UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

WASHINGTON,

D.C. 20549

FORM

6-K

REPORT

OF FOREIGN PRIVATE ISSUER

PURSUANT

TO RULE 13a-16 OR 15d-16 OF THE

SECURITIES

EXCHANGE ACT OF 1934

For

the month of, January 2024

Commission

File Number 001-40848

GUARDFORCE

AI CO., LIMITED

(Translation

of registrant’s name into English)

10

Anson Road, #28-01 International Plaza

Singapore

079903

(Address

of principal executive offices)

Indicate

by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F: Form 20-F

☒ Form 40-F ☐

On January 17, 2024, Guardforce AI Co., Limited (the

“Company”) announced that Mr. Yu-heng Ma (“Mr. Ma”), the Company’s Chief Financial Officer (“CFO”),

was resigning from his position as CFO, effective immediately. Mr. Ma’s resignation as CFO is not the result of any disagreement

with the Company on any matter relating to its operation, policies (including accounting or financial policies) or practices.

Effective January 18, 2024, Yuting Zuo (“Ms.

Zuo”) became the Company’s CFO, replacing Mr. Ma in this position.

Ms.

Zuo has over a decade of experience in corporate finance, accounting, SEC reporting and working with U.S.-listed companies. Ms. Zuo has

served in a financial reporting and investment position, directly reporting to the CEO and CFO of Aurora Mobile Limited (Nasdaq: JG),

a leading mobile big data solutions company in China. In this role she oversaw financial reporting and accounting operations, investor

relations and led merger and acquisition activities. Previously, she was the corporate accounting manager at Farmers Business Network,

a farmer-to-farmer network and e-commerce platform, based in California. Prior to that, Ms. Zuo served as an auditor at PricewaterhouseCoopers

and at Ernest & Young in the U.S. Ms. Zuo holds a bachelor’s degree in accounting and finance from the University of Richmond

and also completed an undergraduate program in Finance at the University of Hong Kong in 2013. She is a certified public accountant.

On

January 18, 2024, the Company entered into a consulting agreement with Ms. Zuo, effective on the same day (the “Consulting Agreement”),

pursuant to which Ms. Zuo will receive (a) Cash Compensation of $200,000 per year (the “Annual Fee”), which Annual Fee shall

be paid to Ms. Zuo in monthly installments no later than the seventh business day of each calendar month following the effective date

of the Consulting Agreement; (b) a one-time sign-on bonus of $30,000 (the “Sign-On Cash Bonus”) and the Company’s restricted

ordinary shares with a total estimated value of $20,000 (the “Sign-On Stock Bonus”, together with the Sign-On Cash Bonus,

the “Sign-On Bonus”). The Sign-On Cash Bonus will be paid to the Consultant within fourteen (14) calendar days of Ms. Zuo’s

start date with the Company. The Sign-On Stock Bonus will be granted to Ms. Zuo within a year of her start date with the Company, subject

to the terms and conditions of the Company’s equity incentive plan. In the event that Ms. Zuo voluntarily resigns at any time before

the second anniversary of employment with the Company, she shall be required to repay the full amount of the Sign-On Bonus to the Company

within 90 days from the cessation of consulting services; and (c) an equity compensation consisting of, in the aggregate, 40,000 Restricted

Stock Units (the “RSUs”) of the Company per year, on the terms and conditions and subject to the restrictions set forth in

the Amendment No.1 to Guardforce AI Co., Limited 2022 Equity Incentive Plan.

The

summary of the Consulting Agreement set forth above does not purport to be complete and is qualified in its entirety by reference to

the full text of the agreement, a form of which is attached to this Report on Form 6-K as Exhibit 10.1 and incorporated by reference

herein.

The

Company issued a press release on January 17, 2024, announcing the appointment of Ms. Zuo as the Chief Financial Officer, a copy of which

is attached to this Form 6-K as Exhibit 99.1.

This

report on Form 6-K is incorporated by reference into (i) the prospectus contained in the Company’s registration statement on Form F-3 (SEC File No. 333-261881) declared effective by the Securities and Exchange Commission (the “Commission”) on January

5, 2022; (ii) the prospectus dated February 9, 2022 contained in the Company’s registration statement on Form F-3 (SEC File No.

333-262441) declared effective by the Commission on February 9, 2022; and (iii) the prospectus contained in the Company’s Post-Effective

Amendment No. 1 to Form F-1 on Form F-3 (SEC File No. 333-258054) declared effective by the Commission on June 14, 2022.

EXHIBIT

INDEX

SIGNATURES

Pursuant

to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by

the undersigned, thereunto duly authorized.

| Date: January 23, 2024 |

Guardforce

AI Co., Limited |

| |

|

|

| |

By: |

/s/

Lei Wang |

| |

Lei Wang |

| |

Chief Executive Officer |

3

Exhibit 10.1

Consulting Agreement

This Consulting Agreement (the “Agreement”)

sets forth the terms and conditions governing the contractual agreement between Guardforce AI Co., Limited, a company incorporated in

Cayman Islands with its principal place of business at 10 Anson Road, #28-01 International Plaza, Singapore 079903 (the “Company”),

and Catherine (Yuting) Zuo, residing at Room 27A, Block 2, Century Huating, No. 15 Jingtian Street East, Futian District, Shen Zhen, Guargdong,

China (the “Consultant”), both of whom agree to be bound by this Agreement.

WHEREAS, the Consultant offers consulting

services in the field of financial support in the Company’s Hong Kong office located at 504, 5/F, Guardforce Centre, 3 Hok Yuen

Street East, Kowloon, Hong Kong; and

WHEREAS, the Company desires to retain

the services of the Consultant to render consulting services with regard to financial support consulting services according to the terms

and conditions herein.

NOW, THEREFORE, in consideration of the

mutual covenants and promises made by the parties hereto, the Consultant and the Company (individually, each a “Party”

and collectively, the “Parties”) covenant and agree as follows:

1. Term

This Agreement shall commence on the 18th

of January 2024 and terminate on the 17th of January 2025.

2. Consulting Services

The Consultant agrees that she shall provide its

expertise to the Company in all matters pertaining to financial support consulting services in the Company’s Hong Kong office located

at 504, 5/F, Guardforce Centre, 3 Hok Yuen Street East, Kowloon, Hong Kong (the “Consulting Services”).

3. Compensation

In consideration for the Consulting Services,

the Company shall pay the Consultant as outlined below, and the Consultant shall be responsible for her own personal tax liability, if

applicable.

(a) Cash

Compensation. Following the commencement of the term of this Agreement, for all services to be rendered by the Consultant in any

capacity hereunder, the Company agrees to compensate the Consultant a fee of $200,000 per year in cash (the “Annual

Fee”), which Annual Fee shall be paid to the Consultant in monthly installments no later than the seventh business day of

each calendar month following the Effective Date. The Consultant shall be responsible for her own individual income tax payment on

the Annual Fee in jurisdictions where the Director resides.

Based on the Consultant’s hire date and

the current annual review program, the Consultant is eligible to receive her first annual review in the spring of 2025 and each spring

thereafter, with annual adjustments based on her performance, business needs and economic factors.

(b) Sign-On

Bonus. The Company agrees to provide the Consultant with a one-time sign-on bonus of $30,000 (the “Sign-On Cash

Bonus”) and the Company’s restricted ordinary shares with a total estimated value of $20,000 (the “Sign-On

Stock Bonus”, together with the Sign-On Cash Bonus, the “Sign-On Bonus”). The Sign-On Cash Bonus will

be paid to the Consultant within fourteen (14) calendar days of the Consultant’s start date with the Company. The Sign-On

Stock Bonus will be granted to the Consultant within a year of the Consultant’s start date with the Company, subject to the terms

and conditions of the Company’s equity incentive plan. In the event that the Consultant voluntarily resigns at any time before the

second anniversary of employment with the Company, the Consultant shall be required to repay the full amount of the Sign-On Bonus to

the Company within 90 days from the cessation of consulting services.

(c) Equity

Compensation. Upon execution of this Agreement, the Consultant shall be entitled to receive an equity compensation consisting

of, in the aggregate, 40,000 Restricted Stock Units (the “RSUs”) of the Company (the “Equity

Compensation”) per year, on the terms and conditions and subject to the restrictions set forth in the Amendment No.1 to

Guardforce AI Co., Limited 2022 Equity Incentive Plan, as the same may be amended from time to time (the “Plan”);

and shall be granted subject to the execution and delivery of a Restricted Stock Unit Agreement, as approved by the Board, in

substantially the same form as attached hereto as Exhibit A (the “Award Agreement”). Capitalized terms

that are used but not defined herein have the meaning ascribed to them in the Plan. The parties hereby agree that to the extent

permitted by the Plan, in event the Company effects one or more share consolidation of its Ordinary Shares, the number of shares

underlying the Restricted Share Award and the exercise price per share of the Stock Option shall be adjusted in proportion to the

reverse stock split ratio.

In the event that the Consultant works less than

a full year, the Company shall only be obligated to pay the pro rata portion of such Annual Fee to the Consultant for her services performed

during such year. Furthermore, the vesting of the Equity Compensation shall not accelerate in the event the Consultant works less than

a full year.

4. Intellectual Property Rights in Work Product

The Parties acknowledge and agree that the Company

will hold all intellectual property rights in any work product resulting from the Consulting Services including, but not limited to, copyright

and trademark rights. The Consultant agrees not to claim any such ownership in such work product’s intellectual property at any

time prior to or after the completion and delivery of such work product to the Company.

5. Confidentiality

The Consultant shall not disclose to any third

party any details regarding the Company’s business, including, without limitation any information regarding any of the Company’s

customer information, business plans, financial information or price points (the “Confidential Information”), (ii)

make copies of any Confidential Information or any content based on the concepts contained within the Confidential Information for personal

use or for distribution unless requested to do so by the Company, or (iii) use Confidential Information other than solely for the benefit

of the Company.

6. Noncompetition

During the term of this Agreement and for 1 year

thereafter, the Consultant shall not engage, directly or indirectly, as an employee, officer, manager, partner, manager, consultant, agent,

owner or in any other capacity, in any competition with the Company or any of its subsidiaries, including any company engaged in AI robotics

business.

7. Nonsolicitation of Customers

During the term of this Agreement and for 1 year

thereafter, the Consultant will not, directly or indirectly, solicit or attempt to solicit any business from any of the Company’s

clients, prospects, employees or contractors.

8. Nonsolicitation of Employees

During the term of this Agreement and for 1 year

thereafter, the Consultant will not, directly or indirectly, recruit, solicit, or induce, or attempt to recruit, solicit, or induce, any

of the Company’s employees, or contractors for work at another company.

9. Indemnification

the Company agrees to indemnify, defend, and protect

the Consultant from and against all lawsuits and costs of every kind pertaining to the Company’s business including reasonable legal

fees due to any act or failure to act by the Company based upon the Consulting Services.

10. No Modification Unless in Writing

No modification of this Agreement shall be valid

unless in writing and agreed upon by both Parties.

11. Applicable Law

This Consulting Agreement and the interpretation

of its terms shall be governed by the laws of Hong Kong Special Administrative Region.

IN WITNESS WHEREOF, the parties hereto

have executed this Consulting Agreement effective as of the date written below.

| /s/ Zuo Yuting |

|

| NAME: |

Zuo Yuting |

|

| DATE: |

January 18, 2024 |

|

| |

|

| Guardforce AI Co., Limited |

|

| |

|

| /s/ Lei Wang |

|

| Name: |

Lei Wang |

|

| Title: |

Chief Executive Officer |

|

| DATE: |

January 18, 2024 |

|

Exhibit A

Form of Award Agreement

RESTRICTED SHARE UNIT AWARD

AGREEMENT

This Restricted

Share Unit Award Agreement (this “Agreement”) is made and entered into as of _______________ (the “Grant Date”),

by and between Guardforce AI Co., Limited, an exempted company incorporated under the laws of the Cayman Islands (the “Company”),

and ______________ (the “Grantee”).

WHEREAS,

the Company has adopted the Amendment No.1 to Guardforce AI Co., Limited 2022 Equity Incentive Plan (the “Plan”) pursuant

to which awards of Restricted Share Units may be granted; and

WHEREAS,

the Committee has determined that it is in the best interests of the Company and its shareholders to grant the award of Restricted Share

Units provided for herein.

NOW, THEREFORE, the parties

hereto, intending to be legally bound, agree as follows:

1. Grant

of Restricted Share Units. Pursuant to Section 7.2 of the Plan, the Company hereby issues to the Grantee on the Grant Date

_______________ Restricted Share Units (the “Restricted Share Units”). Each Restricted Share Unit represents an

unfunded, unsecured right to receive one Ordinary Share of the Company on the Payment Date(s) specified in Section 3.4, subject to

the terms and conditions set forth in this Agreement and the Plan. Capitalized terms that are used but not defined herein have the

meaning ascribed to them in the Plan.

2. Consideration.

The grant of the Restricted Share Units is made in consideration of the services to be rendered by the Grantee to the Company.

3. Vesting; Payment.

3.1.

Except as otherwise provided herein, provided that the Grantee remains in Continuous Service through the applicable vesting date,

the Restricted Share Units will vest in accordance with the following schedule (each, a “Vesting Date”):

| Vesting Date |

|

Restricted Share Units |

| [VESTING DATE] |

|

[NUMBER OR PERCENTAGE OF SHARES THAT VEST ON THE VESTING DATE] |

| [VESTING DATE] |

|

[NUMBER OR PERCENTAGE OF SHARES THAT VEST ON THE VESTING DATE] |

3.2.

The foregoing vesting schedule notwithstanding, if the Grantee’s Continuous Service terminates for any reason at any time before

all of his or her Restricted Share Units have vested, the Grantee’s unvested Restricted Share Units shall be automatically forfeited

upon such termination of Continuous Service and neither the Company nor any Affiliate shall have any further obligations to the Grantee

under this Agreement.

3.3.

The foregoing vesting schedule notwithstanding, in the event of the Grantee’s death or if the Grantee’s Continuous Service

is terminated by the Company or an Affiliate due to the Grantee’s Disability, 100% of the unvested Restricted Share Units shall

vest as of the date of such termination.

3.4.

The Company shall, as soon as reasonably, practicable following a Vesting Date (and in no event later than March 15th of the calendar

year following the calendar year in which the Applicable Vesting Date occurs) (each a “Payment Date”), deliver (or

cause to be delivered) to the Participant one Ordinary Share with respect to each vested Restricted Share Unit, as settlement of such

Restricted Share Unit and each such Restricted Share Unit shall thereafter be cancelled.

4. Restricted Share Unit Transfer Restrictions. Subject to any exceptions set forth in this Agreement or the Plan, the Restricted Share Units may not be assigned, alienated, pledged, attached, sold or otherwise transferred or encumbered by the Grantee. Any attempt to assign, alienate, pledge, attach, sell or otherwise transfer or encumber the Restricted Share Units or the rights relating thereto shall be wholly ineffective and, if any such attempt is made, the Restricted Share Units shall be forfeited by the Grantee and all of the Grantee’s rights to such Restricted Share Units shall immediately terminate without any payment or consideration by the Company.

5. Rights as Shareholder; Dividend Equivalents.

5.1.

The Grantee shall have no rights as a shareholder of the Company with respect to Ordinary Shares covered by the Restricted Share Units.

5.2.

With respect to ordinary cash dividends in respect of Ordinary Shares covered by any outstanding Restricted Share Units, the Grantee

shall have the right to receive an amount in cash equal to (i) the amount of any ordinary cash dividend paid with respect to one Ordinary

Share, multiplied by (ii) the number of Ordinary Shares covered by such Restricted Share Units (a “Dividend Equivalent”).

A Dividend Equivalent shall be subject to the same vesting restrictions as the Restricted Share Units to which such Dividend Equivalent

relates, as set forth in Section 3.1. Unless otherwise determined by the Committee, Dividend Equivalents shall be held, without interest

thereon, until delivered to the Grantee within 30 days after the date the Restricted Share Units to which such Dividend Equivalents related

vest, in each case, subject to Section 8. Any Dividend Equivalents in respect of Restricted Share Units that do not vest, shall be forfeited

and retained by the Company. In no event shall a Dividend Equivalent be paid that would result in the Grantee receiving both the Dividend

Equivalent and the actual dividend with respect to a Restricted Share Unit and the corresponding Ordinary Share.

6. No Right to Continued Service. Neither the Plan nor this Agreement shall confer upon the Grantee any right to be retained in any position, as an Employee, Consultant or Director of the Company. Further, nothing in the Plan or this Agreement shall be construed to limit the discretion of the Company to terminate the Grantee’s Continuous Service at any time, with or without Cause.

7. Adjustments.

If any change is made to the outstanding Ordinary Shares or the capital structure of the Company, if required, the Ordinary Shares

underlying the Restricted Share Units shall be adjusted or terminated in any manner as contemplated by Section 11 of the Plan.

8. Tax Liability and Withholding.

8.1.

Solely to the extent applicable, the Grantee shall be required to pay to the Company, and the Company shall have the right to deduct

from any compensation paid to the Grantee pursuant to the Plan, the amount of any required withholding taxes in respect of the Restricted

Share Units and to take all such other action as the Committee deems necessary to satisfy all obligations for the payment of such withholding

taxes. The Committee may permit the Grantee to satisfy any federal, state or local tax withholding obligation by any of the following

means, or by a combination of such means: (a) tendering a cash payment; (b) authorizing the Company to withhold Ordinary Shares from the

Ordinary Shares otherwise issuable or deliverable to the Grantee as a result of the settlement of the Restricted Stock Units; provided,

however, that no Ordinary Shares shall be withheld with a value exceeding the minimum amount of tax required to be withheld by law;

or (c) delivering to the Company previously owned and unencumbered Ordinary Shares. Notwithstanding the foregoing, if the Company’s

Ordinary Shares are publicly-traded, in the event a taxable event with respect to this Agreement occurs during a “blackout”

period (whether scheduled or unscheduled) during which Participants in the Plan, including the Grantee, are prohibited by Company policy

from selling Ordinary Shares, the Grantee’s statutorily required withholding obligation will be satisfied by the Company automatically

withholding from the Ordinary Shares otherwise deliverable to the Grantee a number of Ordinary Shares having an aggregate Fair Market

Value equal to the Grantee’s statutorily required withholding obligation (with any fraction of one Ordinary Share required to satisfy

such obligation being disregarded and the amount due paid instead in cash by the Participant); provided, however, the Grantee

may elect, by written notice to the Committee during an open trading window, to satisfy his or her applicable federal, state or local

tax withholding obligation, in which case the Grantee shall be required, prior to any applicable taxable event, to remit to the Company

an amount in cash sufficient to satisfy his or her applicable federal, state or local tax withholding obligations in connection with such

taxable event.

8.2.

Notwithstanding any action the Company takes with respect to any or all income tax, social insurance, payroll tax, or other tax-related

withholding (“Tax-Related Items”), the ultimate liability for all Tax-Related Items is and remains the Grantee’s

responsibility and the Company (a) makes no representation or undertakings regarding the treatment of any Tax-Related Items in connection

with the grant, vesting, or settlement of the Restricted Share Units or the subsequent sale of any shares; and (b) does not commit to

structure the Restricted Share Units to reduce or eliminate the Grantee’s liability for Tax-Related Items.

9. Non-competition and Non-solicitation.

9.1.

During the Grantee’s Continuous Service, in consideration of the Restricted Share Units, the Grantee agrees and covenants

not to:

(a)

contribute his or her knowledge, directly or indirectly, in whole or in part, as an employee, officer, owner, manager, advisor,

consultant, agent, partner, director, shareholder, volunteer, intern or in any other similar capacity to an entity engaged in the same

or similar business as the Company and its Affiliates;

(b)

directly or indirectly, solicit, hire, recruit, attempt to hire or recruit, or induce the termination of employment of any employee

of the Company or its Affiliates; or

(c)

directly or indirectly, solicit, contact (including, but not limited to, e-mail, regular mail, express mail, telephone, fax, and

instant message), attempt to contact or meet with the current, former or prospective customers of the Company or any of its Affiliates

for purposes of offering or accepting goods or services similar to or competitive with those offered by the Company or any of its Affiliates.

9.2. If the Grantee breaches any of the covenants set forth in Section 9.1:

(a)

all unvested Restricted Share Units or vested Restricted Share Units that have not been settled shall be immediately forfeited;

and

(b) the

Grantee hereby consents and agrees that the Company shall be entitled to seek, in addition to other available remedies, a temporary

or permanent injunction or other equitable relief against such breach or threatened breach from any court of competent jurisdiction,

without the necessity of showing any actual damages or that money damages would not afford an adequate remedy, and without the

necessity of posting any bond or other security. The aforementioned equitable relief shall be in addition to, not in lieu of, legal

remedies, monetary damages or other available forms of relief.

10. Compliance

with Law. The granting of the Restricted Share Units and the issuance and transfer of Ordinary Shares shall be subject to

compliance by the Company and the Grantee with laws of Cayman Islands as they relate to the Company and its Ordinary Shares, with

all applicable requirements of federal and state securities laws and with all applicable requirements of any stock exchange on which

the Company’s Ordinary Shares may be listed. No Restricted Share Units shall be granted and no Ordinary Shares shall be issued

or transferred unless and until any then applicable requirements of Cayman Islands laws, state and federal laws and regulatory

agencies have been fully complied with to the satisfaction of the Company and its counsel. The Grantee understands that the Company

is under no obligation to register the Ordinary Shares with the Securities and Exchange Commission, any state securities commission

or any stock exchange to effect such compliance.

11. Notices.

Any notice required to be delivered to the Company under this Agreement shall be in writing and addressed to the Konki Lo of the

Company at the Company’s principal corporate offices. Any notice required to be delivered to the Grantee under this Agreement

shall be in writing and addressed to the Grantee at the Grantee’s address as shown in the records of the Company. Either party

may designate another address in writing (or by such other method approved by the Company) from time to time.

12. Governing

Law. This Agreement will be construed and interpreted in accordance with the laws of the Cayman Islands without regard to

conflict of law principles.

13. Section

409A. Although the Company makes no guarantee with respect to the tax treatment of the Restricted Share Units, the award of

Restricted Share Units and Dividend Equivalents pursuant to this Agreement is intended to comply with, or to be exempt from, Section

409A of the Code and shall be limited, construed and interpreted in accordance with such intent. The Restricted Share Units and

Dividend Equivalents shall be limited, construed and interpreted in accordance with such intent; provided that the Company

does not guarantee to the Grantee any particular tax treatment of the Restricted Share Units or Dividend Equivalents. In no event

whatsoever shall the Company or its Affiliates be liable for any additional tax, interest or penalties that may be imposed on the

Grantee by Section 409A of the Code or any damages for failing to comply with Section 409A of the Code. Dividend Equivalents shall

be treated separately from the Restricted Share Units and the rights arising in connection therewith for purposes of the designation

of time and form of payments required by Section 409A of the Code. Each payment under this Agreement shall be treated as a separate

payment for purposes of Section 409A of the Code. In no event may the Grantee, directly or indirectly, designate the calendar year

of any payment to be made under this Agreement.

14. Interpretation.

Any dispute regarding the interpretation of this Agreement shall be submitted by the Grantee or the Company to the Committee for

review. The resolution of such dispute by the Committee shall be final and binding on the Grantee and the Company.

15. Restricted

Share Units Subject to Plan. This Agreement is subject to the Plan as approved by the Company’s shareholders. The terms

and provisions of the Plan as it may be amended from time to time are hereby incorporated herein by reference. In the event of a

conflict between any term or provision contained herein and a term or provision of the Plan, the applicable terms and provisions of

the Plan shall govern and prevail.

16. Successors and Assigns. The Company may assign any of its rights under this Agreement. This Agreement shall be binding upon and inure to the benefit of the successors and assigns of the Company. Subject to the restrictions on transfer set forth herein, this Agreement shall be binding upon the Grantee and the Grantee’s beneficiaries, executors, administrators and the person(s) to whom the Restricted Share Units may be transferred by will or the laws of descent or distribution.

17. Severability. The invalidity or unenforceability of any provision of the Plan or this Agreement shall not affect the validity or enforceability of any other provision of the Plan or this Agreement, and each provision of the Plan and this Agreement shall be severable and enforceable to the extent permitted by law.

18. Discretionary Nature of Plan. The Plan is discretionary and may be amended, cancelled or terminated by the Company at any time, in its discretion. The grant of the Restricted Share Units in this Agreement does not create any contractual right or other right to receive any Restricted Share Units or other Awards in the future. Future Awards, if any, shall be at the sole discretion of the Company. Any amendment, modification, or termination of the Plan shall not constitute a change or impairment of the terms and conditions of the Grantee’s employment with the Company.

19. Amendment. The Committee has the right to amend, alter, suspend, discontinue or cancel the Restricted Stock Units, prospectively or retroactively; provided, that, no such amendment shall adversely affect the Grantee’s material rights under this Agreement without the Grantee’s consent.

20. No Impact on Other Benefits. The value of the Grantee’s Restricted Share Units is not part of his normal or expected compensation for purposes of calculating any severance, retirement, welfare, insurance or similar employee benefit.

21. Counterparts. This Agreement may be executed in counterparts, each of which shall be deemed an original but all of which together shall constitute one and the same instrument. Counterpart signature pages to this Agreement transmitted by facsimile transmission, by electronic mail in portable document format (.pdf), or by any other electronic means intended to preserve the original graphic and pictorial appearance of a document, shall have the same effect as physical delivery of the paper document bearing an original signature.

22. Acceptance. The Grantee hereby acknowledges receipt of a copy of the Plan and this Agreement. The Grantee has read and understands the terms and provisions thereof, and accepts the Restricted Share Units subject to all of the terms and conditions of the Plan and this Agreement. The Grantee acknowledges that there may be adverse tax consequences upon the grant, vesting, or settlement of the Restricted Share Units or disposition of the shares and that the Grantee has been advised to consult a tax advisor prior to such grant, vesting or disposition.

[SIGNATURE PAGE FOLLOWS]

IN WITNESS WHEREOF, the parties

hereto have executed this Agreement as of the date first above written.

| |

COMPANY: |

| |

|

| |

GUARDFORCE AI CO., LIMITED |

| |

|

| |

By: |

|

| |

|

Name: |

Lei Wang |

| |

|

Title: |

Chief Executive Officer |

| |

Address: |

|

| |

|

|

| |

|

|

| |

|

|

| |

GRANTEE: |

| |

|

| |

|

| |

(Signature) |

| |

|

| |

|

| |

(Name) |

| |

|

| |

Address: |

|

| |

|

|

| |

|

|

| |

|

|

| |

SSN: |

|

Exhibit 99.1

Guardforce AI Appoints Yuting Zuo as Chief Financial Officer

New York, NY/ January 17, 2024 / Guardforce

AI Co., Limited (“Guardforce AI” or the “Company”) (NASDAQ: GFAI, GFAIW), an integrated security, AI and Robot-as-a-Service

(RaaS) provider, announced the appointment of Ms. Yuting (Catherine) Zuo as Chief Financial Officer, effective immediately. Additionally,

the Company announced that Mr. Yuheng (Brian) Ma has resigned from his position as Chief Financial Officer to pursue other interests.

The resignation of Mr. Ma was not the result of any disagreement with the Company on any matter relating to its operation, policies (including

accounting or financial policies) or practices.

Ms. Zuo has over a decade of experience in corporate

finance, accounting, SEC reporting and working with U.S.-listed companies. Ms. Zuo has served in a financial reporting and investment

position, directly reporting to the CEO and CFO of Aurora Mobile Limited (Nasdaq: JG), a leading mobile big data solutions company in

China. In this role she oversaw financial reporting and accounting operations, investor relations and led merger and acquisition activities.

Previously, she was the corporate accounting manager at Farmers Business Network, a farmer-to-farmer network and e-commerce platform,

based in California. Prior to that, Ms. Zuo served as an auditor at PricewaterhouseCoopers and at Ernest&Young in the U.S. Ms. Zuo

holds a bachelor’s degree in accounting and finance from the University of Richmond and also completed an undergraduate program

in Finance at the University of Hong Kong in 2013. She is a certified public accountant.

Lei (Olivia) Wang, Chairwoman and Chief Executive

Officer of Guardforce AI, states, “We are excited to welcome Catherine to our leadership team. Her diligent and serious approach

to financial management, and strong background in regulatory matters and capital markets, will be a strong asset for our company’s development

and corporate governance. Her breadth of experience in corporate finance and M&A will be invaluable as we execute our growth strategy

and expand into new business lines within AI and robotics. Importantly, as we accelerate activities around our AI business, Catherine

brings tremendous energy and relevant expertise to help drive the development of this business. We would also like to thank Brian for

his service and wish him success in his future endeavors.”

About Guardforce AI Co., Ltd.

Guardforce AI Co., Ltd. (NASDAQ: GFAI, GFAIW)

is a global security solutions provider, building on its legacy secured logistic business, while expanding and transforming it into an

integrated AI and Robot-as-a-Service (RaaS) business. With more than 40 years of professional experience and a strong customer foundation,

Guardforce AI is developing RaaS solutions that improve operational efficiency, quickly establishing its presence in the Asia Pacific

region, while expanding globally. For more information, visit www.guardforceai.com

Twitter: @Guardforceai

Safe Harbor Statement

This press release contains statements that

do not relate to historical facts but are “forward-looking statements” within the meaning of the safe harbor provisions of the

U.S. Private Securities Litigation Reform Act of 1995. These statements can generally (although not always) be identified by their use

of terms and phrases such as anticipate, appear, believe, continue, could, estimate, expect, indicate, intend, may, plan, possible, predict,

project, pursue, will, would and other similar terms and phrases, as well as the use of the future tense. Forward-looking statements are

neither historical facts nor assurances of future performance. Instead, they are based only on current beliefs, expectations and assumptions

regarding the future of the business of the Company, future plans and strategies, projections, anticipated events and trends, the economy

and other future conditions. Because forward-looking statements relate to the future, they are subject to inherent uncertainties, risks

and changes in circumstances that are difficult to predict and many of which are outside of our control, including the risks described

in our registration statements and reports under the heading “Risk Factors” as filed with the Securities and Exchange Commission.

Actual results and financial condition may differ materially from those indicated in the forward-looking statements. Therefore, you should

not rely on any of these forward-looking statements. Forward-looking statements in this press release speak only as of the date hereof.

Unless otherwise required by law, we undertake no obligation to publicly update or revise these forward-looking statements, whether because

of new information, future events or otherwise.

Investor Relations:

David Waldman or Natalya Rudman

Crescendo Communications, LLC

Email: gfai@crescendo-ir.com

Tel: 212-671-1020

Guardforce AI Corporate Communications

Hu Yu

Email: yu.hu@guardforceai.com

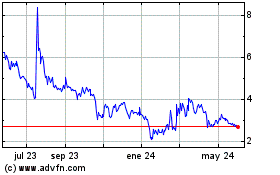

Guardforce AI (NASDAQ:GFAI)

Gráfica de Acción Histórica

De Nov 2024 a Dic 2024

Guardforce AI (NASDAQ:GFAI)

Gráfica de Acción Histórica

De Dic 2023 a Dic 2024