Knightscope Announces Proposed Public Offering

21 Noviembre 2024 - 3:15PM

Business Wire

Knightscope, Inc. [Nasdaq: KSCP] (“Knightscope” or the

“Company”), an innovator in robotics and artificial intelligence

(“AI”) technologies focused on public safety, today announces that

it is proposing to offer and sell, subject to market conditions,

shares of its Class A common stock (or pre-funded warrants in lieu

thereof) in an underwritten public offering. Knightscope expects to

grant the underwriter a 30-day option to purchase up to an

additional 15% of the number of shares of Class A common stock and

pre-funded warrants to be offered in this public offering on the

same terms and conditions. The offering is subject to market and

other conditions, and there can be no assurance as to whether or

when the offering may be completed, or as to the actual size or

terms of the offering.

Knightscope intends to use the net proceeds from the offering

for general corporate purposes, including working capital.

Titan Partners Group, a division of American Capital Partners,

is acting as sole bookrunner for this offering.

The securities described above will be offered pursuant to a

shelf registration statement on Form S-3 (File No. 333-269493),

which was previously filed with the Securities and Exchange

Commission (“SEC”) and became effective on February 8, 2023. A

preliminary prospectus supplement and accompanying base prospectus

relating to and describing the terms of the offering will be filed

with the SEC and will be available on the SEC’s website located at

http://www.sec.gov, copies of which may be obtained, when

available, for free by contacting Titan Partners Group LLC, a

division of American Capital Partners, LLC, 4 World Trade Center,

29th Floor, New York, New York 10007, by phone at (929) 833-1246 or

by email at prospectus@titanpartnersgrp.com. Before investing in

this offering, interested parties should read in their entirety the

preliminary prospectus supplement and the accompanying base

prospectus and the other documents that the Company has filed with

the SEC that are incorporated by reference into such preliminary

prospectus supplement and the accompanying base prospectus, which

provide more information about the Company and such offering. The

final terms of the offering will be disclosed in a final prospectus

supplement to be filed with the SEC.

This offering will be made only by means of a prospectus. This

press release shall not constitute an offer to sell or the

solicitation of an offer to buy any of the securities described

herein, nor shall there be any sale of these securities in any

state or other jurisdiction in which such offer, solicitation or

sale would be unlawful prior to the registration or qualification

under the securities laws of any such state or other

jurisdiction.

About Knightscope

Knightscope builds cutting-edge technologies to improve public

safety, and our long-term ambition is to make the United States of

America the safest country in the world. Learn more about us at

www.knightscope.com.

Forward-Looking Statements

This press release contains “forward-looking statements” within

the meaning of the Private Securities Litigation Reform Act of

1995. Such forward-looking statements can be identified by the use

of words such as “should,” “may,” “intends,” “anticipates,”

“believes,” “estimates,” “projects,” “forecasts,” “expects,”

“plans,” “proposes” and similar expressions. Forward-looking

statements contained in this press release and other communications

include, but are not limited to, statements about the Company’s

goals, profitability, growth, prospects, reduction of expenses, and

outlook. Although Knightscope believes that the expectations

reflected in these forward-looking statements are based on

reasonable assumptions, there are a number of risks, uncertainties

and other important factors that could cause actual results to

differ materially from such forward-looking statements, including

the factors discussed under the heading “Risk Factors” in

Knightscope’s Annual Report on Form 10-K for the year ended

December 31, 2023, as updated by its other filings with the

Securities and Exchange Commission. Forward-looking statements

speak only as of the date of the document in which they are

contained, and Knightscope does not undertake any duty to update

any forward-looking statements, except as may be required by

law.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20241121412208/en/

Public Relations: Stacy Stephens Knightscope,

Inc. (650) 924-1025

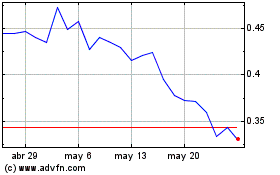

Knightscope (NASDAQ:KSCP)

Gráfica de Acción Histórica

De Oct 2024 a Nov 2024

Knightscope (NASDAQ:KSCP)

Gráfica de Acción Histórica

De Nov 2023 a Nov 2024