UNITED STATES

SECURITIES AND

EXCHANGE COMMISSION

WASHINGTON, D.C.

20549

FORM 6-K

REPORT OF FOREIGN

PRIVATE ISSUER

PURSUANT TO RULE

13a-16 OR 15d-16 OF THE

SECURITIES EXCHANGE

ACT OF 1934

For the month of,

January 2024

Commission File

Number 001-40848

GUARDFORCE

AI CO., LIMITED

(Translation of

registrant’s name into English)

10 Anson Road,

#28-01 International Plaza

Singapore 079903

(Address of

principal executive offices)

Indicate by check mark whether the registrant

files or will file annual reports under cover of Form 20-F or Form 40-F:

Form 20-F ☒

Form 40-F ☐

Other Events

On December 1,

2023, the Board of Directors of Guardforce AI Co., Limited (the “Company”) adopted an Amended and Restated Audit Committee

Charter, Amended and Restated Corporate Governance Guidelines, and a Clawback Policy.

Copies of the Amended

and Restated Audit Committee Charter, the Amended and Restated Corporate Governance Guidelines, and the Clawback Policy are filed as

Exhibits 99.1, 99.2, and 99.3, respectively, to this Report on Form 6-K.

This report on

Form 6-K is incorporated by reference into (i) the prospectus contained in the Company’s registration statement on Form F-3 (SEC

File No. 333-261881) declared effective by the Securities and Exchange Commission (the “Commission”) on January 5,

2022; (ii) the prospectus dated February 9, 2022 contained in the Company’s registration statement on Form F-3 (SEC File No. 333-262441)

declared effective by the Commission on February 9, 2022; and (iii) the prospectus contained in the Company’s Post-Effective Amendment

No. 1 to Form F-1 on Form F-3 (SEC File No. 333-258054) declared effective by the Commission on June 14, 2022.

Exhibits

SIGNATURES

Pursuant to the requirements of the

Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto

duly authorized.

| Date: January 18, 2024 |

Guardforce AI Co., Limited |

| |

|

|

| |

By: |

/s/ Lei Wang |

| |

Lei Wang |

| |

Chief Executive Officer |

3

Exhibit

99.1

GUARDFORCE

AI CO., LIMITED

AMENDED

AND RESTATED AUDIT COMMITTEE CHARTER

Adopted

by the Board on December 1, 2023

The

Audit Committee (the “Committee”) is appointed by the Board of Directors (the “Board”) of Guardforce AI Co.,

Limited (the “Company”) as a committee of the Board. The purpose of the Committee is to assist the Board in fulfilling its

oversight responsibility relating to (i) the monitoring of the integrity of the Company’s and its subsidiaries’ financial

statements and financial reporting process and the Company’s and its subsidiaries’ systems of internal accounting and financial

controls, (ii) the monitoring of the effectiveness of and performance of the internal and external, control, risk management and audit

services function, (iii) the monitoring of the annual independent audit of the Company’s and subsidiaries’ financial statements,

the engagement of the independent auditors and the evaluation of the independent auditors’ qualifications, independence and performance,

(iv) the compliance by the Company with legal and regulatory requirements, including the Company’s disclosure of controls and procedures,

(v) the compliance with the Company’s Code of Ethics and Business Conduct and conduct of the Company’s officers and directors,

(vi) the evaluation of enterprise risk issues, and (vii) the fulfillment of the other responsibilities set out herein.

I.

Purpose and authority

The

Committee shall oversee the accounting and financial reporting processes of the Company and the audits of the Company’s financial

statements. The Committee is responsible for:

| ● | Overseeing

the Company’s accounting and financial reporting processes and financial statement

audits |

| ● | Overseeing

the Company’s compliance with legal and regulatory requirements |

| ● | Overseeing

the Company’s independent auditor’s qualifications and independence |

| ● | Overseeing

the performance of the Company’s independent auditor |

| ● | Overseeing

the Company’s systems of disclosure and controls procedures |

| ● | Overseeing

the Company’s internal controls over financial reporting |

| ● | Overseeing

the Company’s compliance with ethical standards adopted by the Company |

The

Committee should encourage continuous improvement and should foster adherence to the Company’s policies, procedures and practices

at all levels. The Committee has the authority to conduct investigations into any matters within its scope of responsibility and obtain

advice and assistance from outside legal, accounting, or other advisers when necessary to perform its duties and responsibilities.

In

carrying out its duties and responsibilities, the Committee has the authority to engage outside legal, accounting, or other advisers,

and to seek any information it requires from employees, officers, and directors.

The

Company will provide appropriate funding, as determined by the Committee, for the compensation to the independent auditor, to any advisers

that the Committee chooses to engage, and for payment of ordinary administrative expenses of the Committee that are necessary or appropriate

in carrying out its duties.

The

Audit Committee serves a Board level oversight role where it oversees the relationship with the independent auditor, as set forth in

this Charter, receives information and provides advice, counsel and general direction, as it deems appropriate, to management and the

auditors, taking into account the information it receives, discussions with the auditor, and the experience of the Committee’s

members in business, financial and accounting matters. The fundamental responsibility for the Company’s financial statements and

disclosures rests with management and the independent auditor.

II.

Composition and meetings

Membership

and Structure. The Committee shall consist of at least one (1) independent non- executive director who has competence in accounting

or auditing. The Committee members shall be elected by the Board, upon the recommendation of the Nominating and Corporate Governance

Committee, on such terms as may be specified by the Board.

Appointment.

Committee members will be appointed by the board at the annual board meeting to serve until their successors are elected. Unless a chair

is elected by the full board, the members of the Committee may designate a chair by majority rule.

Qualifications.

All Committee members shall meet all applicable independence requirements of The Nasdaq Stock Market LLC and any successor thereto (“Nasdaq”)

and of Rule 10A- 3(b)(1) of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), subject to the exemptions

provided in Rule 10A-3(c) under the Exchange Act, and other applicable rules and regulations of the SEC. Additionally, no member of the

Committee shall have participated in the preparation of the financial statements of the Company or any current subsidiary of the Company

at any time during the preceding three (3) years and all members of the Committee must be able to read and understand fundamental financial

statements, including a balance sheet, income statement, and cash flow statement.

Financial

Expert. As a matter of best practices, the Committee will endeavor to have at least one of its members with the requisite qualifications

to be designated by the Board as an “audit committee financial expert,” as such term is defined by Item 407(d)(5) of Regulation

S-K as promulgated by the SEC (“Regulation S-K”). The Committee shall report to the Board for further action as appropriate,

including, but not limited to, a determination by the Board that the Committee membership includes or does not include one or more “audit

committee financial experts” and any related disclosure to be made concerning this matter. The designation of a member of the Committee

as an “audit committee financial expert” will not increase the duties, obligations or liability of the designee as compared

to the duties, obligations and liability imposed on the designee as a member of the Committee and of the Board. If the Committee does

not have an “audit committee financial expert,” then, in accordance with Nasdaq requirements, at least one member of the

Committee must be financially sophisticated, in that he or she has past employment experience in finance or accounting, requisite professional

certification in accounting, or any other comparable experience or background which results in the individual’s financial sophistication,

including but not limited to being or having been a chief executive officer, chief financial officer, other senior officer with financial

oversight responsibilities.

Chair.

Unless the Chair of the Committee (the “Chair”) is elected by the full Board, the Committee members may designate a Chair

consistent with any recommendation of the Nominating and Corporate Governance Committee.

Resignation,

Removal and Replacement. Any director may resign from the Committee at any time upon notice of such resignation to the Company. An

independent director who ceases to be independent under Nasdaq requirements shall promptly resign to the extent required for the Company

to comply with applicable laws, rules and regulations. The Board shall have the power at any time to remove a member of the Committee

with or without cause, to fill all vacancies, and to designate alternate members, upon the recommendation of the Committee, to replace

any absent or disqualified members, so long as the Committee shall at all times have at least three (3) members and be composed solely

of independent board members.

Meetings.

The board will determine that a director’s simultaneous service on multiple Committees will not impair the ability of such member

to serve on the Committee. The Committee will meet at least quarterly or more frequently as circumstances dictate. The Committee chair

will approve the agenda for the Committee’s meetings and any member may suggest items for consideration. Briefing materials will

be provided to the Committee as far in advance of meetings as practicable.

Each

regularly scheduled meeting will conclude, at the discretion of the Committee chair, with an executive session of the Committee absent

members of management. The Committee may also, at its discretion, meet with the independent auditors in executive session.

III.

Responsibilities and duties

The

function of the Committee is to oversee the Company’s management and independent accountants in the production of the Company’s

financial statements, as well as all controls and procedures relating thereto. The Company’s management is primarily responsible

for the preparation and presentation of the Company’s financial statements and for maintaining appropriate systems for accounting

and financial reporting principles and policies and internal controls and procedures that provide for compliance with accounting standards

and applicable laws and regulations. The Company’s independent accountants are primarily responsible for planning and carrying

out a proper audit of the Company’s annual financial statements, reviewing the Company’s unaudited interim financial statements

and auditing management’s assessment of effectiveness of internal control over financial reporting in accordance with the standards

of the Public Company Accounting Oversight Board (the “PCAOB”) and other procedures. The independent accountants are accountable

to the Board and the Committee, as representatives of the Company’s shareholders. The Board and the Committee have the ultimate

authority and responsibility to select, evaluate and, where appropriate, replace the Company’s independent accountants. For purposes

of this Charter, the term “management” means the appropriate officers of each of the Company and its subsidiaries and the

phrase “internal accounting staff” means the appropriate officers and employees of each of the Company and its subsidiaries.

In

fulfilling their responsibilities hereunder, it is recognized that members of the Committee are not full-time employees of the Company

or members of management and are not, and do not represent themselves to be, accountants or auditors by profession. As such, it is not

the duty or the responsibility of the Committee or its members to conduct “field work” or other types of auditing or accounting

reviews or procedures to determine if the financial statements are complete and accurate and whether they have been prepared in accordance

with International Financial Reporting Standards (“IFRS”), as issued by the International Accounting Standards Board, or

to set auditor independence standards.

Each

member of the Committee shall be entitled to rely on (i) the integrity of those persons within and outside the Company and management

from which it receives information, (ii) the accuracy of the financial and other information provided to the Committee absent actual

knowledge to the contrary (which shall be promptly reported to the Board), and (iii) statements made by the officers and employees of

the Company and its subsidiaries or other third parties as to any information technology, internal and external audit and other non-audit

services provided by the independent accountants to the Company. In carrying out its responsibilities, the Committee’s policies

and procedures shall be adapted, as appropriate, to best react to changing markets and regulatory environments.

Nothing

in this Charter shall be interpreted as diminishing or derogating the duties, responsibilities or obligations of the Board. Subject to

the requirements of the Company’s second amended and restated articles and memorandum of association, the Committee shall:

Retention

of Independent Accountants and Approval of Services

1.

Select or retain each year a firm or firms of independent accountants to audit the accounts and records of the Company and its subsidiaries,

to approve the terms of compensation of such independent accountants (including negotiating and executing on behalf of the Company engagement

letters) and to terminate such independent accountants as it deems appropriate.

2.

Pre-approve any independent accountants’ engagement to render audit and/or permissible non-audit services (including the fees charged

and proposed to be charged by the independent accountants), subject to the de minimus exceptions under Section 10A(i)(1)(B) of

the Exchange Act, and as otherwise required by law.

3.

The Committee may delegate its pre-approval responsibilities to one (1) or more of its members. The member(s) to whom such responsibility

is delegated must report, for informational purposes only, any pre-approval decisions to the Committee at its next scheduled meeting.

Oversight

of the Independent Accountants

4.

Obtain and review a report from the independent accountants at least annually regarding:

| (a) | the

independent accountants’ internal quality-control procedures; |

| (b) | any

material issues raised by the most recent internal quality-control review, peer review, or

review by the PCAOB, of the firm, or by any inquiry or investigation by governmental or professional

authorities within the preceding five (5) years respecting one (1) or more independent audits

carried out by the firm; |

| (c) | any

steps taken with regard to the issues identified in (a) or (b) above; and |

| (d) | all

relationships between the independent accountants and the Company and its subsidiaries. |

5.

Obtain from the independent accountants annually a formal written statement of the fees billed in each of the last two (2) fiscal years

for each of the following categories of services rendered by the independent accountants:

| (a) | the

audit of the Company’s annual financial statements and the reviews of the financial

statements included in the Company’s interim reports or services that are normally

provided by the independent accountants in connection with statutory or regulatory filings

or engagements; |

| (b) | that

are reasonably related to the performance of the audit or review of the Company’s financial

statements, in the aggregate and by each service; |

| (c) | tax

compliance, tax advice and tax planning services, in the aggregate and by each service; and |

| (d) | all

other products and services rendered by the independent accountants, in the aggregate and

by each service. |

6.

Evaluate the qualifications, performance and independence of the independent accountants, including the following:

| (a) | evaluating

the performance of the lead (or coordinating) audit partner, and the quality and depth of

the professional staff assigned to the Company and its subsidiaries; |

| (b) | considering

whether the accountant’s quality controls are appropriate and adequate in light of

the standards and requirements established by the PCAOB and under applicable law at such

time; and |

| (c) | considering

whether the provision of permitted non-audit services is compatible with maintaining the

accountant’s independence. |

7.

Consider the opinions of management and the internal accounting staff in connection with the foregoing responsibilities. The Committee

shall present its conclusions with respect to the independent accountants to the Board.

8.

Monitor the rotation required by applicable law of the lead (or coordinating) audit partner having primary responsibility for the audit

and the audit partner responsible for reviewing the audit.

9.

Oversee compliance with the following guidelines relating to the Company’s hiring of employees or former employees of the independent

accountants:

| (a) | no

member of the audit team that is auditing the Company can be hired by the Company in a financial

reporting oversight role (as defined in the SEC’s Regulation S-X) for a period of one

(1) year following association with that audit; and |

| (b) | the

Company’s Chief Financial Officer shall report annually to the Committee the profile

of the preceding year’s hires from the independent accountants. |

10.

Consider the effect on the Company of:

| (a) | any

changes in accounting principles or practices proposed by management or the independent accountants; |

| (b) | any

changes in service providers, such accountants, that could impact the Company’s internal

control over financial reporting; and |

| (c) | any

changes in schedules (such as fiscal or tax year-end changes) or structures or transactions

that require special accounting activities, services or resources. |

11.

Review any presentations or reports prepared by the independent accountants with respect to any applicable tax matters.

12.

Annually review a formal written statement from the independent accountants delineating all relationships between the independent accountants

and the Company, consistent with applicable requirements and standards of the SEC and the PCAOB, and discuss with the independent accountants

their methods and procedures for ensuring independence.

13.

Evaluate the efficiency and appropriateness of the services provided by the independent accountants, including any significant difficulties

with the audit or any restrictions on the scope of their activities or access to required records, data and information.

14.

Interact with the independent accountants, including reviewing and, where necessary, resolving any problems or difficulties the independent

accountants may have encountered in connection with the annual audit or otherwise, any management letters provided to the Committee and

the Company’s responses. Such review shall address any difficulties encountered in the course of the audit work, including any

restrictions on the scope of activities or access to required information, any disagreements that have arisen between management and

the independent accountants regarding financial reporting.

15.

Review with the independent accountants the effect of regulatory and accounting initiatives, as well as off-balance sheet structures,

on the financial statements of the Company.

Financial

Statements and Disclosure Matters

16.

Review and discuss with management and the independent accountants the annual audited financial statements, including disclosures made

in management’s discussion and analysis of financial condition and results of operations, and recommend to the Board whether the

audited financial statements should be included in the Company’s Annual Report on Form 20-F.

17.

Review and discuss with management and the independent accountants the Company’s interim financial statements, including disclosures

made in management’s discussion and analysis of financial condition and results of operations, prior to the filing of its reports

on Form 6-K, including the results of the independent accountants’ reviews of the interim financial statements.

18.

Review with the Company’s Chief Executive Officer, Chief Financial Officer and independent accountants, the adequacy and effectiveness

of the Company’s and its subsidiaries’ internal control over financial reporting and review periodically, but in no event

less frequently than semiannually, management’s conclusions about the effectiveness of such internal control over financial reporting,

including any significant deficiencies and material weaknesses in, or material non-compliance with, such internal control.

19.

Review with the Company’s Chief Executive Officer, Chief Financial Officer and independent accountants, the adequacy and effectiveness

of the Company’s and its subsidiaries’ disclosure controls and procedures and review periodically, but in no event less frequently

than semiannually, management’s conclusions about the effectiveness of such disclosure controls and procedures, including any significant

deficiencies in, or material non-compliance with, such controls and procedures.

20.

Review disclosures made to the Committee by the Company’s Chief Executive Officer and Chief Financial Officer, or persons performing

similar roles, during their certification process for the Company’s Annual Report on Form 20-F and reports on Form 6-K concerning

any significant deficiencies in the design or operation of disclosure controls and procedures and, when applicable, internal control

over financial reporting, or material weaknesses in such control, and any fraud involving management or other employees who have a significant

role in the Company’s disclosure controls and procedures and internal control over financial reporting.

21.

Review and discuss the types of information to be disclosed and the types of presentation to be made in connection with earnings releases

by the Company and its subsidiaries.

22.

Review and discuss the types of financial and non-financial information and earning guidance to be provided to analysts and ratings agencies.

23.

Meet with the Company’s independent accountants at least four times during each fiscal year, including private meetings, and review

written materials prepared by the independent accountants, as appropriate. At these meetings, the Committee shall:

| (a) | review

the arrangements for and the scope of the annual audit and any special audits or other special

permissible services; |

| (b) | review

the Company’s financial statements and to discuss any matters of concern arising in

connection with audits of such financial statements, including any adjustments to such statements

recommended by the independent accountants or any other results of the audits; |

| (c) | consider

and review, as appropriate and in consultation with the independent accountants, the appropriateness

and adequacy of the Company’s financial and accounting policies, internal control over

financial reporting and, as appropriate, the internal controls of key service providers,

and to review management’s responses to the independent accountants’ comments

relating to those policies, procedures and controls, and to take any necessary action in

light of material control deficiencies; |

| (d) | review

with the independent accountants their opinions as to the fairness of the financial statements;

and |

| (e) | review

and discuss semiannual reports from the independent accountants relating to: (1) all critical

accounting policies and practices to be used; (2) all alternative treatment of financial

information within IFRS that have been discussed with management, ramifications of the use

of such alternative disclosures and treatments and the treatment preferred by the independent

accountants; and (3) other material written communications between the independent accountant

and management, such as any management letter or schedule of unadjusted differences. |

24.

Prepare the report and filing required by the SEC to be included in the Company’s public filing.

Compliance

Oversight

25.

Administer the following procedures relating to the receipt, retention and treatment of complaints received by the Company regarding

questionable accounting, internal accounting controls over financial reporting or auditing matters, and the confidential, anonymous submission

by employees of the Company of concerns regarding questionable accounting or auditing matters:

| (a) | the

Company shall forward to the Committee any complaints or concerns that it has received regarding

questionable financial statement disclosures, accounting, internal accounting controls or

auditing matters; |

| (b) | the

Company shall establish and publish on its website an e-mail address for receiving anonymous

complaints or concerns related to questionable financial statement disclosures, accounting,

internal accounting controls or auditing matters, provided that the Company may engage the

services of a third-party service provider to receive such complaints on behalf of the Company

via telephone, email or other appropriate method; |

| (c) | any

employee of the Company may submit, on a confidential, anonymous basis if the employee so

desires, any concerns regarding questionable financial statement disclosures, accounting,

internal accounting controls or auditing matters by setting forth such concerns in writing

and forwarding them in a sealed envelope to the Chairman of the Committee, such envelope

to be labeled with a legend such as “To be opened by the Committee only” (employees

may deposit such envelope in the Company’s internal mail system or deliver it by hand

to a member of the Committee and if an employee would like to discuss any matter with the

Committee, the employee should indicate this in the submission and include a telephone number

at which he or she might be contacted if the Committee deems it appropriate); |

| (d) | the

Committee shall review and consider any such complaints and concerns that it has received

and take any action that it deems appropriate in order to respond thereto; |

| (e) | the

Committee may request special treatment for any complaint or concern, including the retention

of outside counsel or other advisors; and |

| (f) | the

Committee shall retain any such complaints or concerns for a period of no less than five

(5) years. |

The

Committee shall annually reassess the effectiveness of the procedures described immediately above and modify them as necessary

26.

The Committee will be designated as and serve as the Qualified Legal Compliance Committee (the “QLCC”) for the Company in

accordance with the provisions of Section 307 of Sarbanes-Oxley Act of 2002. Upon receipt of a report of evidence of a material legal

violation, the Committee will notify the Board of such report, investigate and recommend appropriate measures to the Board. If the Company

does not appropriately respond, the Committee may take further appropriate action, including notification to the SEC. In its capacity

as the QLCC, the Committee shall have responsibility for the matters set forth in Appendix A to this charter.

27.

Review with management or any external counsel as the Committee considers appropriate, any legal matters (including the status of pending

litigation) that may have a material impact on the Company and any material reports or inquiries from regulatory or governmental agencies.

28.

Review with management the adequacy and effectiveness of the Company’s procedures to ensure compliance with its legal and regulatory

responsibilities.

29.

Oversee compliance with the Company’s Code of Ethics and Business Conduct.

30.

Discuss with management, the independent accountants, outside counsel, as appropriate, and, in the judgment of the Committee, such special

counsel, separate accounting firm and other consultants and advisors as the Committee deems appropriate, any correspondence with regulators

or governmental agencies and any published reports which raise material issues regarding the Company’s financial statements, accounting

policies or internal control over financial reporting.

31.

Obtain reports from management, the internal or external auditor or internal or external audit service provider, as the case may be,

and the independent auditor regarding compliance with applicable legal and regulatory requirements.

Oversight

of Company’s Internal And External Audit Function

32.

The internal and external auditor or internal and external audit service provider, as the case may be, shall report periodically to the

Committee regarding any significant deficiencies in the design or operation of the Company’s and its subsidiaries’ internal

control over financial reporting, material weaknesses in the internal control over financial reporting and any fraud (regardless of materiality)

involving persons having a significant role in the internal control over financial reporting, as well as any significant changes in internal

control over financial reporting implemented by management during the most recent reporting period of the Company.

33.

Discuss with management, the internal and external auditor or internal and external audit service provider, as the case may be, and the

independent accountant the Company’s major risk exposures (whether financial, operations or both) and the steps management has

taken to monitor and control such exposures, including the Company’s risk assessment and risk management policies.

34.

With respect to any internal and external audit services that may be outsourced, engage, evaluate and terminate internal and external

audit service providers and approve fees to be paid to such internal and external audit service providers.

Financial

Oversight

35.

Review and approve decisions by the Company and its subsidiaries to enter into derivative transactions (including, but limited to, swaps,

put and call options or combinations thereof, caps, floors, collars, and forward or spot exchanges) and related matters, as appropriate,

as well as non-cleared swaps that are exempt from the clearing and trade execution requirements established under applicable federal

law, rules and regulations, including swaps that are entered into in reliance upon the “end-user exceptions” to the mandatory

execution and clearing requirements of the Dodd-Frank Wall Street Reform and Consumer Protection Act and related regulations. The Committee

may review and approve swap transactions submitted to it by management on (a) an individual transaction basis or (b) a blanket basis,

with respect to all non- cleared swaps that are exempt from the federal clearing and trade execution requirements, which approval must

be reviewed at least annually.

36.

Periodically review, at least on an annual basis, or more often (particularly in the event of a material change in hedging strategy)

and approve the Company’s policies for the use of swaps that are entered into in reliance upon the end-user exceptions.

Other

37.

Prepare the disclosure required by Item 407(d)(3)(i) of Regulation S-K.

38.

Report its activities to the Board on a regular basis and to make such recommendations with respect to the matters described above and

other matters as the Committee may deem necessary or appropriate.

39.

Perform an annual self-evaluation of the Committee’s performance and annually review and reassess the adequacy of and, if appropriate,

propose to the Board, any desired changes in, this Charter, all to supplement the oversight authority by the Nominating and Corporate

Governance Committee with respect to such matters.

40.

The Committee shall have such further responsibilities as are given to it from time to time by the Board. The Committee shall consult,

on an ongoing basis, with management, the independent accountants and counsel as to legal or regulatory developments affecting its responsibilities,

as well as relevant tax, accounting and industry developments.

The

foregoing list of duties is not exhaustive, and the Committee may, in addition, perform such other functions as may be necessary or appropriate

for the performance of its duties.

The

Committee shall have the right to use reasonable amounts of time of the Company’s independent accountants, outside lawyers and

other internal staff and also shall have the right to hire independent experts, lawyers and other consultants to assist and advise the

Committee in connection with its responsibilities. The Committee shall also be given the resources, as determined by the Committee, for

payment of (i) compensation to any registered independent public accounting firm engaged for the purpose of preparing or issuing an audit

report or performing other audit, review or attest services for the Company, (ii) compensation to any independent experts, lawyers and

other consultants hired to assist and advise the Committee in connection with its responsibilities, and (iii) ordinary administrative

expenses of the Committee that are necessary or appropriate in carrying out its duties. The Committee shall keep the Company’s

Chief Financial Officer advised as to the general range of anticipated expenses for outside consultants, and shall obtain the concurrence

of the Board in advance for any expenditures.

Any

amendments to this Charter must be approved or ratified by a majority vote of the Company’s Board, including a majority of independent

directors.

| VI. | Disclosure

of Charter. |

This

Charter will be made available on the Company’s website at “https://ir.guardforceai.com/corporate-governance/governance-documents/”

Adopted,

as amended and restated, by the Board of Directors on December 1, 2023

APPENDIX

A

THE

AUDIT COMMITTEE’S RESPONSIBILITIES AS A

QUALIFIED LEGAL COMPLIANCE COMMITTEE

In

its capacity as the Qualified Legal Compliance Committee, the Audit Committee shall have responsibility for the following matters:

| ● | To

review any report by an attorney or a legal counsel representing the Company and/or its subsidiaries

of a material violation of U.S. federal or state securities law, a material breach of fiduciary

duty arising under U.S. federal or state law or a similar material violation of any U.S.

federal or state law (each, a “material violation”). |

| ● | Any

report or referral under this charter shall be made in the first instance to the Chair of

the Audit Committee by direct communication, either in person or by telephone. If it is an

exigent matter and the Chair of the Audit Committee is unavailable, then an attorney or a

legal counsel representing the Company and/or its subsidiaries shall report the matter to

another member of the Audit Committee. |

| ● | A

reporting attorney or legal counsel shall ensure that the person to whom he or she reports

is expressly advised that the attorney is making a report or referral under this charter. |

| ● | Reports

to the Audit Committee by an attorney or a legal counsel representing the Company and/or

its subsidiaries shall be subject to the attorney-client privilege. The Audit Committee shall

maintain the confidentiality of such reports, except to the extent the Audit Committee deems

it necessary to disclose such reports or related information in carrying out its functions

under this charter and the SEC rules. |

| ● | Upon

receipt of a report, the Audit Committee shall: |

| ● | inform

Chief Executive Officer of such report, unless such notification would be futile; and |

| ● | determine

whether an investigation is necessary regarding any report of evidence of a material violation

by the Company, its officers, directors, employees or agents. |

| ● | If

the Audit Committee determines an investigation is necessary or appropriate, the Audit Committee shall: |

notify the Board of Directors; and initiate an investigation, which may be conducted

by an attorney or a legal counsel representing the Company and/or its subsidiaries.

| ● | At

the conclusion of any such investigation, the Audit Committee shall: |

recommend that the Company

implement an appropriate response to the evidence of a material violation, which appropriate

response may include:

| ● | a

finding that no material violation has occurred, is ongoing or is about to occur; |

| ● | the

adoption of appropriate remedial measures, including appropriate steps or sanctions to stop

any material violations that are ongoing, to prevent any material violation that has yet

to occur, and to remedy or otherwise appropriately address any material violation that has

already occurred and to minimize the likelihood of its recurrence; or |

| ● | retaining

or directing an attorney or a legal counsel representing the Company and/or its subsidiaries

to review the reported evidence of a material violation, and either (i) the Company substantially

implements any remedial recommendations made by an attorney or a legal counsel representing

the Company and/or its subsidiaries after a reasonable investigation and evaluation of the

reported evidence, or (ii) the attorney or legal counsel representing the Company and/or

its subsidiaries advises the Company that he or she may, consistent with his or her professional

obligations, assert a colorable defense on behalf of the Company or its officers, directors,

employees or agents, in any investigation or judicial or administrative proceeding relating

to the reported evidence or a material violation; and |

| ● | inform

the Chief Executive Officer and the Board of Directors of the results of any such investigation

initiated by the Audit Committee, and the appropriate remedial measures to be adopted. |

| ● | The

Audit Committee may take all other appropriate action, including notifying the SEC, if the Company fails in any material respect to implement

an appropriate response that the Audit Committee has recommended that the Company take. |

13

Exhibit 99.2

GUARDFORCE AI CO., LIMITED

AMENDED AND RESTATED CORPORATE

GOVERNANCE GUIDELINES

Adopted by the Board on December

1, 2023

OBJECTIVES

The following Corporate Governance

Guidelines (these “Guidelines”) have been adopted by the Board of Directors (the “Board”) of Guardforce AI Co.,

Limited (the “Company”), to assist the Board in the exercise of its responsibilities. These Guidelines reflect the Board’s

commitment to monitor the effectiveness of policy and decision making both at the Board and management level, with a view to enhancing

long-term member value. These Guidelines are not intended to change or interpret any national, federal, provincial or state law or regulation,

applicable exchange listing standards, or memorandum and articles of association of the Company, and the Board shall continue to comply

with those laws, regulations and corporate documents. These Guidelines are intended to serve as a flexible framework within which the

board may conduct its business and not as a set of legally binding obligations. These Guidelines are subject to modification from time

to time by the Board.

The Board’s Goals

The primary mission of the Board

is to advance the interests of the Company’s shareholders by creating a valuable long-term business. The Board understands that

the shareholders rely upon the Board to act in the best interest of the Company in making decisions or taking actions not requiring shareholders’

approval and shall at all times act accordingly.

Director Selection

Board Membership Criteria.

The Nominating Committee is responsible for reviewing with the Board, at least annually, the appropriate skills and experience of new

Board members, as well as the composition of the Board as a whole. This assessment should include factors such as independence, judgment,

skill, diversity, integrity and experience in the context of the needs of the Board.

Selection of Director Nominees.

The Nominating Committee will recommend candidates for election to the Board in accordance with the policies and principles in its charter

and the criteria described in these Guidelines. The invitation to join the Board should be extended by the Board jointly through the Chief

Executive Officer of the Company (the “CEO”) and the Chair of the Nominating Committee. The Nominating Committee will review

the nomination of an incumbent director for re-election to the Board upon expiration of such director’s term.

Director Compensation and

Performance

Compensation

Policy and Annual Compensation Review. It is the policy of the Board to provide independent directors with a mix of

compensation, including an annual fee, as well as equity and/or derivative security awards, which may be contingent upon certain

criteria as determined by the Board at the time of grant. Proposed changes in Board compensation shall initially be reviewed by the

Compensation Committee, but any changes in the compensation of directors shall require the approval of the Board. The Compensation

Committee shall periodically review the status of Board compensation in relation to other comparable companies and consider other

factors the Committee deems appropriate, including whether directors’ independence may be jeopardized if (i) director compensation

and perquisites exceed customary levels or (ii) the Company makes substantial charitable contributions to organizations with which a

director is affiliated. The Committee shall discuss its review with the Board.

Annual

Performance Evaluation. The Board of Directors will conduct an annual self-evaluation to determine whether it and its committees

are functioning effectively. In connection with such evaluation, the Chair will receive comments from all directors and report annually

to the Board with an assessment of the Board’s performance and procedures. This will be discussed with the full Board following the end

of each fiscal year.

Transactions

with Directors or their Affiliates. Except for employment or consulting arrangements with executive officers, the Company does

not engage in transactions with directors or their affiliates if a transaction would cast into doubt the independence of a director, present

the appearance of a conflict of interest, or is otherwise prohibited by law, rule or regulation. This includes, directly or indirectly,

any extension, maintenance or renewal of an extension of credit to any director or member of management of the Company. This prohibition

also includes significant business dealings with directors or their affiliates, substantial charitable contributions to organizations

in which a director is affiliated.

Board Meetings and Communications

to Independent Directors

Schedule.

Board meetings are scheduled in advance and held not less than quarterly. The Board holds special meetings as required.

Agendas.

The CEO and other members of senior management will establish the agenda for each Board meeting. Each Board member may submit items to

be included on the agenda. Board members also may raise subjects that are not on the agenda at any meeting.

Distribution

of Board Material. Information that is important to the Board’s understanding of the Company’s business should be

distributed to the Board members by a reasonable period of time before the Board meeting.

Strategic

Planning. The Board will review the Company’s long-term strategic plans and principal issues that the Company will face in the

future during at least one Board meeting each year. The timing and agenda of this meeting shall be determined by the CEO.

Meetings

of Independent Directors. Independent directors can meet without any non- independent directors present. A majority of the independent

directors may call a meeting of the independent directors at any time.

Board

Presentations and Access to Employees and Advisors. Directors shall have full access to officers and employees of the Company

and, as necessary and appropriate, the Company’s independent advisors, including legal counsel and independent accountants. Any

meetings or contacts that a director wishes to initiate may be arranged through the CEO or the Corporate Secretary or directly by the

director. The directors will use their judgment to ensure that any such contact is not disruptive to the business operations of the Company

and will, to the extent appropriate, provide the CEO with a copy of any written communications between a director and an officer or employee

of, or adviser to, the Company.

The Board

encourages senior management to invite to Board meetings officers and other key employees who can provide additional insight into the

items being discussed, or that senior management believes should be given exposure to the Board.

Communication/Reporting

Consistent

with NASDAQ’s listing requirements, the Board has established the Audit Committee, the Nominating and Corporate Governance Committee and

the Compensation Committee. These committees shall report directly to the Board of Directors regarding committee activities, issues and

related recommendations. The charters of each committee will be reviewed annually with a view to delegating committees with the authority

of the board. Such authorities have been set forth in board resolutions pertaining to the charters of the Board committees.

Responsibilities

The business and affairs of the

Company shall be managed by or under the direction of the Board. A director is expected to spend the time and effort necessary to properly

discharge such director’s responsibilities. Accordingly, a director is expected to regularly attend meetings of the Board and committees

on which such director sits, and to review prior to meetings material distributed in advance for such meetings. A director is expected

to attend the Company’s annual meeting of members. A director who is unable to attend any meeting (which it is understood will occur

on occasion) is expected to notify the Chair of the Board or the Chair of the appropriate committee in advance of such meeting. In addition,

directors are expected to act in the best interests of the Company, maintain independence and integrity, develop and maintain a sound

understanding of the Company’s strategies, industries and businesses, review management development and succession planning, endeavor

to be available on reasonable notice, attend and prepare for meetings, and provide active, objective and constructive participation at

meetings of the Board and its committees.

The Board’s specific responsibilities

in carrying out its oversight role are delineated in the Checklist and the Matrix attached hereto (together, “the Documents”).

The Documents will be updated from time to time to reflect changes in regulatory requirements, authoritative guidance, and evolving oversight

practices. The most recently updated Documents will be considered to be an addendum to this charter.

The Board of Directors will represent

the Company’s point of view through interpretation of its products and services, and advocacy for them. The Board will govern the

Company through Board policies and objectives, formulated and agreed upon by the Company’s Chief Executive Officer and its employees.

The Board will acquire sufficient resources for the Company’s operations and to finance its products and services adequately.

Adopted, as amended and restated,

by the Board of Directors on December 1, 2023.

BOARD OF DIRECTORS AUTHORIZATION

CHARTER CHECKLIST

WHEN PERFORMED

| |

Spring |

Summer |

Autumn |

Winter |

As Needed |

| 1. |

Determine/update the Company’s mission and purpose.

The Board will determine the company’s purpose and values, determine the strategy to achieve

its purpose and to implement values. |

|

|

|

|

X |

| 2. |

Ensure effective organizational planning. The Board should exercise leadership, enterprise, integrity and judgment in directing the Company so as to achieve continuing prosperity for the Company. |

|

|

|

|

X |

| 3. |

Determine and monitor the Company’s programs and services. The Board will monitor and evaluate the implementation of strategies, policies, management performance criteria and business plans. |

|

|

|

|

X |

| 4. |

Approve annual objectives. The Board is responsible for approving the annual objectives of the Company. |

|

|

|

X |

|

|

5. |

Ensure that management has identified and prioritized the principal risks the Company faces, indicate the likelihood that they will actually occur and estimate their potential cost versus the cost of preventing them. The Board should meet with management on a regular basis to discuss and evaluate such risks. |

|

|

|

|

X |

|

6. |

Ensure that management has developed processes to identify

major risks and has developed plans to deal with such risks. Such processes should be reviewed and

approved by the Board. The Board should monitor the implementation

of the risk reducing processes and evaluate them on a regular basis. |

|

|

|

|

X |

|

7. |

Select the key executives and directors of the Company. The Board is responsible for the selection and where appropriate replacement of the key executives and directors. |

|

|

|

|

X |

| 8. |

Support the Key executives and review their performance. The Board is responsible for evaluating the Key executives on their performance. |

|

|

|

|

X |

| 9. |

Review and approve key executives’ compensation plan, including salary, bonuses, stock compensation and fringe benefits. |

|

|

|

|

X |

| 10. |

Approve budgets for the next year |

|

|

|

X |

|

| 11. |

Periodically review actual results vs. budget and investigate unusual items. |

X |

X |

X |

X |

|

| 12. |

Approve guidelines for authorization of expenditures established by management |

|

|

|

|

X |

|

13. |

Approve major expenditures outside authorized budget. The Board shall exercise business judgment in establishing and revising guidelines for authorization of expenditures or other corporate actions, and management will periodically review this. |

|

|

|

|

X |

|

14. |

Review results of Audit Committee, Compensation Committee,

and Nomination

and Governance Committee periodically concerning matters

specific to each committee. |

|

|

|

|

X |

|

15. |

Directors should be alert to potential Board candidates with appropriate skills and characteristics and communicate information regarding board selection matters to the appropriate committee. |

|

|

|

|

X |

| 16. |

Review and update the Board of Directors Authorization Charter Checklist annually. |

|

|

|

X |

|

|

17. |

Review policies and procedures with respect to transactions between the Company and officers and directors, or affiliates of officers of directors, or transactions that are not a normal part of the Company’s business. |

|

|

|

|

X |

| 18. |

Where there is concern, the Board can review the public relation expenses for the key administration staff. |

|

|

|

|

X |

| 19. |

Answer/Reply to SEC and/or other regulatory bodies for important legal/accounting/operational/compliance matters. |

|

|

|

|

X |

BOARD OF DIRECTORS AUTHORITY

MATRIX

| Category |

Descriptions/Examples |

Scope/Considerations |

|

Appointment and removal

of key executives |

Members of the Board, CEO, President, CFO, COO |

ALL |

|

Executive Compensation |

Key executive contracts, salary, bonuses, fringe benefits,

stock-based compensation, reimbursable expenses |

Annual compensation of key executives (following recommendation

by the Compensation Committee).

Compensation of all Members of the Board (following recommendation

by the Compensation Committee).

For reimbursable expenses, all

key executives below CEO shall be approved by CEO, CEO shall be approved by the Board if greater than US$10,000. |

| Employee Incentive Plan |

Approval of employee incentive plan

and issuance of stocks/options/others under the plan |

ALL |

|

Related Party1 |

Transactions with affiliated companies, executives,

and executives’ family members (as specified in the Company’s Related Party

Transactions Policy) |

See the Company’s Related Party Transactions Policy |

| Investments |

Derivatives & hedging transactions, investment strategy & policy |

ALL |

|

Capital Expenditures |

Significant system implementation, acquisition of major

Property, Plant, and Equipment (PP&E)

Disposal of major PP & E |

the greater of US$1,000,000,

or two percent of the Company’s total annual revenues

the greater of US$1,000,000,

or two percent of the Company’s total annual revenues |

| Mergers and Acquisitions |

New product lines, new company acquisitions |

ALL |

|

Expenditures |

Payout for any single expenditure, regardless of the nature

of the expenditure (excluding executive compensation, operating obligations, investments, capital expenditure, and

approved budgeted expenses). |

the greater of US$500,000, or

one percent of the Company’s total annual revenues.

If under USD500,000 can be approved.

by CEO. |

| Financing |

Equity and/or debt financing |

ALL (except operational debt financing) |

| 1 | The Company’s Audit Committee is responsible for approving

all “related party” transactions in which (1) the aggregate amount involved will or may be reasonably expected to exceed

the lesser of $120,000 or one percent of the average of the Company’s total assets at year-end for the last two completed fiscal

years, (2) the Company or any of its subsidiaries is a participant, and (3) any related party has or will have a direct or indirect interest. |

5/5

Exhibit 99.3

GUARDFORCE AI CO., LIMITED

CLAWBACK

POLICY

Adopted by the Board on December

1, 2023

In accordance with

the applicable rules of The Nasdaq Stock Market LLC Rules (the “Nasdaq Rules”), Section 10D and Rule 10D-1 of the Securities

Exchange Act of 1934, as amended (the “Exchange Act”) (“Rule 10D-1”), the Board of Directors (the

“Board”) of Guardforce AI Co., Limited (the “Company”) has adopted this Policy (the “Policy”)

to provide for the recovery of erroneously awarded Incentive-based Compensation from Executive Officers. All capitalized terms used and

not otherwise defined herein shall have the meanings set forth in Section H, below.

| B. | RECOVERY OF ERRONEOUSLY AWARDED COMPENSATION |

(1) In

the event of an Accounting Restatement, the Company will reasonably promptly recover the Erroneously Awarded Compensation Received in

accordance with Nasdaq Rules and Rule 10D-1 as follows:

| (i) | After an Accounting Restatement, the Compensation Committee

of the Board (the “Committee”) shall determine the amount of any Erroneously Awarded Compensation Received by each

Executive Officer and shall promptly notify each Executive Officer with a written notice containing the amount of any Erroneously Awarded

Compensation and a demand for repayment or return of such compensation, as applicable. |

| (a) | For Incentive-based Compensation based on (or derived from) the Company’s stock price or total shareholder

return, where the amount of Erroneously Awarded Compensation is not subject to mathematical recalculation directly from the information

in the applicable Accounting Restatement: |

| i. | The amount to be repaid or returned shall be determined by the Committee based on a reasonable estimate

of the effect of the Accounting Restatement on the Company’s stock price or total shareholder return upon which the Incentive-based

Compensation was Received; and |

| ii. | The Company shall maintain documentation of the determination of such reasonable estimate and provide

the relevant documentation as required to Nasdaq. |

| (ii) | The Committee shall have discretion to determine the appropriate means of recovering Erroneously Awarded

Compensation based on the particular facts and circumstances. Notwithstanding the foregoing, except as set forth in Section B(2) below,

in no event may the Company accept an amount that is less than the amount of Erroneously Awarded Compensation in satisfaction of an Executive

Officer’s obligations hereunder. |

| (iii) | To the extent that the Executive Officer has already reimbursed the Company for any Erroneously Awarded

Compensation Received under any duplicative recovery obligations established by the Company or applicable law, it shall be appropriate

for any such reimbursed amount to be credited to the amount of Erroneously Awarded Compensation that is subject to recovery under this

Policy. |

| (iv) | To the extent that an Executive Officer fails to repay all Erroneously Awarded Compensation to the Company

when due, the Company shall take all actions reasonable and appropriate to recover such Erroneously Awarded Compensation from the applicable

Executive Officer. The applicable Executive Officer shall be required to reimburse the Company for any and all expenses reasonably incurred

(including legal fees) by the Company in recovering such Erroneously Awarded Compensation in accordance with the immediately preceding

sentence. |

(2) Notwithstanding

anything herein to the contrary, the Company shall not be required to take the actions contemplated by Section B(1) above if the Committee

determines that recovery would be impracticable and any of the following two conditions are met:

| (i) | The Committee has determined that the direct expenses paid to a third party to assist in enforcing the

Policy would exceed the amount to be recovered. Before making this determination, the Company must make a reasonable attempt to recover

the Erroneously Awarded Compensation, document such attempt(s) and provide such documentation to Nasdaq; |

| (ii) | Recovery would violate home country law where that law was adopted prior to November 28, 2022, provided

that, before determining that it would be impracticable to recover any amount of Erroneously Awarded Compensation based on violation of

home country law, the Company has obtained an opinion of home country counsel, acceptable to Nasdaq, that recovery would result in such

a violation and a copy of the opinion is provided to Nasdaq; and |

| (iii) | Recovery would likely cause an otherwise tax-qualified retirement plan, under which benefits are broadly

available to employees of the Company, to fail to meet the requirements of Section 401(a)(13) or Section 411(a) of the Internal Revenue

Code of 1986, as amended, and regulations thereunder. |

| C. | DISCLOSURE REQUIREMENTS |

The Company shall

file all disclosures with respect to this Policy required by applicable U.S. Securities and Exchange Commission (“SEC”)

filings and rules.

| D. | PROHIBITION OF INDEMNIFICATION |

The Company

shall not be permitted to insure or indemnify any Executive Officer against (i) the loss of any Erroneously Awarded Compensation

that is repaid, returned or recovered pursuant to the terms of this Policy, or (ii) any claims relating to the Company’s

enforcement of its rights under this Policy. Further, the Company shall not enter into any agreement that exempts any

Incentive-based Compensation that is granted, paid or awarded to an Executive Officer from the application of this Policy or that

waives the Company’s right to recovery of any Erroneously Awarded Compensation, and this Policy shall supersede any such

agreement (whether entered into before, on or after the Effective Date of this Policy). It is hereby acknowledged that Rule

10D-1(b)(1)(v) and Nasdaq Rule 5608 provide that the Company is prohibited from indemnifying any executive officer or former

executive officer against the loss of erroneously awarded compensation. It is therefore acknowledged that such indemnification is

prohibited by applicable law for all purposes, including any and all such agreements.

| E. | ADMINISTRATION AND INTERPRETATION |

This Policy shall

be administered by the Committee, and any determinations made by the Committee shall be final and binding on all affected individuals.

The Committee

is authorized to interpret and construe this Policy and to make all determinations necessary, appropriate, or advisable for the administration

of this Policy and for the Company’s compliance with Nasdaq Rules, Section 10D, Rule 10D-1 and any other applicable law, regulation,

rule or interpretation of the SEC or Nasdaq promulgated or issued in connection therewith.

The Committee

may amend this Policy from time to time in its discretion and shall amend this Policy as it deems necessary. Notwithstanding anything

in this Section F to the contrary, no amendment or termination of this Policy shall be effective if such amendment or termination would

(after taking into account any actions taken by the Company contemporaneously with such amendment or termination) cause the Company to

violate any federal securities laws, SEC rule or Nasdaq rule.

This Policy shall

be binding and enforceable against all Executive Officers and, to the extent required by applicable law or guidance from the SEC or Nasdaq,

their beneficiaries, heirs, executors, administrators or other legal representatives. The Committee intends that this Policy will be applied

to the fullest extent required by applicable law. Any employment agreement, equity award agreement, compensatory plan or any other agreement

or arrangement with an Executive Officer shall be deemed to include, as a condition to the grant of any benefit thereunder, an agreement

by the Executive Officer to abide by the terms of this Policy. Any right of recovery under this Policy is in addition to, and not in lieu

of, any other remedies or rights of recovery that may be available to the Company under applicable law, regulation or rule or pursuant

to the terms of any policy of the Company or any provision in any employment agreement, equity award agreement, compensatory plan, agreement

or other arrangement.

For purposes of this Policy, the following capitalized terms

shall have the meanings set forth below.

(1) “Accounting Restatement” means an accounting restatement due to the material noncompliance of the Company with any financial reporting requirement under the securities laws, including any required accounting restatement to correct an error in previously issued financial statements that is material to the previously issued financial statements (a “Big R” restatement), or that would result in a material misstatement if the error were corrected in the current period or left uncorrected in the current period (a “little r” restatement).

(2) “Clawback Eligible Incentive Compensation” means all Incentive-based Compensation Received by an Executive Officer (i) on or after the effective date of the applicable Nasdaq rules, (ii) after beginning service as an Executive Officer, (iii) who served as an Executive Officer at any time during the applicable performance period relating to any Incentive-based Compensation (whether or not such Executive Officer is serving at the time the Erroneously Awarded Compensation is required to be repaid to the Company), (iv) while the Company has a class of securities listed on a national securities exchange or a national securities association, and (v) during the applicable Clawback Period (as defined below).

(3) “Clawback Period” means, with respect to any Accounting Restatement, the three completed fiscal years of the Company immediately preceding the Restatement Date (as defined below), and if the Company changes its fiscal year, any transition period of less than nine months within or immediately following those three completed fiscal years.

(4) “Erroneously Awarded Compensation” means, with respect to each Executive Officer in connection with an Accounting Restatement, the amount of Clawback Eligible Incentive Compensation that exceeds the amount of Incentive-based Compensation that otherwise would have been Received had it been determined based on the restated amounts, computed without regard to any taxes paid.

(5) “Executive Officer” means each individual who is currently or was previously designated as an “officer” of the Company as defined in Rule 16a-1(f) under the Exchange Act. For the avoidance of doubt, the identification of an executive officer for purposes of this Policy shall include each executive officer who is or was identified pursuant to Item 401(b) of Regulation S-K or Item 6.A of Form 20-F, as applicable, as well as the principal financial officer and principal accounting officer (or, if there is no principal accounting officer, the controller).

(6) “Financial Reporting Measures” means measures that are determined and presented in accordance with the accounting principles used in preparing the Company’s financial statements, and all other measures that are derived wholly or in part from such measures. Stock price and total shareholder return (and any measures that are derived wholly or in part from stock price or total shareholder return) shall, for purposes of this Policy, be considered Financial Reporting Measures. For the avoidance of doubt, a Financial Reporting Measure need not be presented in the Company’s financial statements or included in a filing with the SEC.

(7) “Incentive-based Compensation” means any compensation that is granted, earned or vested based wholly or in part upon the attainment of a Financial Reporting Measure.

(8) “Nasdaq” means The Nasdaq Stock Market LLC.

(9) “Received” means, with respect to any Incentive-based Compensation, actual or deemed receipt, and Incentive-based Compensation shall be deemed received in the Company’s fiscal period during which the Financial Reporting Measure specified in the Incentive-based Compensation award is attained, even if the payment or grant of the Incentive-based Compensation to the Executive Officer occurs after the end of that period.

(10) “Restatement Date” means the earlier to occur of (i) the date the Board, a committee of the Board or the officers of the Company authorized to take such action if Board action is not required, concludes, or reasonably should have concluded, that the Company is required to prepare an Accounting Restatement, or (ii) the date a court, regulator or other legally authorized body directs the Company to prepare an Accounting Restatement.

Adopted by the Board of Directors on December 1, 2023.

Page | 4

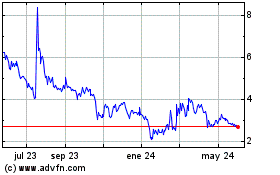

Guardforce AI (NASDAQ:GFAI)

Gráfica de Acción Histórica

De Nov 2024 a Dic 2024

Guardforce AI (NASDAQ:GFAI)

Gráfica de Acción Histórica

De Dic 2023 a Dic 2024