Form 8-K

filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ☐ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

|

| ☐ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

|

| ☐ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

|

| ☐ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b)

of the Act:

| Title of each class |

|

Trading Symbol(s) |

|

Name of each exchange on which registered |

| Class A common stock, par value $0.0001 per share |

|

FFIE |

|

The Nasdaq Stock Market LLC |

| Redeemable warrants, exercisable for shares of Class A common stock at an exercise price of $11.50 per share |

|

FFIEW |

|

The Nasdaq Stock Market LLC |

Indicate by check mark whether the registrant

is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the

Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☒

If an emerging growth company, indicate by check

mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting

standards provided pursuant to Section 13(a) of the Exchange Act.

Item 7.01. Regulation FD Disclosure

On July 31, 2024, Matthias Aydt, the Global Chief Executive Officer

of Faraday Future Intelligent Electric Inc., a Delaware corporation (the “Company”), released a video providing a brief update

regarding the results of the Company’s annual meeting of stockholders. The transcript of this video is attached hereto as Exhibit

99.1 and is incorporated herein by reference.

The information contained in this Current Report on Form 8-K, including

Exhibit 99.1, is being furnished and shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act

of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities of that section, nor shall it be deemed

incorporated by reference in any filing under the Securities Act of 1933, as amended, or the Exchange Act, except as expressly set forth

by specific reference in such a filing.

Item 9.01. Financial Statements and Exhibits

(d) Exhibits

SIGNATURE

Pursuant to the requirements of the Securities

Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| |

FARADAY FUTURE INTELLIGENT ELECTRIC INC. |

| |

|

| Date: August 1, 2024 |

By: |

/s/ Jonathan Maroko |

| |

Name: |

Jonathan Maroko |

| |

Title: |

Interim Chief Financial Officer |

Exhibit 99.1

Forward Looking Statements Disclaimer (Shown on Video)

This communication includes “forward looking statements”

within the meaning of the safe harbor provisions of the United States Private Securities Litigation Reform Act of 1995. When used in this

video, the words “estimates,” “projected,” “expects,” “anticipates,” “forecasts,”

“plans,” “intends,” “believes,” “seeks,” “may,” “will,” “should,”

“future,” “propose” and variations of these words or similar expressions (or the negative versions of such words

or expressions) are intended to identify forward-looking statements. These forward-looking statements, which include statements regarding

Faraday Future Intelligent Electric Inc.’s (the “Company’s”) “Bridge Strategy,” the Company’s growth strategy,

fundraising activities and prospects, the development of markets in which the Company operates or seeks to operate, and the production

and delivery of the FF 91, and future compliance with Nasdaq listing requirements are not guarantees of future performance, conditions

or results, and involve a number of known and unknown risks, uncertainties, assumptions and other important factors, many of which are

outside the Company’s control, that could cause actual results or outcomes to differ materially from those discussed in the forward-looking

statements. These forward-looking statements speak only as of the date of this call, and the Company expressly disclaims any obligation

or undertaking to disseminate any updates or revisions to any forward-looking statement contained herein to reflect any change in the

Company’s expectations with regard thereto or any change in events, conditions or circumstances on which any such statement is based.

Important factors, among others, that may affect actual results or

outcomes include, among others: the Company’s ability to continue as a going concern and improve its liquidity and financial position;

the Company’s ability to regain compliance with, and thereafter continue to comply with, the Nasdaq listing requirements; the Company’s

ability to pay its outstanding obligations; the Company’s ability to raise necessary capital, including but not limited to the capital

required to fund production of the FF 91 and the Bridge Strategy; the Company’s ability to remediate its material weaknesses in

internal control over financial reporting and the risks related to the restatement of previously issued consolidated financial statements;

the Company’s limited operating history and the significant barriers to growth it faces; the Company’s history of losses and

expectation of continued losses; the success of the Company’s payroll expense reduction plan; the Company’s ability to execute

on its plans to develop and market its vehicles and the timing of these development programs; the Company’s estimates of the size

of the markets for its vehicles and cost to bring those vehicles to market; the rate and degree of market acceptance of the Company’s

vehicles; the Company’s ability to cover future warrant claims; the success of other competing manufacturers; the performance and

security of the Company’s vehicles; current and potential litigation involving the Company; the Company’s ability to receive

funds from, satisfy the conditions precedent of and close on the various financings described elsewhere by the Company; the result of

future financing efforts, the failure of any of which could result in the Company seeking protection under the Bankruptcy Code; the Company’s

indebtedness; the Company’s ability to cover future warranty claims; insurance coverage; general economic and market conditions

impacting demand for the Company’s products; potential negative impacts of a reverse stock split; potential cost, headcount and

salary reduction actions may not be sufficient or may not achieve their expected results; circumstances outside of the Company’s

control, such as natural disasters, climate change, health epidemics and pandemics, terrorist attacks, and civil unrest; risks related

to the Company’s operations in China; the success of the Company’s remedial measures taken in response to the Special Committee

findings; the Company’s dependence on its suppliers and contract manufacturer; the Company’s ability to develop and protect

its technologies; the Company’s ability to protect against cybersecurity risks; the ability of the Company to attract and retain

employees; any adverse developments in existing legal proceedings or the initiation of new legal proceedings; and volatility of the Company’s

stock price. You should carefully consider the foregoing factors and the other risks and uncertainties described in the “Risk Factors”

section of the Company’s Form 10-K filed with the Securities and Exchange Commission (“SEC”) on May 28, 2024, as amended

on May 30, 2024, and June 24, 2024, as updated by the “Risk Factors” section of the Company’s Form 10-Q filed with the

SEC on July 30, 2024, and other documents filed by the Company from time to time with the SEC.

Video Transcript

Hello, I’m Matthias Aydt, Global CEO of Faraday Future. I’m

speaking to you again for the second time in just as many days. I want to ensure you are getting the latest information on what is happening

at Faraday Future and hearing from me firsthand.

I shared some important updates on the company yesterday, including

that we successfully met one of the two compliance deadlines we needed by filing our first quarter 10-Q.

I also gave updates on our financial situation, the China-U.S. Automotive

Bridge Strategy, fundraising efforts and our successful Investor Community Day.

Today I want to share with you the results of our annual meeting of

stockholders (or AGM as we call it).

We’ve been asking for our stockholders’ support for this

AGM and to vote in favor of the six proposals that were on the table – which were critical to the future of the company.

I’m very happy to report that all proposals were approved this

morning.

Now while there were obviously many things that needed to be voted

on, including the reelection of our Directors and the ratification of our accounting firm, I want to share with you the meaning of some

of the key results. Basically what does this actually mean to the company and our stockholders.

In a nutshell, it means that with your vote and support FF can continue

on a path for additional future strategic equity investments that could support a ramp up in production and delivery of our performance

and technologically capable FF 91 2.0 EV. This is a terrific product and it deserves to continue being produced and sold in the marketplace.

But it also means that the approval of the reverse stock split proposal

will help the Company meet the minimum bid price requirement necessary to maintain listing status on the Nasdaq Capital Market. We believe

that it’s important to help in our future fundraising efforts.

And lastly, we believe that the approved proposals could help support

the development of a beneficial China-US automotive industry bridge strategy and could help accelerate our entry into the UAE, both of

which we have mentioned in the past.

Everyone here at FF wants to express our sincere gratitude for your

ongoing support and to thank you for your confidence and your vote at this recent Annual Meeting of Stockholders.

I look forward to sharing more updates and successes in the near future.

v3.24.2.u1

Cover

|

Jul. 31, 2024 |

| Document Type |

8-K

|

| Amendment Flag |

false

|

| Document Period End Date |

Jul. 31, 2024

|

| Entity File Number |

001-39395

|

| Entity Registrant Name |

Faraday Future Intelligent Electric Inc.

|

| Entity Central Index Key |

0001805521

|

| Entity Tax Identification Number |

84-4720320

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity Address, Address Line One |

18455 S. Figueroa Street

|

| Entity Address, City or Town |

Gardena

|

| Entity Address, State or Province |

CA

|

| Entity Address, Postal Zip Code |

90248

|

| City Area Code |

424

|

| Local Phone Number |

276-7616

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Entity Emerging Growth Company |

true

|

| Elected Not To Use the Extended Transition Period |

false

|

| Class A common stock, par value $0.0001 per share |

|

| Title of 12(b) Security |

Class A common stock, par value $0.0001 per share

|

| Trading Symbol |

FFIE

|

| Security Exchange Name |

NASDAQ

|

| Redeemable warrants, exercisable for shares of Class A common stock at an exercise price of $11.50 per share |

|

| Title of 12(b) Security |

Redeemable warrants, exercisable for shares of Class A common stock at an exercise price of $11.50 per share

|

| Trading Symbol |

FFIEW

|

| Security Exchange Name |

NASDAQ

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=FFIE_ClassCommonStockParValue0.0001PerShareMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=FFIE_RedeemableWarrantsExercisableForSharesOfClassCommonStockAtExercisePriceOf11.50PerShareMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

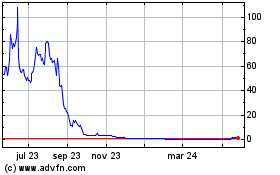

Faraday Future Intellige... (NASDAQ:FFIE)

Gráfica de Acción Histórica

De Jul 2024 a Ago 2024

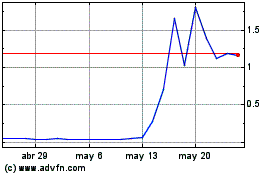

Faraday Future Intellige... (NASDAQ:FFIE)

Gráfica de Acción Histórica

De Ago 2023 a Ago 2024