ALPS Adds Momentum to Its ETF Factor Lineup

10 Enero 2017 - 8:00AM

Business Wire

Dorsey, Wright & Associates to Provide

Unique Dual Relative Strength Screen

ALPS, a subsidiary of DST Systems, Inc. (NYSE: DST) providing

products and services to the financial services industry, today

announced a strategic alliance with Dorsey, Wright &

Associates, a Nasdaq Company (DWA) to launch a new factor

exchange-traded fund (ETF), which is designed to capture momentum

investing at both the sector and stock level.

The ALPS Dorsey Wright Sector Momentum ETF (Nasdaq Ticker:

SWIN) leverages Dorsey Wright’s proprietary Point and Figure

Relative Strength charting to create a high conviction portfolio of

50 stocks. The Fund seeks to track, before fees and expenses, the

Dorsey Wright US Sector Momentum Index (DWUSSR), an equally

weighted index consisting of 50 large and midcap stocks listed in

the US.

“We are excited to collaborate with such a prestigious company,”

says Tom Carter, President of ALPS Advisors Inc., “The combination

of Dorsey Wright’s research and our focus on product innovation has

created a new strategy for enhancing portfolio construction.”

Historically, momentum strategies tend to perform best when

clear leadership is established and sustained for a meaningful

period; they often lag during time when there is no clear

leadership among sectors. “SWIN is the first Momentum ETF to

combine both macro (sector) and micro (stock) level screens,” says

Mike Akins, SVP & Head of ETFs for ALPS, “We believe its unique

two-screen construct creates opportunity for outperformance in

strong sector momentum cycles, while simultaneously maintaining a

diversification cushion to help weather periods where no clear

sector leadership is present.”

Although SWIN is concentrated on the top performing momentum

sectors, it maintains an equal-weighted strategy at the stock

level. “At ALPS we strive to help investors and advisors build

better portfolios,” says Akins, “ALPS Sector Dividend Dog ETF

(SDOG), which employs an equal-weight sector and stock strategy

with a tilt toward equity income, and SWIN are complementary

strategies that provide diversified exposure to both value and

momentum.”

Important Disclosures & Definitions

An investor should consider the investment objectives, risks,

charges and expenses carefully before investing. To obtain a

prospectus which contain this and other information call

866.675.2639 or visit www.alpsfunds.com. Read the

prospectus carefully before investing.

ALPS Dorsey Wright Sector Momentum ETF Shares are not

individually redeemable. Investors buy and sell shares of the ALPS

Dorsey Wright Sector Momentum ETF on a secondary market. Only

market makers or “authorized participants” may trade directly with

the Fund, typically in blocks of 50,000 shares.

An investment in the Fund is subject to investment risk,

including the possible loss of the entire principal amount that you

invest.

Diversification does not eliminate risk.

The Fund is subject to the additional risks associated with

concentrating its investments in companies in the market

sector.

The Fund is considered non-diversified and can invest a greater

portion of its assets in securities of individual issuers than a

diversified fund.

ALPS Dorsey Wright Sector Momentum Index is a rules-based index

intended to track the overall performance of the stocks with the

highest relative strength or “momentum” within the NASDAQ US Large

Mid Cap Index (the “NASDAQ Index”) on a sector-by-sector basis.

An investor cannot invest directly in an index.

Point and Figure Relative Strength: measures how one security is

doing versus another security or benchmark. The calculation

consists of dividing the price of one security by the price of

another security or benchmark index. The ratio is then plotted on a

Point & Figure chart providing a logical way to filter out the

short term noise and provide objective interpretations of the trend

in relative strength.

“Relative strength” is an investing strategy that seeks to

determine the strongest performing securities by measuring certain

factors, such as a security’s relative positive performance against

the overall market or a security’s relative strength value, which

is derived by comparing the rate of increase of the security’s

price to that of a benchmark index. Nasdaq, Inc. (the “Index

Provider”) uses a proprietary methodology to analyze the relative

strength of each security within the universe of eligible

securities and determine a “momentum” score. In general, momentum

is the tendency of a security to exhibit persistence in its

relative strength; a “momentum” style of investing emphasizes

investing in securities that have had better recent performance

compared to other securities. The momentum score for each security

included in the Underlying Index is based on intermediate and

long-term upward price movements of the security as compared to a

representative benchmark and other eligible securities within the

universe.

The fund is new and has limited operating history.

ALPS Portfolio Solutions Distributor, Inc. is the distributor

for the ALPS Dorsey Wright Sector Momentum ETF.

*Tom Carter is a registered representative of ALPS Portfolio

Solutions Distributor, Inc.

About ALPS

Through its subsidiary companies, ALPS Holdings, Inc. is a

leading provider of innovative investment products and customized

servicing solutions to the financial services industry. Founded in

1985, Denver-based ALPS delivers its Asset Gathering and Asset

Servicing Solutions through offices in Boston, New York, Seattle,

and Toronto. ALPS is a wholly-owned subsidiary of Kansas City-based

DST Systems, Inc. For more information about ALPS and its services,

visit www.alpsinc.com. Information about ALPS products is available

at www.alpsfunds.com.

View source

version on businesswire.com: http://www.businesswire.com/news/home/20170110005268/en/

DST Global Public RelationsLaura M. Parsons,

816-843-9087mediarelations@dstsystems.com

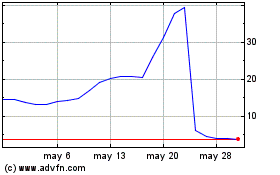

Solowin (NASDAQ:SWIN)

Gráfica de Acción Histórica

De Nov 2024 a Dic 2024

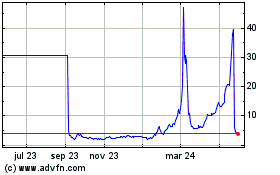

Solowin (NASDAQ:SWIN)

Gráfica de Acción Histórica

De Dic 2023 a Dic 2024