UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

SCHEDULE

14A

(Rule 14a-101)

Proxy

Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

Filed

by the Registrant ☒

Filed

by a Party other than the Registrant ☐

Check

the appropriate box:

| ☐ |

|

Preliminary

Proxy Statement |

| ☐ |

|

Confidential,

for use of the Commission only (as permitted by Rule 14a-6(e)(2)) |

| ☐ |

|

Definitive

Proxy Statement |

| ☒ |

|

Definitive

Additional Materials |

| ☐ |

|

Soliciting

Material Pursuant to §240.14a-12 |

WORKHORSE

GROUP INC.

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement,

if Other Than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| ☒ |

No

fee required. |

| |

|

| ☐ |

Fee

paid previously with preliminary materials. |

| |

|

| ☐ |

Fee

computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

Workhorse Stockholder Q&A Webcast

August

24, 2023

Corporate Speakers

| ● | Stan March; Workhorse Group Inc.; VP of Corporate Development & Communications |

| ● | Richard Dauch; Workhorse Group Inc.; President, CEO & Director |

| ● | Robert Ginnan; Workhorse Group Inc.; CFO |

PRESENTATION

Stan March: Hello. And thank you for joining us this morning.

I’m Stan March, Vice President of Corporate Development and Communications

here at Workhorse. Joining me today are Rick Dauch, our CEO; and Bob Ginnan, our CFO.

Before we begin today’s webcast, I’ll read the disclaimer.

Today’s webcast contains certain forward-looking statements within

the meaning of federal securities laws with respect to Workhorse Group, including statements relating to the amendment of our Articles

of Incorporation in Nevada and its potential impact on the company’s ability to obtain financing to build our offerings for commercial

and aerospace vehicles.

Forward-looking statements are predictions, projections and other statements

about future events based on current expectations and assumptions, and as a result are subject to risks and uncertainties.

Many factors could cause actual future events to differ materially

from the forward-looking statements made on today’s webcast, including but not limited to changes in voting and the actual vote counts

on the day of the annual meeting, the availability of and need for capital, and the risks and factors and other uncertainties regarding

the company’s business which are described in the risk factors section of the company’s annual report which is filed on Form 10-K with

the Securities and Exchange Commission for the December 31, 2022, calendar year, which was filed on March 1, 2023, and the company’s quarterly

report on Form 10-Q for the fiscal quarter ending June 30, 2023, filed with the SEC on August 14, 2023.

These filings identify and address other important risks and uncertainties

that could cause actual events and results to differ materially from those contained in the forward-looking statements.

The company assumes no obligation and does not intend to update or

revise these forward-looking statements.

And with that, let’s now turn the call over to Rick Dauch.

Rick?

Richard Dauch: Thanks, Stan. Good morning, everybody. And good morning.

A special good morning to my fellow Workhorse stockholders. Thank you for joining us today.

As you know, this is a critically important time for us here at Workhorse.

As we continue to advance our product portfolio roadmaps, we are evaluating

several financial -- financing options to help Workhorse build a bridge to its next phase of growth and value creation. The only way for

these financing options to be available to us are going to, if the -- our stockholders vote for the proposal to increase Workhorse authorized

shares ahead of the special meeting of stockholders which is just a few days later, on August 28.

Over the last several weeks, we’ve been engaged with many of our stockholders.

We respect their views. We appreciate how sophisticated, knowledgeable and I would say passionate you are about Workhorse. Thanks for

your continued interest and support of our company. We also recognize that you want to have as much information as possible as we approach

the special meeting next Monday. Our goal with this webcast today is to address your questions and explain about the proposal, our business

and how we are working on behalf of stockholders to rebuild Workhorse and create long-term shareholder value.

We invited your questions last week, and we are quite impressed by

the number of people submitting questions, well over 100 questions were received. We intend to answer as many questions as we can. We

received a number of duplicate answers, so we combine some of those, and we’ll try to get through all of those. Stan is going to read

the questions and then Bob and I will take turns to answer the questions depending on what the question is.

Before we jump into Q&A, I want to give you my perspective on the

importance of the vote. I’ve had the opportunity to hold executive leadership positions at multiple companies across the global industry

over my 30-year automotive career, and I’ve been through some of the toughest times ever, the 2008 and 2009 global recession and the COVID

period of 2019 and ’20. We understand what tough times are in the auto industry. When I joined Workhorse as CEO in August ’21, some of

my experience was sought after because we knew we had some challenging situations here at Workhorse.

I knew the company had incredible potential, but we had to address

some legacy issues, and we’ve talked about those very openly with our shareholders over the last few years, and we’ve put 95% of

those behind us. Since then, we have transformed this business, executing a clear strategy to stabilize, fix, and properly grow Workhorse

into a viable commercial EV OEM, easier said than done. We’ve revamped our management team. We’ve revitalized our facilities. We doubled

our engineering staffs. We’ve advanced our roadmaps with our products, both on the commercial vehicle side and also over on the drone

side of the business. We strengthened the company’s financial position, giving us the financial flexibility to execute the plan we put

together. And I have complete confidence that we’re on the right path.

Our goal to increase Workhorse share authorization is to protect our

shareholders and create long-term value. We’re looking to issue the shares we need, so we can continue to fund our operations and our

future growth of the company. Our ask of you is very simple. We need your support for the vote, and we encourage you to vote as soon as

possible. We intend to use the financing we raise to strengthen our business and drive forward on our plans. Revamped leadership team

is laser-focused on executing new designs, ramping up production, profitably growing our revenue, and creating value for all stakeholders.

We will use the capital to expand and advance our product roadmaps.

We’re launching 3 new vehicles in 12 months and 9 vehicles over 3 years. That requires investment in our plants, in our people, in our

suppliers, and with our dealers and distributors. We’re ramping up production of the W4 CC and W750. As we said earlier, those vehicles

are now in production. Beginning next week, we start our first official production of the W56. To date, we’ve only done program build

or test vehicles. We’re now starting production next Monday. We have the parts all due in today, it will be all sorted out this

weekend, and we’ll start our production next week. And then we’ll start the WNext later on in this year and won’t launch

until ’25, ’26. As I said, the W56 chassis is rolling down the line next week, and we’re excited to continue that ramp up

production throughout the month of September and into October.

In addition, we continue to invest in supplier tooling and assembly

equipment and painting equipment as we move into full production as the W56 step van, hopefully, by the end of September and early October.

Right now we’re at a point where there’s a funding gap in order to continue with our plans and grow the company. While our first line

of new products are finally ready for the market, we have a full product line -- we need to have a full product lineup to be successful

long term. Think about the auto companies you know or the truck companies. They don’t live on one vehicle only. They have multiple platforms

and vehicles. And they’ve got to refresh those vehicles every 2 or 3 years. That’s exactly what we’re creating here, a real automotive

OEM company.

In addition, the overall adoption of EV technologies is going slower

across industry than was the forecast by industry analysts. A big factor in that is the charging infrastructure or the lack thereof. Also

I’d say there’s some people who are a little bit shy of how electric vehicles will work, especially in the commercial vehicle space in

terms of range anxiety and payload capacity. They’ve had some failures in the past. That’s why we’ve been so hard on ourselves in making

sure our trucks are well designed, tested, and ready for production before we put them out on the market. We don’t want to get a truck

out there that doesn’t work. We’ve had other people in the industry do that. We did that ourselves for the C1000. That’s in the past.

We’re focused on the future.

We’ve been very strategic on how we cleaned up our balance sheet when

we first got here and financed our efforts to date. We’ve been good stewards of your capital. The financing options we are looking at

today now require us to be able to issue more shares. As we mentioned, these include raising money through convertible debt, but we can’t

access that financing without being able to issue more equity. We set up a website, you have likely seen www.votewkhs.com with information

on how to vote on the share authorization proposal. We encourage you to visit and learn how to get your vote for the poll today.

With that, I’ll turn it over to Stan to kick off the Q&A portion

and Bob and I look forward to answering your questions.

QUESTIONS AND ANSWERS

Stan March: Thanks, Rick. As Rick mentioned, we received over 100 questions,

it was 113 to be exact. Many were duplicates because there’s a common alignment. So we bucketed those. And I’ll be going through your

questions, almost verbatim in you all’s words, the shareholders who sent those in. And I’m now going to ask Rick the questions. So let’s

start the number 1.

In the category of additional authorized share and use of proceeds,

the first question is, and I think, Rick, I’ll throw this one to you.

Richard Dauch: Okay.

Stan March: What is Workhorse’s plan with the additional 200 million

authorized shares and the proceeds you intend to raise from the share issuance?

Richard Dauch: Well, Stan, we need to -- we need the addition CapEx

or capital, I should say, to fund our next phase of execution, primarily on the product engineering side of the house on our next wave

of vehicles and to run our day-to-day business. We have working capital needs. Now we have inventory coming out. We have finished goods,

et cetera, pay our people, pay our suppliers, develop our products. From a position of strength, we’re exploring several financing options,

but those options will only be available to us if shareholders vote for the proposal. Primarily, we’ll use the proceeds to finance and

advance our expanded product roadmaps, continue to support our aerospace business that goes into production and continue investments in

supplier tooling, assembly and paint equipment as we move into production of the W56. As we said, we’ll plan to use the financing towards

working capital, operating expenses, and some capital expenditure needs.

Stan March: Okay. Thanks. So Bob, one of the questions that came in

was, why did you wait so long to raise funds?

Robert Ginnan: Well, Stan, we’ve been raising funds throughout 2023.

Needing more shares is different. We have the resources to run the business in the near term, and now we’re looking for financing from

our front foot and from a position of strength.

Stan March: Okay. Bob, I’ll throw this one to you too. Will these additional

shares be counted as voting share for all sitting on our ATM apparatus, people are worried about the board controlling over 50% of the

voting shares?

Robert Ginnan: Until the shares are actually issued, nobody votes them.

In the ATM, they are not issued and nonvoting. We’re not giving voting control of the company to the board. This is about maintaining

flexibility. We’re only asking for authorization to issue new shares. We aren’t issuing them. The proceeds are not going to the Board

of Directors or management. As we mentioned, any new shares would be used to help us obtain new financing, so we can fund our execution

and growth plans.

Stan March: Okay. On that same thread, Bob, you said that the intent

is to sell the shares in the open market as needed. How many shares will you sell at any given time?

Robert Ginnan: We can’t really speculate on the specific number of

shares we will issue at a given time. We’re evaluating a range of financing options. The goal is to fund the business for protecting our

shareholders, enabling us to create the most value for them. As always, we’re really prudent about to make sure the financing pursue to

ensure it is the best interest of all stockholders.

Stan March: Okay. And I think another related question here, Bob for

you is, we heard there are different types of offerings the company can do, such as selling restricted shares to current stockholders

at a discount, to offering preferred equity shares, what options are you considering?

Robert Ginnan: Well, the only shares we can issue from this request,

once authorized, are common shares. As we said the goal is to ensure we get financing need while protecting our shareholders, enabling

us to create the most value for them.

Stan March: Okay. So Rick, I think I’ll turn to you because this is

a follow-up to the questions I just asked Bob, can you definitely state that the funds raised from the share issuance will not be used

for any of the following; to facilitate a sale or buyout, to facilitate taking the company private; for Executive or Board compensation?

Richard Dauch: Yes. Stan, as I’ve already mentioned, we fully intend

to use the proceeds from the share issuances to run the business, product development, tooling, capital investment, pay for our engineering

team. As I said, we need to expand our product roadmaps, as you guys know, the W56 will come in 3 different versions, 3 different lengths,

and we’ve got some more work to do there. So as the shareholders’ representatives -- your representatives are the Board of

Directors and any transaction requires their approval. We have no intention to sell the company or take it private as part of this process.

As a general matter, if we wanted to do something like that, facilitate a sale or buyout, we would not be looking to increase the number

of shares. That’s the last thing we want to do, so.

Stan March: Okay. Bob, I want to throw it back to you because there

are several questions that came in about why are you asking to authorize 200 million shares instead of a smaller amount? It doesn’t seem

like you should need this many to reach 2025 when you get -- when you’ve stated you expect to be breakeven. Couldn’t we authorize 100

million to get us through 2024, then authorize more if needed and warranted at that time?

Robert Ginnan: Well, Stan, we’ve already considered a number of different

options in terms of financing and the number of additional shares we need to issue. In addition, the process to get authorization is time

consuming and costly. We believe it’s better for stockholders if we do this once now, then focus our time and resources on building and

selling commercial EVs and trucks.

Stan March: So another follow-up to that one Bob, how big of a hit

will the issuance of the additional shares be to the shares I own now? Will increasing the number of authorized shares of Workhorse common

stock further dilute the current share price?

Robert Ginnan: Well, as of the record date, there were 210,793,111

shares of Workhorse common stock issued and outstanding under our current authorization of 250 million shares. We are looking to increase

the number of authorized shares of common stock to 450 million shares. If the company issues additional shares, the ownership interest

of holders (inaudible) will be diluted accordingly. We take any action like this incredibly seriously, and we wouldn’t do it if it wasn’t

necessary and we didn’t think it was ultimately good for our stockholders in the long term.

Stan March: Okay. A follow-up on that, Bob, how will stockholders see

value creation with dilution given the stock is trading at multiyear lows?

Robert Ginnan: Simply put, we need our stockholders to help us build

a bridge to long-term growth and stockholder value. We need to be able to issue shares to get financing so we can fund our execution of

our growth plans. We’re confident in the important work underway and the progress we are making across our EV portfolio will deliver value

to shareholders over the long term.

Stan March: Okay. A bunch of questions came in, Bob, because in the

filings that were made as part of the process of the proxy statement as well as the S3 statement. Why does the company want to have options

of selling shares directly or indirectly to those who are shorting the stock?

Robert Ginnan: Well, on August 21, we filed a prospectus supplement

to our Form S3 removing references to all short sale transactions as we do not contemplate that in our plans for distribution. We intend

to obtain new financing to advance our commercial EV product roadmaps, support our Aero business and fund our operations.

Stan March: Okay. Rick, I’m going to throw this one to you.

Richard Dauch: Alight.

Stan March: Why does the vote referendum not have a clause saying that

Workhorse will buy back shares once profitable?

Richard Dauch: Well, first of all, our Board regularly reviews our

capital allocation priorities, and I’m sure that all in the future they will consider implementing a stock buyback or capital return program

in the future. But our clear focus is, first, we need to launch our company. We need to design, build and sell trucks and drones to generate

revenue of this company to get to a point where we have positive free cash flow. And we do that, then we have more options. And I’ve been

around that before. It takes a while to get a company up and running, so. Back to my days at American Axle, we took 3 or 4 years, spent

over $500 million of capital a year before we could actually get the company up and running until we could return share to our customer

(inaudible). We went from a penny a share to $14 a share in the stock.

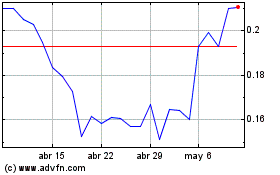

Stan March: Okay. How does the recent stock performance affect the

proposal, Rick?

Richard Dauch: Hey of course, we see the daily fluctuations in our

stock price. Some are explainable, some are not. And there’s plenty of reason to those dynamics. Some are inside our control and some

are not. But our stock price doesn’t affect the proposal. We’re doing what is needed right now so we can execute on our business plans.

We believe we can create long-term value as we advance and expand our product roadmaps to sell trucks and drones.

Stan March: Okay. Rick, if you don’t receive stockholder approval for

the proposal, what are your plans to raise capital to fund the business?

Richard Dauch: Well that’d be disappointing, but we’re not going to

speculate right now. What I will say is that is the proposal ultimately does not go through it would limit our financing options to the

detriment of all our stockholders, all of us. So we encourage all of our stockholders to get their votes in and to vote for the proposal.

Stan March: Okay. Bob, I’ll now throw this one to you. Does Workhorse

have a plan to reverse split shares of common stock in the event the company becomes deficient per NASDAQ’s listing requirements? Does

Workhorse have a plan in place to prevent delisting on the NASDAQ that does not require a reverse split of any kind?

Robert Ginnan: Well, as Rick said, we are aware of our stock price,

and we’re also aware of the NASDAQ listing requirements. We continue to monitor it and prepare accordingly.

Stan March: Okay. I’m going to go to a new bucket now, which is about

financials stands and the guidance that we most recently updated with our earnings. So Rick, I’ll throw this to you, what’s your confidence

level on achieving the lower end of the revised guidance of $65 million, given the significant sales required despite delays to date?

Richard Dauch: Again, Bob and I sit down with our sales teams, both

on the CV side and the drone side every month and go through their prospectus. And we actually get an update after week, every Monday,

we get an update. And so we think we have a solid plan to meet or beat it. We’ve got about 170 W4 CC units in our finished goods right

now, ready to sell. We’re ramping up in W750 production, we’ve already doubled from 1 to 2 a week, and we’re moving towards 4 or 5 a week.

We have multiple demos now out in the fields with customers, and they’re getting good positive reviews and we hope to turn those demos

into real orders, confirmed orders. And again, we are launching the W56 next week.

We have 6 of our 12 dealers now signed up and through the certification

process, and we’re close to signing up another 2 or 3 dealers. And of course, when you sign up a dealer, they get stocking order, so anywhere

from 10 to 30 trucks depending on how many dealer sites they have. And we hope to have those signed up yet this quarter.

We have finished goods. We’ve got production capability now finally

after 2 years and we can build and sell trucks. We also have some drones out in the field being demoed right now and we hope to get some

more drone orders yet this order, this quarter. We’re also working with the government, and we’ve done a very good job over the drone

business in the last 2 years exercising our drones, and we’re getting more and more confident, we’re getting more confidence with the

government because it will help to support us going forward, so.

The one challenge we have been talking about in the last earnings call,

is we don’t have the HVIP vouchers out in California. I’m personally going out there next week myself to meet with the CARB officials

and CALSTART officials to see if we can get that resolved. It’s really an administrative issue. It’s kind of bureaucratic. We have orders

out there. We have trucks in Indiana. We want to figure out how to get the paperwork so we can get those trucks shipped out there and

serve the needs of the California market, especially with the pending in California clean fleet rules that take effect next year, people

are going to start buying electric trucks. They have to by law, so.

So we wouldn’t put out the guidance if we weren’t confident or didn’t

have plan to get there. I’ll caveat that with the risk of the HVIP voucher, which can be 60 or 80 trucks.

Stan March: Drill that a little bit further because one of the shareholders

asked, can you please explain how the 2023 revenue goals can reasonably be achieved given the revenue miss on your last earnings call,

Rick?

Richard Dauch: Yes, our second quarter results were lower than we expected,

primarily because of some of the ramp-up challenges we have in the W750, but primarily because of the HVIP voucher avaiability. Once we

get that resolved I think we can do it. We’ve got 3 clear actionable priorities remaining in the year: One, secure the HVIP voucher process

in California. That’s a critical enabler for us. Sell the W4 CCs, based on input from dealer deals we’ve had in the last few weeks, we

think we can do so. And obviously the ramp up the W750 production and then get W56 going down the line next week and all the way to step

van. So by the end of the year, we’ll have full float, 200 to 300 W4 CCs, 50 W750s and close to 100, 130 W56. And that will more than

cover the 65 million minimum guidance we have out there.

Stan March: Okay. Bob, a question about what are the drivers of revenue

growth and what is the best use of the cash on Workhorse’s balance sheet? Will Workhorse consider some share buyback at these low levels?

Robert Ginnan: Well, the drivers of revenue growth are going to be

vehicle and drone sales. We’re looking to sell the W4 CCs we have an inventory, ramp up production of the sales for W750s, launch the

W56 chassis in August and then step van in September and get demos in the hands for our key customers. The best use of cash is to fund

our growth plans and invest in the company. We are not buying back shares right now.

Stan March: Okay. All right. Rick, what cost-cutting measures are being

put in place to reduce the cash burn at a time when the economy is weak and expenses remain elevated?

Richard Dauch: Yes. In terms of cash, the first priority is selling

the trucks, we have to finish those inventories. I think, Bob, we have $25 million to $30 million of inventory, purchased from GreenPower.

It’s been processed through the plant and it’s sitting waiting to go. So that’s our number one source of cash. Second will

be our free cash and consulting cash CapEx spending and consulting was heavy in the first half of the year as we were doing the development

of the W56, tooling up suppliers, getting the plant ready to go and putting it the assembly lines in for the drone business. That’s still

-- that’s going to slow down. It has already slowed down in the second, so that’s going to help us out.

We’re also looking at all of our spends, obviously, right? So we’ve

also already talked to GreenPower about slowing the delivery of the next tranche of GreenPower chassis. We think we have sufficient product

on the ground in Union City either in finished goods, in the plant or in raw material status, to cover the needs we have for the balance

of the year. And we’re working with them to make sure we have enough trucks going ready for next year, so. We always take a look at how

we’re going to control the variable spend, of course, without impacting our ability to design and launch our products that won’t

impact our sales efforts or our future product development, so.

Again, we expect our cash burn rate to slow down and decrease the rest

of 2023, and we’re absolutely committed to making sure we demonstrate a disciplined capital spend process as we execute our go-forward

plans. I’ve seen plenty of examples in the auto industry, where people pull back on their spending or slash their spending, it only leads

to more trouble. You got to fight your way through that and go forward to grow the company, so.

Stan March: Okay. Rick, another one for you. If the proposal for more

shares is approved, can you give a firm answer on the number of trucks that we sold by the end of the year 2023?

Richard Dauch: Yes, I’d love to give you a firm number, but there’s

a lot of factors that are -- some are in our control and some are outside of our control, right? We don’t control customer demand. We

don’t control voucher approvals. We don’t control infrastructure spending or the connection to the grid. So we have our targets. We need

to sell 60 to 100 trucks in the third quarter and about over 300, 350 by the end of the year to make our $65 million to $85 million guidance.

Based on the conversations we’ve had with customers, we think we can do that. Again, we don’t control some of the things outside of our

control, but where we can sell trucks, we’re going to sell the hell out of trucks.

Stan March: Okay. I want to go to another category of questions, guys,

production and future development. So Rick, first question to you. With only $10 million of revenue generated through 8 months, why shouldn’t

we still consider Workhorse a PowerPoint company, to use your term?

Richard Dauch: Well, that’s a good zinger, and I appreciate. I’ll take

that one right on the chin here. So let me tell you why, we have 315 dedicated associates at this company across the aerospace business,

commercial vehicle business, and here at headquarters, right? We’ve got over 400,000 square feet of manufacturing space up in Indiana

and another 75,000 here in Ohio to build trucks and drones. We got real products, Class 4, Class 5, Class 6 and 2 types of drones. That’s

real hard work we put in place in the last two years. So we’ve learned many lessons along the way, building products that we think are

great that aren’t selling right now, we’ve got to figure out that commercial gap between our production and engineering process

to the customers. We didn’t quite understand some of the interesting challenges we had in terms of manufacturing licenses, et cetera,

and getting all the dealer agreements in place, but we have that now. So I think we’re going to be ready to go but just a matter of time,

so.

Stan March: Okay. Rick, move to another related question. Workhorse

seems to have a large management team. Do you currently have enough hands on assemblers to produce the W56?

Richard Dauch: Yes, sure. Up in Union City we have about 106 employees,

34 of them are salary. That would be your finance team, your HR team, your engineering team, your materials team, your quality team. We

have 72 hourly people, either direct or indirect physicians, direct are the people on the assembly line, putting products together and

the balance are either the quality inspectors, material handlers or the maintenance. So we have plenty of pull to build W56. We’re actually

in the process of adding 10 to 20 new hourly assemblers in the plant, about 5 per week over the next 4 weeks, and we already have those

people lined up, so. As we ramp up W56 further, we’ll add further staff to the plant, and we think we have the ability to get those people

on board.

Outside of the plant, remember when we got here, I think we doubled

our engineering staff, both in CV and Aero, we built our own supply chain team. We built our own manufacturing team. When we got here

2 years ago, 100% of our manufacturing engineers were outside consultants, only had 2 people in the supply chain. We’re really a supply

chain company. We’re buying parts from suppliers and assembling them into trucks and drones. You can’t run a company with just 2 supply

chain people, okay? We didn’t have a big finance staff or an HR staff, it’s a public company. We didn’t have the systems in

place, the IT systems. So we’ve had to build some of that as part of being a public company. We have that in place, and we have the staff

in place to grow to be a large OEM.

Stan March: Okay. Another question on the plan. What are the working

hours of the factories currently? How many people do you have that are building trucks versus people in management positions? Are we utilizing

all the empty space in the factory properly?

Richard Dauch: Yes, we’re sitting at about 4 days a week, 10 hours

a day shift on Monday through Thursday. We use Friday for installation of equipment or doing some tweaks, doing some repairs if we need

to as we learn how to build trucks, very small crew on the weekends. At Union City, as I said, we have about 106 and now we’ll ramp up

to 150 later on this year. In terms of floor space, about half of the Union City plant is set up for the W56. We’ve got 12 stations

for the chassis assembly line, followed by the Dino, the trucks that leave the plant, put on the test track, they come back in, if they’re

going to have a box put on. And we’re still putting together the stations to build the cab and the body, goes right back up to the other

side of the plan and we are ready to go.

Across from our plant, we leased about 160,000 square foot facility.

We’ve upgraded it. That’s where our maintenance is at. It’s where we bring in our raw materials in, minus batteries. We bring our batteries

to a separate place from a safety standpoint. We do bring some parts directly to the assembly line. And we’re also right now in the process

of installing a new paint line there. It takes up about 1/3 of the warehouse building. All the materials on site to build the paint line,

it will be up and in commission in October, so. The plant has the capacity at Union City with no building expansion to add 1 or 2 more

product lines and build up to 10,000 vehicles a year. You can do the math, 10,000 vehicles a year at a sales price of somewhere between

$130,000 to $200,000 per truck. That’s a lot of revenue. That’s what we’re building here at Workhorse. We’re not building a baby startup.

We’re building a startup that’s going to turn into a real OEM to drive free cash flow.

Stan March: Okay. In that same vein, once in production, if the demand

is there, how quickly will you be able to build a second shift of assemblers?

Richard Dauch: Great. One of the great things about being up in the

Union City is it’s a small town, about 8,000 people, and we have access to a good workforce. We already have over 400 applicants that

inquired to join the Workhorse team. And we’re in the process of screening those and see who is really qualified and wants to come in

and work. We’re confident in our ability to scale up. It’s one of the key questions, almost every fleet customer asks us, if we give your

business, can you meet our demand? I was with a customer yesterday that said I have orders backlogged for 6 to 12 months from the existing

OEMs, not even just for EV products, just for regular production ICE vehicles. He said, we’re looking for EV companies that are going

to be here and be here long term and have the ability to ramp up and grow with us, I think we can do that.

In its heyday the Union City factory had over 800 people. So almost

10% of the city was employed at Workhorse. And we got here, I think we had less than 50 people there. That’s an example of the devastation

that happened across the Midwest as people outsource work down to Mexico or China. We’re building a plant back in the heartland of the

United States of America. It’s a great place to work. We’ve cleaned it up. We’ve made the great facilities. We’ve got proper breakrooms.

We’ve got the safety features. It’s well lit. We got good parking lots, it’s secured, fenced in. It’s going to be a world-class EV operation

here in the heartland.

Stan March: Okay. Another question there. Rick’s latest production

update is the beginning of September for the W56. Realistically, how many might roll out of the assembly plant each week by November 1?

Richard Dauch: Yes, we start to launch officially next week. We have

a program review every 2 weeks at my level and Bob’s level. We gave them the greenlight and go. Our teams told us we’re ready from

a safety standpoint. We’re ready from a quality controls and tooling standpoint. The fixtures are in place for 95% of the assembly line,

of the chassis line. We got a few more things to do this week. We got quite a few things left to go through the step van. But we think

we’ll build at least one next week, and then we’re going to ramp up based on the availability of parts from our suppliers. Our goal is

to have 12 to 15 chassis built over the first 3 or 4 weeks of September, so we’re ready to start putting boxes and cabs on when we get

our final tooling there, so.

It takes time. We are getting to the final engineering designs based

on the feedback from the test tracks, we’re tweaking that. The suppliers are changing their tooling. We’re running those parts off (inaudible)

and we’re modifying work construction accordingly.

Stan March: Okay. Rick, we received another question that said, you’ve

consistently said you can sell every truck you make. Is that still true?

Richard Dauch: I believe that. And I say that based on not my opinion

or my dream. It’s based on the feedback we’re getting from our dealers. And I’ll give you a couple of examples that we had last week from

California dealers. One of them told me if you get those vouchers, I can tell you, I can sell 15 to 20 W4 CCs a month. Do the math, that’s

180, 240 trucks alone. Just one dealer in the San Joaquin Valley. He’s got multiple opportunities out there, and we’re going to meet with

some of his customers next week. One is a large last mile delivery and industrial supplies company. Another one is a moving company that

wants to be the very first company in all of California to be 100% green fleet and they can use our W750 mix, right.

The other dealer we just signed up, I think we announced a few weeks

ago, Western Truck. They’re down at the LA County area, they said they have numerous folks that have come in from government-funded agencies

who have the money that are being getting ahead of the curve for the clean fleet, they want to buy EV trucks. He said, “Rick, you

get us trucks, we’ll sell trucks.” So we have meetings with both dealers next week and with multiple customers. Again, I’ll be in

California next week to help try to resolve this HVIP issue, to meet with some of the dealers, to meet with some of the customers firsthand

and really get some feedback.

But we have strong demand. And right now, based on the car rules as

they go in effect, California is the motherlode. That’s what we need to be successful. That’s where we can have trucks, and we’ve already

got 3 dealers out in California. So I think we can sell trucks out there so.

Stan March: Okay. A very specific question came in. Did you redesign

the W56 for the brackets to not break during driving tests?

Richard Dauch: Absolutely, so. Hey, one of the reasons they put these

trucks through such a rigorous test and they should be, is they’re designed to do last 15 to 20 years, which is the expectation

of people like UPS and FedEx. This is not like a car that you or I would buy and have been driving for 3 or 5 years. This is not a big

Class 8 truck, that something like Penske Logistics or Ryder truck holds for 3 to 6 years. These are trucks that are built that make 100

to 150 stops a day and they got to do that in hot weather, cold weather, nice weather, stormy weather like Cincinnati today, over 15 to

20 years. We’re testing the hell out of our trucks. And yes, you have a few break as part of the tests.

In fact, that’s I think I told you. I went out personally to one of

the test tracks to understand just how hard that test is. And let me tell you, it’s a jaw routing test. Our trucks are performing very

well as our engineers have been very quick to make design changes, our supplies (inaudible) up quickly. We’ve had trucks turn around less

than 72 hours taken from Navistar’s test track in the north part of Indiana, brought back to Cincinnati, old parts torn off, new

parts back on in less than 48 hours back on the test track and back up and running. And even this last couple of weeks, we’ve had some

issues that came up well into over 150,000 to 160,000 miles of real-world testing, well past the warranty, but we’re making sure our tests,

our trucks are more improved. That’s what we’re doing, so.

Stan March: Okay. I’m going to shift to a different product here, but

same product focus. If you already delivered W750s, the potential customers for demo, what’s the current production ability of Workhorse

for W750s in terms of units over time?

Richard Dauch: Yes, great question, Stan. We’re really happy with the

W750, it was a hell of a truck, the design and getting the production took us longer than we thought. We have 5 trucks operating every

day on Stables, which Stan runs every day. We’re getting really good feedback from our drivers there, and they’re performing magnificently.

Typically, coming back to the shop at the end of the day, they have still 50% of their charge, plug them in or 100% charge the next day,

it’s one of the great things. One of our big potential customers asked if he can personally go visit the Stables and Stalls and see what

we’re doing there because he’s got to do that and process his fleet. And again, remind you that we’re doing that with the FedEx ground

route in Lebanon, Ohio, so.

We have W750 is starting to test on Monday this week with a large merchandiser

on the East Coast. So far, so good. The feedback I got from one of our dealers last night that W750 is by far outperforming all the other

trucks on the test right now, so. We also have demo trucks now finally in the hands of our sales teams, both in the East Coast and the

West Coast, and you now have dealers in place showing those trucks. And we actually had one over in Columbus, Indiana, yesterday where

I gave a presentation and we had probably 120 people at an industry conference, mostly suppliers, but also some customers like Ryder truck

were there yesterday, driving our W56 and our W750, so. Our capacity has ramped up on W750 from 1 a day, 1 a week, I should say, to 2,

and we’re working towards a goal of 4 or 5, and we’ll be able to build about 50 to 60 of those trucks this year, so.

Stan March: Okay. All right. I’m going to shift a little bit, still

in the facilities question. With all the money being put into the factory, has any gone towards automating some of the building process

in order to be able to ramp up production? If not, why not? If we aim to ramp production, how do we intend to do that?

Richard Dauch: Yes, it’s a great question. So let me say we’re blessed

with the fact that when we got here, we had a facility that had good bones, what I call good infrastructure, we have good walls, we had

good roofs. We didn’t have leaks. We have good utility connections, we have excess power to the plant, and we have lots of land. So that’s

really great. That’s the good news. The bad news was the inside was old equipment, tired, dirty, unlit, disorganized, not well maintained.

We have cleaned that up. I ask any one of you. If you want to come up, let us know, we’ll host you at the plant. We’re happy to show off

our plant, we’re really proud of it. So we had a potential customer come in this week, Stan hosted them up there. They’ve been here 3

years ago and they were shocked with the differences. And I can’t wait to get some of the big fleets who were here 2 or 3 years ago and

show them we’re a real company up here, so.

We’ve expanded the footprint up there again, from 200,000 square feet

to over 400,000. We leased the battery building. We put the test track and we’re in good shape up there. So right now, at the stage we’re

at right now we don’t need broad automation or sophisticated automation. The volumes are too low. Our tack times will be around 21 minutes.

If you were opening a big automotive OEM and you’re building 1 truck a minute, then you need automation. We’re building 1 every 21 minutes,

and we have plenty of time. We also have most of the parts we can handle, what we call jigs or fixtures, to pick up and put the parts

in place. The 1 place we’re going to have automation is in October, our automatic ground vehicles will come in and they’ll move Station

10, up through Station 120.

By Station 120 now we have the batteries in, we have the axles in,

we have the steering in, we can drive the truck off the line on the Dino. So that’s the one area where we’re going to do that, okay? In

the short start-up of the ramp, we can push those trucks with 5 or 6 people down the line here. So we may automate down the line in areas

where either quality requirements or safety requirements dictate we do so. I’ve done that in every plant I’ve had around the

world, whether it’s in Mexico or Romania, China, wherever, okay? So today, we have -- we only need to have our employees. They have all

the right tools. We’ve got all the right safety devices in the plant. We have all the quality control processes, really critical in assembly

process is the torquing of the nuts and bolts.

Well over 50% of the warranty costs in the automotive industry in general

are because people don’t torque the nuts and bolts correctly and things get loose and fall off. So again, we’re not a Class 1 or 2 automotive,

high-volume plant at 60 jobs an hour. We’re basically looking at about every 21 minutes -- 3 trucks an hour basis, we’ll be able to build

something.

Stan March: Okay. Rick, what are Workhorse’s plans to enter the civilian

truck market?

Richard Dauch: Yes. We don’t have any plans in to the civilian truck

market, okay? That’s not where we play. That’s for the big boys like General Motors, Ram Truck, Toyota, Ford, et cetera. So we’re talking

about building Class 4-6 work trucks, fewer strip chassis, cab chassis or full supine, different variations of links that are different

classes, Class 4, 5, 6.

Stan March: Okay. Did the plant pause production? If not, what are

the current production rates of the W4 CC and W750? Also, how many finished W4 CCs are there an inventory? Based on the past rates provided,

it seems like there should be a lot more finished inventory?

Richard Dauch:Yes, right now, we sit in 175 W4 CC as of last night.

We’re building over enough two a day rather than 4 a day. We did pause production for a few weeks to move some people over to some of

the production of the W56 program builds and help on the W56 launch back in May and June. But right now, we have sufficient inventory

at 175 to meet our current customer demands. We have another 125 trucks on site that we can process through the plant and be in production

and outgrowing 100%. Regarding the W750, we’ve gone from 1 a week to 2 a week, which is, okay, not very fast, but okay we’re getting there.

But I can tell you, every truck is getting this a little bit better and guys can become much more efficient in how we put the truck together.

And we’re hoping to ramp that up to 4 or 5 trucks a week by the end of the year, sometime late October, December.

Stan March: Okay. Rick, can you discuss meeting with the big 3 of the

last mile delivery sector? Our company barely received any updates. Why have the contract been struggling?

Richard Dauch: Those relations take time. Some of those relationships

were maybe before I even got here to be quite honest, at least 2 of them were very strained. One of them said they have no interest in

Workhorse trucks. They didn’t think they were capable. That’s been cleaned up. Now they’re coming back in to see us. I have a phone

call with one of their top leaders today, and we expect to have it in the site sometime here in September. Another one told me, you have

orders from us, but your trucks don’t meet our needs. Now our trucks do meet their needs. Their needs are very specific. They want 8,000-pound

payload. They want a 120-mile range. W56 can carry 10,000 pounds and the range is 150 miles plus. The W4 CC and the W750 do not meet those

requirements. They can only carry 5,000 pound payload. They do have 150-mile range. So it’s basically customer-dependent.

I’m confident that when we have these trucks as they’ve told us, you

get your trucks through the durability test and show us the test results and bring us to the fact when you’re actually doing production

and not one-off bills, we will be ready to start talking about orders. And so when people start to ask me about what’s your production

plan for the balance of the year in ’24 and ’25, that tells me they’re thinking about can they work for us and we hope to land that. Also

important for us is we’re going to bring in a new national accounts director starting September 5. Someone I’ve worked with in the past.

He’s got deep relations about 15 to 20 years with over 40 to 50 of the major fleets here in North America. You know their names, FedEx,

UPS, DHL, Frito-Lay, PepsiCo, Amazon, et cetera, okay? So we’re building the right sales team now that we have the right products.

Stan March: Okay. Another question came in, Rick, and asked, why have

you not had more luck getting contract manufacturing work like the current golf cart contract? You say other companies do not have a manufacturing

plant, can’t you show them the savings inherent in you building their product?

Richard Dauch: Yes, we’re being very judicious on how we allocate our

space. First and foremost, we’ve taken care of our own products first, W56, W4 CC, W750 and then obviously the WNext in the future. So

we have adequate space to produce 4 or 5 different versions of trucks. We took on the Tropos contract, and we think it has upside this

year and next year. They’ve had some launch issues, specific supply chain issues in terms of getting the full bill materials in the box

or getting some quality issues there. We’re pretty -- most of those issues are behind us. The last 16 trucks we built went together were

almost flawlessly. They building up their order bank, and we expect to be ramping up to about 50 units a month. The long-term target is

to get that to about 150 to 200 a month, that would be a good business for us. So good money for us and get paid for out labor sum.

We passed on 2 opportunities to date. One was a Class 1, 2 vehicle,

pretty significant volumes. Would’ve taken up a large portion of the warehouse. We decided no, we’d rather put the pain line

there and use the raw materials. That product also required complete homologation to U.S. safety standards in the Class 1, 2 sector that

would have taken about 18 to 20 months, and we didn’t want to do that, okay? So we turned them down. They also want us to invest

$25 million in their company, and we said no, we prefer to keep the $25 million in our company and invest in Workhorse. We have another

opportunity that we are still in the running for it’s for a larger Class 6 to 8 type vehicle. I won’t say who it’s with.

We think we’re down to one of the last 2 contract manufacturers they’re

considering. They chose to delay that sourcing for up to 12 or 18 months, which actually benefited us because they didn’t distract our

manufacturing team, our engineering team for what we have to do with the W56. If that opportunity comes our way, we want to consider how

we deploy engineers or hire additional engineers or manufacturing who are going to handle it. We will not be the design requirement people,

but we will have responsibility of the localized sourcing. We have to one off those parts and to build the parts. We won’t have materials,

they’ll be responsible for the materials, so won’t be a working capital issue for us.

Again, there are several OEMs out there in the EV space who have products,

but they don’t have manufacturing floor space. As I’ve told people, countless times, you can’t build a plant in 6 months or 12 months,

it takes 2 or 3 years. So those who need to build products, if we think we can build it officially and we can find the right man power

and we make money doing so, we take a look at it. If we don’t have the people, we’re not going to make money. It’s going to be a distraction

to our main programs, and we aren’t going to do it, so.

Stan March:All right. Rick, how many GreenPower trucks are we shipping

to customers?

Richard Dauch: Good, good questions. As many as we can. So every vehicle

we shipped today is I think and now we’re up to about 80 or 90 has been GreenPower trucks. So we’re happy to have chosen GreenPower as

our partner. Together, we have a lot of learning experience. So I can tell you our meetings sometimes are pretty tough, but we end up

at the end of the day shaking hands and they go forward and solve the problems. What we have to find is get those HVIP vouchers which

actually the opening for us to really ship a lot of those trucks over them to the California area.

In terms of W4 CC, remember we had to ship those out to cut some body

builders and then they get up fitted out there in those custom body builders. We already have our strong relationship with the frigate

family and do a lot of our custom body building and updating for us to prepare to go and so we have those build slots. When we added smart

trucks to our dealer network, now we call ECV for dealers and smarter for trucks. They’ve got 700,000 square foot factory and they can

do 100 trucks a week, they do 100 trucks a week and they’ve opened up some custom body building trucks. We have 30 trucks on the way down

there right now. They have bodies built on 12 or 14, 16 foot boxes, that gives our sales team finished trucks they can sell rather than

self-cap chassis.

On the 750, once we build those, we can ship those directly to customers

as we ramp up and be able to sell those W56 chassis what put boxes on them ourselves. That’s our primary source of revenue will be for

W56, but we’ll also have a few strip chassis. The way this industry works is the end customer size, which chassis they are and which box

we want. One of the strategic advantages of Workhorse will be the only company, the only company in the EV Class 5, 6 space that can build

a full EV-powered chassis and the cabin body. Everybody else in this space has to buy a chassis or has to buy a body. No one else does

the whole thing. That should be an advantage for us from a material standpoint and a cost standpoint in the marketplace.

Stan March: Okay. If Workhorse is going to get a fleet contract for

next year, wouldn’t they have already signed the paper work by now, Rick?

Richard Dauch: Not necessarily. The big truck guys basically look at

their needs for next year, they’re doing that right now, they’re building their budgets for 2024, and they decide how much money they’re

going to allocate to do those first. So we should probably have DL sit-down with those customers. Again, they’re coming to our plan in

September and early October. They get a test drive, new demos with our vehicles, sometimes we’re up to 30 days. I think the depot we’re

doing in the East Coast in now in the 2-week or 4-week demo. And I get an update every Mondat from our sales team and our engineers on

the meeting, we know how our truck is performing so far so good. So I’d expect we should be in a position to land some contracts here

in October.

Stan March: Okay. Changing gears a little bit. Why did Workhorse not

try to sell the mail truck to other countries? The company had a truck that was designed and tested and other countries have a mail service?

Richard Dauch: Yes. That decision was made before I got here. But quite

frankly, our trucks that we had didn’t perform very well on the test data that I’ve seen. I think we had 5 or 6 trucks in the government.

We got our hands on the test data and our truck had some faults, okay? When we -- the new leadership team got here, we decided, let’s

not pursue that Class 2 Avenue. They’ve already awarded the contract to Oshkosh anyway, so we decided to keep our focus here on the last

mile delivery workspace, okay? If and when, if the post office wants to come back in and either sell W56s or get involved, I do see that

they’re going to commit -- they comitted they can convert 75% of the U.S. also service fleet to EVs over the next 5 or 10 years. So that

opportunity might come back and there’s nothing for us to report on today.

Stan March: Okay. So when do you expect the fleet contract or a contract

for any significant volume for either trucks or drones?

Richard Dauch: Yes, I’d be disappointed if we don’t have a couple of

those contracts in the end by the fourth quarter this year, so. Both on the truck and drone side of the house.

Stan March: Okay. Last question in this category is what is W next,

what is about it-- what about is next generation? Is it a vehicle for confidential special purpose? How important is it to the future

projected share of production revenues and the development status?

Richard Dauch: Yes. When we got here, we assessed pretty quickly what

we had when we got here in terms of products, we knew it wasn’t capable of lasting 15 to 20 years out in the rugged environment of the

last month delivery space. We sat down and we looked at the benchmark of where the competitors were, what the customers wanted, and we

sorted out, we want the W56 first. Specifically, one of the W56, 178-inch step in first. That’s the biggest volume in the sector. We also

then prioritized the 208, which comes next to the 168. Those are the 3 main variants of the Class 5, 6 step and that meet the needs of

the big last-mile delivery people.

The WNext, which we originally called the W34, we’ve morphed that in

the WNext. We think we’re going to move more towards W, a Class 4 vehicle. We found a niche in the segment with the GreenPower vehicles

that is asserted by other people. The WNext will be a special vehicle. We’re going to take some of the lessons learned we have from our

old eGens that are still in operation, about 280 out of the vehicle 9 million miles on it, a low floor board, and we’re sorting out what

kind of ADAS, the safety features of lane change, et cetera, cameras on the front back. And that product is earmarked to the Class 4 sector

to replace the W4 CC and W56, but it won’t come out until late ’25 or early ’26 and to answer your question is that it’s not for

a confidential purpose it’s for a commercial purpose out in the field in a niche that these trucks will be a little bit more rugged

and capable of higher payloads then a Class 3 that you have like a transit or a dimer sprinter and a little bit less costly and a little

bit less cubic space than in W56.

Stan March: Okay. We’re going to go over to another category now. It’s

called EV demand and sales. First question in this category, when do you anticipate achieving qualification for HVIP vouchers on W4 CC,

the W750 and the W56?

Richard Dauch: Yes, that’s the $65 million question in the room, right?

And so that’s the highest priority here at Workhorse to go out and secure those vouchers. I hope we get that done. We’re working in 2

different channels. One through GreenPower and one directly with CalStar in car up to including the carbon director. So we hope to have

that resolved very quickly. So but we’re on track right now for the W56. That’s a manufactured vehicle ourselves. We’re all -- we got

to finish up our EPA certification. We have all the paperwork. I know in the last week, we’ve passed break testing. We’ve got a range

of certification. We’ve got almost every subsystem now 100% signed off. We’ll dot our Is and cross out Ts. We’ll submit our documentation

and we’ll get that voucher for the 23-mile a year for W56.

One of the complications on the vouchers is because the GreenPower

enforced that truck called the EV star, and we converted into W4 CC and W750, GreenPower is the manufacturer records, they have the licenses

in the voucher. So we need those vouchers from them or we got to get the directed in the car, they allow us to do that. So that’s what

we’re working on, so.

Stan March: Okay. We actually answered the other question. The next

question, which was what happened to the HVIP voucher on the W4 CC and the W750? I’ll move to a follow-on question then. Did Workhorse

get the EV voucher program in all states? Did Workhorse get manufacturer certification in all spaces?

Richard Dauch: Yes. I think we’ve reported to you before, I think we

have a manufacturer license now in 23 states. There are 4 states required to have a dealer before we can get our manufacturing license

submit our request for that. Remind we have again 2 dealers groups that were lineup that have dealer size in those locations. I think

we’re getting that done. So we have the way to get vouchers in New York, New Jersey, which are critical, Texas. The only places we don’t

have now in California, so. And I tell you, we have a lot of our leadership team here working on that. We have an outside legal team helping

us work on that in California. We have dealers out that work out in California, and we have a GreenPower mill that is helping us outin

California. It drives me crazy to know that we have customers that want to order EVs, we have dealers who want to sell those EVs. We have

upfitters who already upfit those EVs, and we have to finish goods and only hold us up right nowis administrative bureaucracy.

Stan March: All right. Well, then we’ll move to Bob for a couple questions.

All right. Bob, who gets the rebates on these vouchers? Do they go directly to Workhorse, the retail dealer, or the end purchaser? And

what about the vehicles leased? How does that work?

Robert Ginnan: Well, they don’t go to Workhorse. The dealer is required

to reduce the sales price of the vehicle by the amount of the voucher and then it’s reimbursed by HVIP.. Once the dealer has assigned

purchase order from a buyer, they will apply for reimbursement of the HVIP, the vendors reimbursed by HVIP at the time of delivery of

the vehicle. The case of leasing, the process works pretty much the same, except for the buyer, in this case, is a leasing company. This

reduction will go in affect with monthly lease costs.

Stan March: Okay. And in that vein, Bob, what’s the timeline for having

some sort of boilerplate setup for all federal, state, and local government rebates, needs to be exact and understandable and almost filled

out when presented to the buyer doesn’t it?

Robert Ginnan: Well, it’s really between the dealer and the buyer and

it varies by state. Our dealer portal does include instructions information for all of our quality dealers, including eligible incentives.

Stan March: Okay. Good. All right. Next bucket is Aerospace for the

drone business. So Rick, I’ll ask you ask you, why haven’t you submitted a final paperwork for FAA certification? There were no updates

provided during the recent earnings call by the Aerospace division regarding certification status?

Rick Dauch: Yes, so I’ll refer to my notes on this one, Stan, because

this is not my forte. Let me start by saying John Graber and his team, people like Mike Gerdes to combine, they have well over 100 years

of experience working with the FAA. They’re accomplished pilots. They’ve run big airlines. They know how the FAA works, so I’m not.

We’re still participating in the FAA type certification process. However, the FAA is selecting Workhorse Aero to participate in a program

based on the Section 44807, special authority for search unmanned systems that the FAA recently revised and updated. The process allows

OEMs to complete a thorough questionnaire, implied test hours, similar to type 135 certification, but in an expedited manner. After submitting

the completed questionnaire, providing our test results and documentation to FAA, we’ll size the 44807.

We’ve had multiple meetings. Jonathan and the guys have had multiple

meetings with the FAA for guidance and clarification of the program and have begun the process to submit the 44807 with the goal of completing

it by the end of 2023 with the WA4-100 or what we call the Horsefly at UAS. How’s that?

Stan March: All right. There you go. That’s how --

Rick Dauch: Sounds like the government may be involved in the certification

process.

Stan March: It does. So when do you anticipate applying from the FAA

certification on drones? And why haven’t you applied yet, that was a related question.

Rick Dauch: Yes, its typically taken some other people in the industry

up for 4 years. We’ve already been in the process for up to 2 years right now. The 44807 will give Aero and our customers the benefits

of documentation in a fraction of that time. So hopefully again, hopefully this year.

Stan March: Okay. A more detailed question on the drones. With our

drones being the only drones for the patented winch system rather than what other companies use which are parachutes or drop and go style

delivery systems, why is that no other company that are using drones for delivery have reached out to us for our drones for their business?

If it’s the safest way to deliver a package and twice the weight of what everybody else can deliver, then why haven’t anybody bitten?

It seems like shoo in.

Rick Dauch : Yes, a good question. That’s a really good question. So

we’re really proud of our winch system, not only can it deliver a package of up to 10 pounds, it can also pull that package back up 30

feet. And from an engineering standpoint, that’s pretty crazy. I didn’t think they could do it at first when I got here, they can and

they have proven it, so. The winch system is what earned us the Valqari business. If you’ve seen the videos online or on reddit, et cetera,

basically the drone comes in and hovers above the mailbox station and drops the drone onto the location. Tthe boxes in the center, it

goes down an elevator and goes down into a box where customers can drive up and pick it up. Pretty sophisticated and Valqari is extremely

happy based on the 6 or 7 weeks they’ve been testing our system.

But we’re getting another customer, and I’m not allowed to disclose

who that customer is, they do have our drone, they purchased it. And we’re the only drone company that they’re working with right now

for packages under 10 pounds. That company tells us they have about 5% to 10% of their overall global packages delivered that are less

than 5 pounds, and we can figure out how to deliver that to houses with a drone. The FAA’s permission will be a game changer and

reduce the delivery cost by over 90%, 95%. So there are unique locations in the country. As we said before, out in the country where it’s

a long way between farms or across riverways, where you’ve got to go to a bridge or a bridge gets backed up, you can deliver a drone much

more efficiently than the with truck. They can deliver 5 or 6 more packages in 20 minutes than they can by doing it by truck, with drones.

Stan March: Okay. So a broader question, why continue with the Aero

business, Rick?

Richard Dauch: Yes. I think there’s potential in the Aerospace business.

I think I’ve been pretty upfront when I got here. I had some doubts about that. I went and met with people like UPS Flight Forward, I

met the government officials and there’s something here. We’re in the very early stages. I’d say we’re even in the preseason innings of

the drone delivery space. And so I think there’s going to be a marketplace for that. We see other companies that are doing that outside

the United States. We chose to stay here with our resources in North America. We also think that the opportunity to use the drones for

scanning and with the government for multiple applications has real upside opportunity. We’ve seen multiple brands around that multimillion

dollar brands already, both at the federal and state level. So we think there’s an opportunity to grow business as a drones for service,

which is also new business for us.

Stan March: Okay. Have you talked to Homeland Security about selling

them the drones that monitor the boarder?

Richard Dauch: I would say this, we are in discussions with a number

of government agencies. Some we’re allowed to talk about, some we’re not. But that includes Homeland Security about our drone

capabilities. The DJI replacement is needed. DJI is a Chinese made drone, the biggest drone company in the world, and there’s been some

states who outlawed the DJI. And so we’re moving very quickly where that has happened to see if we can pick up that slack and that could

create some opportunities for us on the drone side.

Stan March: Okay. Workhorse has clearly shown an interest in selling

drones to other countries and even built a new drone model to cater to the specific needs of those that we’re trying to sell, but no one’s

bitten yet. Last year we only sold 2 drones with all the events, demos, and use cases and event presented, is it flawed somehow, Rick?

Richard Dauch: No, we’re very confident in our technology and drone

capabilities. We’ve had some of the best drone people in the world and around country come in to take a look at drone and they say it’s

a rock-solid design, both from a structural standpoint and from a software standpoint. The fact that they can go up to 10 or 12 miles,

they can carry 5 to 10 pounds, and they can do so autonomously with no controls, just program and it goes and drops in and it’s got a

very set pattern. So very, very sophisticated technology, high tech for sure.

There are certain applications that will have to be customized. We’re

working with some customers on that, what they want to see changed. Some things we’ve done as I got here, we got feedback, we want a parachute

recovery system, control the decent if something happens to the drone. We need to have the winch not just drop a package out, it needs

to be able to pull the package back up, but we want to be in a flight time of 45 to 50 minutes out of every hour, okay, we have to quick

change batteries. We’ve accomplished all of those engineering feats. I’ll tell you, the engineering team and the pilot teams over there

at Aero, they are doing a great job. And we are ready. We’ve just got to break through and get these orders, okay, so.

Stan March: All right. Moving to the next bucket, which is about corporate

governance. Bob, I think I’ll throw this question to you.

Robert Ginnan: Okay.

Stan March: A lot of stockholders are asking for more transparency

from Workhorse, including a periodic investor newsletter separate from earnings and ongoing investor communications updates. Would you

consider this?

Robert Ginnan: We recognize you follow up closely and want as much

information as possible. We’re committed to providing regular updates to the market. As we’re sure you can appreciate, we have been focused

on stabilizing, fixing and growing the business. We’ve announced a number of recent milestones and achievements across the business and

look forward to continuing to provide these notable updates to our stockholders. We also continue to look for ways to engage with our

stockholders and keep them informed and engaged in our growth and developments.

Stan March: Okay. Thanks, Bob. Rick, will the management team commit

to buying more shares of Workhorse?

Richard Dauch: We don’t force our management to buy shares. As you

can see from the proxy statement, our management team already owns stock and their interests are strongly aligned with our Workhorse stockholders.

I am personally along with my wife a meaningful owner of Workhorse shares. We have like every public company, we have stock ownership

guidelines, which are publicly available, and we review them annually with the Board of Directors and our Comp Committee, and all of our

executives are moving in the right direction to own the right shares of Workhorse stock. I bought some shares at $3.10, I bought some

shares at $1.87. So I feel your pain, trust me.

Stan March: Rick, why should stockholders remain confident in current

leadership given product delays and reduced guidance?

Richard Dauch: Yes. Okay. That’s great. No one said the transition

from being a technology startup to a full-service OEM in the EV technology would be easy. And let me tell you, for sure it’s not. All

right. We’ve had some hiccups along the way. We’ve responded quickly. We’ve had some lessons learned. We’ve addressed those. We had some

unexpected issues on some of the trucks. We inherited some issues that we’ve addressed. I’m damn proud of our team. We announced the W56

launch over to and about three months into my tenure, we decided we had to pivot to a new product strategy. We had to hire a team. We

really didn’t start that product process until January of ’22. Here we are 18 months later, and we’re within 1 month of our original

target for the W56 after having some engineering testing issues that we had to address with our suppliers.

We pulled ahead the step van launch by 4 months when we started realizing

the customers really want to step van, not just the just the cab, just the chassis, okay? So we’re proud of that. Tell me anybody, other

company. that has gone from start to production in 18 months. Let me know and I’ll go visit them, see what I learn from them, okay? I’m

proud of our team, okay? We have some difficulties with GreenPower, which we have pivoted to, to bring in the Class 4 trucks and we at

least have a product to sell in the marketplace. And together, working with GreenPower and their supplier, we’ve engineered many advancements

in that product. I think we’re putting on 85 to 90 parts on the W4 CC, to create the W4 CC, over 700 parts on the W750. We did all that

in less than a year, okay?

And some of the guys have done herculean tasks. We had some issues

to get parts done, guys were driving their personal trucks down to and from North Carolina or up Elkhart, Indiana. And that’s the kind

of commitment we have here at Workhorse to get the job done.

Stan March: Okay. Different subject, the same bucket. Will executive

leadership and / or members of the Board of Directors be receiving a reduction in compensation as part of cost-cutting efforts until the

company is profitable?

Richard Dauch: Unfortunately I’ve had that experience in my life. First,

when I became a VP at American Axle and next week, there was a strike at GM and the officers of the company took no pay for about 30 days.

Got it. And during the great recession, I was the first person in Acument to reduce my pay 20% for almost a year, and I was the last person

to get my pay back, and we know what we had to do during the COVID period, so. We understand and that includes not just as executives

of the company potentially Board members. I’ve been on a board before where the company had some struggles and the board, along with the

management team reduced their pay for a short period until we could get the company stable. If we have to do that, we can do that.

Stan March: Okay. All right. And then our last category is something

I’ll call other. Bob, I’ll throw this question to you. In 2022 Tesla made $1.7 billion selling their car credits to companies that sell

ICE vehicles. Has Workhorse explored this income stream? If so, will Workhorse or GreenPower be getting any credit for the GreenPower

trucks that we sell?

Robert Ginnan: The OEM may be eligible to sell carbon offsets in one

of several of the cap-and-trade programs. GreenPower would be eligible for the GreenPower vehicles. Workhorse has investigated the potential

and will participate in these programs once the W56 is available in the public.

Stan March: Okay. Bob, another one for you. Have you considered a Delaware

Statutory Trust or sale-leaseback for Workhorse’s manufacturing complex?

Robert Ginnan: Well, we are exploring to broad range of financing options

to best to fund our operations and drive stockholder value. We have looked at these options and a number of others. The fact is they would

only go so far. We still need to authorize more shares to get financing and funding that we need to build a bridge to long-term growth

and stockholder value creation.

Stan March: Okay.

Richard Dauch: Can I jump in on that. I think one of the great assets

when we got here, we knew it right from the start, is our Union City facility. We’ve converted into a world-class plant. And if we can

use some of that in a sale-leaseback, it helps us finance the company to do so. But as Bob said, it’s not enough, we need to do both the

shares and something like that.

Stan March: Okay. Rick, have you considered buying the GreenPower school

bus chassis and converting that into a Workhorse EV?

Richard Dauch: No, we have not. We are 100% focused on just the last

mile delivery vehicles. We understand what GreenPower is doing there. We understand the money that’s put forward in the infrastructure

bill for busses, but that’s not something we’re doing today.

Stan March: Okay. Bob, this one I think is for you. Why doesn’t Workhorse