UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

WASHINGTON,

D.C. 20549

FORM

6-K

REPORT

OF FOREIGN PRIVATE ISSUER

PURSUANT

TO RULE 13a-16 OR 15d-16 OF THE

SECURITIES

EXCHANGE ACT OF 1934

For

the month of, February 2024

Commission

File Number 001-40848

GUARDFORCE

AI CO., LIMITED

(Translation

of registrant’s name into English)

10

Anson Road, #28-01 International Plaza

Singapore

079903

(Address

of principal executive offices)

Indicate

by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F: Form 20-F

☒ Form 40-F ☐

On

February 6, 2024, Guardforce AI Co., Limited (the “Company”) entered into a Sale and Purchase Agreement (the “Purchase

Agreement”), by and among the Company, Handshake Networking Limited (the “Target”), and three Hong Kong residents (the

“Purchasers”), in which the Company sold 510 ordinary shares of the Target, representing 51% of the issued and outstanding

share capital of the Target, to the Purchasers in exchange for (i) $510 Hong Kong dollars (approximately $65 U.S. dollars) and (ii) the

cancellation of 1,091 ordinary shares of the Company beneficially owned by the Purchasers. As a result of this transaction, the Target

ceased to be a subsidiary of the Company.

The

Purchase Agreement stipulated that, among other things, (i) the Target shall pay off a loan (inclusive of principal in the amount of

US$100,000.00 and accrued interest in the amount of US6,747.11 as of February 6, 2024) that the Target owes to the Company and (ii) the

Purchasers shall enter into a cancellation agreement (the “Cancellation Agreement”) with the Company to cancel 1,091 ordinary

shares of the Company beneficially owned by the Purchasers.

The

summary of the Purchase Agreement and Cancellation Agreement set forth above does not purport to be complete and is qualified in its

entirety by reference to the full text of the agreements, forms of which are attached to this Report on Form 6-K as Exhibit 10.1 and

Exhibit 10.2 and incorporated by reference herein.

This

report on Form 6-K is incorporated by reference into (i) the prospectus contained in the Company’s registration statement on Form

F-3 (SEC File No. 333-261881) declared effective by the Securities and Exchange Commission (the “Commission”) on January

5, 2022; (ii) the prospectus dated February 9, 2022 contained in the Company’s registration statement on Form F-3 (SEC File No.

333-262441) declared effective by the Commission on February 9, 2022; and (iii) the prospectus contained in the Company’s Post-Effective

Amendment No. 1 to Form F-1 on Form F-3 (SEC File No. 333-258054) declared effective by the Commission on June 14, 2022.

EXHIBIT

INDEX

| Exhibit

No. |

|

Description |

| 10.1 |

|

Sale and Purchase Agreement, by and among Guardforce AI Co., Limited, Handshake Networking Limited, and the Purchasers, dated February 6, 2024. |

| 10.2 |

|

Cancellation Agreement, by and among Guardforce AI Co., Limited, and the Purchasers, dated February 6, 2024. |

SIGNATURES

Pursuant

to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by

the undersigned, thereunto duly authorized.

| Date: February 23, 2024 |

Guardforce AI Co., Limited |

| |

|

|

| |

By: |

/s/ Lei Wang |

| |

|

Lei Wang |

| |

|

Chief Executive Officer |

3

Exhibit

10.1

Dated February 6, 2024

Guardforce AI Co., Limited

(as “Vendor”)

and

[ ]

[ ]

[ ]

(as “Purchasers”)

SALE AND PURCHASE AGREEMENT

relating to 510 ordinary shares in

Handshake Networking Limited

(as “Company”)

THIS AGREEMENT is made on February 6, 2024

BETWEEN

| (1) | Guardforce AI Co., Limited, an exempted company with limited liability incorporated under the laws

of the Cayman Islands with its registration address at Cricket Square, Hutchins Drive, P.O. Box 2681, Grand Cayman KY1-1111, Cayman Islands

(the “Vendor”), the Vendor is presently quoted on the US Nasdaq Capital Market for the symbol GFAI; |

| (2) | [ ], with his residential address at [ ] (the “Purchaser A”); |

| (3) | [ ], [ ], with his residential address at [ ] (the “Purchaser B”); |

| (4) | [ ], [ ], with his residential address at [ ] (the “Purchaser C”); and |

(the “Purchaser A”, the “Purchaser

B” and the “Purchaser C” shall be collectively referred to as the “Purchasers”)

| (5) | Handshake Networking Limited, a company incorporated in Hong Kong (Company registration No. 887257

and Business Registration No. 34353895) with registered office address at 16/F Metro Loft, 38 Kwai Hei Street, Kwai Chung, New Territories,

Hong Kong (the “Company”). |

(each a “Party”, collectively the

“Parties”)

WHEREAS:-

| (A) | As at the date of this Agreement, the Company has an issued share capital of HKD1,000.00 divided into

1,000 ordinary shares (the “Shares”). |

| (B) | The Vendor is the legal and beneficial owner of 510 Shares, representing 51% of the issued share capital

of the Company (the “Sale Shares”). The Vendor desires to sell, and the Purchasers desire to purchase the Sale Shares on the

terms and subject to the conditions of this Agreement. |

NOW IT IS HEREBY AGREED as follows:-

| 1. | DEFINITIONS AND INTERPRETATIONS |

| 1.1 | In this Agreement and the Recitals hereto unless otherwise expressed or required by context, the following

expressions shall have the respective meanings set opposite thereto, as follows:- |

| Expression |

Meaning |

| |

|

| “2021 SPA” |

a Sale and Purchase Agreement in respect of the Vendor’s

acquisition of the Shares dated 4 February 2021 |

| |

|

| “Business Day” |

any day other than a Saturday, Sunday or public holiday

on which The Hongkong and Shanghai Banking Corporation Limited is open for business in Hong Kong |

| |

|

| “Company” |

Handshake Networking Limited, whose particulars are

set out in Schedule 1, and includes all subsidiaries for the purpose of Schedule 2 |

| |

|

| “Closing” |

closing of the sale and purchase of the Sale Shares

which is to be effected on the Closing Date at Unit 01, 5/F., Guardforce Center, No.3 Hok Yuen Street East, Hung Hom, Kowloon, Hongkong. |

| |

|

| “Closing

Date” |

February

6, 2024 or another date to be further determined by the Parties hereto via a written confirmation letter |

| |

|

| “Encumbrance” |

any

security interest, pledge, mortgage, lien, charge, limitation, condition, equitable interest, option, easement, encroachment, right

of first refusal or similar adverse claim or restriction, including any restriction on transfer or other assignment, as security

or otherwise, of or relating to use, quiet enjoyment, voting, receipt of income or exercise of any other attribute of ownership |

| “HK$” |

Hong Kong dollars |

| |

|

| “Hong Kong” |

the Hong Kong Special Administrative Region of the People’s Republic

of China |

| |

|

| “Purchase Price” |

HK$510 (HK$235 to be paid by Purchaser A, HK$235

to be paid by Purchaser B and HK$40 to be paid by Purchaser C) |

| |

|

| “Sale Shares” |

the 510 Shares beneficially owned by the Vendor representing 51% of

the issued share capital of the Company (235 Shares thereof to be transferred to Purchaser A, 235 Shares thereof to be transferred

to Purchaser B, and remaining 40 Shares thereof to be transferred to Purchaser C pursuant to the terms and conditions herein contained) |

| |

|

| “Share(s)” |

ordinary share(s) in the Company |

| |

|

| “Vendor’s

Account” |

the

bank account of the Vendor particularised in Schedule 3 |

| |

|

| “US$” |

United

States dollars, the lawful currency of the United States of America |

| |

|

| “Warranties” |

the warranties, representations, and undertakings

given by the Vendor to the Purchasers hereunder |

| 1.2 | The headings to the Clauses of this Agreement are for ease of reference only and shall be ignored in interpreting

this Agreement. |

| 1.3 | References to Clauses, Schedules and Recitals are references to clauses, schedules and recitals of this

Agreement and all shall form part of this Agreement. |

| 1.4 | Words and expressions in the singular include the plural and vice versa and words importing a gender include

every gender. |

| 1.5 | References to person include any public body and any body of persons, corporate, unincorporated associations

and partnership. |

| 1.6 | References to Acts, Ordinances, statutes, legislation or enactments shall be construed as references to

such Acts, Ordinances, statutes, legislation or enactments as may be amended or re-enacted from time to time and for the time being in

force. |

| 2. | SALE AND PURCHASE OF SHARE |

| 2.1 | Subject to the terms and conditions of this Agreement, the Vendor as legal and beneficial owner of the

Sale Shares hereby agrees to sell and the Purchasers hereby agree to purchase at the Purchase Price the Sale Shares free from any Encumbrances

or third-party rights of whatsoever nature and with all rights now or hereafter becoming attached thereto (including, the right to receive

all dividends and distributions declared, made or paid on or after the signing of this Agreement). |

| 2.2 | Subject to the terms and conditions of this Agreement, it is agreed that the Purchase Price is to be paid

by the Purchasers to the Vendor on or before the Closing Date via wire transfer of immediately available funds to the Vendor’s Account. |

| 2.3 | If any of the conditions in Clause 3 is not satisfied by the date or dates specified in that clause or

any Party validly terminates this Agreement, the Purchasers shall then have no obligation to pay the Purchase Price to the Vendor and

the Vendor shall have no obligation to sell and deliver the Sale Shares to the Purchasers. |

| 3.1 | Closing shall take place on the Closing Date when: |

| (a) | The Vendor shall have delivered to the Purchasers the following: |

| (i) | bought and sold notes and instruments of transfer signed by the Vendor in favour of the Purchasers (or

as directed by the Purchasers) in relation to the Sale Shares; |

| (ii) | copy of any necessary resolution and/or consent from the board of directors of the Vendor to give effect

to the entry into and performance by the Vendor of (a) this Agreement and (b) the Share Cancellation Agreement between the Purchasers

and the Vendor (the “Share Cancellation Agreement”), to cancel, via the Vendor’s transfer agent (namely, VStock Transfer,

LLC), any shares of the Vendor held by the Purchasers (the “Share Cancellation”); |

| (iii) | copy of (a) the Agreement and (b) the Share Cancellation Agreement duly executed by the Vendor; |

| (vi) | copy of any necessary resignation letter from [ ], [ ] (if applicable) and [ ] to give effect to the resignation

of directorship from the Company; and |

| (vii) | access to the Company’s social media accounts including

but not limited to LinkedIn and Facebook, permitting materials previously posted therein to be removed, as the Purchasers and the Company

deem necessary. |

| (b) | The Purchasers shall have delivered to the Vendor the following:- |

| (i) | bought and sold notes and instruments of transfer in favour of the Vendor signed by each of the Purchasers

in relation to the Sale Shares; |

| (ii) | copy of (a) the Agreement and (b) the Share Cancellation Agreement signed by the Purchasers; and |

| (iii) | copy of a payment slip(s) or similar document(s) evidencing

that the Purchase Price has been paid by the Purchasers to the Vendor. |

| (c) | The Company shall have delivered to the Vendor the following: |

| (i) | copy of any necessary resolution and/or consent from the board of directors of the Company to give effect

to (a) the entry into and performance by the Company of this Agreement; (b) the transfer of the Sale Shares from the Vendor to the Purchasers

(or any parties as directed by the Purchasers); and (c) resignation of directors as set out in Clause 3.1(a)(vi); |

| (ii) | copy of the Agreement signed by the Company; and |

| (iii) | copy of a payment slip or similar document evidencing that a loan (inclusive of principal in the amount

of US$100,000.00 and accrued interest as at February 6, 2024 in the amount of US$ 6,747.11) (the “Loan”), as stipulated

by the Loan Agreement signed and executed on 8 November 2021 (as extended on 31 December 2022) by and between the Company as borrower

thereof and the Vendor as lender thereof (the “Loan Agreement”), has been paid off by the Company to the Vendor, and the Vendor

has confirmed receipt of such payment. |

| 4.1 | Following the Closing, each Party shall bear no responsibility and

liability to any other Party, including, but not limited to, any obligations (including any representations and warranties) under the

2021 SPA, except as otherwise herein expressly contemplated. |

| 4.2 | Any unfinished or unclosed business or purchasing orders in the normal

course between the Company and Vendor hereof shall be further discussed and arranged by the Parties in a reasonable manner. |

| 4.3 | The Parties hereto may further discuss and enter into separate service

agreement(s) in relation to electronic mail server and website server as may be utilized by the Vendor, any pricing scheme shall be further

determined and agreed by the relevant Parties. |

| 4.4 | The Company hereby agrees to provide to the Vendor a copy of its annual

audited report for the 2023 fiscal year ending on 31 December 2023 on or before 15 March 2024. |

| 4.5 | The Purchasers and the Company hereby agree to provide any necessary

assistance and support to the Vendor in relation to the Vendor’s annual audit for the 2023 fiscal year. |

| 5. | REPRESENTATIONS, WARRANTIES AND UNDERTAKINGS |

| 5.1 | The Vendor hereby represents and warrants to and undertakes with the Purchasers that, except as disclosed

herein, each of the Warranties set out in Schedule 2 as at the date hereof is and shall be for all times up to and inclusive of the Closing

Date true and correct in all respects. |

| 5.2 | The Vendor shall on demand indemnify each Purchaser against any loss, damage, cost or expense suffered

or incurred by the Purchaser or the Company arising directly or indirectly from the breach of any of the Warranties or any other terms

of this Agreement, such loss, damage, cost and expense including, but not limited to: |

| (a) | any cost of remedying such breach; |

| (b) | any consequential loss suffered by a Purchaser as a result of or in connection with such breach; |

| (c) | any internal costs incurred by a Purchaser as a result of or in connection with the rectification of such

breach; and |

| (d) | all solicitors, accountants and other adviser’s costs, including legal or other costs associated with

the enforcement or realisation of this indemnity. |

| 5.3 | (a) |

The Vendor acknowledges that each Purchaser has entered into this Agreement in reliance upon the Vendor’s Warranties. |

| (b) | Each of the Warranties shall constitute a separate and independent warranty, and each Purchaser shall

have a separate claim and right of action in respect of every breach of any of the Warranties. |

| (c) | The Vendor’s Warranties shall survive Closing. |

| (d) | The Vendor shall give to each Purchaser, information and documentation

relating to the Vendor as the Purchasers shall reasonably require to enable them to satisfy themselves as to the accuracy and due observance

of the Vendor’s Warranties. |

| 5.4 | Each Party covenants and warrants with the other Party that he shall at all times comply with all the

laws, rules, regulations and policies (including applicable financial crime compliance laws and regulations such as those related to anti-money

laundering, anti-terrorism financing, anti-bribery and corruption) applicable to a Party in relation to the performance of this Agreement.

In particular, a Party shall not directly or indirectly, pay, offer, provide, promise or authorise payment of money or anything of value

in order to exert any improper influence thereon to obtain any advantage, and/or to attempt to obtain any improper advantage or benefit

for either Party in connection with this Agreement to any of the following persons: |

| (a) | official, person in charge, agent or employee of a government or of any department agency; |

| (b) | political party official, or candidate for political office

(including election candidates, party members and administrative staff); |

| (c) | employee, person in charge, or agent of a public body or public

international organisation; or |

| (d) | employee or representative of any entity or company. |

If at any time any one or more provisions

hereof is or becomes invalid, illegal, unenforceable or incapable of performance in any respect, the validity, legality, enforceability

or performance of the remaining provisions hereof shall not thereby in any way be affected or impaired.

This Agreement constitutes the entire

agreement and understanding between the Parties hereto in connection with the sale and purchase of the Sale Shares under this Agreement

and supersedes all previous negotiation proposals, representations, understanding, warranties, agreements or undertakings relating thereto

whether oral, written or otherwise.

| 8.1 | Time shall be of the essence of this Agreement in every respect. |

| 8.2 | No time or indulgence given by any Party to the other shall be deemed or in any way be construed as a

waiver of any of its rights and remedies hereunder. |

| 9.1 | The Vendor shall execute, do and perform or procure to be executed, done and performed such further and

reasonable acts, agreements, assignments, assurances, deeds and documents as the Purchasers may reasonably require to vest effectively

the legal and beneficial ownership of the Sale Shares in the Purchasers. |

| 10.1 | This Agreement shall not be assignable by any Party hereto

without the written consent of the other Parties whose consent shall not be unreasonably withheld. |

| 11.1 | If at any time any one or more of the provisions of this Agreement is/are or become(s) illegal, invalid

or unenforceable in any respect under laws of any jurisdiction, the legality, validity or enforceability of the remaining provisions of

this Agreement shall not in any way be affected or impaired thereby. |

| 12. | NOTICES AND OTHER COMMUNICATIONS |

| 12.1 | All notices, requests, reports, submissions and other communications

permitted or required to be given under this Agreement shall be in writing and may be delivered by personal service, by post/courier,

or by email to the below addresses: |

Address: Cricket Square, Hutchins Drive, P.O. Box 2681, Grand Cayman KY1-1111, Cayman Islands

Email: olivia.wang@guardforceai.com

Contact person: Ms. Lei (Olivia) Wang

Correspondence address in Hong Kong:

Unit 04, 5/F., Guardforce Center, No.3 Hok Yuen Street East, Hung Hom, Kowloon, Hong Kong

Address: [ ]

Email: [ ]

Contact person: [ ]

Address: [ ]

Email: [ ]

Contact person: [ ]

Address: [ ]

Email: [ ]

Contact person: [ ]

Address: [ ]

Email: [ ]

Contact person: [ ]

| 12.2 | Each notice, request, report, submission and other communication given, made or served under this Agreement

shall be deemed given and received by the receiving Party: |

| (a) | within 3 Business Days after the date of posting by local mail/courier; or 5 Business Days after the date

of posting by air mail/courier; or |

| (b) | when delivered if delivered by hand or by electronic mail. |

| 12.3 | If any Party shall change the contact details stated in Clause 12.1, such Party shall give not less than

5 Business Days’ prior written notice before such change is effective. |

| 13.1 | Subject to Clauses 13.2 and 13.3, the Parties hereto shall bear their own legal and professional fees,

costs and expenses in the preparation and closing of this Agreement, and any other documents in relation thereto and in connection with

the sale and purchase herein. The Parties also hereby expressly state that he/she/it has consulted his/her/its own independent lawyers

and/or other professional party(ies) before entering into this Agreement. |

| 13.2 | The Purchasers shall pay any cost, fees and stamp duty in

relation to the transfer of the Sales Shares and any reporting to the Companies Registry in Hong Kong and Inland Revenue Department in

Hong Kong. |

| 13.3 | The Vendor shall pay any cost and fees (exclusive of stamp

duty, if any, in Hong Kong) in relation to the Share Cancellation. |

| 13.4 | The Parties’ duties and obligations under this Clause shall survive closing. |

| 14.1 | Each Party undertakes to the other Parties that except with the prior consent in writing of the other

Parties, a Party will not at any time hereafter make use of or disclose or divulge to any third party any information relating to this

Agreement and the other Parties obtained by him/it pursuant to the terms and conditions of this Agreement, other than any information: |

| (a) | made available to the public that is not caused by a breach

of this Clause by a Party; |

| (b) | disclosed or divulged pursuant to an order or a court of competent

jurisdiction or a request of a regulatory authority of competent jurisdiction; or |

| (c) | disclosed to seek professional advice from legal or financial

advisers. |

| 15.1 | This Agreement may be executed in any number of counterparts, all of which taken together shall constitute

one and the same instrument and any Party hereto may execute this Agreement by signing any such counterparts. Facsimile, emailed PDFs

and electronic signatures shall be deemed originals. |

| 16.1 | Each Party agrees that it will not make any public statements

which materially disparage the other Party. Notwithstanding the foregoing, nothing in this clause shall prohibit any person from making

truthful statements when required by law, order of a court or other body (inter alia, the U.S. Securities and Exchange Commission)

having jurisdiction. |

| 17. | GOVERNING LAW AND JURISDICTION |

| 17.1 | This

Agreement is governed by and shall be construed in accordance with the laws of Hong Kong SAR and

all disputes arising from or in connection with this Agreement shall be irrevocably submitted to the non-exclusive jurisdiction of courts

in the Hong Kong SAR for resolution. |

[Signature page to follow]

AS WITNESS whereof the Parties

hereto have signed this Agreement on the date set forth on the first page of this Agreement.

| The Vendor: |

|

| |

|

| SIGNED by Wang Lei, CEO and a Director |

) |

| for and on behalf of |

) |

| Guardforce AI Co., Limited |

) |

| |

) |

| |

) |

| in the presence of: Yangfan Zou |

) |

| |

|

| The Purchaser A: |

|

| |

|

| SIGNED, SEALED AND DELIVERED by |

) |

| [ ] |

) |

| in the presence of: |

) |

| |

|

| The Purchaser B: |

|

| |

|

| SIGNED, SEALED AND DELIVERED by |

) |

| [ ] |

) |

| in the presence of: |

) |

| |

|

| The Purchaser C: |

|

| |

|

| SIGNED, SEALED AND DELIVERED by |

) |

| [ ] |

) |

| [ ] |

) |

| in the presence of: |

) |

| |

|

| The Company: |

|

| |

|

| SIGNED by [ ], a Director |

) |

| for and on behalf of |

) |

| Handshake Networking Limited |

) |

| |

) |

| |

) |

| in the presence of: |

) |

SCHEDULE

1

PARTICULARS

OF THE COMPANY

| (1) |

Company

Name |

: |

Handshake

Networking Limited |

| |

|

|

|

| (2) |

Company

No. |

: |

887257 |

| |

|

|

|

| (3) |

Place

of Incorporation |

: |

Hong

Kong |

| |

|

|

|

| (4) |

Date

of Incorporation |

: |

8

March 2004 |

| |

|

|

|

| (5) |

Registered

Office |

: |

[ ] |

| |

|

|

|

| (6) |

Issued

and paid-up Share Capital |

: |

HKD1,000.00 |

| |

|

|

|

| (7) |

Shareholder

and Shareholdings |

: |

a.

510 Shares of Company held by Guardforce AI Co., Limited; |

| |

|

|

|

| |

|

|

b.

245 Shares of the Company held by [ ]; and |

| |

|

|

|

| |

|

|

c.

245 Shares of the Company held by [ ]. |

| |

|

|

|

| (8) |

Directors |

: |

[ ]; |

| |

|

|

[ ]; |

| |

|

|

[ ]; |

| |

|

|

[ ];

and |

| |

|

|

[ ] |

SCHEDULE 2

WARRANTIES

The Vendor hereby represents and warrants to the

Purchaser that all representations and statements set out in this Schedule 2 or otherwise contained in this Agreement are and will be

true and accurate as at the date hereof and on the Closing Date with reference to the facts and circumstances subsisting at such time.

| 1.1 | The Vendor has full power and authority, and has obtained all necessary consents and approvals, to enter

into this Agreement and to exercise his rights and perform his obligations hereunder and (where relevant) all corporate and other actions

required to authorize the execution of this Agreement and its performance of its obligations hereunder have been duly taken. This Agreement

is a legal, valid and binding agreement on the Vendor and is enforceable in accordance with its terms. |

| 1.2 | The obligations of the Vendor under this Agreement shall at all times constitute direct, unconditional,

unsecured, unsubordinated and general obligations of, and shall rank at least pari passu with, all other present and future outstanding

unsecured obligations, issued, created or assumed by the Vendor. |

| 1.3 | The execution, delivery and performance of this Agreement by the Vendor does not and shall not violate

in any respect any provision of: |

| (a) | any law or regulation or any order or decree of any governmental authority, agency or court of Hong Kong; |

| (b) | the laws and documents incorporating and constituting the Vendor; or |

| (c) | any agreement or other undertaking to which the Vendor or the Company is a party or which is binding upon

it or any of its assets, and does not and shall not result in the creation or imposition of any encumbrance on any of its assets pursuant

to the provisions of any such agreement or other undertaking. |

| 1.4 | All information given by or on behalf of the Vendor or the Company to the Purchaser or any of their representatives

was when given and is at the date of this Agreement and on the Closing Date true, complete and accurate in all respects and not misleading

in any respect. |

| 1.5 | All information about the Company and the Sale Shares which, if disclosed, may reasonably have been expected

to affect the decision of the Purchaser to enter into this Agreement or cause the Purchaser to reduce its assessment of the value of the

Sale Shares or cause it to seek additional contractual obligations, has been disclosed on the basis of the utmost good faith to the Purchaser

in writing prior to the date of this Agreement. |

| 2.1 | The Sale Shares are legally and beneficially owned by the Vendor free from all liens, claims, equities,

charges, encumbrances or third party rights of whatsoever nature. |

| 3.1 | The Company has been and remains validly incorporated or established in accordance with all applicable

laws and regulations of Hong Kong and has not committed any criminal, illegal or unlawful act and there is no violation of or default

with respect to any ordinance, statute, regulation, order, decree of judgment of any court or government agency of Hong Kong (either in

respect of environmental matters or otherwise). All corporate or other documents required to be filed or registered in respect of the

Company with the relevant authorities have been duly filed. |

| 3.2 | All shares, debentures or other securities issued or allotted by the Company have been and remain validly

issued or allotted. |

| 3.3 | The Company (and its directors as such) has at all times prior to Closing complied with its constitutional

documents and all applicable legislation and obtained and complied with all necessary licenses, consents and other permissions and regulatory

or third party approvals (together “Licenses”) relevant to the business of (including transactions entered into by) the Company

(whether in the country in which it is incorporated or elsewhere). All Licenses are in full force and effect and there is no circumstance

which might invalidate any Licenses or render it liable to forfeiture or modification or affect its renewal. |

| 3.4 | The Company has not committed any breach of contract or statutory duty or any other unlawful act which

could lead to a claim for damages against it and no event has occurred as regards the Company which would entitle any third party to terminate

any contract or any benefit enjoyed by the Company or call in any money before its normal due date. |

| 3.5 | None of the Company’s assets or processes used in or aspects of the Company’s business involves

the use, discharge or disposal of materials which is hazardous or otherwise regulated by any environmental legislation or other laws of

Hong Kong, or which may lead to any possible claim by a third party for pollution, contamination, or environmental damage, or which may

require the Company to repair, clean up or otherwise take any remedial action in relation to any environmental damage or degradation. |

| 4.1 | The Company has complied with all other relevant legal requirements relating to registration or notification

for Taxation purposes. |

| (a) | paid or accounted for all Taxation (if any) due to be paid or accounted for by it to the competent fiscal

authority before the date of this Agreement; and |

| (b) | taken all reasonable steps to obtain any repayment of or relief from Taxation available to it. |

| 4.3 | The returns which ought to have been made by or in respect of the Company for any Taxation purposes have

been made and all such returns have been prepared on a correct and proper basis. |

| 5.1 | The Company is not a party to any litigation, arbitration, prosecution, dispute, investigation or to any

other legal or contractual proceeding (together the “Proceedings”). |

| 5.2 | No Proceedings are threatened or pending either by or against the Company or against any person for whose

acts or defaults the Company may be vicariously liable and there are no facts known to the Company or any of its Directors which might

give rise to any such Proceedings or to any payment. |

| 5.3 | The Company is not subject to any order or judgment given by any court or governmental agency and has

not been a party to any undertaking or assurance given to any court or governmental agency which is still in force nor are there any facts

or circumstances which would be likely to result in the Company becoming subject to any such order or judgment or being required to be

a party to any such undertaking or assurance. |

| 6. | Contracts and Commitments |

| 6.1 | The Company is not in breach of any deed, agreement or undertaking

to which it is a party, nor does it have any outstanding actual or contingent liability in respect of any previous deeds, agreements

or undertakings to which it has been a party. |

| 6.2 | In relation to all agreements to which the Company is a party (the “Business Agreements”): |

| (a) | each

Business Agreement is valid, binding and legally enforceable against the Parties thereto

in accordance with its terms; |

| (b) | no

party to any Business Agreement is in breach of any of the terms thereof; and |

| (c) | all

approvals or consents required from any regulatory authorities or third parties in connection

with the Business Agreements have been obtained and remain current. |

| 7.1 | The Company is solvent and able to pay its debts as they fall due and has assets of greater value than

its liabilities. |

| 7.2 | No order has been made or petition presented or resolution passed for the winding up of the Company, nor

has any distress, execution or other process been levied against the Company or action taken to repossess goods in the possession of the

Company. |

| 7.3 | No steps have been taken for the appointment of an administrator or receiver of any part of the Company’s

property and the Company has not made or proposed any arrangement or composition with its creditors or any class of its creditors. |

| 7.4 | No floating charge created by the Company has crystallised and there are no circumstances likely to cause

such a floating charge to crystallise. |

| 7.5 | The Company is not a party to any transaction which could be avoided in a winding up. |

| 8. | Confidential Information |

| 8.1 | The Company is not aware of any misuse of confidential information belonging to third party. |

| 8.2 | There was no disclosure of Company’s confidential information to any third party. |

| 9.1 | The Company has not itself nor vicariously: |

| (a) | committed any breach of any statutory provision, order, bye-law or regulation binding upon it or of any

provision of its memorandum of association or articles of association or of any trust deed, agreement or license to which it is a party

or of any covenant, mortgage, charge or debenture given by it; |

| (b) | entered into any transaction which is or may be unenforceable by reason of the transaction being voidable

at the instance of any other party or ultra vires, void or illegal; or |

| (c) | omitted to do anything required or permitted to be done by it necessary for the protection of its respective

title to or for the enforcement or the preservation of any order or priority of any properties or rights owned by it. |

| 9.2 | No one is entitled to receive from the Vendor any finder’s fee, brokerage or commission in connection

with the sale of the Sale Shares. |

| 9.3 | The Company owns the trademark(s), copyright and patent (collectively the “Intellectual Properties”)

as already disclosed to and confirmed by the Vendor. |

SCHEDULE 3

VENDOR’S ACCOUNT

Bank name: [ ]

Address of the bank: [ ]

Account no.: [ ]

Beneficiary’s name: Guardforce AI Co., Limited

Swift code: [ ]

CHIPS no.: [ ]

-21-

Exhibit

10.2

CANCELLATION

AGREEMENT

THIS

CANCELLATION AGREEMENT (this “Agreement”), is entered into effective as of February 6 , 2024 (the “Effective

Date”), by and among:

| (1) | Guardforce

AI Co., Limited, an exempted company with limited liability incorporated under the laws

of the Cayman Islands with its registration address at Cricket Square, Hutchins Drive, P.O.

Box 2681, Grand Cayman KY1-1111, Cayman Islands (“Party A”); |

| (4) | [ ] ([ ], [ ] and [ ] are collectively referred to as “Party

B”). |

In

this Agreement, each party shall be individually referred to as a “Party” and collectively as the “Parties”.

RECITALS

| A. | As

at the date hereof, [ ], [ ] and [ ], are the legal and beneficial

owners of 504 ordinary shares of Party A, 504 ordinary shares of Party A and 83 ordinary shares of Party A (the “Cancellation

Shares”), respectively. |

| B. | The

Parties have agreed that the Cancellation Shares shall be surrendered by Party B and cancelled by Party A on the terms and subject to

the conditions of this Agreement. |

NOW

THEREFORE, in consideration of the mutual covenants and agreements contained herein and other good and valuable consideration, the

receipt and sufficiency of which is hereby acknowledged, the undersigned do hereby agree as follows:

1.

Each of [ ], [ ] and [ ] hereby unconditionally and irrevocably agrees to surrender the Cancellation Shares registered in their respective

name to Party A free and clear of all claims, charges, liens, options, security interests, mortgages, encumbrances and restrictions of

every kind and nature.

2.

Each of [ ], [ ] and [ ] hereby unconditionally and irrevocably

agrees to (i) deliver to Party A any physical share certificates issued in their name in respect of the Cancellation Shares and (b)

to execute and deliver such other instruments of sale, transfer, conveyance, assignment and confirmation as may be reasonably

requested by Party A in order to effectively transfer, convey and assign title to the Cancellation Shares to Party A.

3.

This Agreement is a binding agreement and constitutes the entire agreement between the Parties with respect to the subject matter hereof.

4.

This Agreement is binding upon and inures to the benefit of the successors and assigns of the Parties hereto.

5.

This Agreement is governed by and shall be construed in accordance with the laws of the Cayman Islands and all disputes arising from

or in connection with this Agreement shall be irrevocably submitted to the non-exclusive jurisdiction of courts in the Cayman Islands

for resolution.

6.

This Agreement may be executed in identical counterparts. Each counterpart hereof shall be deemed to be an original instrument, but all

counterparts hereof taken together shall constitute a single document. Facsimile, emailed PDFs and electronic signatures shall be deemed

originals.

7.

The Parties hereto agree to use their reasonable best efforts to cooperate with one another to discharge their respective obligations

under this Agreement and to satisfy the intents and purposes of this Agreement.

[Signature

page follows]

IN

WITNESS WHEREOF, the parties hereto have caused this Agreement to be executed as of the Effective Date set forth on the first page.

| Executed as a Deed by |

) |

|

| Guardforce AI Co., Limited |

) |

|

| a company incorporated under the laws |

) |

|

| of the Cayman Islands acting by: |

) |

|

| Lei Wang, in the presence of: |

) |

|

| |

) |

|

| |

) |

|

| Witness Signature |

|

|

| SIGNED,

SEALED and DELIVERED by |

) |

|

| |

|

|

| [ ] |

) |

|

| |

|

|

| in the presence of: |

|

|

| |

|

|

|

|

|

| Witness Signature |

|

|

| |

|

|

| SIGNED, SEALED and

DELIVERED by |

) |

|

| |

|

|

| [ ] |

) |

|

| |

|

|

| in the presence of: |

|

|

| |

|

|

|

|

|

| Witness Signature |

|

|

| |

|

|

| SIGNED, SEALED and

DELIVERED by |

) |

|

| |

|

|

| [ ] |

) |

|

| |

|

|

| in the presence of: |

|

|

| |

|

|

|

|

|

| Witness Signature |

|

|

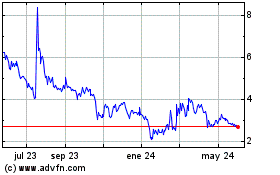

Guardforce AI (NASDAQ:GFAI)

Gráfica de Acción Histórica

De Nov 2024 a Dic 2024

Guardforce AI (NASDAQ:GFAI)

Gráfica de Acción Histórica

De Dic 2023 a Dic 2024