Sinclair, Inc. (Nasdaq: SBGI), the "Company" or "Sinclair,"

today reported financial results for the three and six months ended

June 30, 2024.

Highlights:

- Met second quarter Revenue guidance on Distribution and

Advertising

- Exceeded second quarter Adjusted EBITDA guidance

- As of August 1, the Company has booked $146 million in

political advertising for the second half of the year through

Election Day; this compares to $78 million as of August 1,

2020

- Company increases full-year political advertising guidance to a

range of $385 million to $410 million, representing growth of 10%

to 17% compared to 2020 excluding the Georgia runoff.

CEO Comment:

"Sinclair delivered solid second-quarter results, meeting our

guidance expectations across major financial metrics, including a

$105 million monetization of an investment in our Ventures

portfolio," commented Chris Ripley, Sinclair's President and Chief

Executive Officer. "Total advertising revenue was up 11%

year-over-year and distribution revenues grew by 4%. With almost

60% of our Big 4 subscribers still to be renewed this year, we are

confident in our ability to grow net retrans in line with our

2-year CAGR estimates. As we enter the second half of the year, we

are buoyed by strong momentum and multiple cash flow drivers.

Political advertising revenue is on track to be our largest ever,

with expected double-digit growth rates over the 2020 presidential

election year. Coupled with growth in distribution revenues, and

continued strength in core advertising trends, we are

well-positioned for a robust finish to the year."

Recent Company

Developments:

Content and Distribution:

- Year-to-date, Sinclair's newsrooms have won a total of 176

journalism awards, including 24 RTDNA Regional Edward R. Murrow

Awards for Outstanding Journalism, 4 National Headliner Awards, and

23 regional Emmy awards.

Community:

- In June and July, the Company partnered with Feeding America®

to coordinate Sinclair Cares: Summer Hunger Relief, an awareness

and fundraising campaign to help provide meals to children and

families across the U.S. this summer.

- Also in July, the Company announced that it has awarded

scholarships to 12 university students as a part of its annual

Diversity Scholarship program. Having provided more than $370,000

in tuition assistance since 2013, the annual Sinclair Broadcast

Group Diversity Scholarship aims to invest in the future of the

local media industry and help students from diverse backgrounds,

who reflect Sinclair’s audiences nationwide, complete their

education and pursue careers in local media journalism, digital

storytelling, and marketing.

Investment Portfolio:

- During the second quarter, Ventures made investments of

approximately $26 million in minority investments and received

distributions, including exit payments, of approximately $109

million.

NextGen Broadcasting (ATSC 3.0):

- To date, the Company has launched NextGen Broadcast in 45

markets, including the recent launch of Myrtle Beach-Florence, SC.

NextGen Broadcast is now available in over 75% of the TV households

in Sinclair's licensed footprint.

Financial Results:

Three Months Ended June 30, 2024 Consolidated Financial

Results:

- Total revenues increased 8% to $829 million versus $768 million

in the prior year period. Media revenues increased 8% to $819

million versus $761 million in the prior year period.

- Total advertising revenues of $343 million increased 11% versus

$309 million in the prior year period. Core advertising revenues,

which exclude political revenues, were $303 million, in line with

the prior year period.

- Distribution revenues of $435 million increased versus $418

million in the prior year period.

- Operating income of $64 million increased versus an operating

loss of $3 million in the prior year period.

- Net income attributable to the Company was $17 million versus

net loss of $89 million in the prior year period.

- Adjusted EBITDA increased 42% to $158 million from $111 million

in the prior year period.

- Diluted earnings per common share was $0.27 as compared to

diluted loss per common share of $1.38 in the prior year

period.

Six Months Ended June 30, 2024 Consolidated Financial

Results:

- Total revenues increased 6% to $1,627 million versus $1,541

million in the prior year period. Media revenues increased 6% to

$1,611 million versus $1,527 million in the prior year period.

- Total advertising revenues of $664 million increased 7% versus

$618 million in the prior year period. Core advertising revenues,

which excludes political revenues, of $600 million were down 1%

versus $609 million in the prior year period.

- Distribution revenues of $871 million increased versus $844

million in the prior year period.

- Operating income of $106 million increased versus operating

income of $18 million in the prior year period.

- Net income attributable to the Company was $40 million versus

net income of $96 million in the prior year period.

- Adjusted EBITDA increased 28% to $297 million from $232 million

in the prior year period.

- Diluted earnings per common share was $0.61 as compared to

diluted earnings per common share of $1.43 in the prior year

period.

Segment financial information is included in the following

tables for the periods presented. The Local Media segment consists

primarily of broadcast television stations, which the Company owns,

operates or to which the Company provides services, and includes

multicast networks and original content. The Local Media segment

assets are owned and operated by Sinclair Broadcast Group, LLC

(SBG). The Tennis segment consists primarily of Tennis Channel, a

cable network which includes coverage of most of tennis' top

tournaments and original professional sport and tennis lifestyle

shows; the Tennis Channel International subscription and streaming

service; Tennis Channel Plus streaming service; T2 FAST, a 24-hours

a day free ad-supported streaming television channel; and

Tennis.com. Other includes non-broadcast digital solutions,

technical services, and other non-media investments. For periods

presented subsequent to June 1, 2023 (the date of the

reorganization), the assets of the Tennis segment and Other are

owned and operated by Sinclair Ventures, LLC (Ventures). The

highlights below include the divestiture of Stadium (May 2,

2023).

Three months ended June 30,

2024

Local

Media

Tennis

Other

Corporate

and

Eliminations

Consolidated

($ in millions)

Distribution revenue

$

384

$

51

$

—

$

—

$

435

Core advertising revenue

285

14

9

(5

)

303

Political advertising revenue

40

—

—

—

40

Other media revenue

41

2

—

(2

)

41

Media revenues

$

750

$

67

$

9

$

(7

)

$

819

Non-media revenue

—

—

11

(1

)

10

Total revenues

$

750

$

67

$

20

$

(8

)

$

829

Media programming and production

expenses

$

382

$

43

$

—

$

—

$

425

Media selling, general and administrative

expenses

178

17

5

(6

)

194

Non-media expenses

2

—

12

(1

)

13

Amortization of program costs

18

—

—

—

18

Corporate general and administrative

expenses

29

—

1

20

50

Stock-based compensation

10

—

—

—

10

Non-recurring and unusual transaction,

implementation, legal, regulatory and other costs

12

—

1

6

19

Interest expense (net)(a)

71

—

(3

)

—

68

Capital expenditures

23

—

—

—

23

Distributions to the noncontrolling

interests

3

—

—

—

3

Cash distributions from equity

investments

—

—

109

—

109

Net cash taxes paid

1

Net income

19

Operating income (loss)

83

1

—

(20

)

64

Adjusted EBITDA(b)

163

7

3

(15

)

158

Note: Certain amounts may not summarize to

totals due to rounding differences.

(a)

Interest expense (net) excludes deferred

financing costs, original issue discount amortization, and other

non-cash interest expense, and is net of interest income.

(b)

Adjusted EBITDA is defined as earnings

before interest, tax, depreciation and amortization, and

non-recurring and unusual transaction, implementation, legal,

regulatory and other costs, as well as certain non-cash items such

as stock-based compensation expense and other gains and losses less

amortization of program costs. Refer to the reconciliation at the

end of this press release and the Company’s website.

Three months ended June 30,

2023

Local

Media

Tennis

Other

Corporate

and

Eliminations

Consolidated

($ in millions)

Distribution revenue

$

372

$

46

$

—

$

—

$

418

Core advertising revenue

287

14

6

(4

)

303

Political advertising revenue

6

—

—

—

6

Other media revenue

34

—

—

—

34

Media revenues

$

699

$

60

$

6

$

(4

)

$

761

Non-media revenue

—

—

8

(1

)

7

Total revenues

$

699

$

60

$

14

$

(5

)

$

768

Media programming and production

expenses

$

369

$

40

$

5

$

(1

)

$

413

Media selling, general and administrative

expenses

175

12

6

(3

)

190

Non-media expenses

3

—

7

(1

)

9

Amortization of program costs

19

—

—

—

19

Corporate general and administrative

expenses

46

—

—

16

62

Stock-based compensation

10

—

—

2

12

Non-recurring and unusual transaction,

implementation, legal, regulatory and other costs

18

—

4

2

24

Interest expense (net)(a)

66

—

(5

)

—

61

Capital expenditures

19

—

1

—

20

Distributions to the noncontrolling

interests

4

—

—

—

4

Cash distributions from equity

investments

—

—

5

—

5

Net cash taxes paid

2

Net loss

(87

)

Operating income (loss)

22

3

(12

)

(16

)

(3

)

Adjusted EBITDA(b)

115

8

—

(12

)

111

Note: Certain amounts may not summarize to

totals due to rounding differences.

(a)

Interest expense (net) excludes deferred

financing costs, original issue discount amortization, and other

non-cash interest expense, and is net of interest income.

(b)

Adjusted EBITDA is defined as earnings

before interest, tax, depreciation and amortization, and

non-recurring and unusual transaction, implementation, legal,

regulatory and other costs, as well as certain non-cash items such

as stock-based compensation expense and other gains and losses less

amortization of program costs. Refer to the reconciliation at the

end of this press release and the Company’s website.

Consolidated Balance Sheet and Cash

Flow Highlights of the Company:

- Total Company debt as of June 30, 2024 was $4,143 million, of

which $4,127 million is SBG debt and $16 million is Ventures

debt.

- Cash and cash equivalents for the Company as of June 30, 2024

was $378 million, of which $52 million is SBG cash and $326 million

is Ventures cash.

- As of June 30, 2024, 42.5 million Class A common shares and

23.8 million Class B common shares were outstanding, for a total of

66.3 million common shares.

- In June, the Company paid a quarterly cash dividend of $0.25

per share.

- Capital expenditures for the second quarter of 2024 were $23

million.

Notes:

Certain reclassifications have been made to prior years'

financial information to conform to the presentation in the current

year.

Outlook:

The Company currently expects to achieve the following results

for the three months ending September 30, 2024 and the twelve

months ending December 31, 2024.

For the three months ending September

30, 2024 ($ in millions)

Local Media

Tennis

Other

Corporate

and

Eliminations

Consolidated

Core advertising revenue

$288 to 300

$10

$9

$(5)

$302 to 315

Political advertising revenue

113 to 128

—

—

—

113 to 128

Advertising revenue

$401 to 428

$10

$9

$(5)

$415 to 443

Distribution revenue

381 to 383

51

—

—

433 to 435

Other media revenue

41

1

—

(1)

41

Media revenues

$823 to 852

$63

$9

$(7)

$889 to 919

Non-media revenue

—

—

10

—

10

Total revenues

$823 to 852

$63

$19

$(7)

$898 to 929

Media programming & production

expenses and media selling, general and administrative expenses

$569 to 574

$49

$6

$(7)

$618 to 623

Non-media expenses

2

—

12

—

14

Amortization of program costs

18

—

—

—

18

Corporate general and administrative

23

—

1

13

38

Stock-based compensation

8

—

—

—

8

Non-recurring and unusual transaction,

implementation, legal, regulatory and other costs

8

—

2

—

9

Interest expense (net)(a)

71

—

(3)

—

68

Capital expenditures

24 to 26

1

—

—

25 to 27

Distributions to the noncontrolling

interests

3

—

—

—

3

Cash distributions from equity

investments

—

—

2

—

2

Net cash tax payments

1

Operating Income

$153 to 178

$8

$(1) to 0

$(13)

$148 to 173

Adjusted EBITDA(b)

$227 to 252

$13

$1 to 2

$(13)

$229 to 254

Note: Certain amounts may not summarize to

totals due to rounding differences.

(a)

Interest expense (net) excludes deferred

financing costs, original issue discount amortization, and other

non-cash interest expense, and is net of interest income.

(b)

Adjusted EBITDA is defined as earnings

before interest, tax, depreciation and amortization, and

non-recurring and unusual transaction, implementation, legal,

regulatory and other costs, as well as certain non-cash items such

as stock-based compensation expense and other gains and losses less

amortization of program costs.

For the twelve months ending December

31, 2024 ($ in millions)

Consolidated

Media programming & production

expenses and media selling, general and administrative expenses

$2,471 to 2,481

Non-media expenses

$55

Amortization of program costs

$74

Corporate general and administrative

$182

Stock based compensation included in

corporate, media, and non-media expenses above

$54

Non-recurring and unusual transaction,

implementation, legal, regulatory and other costs included in

corporate, media, and non-media expenses above

$42

Interest expense (net)(a)

$266

Capital expenditures

$93 to 98

Distributions to noncontrolling

interests

$10

Cash distributions from equity

investments

$189

Net cash tax payments

$6 to 10

Note: Certain amounts may not summarize to

totals due to rounding differences.

(a)

Interest expense (net) excludes deferred

financing costs, original issue discount amortization, and other

non-cash interest expense, and is net of interest income.

Sinclair Conference Call:

The senior management of Sinclair will hold a conference call to

discuss the Company's second quarter 2024 results on Wednesday,

August 7, 2024, at 4:30 p.m. ET. The call will be webcast live and

can be accessed at www.sbgi.net under "Investor Relations/Events

and Presentations." After the call, an audio replay will remain

available at www.sbgi.net. The press and the public will be welcome

on the call in a listen-only mode. The dial-in number is (888)

506-0062, with entry code 355312.

About Sinclair:

Sinclair, Inc. is a diversified media company and a leading

provider of local news and sports. The Company owns, operates

and/or provides services to 185 television stations in 86 markets

affiliated with all the major broadcast networks; and owns Tennis

Channel and multicast networks Comet, CHARGE!, TBD., and The Nest.

Sinclair’s content is delivered via multiple platforms, including

over-the-air, multi-channel video program distributors, and the

nation’s largest streaming aggregator of local news content,

NewsON. The Company regularly uses its website as a key source of

Company information which can be accessed at www.sbgi.net.

Sinclair, Inc. and Subsidiaries

Preliminary Unaudited Consolidated

Statements of Operations

(In millions, except share and per

share data)

Three Months Ended

June 30,

Six Months Ended

June 30,

2024

2023

2024

2023

REVENUES:

Media revenues

$

819

$

761

$

1,611

$

1,527

Non-media revenues

10

7

16

14

Total revenues

829

768

1,627

1,541

OPERATING EXPENSES:

Media programming and production

expenses

425

413

833

811

Media selling, general and administrative

expenses

194

190

390

381

Amortization of program costs

18

19

37

41

Non-media expenses

13

9

25

21

Depreciation of property and equipment

25

32

50

56

Corporate general and administrative

expenses

50

62

108

120

Amortization of definite-lived intangible

assets

38

41

76

82

Loss on asset dispositions and other, net

of impairment

2

5

2

11

Total operating expenses

765

771

1,521

1,523

Operating income (loss)

64

(3

)

106

18

OTHER INCOME (EXPENSE):

Interest expense including amortization of

debt discount and deferred financing costs

(76

)

(76

)

(152

)

(150

)

Gain on extinguishment of debt

—

11

1

11

Income (loss) from equity method

investments

78

(1

)

92

30

Other expense, net

(42

)

(38

)

(2

)

(27

)

Total other expense, net

(40

)

(104

)

(61

)

(136

)

Income (loss) before income taxes

24

(107

)

45

(118

)

INCOME TAX (PROVISION) BENEFIT

(5

)

20

(1

)

224

NET INCOME (LOSS)

19

(87

)

44

106

Net loss attributable to the redeemable

noncontrolling interests

—

—

—

4

Net income attributable to the

noncontrolling interests

(2

)

(2

)

(4

)

(14

)

NET INCOME (LOSS) ATTRIBUTABLE TO

SINCLAIR

$

17

$

(89

)

$

40

$

96

EARNINGS PER COMMON SHARE ATTRIBUTABLE TO

SINCLAIR:

Basic earnings per share

$

0.27

$

(1.38

)

$

0.61

$

1.44

Diluted earnings per share

$

0.27

$

(1.38

)

$

0.61

$

1.43

Basic weighted average common shares

outstanding (in thousands)

66,189

64,012

65,172

66,862

Diluted weighted average common and common

equivalent shares outstanding (in thousands)

66,189

64,012

65,296

66,947

Adjusted EBITDA is a non-GAAP operating performance measure that

management and the Company’s Board of Directors uses to evaluate

the Company’s operating performance and for executive compensation

purposes. The Company believes that Adjusted EBITDA provides useful

information to investors by allowing them to view the Company’s

business through the eyes of management and is a measure that is

frequently used by industry analysts, investors and lenders as a

measure of relative operating performance.

Adjusted EBITDA is provided on a forward-looking basis under the

section entitled “Outlook” above. The Company has not included a

reconciliation of projected Adjusted EBITDA to net income, which is

the most directly comparable GAAP measure, for the periods

presented in reliance on the unreasonable efforts exception

provided under Item 10(e)(1)(i)(B) of Regulation S-K. The Company’s

projected Adjusted EBITDA excludes certain items that are

inherently uncertain and difficult to predict including, but not

limited to, income taxes. Due to the variability, complexity and

limited visibility of the adjusting items that would be excluded

from projected Adjusted EBITDA in future periods, management does

not rely upon them for internal use or measurement of operating

performance, and therefore cannot create a quantitative projected

Adjusted EBITDA to net income reconciliation for the periods

presented without unreasonable efforts. A quantitative

reconciliation of projected Adjusted EBITDA to net income for the

periods presented would imply a degree of precision and certainty

as to these future items that does not exist and could be confusing

to investors. From a qualitative perspective, it is anticipated

that the differences between projected Adjusted EBITDA to net

income for the periods presented will consist of items similar to

those described in the reconciliation of historical results below.

The timing and amount of any of these excluded items could

significantly impact the Company’s net income for a particular

period. When planning, forecasting and analyzing future periods,

the Company does so primarily on a non-GAAP basis without preparing

a GAAP analysis.

In addition to the reconciliation of Adjusted EBITDA to its most

directly comparable GAAP measure, net income, below, the Company

also discloses a reconciliation of the Adjusted EBITDA of its

segments to its more directly comparable GAAP measure, segment

operating income.

Non-GAAP measures are not formulated in accordance with GAAP,

are not meant to replace GAAP financial measures and may differ

from other companies’ uses or formulations. Further discussions and

reconciliations of the Company's non-GAAP financial measures to

their most directly comparable GAAP financial measures can be found

on its website www.sbgi.net.

Sinclair, Inc. and Subsidiaries

Reconciliation of Non-GAAP Measurements

- Unaudited

All periods reclassified to conform

with current year GAAP presentation and Adjusted EBITDA

definitional change due to routine SEC comment process

(in millions)

Three Months Ended

June 30,

Six Months Ended

June 30,

2024

2023

2024

2023

Reconciliation of Consolidated

Sinclair, Inc. Net Income to Consolidated Adjusted EBITDA

Net income (loss)

$

19

$

(87

)

$

44

$

106

Add: Income tax provision (benefit)

5

(20

)

1

(224

)

Add: Other expense (income)

2

(3

)

(26

)

(3

)

Add: (Income) loss from equity method

investments

(78

)

1

(92

)

(30

)

Add: Loss from other investments and

impairments

47

52

45

53

Add: Gain on extinguishment of

debt/insurance proceeds

(1

)

(11

)

(3

)

(11

)

Add: Interest expense

76

76

152

150

Less: Interest income

(6

)

(11

)

(15

)

(23

)

Less: Loss on asset dispositions and

other, net of impairment

2

5

2

11

Add: Amortization of intangible assets

& other assets

38

41

76

82

Add: Depreciation of property &

equipment

25

32

50

56

Add: Stock-based compensation

10

12

38

35

Add: Non-recurring and unusual

transaction, implementation, legal, regulatory and other costs

19

24

25

30

Adjusted EBITDA

$

158

$

111

$

297

$

232

Three months ended June 30,

2024

Local Media

Tennis

Other

($ in millions)

Total revenues

$

750

$

67

$

20

Media programming and production

expenses

382

43

—

Media selling, general and administrative

expenses

178

17

5

Depreciation and intangible amortization

expenses

58

6

—

Amortization of program costs

18

—

—

Corporate general and administrative

expenses

29

—

1

Non-media expenses

2

—

12

Loss on asset dispositions and other, net

of impairment

—

—

2

Segment operating income

$

83

$

1

$

—

Reconciliation of Segment GAAP

Operating Income to Segment Adjusted EBITDA:

Segment operating income

$

83

$

1

$

—

Depreciation and intangible amortization

expenses

58

6

—

Loss on asset dispositions and other, net

of impairment

—

—

2

Stock-based compensation

10

—

—

Non-recurring and unusual transaction,

implementation, legal, regulatory and other costs

12

—

1

Segment Adjusted EBITDA

$

163

$

7

$

3

Three months ended June 30,

2023

Local Media

Tennis

Other

($ in millions)

Total revenues

$

699

$

60

$

14

Media programming and production

expenses

369

40

5

Media selling, general and administrative

expenses

175

12

6

Depreciation and intangible amortization

expenses

67

5

1

Amortization of program costs

19

—

—

Corporate general and administrative

expenses

46

—

—

Non-media expenses

3

—

7

(Gain) loss on asset dispositions and

other, net of impairment

(2

)

—

7

Segment operating income (loss)

$

22

$

3

$

(12

)

Reconciliation of Segment GAAP

Operating Income to Segment Adjusted EBITDA:

Segment operating income (loss)

$

22

$

3

$

(12

)

Depreciation and intangible amortization

expenses

67

5

1

(Gain) loss on asset dispositions and

other, net of impairment

(2

)

—

7

Stock-based compensation

10

—

—

Non-recurring and unusual transaction,

implementation, legal, regulatory and other costs

18

—

4

Segment Adjusted EBITDA

$

115

$

8

$

—

Forward-Looking

Statements:

The matters discussed in this news release, particularly those

in the section labeled “Outlook,” include forward-looking

statements regarding, among other things, future operating results.

When used in this news release, the words “outlook,” “intends to,”

“believes,” “anticipates,” “expects,” “achieves,” “estimates,” and

similar expressions are intended to identify forward-looking

statements. Such statements are subject to a number of risks and

uncertainties. Actual results in the future could differ materially

and adversely from those described in the forward-looking

statements as a result of various important factors, including and

in addition to the assumptions set forth therein, but not limited

to, the rate of decline in the number of subscribers to services

provided by traditional and virtual multi-channel video programming

distributors (“Distributors”); the Company’s ability to generate

cash to service its substantial indebtedness; the successful

execution of outsourcing agreements; the successful execution of

retransmission consent agreements; the successful execution of

network and Distributor affiliation agreements; the Company’s

ability to identify and consummate acquisitions and investments, to

manage increased financial leverage resulting from acquisitions and

investments, and to achieve anticipated returns on those

investments once consummated; the Company’s ability to compete for

viewers and advertisers; pricing and demand fluctuations in local

and national advertising; the appeal of the Company’s programming

and volatility in programming costs; material legal, financial and

reputational risks and operational disruptions resulting from a

breach of the Company’s information systems; the impact of FCC and

other regulatory proceedings against the Company; compliance with

laws and uncertainties associated with potential changes in the

regulatory environment affecting the Company’s business and growth

strategy; the impact of pending and future litigation claims

against the Company; the Company’s limited experience in operating

or investing in non-broadcast related businesses; and any risk

factors set forth in the Company’s recent reports on Form 10-Q

and/or Form 10-K, as filed with the Securities and Exchange

Commission. There can be no assurances that the assumptions and

other factors referred to in this release will occur. The Company

undertakes no obligation to publicly release the result of any

revisions to these forward-looking statements except as required by

law.

Category: Financial

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240807752862/en/

Investor Contacts: Christopher C. King, VP, Investor Relations

Billie-Jo McIntire, AVP, Investor Relations (410) 568-1500

Media Contact: Sinclair@5wpr.com

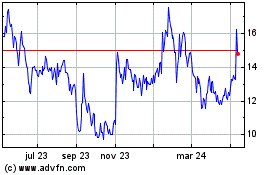

Sinclair (NASDAQ:SBGI)

Gráfica de Acción Histórica

De Jul 2024 a Ago 2024

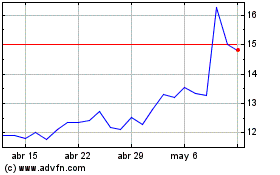

Sinclair (NASDAQ:SBGI)

Gráfica de Acción Histórica

De Ago 2023 a Ago 2024