MSP Recovery, Inc. d/b/a LifeWallet (NASDAQ: LIFW) (“LifeWallet” or

the “Company”) announces it reached a preliminary $2 million

settlement as part of its portfolio of pharmaceutical

litigation cases, while engaging in ongoing settlement negotiations

with other pharmaceutical and medical device manufacturers, as well

as property and casualty (“P&C”) insurers. LifeWallet also

recently entered into an agreement with one of the Company’s

lenders, securing a limited waiver of the Company’s obligation to

pay a promissory note, which is expected to provide additional

liquidity to the Company.

LifeWallet CEO, John H. Ruiz, is confident in the Company’s

continued progress, saying, “Our commitment to discovering waste

and recovering improper healthcare payments will continue to have a

positive widespread impact.” He continues, “By tackling waste

through legal, operational, and technological avenues, LifeWallet

is committed to recovering improperly paid funds and promoting

accountability within the healthcare system, benefitting all

Americans.”

Pharmaceutical Litigation Settlement

On November 21, 2024, LifeWallet reached a preliminary

settlement totaling $2 million, subject to finalizing terms in a

global settlement agreement, against a defendant for alleged

violations of the Racketeer Influenced and Corrupt Organizations

Act (“RICO”), and violation of various state consumer protection

laws and unjust enrichment laws. The terms of the settlement

are a combination of monetary and non-monetary considerations, with

the non-monetary considerations involving LifeWallet obtaining

prescription drug claims data that will assist in identifying and

recovering against other responsible parties, including, but not

limited to, at least twelve other pharmaceutical manufacturers, and

distributors.

Ongoing Settlement Negotiations

As part of LifeWallet’s owned claims portfolio, the Company is

also engaged in ongoing litigation against property and casualty

insurers and other pharmaceutical and medical device manufacturers

based on claims of anti-competitive pricing, RICO, violation of

state consumer protection statutes, and defective medical products

or prescription drugs.

On November 11, 2024, the Company announced two comprehensive

settlements with P&C insurers, totaling more than $5.2 million,

which offer a going-forward process to collaboratively and timely

resolve future claims and share important historical data.

LifeWallet’s exclusive data matching with primary payers is

expected to enhance its claims reconciliation capabilities by

identifying claims owned by LifeWallet that it may have a right to

recover on, benefiting Medicare plans and downstream entities.

These recent P&C insurer settlements follow three other

settlements against P&C insurers earlier this year. Some of

these settlements require the P&C insurers to provide data to

the LifeWallet clearinghouse platform that was designed and created

by LifeWallet and Palantir Technologies, Inc.

The LifeWallet/Palantir clearinghouse is a hybrid between a

statistical analysis system model and one that identifies improper

payments, while also having the capability to provide patients,

providers, and attorneys with an individual's current and past

medical conditions as they relate to improper payments or potential

claims against the world's largest pharmaceutical and medical

device companies.

LifeWallet notes these settlements are not a guarantee that its

portfolio of assigned claims (owed by other Primary Payers) can be

settled with the same or similar terms. The settlement values are a

combination of monetary and non-monetary considerations, with the

non-monetary considerations involving LifeWallet obtaining data on

all the claims that were processed and paid by the P&C

Insurers, and the P&C Insurers' assignment of rights to collect

against other responsible parties. LifeWallet expects this will

enhance its ability to discover liens and recover payments owed

more efficiently than through litigation. It also enables

LifeWallet to pursue a diversified number of entities that failed

to pay liens or collected twice for the same bills, both from the

insurer and LifeWallet's assignor clients.

LifeWallet's Efforts to Discover and Recover Medicare

and Medicaid Waste

The Scope of the Problem

Improper payments by Medicare and Medicaid contribute

significantly to government waste, accounting for billions of

dollars annually.

- In fiscal year 2022, the United States Government

Accountability Office (GAO) reported $247 billion in improper

payments across 82 programs, with approximately 52% attributed to

Medicare and Medicaid1. This statistic was highlighted by Elon

Musk, who is expected to head the newly established Department of

Government Efficiency (DOGE) (x.com/doge), which will function as a

newly created advisory board to President-elect Donald Trump. Musk

commented the above numbers are “just the tip of the iceberg. The

actual fraud and waste in government spending is much higher.”

- With Medicare and Medicaid spending surpassing $1 trillion in

2023,2 estimated waste due to accident-related injuries exceeds

$100 billion.

LifeWallet's Initiatives Align with Reducing Government

Waste

LifeWallet is dedicated to discovering and recovering

substantial improper payments within the Medicare and Medicaid

systems, particularly focusing on the Medicare Advantage program.

These improper payments often result from systemic communication

failures among stakeholders, leading to Medicare erroneously

covering accident-related injuries and failing to recuperate those

funds.

- Litigation Against Improper Payments: In 2024, LifeWallet has

agreed to five settlements against property and casualty insurers,

in aggregate totaling more than $10 million dollars to settle

historical claims of improper payments, as well as obtain data to

pursue claims for additional improper payments and establish a

clearinghouse to efficiently settle future claims with certain

P&C Insurers.

- Additional Claims Acquisition: In October 2024, LifeWallet paid

approximately $2 million dollars to acquire additional Medicare

Secondary Payer (MSP) claims with an overall Paid Amount3 exceeding

$10.6 billion, encompassing over 450,000 Medicare members. This

claims acquisition enhances LifeWallet's ability to identify and

recover improper payments.4

- Technological Enhancements: In 2023, continuing into 2024,

LifeWallet has developed the LifeWallet/Palantir clearinghouse that

connects P&C Insurers to health plans, allowing for elimination

of waste from improper payments made for accident-related

injuries.

While these efforts represent steps toward addressing systemic

issues in Medicare and Medicaid spending, comprehensive reform

requires collaboration among all stakeholders. Individuals expected

to be appointed to President-elect Trump's advisory committee,

called the Department of Government Efficiency (DOGE), are

emphasizing the importance of addressing Medicare waste, advocating

for enhanced oversight and stricter enforcement measures to curb

improper payments. Their efforts align with LifeWallet's continued

mission to reduce waste and improve efficiency in healthcare

spending.

Nomura Limited Waiver of Company's Obligation to

Pay

On November 18, 2024, Company lender, Nomura Securities

International, Inc. ("Nomura"), agreed to a limited waiver of the

Company’s obligation to pay promissory note obligations using the

proceeds of the Standby Equity Purchase Agreement dated November

14, 2023 by and between the Company and YA II PN, Ltd. until

March 31, 2025, and up to an aggregate total of $4 million of

such proceeds that would otherwise be paid to Nomura; provided that

such proceeds be used to fund the operations of the Company. This

waiver is expected to create more liquidity for the Company, to

invest in accelerating healthcare reimbursement recoveries.

Forward Looking Statements

This press release contains forward-looking statements within

the meaning of the federal securities laws. Forward-looking

statements may generally be identified by the use of words such as

“anticipate,” “believe,” “expect,” “intend,” “plan" and “will” or,

in each case, their negative, or other variations or comparable

terminology. These forward-looking statements include all matters

that are not historical facts, including for example statements

regarding potential future settlements. By their nature,

forward-looking statements involve risks and uncertainties because

they relate to events and depend on circumstances that may or may

not occur in the future. As a result, these statements are not

guarantees of future performance or results and actual events may

differ materially from those expressed in or suggested by the

forward-looking statements. Any forward-looking statement made by

the Company herein speaks only as of the date made. New risks and

uncertainties come up from time to time, and it is impossible for

the Company to predict or identify all such events or how they may

affect it. the Company has no obligation, and does not intend, to

update any forward-looking statements after the date hereof, except

as required by federal securities laws. Factors that could cause

these differences include, but are not limited to, the Company’s

ability to capitalize on its assignment agreements and recover

monies that were paid by the assignors; the inherent uncertainty

surrounding settlement negotiations and/or litigation, including

with respect to both the amount and timing of any such results; the

success of the Company's scheduled settlement mediations; the

validity of the assignments of claims to the Company; negative

publicity concerning healthcare data analytics and payment

accuracy; and those other factors included in the Company’s Annual

Report on Form 10-K, Quarterly Reports on Form 10-Q and other

reports filed by it with the SEC. These statements constitute the

Company’s cautionary statements under the Private Securities

Litigation Reform Act of 1995.

About LifeWallet

Founded in 2014 as MSP Recovery, LifeWallet has become a

Medicare, Medicaid, commercial, and secondary payer reimbursement

recovery leader, disrupting the antiquated healthcare reimbursement

system with data-driven solutions to secure recoveries from

responsible parties. LifeWallet provides comprehensive solutions

for multiple industries including healthcare, legal, and sports

NIL. For more information, visit: LIFEWALLET.COM.

CONTACTS:

MediaMedia@lifewallet.com

InvestorsInvestors@LifeWallet.com

1 https://www.gao.gov/products/gao-23-106285 2 https://www.cms.gov/data-research/statistics-trends-and-reports/national-health-expenditure-data/nhe-fact-sheet#:~:text=Medicare%20spending%20grew%205.9%25%20to,21%20percent%20of%20total%20NHE.3

“Paid Amount” (a/k/a Medicare Paid Rate or wholesale price) means

the amount paid to the provider from the health plan or insurer.

This amount varies based on the party making payment. For example,

Medicare typically pays a lower fee for service rate than

commercial insurers. The Paid Amount is derived from the Claims

data we receive from our Assignors. In the limited instances where

the data received lacks a paid value, our team calculates the Paid

Amount with a formula. The formula used provides rates for

outpatient services and is derived from the customary rate at the

95th percentile as it appears from standard industry commercial

rates or, where that data is unavailable, the Billed Amount if

present in the data. These amounts are then adjusted to account for

the customary Medicare adjustment to arrive at the calculated Paid

Amount. Management believes that this formula provides a

conservative estimate for the Medicare paid amount rate, based on

industry studies which show the range of differences between

private insurers and Medicare rates for outpatient services. We

periodically update this formula to enhance the calculated paid

amount where that information is not provided in the data received

from our Assignors. Management believes this measure provides a

useful baseline for potential recoveries, but it is not a measure

of the total amount that may be recovered in respect of potentially

recoverable Claims, which in turn may be influenced by any

applicable potential statutory recoveries such as double damages or

fines. Where we have to extrapolate a Paid Amount to establish

damages, the calculated amount may be contested by opposing

parties. The figures pertaining to Medicare Member Lives as well as

the paid amount were tabulated based on the data provided by health

care plans; these figures may be subject to adjustment upon further

investigation of the paid amounts reflected by the health plans.4

https://investor.lifewallet.com/news-releases/news-release-details/lifewallet-acquires-assignment-additional-msp-claims-overall

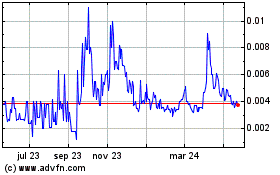

MSP Recovery (NASDAQ:LIFWW)

Gráfica de Acción Histórica

De Nov 2024 a Dic 2024

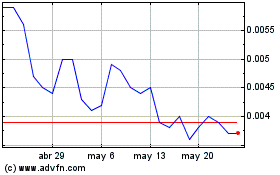

MSP Recovery (NASDAQ:LIFWW)

Gráfica de Acción Histórica

De Dic 2023 a Dic 2024