Just Released ‘How America Pays for College 2024’ Report Finds College Spending Stable with Family Out-of-Pocket Contributions Covering the Largest Share of Cost

06 Agosto 2024 - 9:36AM

Business Wire

Just 29% of Families Who Completed the New

FAFSA® Found it Easier to Complete

Families reported spending $28,409 on college for academic year

2023-24 — in line with $28,026 in 2022-23 — and covered nearly half

(48%) of expenses with income and savings, according to new data in

“How America Pays for College 2024,” the annual study from

Sallie Mae and Ipsos, released today.

This press release features multimedia. View

the full release here:

https://www.businesswire.com/news/home/20240806388079/en/

About 3 in 4 families (74%) reported completing the Free

Application for Federal Student Aid (FAFSA®) for the 2023-2024

academic year, but of those who reported completing the new FAFSA®

for the 2024-2025 academic year, just 29% found it easier to

complete. In addition, of those who experienced a delay, 44%

reported experiencing stress waiting for financial aid decisions,

21% sought out additional financial aid options, 14% considered

switching to a lower-cost school, and 10% transferred schools. When

it comes to financial aid offers from schools, 71% of families said

they support a simplified, standardized letter.

Despite FAFSA® confusion and delays, nearly all families (88%)

believe college is an investment in their child’s future, and 79%

are willing to stretch financially to get there. Six in 10 families

(59%) had a plan to pay for college before the student enrolled,

matching an all-time high. Families also reported using artificial

intelligence (AI) technology in the college planning process. About

one-quarter of students (23%) and 18% of parents used AI in the

college application or decision-making process. Three in 10

families (29%) who used AI utilized it to research financial aid or

scholarship options.

"The study reveals a significant trend: families are

increasingly recognizing the importance of financial planning for

college,” said Jennifer Berg, vice president, Ipsos. “Nearly 6 in

10 families now create a comprehensive plan to cover all years of

college before enrollment, a notable increase compared to five

years ago. This proactive approach not only boosts confidence in

their financial decisions but also equips them to navigate economic

uncertainties more effectively."

Roughly half of families (49%) reported borrowing for college up

from 41% last year. Borrowing covered 23% of costs, up from 19% the

prior year with federal student loans and parent loans used most

frequently. More than 4 in 10 families who borrowed (43%) said they

considered attending more expensive schools because of access to

loans. Roughly half of students (48%) expect their federal loans to

be forgiven; just 40% of families who borrowed discussed who would

be responsible for paying back student loans.

“Borrowing for college makes sense for some families, but it’s

critical to have a plan and do so responsibly,” said Rick

Castellano, vice president, Sallie Mae. “More clarity around the

actual costs of college, greater transparency in federal lending

programs, and better efforts to connect students with grants and

scholarships would go a long way in helping families make informed

decisions about where to go to school, and whether and how much to

borrow for higher education.”

Scholarships and grants were used by 80% of families and covered

27% of costs. On average, families reported receiving $8,250 in

scholarships from their schools. However, misconceptions about

scholarships persist. More than half of families (52%) believe

scholarships are only available for students with exceptional

grades or abilities, and families who didn't apply cited lack of

awareness (50%), doubt in winning (32%), and effort required (21%).

To connect more students and families to scholarships, Scholarship

Search by Sallie easily finds and sorts through hundreds of

available scholarships, with no registration required.

“How America Pays for College 2024” reports the results of

Ipsos' online interviews of 1,000 undergraduate students and 1,000

parents of undergraduate students between April 8 and May 14,

2024.

Access the complete report and infographic at

www.salliemae.com/howamericapays.

Sallie Mae (Nasdaq: SLM) believes education and life-long

learning, in all forms, help people achieve great things. As the

leader in private student lending, we provide financing and

know-how to support access to college and offer products and

resources to help customers make new goals and experiences, beyond

college, happen. Learn more at SallieMae.com. Commonly known as

Sallie Mae, SLM Corporation and its subsidiaries are not sponsored

by or agencies of the United States of America.

Ipsos is one of the largest market research and polling

companies globally. At Ipsos, our passionately curious research

professionals, analysts, and scientists have built unique

multi-specialist capabilities that provide true understanding and

powerful insights into the actions, opinions, and motivations of

citizens, consumers, patients, customers, or employees. Visit

https://www.ipsos.com/en-us to learn more.

Category: Research

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240806388079/en/

Caron Jackson 302.304.3041 Caron.Jackson@SallieMae.com

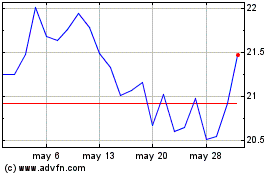

SLM (NASDAQ:SLM)

Gráfica de Acción Histórica

De Oct 2024 a Nov 2024

SLM (NASDAQ:SLM)

Gráfica de Acción Histórica

De Nov 2023 a Nov 2024