UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER

PURSUANT TO RULE 13a-16 OR 15d-16 OF THE

SECURITIES EXCHANGE ACT OF 1934

For the month of December 2023

Commission File Number 001-41672

Top KingWin Ltd

(Translation of registrant’s name into English)

Room 1304, Building No. 25, Tian’an Headquarters

Center, No. 555

North Panyu Avenue, Donghuan Street

Panyu District, Guangzhou, Guangdong Province,

PRC

Zip: 511400

Tel: +86 400 661 3113

(Address of principal executive offices)

Indicate by check mark whether the registrant

files or will file annual reports under cover of Form 20-F or Form 40-F:

Form 20-F ☒ Form 40-F ☐

Entry into a Share Sale and Transfer Agreement

On December 20, 2023, Top KingWin Ltd, a Cayman

Islands exempted company (the “Company”), Sky KingWin Ltd, the Company’s subsidiary incorporated in the British Virgin

Islands (“BVI”) (“Buyer”), Mr. Zhiliang Hu (“Mr. Hu”), Ms. Li Qian (“Ms. Qian”), FutureScope

Advisors LTD, a BVI company ultimately controlled by Mr. Hu (“Seller 1”), and Visionary Strategies LTD, a BVI company ultimately

controlled by Ms. Qian (“Seller 2,” together with Seller 1, Mr. Hu and Ms. Qian, “Sellers”), entered into a share

sale and transfer agreement (the “Share Transfer Agreement”), pursuant to which Buyer will purchase 100% equity interest collectively

held by Seller 1 and Seller 2 in Industry Insights Consulting LTD, a BVI company (the “Target Company”), at a purchase price

of US$4,000,000 (the “Purchase Price”) (the “Transaction”).

Pursuant to the Share Transfer Agreement, Sellers

shall complete certain reorganizations no later than June 30, 2024, after which the Target Company will indirectly hold 100% equity interest

in 1) Shenzhen Zhongtou Business Consultants Co., Ltd., a company incorporated under the laws of People’s Republic of China (“PRC”)

(“Domestic Operating Entity 1”), 2) Shenzhen Zhongtou Industry Economic Consulting Co., Ltd., a PRC company (“Domestic

Operating Entity 2”), and 3) Shenzhen Zhongtou Industry Research Institute Co., Ltd., a PRC company (“Domestic Operating Entity

3,” together with Domestic Operating Entity 1 and Domestic Operating Entity 2, the “Domestic Operating Entities”). As

a result of the Transaction, Buyer will indirectly hold 100% equity interest in the Domestic Operating Entities.

Pursuant to the Share Transfer Agreement, Buyer

shall pay to Sellers the Purchase Price on or before the Closing Date (as defined below). “Closing Date” means the seventh

day after all of the following conditions have been met: (1) the Share Transfer Agreement has been signed by all parties; (2) Buyer, Seller

and the Target Company have respectively obtained their internal approvals related to the Translation; and (3) The Target Company has

completed the acquisition of the Domestic Operating Entities.

Pursuant to the Share Transfer Agreement, each

of Mr. Hu and Ms. Qian will enter into an employment agreement (the “Employment Agreement”) with the Company and the Target

Company, and will be employed as the management personnel of the Target Company after the Transaction. The Company plans to grant cash

or shares award to Mr. Hu and Ms. Qian as incentive if the Target Company’s performance meets certain requirements, which are expected

to be specified in the Employment Agreements.

The foregoing summary of the terms of the Share

Transfer Agreement is subject to, and qualified in its entirety by reference to, a copy of the Share Transfer Agreement that is filed

as Exhibit 99.1 to this Report on Form 6-K and is incorporated herein by reference.

About the Target Company

and the Domestic Operating Entities

The Target Company was incorporated under the

laws of BVI and it is an intermediate holding company to facilitate financing.

Domestic Operating Entity 1 primarily provides

industrial consulting services to governments and industrial parks. Its services include regional planning, industrial planning, and industrial

park planning, along with investment planning, agency, and conference services.

Domestic Operating Entity 2 customizes industry

research services for corporate clients, covering market size research, industry trend studies, and industry opportunity research, along

with strategic advice for industry investment development.

Domestic Operating Entity 3 focuses on providing

industrial research services to corporate clients, offering industry research reports such as investment analysis, city investment environment

assessment, and foreign investment environment research.

SIGNATURES

Pursuant to the requirements of the Securities

Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| Date: December 20, 2023 |

Top KingWin Ltd |

| |

|

|

| |

By: |

/s/ Ruilin Xu |

| |

|

Ruilin Xu |

| |

|

Chief Executive Officer |

EXHIBIT INDEX

3

Exhibit 99.1

Share Sale and Transfer Agreement

This Share Sale and Transfer Agreement (hereinafter

referred to as “this Agreement”) is entered into on December 20, 2023 in Shenzhen, Guangdong Province, China, by and between

the following parties:

FutureScope Advisors LTD (hereinafter referred

to as “Seller 1”), a company registered and existing under the laws of the British Virgin Islands with a registered address

at Start Chambers, Wickham’s Cay II, P. O. Box 2221, Road Town, Tortola, British Virgin Islands;

Visionary Strategies LTD (hereinafter referred

to as “Seller 2”), a company registered and existing under the laws of the British Virgin Islands with a registered address

at Start Chambers, Wickham’s Cay II, P. O. Box 2221, Road Town, Tortola, British Virgin Islands;

Hu Zhiliang (hereinafter referred to as “Seller

3”), with an identification number of _______ ;

Qian Li (hereinafter referred to as “Seller

4”), with an identification number of _______ ;

Sky KingWin Ltd (hereinafter referred to as “Buyer”),

a company registered and existing under the laws of the British Virgin Islands with a registered address at Ritter House, Wickhams Cay

Il, PO Box 3170, Road Town, Tortola VG1110, British Virgin Islands;

Top KingWin Ltd (hereinafter referred to as “Listed

Company”), a company registered and existing under the laws of the Cayman Islands and listed on NASDAQ in the United States, with

a registered address at 89 Nexus Way, Camana Bay, Grand Cayman, KY1-9009, Cayman Islands;

Shenzhen Zhongtou Business Consulting Co., Ltd.

(hereinafter referred to as “Zhongtou Business”), a company registered and existing under the laws of the People’s Republic

of China with a registered address at Room 4D, Block A, Xuesong Building, Taikang 6th Road, Chegongmiao, Futian District, Shenzhen;

Shenzhen Zhongtou Industry Research Institute

Co., Ltd. (hereinafter referred to as “Zhongtou Research Institute”), a company registered and existing under the laws of the

People’s Republic of China with a registered address at Room 4D, Block A, Xuesong Building, Taikang 6th Road, Chegongmiao, Futian District,

Shenzhen;

Shenzhen Zhongtou Industry Economic Consulting

Co., Ltd. (hereinafter referred to as “Zhongtou Consulting”), a company registered and existing under the laws of the People’s

Republic of China with a registered address at Room 4D, Block A, Xuesong Building, Taikang 6th Road, Chegongmiao, Futian District, Shenzhen.

The above-mentioned Seller 1, Seller 2, Seller

3, and Seller 4 are hereinafter collectively referred to as the “Seller”, and together with other parties, they are collectively

referred to as the “Parties”, and any of the above parties alone is referred to as a “Party”.

In consideration of:

| 1. | Industry

Insights Consulting LTD (hereinafter referred to as the “Target Company”) is a company registered and existing under the laws

of the British Virgin Islands. Seller 1 holds 50% of its shares, and Seller 2 holds 50% of its shares; Seller 3 holds 100% of Seller

1’s shares, and Seller 4 holds 100% of Seller 2’s shares. |

| 2. | Zhongtou

Business, Zhongtou Research Institute, and Zhongtou Consulting (hereinafter collectively referred to as “Domestic Operating Entities”)

are all companies registered and existing under law of People’s Republic of China. The target Company will establish a subsidiary

in Hong Kong, China, and the subsidiary will acquire Shenzhen Gaoshengde Investment Management Co., Ltd. (hereinafter referred to as

“Gaoshengde”), a shareholder that indirectly holds 100% equity of the three Domestic Operating Entities. That is, the Target

Company will indirectly hold 100% equity of the three Domestic Operating Entities by re-structuring. |

| 3. | Based

on mutual agreement, the Seller intends to sell and transfer the shares to the Buyer in accordance with the terms and conditions of this

Agreement, and the Buyer agrees to accept and purchase the shares held by the Seller in the Target Company in accordance with the terms

and conditions of this Agreement. |

The Parties have come to the following agreement:

Article 1 Sale and Transfer

1.1 Sale and Transfer of Shares. The Parties

hereby confirm that the overall transfer consideration for the three Domestic Operating Entities is USD 4,000,000, of which Zhongtou Business

transfer consideration is USD509,349, Zhongtou Research Institute transfer consideration is USD 1,264,135, and Zhongtou Consulting transfer

consideration is USD 2,226,515. The three Domestic Operating Entities are currently undergoing domestic and foreign restructuring and

will indirectly become wholly-owned subsidiaries of the Target Company after completing the restructure. Based on this, according to the

terms and conditions in this Agreement, the Seller hereby agrees to sell and transfer all the restructure shares of the Target Company

held by it (hereinafter referred to as “Target Shares”) to the Buyer, and the Buyer agrees to purchase and accept the Target

Shares at a consideration of USD 4,000,000 (hereinafter referred to as the “Transfer Consideration”) in accordance with the

terms of this Agreement.

1.2 The Buyer is only obligated to transfer

the purchase price to the Seller’s joint bank account in accordance with the agreement. Once the Buyer has transferred the purchase price

to the Seller’s appointed bank account in accordance with the agreement, it is deemed that the Buyer has fully performed its payment obligations

for the acquisition of the target shares under this agreement. How the Seller handles the transfer price after receipt does not affect

the fact that the Buyer has fulfilled its entire payment obligation for the acquisition of the target shares under this agreement.

1.3 The Seller guarantees that the basic

situation of the target company and its subsidiaries are as shown in Appendix 1 of this agreement, and the information of the target company

and its subsidiaries stated in Appendix 1 is true, accurate, and free from misleading statements.

1.4 The Seller guarantees that the target

shares have no mortgages, pledge rights, security rights, preemptive rights, property burdens, or any form of third-party rights or claims,

or any claims for compensation, at the time of signing this agreement and until the closing date. The target company shall not distribute

any dividends, bonuses, or any other investment benefits to its respective shareholders before the Buyer obtains the target shares.

1.5 Closing. For the purposes of this agreement,

“Closing Date” refers to the seventh (7th) day after all of the following conditions have been met: (1) This Agreement has been

signed by all parties; (2) Internal resolutions (as defined below) have been obtained by the Buyer, Seller and the Target Company related

to the transfer of shares; (3) The Target Company has completed the acquisition of the three Domestic Operating Entities in accordance

with Article 3.3 of this Agreement. The completion of the transfer of the target shares (hereinafter referred to as the “Transfer”)

should occur on the Closing Date. The Buyer should pay the Transfer Consideration stipulated in Article 1.1 to the Seller’s designated

bank account on or before the Closing Date.

1.6 Expenses. Unless otherwise agreed in

this agreement or by the parties, each party should bear all expenses for negotiating and preparing this agreement and any other related

agreements proposed to be established under this agreement, as well as fulfilling or complying with all obligations and conditions that

must be fulfilled or complied with by it under this agreement and other agreements, including any fees, expenses, or expenditures incurred

by any lawyers and/or accountants engaged by them.

1.7 Priority of shares acquisition. If the

Listed Company intends to release the shares of the target company in the future, the Seller may have priority to acquire the shares of

the target company under the same conditions after the notification of the Listed Company.

Article 2 Management

Retention

2.1 To ensure the continuous profitability

and stable performance of the target company and its subsidiaries, Mr. Hu Zhiliang and Ms. Qian Li will be employed in the target company

after the completion of this acquisition.

2.2 After this agreement taking effect,

Mr. Hu Zhiliang and Ms. Qian Li will be appointed as management personnel of the target company (Official Employment Agreement will be

established between Mr. Hu Zhiliang, Ms. Qian Li and the target company). If the performance of the target company and its subsidiaries

continues to grow and meet the specific performance indicators required by the Listed Company during the tenure of Mr. Hu Zhiliang and

Ms. Qian Li, they will be rewarded by performance incentives, including but not limited to cash and stocks. The specific performance indicators,

methods, and amounts of performance incentives are subject to the terms of the respective employment agreements.

Article 3 Representations

and Warranties of the Parties

3.1 Based on the Buyer and the Listed Company’s

agreement to sign this agreement, the Seller hereby makes to the Buyer and the Listed Company the representations and warranties set out

in Appendix 2 of this agreement, which are true, accurate, and correct in all respects as of the date of signing this agreement and the

closing date.

3.2 Based on the Seller’s agreement to sign

this agreement, the Buyer and the Listed Company hereby making the following representations and warranties to the Seller:

(i) They have been legally established and validly existing in accordance with the laws of their registered location;

(ii) They have taken all necessary corporate

actions and have all necessary powers and authorizations to sign, deliver, and fulfill their obligations under this agreement;

(iii)

This agreement has been validly authorized by them, and upon their signature and delivery, it constitutes a legal, valid, and binding

obligation on them, which can be enforced against them in accordance with the agreement.

3.3 The Seller and the three domestic operating

entities provide commitments and guarantees to the Buyer and the Listed Company that the target company should complete the acquisition

of 100% equity of the three domestic operating entities by no later than June 30, 2024.

3.4 At any time before or after the closing

date, the Seller and the target company shall not make or omit or permit or cause any other person to make or omit any act or matter that

will (or may) result in, constitute, or give rise to a material breach of any representation or warranty without obtaining prior written

consent from the Buyer.

3.5 The Buyer’s rights and compensation

for any inaccurate, untrue, or unfulfilled representations and warranties made by the Seller shall not be affected by:

(i) The completion of the sale and transfer of the shares under this agreement by the Seller to the Buyer;

(ii) The Buyer’s failure to exercise or delay in exercising any rights or compensation against the Seller and/or the target company.

Article 4 Actions

Prior to Closing

4.1 The Seller hereby undertakes to the

Buyer that prior to the closing date, the target company and its subsidiaries will operate their businesses in their usual and customary

manner and maintain their continued operations. Without obtaining the Buyer’s written consent or unless otherwise specified in this agreement,

the target company and its subsidiaries will not:

(i) Accept any commitments, obligations, or responsibilities that are material to the business of the target company and its subsidiaries

or that involve an amount of not less than RMB 500,000;

(ii) Terminate or sell all or part of the business of the target company and its subsidiaries;

(iii) Acquire or sell any business, assets, properties, contractual rights, leases, or licenses that have a significant impact on the

current business of the target company and its subsidiaries;

(iv) Make any significant changes to the composition, management structure, or arrangements of the Board of Directors of the target company

and its subsidiaries or employment contracts (including but not limited to hiring and firing);

(v) Settle or compromise any current disputes or lawsuits related to the business of the target company and its subsidiaries;

(vi) Distribute, declare distribution,

or pay any dividends or profits to the target company and its subsidiaries;

(vii) Modify the articles of association

of the target company and its subsidiaries, or make any changes to the registered capital, shareholders, or shareholdings of the target

company and its subsidiaries except as otherwise specified in this agreement;

(viii) Transfer the property of the target company and its subsidiaries free of charge;

(ix) Engage in transactions by the target company and its subsidiaries at obviously unreasonable prices;

(x) Provide property guarantees for unsecured debts of the target company and its subsidiaries;

(xi) Prepay any unpaid debts of the target company and its subsidiaries before maturity;

(xii) Waive any claims by the target company and its subsidiaries;

(xiii) Add new fixed assets to the target company and its subsidiaries (except for new fixed assets, changes to fixed assets of the target

company and its subsidiaries prior to the closing date should be limited to normal depreciation, and the original value of intangible

assets shall not be changed and limited to normal amortization), or make significant adjustments to the assets and liabilities of the

target company and its subsidiaries; and

(xiv) Engage in any other acts or omissions that damage or may damage the shareholder rights or value of the target shares enjoyed by

the Buyer after acquiring the target shares.

Article 5 Approval

and Registration

5.1 Revision of Transaction Documents. The

framework intention agreement signed between the Seller and the Buyer shall terminate on the closing date.

5.2 Board Resolution. The parties shall

promptly and not later than seven (7) days after the signing of this agreement: (i) promote the unanimous approval of the Board of Directors

of the target company to resolve to approve the share transfer and related matters under this agreement (“board resolution”)

and (ii) promote the approval of the shareholders of the target company for this share transfer.

5.3 Approval by Buyer and Seller. Not later

than seven (7) days after the signing of this agreement, the Seller shall promote the approval of the Board of Directors of the Seller

for the share transfer and related matters under this agreement, and the Buyer shall promote the approval of the Board of Directors of

the Buyer for the share transfer and related matters under this agreement and promote the approval of the Board of Directors of the Listed

Company for the share transfer and related matters under this agreement (the board’s resolutions of the target company and the parties

approving the share transfer and related matters under this agreement are collectively referred to as “internal resolutions of the

Buyer, Seller, and target company”).

5.4 Registration Changes. Within seven (7)

days after the completion of the reorganization of the target company at home and abroad or any other date agreed by both parties, the

parties shall facilitate the target company to complete corresponding registration procedures for the share transfer under this agreement

with its registration authority, update the shareholder register of the target company, and take all other necessary actions to expedite

the completion of the aforementioned registration and changes. Without limiting the foregoing provisions, the Buyer and Seller agree to

assist the target company in completing the aforementioned registration and changes not later than June 30, 2024.

Article 6 Effectiveness

of Share Transfer

6.1 From the closing date onwards, the Buyer

shall enjoy and assume the statutory rights and obligations under the target shares, and the Seller shall no longer enjoy and assume such

rights and obligations.

Article 7 Information

7.1 Following the closing date, if requested

by the Buyer, the Seller shall return all documents related to the target company that are in its possession or obtained by it as a shareholder,

director, manager, or employee of the target company (whether in paper, electronic, or other form) to the target company or the Buyer.

Article 8 Change

and Termination of Agreement

8.1 Unless otherwise specified by law, any

modifications or termination of this agreement must be binding only after being signed in writing by all parties or their representatives.

Article 9 Compensation

9.1 Obligations of Parties. Any party shall

fully compensate any other party for any and all direct and indirect losses incurred by such other party as a result of any breach or

failure to perform any representations, warranties, or agreements made by such party under this agreement or in connection with this agreement.

9.2 Procedures.

(a) Notice. If any party (“compensated

party”) is entitled to compensation under this agreement, such compensated party may give notice to the party obligated to make compensation

(“compensating party”).

(b) Defense. If any rights, claims, or liabilities are asserted by any third party against any compensated party in connection with any

matter for which compensation is owed under this agreement, the compensating party shall defend any litigation or other proceeding initiated

by such third party against such compensated party if requested in writing by such compensated party. If, after receiving a request to

defend in such litigation or other proceeding, the compensating party fails to defend such compensated party, an adverse judgment against

such compensated party shall be deemed conclusive evidence requiring the compensating party to provide compensation to such compensated

party. However, if the compensating party did not receive reasonable notice of such litigation or other proceeding or was not allowed

by the compensated party to control such defense, an adverse judgment against such compensated party shall be only presumptive evidence

of requiring the compensating party to provide compensation to such compensated party. With respect to any defense of any claim, each

party shall allow the party controlling such defense to request delivery of all documents, records, and other papers in its possession

that are necessary or applicable for such defense.

9.3 Force Majeure. If losses are incurred

by the target company and its subsidiaries due to force majeure events or business litigation and the amount of losses does not exceed

20% of the overall valuation of the target company, it shall not constitute a breach by the Seller under this agreement, and the Seller

shall not be liable for compensation.

9.4 Non-Exclusive Remedy. This Article 9

shall not be deemed to exclude or limit in any way any other rights or remedies for breach of contract or misrepresentation under this

agreement.

Article 10 Applicable

Law

10.1 The formation, effectiveness, interpretation,

performance, amendment, and termination of this agreement, as well as the resolution of disputes arising from or in connection with this

agreement, shall be governed by the laws of the People’s Republic of China.

Article 11 Dispute

Resolution

11.1 Any disputes, differences, or claims

arising among the parties regarding the interpretation, breach, termination, or effectiveness of this agreement that are generated from

or related to this agreement (each referred to as a “dispute”) shall be resolved first through consultation among the parties.

Such consultation shall be conducted immediately after one party sends a written request for consultation to the other relevant parties.

If such dispute is not resolved within thirty (30) days after such notice is sent, such dispute shall be submitted to an arbitration institution

for review upon any party sending notice informing the other relevant parties of their intention to initiate arbitration (“arbitration

notice”).

11.2 Such arbitration shall be conducted

at the Shenzhen Court of International Arbitration (“SCIA”) in accordance with its effective arbitration rules at that time,

conducted in Chinese, and held in Shenzhen. The arbitration tribunal shall consist of three arbitrators. The Buyer and Seller shall each

appoint one arbitrator from SCIA’s list of arbitrators, and the third arbitrator shall be appointed by SCIA.

11.3 The arbitration decision shall be final

and binding on all parties, and the prevailing party may apply to a court with jurisdiction for enforcement of the decision. Either party

shall have the right, where possible, to apply to a court with jurisdiction for preliminary injunctive relief before the arbitration decision

is made. Unless otherwise specified in the arbitration decision, the arbitration fees shall be borne by the losing party.

Article 12 Other

Provisions

12.1 Copies. This Agreement shall be executed

in nine (9) original counterparts, with each party holding one (1) original counterpart, and the remaining two original counterparts being

retained by the target company or used for relevant registration procedures with the registration authority.

12.2 Notices. All notices and other communications

made under this Agreement shall be in writing, in Chinese or both Chinese and English, and shall be sent to the address specified by the

relevant party below or to such other address as the receiving party may notify to the other parties by giving notice in writing. The

effective date of delivery of a notice shall be determined as follows:

(a) A notice delivered by hand shall be

deemed effectively delivered on the date of delivery;

(b) A notice sent by express courier shall

be deemed effectively delivered on the date of signature shown on the courier company’s website or system;

(c) A notice sent by fax or email shall

be deemed effectively delivered on the date of transmission (as shown on the fax document or email).

12.3 Accumulation of Rights and Remedies;

No Implied Waiver. All rights and remedies under this Agreement are cumulative and are not exclusive of any other rights or remedies that

may be available. The failure or delay by any party in exercising any right under this Agreement shall not operate as a waiver, nor shall

any single or partial exercise of any right preclude any further exercise of any other right.

12.4 Severability. If any provision of this

Agreement is held to be invalid, illegal or unenforceable in any respect under applicable law, the validity, legality and enforceability

of the remaining provisions shall not in any way be affected or impaired.

12.5 Assignment. This Agreement and any

rights or obligations under this Agreement may not be assigned without the prior written consent of the other parties.

12.6 Further Assurances. The parties agree

that, in order to facilitate the entry into force of this Agreement within a reasonable time, they will, at the request of the other party,

execute and deliver all necessary documents, take all necessary actions and procure all necessary actions by others.

[No content below,The

following pages are the signing pages]

Signing Page of

Share Sale and Transfer Agreement

This agreement was signed by the authorized

representatives of each party on the date specified at the beginning of this agreement.

| |

FutureScope Advisors LTD |

| |

|

| |

FutureScope Advisors LTD (seal) |

| |

|

| |

/s/ Hu Zhiliang |

| |

|

| |

Authorized representative:__________________ |

| |

|

| |

Name: |

| |

|

| |

Position: |

| |

Visionary Strategies LTD |

| |

|

| |

Visionary Strategies LTD (seal) |

| |

|

| |

/s/ Qian Li |

| |

|

| |

Authorized representative:__________________ |

| |

|

| |

Name: |

| |

|

| |

Position: |

Signing Page of

Share Sale and Transfer Agreement

This

agreement is signed by the authorized representatives of the parties on the date stated at the beginning of this agreement.

| Hu Zhiliang |

|

| |

|

| /s/ Hu Zhiliang |

|

| |

|

| |

|

| |

|

| Qian Li |

|

| |

|

| /s Qian Li |

|

| |

|

| |

|

Signing Page of

Share Sale and Transfer Agreement

This

agreement is signed by the authorized representatives of the parties on the date stated at the beginning of this agreement.

| Sky KingWin Ltd |

|

| |

|

| Sky KingWin Ltd (seal) |

|

| |

|

| /s/ Xu Ruilin |

|

| |

|

| Authorized

Representative: _______________ |

|

Signing Page of

Share Sale and Transfer Agreement

This

agreement is signed by the authorized representatives of the parties on the date stated at the beginning of this agreement.

| Top KingWin Ltd |

|

| |

|

| Top KingWin Ltd (seal) |

|

| |

|

| /s/ Xu Ruilin |

|

| |

|

| Authorized Representative:

________________ |

|

Signing Page of

Share Sale and Transfer Agreement

This

agreement is signed by the authorized representatives of the parties on the date stated at the beginning of this agreement.

| |

Shenzhen Zhongtou Commercial Consulting Co., Ltd(Chop) |

| |

|

| |

|

| |

Shenzhen Zhongtou Commercial Consulting Co., Ltd (seal) |

| |

|

| |

/s/ Hu Zhiliang |

| |

|

| |

Authorized representative:__________________ |

| |

|

| |

Name: |

| |

|

| |

Position: |

| |

|

| |

Shenzhen Zhongtou Industry Research Institute Co., Ltd.(Chop) |

| |

|

| |

Shenzhen Zhongtou Industry Research Institute Co., Ltd. (seal) |

| |

|

| |

/s/ Hu Zhiliang |

| |

|

| |

Authorized representative:__________________ |

| |

|

| |

Name: |

| |

|

| |

Position: |

| |

|

| |

Shenzhen Zhongtou Industry Economic Consulting Co., Ltd.(Chop) |

| |

|

| |

Shenzhen Zhongtou Industry Economic Consulting Co., Ltd. (seal) |

| |

|

| |

/s/ Hu Zhiliang |

| |

|

| |

Authorized representative:__________________ |

| |

|

| |

Name: |

| |

|

| |

Position: |

Appendix 1

Basic Information of the Target Company and its Subsidiaries

As of the date of signing this agreement, the

basic information of the target company and its subsidiaries is as follows:

(1) Target Company

Name: Industry Insights Consulting LTD

Certificate of Incorporation Number: 2136266

Registered Address: Start Chambers, Wickham’s Cay II, P. O. Box 2221, Road Town, Tortola, British Virgin Islands

Authorized Share Capital: 50,000

Issued Share Capital: 2

Type of Company: Holding Company

Date of Establishment: November 17, 2023

Director: Zhiliang Hu

Shareholders and Shareholding: FutureScope Advisors LTD holds 50%; Visionary Strategies LTD holds 50%.

(2) Subsidiary of Target Company - Shenzhen Gaoshengde

Investment Management Co., Ltd.

Name: Shenzhen Gaoshengde Investment Management Co., Ltd.

Unified Social Credit Identifier: 91440300349807771R

Address: Room 201, Building A, No.1 Qianwan Yilu, Qianhai Shenzhen-Hong Kong Cooperation Zone, Shenzhen

Legal Representative: Huang Xiaohong

Registered Capital: RMB 50 million

Paid-in Capital: -

Type of Company: Limited Liability Company

Business Scope: General operating projects include investment management, investment consulting, enterprise management consulting, investment

project planning (excluding restricted projects); enterprise marketing planning, economic information consulting (excluding talent agency

services and restricted projects); domestic trade (excluding exclusive products that require licensing and approval).

Date of Establishment: July 29, 2015

Operation Period: July 29, 2015 to Indefinite

Director: Huang Xiaohong

Shareholders and Shareholding: Zhiliang Hu holds

50%, Huang Xiaohong holds 50%.

(Note: Please translate the remaining information

of Subsidiaries of the Target Company similarly.)

(3) Subsidiary Company of the Target Company

- Shenzhen Zhongtou Business Consulting Co., Ltd.

Name: Shenzhen Zhongtou Business Consulting Co.,

Ltd

Unified Social Credit Code: 914403007432145792

Address: 4D, Cedar Building, Taeran 6th Road,

Chegongmiao, Futian District, Shenzhen

Legal Representative: Ling Zhihua

Registered Capital: CNY 5 million

Paid-up Capital: CNY 5 million

Company Type: Limited Liability Company

Business Scope: General business projects include

Industrial Planning Consulting, Urban Planning and Design, Marketing Planning, Corporate Image Planning, Corporate Management Consulting,

Investment Consulting, Business Information Consulting (excluding projects prohibited by laws, administrative regulations, and decisions

of the State Council; restricted projects require permission before operation)

Establishment Date: September 20, 2002

Operating Period: September 20, 2002, to September

20, 2032

Board of Directors: Ling Zhihua

Shareholders and Shareholding Ratio: Hu Zhiliang

holds 50%, Huang Xiaohong holds 50%

(4) Subsidiary Company of the Target Company

- Shenzhen Zhongtou Industrial Research Institute Co., Ltd.

Name: Shenzhen Zhongtou Industrial Research Institute

Co., Ltd.

Unified Social Credit Code: 91440300093624647B

Address: 4D, Cedar Building, Taeran 6th Road,

Chegongmiao, Futian District, Shenzhen

Legal Representative: Ling Zhihua

Registered Capital: CNY 500,000

Paid-up Capital: Not specified

Company Type: Limited Liability Company

Business Scope: General business projects include

Industrial Research Consulting Services, Economic Information Consulting Services, Investment Management Consulting Services, Corporate

Management Consulting Services (excluding restricted projects), Engineering Cost Certification Consulting Services.

Establishment Date: March 28, 2014

Operating Period: March 28, 2014, to No fixed

period

Board of Directors: Ling Zhihua

Shareholders and Shareholding Ratio: Hu Zhiliang

holds 50%, Ling Zhihua holds 50%

(5) Subsidiary Company of the Target Company

- Shenzhen Zhongtou Industrial Economic Consulting Co., Ltd.

Name: Shenzhen Zhongtou Industrial Economic Consulting

Co., Ltd.

Unified Social Credit Code: 91440300MA5ELMKN9M

Address: 4D, Cedar Building, Taeran 6th Road,

Chegongmiao, Futian District, Shenzhen

Legal Representative: Hu Zhiliang

Registered Capital: CNY 5 million

Paid-up Capital: Not specified

Company Type: Limited Liability Company

Business Scope: General business projects include

Economic Information Consulting Services, Investment Consulting Services, Corporate Management Consulting Services; Industrial Planning,

Urban and Rural Planning (operated with relevant licenses); Financial Consulting Services, Market Survey Consulting, Information Consulting,

Corporate Marketing Planning, Cultural Activity Planning, Corporate Image Planning, Event Planning; Technical development of computer

software (except for projects that require approval according to the law, business activities are carried out independently based on

the business license)

Establishment Date: July 3, 2017

Operating Period: July 3, 2017, to No fixed period

Board of Directors: Hu Zhiliang

Shareholders and Shareholding Ratio: Hu Zhiliang

holds 50%, Ling Zhihua holds 50%

Appendix 2

Representations and Warranties

On the date of signing this agreement, the Seller

represents and warrants to the Buyer as follows, which shall be deemed to be made on the closing date as well:

| 1. | The

Seller has been legally established and is validly existing under the laws of the British Virgin Islands or is a natural person with

full civil rights and capacity for civil conduct. |

| 2. | It

has taken all necessary corporate actions (if applicable) and possesses all necessary powers and authorizations to sign, deliver, and

perform its obligations under this agreement. |

| 3. | Its

signing, delivery, and performance of this agreement do not violate and will not violate: (1) any of its articles of association, business

licenses, or other constituent documents, or (2) any judgments, decrees, orders of any government agencies or courts in the British Virgin

Islands. |

| 4. | This

agreement has been validly authorized by it, and upon its signing and delivery, it constitutes a legal, valid, and binding obligation

on it, enforceable against it in accordance with the terms of the agreement. |

| 5. | The

100% shares of the target company transferred to the Buyer by the Seller 1 and Seller 2, and the shares or equity interests in the target

company’s subsidiaries held by the target company are not subject to any liens, mortgages, any form of property burdens, or third-party

rights and other adverse claims. They are entitled to transfer the target shares to the Buyer in accordance with the terms of this agreement. |

| 6. | The

shareholder contributions corresponding to the 100% shares of the target company transferred to the Buyer by the Seller 1 and Seller

2, and the shares of the target company’s subsidiaries held by the target company comply with the relevant laws, regulations, and articles

of association of their respective locations. The shareholders have completed the contributed portions without any situations such as

capital withdrawal, or false capital contribution that affect the value or realization of rights of the shares or equity interests. |

| 7. | The

target company will legally and effectively hold 100% shares or equity interests in the target company’s subsidiaries directly or indirectly

and will obtain all required approvals, registrations, filings, and complete other required government procedures in accordance with

applicable laws and regulations for investments or acquisitions of such equity interests or shares. |

| |

8. |

There are no material matters or circumstances related to the assets, business, or financial condition of the target company and its subsidiaries that have not been fully and fairly disclosed to the Buyer, which, if disclosed, could affect the Buyer’s decision to enter into this agreement. |

| 9. | Except

for the liabilities reflected or reserved in the financial statements, the target company and its subsidiaries do not have any other

liabilities. |

| 10. | The

personnel appointed by the Seller to the target company and its subsidiaries have not made any waivers or compromises of valuable rights

or liabilities in favor of the target company and its subsidiaries. |

| 11. | The

target company and its subsidiaries have not provided any loans or guarantees to their employees, managers, directors, or their relatives

or provided loans or guarantees for the benefit of the foregoing persons, except for prepaid travel expenses and other expenses incurred

in the normal course of business. |

| 12. | All

financial documents or explanations provided by the target company and its subsidiaries and their contents are true, complete, and accurate,

and there are no material omissions, concealments, or misleading statements that could materially affect the transactions described in

this agreement. The target company does not have any asset sales, assignments, or transfers not reflected in the financial statements

or any assumption of liabilities. |

| 13. | The

financial statements of the target company and its subsidiaries correctly reflect the financial position, assets and liabilities, profits,

losses, and operating results of the target company and its subsidiaries as of the dates and periods indicated therein. They include

all adjustments necessary to present fairly and comprehensively, in accordance with generally accepted accounting principles in the country/region

where they are located, the financial position, operating results, and cash flows of the target company and its subsidiaries as of the

reporting dates or corresponding periods. Except as set forth in the financial statements of the target company and its subsidiaries,

there are no off-balance sheet liabilities or contingent liabilities not disclosed to the Buyer. The financial statements are prepared

in accordance with generally accepted accounting principles in the country/region where they are located. Prior to the signing of this

agreement, there were no documents related to the financial condition of the target company and its subsidiaries that were not disclosed

to the Buyer. |

| 14. | The

target company and its subsidiaries possess all necessary powers and authorizations to engage in their existing businesses and to own,

lease, transfer, and use their properties. |

| 15. | The

target company and its subsidiaries have complied with applicable laws and regulations in all material respects and have not breached

any loan agreements, supply agreements, orders, sales agreements, or other material contracts binding them as a party or encumbering

their properties. |

| 16. | The

target company and its subsidiaries possess all necessary licenses, certificates, consents, orders, approvals, and other authorizations

issued by government agencies required or necessary to own or lease (as applicable), use their properties, and conduct their currently

operated businesses. They have completed all relevant explanations and registrations with all government agencies (hereinafter referred

to as “government approvals”), and such government approvals are valid. The target company and its subsidiaries have not received

any notifications regarding procedures for revoking or adjusting such government approvals. |

| 17. | The

target company and its subsidiaries have good ownership of all their properties that are important for their respective businesses and

are not subject to any encumbrances (excluding those incurred in the ordinary course of business) as of the date of signing this agreement

and the closing date. |

| 18. | All

required tax filings for the target company and its subsidiaries have been filed (considering all extended due dates), and all filings

are true, complete, and accurate. All taxes due for the target company and its subsidiaries have been fully paid in accordance with applicable

laws. The books and records of the target company and its subsidiaries contain appropriate records and provisions for accrued expenses

and provisions related to tax obligations for periods that are not finally determined but taxable in accordance with relevant laws and

accounting standards for bookkeeping and records. |

| 19. | The

target company and its subsidiaries have obtained and hold all licenses, certificates, consents, orders, approvals, and other authorizations

(hereinafter referred to as “qualifications”) issued by government agencies necessary to own, license, and use their intellectual

property rights. Such qualifications are valid. The target company and its subsidiaries possess legitimate rights, powers, and authorizations

to own, license, and use their intellectual property rights free from any encumbrances. |

| 20. | After

the transfer of shares under this agreement to the Buyer, the Seller or its affiliates do not retain any rights to the movable and immovable

properties of the target company and its subsidiaries. |

| 21. | Except

for the reserved amounts (in whole or in part) specified in the financial statements of the target company (if any), all accounts receivable

reflected in the financial statements, as well as the receivables existing on the closing date, shall constitute valid and undisputed

rights fully held by the target company, free from any valid rights limited by setoff, counterclaim, or other defenses (excluding normal

cash discounts incurred in the ordinary course of business). All accounts receivable reflected in the financial statements, accumulated

from the date of recording to the closing date, are valid receivables (excluding bad debt provisions reflected in the financial statements),

which have been recovered, are recoverable, or can be recovered within 365 days after the closing date without the need for litigation. |

| 22. | Neither

the target company nor its subsidiaries are currently subject to any administrative investigations, penalties, rectification measures,

or other legal proceedings due to any violations of laws and regulations, or there is evidence indicating that such legal proceedings

are about to be initiated. |

| 23. | There

are no ongoing or foreseeable major litigation or arbitration against or concerning the senior management of the target company and its

subsidiaries, or any disputes over the assets, shares, or equity of the target company and its subsidiaries, as well as their business

and operational activities. |

| 24. | If

at any time any institution or individual claims against the target company and its subsidiaries for actual and/or potential contingent

liabilities, responsibilities, unpaid taxes, fines, litigation, arbitration, or other claims related to the business, operation, and

management of the target company and its subsidiaries prior to the closing date based on civil laws, administrative laws, or other legal

provisions, the Seller shall be responsible for all resulting liabilities and losses incurred by the Buyer and provide corresponding

compensation to the Buyer. |

| 25. | The

Seller or its affiliates have not taken and will not take any measures to notify, request, or induce any suppliers, customers, or partners

of the target company and its subsidiaries to suspend, delay, reduce, or terminate their cooperation and business relationships with

the target company and its subsidiaries. |

| 26. | Within

two years from the closing date, the Seller shall not directly or indirectly engage in self-operation, investment, employment, or entrust

others to operate, invest in, or be employed by any entity or business that is identical, similar, or competitive with the business of

the target company and its subsidiaries. |

| 27. | The

Seller shall be jointly and severally liable for any liabilities, responsibilities, or losses that the target company or its subsidiaries

may be required to compensate due to any illegal, or breaching behaviors existing in the target company or its subsidiaries prior to

the closing date, regardless of whether such liabilities and responsibilities arise before or after the closing date as a result of pre-closing

actions. |

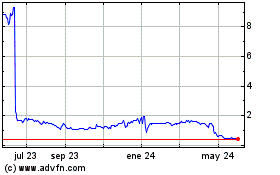

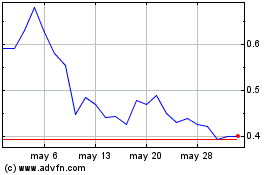

Top KingWin (NASDAQ:TCJH)

Gráfica de Acción Histórica

De Abr 2024 a May 2024

Top KingWin (NASDAQ:TCJH)

Gráfica de Acción Histórica

De May 2023 a May 2024