- Provides business update on strategic developments and

operational progress.

Faraday Future Intelligent Electric Inc. (Nasdaq: FFIE) (“FF” or

the “Company”), a California-based global shared intelligent

electric mobility ecosystem company today provided a business

update, highlighting significant strategic developments and

operational progress, including regaining compliance with Nasdaq

timely reporting requirements.

Overview

- Financial Update – First Quarter 2024

- China-U.S. Automotive Bridge Strategy

- Fundraising and Expense Initiatives

- Investor Community Day

- Nasdaq Listing Compliance

Financial Update – First Quarter 2024

The Company continued its efforts to control costs and reduce

operating expenses:

- Operating expenses declined significantly to $22.9 million

compared to $95.8 million in the same prior year quarter.

- Loss from operations declined to $43.6 million compared to a

loss of $95.8 million in same prior year quarter.

- Cash from operating activities improved meaningfully to a loss

of $14.7 million compared to negative $103.0 million in first

quarter 2023.

- The Company had $499.9 million of assets, $298.4 million

liabilities and a book value of $201.5 million at quarter end March

31, 2024.

- Shares of Class A common stock outstanding on July 30, 2024

were 441.3 million, as compared to Class A shares outstanding on

May 17, 2024 of 439.7 million.

"The start of 2024 marked a transformative period for the

Company,” said Matthias Aydt, Global CEO of Faraday Future. “Our

new China-U.S. Automotive Bridge Strategy positions us to leverage

our cutting-edge AI and software technologies across multiple

market segments, potentially accelerating our mass-market entry

while maintaining our ultra-luxury offering. Coupled with our

fundraising efforts, Nasdaq compliance efforts, and the success of

our first Investor Community Day held recently, these developments

underscore our commitment to innovation, sustainable growth, and

stockholder value. As we move forward, we remain focused on

executing our global strategy and bringing our unique vision of

intelligent electric mobility to a broader audience."

China-U.S. Automotive Bridge Strategy

FF has unveiled its innovative China-U.S. Automotive Bridge

Strategy, marking a return to a two-brand approach. As part of its

dual-home-market strategy, FF could leverage its unique bridge

value to integrate the strengths of the U.S. automotive industry

with those of Chinese car companies and their respective supply

chains. This strategy aims to establish a second mass

market-focused brand by collaborating with China-based OEMs and

parts suppliers. FF plans to enhance procured components with its

proprietary AI and Vehicle Software technology, creating a

compelling value proposition for the AI EV mass-market.

Fundraising and Expense Initiatives

The Company reported progress on strategic financing. If

strategic investments are secured, this could allow for a ramp in

production and additional deliveries of the FF 91. Furthermore,

incremental funding could support the development of the China-U.S.

Automotive Bridge Strategy that is being developed. FF will also

keep working to optimize operations to support sustainability. This

includes ongoing evaluations of current cost reductions and

spending efficiency, including daily operations and FF 91 materials

costs.

Investor Community Day

FF’s Investor Community Day, held in July, provided a tour of

the Company’s facilities and an opportunity to experience the FF 91

firsthand. FF executives spent the day showcasing the Company's

core values and marketplace advantages. The event highlighted FF's

unique product power, transformative technology, brand strength,

and innovative user ecosystem.

Nasdaq Listing Compliance

FF received approval for continued listing from the Nasdaq

Hearings Panel, subject to compliance deadlines. FF successfully

met one compliance deadline with the filing today of its Form 10-Q

for the quarter ended March 31, 2024.

ABOUT FARADAY FUTURE

Faraday Future is the pioneer of the Ultimate AI TechLuxury

ultra spire market in the intelligent EV era, and the disruptor of

the traditional ultra-luxury car civilization epitomized by Ferrari

and Maybach. FF is not just an EV company, but also a

software-driven intelligent internet company. Ultimately FF aims to

become a User Company by offering a shared intelligent mobility

ecosystem. FF remains dedicated to advancing electric vehicle

technology to meet the evolving needs and preferences of users

worldwide, driven by a pursuit of intelligent and AI-driven

mobility.

FORWARD LOOKING STATEMENTS

This communication includes “forward looking statements” within

the meaning of the safe harbor provisions of the United States

Private Securities Litigation Reform Act of 1995. When used in this

press release, the words “estimates,” “projected,” “expects,”

“anticipates,” “forecasts,” “plans,” “intends,” “believes,”

“seeks,” “may,” “will,” “should,” “future,” “propose” and

variations of these words or similar expressions (or the negative

versions of such words or expressions) are intended to identify

forward-looking statements. These forward-looking statements, which

include statements regarding the Company’s “Bridge Strategy,” the

Company’s growth strategy and the development of the markets in

which it operates, and the production and delivery of the FF 91,

and future compliance with Nasdaq listing requirements are not

guarantees of future performance, conditions or results, and

involve a number of known and unknown risks, uncertainties,

assumptions and other important factors, many of which are outside

the Company’s control, that could cause actual results or outcomes

to differ materially from those discussed in the forward-looking

statements.

Important factors, among others, that may affect actual results

or outcomes include, among others: the Company’s ability to

continue as a going concern and improve its liquidity and financial

position; the Company’s ability to regain compliance with, and

thereafter continue to comply with, the Nasdaq listing

requirements; the Company’s ability to pay its outstanding

obligations; the Company’s ability to raise necessary capital,

including but not limited to the capital required to fund

production of the FF 91 and the Bridge Strategy; the Company’s

ability to remediate its material weaknesses in internal control

over financial reporting and the risks related to the restatement

of previously issued consolidated financial statements; the

Company’s limited operating history and the significant barriers to

growth it faces; the Company’s history of losses and expectation of

continued losses; the success of the Company’s payroll expense

reduction plan; the Company’s ability to execute on its plans to

develop and market its vehicles and the timing of these development

programs; the Company’s estimates of the size of the markets for

its vehicles and cost to bring those vehicles to market; the rate

and degree of market acceptance of the Company’s vehicles; the

Company’s ability to cover future warrant claims; the success of

other competing manufacturers; the performance and security of the

Company’s vehicles; current and potential litigation involving the

Company; the Company’s ability to receive funds from, satisfy the

conditions precedent of and close on the various financings

described elsewhere by the Company; the result of future financing

efforts, the failure of any of which could result in the Company

seeking protection under the Bankruptcy Code; the Company’s

indebtedness; the Company’s ability to cover future warranty

claims; insurance coverage; general economic and market conditions

impacting demand for the Company’s products; potential negative

impacts of a reverse stock split; potential cost, headcount and

salary reduction actions may not be sufficient or may not achieve

their expected results; circumstances outside of the Company’s

control, such as natural disasters, climate change, health

epidemics and pandemics, terrorist attacks, and civil unrest; risks

related to the Company’s operations in China; the success of the

Company’s remedial measures taken in response to the Special

Committee findings; the Company’s dependence on its suppliers and

contract manufacturer; the Company’s ability to develop and protect

its technologies; the Company’s ability to protect against

cybersecurity risks; the ability of the Company to attract and

retain employees; any adverse developments in existing legal

proceedings or the initiation of new legal proceedings; and

volatility of the Company’s stock price. You should carefully

consider the foregoing factors and the other risks and

uncertainties described in the “Risk Factors” section of the

Company’s Form 10-K filed with the Securities and Exchange

Commission (“SEC”) on May 28, 2024, as amended on May 30, 2024 and

June 24, 2024, as updated by the “Risk Factors” section of the

Company’s Form 10-Q filed with the SEC on July 30, 2024, and other

documents filed by the Company from time to time with the SEC.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240730457701/en/

Investors (English): ir@faradayfuture.com

Investors (Chinese): cn-ir@faradayfuture.com

Media: john.schilling@ff.com

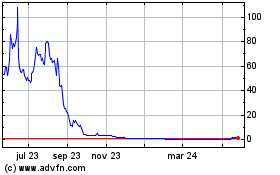

Faraday Future Intellige... (NASDAQ:FFIE)

Gráfica de Acción Histórica

De Jul 2024 a Jul 2024

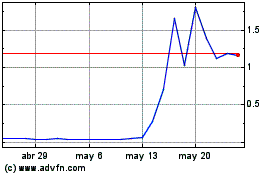

Faraday Future Intellige... (NASDAQ:FFIE)

Gráfica de Acción Histórica

De Jul 2023 a Jul 2024