Knightscope Announces Pricing of $12.1 Million Public Offering

21 Noviembre 2024 - 7:22PM

Business Wire

Knightscope, Inc. [Nasdaq: KSCP] (“Knightscope” or the

“Company”), an innovator in robotics and artificial intelligence

(“AI”) technologies focused on public safety, today announces the

pricing of an underwritten public offering of 1,210,000 shares of

its Class A common stock (or pre-funded warrants in lieu thereof)

at a public offering price of $10.00 per share. The pre-funded

warrants will be immediately exercisable and may be exercised at

any time until all of the pre-funded warrants are exercised in

full. The purchase price of each pre-funded warrant sold in the

offering will be equal to the price at which a share of common

stock is sold in the offering, minus $0.001, and the exercise price

of each pre-funded warrant will equal $0.001 per share. In

connection with the offering, Knightscope has granted the

underwriter a 30-day option to purchase an additional 181,500

shares of Class A common stock (or pre-funded warrants) from the

Company at the public offering price, less underwriting discounts

and commissions. The offering is expected to close on or about

November 25, 2024, subject to customary closing conditions.

The gross proceeds of the offering are expected to be $12.1

million, excluding the exercise of the underwriter’s option, if

any, of approximately $1.8 million, and excluding underwriting

discounts and commissions and other offering-related expenses. The

Company intends to use the net proceeds from the offering for

general corporate purposes, including working capital.

Titan Partners Group, a division of American Capital Partners,

is acting as sole bookrunner for the offering.

The securities described above are being offered pursuant to a

shelf registration statement on Form S-3 (File No. 333-269493),

which was previously filed with the Securities and Exchange

Commission (“SEC”) and became effective on February 8, 2023. A

preliminary prospectus supplement and accompanying base prospectus

relating to and describing the terms of the offering has been filed

with the SEC and is available on the SEC’s website located at

http://www.sec.gov, copies of which may be obtained, for free by

contacting Titan Partners Group LLC, a division of American Capital

Partners, LLC, 4 World Trade Center, 29th Floor, New York, New York

10007, by phone at (929) 833-1246 or by email at

prospectus@titanpartnersgrp.com. Before investing in this offering,

interested parties should read in their entirety the preliminary

prospectus supplement and the accompanying base prospectus and the

other documents that the Company has filed with the SEC that are

incorporated by reference into such preliminary prospectus

supplement and the accompanying base prospectus, which provide more

information about the Company and such offering. The final terms of

the offering will be disclosed in a final prospectus supplement to

be filed with the SEC.

This offering is being made only by means of a prospectus. This

press release shall not constitute an offer to sell or the

solicitation of an offer to buy any of the securities described

herein, nor shall there be any sale of these securities in any

state or other jurisdiction in which such offer, solicitation or

sale would be unlawful prior to the registration or qualification

under the securities laws of any such state or other

jurisdiction.

About Knightscope

Knightscope builds cutting-edge technologies to improve public

safety, and our long-term ambition is to make the United States of

America the safest country in the world. Learn more about us at

www.knightscope.com.

Forward-Looking Statements

This press release contains “forward-looking statements” within

the meaning of the Private Securities Litigation Reform Act of

1995. Such forward-looking statements can be identified by the use

of words such as “should,” “may,” “intends,” “anticipates,”

“believes,” “estimates,” “projects,” “forecasts,” “expects,”

“plans,” “proposes” and similar expressions. Forward-looking

statements contained in this press release and other communications

include, but are not limited to, statements about the Company’s

goals, profitability, growth, prospects, reduction of expenses, and

outlook. Although Knightscope believes that the expectations

reflected in these forward-looking statements are based on

reasonable assumptions, there are a number of risks, uncertainties

and other important factors that could cause actual results to

differ materially from such forward-looking statements, including

the factors discussed under the heading “Risk Factors” in

Knightscope’s Annual Report on Form 10-K for the year ended

December 31, 2023, as updated by its other filings with the

Securities and Exchange Commission. Forward-looking statements

speak only as of the date of the document in which they are

contained, and Knightscope does not undertake any duty to update

any forward-looking statements, except as may be required by

law.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20241121012377/en/

Public Relations: Stacy Stephens Knightscope,

Inc. (650) 924-1025

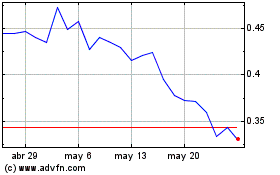

Knightscope (NASDAQ:KSCP)

Gráfica de Acción Histórica

De Oct 2024 a Nov 2024

Knightscope (NASDAQ:KSCP)

Gráfica de Acción Histórica

De Nov 2023 a Nov 2024