Form 6-K - Report of foreign issuer [Rules 13a-16 and 15d-16]

27 Diciembre 2023 - 3:21PM

Edgar (US Regulatory)

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM

6-K

REPORT

OF FOREIGN PRIVATE ISSUER

PURSUANT

TO RULE 13a-16 OR 15d-16

UNDER

THE SECURITIES EXCHANGE ACT OF 1934

For

the month of December 2023

Commission

File Number: 001-41672

TOP

KINGWIN LTD

(Exact

name of registrant as specified in its charter)

Room

1304, Building No. 25, Tian’an Headquarters Center, No. 555

North Panyu Avenue, Donghuan Street

Panyu

District, Guangzhou, Guangdong Province, PRC

(Address

of principal executive offices)

Indicate

by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F:

Form

20-F ☒ Form 40-F ☐

Explanatory

Note

The

unaudited semi-annual report for the six months ended June 30, 2023 of Top KingWin Ltd is attached hereto as Exhibit 99.1.

SIGNATURES

Pursuant

to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by

the undersigned, thereunto duly authorized.

| |

Top

KingWin Ltd |

| |

|

|

| Date:

December 27, 2023 |

By: |

/s/

Ruilin Xu |

| |

Name: |

Ruilin

Xu |

| |

Title: |

Chief

Executive Officer |

EXHIBIT

INDEX

Exhibit 99.1

The

financial statements for the first half year ended June 30, 2023 of Top KingWin Ltd (the “Company”, “we” or “us”)

included herein have not been audited by the Company’s independent registered accounting firm.

TOP

KINGWIN LTD

UNAUDITED INTERIM CONDENSED CONSOLIDATED BALANCE SHEETS AS OF JUNE 30, 2023

AND DECEMBER 31, 2022

(In USD)

| | |

June 30,

2023 | | |

December 31,

2022 | |

| | |

| | |

| |

| ASSETS | |

| | |

| |

| CURRENT ASSETS | |

| | |

| |

| Cash | |

$ | 4,892,680 | | |

$ | 2,654,185 | |

| Accounts receivable, net | |

| 798,482 | | |

| 95,691 | |

| Accounts receivable – related party, net | |

| 379,248 | | |

| - | |

| Prepayments | |

| 379,083 | | |

| 12,248 | |

| Prepayment for mergers and acquisitions | |

| 4,000,000 | | |

| - | |

| Other receivables | |

| 166,836 | | |

| 97,911 | |

| Total current assets | |

| 10,616,329 | | |

| 2,860,035 | |

| | |

| | | |

| | |

| NON-CURRENT ASSETS | |

| | | |

| | |

| Property and equipment, net | |

| 183,917 | | |

| 210,330 | |

| Intangible assets, net | |

| 32,697 | | |

| 30,538 | |

| Operating lease right-of-use assets | |

| 417,116 | | |

| 522,278 | |

| Deferred tax assets | |

| - | | |

| 118,159 | |

| Other non-current assets | |

| 38,405 | | |

| 40,376 | |

| Deferred offering costs | |

| - | | |

| 1,306,313 | |

| Total non-current assets | |

| 672,135 | | |

| 2,227,994 | |

| | |

| | | |

| | |

| TOTAL ASSETS | |

$ | 11,288,464 | | |

$ | 5,088,029 | |

| | |

| | | |

| | |

| LIABILITIES | |

| | | |

| | |

| CURRENT LIABILITIES | |

| | | |

| | |

| Accounts payable | |

$ | 521,034 | | |

$ | 264,006 | |

| Operating lease liabilities - current | |

| 169,656 | | |

| 165,506 | |

| Advance from clients | |

| 611,425 | | |

| 187,630 | |

| Due to related parties | |

| 29,098 | | |

| 1,129,005 | |

| Taxes payable | |

| 81,799 | | |

| 37,919 | |

| Accruals and other payables | |

| 828,609 | | |

| 1,108,910 | |

| Total current liabilities | |

| 2,241,621 | | |

| 2,892,976 | |

| | |

| | | |

| | |

| NON-CURRENT LIABILITIES | |

| | | |

| | |

| Operating lease liabilities - non-current | |

| 266,414 | | |

| 373,068 | |

| Total non-current liabilities | |

| 266,414 | | |

| 373,068 | |

| | |

| | | |

| | |

| TOTAL LIABILITIES | |

| 2,508,035 | | |

| 3,266,044 | |

| | |

| | | |

| | |

| SHAREHOLDERS’ EQUITY | |

| | | |

| | |

| Class A ordinary shares, $0.0001 par value, 300,000,000 shares authorized, 8,213,040 and 10,963,040 shares issued and outstanding as of December 31, 2022 and June 30, 2023 | |

$ | 1,096 | | |

$ | 821 | |

| Class B ordinary shares, $0.0001 par value, 200,000,000 shares authorized, 3,786,960 shares issued and outstanding as of December 31, 2022 and June 30, 2023 | |

| 379 | | |

| 379 | |

| Share subscription receivables | |

| - | | |

| (1,200 | ) |

| Additional paid-in capital | |

| 8,160,307 | | |

| 114,726 | |

| Statutory reserve | |

| 282,545 | | |

| 282,545 | |

| Retained earnings | |

| 542,079 | | |

| 1,563,563 | |

| Accumulated other comprehensive loss | |

| (205,977 | ) | |

| (138,849 | ) |

| Total shareholders’ equity | |

| 8,780,429 | | |

| 1,821,985 | |

| | |

| | | |

| | |

| TOTAL LIABILITIES AND SHAREHOLDERS’ EQUITY | |

$ | 11,288,464 | | |

$ | 5,088,029 | |

TOP

KINGWIN LTD

UNAUDITED INTERIM CONDENSED CONSOLIDATED STATEMENTS OF (LOSS) INCOME AND

COMPREHENSIVE (LOSS) INCOME FOR THE SIX MONTHS ENDED JUNE 30, 2023

AND 2022

(In USD)

| | |

Six Months Ended | |

| | |

June 30, | |

| | |

2023 | | |

2022 | |

| | |

| | |

| |

| REVENUES | |

| 2,814,664 | | |

| 1,726,719 | |

| | |

| | | |

| | |

| COST OF REVENUES | |

| (746,661 | ) | |

| (370,298 | ) |

| | |

| | | |

| | |

| GROSS PROFIT | |

| 2,068,003 | | |

| 1,356,421 | |

| | |

| | | |

| | |

| OPERATING EXPENSES | |

| | | |

| | |

| Selling expenses | |

| (1,203,472 | ) | |

| (319,262 | ) |

| General and administrative expenses | |

| (1,877,461 | ) | |

| (730,725 | ) |

| Total operating expenses | |

| (3,080,933 | ) | |

| (1,049,987 | ) |

| | |

| | | |

| | |

| (LOSS) INCOME FROM OPERATIONS | |

| (1,012,930 | ) | |

| 306,434 | |

| | |

| | | |

| | |

| OTHER INCOME (EXPENSE), NET | |

| | | |

| | |

| Other income | |

| 58,524 | | |

| 17,667 | |

| Other expense | |

| (6,638 | ) | |

| (3,733 | ) |

| Total other income, net | |

| 51,886 | | |

| 13,934 | |

| | |

| | | |

| | |

| NET (LOSS) INCOME BEFORE INCOME TAXES | |

| (961,044 | ) | |

| 320,368 | |

| | |

| | | |

| | |

| Income tax (expense) benefit | |

| (117,629 | ) | |

| 67,183 | |

| | |

| | | |

| | |

| NET (LOSS) INCOME | |

$ | (1,078,673 | ) | |

$ | 387,551 | |

| | |

| | | |

| | |

| Other comprehensive loss | |

| | | |

| | |

| Foreign currency translation loss | |

| (65,734 | ) | |

| (150,132 | ) |

| | |

| | | |

| | |

| TOTAL COMPREHENSIVE (LOSS) INCOME | |

$ | (1,144,407 | ) | |

$ | 237,419 | |

| | |

| | | |

| | |

| Basic and diluted (loss) earnings per share* | |

$ | (0.08 | ) | |

$ | 0.03 | |

| | |

| | | |

| | |

| Weighted average number of common shares outstanding - basic and diluted* | |

| 13,115,278 | | |

| 12,000,000 | |

| * |

Giving retroactive effect to the nominal issuance of shares effected on January 10, 2023 |

First

Half 2023 Financial Results

Revenues

Revenues

for the first half of 2023 reached $2,814,664, marking an increase of 63% from the $1,726,719 reported in the same period of 2022, primarily

due to the increase in the revenue generated from corporate business training services.

| Service Category | |

1H 2023 | | |

1H 2022 | | |

% | |

| Advisory and transaction services | |

$ | 1,256,894 | | |

$ | 1,263,517 | | |

| (1 | ) |

| Corporate business training services | |

| 1,483,471 | | |

| 160,079 | | |

| 827 | |

| Corporate consulting services | |

| 74,299 | | |

| 300,675 | | |

| (75 | ) |

| Others | |

| - | | |

| 2,448 | | |

| (100 | ) |

| Total | |

$ | 2,814,664 | | |

$ | 1,726,719 | | |

| 63 | |

Cost

of Revenues

Cost

of revenues was $746,661 for the first half of 2023, reflecting a 102% increase as compared to $370,298 for the same period of 2022.

The increase was primarily due to the increase of costs of revenues from corporate business training services, which was proportionally

in line with the increase of revenue from corporate business training services.

Gross

Profit

The

gross profit was $2,068,003 and $1,356,421 with gross margins of 73% and 79% for the six months ended June 30, 2023 and 2022, respectively.

The decrease in gross margin was primarily due to the fact that we incurred more referral fees and commission fees to improve our corporate

business training services, which was in line with the increase of revenue generated from corporate business training services.

Operating

Expenses

Total

operating expenses were $3,080,933 in the first half of 2023, representing an increase of 193% as compared to $1,049,987 for the

same period of 2022. Selling expenses increased by $884,210 or 277%, which was mainly driven by the expansion of the marketing

department staff and an increase in travel expenses during the period. General and administrative expenses increased by $1,146,736

or 157%, which was mainly due to one-time costs related to the initial public offering, the business expansion and the corresponding

increase in the number of employees, leading to a rise in wage costs.

(Loss)

Income from Operations

Loss

from operations was $1,012,930 for the first half of 2023, as compared to an income from operations of $306,434 for the same period of

2022.

Total

other income, net

Total

other income was $51,886 for the first half of 2023, as compared to $13,934 for the same period of 2022.

Net

(Loss) Income

Net

loss was $1,078,673 for the first half of 2023, as compared to a net income of $387,551 for the same period of 2022.

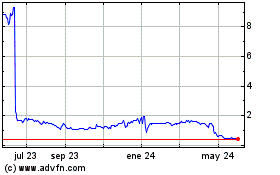

Top KingWin (NASDAQ:TCJH)

Gráfica de Acción Histórica

De Abr 2024 a May 2024

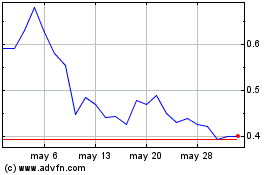

Top KingWin (NASDAQ:TCJH)

Gráfica de Acción Histórica

De May 2023 a May 2024