Outset Medical, Inc. (Nasdaq: OM) (“Outset” or the “Company”), a

medical technology company pioneering a first-of-its-kind

technology to reduce the cost and complexity of dialysis, today

reported financial results for the second quarter ended June 30,

2024.

“During the quarter, the number of treatments performed each

month on Tablo continued at record levels, as utilization remained

high and gross margin materially expanded as it has each quarter

for more than 3 years,” said Leslie Trigg, Chair and Chief

Executive Officer. “These results reflect the strength and

differentiation of Tablo and the positive impact it is having on

the lives of patients and providers.

“At the same time, new console placements were below our

expectations and will be lower than we originally forecasted for

the year. We are taking clear steps to improve our execution and

grow the business over the long term to bring the benefits of Tablo

to even more providers and dialysis patients.”

Second Quarter 2024 Financial Results

Revenue for the second quarter was $27.4 million compared to

$36.0 million in the second quarter of 2023, driven by a decline in

product revenue to $19.2 million. Service and other revenue was

$8.2 million, an increase of 21.5% compared to $6.7 million in the

second quarter of 2023. Recurring revenue from the sale of Tablo

cartridges and service increased by 24% as compared to the

prior-year period.

Total gross profit was $9.8 million, compared to $7.7 million

for the second quarter of 2023. Total gross margin was 35.7%,

compared to 21.4% in the second quarter of 2023. On a non-GAAP

basis, gross margin improved to 37.3% from 22.5% in the second

quarter of 2023. Product gross profit was $8.7 million, compared to

$7.1 million in the second quarter of 2023. Product gross margin

was 45.1%, compared to 24.3% in the second quarter of 2023. Service

and other gross profit was $1.1 million, compared to $0.6 million

in the second quarter of 2023. Service and other gross margin was

13.6%, compared to 8.7% in the second quarter of 2023.

Operating expenses declined 21% from the prior-year period to

$40.5 million, including research and development (R&D)

expenses of $9.7 million, sales and marketing (S&M) expenses of

$18.1 million, and general and administrative (G&A) expenses of

$12.7 million. This compared to operating expenses of $51.2 million

in the second quarter of 2023, including R&D expenses of $14.9

million, S&M expenses of $25.0 million, and G&A expenses of

$11.3 million.

Excluding stock-based compensation expense and severance and

related charges, net of adjustments to compensation accrual,

non-GAAP operating expenses were $31.2 million, including R&D

expenses of $7.5 million, S&M expenses of $15.5 million, and

G&A expenses of $8.2 million.

Net loss was $34.5 million, or $(0.66) per share, compared to

net loss of $44.0 million, or $(0.90) per share, for the same

period in 2023. On a non-GAAP basis, net loss was $24.7 million, or

$(0.47) per share, compared to non-GAAP net loss of $33.9 million,

or $(0.69) per share for the same period in 2023.

Total cash, including restricted cash, cash equivalents and

short-term investments, was $198.2 million as of June 30, 2024.

Full Year 2024 Financial Guidance

Outset now expects 2024 revenue to be approximately $110

million, revised from a prior range of $145 million to $153

million, and non-GAAP gross margin to be in the low-to-mid 30%

range, revised from prior guidance in the low-30% range for 2024

and exiting the year in the mid-30% range for the fourth

quarter.

Webcast and Conference Call Details

Outset will host a conference call today, August 7, 2024, at

2:00 p.m. PT / 5:00 p.m. ET to discuss its second quarter 2024

financial results. Those interested in listening to the conference

call may do so by registering online. Once registered, participants

will receive dial-in numbers and a unique pin to join the call.

Participants are encouraged to register more than 15 minutes before

the start of the call. A live webcast of the conference call will

be available on the Investor Relations section of the Company's

website at https://investors.outsetmedical.com. The webcast will be

archived on the website following the completion of the call.

Use of Non-GAAP Financial Measures

The Company may report non-GAAP results for gross profit/loss,

gross margin, operating expenses, operating margins, net

income/loss, basic and diluted net income/loss per share, other

income/loss, and cash flows. These non-GAAP financial measures are

in addition to, and not a substitute for, or superior to, financial

measures calculated in accordance with GAAP. As listed in the

itemized reconciliations between GAAP and non-GAAP financial

measures included in this press release, the Company’s GAAP

financial measures include stock-based compensation expense, as

well as severance and related charges net of the reversal of

compensation accruals for impacted employees. Stock-based

compensation is a non-cash expense, and severance and related

charges arise outside the ordinary course of continuing operations

and are not reflective of the Company's current operating

performance. As such, management has excluded the effects of these

items in non-GAAP measures to assist investors in analyzing and

assessing past and future operating performance and

period-to-period comparisons. There are limitations related to the

use of non-GAAP financial measures because they are not prepared in

accordance with GAAP, may exclude significant expenses required by

GAAP to be recognized in the Company’s financial statements, and

may not be comparable to non-GAAP financial measures used by other

companies. The Company encourages investors to carefully consider

its results under GAAP, as well as its supplemental non-GAAP

information and the reconciliation between these presentations, to

more fully understand its business. Reconciliations between GAAP

and non-GAAP results are presented in the Appendix A of this press

release.

Forward-Looking Statements

This press release contains forward-looking statements within

the meaning of Section 27A of the Securities Act of 1933, as

amended, and Section 21E of the Securities Exchange Act of 1934, as

amended. All statements other than statements of historical fact

are forward-looking statements. Forward-looking statements are

based on management’s current assumptions and expectations of

future events and trends, which affect or may affect the Company’s

business, strategy, operations or financial performance, and actual

results and other events may differ materially from those expressed

or implied in such statements due to numerous risks and

uncertainties. Forward-looking statements include, but are not

limited to, statements about the Company’s possible or assumed

future results of operations and financial position, including

expectations regarding projected revenues, gross margin, operating

expenses, capital expenditures, cash burn, cash position,

profitability and outlook; statements regarding the anticipated

impacts and benefits of the Company’s cost reduction actions,

initiatives to optimize the commercial organization and

restructurings; statements regarding the Company’s overall business

strategy, plans and objectives of management; the Company’s

expectations regarding the market sizes and growth potential for

Tablo and the total addressable market opportunities for Tablo;

continued execution of the Company’s initiatives designed to expand

gross margins; the Company’s ability to respond to and resolve any

reports, observations or other actions by the Food and Drug

Administration or other regulators in a timely and effective

manner; as well as the Company’s expectations regarding the impact

of macroeconomic factors on the Company, its customers and

suppliers. Forward-looking statements are inherently subject to

risks and uncertainties, some of which cannot be predicted or

quantified. Factors that could cause actual results or other events

to differ materially from those contemplated in this press release

can be found in the Risk Factors section of the Company’s public

filings with the Securities and Exchange Commission, including its

latest annual and quarterly reports. Because forward-looking

statements are inherently subject to risks and uncertainties, you

should not rely on these forward-looking statements as predictions

of future events. These forward-looking statements speak only as of

their date and, except to the extent required by law, the Company

undertakes no obligation to update these statements, whether as a

result of any new information, future developments or

otherwise.

About Outset Medical, Inc.

Outset is a medical technology company pioneering a

first-of-its-kind technology to reduce the cost and complexity of

dialysis. The Tablo® Hemodialysis System, FDA cleared for use from

the hospital to the home, represents a significant technological

advancement that transforms the dialysis experience for patients

and operationally simplifies it for providers. Tablo serves as a

single enterprise solution that can be utilized across the

continuum of care, allowing dialysis to be delivered anytime,

anywhere and by anyone. The integration of water purification and

on-demand dialysate production enables Tablo to serve as a dialysis

clinic on wheels, with 2-way wireless data transmission and a

proprietary data analytics platform powering a new holistic

approach to dialysis care. Tablo is a registered trademark of

Outset Medical, Inc.

Outset Medical, Inc.

Condensed Statements of

Operations

(in thousands, except per share

amounts)

(unaudited)

Three Months Ended

Six Months Ended

June 30,

June 30,

2024

2023

2024

2023

Revenue:

Product revenue

$

19,238

$

29,330

$

39,666

$

57,109

Service and other revenue

8,150

6,710

15,890

12,398

Total revenue

27,388

36,040

55,556

69,507

Cost of revenue:

Cost of product revenue (2)

10,567

22,212

23,148

43,029

Cost of service and other revenue

7,039

6,125

14,411

12,347

Total cost of revenue

17,606

28,337

37,559

55,376

Gross profit (1)

9,782

7,703

17,997

14,131

Gross margin (1)

35.7

%

21.4

%

32.4

%

20.3

%

Operating expenses:

Research and development (2)

9,734

14,906

22,369

28,699

Sales and marketing (2)

18,128

24,985

39,176

49,318

General and administrative (2)

12,684

11,290

24,128

23,077

Total operating expenses

40,546

51,181

85,673

101,094

Loss from operations

(30,764

)

(43,478

)

(67,676

)

(86,963

)

Interest income and other income, net

2,471

2,668

5,569

5,316

Interest expense

(6,010

)

(3,103

)

(11,978

)

(6,045

)

Loss before provision for income taxes

(34,303

)

(43,913

)

(74,085

)

(89,059

)

Provision for income taxes

151

133

313

325

Net loss

$

(34,454

)

$

(44,046

)

$

(74,398

)

$

(89,384

)

Net loss per share, basic and diluted

$

(0.66

)

$

(0.90

)

$

(1.45

)

$

(1.79

)

Shares used in computing net loss per

share, basic and diluted

51,880

48,951

51,391

49,085

(1) Gross profit and gross margin by

source consisted of the following:

Three Months Ended

Six Months Ended

June 30,

June 30,

2024

2023

2024

2023

Gross profit

Product revenue

$

8,671

$

7,118

$

16,518

$

14,080

Service and other revenue

1,111

585

1,479

51

Total gross profit

$

9,782

$

7,703

$

17,997

$

14,131

Gross margin

Product revenue

45.1

%

24.3

%

41.6

%

24.7

%

Service and other revenue

13.6

%

8.7

%

9.3

%

0.4

%

Total gross margin

35.7

%

21.4

%

32.4

%

20.3

%

(2) Include stock-based compensation

expense and severance and related charges, net as follows:

Three Months Ended

Six Months Ended

Stock-based

compensation expense

June 30,

June 30,

2024

2023

2024

2023

Cost of revenue

$

531

$

403

$

796

$

761

Research and development

2,293

2,824

4,625

5,439

Sales and marketing

2,494

3,545

3,953

6,143

General and administrative

4,502

3,333

8,649

6,300

Total stock-based compensation expense

$

9,820

$

10,105

$

18,023

$

18,643

Three Months Ended

Six Months Ended

Severance and

related charges, net*

June 30,

June 30,

2024†

2023

2024

2023

Cost of revenue

$

(78

)

$

—

$

201

$

—

Research and development

(29

)

—

963

—

Sales and marketing

99

—

892

—

General and administrative

(41

)

—

370

—

Total severance and related charges,

net

$

(49

)

$

—

$

2,426

$

—

* Net of adjustments to compensation

accrual

† These amounts represent the change in

estimated accrual from March 31, 2024

Outset Medical, Inc.

Condensed Balance

Sheets

(in thousands, except per share

amounts)

June 30,

December 31,

2024

2023

(Unaudited)

Assets

Current assets:

Cash and cash equivalents

$

37,859

$

68,509

Short-term investments

156,989

134,815

Accounts receivable, net

34,121

32,980

Inventories

61,599

49,215

Prepaid expenses and other current

assets

4,569

5,700

Total current assets

295,137

291,219

Restricted cash

3,329

3,329

Property and equipment, net

10,873

13,273

Operating lease right-of-use assets

4,675

5,375

Other assets

520

605

Total assets

$

314,534

$

313,801

Liabilities and stockholders'

equity

Current liabilities:

Accounts payable

$

5,255

$

5,827

Accrued compensation and related

benefits

11,431

19,005

Accrued expenses and other current

liabilities

9,747

13,459

Accrued warranty liability

2,199

3,712

Deferred revenue, current

13,108

11,727

Operating lease liabilities, current

1,693

1,593

Total current liabilities

43,433

55,323

Accrued interest

1,762

896

Deferred revenue

130

101

Operating lease liabilities

3,616

4,482

Term loans

196,994

130,113

Total liabilities

245,935

190,915

Commitments and contingencies

Stockholders' equity:

Preferred stock, $0.001 par value; 5,000

shares authorized, and no shares issued and outstanding as of June

30, 2024 and December 31, 2023

—

—

Common stock, $0.001 par value; 300,000

shares authorized as of June 30, 2024 and December 31, 2023; 52,084

and 50,317 shares issued and outstanding as of June 30, 2024 and

December 31, 2023, respectively

52

50

Additional paid-in capital

1,104,994

1,084,515

Accumulated other comprehensive income

(loss)

(302

)

68

Accumulated deficit

(1,036,145

)

(961,747

)

Total stockholders' equity

68,599

122,886

Total liabilities and stockholders'

equity

$

314,534

$

313,801

Outset Medical, Inc.

Condensed Statements of Cash

Flows

(in thousands)

(unaudited)

Six Months Ended June

30,

2024

2023

Net cash used in operating activities

$

(79,247

)

$

(72,932

)

Net cash (used in) provided by investing

activities

(20,090

)

29,796

Net cash provided by financing

activities

68,687

6,320

Net decrease in cash, cash equivalents and

restricted cash

(30,650

)

(36,816

)

Cash, cash equivalents and restricted cash

at beginning of the period

71,838

76,533

Cash, cash equivalents and restricted cash

at end of the period (1)

$

41,188

$

39,717

(1) The following table provides a

reconciliation of cash, cash equivalents and restricted cash

reported within the accompanying condensed balance sheets that sum

to the total of the amounts shown in the accompanying condensed

statements of cash flows (in thousands):

June 30,

2024

2023

Cash and cash equivalents

$

37,859

$

36,388

Restricted cash

3,329

3,329

Total cash, cash equivalents and

restricted cash*

$

41,188

$

39,717

* The total cash, including restricted

cash, cash equivalents and investment securities as of June 30,

2024 was $198.2 million; compared to $226.1 million as of June 30,

2023.

Appendix A

Outset Medical, Inc.

Results of Operations –

Non-GAAP

(in thousands, except per share

amounts)

(unaudited)

Reconciliation between GAAP and

non-GAAP net loss per share:

Three Months Ended

Six Months Ended

June 30,

June 30,

2024

2023

2024

2023

GAAP net loss per share, diluted

$

(0.66

)

$

(0.90

)

$

(1.45

)

$

(1.79

)

Stock-based compensation expense

0.19

0.21

0.35

0.38

Severance and related charges, net

—

—

0.05

—

Non-GAAP net loss per share, diluted

$

(0.47

)

$

(0.69

)

$

(1.05

)

$

(1.41

)

Reconciliation between GAAP and

non-GAAP net loss:

Three Months Ended

Six Months Ended

June 30,

June 30,

2024

2023

2024

2023

GAAP net loss, diluted

$

(34,454

)

$

(44,046

)

$

(74,398

)

$

(89,384

)

Stock-based compensation expense

9,820

10,105

18,023

18,643

Severance and related charges, net

(49

)

—

2,426

—

Non-GAAP net loss, diluted

$

(24,683

)

$

(33,941

)

$

(53,949

)

$

(70,741

)

Reconciliation between GAAP and

non-GAAP results of operations:

Three Months Ended

Six Months Ended

June 30,

June 30,

2024

2023

2024

2023

GAAP gross profit

$

9,782

$

7,703

$

17,997

$

14,131

Stock-based compensation expense

531

403

796

761

Severance and related charges, net

(78

)

—

201

—

Non-GAAP gross profit

$

10,235

$

8,106

$

18,994

$

14,892

GAAP gross margin

35.7

%

21.4

%

32.4

%

20.3

%

Stock-based compensation expense

1.9

1.1

1.4

1.1

Severance and related charges, net

(0.3

)

—

0.4

—

Non-GAAP gross margin

37.3

%

22.5

%

34.2

%

21.4

%

GAAP research and development

expense

$

9,734

$

14,906

$

22,369

$

28,699

Stock-based compensation expense

(2,293

)

(2,824

)

(4,625

)

(5,439

)

Severance and related charges, net

29

—

(963

)

—

Non-GAAP research and development

expense

$

7,470

$

12,082

$

16,781

$

23,260

GAAP sales and marketing

expense

$

18,128

$

24,985

$

39,176

$

49,318

Stock-based compensation expense

(2,494

)

(3,545

)

(3,953

)

(6,143

)

Severance and related charges, net

(99

)

—

(892

)

—

Non-GAAP sales and marketing expense

$

15,535

$

21,440

$

34,331

$

43,175

GAAP general and administrative

expense

$

12,684

$

11,290

$

24,128

$

23,077

Stock-based compensation expense

(4,502

)

(3,333

)

(8,649

)

(6,300

)

Severance and related charges, net

41

—

(370

)

—

Non-GAAP general and administrative

expense

$

8,223

$

7,957

$

15,109

$

16,777

GAAP total operating expense

$

40,546

$

51,181

$

85,673

$

101,094

Stock-based compensation expense

(9,289

)

(9,702

)

(17,227

)

(17,882

)

Severance and related charges, net

(29

)

—

(2,225

)

—

Non-GAAP total operating expense

$

31,228

$

41,479

$

66,221

$

83,212

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240807985057/en/

Investor Contact Jim Mazzola Investor Relations

jmazzola@outsetmedical.com

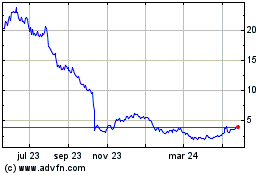

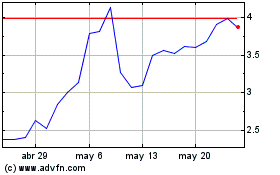

Outset Medical (NASDAQ:OM)

Gráfica de Acción Histórica

De Oct 2024 a Nov 2024

Outset Medical (NASDAQ:OM)

Gráfica de Acción Histórica

De Nov 2023 a Nov 2024