UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of

the

Securities Exchange Act of 1934

(Amendment No. )

Filed by the Registrant ☒

Filed by a Party other than the Registrant ☐

Check the appropriate box:

| ☐ |

Preliminary Proxy Statement |

| ☐ |

Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| ☐ |

Definitive Proxy Statement |

| ☒ |

Definitive Additional Materials |

| ☐ |

Soliciting Material Pursuant to §240.14a-12 |

MASIMO CORPORATION

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if

other than the Registrant)

| Payment of Filing Fee (Check the appropriate box): |

| |

| ☒ |

No fee required. |

| ☐ |

Fee paid previously with preliminary materials. |

| ☐ |

Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11. |

Persons who are to respond to the collection of information contained

in this form are not required to respond unless the form displays a currently valid OMB control number.

On July 23, 2024, Joe Kiani, the Chief Executive Officer and Chairman

of the Board of Masimo Corporation (“Masimo” or the “Company”), sent the letter below relating to the Company’s

2024 Annual Meeting of Stockholders to certain of the Company’s stockholders:

Dear Shareholder,

Thank you for being an owner of Masimo. I know you are well aware of

the contentious back and forth that continues about Masimo’s future. I can also imagine that after hearing my perspective and those

of independent Board members Bob Chapek and Craig Reynolds compared to Quentin Koffey’s, it would seem we have been discussing two

completely different companies and realities. While Mr. Koffey is new to our story, we have built Masimo for 35 years and done everything

we could to benefit our shareholders, as well as patients and healthcare givers who use our products, during that time. For nearly four

decades and for as long as I remain at Masimo, we have been guided by and will continue to follow the ethical and inspirational principles

proudly listed on our web site and featured in the halls and workspaces of Masimo’s offices.

Mr. Koffey is trying to repaint who I am and who we are. Shame on him

for doing this, but shame on me if I fail to do everything I can to ensure you have the truth. This is precisely why we have sued to correct

the misimpressions and misstatements Mr. Koffey has made about me and Masimo. Please read the complaint. Already through motions, Mr.

Koffey is trying to stop any discovery regarding the facts.

I fear that Mr. Koffey will destroy the innovation at Masimo and greatly

harm both shareholders and patients. This is why I am trying so hard to get the facts to you. I care deeply about our shareholders, the

employees I have worked with for decades and the patients and healthcare workers that we continue to support. I will do everything I can

to prevent Mr. Koffey from further damaging Masimo and its constituents.

I will step aside any time our shareholders or Masimo’s independent

Board no longer want me to lead Masimo. You will have this chance at our AGM, and please know I will respect your decision. I have stayed

as long as I have, down from 100% to less than 10% ownership of Masimo, because I love Masimo, those I work with, and those we support

throughout hospitals around the world.

Every Board and every shareholder election prior to Mr. Koffey’s

arrival has asked me to continue to lead Masimo. I am not a “for hire” CEO. I lead Masimo because I founded Masimo. While

I acknowledge that I have not managed Masimo to satisfy the whims of proxy advisors who have never run a company, I am confident no one

would run Masimo as ethically, effectively and efficiently as I have. I founded Masimo as a garage start up with a second loan I took

out on my condo and grew it to a multi-billion dollar company by following our guiding principles and building a company to last. I work

to attract incredible employees and Board members. I push and participate in the innovation of products our competitors dismiss as impossible.

I work directly with sales, visiting hospitals, our OEM customers, and others about what else we might be able to do to improve patient

care. I believe what I do and how I do it inspires the team to deliver incredible results. But at the end of the day, I hope those who

invest in companies like Masimo vote for board members who know what great businesses should do – make great products and sell them

by recruiting and retaining the best team members; and, do it the most ethical way possible.

In 35 years, with the help of our incredible team, Masimo has made

great products and sold them successfully despite the bullies and monopolists trying to stop us. Through it all, I never took a short

cut nor put my own interests ahead of those of other shareholders. In fact, there are numerous times where I was put to the test. In 2006,

after seven years of hard-fought litigation, we won our patent lawsuit against Nellcor (now part of Medtronic) and obtained an injunction

and damages for their past infringement. As a result, Nellcor wired us $330 million. It just so happened that two months later, all of

the mandatory redemptions of our VC investors were up. One of our early investors implored me to pay the VCs their investment back with

the interest. That investor urged that doing so would be worth over $500 million to me. I refused, because I didn’t think that was

the real deal I had made with those investors. So, we issued a dividend to our shareholders and employees and took Masimo public a year

later. From our IPO, some of our investors made over 1000 times their initial investment. And since our IPO, many of our public investors

have made over 10 times their money.

I continued to place Masimo stakeholders’ interests above mine

again more recently. In 2009, I saw healthcare moving into the home and steered Masimo towards that direction; and a few years ago we

took major action to get us there. Some people implored me to do it on my own so I could own much more than 10%. Instead of doing it on

my own, I tried to build that vision for Masimo. Some of you have made clear that you do not want the consumer vision/business for Masimo,

and therefore I will continue to support a separation per the majority shareholders’ desire. In this process, I have stated publicly

I will not support the Joint Venture separation path without Mr. Koffey’s support, to alleviate the heinous false allegations that

I seek to move assets important to Masimo. These and other despicable false allegations are at the center of our recent lawsuit that seeks

to arm our shareholders with the facts. While we have grown Masimo far faster than most other companies and have built a very profitable

and successful company, we haven’t gotten every decision right. I feel we have made far more good decisions than an occasional bad

one, but it is always my intention to learn and correct any mistake. That said, I have never lied and I have never put myself before my

current shareholders at the time. It upsets me to have a serial activist who so far has been very unsuccessful at his own fund accusing

me of lying and specifically claiming I will intentionally license IP in a way unfair to Masimo. I have defended Masimo’s IP against

Medtronic, Mindray, Philips and Apple at great expense. I would never give Masimo’s IP away. The only reason I would sell a majority

stake of consumer to a JV is if it is a better outcome for shareholders than selling consumer audio alone. My allegiance is to my shareholders,

employees, customers and patients.

We changed the record date of our AGM once at Mr. Koffey’s demand,

and I hope he does not make a second demand, so we can hold our AGM on September 19th. I hope by then, through our lawsuit

in Federal Court, you will get to see Mr. Koffey correct his statements and you will get to know him as the activist that our independent

directors and I have endured over the past two years. With the truth in your hands, we look forward to your vote, however you choose to

cast it.

To good health!

Joe

Masimo’s guiding principles:

Remain faithful to your promises and responsibilities

Thrive on fascination and accomplishment, not power and greed

Make every day as fun as possible

Improve yourself each year

Do what is best for patient care

# # #

Forward-Looking Statements

This communication includes forward-looking statements

as defined in Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended,

in connection with the Private Securities Litigation Reform Act of 1995. These forward-looking statements include, among others, statements

regarding the 2024 Annual Meeting of Stockholders (the “Annual Meeting”) of Masimo Corporation (“Masimo” or the

“Company”), the potential stockholder approval of the Board’s nominees and Masimo’s litigation against Politan

Capital Management LP (“Politan”) and its affiliates (the “Litigation”). These forward-looking statements are

based on current expectations about future events affecting Masimo and are subject to risks and uncertainties, all of which are difficult

to predict and many of which are beyond Masimo’s control and could cause its actual results to differ materially and adversely from

those expressed in its forward-looking statements as a result of various risk factors, including, but not limited to (i) uncertainties

regarding the Litigation, (ii) uncertainties regarding future actions that may be taken by Politan in furtherance of its nomination of

director candidates for election at the Annual Meeting, (iii) the potential cost and management distraction attendant to Politan’s

nomination of director nominees at the Annual Meeting or to the Litigation and (iv) factors discussed in the “Risk Factors”

section of Masimo’s most recent periodic reports filed with the Securities and Exchange Commission (“SEC”), which may

be obtained for free at the SEC’s website at www.sec.gov. Although Masimo believes that the expectations reflected

in its forward-looking statements are reasonable, the Company does not know whether its expectations will prove correct. All forward-looking

statements included in this communication are expressly qualified in their entirety by the foregoing cautionary statements. You are cautioned

not to place undue reliance on these forward-looking statements, which speak only as of today’s date. Masimo does not undertake

any obligation to update, amend or clarify these statements or the “Risk Factors” contained in the Company’s most recent

reports filed with the SEC, whether as a result of new information, future events or otherwise, except as may be required under the applicable

securities laws.

Additional Information Regarding the 2024 Annual Meeting of Stockholders

and Where to Find It

On June

21, 2024, the Company filed a definitive proxy statement containing a form of GOLD proxy card with the SEC in connection with its solicitation

of proxies for the Annual Meeting (the “Original 2024 Proxy Statement”), and anticipates that it will prepare and file a revised

version of the Original 2024 Proxy Statement (the “Revised Proxy Statement”) and mail the Revised Proxy Statement to its stockholders

of record as of the new August 12, 2024 record date for the Annual Meeting. Any votes previously submitted by Masimo stockholders in connection

with the Annual Meeting will not be counted and previous proxies submitted will be disregarded, and therefore, all stockholders will need

to resubmit their votes after the Revised Proxy Statement has been filed and mailed to stockholders as of the new record date, even if

they have previously voted. THE COMPANY’S STOCKHOLDERS ARE STRONGLY ENCOURAGED TO READ THE REVISED PROXY STATEMENT (AND ANY AMENDMENTS

AND SUPPLEMENTS THERETO) AND ACCOMPANYING GOLD PROXY CARD AS THEY WILL CONTAIN IMPORTANT INFORMATION. Stockholders may obtain the Original

2024 Proxy Statement, the Revised Proxy Statement and any amendments or supplements thereto and other documents as and when filed by the

Company with the SEC without charge from the SEC’s website at www.sec.gov.

Certain Information Regarding Participants

The Company,

its directors and certain of its executive officers and employees may be deemed to be participants in connection with the solicitation

of proxies from the Company’s stockholders in connection with the matters to be considered at the Annual Meeting. Information regarding

the direct and indirect interests, by security holdings or otherwise, of the Company’s directors and executive officers in the Company

is included in the Original 2024 Proxy Statement, which can be found through the SEC’s website at https://www.sec.gov/ix?doc=/Archives/edgar/data/0000937556/000121390024053125/ea0206756-05.htm.

Changes to the direct or indirect interests of Masimo’s securities by directors and executive officers are set forth in SEC filings

on a Statement of Change in Ownership on Form 4 filed with the SEC on June 28, 2024, which can be found through the SEC’s website

at https://www.sec.gov/Archives/edgar/data/937556/000093755624000053/xslF345X05/wk-form4_1719606794.xml. Any other changes to the Original

2024 Proxy Statement may be found in any amendments or supplements to the Original 2024 Proxy Statement, including the expected Revised

Proxy Statement, and other documents as and when filed by the Company with the SEC, which can be found through the SEC’s website

at www.sec.gov.

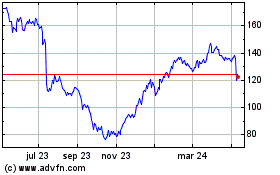

Masimo (NASDAQ:MASI)

Gráfica de Acción Histórica

De Jun 2024 a Jul 2024

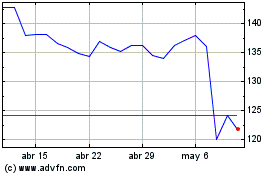

Masimo (NASDAQ:MASI)

Gráfica de Acción Histórica

De Jul 2023 a Jul 2024