LifeWallet Announces Third Quarter 2023 Financial Results

14 Noviembre 2023 - 6:50PM

MSP Recovery, Inc. d/b/a LifeWallet (NASDAQ: LIFW) ("LifeWallet,"

or the "Company"), a Medicare, Medicaid, commercial, and secondary

payer reimbursement recovery and technology leader, announced it

has filed its quarterly report on Form 10-Q for the fiscal quarter

ended September 30, 2023.

Recent Highlights

- LifeWallet

continues to execute and advance its business strategy as the Paid

Value of Potentially Recoverable Claims (“PVPRC”) increased by

about $100 million for a total of $91.5 billion as of September 30,

2023.

- The Company

continues to make progress in its recovery efforts, which include

ongoing litigation. The Company has negotiation sessions scheduled

with auto insurers during Q4 2023 and Q1 2024 to discuss the

settlement of claims owned by the Company. These negotiations

and litigation encompass years of data matching with auto insurers.

Recoveries are dependent on the completion of litigation or

negotiated settlements, the timing of which can be subject to the

risk of delays associated with litigation or settlement. Further,

the Company continues to make progress in the data matching process

associated with settlement negotiations, whereby primary payer

insurers reconcile what they owe through detailed data

exchanges.

- The results for

this quarter are not significant with respect to the total amount

recovered; therefore, the recovery multiple should not be

considered indicative of future results. The overall recovery

multiple for the nine months ended September 30, 2023 is 1.53x the

Paid Amount.

- For the three

months ended September 30, 2023 the Company had an Operating loss

of $136.7 million and an adjusted operating loss of $13.8 million.

The adjusted operating loss excludes non-cash items such as claims

amortization expenses and shared-based compensation.

- For the nine

months ended September 30, 2023 the Company had an operating loss

of $417.8 million and an adjusted operating loss of $55.5 million.

The adjusted operating loss excludes non-cash items such as claims

amortization expenses, paid-in-kind interest, shared-based

compensation, and allowance for credit losses.

- On November 13,

2023, the Company entered into the MTA Amendment No. 2 and

Amendment to the Amended and Restated Security Agreement, with

Virage Capital Management, which extended the maturity date for the

payment obligations to Virage to December 31, 2024.

- On November 13,

2023, the Company entered into an amended and restated promissory

note with Nomura, which extended the maturity date for the Nomura

note to December 31, 2024.

- On November 14,

2023, the Company entered into a $250 million standby equity

purchase agreement with Yorkville, which replaced the existing

Yorkville committed equity facility and which includes a

pre-advancement in the amount of $5 million upon entry into the

facility, and an additional $10 million pre-advancement upon

achievement of certain milestones related to the

facility.

- The Company has reduced its

operating costs and will continue to do so. These cost reductions

do not impact the systems the Company has already created to

support recovery efforts of the claims owned by the Company and

other resources available to third parties.

Third Quarter 2023 Financial Highlights

-

Revenue: Total revenue for the third quarter of

2023 was $440,000 and $7 million for the nine months ended

September 30, 2023.

-

Operating loss: Operating loss for the third

quarter of 2023 was $136.7 million, compared with $125.2 million

during the third quarter of 2022. Adjusted operating loss for the

third quarter of 2023 was $13.8 million, excluding non-cash claims

amortization expense of $121 million and shared-based compensation

of $1.9 million.

- Net

loss: Net loss for the third quarter of 2023 was $224.2

million and $19.8 million to controlling members, or net loss per

share of $1.56 per share, based on approximately 12.7 million

weighted average shares outstanding. Adjusted net loss for the

third quarter of 2023 was $13.4 million, excluding the non-cash

item noted above, change in fair value of warrant and derivative

liabilities of $348 thousand, and $88.3 million of non-cash

expenses related to paid in kind interest.

-

Liquidity: As of September 30, 2023, cash and cash

equivalents were $6.7 million. The Company announced on March 29,

2023, it entered into the Working Capital Credit Agreement

consisting of a commitment to fund up to $48 million in proceeds, a

portion of which was funded as of March 31, 2023. The Company has

potential additional capital resources, which include the Yorkville

Purchase Agreement. In addition, the Investment Capacity Agreement

remains in effect between the Company and Virage Capital

Management, LP, and up to an additional $250 million from the

Prudent Sale; however, it’s uncertain if or when the Company would

transact on these agreements.

Assigned Recovery Rights Claims Paid and

Billed Value

The table below outlines the Company's growth in

claims data received in the most recent periods. The amounts

represent data received from current and new assignors:

| |

|

|

| |

Nine months ended September 30, 2023 |

|

Year EndedDecember 31, 2022 |

|

Year EndedDecember 31, 2021 |

|

Year EndedDecember 31, 2020 |

|

| $ in

billions |

|

|

|

|

|

|

|

|

|

Paid Amount |

$ |

381.1 |

|

$ |

374.8 |

|

$ |

364.4 |

|

$ |

58.4 |

|

| Paid Value of Potentially

Recoverable Claims |

|

91.5 |

|

|

89.6 |

|

|

86.6 |

|

|

14.7 |

|

| Billed Value of Potentially

Recoverable Claims |

|

387.1 |

|

|

377.8 |

|

|

363.2 |

|

|

52.3 |

|

| Recovery Multiple |

N/A(1) |

|

N/A(1) |

|

N/A(1) |

|

N/A(1) |

|

| Penetration Status of

Portfolio |

|

86.6 |

% |

|

85.8 |

% |

|

75.6 |

% |

N/A |

|

- During the nine

months ended September 30, 2023, the Company has received

total recoveries of $6.1 million with a recovery multiple of 1.53x.

However, the settlement amounts do not provide a large enough

sample to be statistically significant, and are therefore not shown

in the table.

- On August 10, 2022,

the United States Court of Appeals, Eleventh Circuit held that a

four-year statute of limitations period applies to certain claims

brought under the Medicare Secondary Payer Act’s private cause of

action, and that the limitations period begins to run on the date

that the cause of action accrued. This opinion may render certain

Claims held by the Company unrecoverable and may substantially

reduce PVPRC and BVPRC as calculated. As the Company’s cases were

filed at different times and in various jurisdictions, and prior to

data matching with a defendant the Company is not able to

accurately calculate the entirety of damages specific to a given

defendant, the Company cannot calculate with certainty the impact

of this ruling at this time. However, the Company has deployed

several legal strategies (including but not limited to seeking to

amend existing lawsuits in a manner that could allow claims to

relate back to the filing date as well as asserting tolling

arguments based on theories of fraudulent concealment) that would

apply to tolling the applicable limitations period and minimizing

any material effect on the overall collectability of its claim

rights. In addition, the Eleventh Circuit decision applies only to

district courts in the Eleventh Circuit. Many courts in other

jurisdictions have applied other statutes of limitations to the

private cause of action, including borrowing the three-year statute

of limitations applicable to the government's cause of action; and

borrowing from the False Claims Act's six-year period. The most

recent decision on the issue from the District Court of

Massachusetts, for example, applies the same statute of limitations

as Eleventh Circuit, but expressly disagrees with the Eleventh

Circuit’s application of the “accrual” rule and instead adopted the

notice-based trigger that the company has always argued should

apply. This would mean that the limitations period for unreported

claims has not even begun to accrue. This is a complex legal issue

that will continue to evolve in jurisdictions across the country.

Nevertheless, if the application of the statute of limitations as

determined by the Eleventh Circuit was applied to all Claims

assigned to us, the Company estimates that the effect would be a

reduction of PVPRC by approximately $8.9 billion. As set forth in

the Company’s Risk Factors, PVPRC is based on a variety of factors.

As such, this estimate is subject to change based on the variety of

legal claims being litigated and statute of limitations tolling

theories that apply.

- Total Paid Amount

of owned claims has increased to $381.1 billion, as of September

30, 2023, up $6.3 billion or 1.7% from $374.8 billion as of

December 31, 2022. This figure represents the amount that the

Company’s clients/assignors have paid for in medical bills

(including capitation payments).

- Paid Value of

Potential Recoverable Claims grew to $91.5 billion, as of September

30, 2023, up $1.9 billion or 2.1% from $89.6 billion as of December

31, 2022. This figure represents the amounts LifeWallet estimates

are potentially recoverable as identified by LifeWallet

algorithms.

Financial Outlook

Recoveries Guidance: Recoveries

are dependent on the completion of litigation and the negotiation

of settlements, which are inherently uncertain and are subject to

risk of delay and litigation outcomes. As a result, the

Company will not provide future guidance on recoveries that are

dependent on litigation or subrogation.

Additional information regarding the non-GAAP

financial measures discussed in this release, including an

explanation of these measures and how each is calculated, is

included below under the heading “Non-GAAP Financial Measures.” A

reconciliation of GAAP to non-GAAP financial measures has also been

provided in the financial tables included below.

|

MSP RECOVERY, INC. and SubsidiariesCondensed

Consolidated Balance Sheets(Unaudited) |

| |

September 30, |

|

|

December 31, |

|

| (In thousands except per share

amounts) |

2023 |

|

|

2022 |

|

| ASSETS |

|

|

|

|

|

| Current

assets: |

|

|

|

|

|

|

Cash and cash equivalents |

$ |

6,659 |

|

|

$ |

3,661 |

|

|

Restricted cash |

|

— |

|

|

|

11,420 |

|

|

Accounts receivable |

|

706 |

|

|

|

6,195 |

|

|

Affiliate receivable (1) |

|

831 |

|

|

|

2,425 |

|

|

Prepaid expenses and other current assets (1) |

|

14,874 |

|

|

|

27,656 |

|

|

Total current assets |

|

23,070 |

|

|

|

51,357 |

|

|

Property, plant and equipment, net |

|

4,890 |

|

|

|

3,432 |

|

|

Intangible assets, net (2) |

|

3,253,707 |

|

|

|

3,363,156 |

|

|

Right-of-use assets |

|

368 |

|

|

|

— |

|

|

Total assets |

$ |

3,282,035 |

|

|

$ |

3,417,945 |

|

| |

|

|

|

|

|

| LIABILITIES AND

EQUITY |

|

|

|

|

|

| Current

liabilities: |

|

|

|

|

|

|

Accounts payable |

$ |

6,643 |

|

|

$ |

8,422 |

|

|

Affiliate payable (1) |

|

19,822 |

|

|

|

19,822 |

|

|

Commission payable |

|

829 |

|

|

|

545 |

|

|

Derivative liability |

|

— |

|

|

|

9,613 |

|

|

Warrant liability |

|

662 |

|

|

|

5,311 |

|

|

Other current liabilities |

|

14,588 |

|

|

|

72,002 |

|

|

Total current liabilities |

|

42,544 |

|

|

|

115,715 |

|

|

Guaranty obligation (1) |

|

900,455 |

|

|

|

787,945 |

|

|

Claims financing obligation and notes payable (1) |

|

513,450 |

|

|

|

198,489 |

|

|

Lease liabilities |

|

264 |

|

|

|

— |

|

|

Loan from related parties (1) |

|

130,709 |

|

|

|

125,759 |

|

|

Interest payable (1) |

|

50,951 |

|

|

|

2,765 |

|

|

Total liabilities |

$ |

1,638,373 |

|

|

$ |

1,230,673 |

|

|

Commitments and contingencies (Note 12) |

|

|

|

|

|

| |

|

|

|

|

|

|

Class A common stock subject to possible redemption, 45,183 shares

at redemption value as of December 31, 2022 (None as of September

30, 2023) |

$ |

— |

|

|

$ |

1,807 |

|

| |

|

|

|

|

|

| Stockholders’ Equity

(Deficit): |

|

|

|

|

|

|

Class A common stock, $0.0001 par value; 5,500,000,000 shares

authorized; 13,799,230 and 2,984,212 issued and outstanding as of

September 30, 2023 and December 31, 2022, respectively |

$ |

1 |

|

|

$ |

- |

|

|

Class V common stock, $0.0001 par value; 130,000,000 shares

authorized; 124,264,645 and 125,919,180 issued and outstanding as

of September 30, 2023 and December 31, 2022, respectively |

|

12 |

|

|

|

13 |

|

|

Additional paid-in capital |

|

347,376 |

|

|

|

137,069 |

|

|

Accumulated deficit |

|

(62,094 |

) |

|

|

(29,203 |

) |

|

Total Stockholders’ Equity (Deficit) |

|

285,295 |

|

|

|

107,879 |

|

|

Non-controlling interest |

|

1,358,367 |

|

|

|

2,077,586 |

|

|

Total equity |

$ |

1,643,662 |

|

|

$ |

2,185,465 |

|

|

Total liabilities and equity |

$ |

3,282,035 |

|

|

$ |

3,417,945 |

|

- As of September 30, 2023 and

December 31, 2022, the total affiliate receivable, affiliate

payable, guaranty obligation and loan from related parties balances

are with related parties. In addition, the prepaid expenses and

other current assets, claims financing obligation and notes

payable, and interest payable includes balances with related

parties. See Note 13, Related Party Transactions, for further

details.

- As of September 30, 2023 and

December 31, 2022, intangible assets, net included $2.0

billion and $2.3 billion, respectively, related to a consolidated

VIE. See Note 9, Variable Interest Entities, for further

details.

The accompanying notes are an integral part of

these unaudited condensed consolidated financial statements.

|

MSP RECOVERY, INC. and SubsidiariesCondensed

Consolidated Statements of Operations (As

Restated)(Unaudited) |

| |

Three months ended

September 30, |

|

|

Nine months ended September 30, |

|

| (In thousands except per share

amounts) |

2023 |

|

|

2022 |

|

|

2023 |

|

|

2022 |

|

| |

|

|

|

As Restated |

|

|

|

|

|

As Restated |

|

|

Claims recovery income |

$ |

440 |

|

|

$ |

2,759 |

|

|

$ |

6,479 |

|

|

$ |

4,225 |

|

| Claims recovery service income

(1) |

|

— |

|

|

|

5,748 |

|

|

|

498 |

|

|

|

17,795 |

|

| Total Claims

Recovery |

$ |

440 |

|

|

$ |

8,507 |

|

|

$ |

6,977 |

|

|

$ |

22,020 |

|

| Operating expenses |

|

|

|

|

|

|

|

|

|

|

|

|

Cost of claim recoveries (2) |

|

574 |

|

|

|

1,198 |

|

|

|

1,972 |

|

|

|

1,906 |

|

|

Claims amortization expense |

|

121,008 |

|

|

|

111,851 |

|

|

|

355,481 |

|

|

|

153,560 |

|

|

General and administrative (3) |

|

6,130 |

|

|

|

6,621 |

|

|

|

20,691 |

|

|

|

17,049 |

|

|

Professional fees |

|

2,466 |

|

|

|

5,904 |

|

|

|

15,611 |

|

|

|

10,973 |

|

|

Professional fees – legal (4) |

|

6,871 |

|

|

|

8,014 |

|

|

|

25,889 |

|

|

|

34,251 |

|

|

Allowance for credit losses |

|

— |

|

|

|

— |

|

|

|

5,000 |

|

|

|

— |

|

|

Depreciation and amortization |

|

85 |

|

|

|

103 |

|

|

|

182 |

|

|

|

254 |

|

|

Total operating expenses |

|

137,134 |

|

|

|

133,691 |

|

|

|

424,826 |

|

|

|

217,993 |

|

|

Operating Loss |

$ |

(136,694 |

) |

|

$ |

(125,184 |

) |

|

$ |

(417,849 |

) |

|

$ |

(195,973 |

) |

| Interest expense (5) |

|

(88,279 |

) |

|

|

(46,180 |

) |

|

|

(204,287 |

) |

|

|

(80,947 |

) |

| Other income, net |

|

408 |

|

|

|

63,138 |

|

|

|

8,697 |

|

|

|

63,175 |

|

| Change in fair value of warrant

and derivative liabilities |

|

348 |

|

|

|

2,670 |

|

|

|

4,247 |

|

|

|

(11,683 |

) |

| Net loss before provision

for income taxes |

$ |

(224,217 |

) |

|

$ |

(105,556 |

) |

|

$ |

(609,192 |

) |

|

$ |

(225,428 |

) |

|

Provision for income tax expense |

|

- |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

| Net loss |

$ |

(224,217 |

) |

|

$ |

(105,556 |

) |

|

$ |

(609,192 |

) |

|

$ |

(225,428 |

) |

|

Less: Net loss attributable to non-controlling members |

|

204,462 |

|

|

|

103,484 |

|

|

|

576,301 |

|

|

|

221,476 |

|

| Net loss attributable to

controlling members |

$ |

(19,755 |

) |

|

$ |

(2,072 |

) |

|

$ |

(32,891 |

) |

|

$ |

(3,952 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Basic and diluted weighted

average shares outstanding, Class A Common Stock |

|

12,703,472 |

|

|

|

2,761,476 |

|

|

|

7,097,032 |

|

|

|

2,125,539 |

|

| Basic and diluted net

loss per share, Class A Common Stock |

$ |

(1.56 |

) |

|

$ |

(0.75 |

) |

|

$ |

(4.63 |

) |

|

$ |

(1.86 |

) |

- For the three and nine months ended

September 30, 2022, claims recovery service income included

$0.0 million and $10.6 million, respectively, of claims

recovery service income from VRM MSP. There was no claims recovery

service income from VRM MSP for the three and nine months ended

September 30, 2023. See Note 13, Related Party Transactions,

for further details.

- For both the three and nine months

ended September 30, 2022, cost of claim recoveries included

$0.3 million of related party expenses. This relates to contingent

legal expenses earned from claims recovery income pursuant to legal

service agreements with the Law Firm. See Note 13, Related Party

Transactions, for further details.

- For the three and nine months ended

September 30, 2022, general and administrative expenses

included $0.2 million and $0.4 million of related party expenses.

See Note 13, Related Party Transactions, for further details. No

such related party expenses were present for the three and nine

months ended September 30, 2023.

- For the three and nine months ended

September 30, 2023 and 2022, Professional Fees—legal included

$4.6 million and $13.5 million, and $4.6 million and $5.0 million,

respectively, of related party expenses related to the Law Firm.

See Note 13, Related Party Transactions, for further details.

- For three and nine months ended

September 30, 2023, interest expense included $67.8 million

and $159.2 million, respectively, related to interest expense due

to VRM. For the three and nine months ended September 30,

2022, interest expense included $33.1 million and $46.5 million,

respectively, related to interest expense due to VRM. See Note 13,

Related Party Transactions, for further details.

The accompanying notes are an integral part of

these unaudited condensed consolidated financial statements.

Non-GAAP Financial Measures

|

MSP RECOVERY, INC. and SubsidiariesNon-GAAP

Reconciliation |

|

| |

Three Months Ended September 30, |

|

|

Nine Months Ended September 30, |

|

| (In thousands) |

2023 |

|

|

2022 |

|

|

2023 |

|

|

2022 |

|

|

GAAP Operating Loss |

$ |

(136,694 |

) |

|

$ |

(125,184 |

) |

|

$ |

(417,849 |

) |

|

$ |

(195,973 |

) |

|

Share-based compensation |

|

1,875 |

|

|

|

— |

|

|

|

1,875 |

|

|

|

20,055 |

|

|

Claims amortization expense |

|

121,008 |

|

|

|

111,851 |

|

|

|

355,481 |

|

|

|

153,560 |

|

|

Allowance for credit losses |

|

— |

|

|

|

— |

|

|

|

5,000 |

|

|

|

— |

|

|

Adjusted operating loss |

$ |

(13,811 |

) |

|

$ |

(13,333 |

) |

|

$ |

(55,493 |

) |

|

$ |

(22,358 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

| GAAP Net

Loss |

$ |

(224,217 |

) |

|

$ |

(105,556 |

) |

|

$ |

(609,192 |

) |

|

$ |

(225,428 |

) |

|

Share-based compensation |

|

1,875 |

|

|

|

— |

|

|

|

1,875 |

|

|

|

20,055 |

|

|

Gain on debt extinguishment |

|

— |

|

|

|

(63,367 |

) |

|

|

— |

|

|

|

(63,367 |

) |

|

Claims amortization expense |

|

121,008 |

|

|

|

111,851 |

|

|

|

355,481 |

|

|

|

153,560 |

|

|

Allowance for credit losses |

|

— |

|

|

|

— |

|

|

|

5,000 |

|

|

|

— |

|

|

Paid-in-kind Interest |

|

88,279 |

|

|

|

46,180 |

|

|

|

204,287 |

|

|

|

80,947 |

|

|

Change in fair value of warrant and derivative liabilities |

|

(348 |

) |

|

|

(2,670 |

) |

|

|

(4,247 |

) |

|

|

11,683 |

|

|

Adjusted net loss |

$ |

(13,403 |

) |

|

$ |

(13,562 |

) |

|

$ |

(46,796 |

) |

|

$ |

(22,550 |

) |

The Company considers “adjusted net loss” and

“adjusted operating loss” as non-GAAP financial measures and

important indicators of performance and useful metrics for

management and investors to evaluate the Company’s ongoing

operating performance on a consistent basis across reporting

periods. The Company believes these measures provide useful

information to investors. Adjusted net loss represents Net loss

adjusted for certain non-cash expenses and adjusted operating loss

items represents Operating loss adjusted for certain non-cash

expenses.

Forward Looking Statements

This press release contains forward-looking

statements within the meaning of the federal securities laws.

Forward-looking statements may generally be identified by the use

of words such as "anticipate," "believe," "expect," "intend,"

"plan" and "will" or, in each case, their negative, or other

variations or comparable terminology. These forward-looking

statements include all matters that are not historical facts,

including for example guidance for 2022 portfolio recovery and

total gross recoverables. By their nature, forward-looking

statements involve risks and uncertainties because they relate to

events and depend on circumstances that may or may not occur in the

future. As a result, these statements are not guarantees of future

performance or results and actual events may differ materially from

those expressed in or suggested by the forward-looking statements.

Any forward-looking statement made by MSP Recovery herein speaks

only as of the date made. New risks and uncertainties come up from

time to time, and it is impossible for the Company to predict or

identify all such events or how they may affect it. the Company has

no obligation, and does not intend, to update any forward-looking

statements after the date hereof, except as required by federal

securities laws. Factors that could cause these differences

include, but are not limited to, the Company’s ability to

capitalize on its assignment agreements and recover monies that

were paid by the assignors; the inherent uncertainty surrounding

settlement negotiations and/or litigation, including with respect

to both the amount and timing of any such results; the success of

the Company's scheduled settlement mediations; the validity of the

assignments of claims to the Company; the ability to successfully

expand the scope of the Company’s claims or obtain new data and

claims from the Company’s existing assignor base or otherwise; the

Company’s ability to innovate and develop new solutions, and

whether those solutions will be adopted by the Company’s existing

and potential assignors; negative publicity concerning healthcare

data analytics and payment accuracy; and those other factors

included in the Company’s Annual Report on Form 10-K, Quarterly

Reports on Form 10-Q and other reports filed by it with the SEC.

These statements constitute the Company's cautionary statements

under the Private Securities Litigation Reform Act of 1995.

About LifeWallet

Founded in 2014 as MSP Recovery, LifeWallet has

become a Medicare, Medicaid, commercial, and secondary payer

reimbursement recovery leader, disrupting the antiquated healthcare

reimbursement system with data-driven solutions to secure

recoveries from responsible parties. LifeWallet provides

comprehensive solutions for multiple industries including

healthcare, legal, education, and sports NIL, while innovating

technologies to help save lives. For more information, visit:

lifewallet.com

CONTACTS

Media

ICR, Inc.

MSP@icrinc.com

Investors

Investors@LifeWallet.com

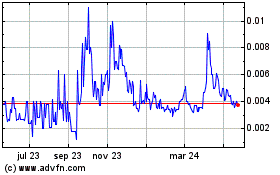

MSP Recovery (NASDAQ:LIFWW)

Gráfica de Acción Histórica

De Nov 2024 a Dic 2024

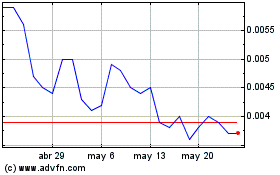

MSP Recovery (NASDAQ:LIFWW)

Gráfica de Acción Histórica

De Dic 2023 a Dic 2024