LifeWallet Announces Reverse Stock Split to Regain Compliance with Nasdaq’s Minimum Bid Price Requirement

03 Octubre 2023 - 3:16PM

MSP Recovery, Inc. d/b/a LifeWallet (NASDAQ: LIFW) ("LifeWallet,"

or the "Company"), a Medicare, Medicaid, commercial, and secondary

payer reimbursement recovery and technology leader, today announced

that it will effect a reverse stock split of its Class A common

stock at a reverse stock split ratio of 1-for-25, effective at the

close of trading on October 12, 2023, in order to regain compliance

with the minimum $1.00 bid price per share requirement of Nasdaq’s

Marketplace Rule 5450(a)(1).

LifeWallet’s Common Stock will continue to trade on the Nasdaq

Global Market (“Nasdaq”) under the symbol “LIFW” and will begin

trading on a split-adjusted basis when the Nasdaq opens on October

13, 2023 (“Effective Time”). The new CUSIP number for the Common

Stock following the reverse split will be: 553745-20-9.

The Company’s stockholders previously approved the reverse stock

split and granted the Company’s board of directors the authority to

determine the final reverse stock split ratio and when to proceed

with the reverse stock split. The Company has filed an amendment to

its Second Amended and Restated Certificate of Incorporation to

effect the reverse stock split at the ratio of 1-for-25 as of the

Effective Time.

As a result of the reverse split, every 25 shares of the

Company's issued and outstanding Common Stock will automatically be

converted into one share of issued and outstanding Common Stock.

The Company’s shares will begin trading on a split-adjusted basis

on the Nasdaq Capital Market commencing upon market open on October

13, 2023. Immediately after the reverse split becomes effective,

there will be approximately 13.3 million shares of Class A common

stock issued and outstanding.

Forward-Looking Statements

This press release includes “forward-looking statements” within

the meaning of that term in Section 27A of the Securities Act of

1933, as amended and Section 21E of the Securities Exchange Act of

1934, as amended, and are made in reliance upon such acts and the

“safe harbor” provisions of the Private Securities Litigation

Reform Act of 1995. The Company’s actual results may differ from

its expectations, estimates and projections and consequently, you

should not rely on these forward-looking statements as predictions

of future events. These forward statements are often identified by

words such as “expect,” “estimate,” “project,” “budget,”

“forecast,” “anticipate,” “intend,” “plan,” “may,” “will,” “could,”

“should,” “believes,” “predicts,” “potential,” “continue,” and

similar expressions. These forward-looking statements include,

without limitation, (i) the impact of the reverse stock split on

the trading market for the Company’s common stock and the Company’s

warrants, including the trading price, liquidity, trading volume,

volatility and marketability of the common stock and the Company’s

warrants after the reverse stock split; (ii) public perception of

the reverse stock split in light of the history of reverse stock

splits for other companies and the potential impacts on the trading

market or price of the common stock and the Company’s warrants;

(iii) the likelihood that the reverse stock split will result in

any permanent increase in the trading price per share of common

stock or price per warrant; and (iv) whether or not the reverse

stock split will cure any deficiency with respect to its under, and

allow the Company to regain compliance with, Nasdaq’s Marketplace

Rule 5450(a)(1). These forward-looking statements involve

significant risks and uncertainties that could cause the actual

results to differ materially from the expected results. Most of

these factors are outside the Company’s control and are difficult

to predict. Factors that may cause such differences include, but

are not limited to: (1) the benefits of the Business Combination

(as defined in the Company’s Annual Report on Form 10-K); (2) the

Company’s ability to continue as a going concern; (3) the future

financial performance of the Company; (4) changes in the market for

the Company’s services; (5) the Company’s ability to successfully

defend litigation; (6) the inherent uncertainty surrounding

settlement negotiations and/or litigation, including with respect

to both the amount and timing of any such results; (7) expansion

plans and opportunities; (8) the Company’s ability to implement its

corporate strategy and the impact of such strategy on its future

operations and financial and operational results; (9) the Company’s

strategic advantages and the impact that those advantages will have

on future financial and operational results; (10) changes in

business, market, financial, political, and legal conditions; (11)

the impact of various interest rate environments on the Company’s

future financial results of operations; (12) the Company’s

evaluation of competition in its markets and its relative position;

(13) the Company’s ability to successfully recover proceeds related

to the claims it owns or services; (14) the Company’s accounting

policies; (15) upgrading and maintain information technology

systems; (16) macroeconomic conditions that may affect the

Company’s business and the healthcare data and health claims

recovery industry in general; (17) political and geopolitical

conditions that may affect the Company’s business and the

healthcare data and health claims recovery industry in general; and

(18) other risks and uncertainties indicated from time to time in

the Company’s filings with the SEC, including those under “Risk

Factors” in the Company’s Annual Report on Form 10-K and its

subsequent filings with the SEC. There may be additional risks that

we consider immaterial or which are unknown, and it is not possible

to predict or identify all such risks. The Company cautions that

the foregoing list of factors is not exclusive. The Company

cautions readers not to place undue reliance upon any

forward-looking statements, which speak only as of the date made.

The Company does not undertake or accept any obligation or

undertaking to release publicly any updates or revisions to any

forward-looking statements to reflect any change in its

expectations or any change in events, conditions or circumstances

on which any such statement is based.

About LifeWalletFounded in 2014 as MSP

Recovery, LifeWallet has become a Medicare, Medicaid, commercial,

and secondary payer reimbursement recovery leader, disrupting the

antiquated healthcare reimbursement system with data-driven

solutions to secure recoveries from responsible parties. LifeWallet

provides comprehensive solutions for multiple industries including

healthcare, legal, education, and sports NIL, while innovating

technologies to help save lives. For more information, visit:

lifewallet.com

Media and Investors:

ICR, Inc.

MSP@icrinc.com

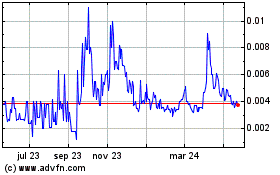

MSP Recovery (NASDAQ:LIFWW)

Gráfica de Acción Histórica

De Nov 2024 a Dic 2024

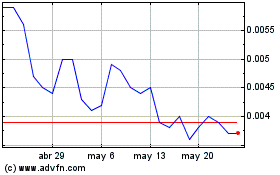

MSP Recovery (NASDAQ:LIFWW)

Gráfica de Acción Histórica

De Dic 2023 a Dic 2024