UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

REPORT OF FOREIGN ISSUER

PURSUANT TO RULE 13a-16 OR 15b-16 OF

THE SECURITIES EXCHANGE ACT OF 1934

For the month of May 2024

Commission File Number 001-35991

AENZA S.A.A.

(Exact name of registrant as specified in its charter)

N/A

(Translation of registrant’s name into English)

Av. Petit Thouars 4957

Miraflores

Lima 34, Peru

(Address of principal executive offices)

Indicate by check mark whether the registrant files

or will file annual reports under cover Form 20-F or Form 40-F.

Form 20-F ☒ Form 40-F ☐

AENZA

S.A.A. AND SUBSIDIARIES

INTERIM CONDENSED CONSOLIDATED

FINANCIAL STATEMENTS (UNAUDITED)

(Free translation from the original in Spanish)

AENZA S.A.A. AND SUBSIDIARIES

INTERIM CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

AS OF MARCH 31, 2024 AND FOR THE THREE-MONTH PERIOD THEN ENDED (UNAUDITED)

S/ = Peruvian Sol

US$ = United States dollar

AENZA S.A.A. and Subsidiaries

Interim Condensed Consolidated Statement of Financial Position

As

of December 31, 2023, and March 31, 2024

| | |

| | |

As of | | |

As of | |

| | |

| | |

December 31, | | |

March 31, | |

| In thousands of soles | |

Note | | |

2023 | | |

2024 | |

| Assets | |

| | |

| | |

| |

| Current assets | |

| | |

| | |

| |

| Cash and cash equivalents | |

| 9 | | |

| 1,003,888 | | |

| 855,952 | |

| Trade accounts receivable, net | |

| 10 | | |

| 1,061,801 | | |

| 1,138,361 | |

| Accounts receivable from related parties | |

| 11 | | |

| 15,443 | | |

| 11,578 | |

| Other accounts receivable, net | |

| 12 | | |

| 348,072 | | |

| 334,025 | |

| Inventories, net | |

| 13 | | |

| 360,497 | | |

| 354,478 | |

| Prepaid expenses | |

| | | |

| 29,098 | | |

| 30,302 | |

| Total current assets | |

| | | |

| 2,818,799 | | |

| 2,724,696 | |

| | |

| | | |

| | | |

| | |

| Non-current assets | |

| | | |

| | | |

| | |

| Trade accounts receivable, net | |

| 10 | | |

| 768,971 | | |

| 773,256 | |

| Accounts receivable from related parties | |

| 11 | | |

| 528,285 | | |

| 529,332 | |

| Other accounts receivable, net | |

| 12 | | |

| 311,404 | | |

| 317,628 | |

| Inventories, net | |

| 13 | | |

| 70,282 | | |

| 70,295 | |

| Prepaid expenses | |

| | | |

| 14,081 | | |

| 9,725 | |

| Investments in associates and joint ventures | |

| 14 | | |

| 12,747 | | |

| 13,542 | |

| Investment property, net | |

| 15 | | |

| 58,260 | | |

| 57,345 | |

| Property, plant and equipment, net | |

| 15 | | |

| 307,165 | | |

| 306,021 | |

| Right-of-use assets, net | |

| 15 | | |

| 36,295 | | |

| 32,677 | |

| Intangible assets and goodwill, net | |

| 15 | | |

| 752,456 | | |

| 725,139 | |

| Deferred tax asset | |

| 22 | | |

| 255,763 | | |

| 262,516 | |

| Total non-current assets | |

| | | |

| 3,115,709 | | |

| 3,097,476 | |

| | |

| | | |

| | | |

| | |

| Total assets | |

| | | |

| 5,934,508 | | |

| 5,822,172 | |

AENZA S.A.A. and Subsidiaries

Interim Condensed Consolidated Statement of Financial Position

As

of December 31, 2023, and March 31, 2024

| | |

| |

As of | | |

As of | |

| | |

| |

December 31, | | |

March 31, | |

| In thousands of soles | |

Note | |

2023 | | |

2024 | |

| Liabilities | |

| |

| | |

| |

| Current liabilities | |

| |

| | |

| |

| Borrowings | |

16 | |

| 516,029 | | |

| 518,008 | |

| Bonds | |

17 | |

| 81,538 | | |

| 82,346 | |

| Trade accounts payable | |

18 | |

| 1,164,266 | | |

| 1,046,827 | |

| Accounts payable to related parties | |

11 | |

| 44,372 | | |

| 40,656 | |

| Current income tax | |

| |

| 38,398 | | |

| 41,453 | |

| Other accounts payable | |

19 | |

| 608,828 | | |

| 633,294 | |

| Other provisions | |

20 | |

| 117,086 | | |

| 117,997 | |

| Total current liabilities | |

| |

| 2,570,517 | | |

| 2,480,581 | |

| | |

| |

| | | |

| | |

| Non-current liabilities | |

| |

| | | |

| | |

| Borrowings | |

16 | |

| 306,678 | | |

| 297,118 | |

| Bonds | |

17 | |

| 741,387 | | |

| 728,450 | |

| Trade accounts payable | |

18 | |

| 4,001 | | |

| 2,295 | |

| Accounts payable to related parties | |

11 | |

| 28,564 | | |

| 28,881 | |

| Other accounts payable | |

19 | |

| 509,311 | | |

| 506,305 | |

| Other provisions | |

20 | |

| 98,067 | | |

| 101,848 | |

| Deferred tax liability | |

22 | |

| 188,694 | | |

| 185,749 | |

| Total non-current liabilities | |

| |

| 1,876,702 | | |

| 1,850,646 | |

| Total liabilities | |

| |

| 4,447,219 | | |

| 4,331,227 | |

| | |

| |

| | | |

| | |

| Equity | |

| |

| | | |

| | |

| Capital | |

21 | |

| 1,371,965 | | |

| 1,371,965 | |

| Other reserves | |

| |

| (68,440 | ) | |

| (63,895 | ) |

| Retained earnings | |

| |

| (41,148 | ) | |

| (56,688 | ) |

| Equity attributable to controlling interest in the

Company | |

| |

| 1,262,377 | | |

| 1,251,382 | |

| Non-controlling interest | |

29 | |

| 224,912 | | |

| 239,563 | |

| Total equity | |

| |

| 1,487,289 | | |

| 1,490,945 | |

| Total liabilities and equity | |

| |

| 5,934,508 | | |

| 5,822,172 | |

The accompanying notes are part of the consolidated

financial statements.

AENZA S.A.A. and Subsidiaries

Interim Condensed Consolidated Statement of Profit or Loss

For the periods ended March 31, 2023, and 2024

| | |

| |

For the three-month period | |

| | |

| |

ended March 31, | |

| In thousands of soles | |

Note | |

2023 | | |

2024 | |

| Revenue | |

| |

| | |

| |

| Revenue from construction activities | |

| |

| 448,643 | | |

| 545,983 | |

| Revenue from services provided | |

| |

| 256,580 | | |

| 278,634 | |

| Revenue from real estate and sale of goods | |

| |

| 144,915 | | |

| 172,668 | |

| Total revenue from ordinary activities arising from contracts

with customers | |

23 | |

| 850,138 | | |

| 997,285 | |

| Cost | |

| |

| | | |

| | |

| Cost of construction activities | |

| |

| (457,892 | ) | |

| (546,801 | ) |

| Cost of services provided | |

| |

| (198,424 | ) | |

| (193,342 | ) |

| Cost of real estate and sale of goods | |

| |

| (112,900 | ) | |

| (129,143 | ) |

| Cost of sales and services | |

24 | |

| (769,216 | ) | |

| (869,286 | ) |

| Gross profit | |

| |

| 80,922 | | |

| 127,999 | |

| Administrative expenses | |

24 | |

| (45,863 | ) | |

| (49,773 | ) |

| Other income and expenses | |

25 | |

| 433 | | |

| (1,030 | ) |

| Operating profit | |

| |

| 35,492 | | |

| 77,196 | |

| Financial expenses | |

26.A | |

| (41,812 | ) | |

| (60,358 | ) |

| Financial income | |

26.A | |

| 18,032 | | |

| 7,549 | |

| Interests for present value of financial asset or liability | |

26.B | |

| 13,806 | | |

| (2,305 | ) |

| Share of the profit or loss of associates and joint ventures accounted for using

the equity method | |

14 | |

| 864 | | |

| 808 | |

| Profit before income tax | |

| |

| 26,382 | | |

| 22,890 | |

| Income tax expense | |

27 | |

| (32,381 | ) | |

| (22,425 | ) |

| Profit (loss) for the period | |

| |

| (5,999 | ) | |

| 465 | |

| | |

| |

| | | |

| | |

| Profit (loss) attributable to: | |

| |

| | | |

| | |

| Controlling interest in the Company | |

| |

| (17,388 | ) | |

| (15,540 | ) |

| Non-controlling interest | |

| |

| 11,389 | | |

| 16,005 | |

| | |

| |

| (5,999 | ) | |

| 465 | |

| | |

| |

| | | |

| | |

| Loss per share attributable to controlling interest in the Company during the period | |

31 | |

| (0.015 | ) | |

| (0.011 | ) |

| Diluted loss per share attributable to controlling

interest in the Company during the period | |

31 | |

| (0.015 | ) | |

| (0.011 | ) |

The accompanying notes

are part of the consolidated financial statements.

AENZA S.A.A. and Subsidiaries

Interim Condensed Consolidated Statement of Other Comprehensive Income

For the periods ended March 31, 2023,

and 2024

| | |

For the three-month period | |

| | |

ended March 31, | |

| In thousands of soles | |

2023 | | |

2024 | |

| Profit (loss) for the period | |

| (5,999 | ) | |

| 465 | |

| Other comprehensive income: | |

| | | |

| | |

| Items that may be subsequently reclassified to profit or loss | |

| | | |

| | |

| Foreign currency translation adjustment, net of tax | |

| 172 | | |

| 4,585 | |

| Exchange difference from net investment in a foreign operation, net of tax | |

| 322 | | |

| (1 | ) |

| Other comprehensive income for the period, net of tax | |

| 494 | | |

| 4,584 | |

| Total comprehensive income for the period | |

| (5,505 | ) | |

| 5,049 | |

| Comprehensive income attributable to: | |

| | | |

| | |

| Controlling interest in the Company | |

| (16,038 | ) | |

| (10,995 | ) |

| Non-controlling interest | |

| 10,533 | | |

| 16,044 | |

| | |

| (5,505 | ) | |

| 5,049 | |

The accompanying notes

are part of the consolidated financial statements.

AENZA S.A.A. and Subsidiaries

Interim Condensed Consolidated Statement of Changes in Equity

For the periods ended March 31, 2023, and 2024

| | |

| |

Number

of | | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

Non- | | |

| |

| | |

| |

shares

in | | |

| | |

Legal | | |

Voluntary | | |

Share | | |

Other | | |

Retained | | |

| | |

controlling | | |

| |

| In

thousands of soles | |

Note | |

thousands | | |

Capital | | |

reserve | | |

reserve | | |

premium | | |

reserves | | |

earnings | | |

Total | | |

interest | | |

Total | |

| Balances

as of January 1, 2023 | |

| |

| 1,196,980 | | |

| 1,196,980 | | |

| 132,011 | | |

| 29,974 | | |

| 1,142,092 | | |

| (97,191 | ) | |

| (1,342,362 | ) | |

| 1,061,504 | | |

| 284,502 | | |

| 1,346,006 | |

| Profit

(loss) for the period | |

| |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| (17,388 | ) | |

| (17,388 | ) | |

| 11,389 | | |

| (5,999 | ) |

| Foreign

currency translation adjustment | |

| |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| 1,030 | | |

| - | | |

| 1,030 | | |

| (858 | ) | |

| 172 | |

| Exchange

difference from net investment in a foreign operation | |

| |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| 320 | | |

| - | | |

| 320 | | |

| 2 | | |

| 322 | |

| Comprehensive

income of the period | |

| |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| 1,350 | | |

| (17,388 | ) | |

| (16,038 | ) | |

| 10,533 | | |

| (5,505 | ) |

| Transactions

with shareholders: | |

| |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Dividend

distribution | |

30 | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| (24,788 | ) | |

| (24,788 | ) |

| Acquisition

of (profit distribution to) non-controlling interests, net | |

| |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| (9,216 | ) | |

| (9,216 | ) |

| Total

transactions with shareholders | |

| |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| (34,004 | ) | |

| (34,004 | ) |

| Balances

as of March 31, 2023 | |

| |

| 1,196,980 | | |

| 1,196,980 | | |

| 132,011 | | |

| 29,974 | | |

| 1,142,092 | | |

| (95,841 | ) | |

| (1,359,750 | ) | |

| 1,045,466 | | |

| 261,031 | | |

| 1,306,497 | |

| Balances

as of January 1, 2024 | |

| |

| 1,371,965 | | |

| 1,371,965 | | |

| - | | |

| - | | |

| - | | |

| (68,440 | ) | |

| (41,148 | ) | |

| 1,262,377 | | |

| 224,912 | | |

| 1,487,289 | |

| Profit

(loss) for the period | |

| |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| (15,540 | ) | |

| (15,540 | ) | |

| 16,005 | | |

| 465 | |

| Foreign

currency translation adjustment | |

| |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| 4,545 | | |

| - | | |

| 4,545 | | |

| 40 | | |

| 4,585 | |

| Exchange

difference from net investment in a foreign operation | |

| |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| (1 | ) | |

| (1 | ) |

| Comprehensive

income of the period | |

| |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| 4,545 | | |

| (15,540 | ) | |

| (10,995 | ) | |

| 16,044 | | |

| 5,049 | |

| Transactions

with shareholders: | |

| |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Dividend

distribution | |

30 | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| (2,569 | ) | |

| (2,569 | ) |

| Acquisition

of (profit distribution to) non-controlling interests, net | |

| |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| 1,176 | | |

| 1,176 | |

| Total

transactions with shareholders | |

| |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| (1,393 | ) | |

| (1,393 | ) |

| Balances

as of March 31, 2024 | |

| |

| 1,371,965 | | |

| 1,371,965 | | |

| - | | |

| - | | |

| - | | |

| (63,895 | ) | |

| (56,688 | ) | |

| 1,251,382 | | |

| 239,563 | | |

| 1,490,945 | |

The accompanying notes

are part of the consolidated financial statements.

AENZA S.A.A. and Subsidiaries

Interim Condensed Consolidated Statement of Cash Flows

For the periods ended March 31, 2023, and 2024

| | |

| |

For the three-month period | |

| | |

| |

ended March 31, | |

| In thousands of soles | |

Note | |

2023 | | |

2024 | |

| | |

| |

| | |

| |

| Operating activities | |

| |

| | |

| |

| Profit before income tax | |

| |

| 26,382 | | |

| 22,890 | |

| Adjustments to profit not affecting cash flows from operating activities: | |

| |

| | | |

| | |

| Depreciation | |

15 | |

| 17,936 | | |

| 13,620 | |

| Amortization of intangible assets | |

15 | |

| 35,286 | | |

| 31,257 | |

| Impairment of inventories | |

| |

| 385 | | |

| - | |

| (Reversal) impairment of accounts receivable and other accounts receivable | |

| |

| (2,342 | ) | |

| 119 | |

| Debt condonation | |

| |

| (192 | ) | |

| - | |

| Impairment of property, plant and equipment | |

| |

| 9 | | |

| - | |

| Other provisions | |

| |

| 6,055 | | |

| 5,677 | |

| Financial expense,net | |

| |

| 30,233 | | |

| 44,787 | |

| Insurance recovery | |

| |

| - | | |

| (24 | ) |

| Share of the profit and loss of associates and joint ventures accounted for using the equity method | |

14 | |

| (864 | ) | |

| (808 | ) |

| Reversal of provisions | |

| |

| (3,471 | ) | |

| (569 | ) |

| Reversal of disposal of assets | |

| |

| (535 | ) | |

| (529 | ) |

| Profit on sale of property, plant and equipment and intangible assets | |

| |

| (420 | ) | |

| (487 | ) |

| (Profit) loss on remeasurement of accounts receivable and accounts payable | |

| |

| (12,541 | ) | |

| 2,305 | |

| Net variations in assets and liabilities: | |

| |

| | | |

| | |

| Trade accounts receivable | |

| |

| 36,132 | | |

| (80,825 | ) |

| Other accounts receivable | |

| |

| (23,885 | ) | |

| 12,733 | |

| Other accounts receivable from related parties | |

| |

| (23,403 | ) | |

| 2,835 | |

| Inventories | |

| |

| (44,556 | ) | |

| 6,275 | |

| Prepaid expenses and other assets | |

| |

| (26,982 | ) | |

| 5,517 | |

| Trade accounts payable | |

| |

| (25,169 | ) | |

| (119,145 | ) |

| Other accounts payable | |

| |

| 60,346 | | |

| 37,791 | |

| Other accounts payable to related parties | |

| |

| 20,157 | | |

| (265 | ) |

| Other provisions | |

| |

| (3,226 | ) | |

| (1,245 | ) |

| Interest paid | |

| |

| (41,412 | ) | |

| (40,595 | ) |

| Payments for purchases of intangible assets - Concessions | |

| |

| - | | |

| (1,706 | ) |

| Income tax paid | |

| |

| (61,703 | ) | |

| (33,539 | ) |

| Net cash applied to operating activities | |

| |

| (37,780 | ) | |

| (93,931 | ) |

| Investing activities | |

| |

| | | |

| | |

| Proceeds from sale of property, plant and equipment and intangible assets | |

| |

| 1,043 | | |

| 716 | |

| Interest received | |

| |

| 6,735 | | |

| 7,520 | |

| Acquisition of investment property | |

| |

| (2 | ) | |

| (51 | ) |

| Acquisition of intangible assets | |

| |

| (47,802 | ) | |

| (6,581 | ) |

| Acquisition of property, plant and equipment | |

| |

| (12,029 | ) | |

| (10,041 | ) |

| Net cash applied to investing activities | |

| |

| (52,055 | ) | |

| (8,437 | ) |

| Financing activities | |

| |

| | | |

| | |

| Borrowing received | |

| |

| 130,140 | | |

| 40,989 | |

| Amortization of borrowings received | |

| |

| (68,824 | ) | |

| (54,068 | ) |

| Amortization of bonds issued | |

| |

| (17,794 | ) | |

| (18,064 | ) |

| Payment for debt transaction costs | |

| |

| (1,836 | ) | |

| (199 | ) |

| Dividends paid to non-controlling interest | |

| |

| (24,788 | ) | |

| (10,654 | ) |

| Cash received (return of contributions) from non-controlling shareholders | |

| |

| (9,216 | ) | |

| - | |

| Net cash provided by (applied to) financing activities | |

| |

| 7,682 | | |

| (41,996 | ) |

| Net decrease in cash | |

| |

| (82,153 | ) | |

| (144,364 | ) |

| Exchange difference | |

| |

| (9,821 | ) | |

| (3,572 | ) |

| Cash and cash equivalents at the beginning of the period | |

| |

| 917,554 | | |

| 1,003,888 | |

| Cash and cash equivalents at the end of the period | |

9 | |

| 825,580 | | |

| 855,952 | |

| Non-cash transactions: | |

| |

| | | |

| | |

| Capitalization of interests | |

| |

| 191 | | |

| 269 | |

| Acquisition of right-of-use assets | |

| |

| 1,684 | | |

| 496 | |

The accompanying notes

are part of the consolidated financial statements.

AENZA S.A.A. and Subsidiaries

Notes to the Interim Condensed Consolidated Financial Statements

As of December 31, 2023, and March 31, 2024

| A. | Incorporation and operations |

AENZA S.A.A. (hereinafter the “Company”

or “AENZA”) is the parent Company of the AENZA Corporation, which comprise the Company and its subsidiaries (hereinafter,

the “Corporation”) and is mainly engaged in holding investments in its subsidiaries. Additionally, the Company provides specialized

management consulting services and operational leasing of offices to the companies of the Corporation. The Company registered office is

at Av. Petit Thouars N° 4957, Miraflores, Lima.

The Corporation is a conglomerate of companies

with operations including different business activities, the most significant are engineering and construction, energy, infrastructure

(public concession ownership and operation) and real estate businesses. See details of operating segments in note 7.

| B. | Authorization for Financial Statements Issuance |

The interim condensed consolidated financial statements

for the period ended March 31, 2024 have been authorized by Management and the Board of Directors on May 15, 2024.

The consolidated financial statements for the

year ended December 31, 2023 were approved by the General Shareholders’ Meeting on March 27, 2024.

| C. | Compliance with laws and regulations |

As a result of the investigations into the cases

known as Club de la Construccion and Lava Jato, AENZA has entered into an effective collaboration process. On September 15, 2022, the

Plea Agreement (the Agreement), was entered into between the Public Prosecutor’s Office, the Attorney General’s Office and

the Company, whereby AENZA accepted they were utilized by certain former executives to commit illicit acts in a series of periods until

2016 and committed to pay a civil penalty to the Peruvian Government of approximately S/488.9 million (approximately S/333.3 million and

US$40.7 million). Agreement was homologated by judgment dated August 11, 2023 and entered into force with its consent, which was notified

to AENZA on December 11, 2023.

According to the Agreement, payment shall be made

within twelve (12) years at a legal interest rate in soles and dollars (3.34% and 2% annual interest as of March 31, 2024, respectively).

The Company also undertakes to establish a series of guarantees through a trust composed of: i) a trust agreement that includes shares

issued by a subsidiary of the Company, ii) mortgage on a property owned by the Company, and iii) a guarantee account with funds equivalent

to the annual installment for the following year. Among other conditions, the Agreement includes a restriction for AENZA and subsidiaries

Cumbra Peru S.A. and UNNA Transporte S.A.C. to participate in public infrastructure and construction, and road maintenance contracts for

two (2) years from the approval of the Agreement. The other member companies of the Corporation are not subject to any impediment or prohibition

to contract with the Peruvian Government.

On December 27, 2023, the initial installment

of the Civil Compensation was paid to the Peruvian Government for S/10.3 million and US$1.2 million. As of March 31, 2024, the balance

amounts to S/473.6 million (S/469.8 million as of December 31, 2023) (see note 19.a).

Pursuant to the provisions of the Agreement that

excludes AENZA from the scope of Law 30737, the company has requested the Ministry of Justice to exclude it from the Lists of Category

2 and 3 Subjects provided for in said law.

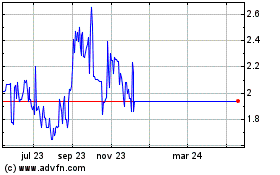

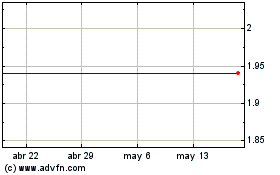

| D. | NYSE Delisting and SEC Deregistration of the ADSs issued

by AENZA. |

On October 31, 2023, AENZA’s Board of Directors

decided to initiate the delisting process of shares, represented by American Depositary Securities (ADSs), on the New York Stock Exchange

(NYSE), and the deregistration process of such instruments with the Securities and Exchange Commission of the United States of America

(SEC) and the termination of the ADS Program.

AENZA S.A.A. and Subsidiaries

Notes to the Interim Condensed Consolidated Financial Statements

As of December 31, 2023, and March 31, 2024

In the opinion of Management and the Board of

Directors, this decision will generate efficiencies for the Company, considering the low liquidity of the ADSs and the high annual costs

of NYSE listing and SEC registration, and will not affect the Company’s long-term plans. AENZA’s shares will continue to be listed on

the Lima Stock Exchange (BVL).

December 7, 2023, was the last day of trading

of the ADSs on the NYSE. AENZA will file a Form 15F with the SEC to terminate its obligations under Section 13(a) and 15(d) of the U.S.

Securities Act of 1933 upon compliance with the requirements of such legislation.

| 2. | Basis of preparation and Summary of Material Accounting Policies |

The interim condensed consolidated financial statements

for the period ended March 31, 2024 have been prepared in accordance with IAS 34 “Interim Financial Reporting”. The interim

condensed consolidated financial statements provide comparative information regarding prior year; however, they do not include all the

information and disclosures required in the consolidated financial statements, so they must be read together with the annual consolidated

financial statements, which have been prepared in accordance with International Standards of Financial Information (hereinafter “IFRS”).

The interim condensed consolidated financial statements are presented in thousands of Peruvian Soles S/(000), unless otherwise stated.

Management continues to have a reasonable expectation

that the Corporation has adequate resources to continue in operation for a reasonable period of time and that the going concern basis

of accounting remains appropriate. Management believes that there are no material uncertainties that may cause significant doubt about

this assumption, and that there is a reasonable expectation that the Corporation has adequate resources to continue operations for the

expected future, and not less than 12 months from the end of the reporting period.

The accounting policies used in the preparation

of these interim condensed consolidated financial statements are consistent with those applied in the preparation of the consolidated

financial statements as of December 31, 2023.

| 3. | Standards, amendments, and interpretation adopted by the Corporation |

Standards, amendments and interpretation that

have entered in force as of January 1, 2024, have not had impact on the interim condensed consolidated financial statements as of March

31, 2024, and for this reason they have not been disclosed. The Corporation has not adopted in advance any amendment and modification

that are not yet effective.

| 4. | Financial Risk Management |

The Corporation’s Management is responsible

for managing financial risks. The corporation Management manages the general administration of financial risks such risks include currency

risk, price risk, fair-value and cash-flow interest rate risks, credit risk, the use of derivative and non-derivative financial instruments,

and investment of liquidity surplus, as well as financial risks; all of which are regularly supervised and monitored.

The Corporation’s activities expose it to

a variety of financial risks: market risks (including currency risk, price risk, fair-value and cash-flow interest rate risks), credit

risk, and liquidity risk.

The Corporation’s general program for risk

management is mainly focused on financial market unpredictability and seeks to minimize potential adverse effects on the Corporation’s

financial performance.

AENZA S.A.A. and Subsidiaries

Notes to the Interim Condensed Consolidated Financial Statements

As of December 31, 2023, and March 31, 2024

Market risk is the risk that the fair value or

future cash flows of a financial instrument will fluctuate due to changes in market prices. Market prices involve four types of risk:

interest rate risk, exchange rate risk, commodity price risk and other price risks. Financial instruments affected by market risk include

bank deposits, trade accounts receivable, other accounts receivable, other financial liabilities, bonds, trade accounts payable, other

accounts payable and accounts receivable from and payable to related parties.

Foreign exchange risk is the risk that the fair

value of future cash flows of a financial instrument will be reduced by adverse fluctuations in exchange rates. Management is responsible

for identifying, measuring, controlling and reporting the exposure to foreign exchange risk.

The Corporation is exposed to foreign exchange

risk arising from local transactions in foreign currencies and from its foreign operations. As of December 31, 2023 and March 31, 2024,

this exposure is focused mainly on fluctuations of the U.S. dollar, Chilean peso, and Colombian peso. The Corporation’s management monitors

this risk by analyzing the country’s macroeconomic variables.

The balances of financial assets and liabilities

denominated in foreign currencies correspond to balances in U.S. Dollars, Chilean pesos and Colombian pesos, which are stated exchange

rate published on that date, according to the currency type:

| | |

As of December 31, | | |

As of March 31, | |

| | |

2023 | | |

2024 | |

| | |

Buy | | |

Sale | | |

Buy | | |

Sale | |

| U.S. Dollars (a) | |

| 3.705 | | |

| 3.713 | | |

| 3.714 | | |

| 3.721 | |

| Chilean Peso (b) | |

| 0.004224 | | |

| 0.004233 | | |

| 0.003783 | | |

| 0.003790 | |

| Colombian Peso (c) | |

| 0.000969 | | |

| 0.000971 | | |

| 0.000967 | | |

| 0.000968 | |

| (a) | U.S. Dollar as published by the Superintendencia de Bancos, Seguros y Administradoras de Fondos de Pensiones

(hereinafter “SBS”). |

| (b) | Chilean peso as published by the Banco Central de Chile. |

| (c) | Colombian peso as published by Banco de la Republica de Colombia. |

The consolidated statement of financial position

as of December 31, 2023 and March 31, 2024, includes the following:

| | |

As of | | |

As of | |

| | |

December 31, | | |

March 31, | |

| In thousands of US dollars | |

2023 | | |

2024 | |

| Assets | |

| | |

| |

| Cash and cash equivalents | |

| 105,542 | | |

| 62,305 | |

| Trade accounts receivable, net | |

| 174,305 | | |

| 156,015 | |

| Accounts receivable from related parties | |

| 142,435 | | |

| 142,435 | |

| Other accounts receivable | |

| 85,535 | | |

| 72,356 | |

| | |

| 507,817 | | |

| 433,111 | |

| | |

| | | |

| | |

| Liabilities | |

| | | |

| | |

| Borrowings | |

| (213,821 | ) | |

| (209,327 | ) |

| Bonds | |

| (3,890 | ) | |

| (3,972 | ) |

| Trade accounts payable | |

| (152,383 | ) | |

| (131,164 | ) |

| Accounts payable to related parties | |

| (3,504 | ) | |

| (3,502 | ) |

| Other accounts payable | |

| (64,277 | ) | |

| (79,402 | ) |

| Other provisions | |

| (2,032 | ) | |

| (2,146 | ) |

| | |

| (439,907 | ) | |

| (429,513 | ) |

The Corporation assumes foreign exchange risk

because it does not use derivative financial instruments to mitigate exchange rate fluctuations.

AENZA S.A.A. and Subsidiaries

Notes to the Interim Condensed Consolidated Financial Statements

As of December 31, 2023, and March 31, 2024

For the periods ended March 31, 2023 and 2024,

the Corporation’s exchange gains and losses (see note 26.A):

| In thousands of soles | |

2023 | | |

2024 | |

| Gain | |

| 54,493 | | |

| 28,163 | |

| Loss | |

| (43,197 | ) | |

| (43,646 | ) |

| | |

| 11,296 | | |

| (15,483 | ) |

The consolidated statement of changes in equity

comprises a foreign currency translation adjustment originated by its subsidiaries. The consolidated statement of financial position includes

the following assets and liabilities in its currency (in thousands):

| | |

As of December 31, | | |

As of March 31, | |

| | |

2023 | | |

2024 | |

| | |

Assets | | |

Liabilities | | |

Assets | | |

Liabilities | |

| Chilean Peso | |

| 37,715,040 | | |

| 53,101,695 | | |

| 33,802,018 | | |

| 44,624,412 | |

| Colombian Peso | |

| 183,305,679 | | |

| 125,307,739 | | |

| 215,515,741 | | |

| 173,807,655 | |

The Corporation is exposed to the risk of hydrocarbon

price fluctuations which impacts on the selling price of the products that it commercializes, which are significantly affected by changes

in global economic conditions, resource availability, and the cycles of related industries. Management considers reasonable these possible

fluctuations in the hydrocarbons prices, based in the Corporation´s economic market environment.

| iii) | Fair-value and cash flow

interest rate risk |

Interest rate risk is the risk that the fair value

or future cash flows of a financial instrument will fluctuate due to changes in market interest rates.

The Corporation’s interest rate risk arises

mainly from its long-term borrowings. Variable rate long-term financial liabilities expose the Corporation to cash-flow interest rate

risk. Fixed-rate financial liabilities expose the Corporation to fair-value interest rate risk.

The Corporation assumes the interest rate risk,

due to they do not use financial derivative instruments for mitigate variations in the interest rate risk.

Credit risk is the risk that a counterparty will

not meet its obligations under a financial instrument or commercial contract, resulting in a financial loss.

Credit risk for the Corporation arises from its

operating activities due to credit exposure to customers and from its financial activities, including deposits with banks and financial

institutions, foreign exchange transactions, and other financial instruments. The maximum exposure to credit risk for the consolidated

financial statements as of December 31, 2023 and March 31, 2024 is represented by the sum of cash and cash equivalents (note 9), trade

accounts receivable (note 10), accounts receivable from related parties (note 11) and other accounts receivable (note 12).

Customer credit risk is managed by Management

subject to the Corporation’s established policies, procedures and control related to customer credit risk management. The credit quality

of a customer is assessed based on an extensive credit rating scorecard and individual credit limits are defined based on this assessment.

The maximum credit risk exposure at the reporting date is the carrying value of each class of financial assets disclosed in note 10.

The Corporation assesses the concentration of

risk with respect to trade accounts receivable as low risk because sales are not concentrated in small customer groups and no customers

account for 10% or more of the Corporation’s revenues.

AENZA S.A.A. and Subsidiaries

Notes to the Interim Condensed Consolidated Financial Statements

As of December 31, 2023, and March 31, 2024

Management monitors the credit risk of other receivables

on an ongoing basis and assesses those receivables that show evidence of impairment to determine the required allowance for doubtful accounts.

Concerning loans to related parties, the Corporation

has measures in place to ensure the recovery of these loans through the controls maintained by Corporate Finance Management and the performance

evaluation conducted by the Board of Directors (note 11).

Management does not expect the Corporation to

incur in losses arisen from the performance of these counterparties, except for the ones already recorded at the consolidated financial

statements.

Prudent liquidity risk management implies holding

enough cash and cash equivalents, and financing available through a proper number of credit sources, and the ability to close positions

in the market. Historically, the Corporation’s cash flows from operations have enabled it to meet its obligations. The Corporation has

implemented various actions to reduce its exposure to liquidity risk and has developed a financial plan based on several steps, which

were designed with a commitment to compliance within a reasonable period of time. The financial plan is intended to meet the various obligations

at the Company and Corporation entities levels.

The Corporate Finance Office monitors the cash

flow projections made on liquidity requirements of the Corporation to ensure it exists sufficient cash to meet operational needs so that

the Corporation does not breach borrowing limits or covenants, where applicable, on any of its borrowing facilities. Less significant

financing transactions are controlled by the Finance Management of each subsidiary.

Such forecasting takes into consideration the

Corporation’s debt financing plans, covenant compliance, compliance with ratio targets in the statement of financial position and,

if applicable, with external regulatory or legal requirements.

As of March 31, 2024, the Company has significant

current payment obligations arising from the Plea Agreement (note 1.C) and the Bridge Loan (note 16.a). For this purpose, Management is

developing a financial plan with the aim of covering the short-term part of these obligations.

Cash surplus on the amounts required for the administration

of working capital are invested in checking accounts that generate interest and time deposits, selecting instruments with appropriate

maturities or sufficient liquidity.

AENZA S.A.A. and Subsidiaries

Notes to the Interim Condensed

Consolidated Financial Statements

As of December 31, 2023, and March 31, 2024

The table below analyzes the Corporation’s

financial liabilities grouped according to the remaining period from the date of the statement of financial position to the date of maturity.

The amounts disclosed in the table below are the contractual undiscounted cash flows, which include interest to be accrued according to

the established schedule.

| | |

| | |

Contractual cash flows | |

| | |

Carrying | | |

Less than | | |

1-2 | | |

2-5 | | |

More than | | |

| |

| In thousands of soles | |

amount | | |

1 year | | |

years | | |

years | | |

5 years | | |

Total | |

| As of December 31, 2023 | |

| | |

| | |

| | |

| | |

| | |

| |

| Other financial liabilities (except lease

liability for right-of-use asset) | |

| 780,145 | | |

| 568,284 | | |

| 165,022 | | |

| 163,943 | | |

| - | | |

| 897,249 | |

| Lease liability for right-of-use asset | |

| 42,562 | | |

| 17,754 | | |

| 23,487 | | |

| 8,725 | | |

| 73 | | |

| 50,039 | |

| Bonds | |

| 822,925 | | |

| 140,546 | | |

| 177,121 | | |

| 345,473 | | |

| 679,085 | | |

| 1,342,225 | |

| Trade accounts payables (except non-financial liabilities) | |

| 1,168,267 | | |

| 1,164,266 | | |

| 4,001 | | |

| - | | |

| - | | |

| 1,168,267 | |

| Accounts payables to related parties | |

| 72,936 | | |

| 44,372 | | |

| 28,564 | | |

| - | | |

| - | | |

| 72,936 | |

| Other accounts payables and other provisions (except non-financial

liabilities) | |

| 673,663 | | |

| 195,279 | | |

| 57,601 | | |

| 138,356 | | |

| 410,377 | | |

| 801,613 | |

| | |

| 3,560,498 | | |

| 2,130,501 | | |

| 455,796 | | |

| 656,497 | | |

| 1,089,535 | | |

| 4,332,329 | |

| As of March 31, 2024 | |

| | |

| | |

| | |

| | |

| | |

| |

| Other financial liabilities (except lease

liability for right-of-use asset) | |

| 776,410 | | |

| 557,063 | | |

| 164,029 | | |

| 156,998 | | |

| - | | |

| 878,090 | |

| Lease liability for right-of-use asset | |

| 38,716 | | |

| 16,364 | | |

| 22,504 | | |

| 5,856 | | |

| 70 | | |

| 44,794 | |

| Bonds | |

| 810,796 | | |

| 141,261 | | |

| 178,920 | | |

| 475,335 | | |

| 520,483 | | |

| 1,315,999 | |

| Trade accounts payables (except non-financial liabilities) | |

| 1,049,122 | | |

| 1,046,827 | | |

| 2,295 | | |

| - | | |

| - | | |

| 1,049,122 | |

| Accounts payables to related parties | |

| 69,537 | | |

| 40,656 | | |

| 28,881 | | |

| - | | |

| - | | |

| 69,537 | |

| Other accounts payables and other provisions (except non-financial

liabilities) | |

| 685,509 | | |

| 205,732 | | |

| 57,322 | | |

| 138,292 | | |

| 408,942 | | |

| 810,288 | |

| | |

| 3,430,090 | | |

| 2,007,903 | | |

| 453,951 | | |

| 776,481 | | |

| 929,495 | | |

| 4,167,830 | |

The Corporation’s objective in managing

capital is to safeguard its ability to continue operations as a going concern basis in order to generate returns to its shareholders,

benefits to stakeholders and keep an optimal capital structure to reduce capital cost. Since 2017, due to the situation of the Corporation,

Management has monitored deviations that might cause the non-compliance of covenants and may renegotiation of liabilities (note 16). In

special situations and events, the Corporation identifies potential deviations, requirements and establishes a plan.

The Corporation may adjust the amount of dividends

payable to shareholders, return capital to shareholders, issue new shares or sell assets to reduce its debt to maintain or adjust the

capital structure.

The Corporation monitors its capital based on

the leverage ratio. This ratio is calculated as net debt divided by the sum of net debt plus equity. The net debt corresponds to the total

financial liabilities (including current and non-current indebtedness) adding the provision for civil compensation less cash and cash

equivalents.

As of December 31, 2023 and March 31, 2024, the

leverage ratio is as follows:

| | |

| | |

As of | | |

As of | |

| | |

| | |

December 31, | | |

March 31, | |

| In thousands of soles | |

Note | | |

2023 | | |

2024 | |

| Total borrowing, bonds and civil compensation (*) | |

| 16 and 17 | | |

| 2,115,471 | | |

| 2,099,540 | |

| Less: Cash and cash equivalents | |

| 9 | | |

| (1,003,888 | ) | |

| (855,952 | ) |

| Net debt (a) | |

| | | |

| 1,111,583 | | |

| 1,243,588 | |

| Total equity (b) | |

| | | |

| 1,487,289 | | |

| 1,490,945 | |

| Total net debt plus equity (a) + (b) | |

| | | |

| 2,598,872 | | |

| 2,734,533 | |

| Gearing ratio | |

| | | |

| 0.43 | | |

| 0.45 | |

(*) As of March 31, 2024, the provision for

civil compensation amounts to S/473.6 million (S/469.8 as of December 31, 2023).

AENZA S.A.A. and Subsidiaries

Notes to the Interim Condensed

Consolidated Financial Statements

As of December 31, 2023, and March 31, 2024

During the periods ended December 31, 2023 and

March 31, 2024, there were no changes in the objectives, policies or processes related to capital management.

| 5. | Critical Accounting Estimates and Judgments |

Estimates and judgments used are continuously

evaluated and are based on historical experience among other factors, including expectations of future events that are believed to be

reasonable under current circumstances.

In preparing these interim condensed consolidated

financial statements, the significant judgements made by management in applying Corporation’s accounting policies and the key sources

of uncertainty were the same as those that applied to the consolidated financial statements for the year ended December 31, 2023, except

for:

| A. | iii Revenue recognition by completion percentage |

As of December 31, 2023, the Corporation

recognized service revenue from construction contracts on a percentage-of-completion basis in accordance with the product method; however,

given the current terms of customer contracts awarded beginning in 2024, management believes that the method that best reflects and measures

the transfer of control of goods and services to its customers and full satisfaction of the performance obligation is the resource method.

Therefore, beginning in 2024, the Corporation applies the resource method to measure the progress of all of its contractual performance

obligations being satisfied over time.

| 6. | Seasonality of Operations |

The Corporation does not present seasonality in

the operations of any of its subsidiaries; and develop its business during the normal course of the period.

Operating segments are reported consistently with

the internal reports that are reviewed by Corporation’s, chief decision-maker; that is the Executive Committee, which is led by

the Chief Executive Officer. This Committee acts as the highest authority in making operational decisions, responsible for allocating

resources and evaluating the performance of each operating segment.

Corporation’s operating segments are assessed

by the activities of the following business units: (i) engineering and construction, (ii) energy, (iii) infrastructure, and (iv) real

estate.

As set forth under IFRS 8, reportable segments

by significance of income are: ‘engineering and construction’, ‘energy’ and ‘infrastructure’. However,

Management has voluntarily decided to report on all its operating segments.

The Corporation has determined four reportable

segments. These operating segments are components of an enterprise for which separate financial information is available and periodically

evaluated by the Corporate Governance Board to decide how to allocate resources and assess performance.

The operations of Corporation in each reportable segment are as follows:

| (a) | Engineering and construction: This segment includes traditional engineering services such as architectural

planning, structural, civil and design engineering for advanced specialties including process design, simulation, and environmental services,

as well as construction at three divisions: i) civil works, such as the construction of hydroelectric power stations and other large infrastructure

facilities; (ii) electromechanical construction, such as concentrator plants, oil and natural gas pipelines, and electric transmission

lines; and iii) building construction, such as offices, residential buildings, hotels, and affordable housing projects, shopping centers,

and industrial facilities. |

AENZA S.A.A. and Subsidiaries

Notes to the Interim Condensed

Consolidated Financial Statements

As of December 31, 2023, and March 31, 2024

| (b) | Energy: This segment includes oil exploration, exploitation, production, treatment, and trade in four

oil deposits, separation and trade of natural gas and its byproducts at the gas processing plant, as well as the construction and assembly

of oil facilities or those linked to the oil and gas industry. It also includes storage and dispatch of fuel and oil byproducts. |

| (c) | Infrastructure: The Corporation has long-term concessions or similar contractual arrangements in Peru

for three highways with tolls, Lima Metro, a sewage treatment plant in Lima, and operation and maintenance services for infrastructure

assets. |

| (d) | Real Estate: The Corporation mainly develops and sells properties for low- and middle-resource sectors,

which are experiencing a significant increase in available income, as well as luxury properties to a lesser degree, it also develops commercial

spaces and offices. |

The Executive Committee uses the Adjusted

EBITDA (earnings before interest, tax, depreciation, and amortization) as the primary relevant measure to understand the Corporation’s

operating performance and its operating segments.

Adjusted EBITDA is not a measurement of results

based on International Financial Reporting Standards. The Corporation’s definition related to adjusted EBITDA may not be comparable

to similar performance measures and disclosures from other entities.

The adjusted EBITDA is reconciled to profit as

follows:

| | |

For the three-month period | |

| | |

ended March 31, | |

| In thousands of soles | |

2023 | | |

2024 | |

| Net (loss) profit | |

| (5,999 | ) | |

| 465 | |

| Financial income and expenses | |

| 23,780 | | |

| 52,809 | |

| Interests for present value of financial asset or liability | |

| (13,806 | ) | |

| 2,305 | |

| Income tax | |

| 32,381 | | |

| 22,425 | |

| Depreciation and amortization | |

| 53,222 | | |

| 44,877 | |

| Adjusted EBITDA | |

| 89,578 | | |

| 122,881 | |

The adjusted EBITDA with non-recurring items per

segment is as follows:

| | |

For the three-month period | |

| | |

ended March 31, | |

| In thousands of soles | |

2023 | | |

2024 | |

| Engineering and construction | |

| (29,543 | ) | |

| (19,753 | ) |

| Energy | |

| 55,845 | | |

| 56,830 | |

| Infrastructure | |

| 56,471 | | |

| 73,217 | |

| Real estate | |

| 2,048 | | |

| 11,917 | |

| Parent company operations | |

| 3,576 | | |

| 18,239 | |

| Intercompany eliminations | |

| 1,181 | | |

| (17,569 | ) |

| | |

| 89,578 | | |

| 122,881 | |

Inter-segmental sales transactions are entered

into prices similar to those that would have been agreed with unrelated third parties. Revenues from external customers reported are measured

in a consistent manner under the basis for preparation of the consolidated financial statements. Sales of goods are related to real estate

segment. Revenues from services are related to other segments.

Corporation sales and receivables are not concentrated

on a few customers. There is no external customer that represents 10% or more of Corporation’s revenue.

AENZA S.A.A. and Subsidiaries

Notes to the Interim Condensed

Consolidated Financial Statements

As of December 31, 2023, and March 31, 2024

The following are the Corporation’s financial statements by operating

segment:

| | |

Engineering | | |

| | |

Infrastructure | | |

| | |

Parent | | |

| | |

| |

| In thousands of soles | |

and

construction | | |

Energy | | |

Toll roads | | |

Transportation | | |

Water treatment | | |

Real estate | | |

Company

operations | | |

Eliminations | | |

Consolidated | |

| As of December 31, 2023 | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| |

| Assets | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| |

| Cash and cash equivalent | |

| 342,120 | | |

| 40,707 | | |

| 124,283 | | |

| 134,252 | | |

| 3,235 | | |

| 175,920 | | |

| 183,371 | | |

| - | | |

| 1,003,888 | |

| Trade accounts receivables, net | |

| 783,231 | | |

| 119,948 | | |

| 26,353 | | |

| 127,336 | | |

| 943 | | |

| 3,038 | | |

| 952 | | |

| - | | |

| 1,061,801 | |

| Accounts receivable from related parties | |

| 57,024 | | |

| 642 | | |

| 59,279 | | |

| 3,569 | | |

| 643 | | |

| 406 | | |

| 161,430 | | |

| (267,550 | ) | |

| 15,443 | |

| Other accounts receivable, net | |

| 265,378 | | |

| 40,298 | | |

| 21,101 | | |

| 6,372 | | |

| 1 | | |

| 10,418 | | |

| 6,849 | | |

| (2,345 | ) | |

| 348,072 | |

| Inventories, net | |

| 51,108 | | |

| 46,064 | | |

| 6,760 | | |

| 43,993 | | |

| - | | |

| 212,582 | | |

| - | | |

| (10 | ) | |

| 360,497 | |

| Prepaid expenses | |

| 15,461 | | |

| 2,022 | | |

| 4,651 | | |

| 334 | | |

| 169 | | |

| 71 | | |

| 6,388 | | |

| 2 | | |

| 29,098 | |

| Total current assets | |

| 1,514,322 | | |

| 249,681 | | |

| 242,427 | | |

| 315,856 | | |

| 4,991 | | |

| 402,435 | | |

| 358,990 | | |

| (269,903 | ) | |

| 2,818,799 | |

| Trade accounts receivable, net | |

| 744 | | |

| - | | |

| 6,430 | | |

| 756,990 | | |

| 1,453 | | |

| 3,354 | | |

| - | | |

| - | | |

| 768,971 | |

| Accounts receivable from related parties | |

| 298,946 | | |

| - | | |

| 17,157 | | |

| 42 | | |

| 14,015 | | |

| - | | |

| 419,282 | | |

| (221,157 | ) | |

| 528,285 | |

| Prepaid expenses | |

| - | | |

| 480 | | |

| 11,920 | | |

| 1,611 | | |

| 580 | | |

| - | | |

| - | | |

| (510 | ) | |

| 14,081 | |

| Other accounts receivable, net | |

| 102,250 | | |

| 77,116 | | |

| - | | |

| - | | |

| 7,346 | | |

| 59,764 | | |

| 64,928 | | |

| - | | |

| 311,404 | |

| Inventories, net | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| 70,282 | | |

| - | | |

| - | | |

| 70,282 | |

| Investments in associates and joint ventures | |

| 968 | | |

| 10,536 | | |

| - | | |

| - | | |

| - | | |

| 2,103 | | |

| 1,737,129 | | |

| (1,737,989 | ) | |

| 12,747 | |

| Investment property, net | |

| - | | |

| - | | |

| - | | |

| 1,427 | | |

| - | | |

| 18,203 | | |

| 38,630 | | |

| - | | |

| 58,260 | |

| Property, plant and equipment, net | |

| 83,146 | | |

| 211,127 | | |

| 5,187 | | |

| 1,047 | | |

| 233 | | |

| 5,562 | | |

| 863 | | |

| - | | |

| 307,165 | |

| Intangible assets and goodwill, net | |

| 143,228 | | |

| 370,370 | | |

| 225,363 | | |

| 138 | | |

| - | | |

| 617 | | |

| 12,740 | | |

| - | | |

| 752,456 | |

| Right-of-use assets, net | |

| 4,874 | | |

| 8,270 | | |

| 3,226 | | |

| 25 | | |

| 122 | | |

| 1,317 | | |

| 28,700 | | |

| (10,239 | ) | |

| 36,295 | |

| Deferred income tax asset | |

| 153,841 | | |

| 5,142 | | |

| 24,098 | | |

| - | | |

| 421 | | |

| 15,577 | | |

| 56,670 | | |

| 14 | | |

| 255,763 | |

| Total non-current assets | |

| 787,997 | | |

| 683,041 | | |

| 293,381 | | |

| 761,280 | | |

| 24,170 | | |

| 176,779 | | |

| 2,358,942 | | |

| (1,969,881 | ) | |

| 3,115,709 | |

| Total assets | |

| 2,302,319 | | |

| 932,722 | | |

| 535,808 | | |

| 1,077,136 | | |

| 29,161 | | |

| 579,214 | | |

| 2,717,932 | | |

| (2,239,784 | ) | |

| 5,934,508 | |

| Liabilities | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Borrowings | |

| 24,081 | | |

| 39,052 | | |

| 15,358 | | |

| 26 | | |

| 5 | | |

| 11,618 | | |

| 437,729 | | |

| (11,840 | ) | |

| 516,029 | |

| Bonds | |

| 3,611 | | |

| - | | |

| 49,369 | | |

| 28,558 | | |

| - | | |

| - | | |

| - | | |

| - | | |

| 81,538 | |

| Trade accounts payable | |

| 928,109 | | |

| 111,816 | | |

| 48,232 | | |

| 38,272 | | |

| 121 | | |

| 21,622 | | |

| 16,094 | | |

| - | | |

| 1,164,266 | |

| Accounts payable to related parties | |

| 78,561 | | |

| 80,357 | | |

| 47,599 | | |

| 69,632 | | |

| 7 | | |

| 10,990 | | |

| 17,154 | | |

| (259,928 | ) | |

| 44,372 | |

| Current income tax | |

| 19,370 | | |

| 677 | | |

| 3,159 | | |

| 13,160 | | |

| 54 | | |

| 323 | | |

| 1,655 | | |

| - | | |

| 38,398 | |

| Other accounts payable | |

| 416,927 | | |

| 26,122 | | |

| 34,045 | | |

| 10,429 | | |

| 1,167 | | |

| 86,968 | | |

| 33,170 | | |

| - | | |

| 608,828 | |

| Provisions | |

| 83,831 | | |

| 20,215 | | |

| 1,171 | | |

| 1,925 | | |

| - | | |

| 193 | | |

| 9,751 | | |

| - | | |

| 117,086 | |

| Total current liabilities | |

| 1,554,490 | | |

| 278,239 | | |

| 198,933 | | |

| 162,002 | | |

| 1,354 | | |

| 131,714 | | |

| 515,553 | | |

| (271,768 | ) | |

| 2,570,517 | |

| Borrowings | |

| 697 | | |

| 84,989 | | |

| 594 | | |

| - | | |

| 123 | | |

| 73,058 | | |

| 147,399 | | |

| (182 | ) | |

| 306,678 | |

| Bonds | |

| 10,834 | | |

| - | | |

| 130,750 | | |

| 599,803 | | |

| - | | |

| - | | |

| - | | |

| - | | |

| 741,387 | |

| Trade accounts payable | |

| - | | |

| - | | |

| - | | |

| 4,001 | | |

| - | | |

| - | | |

| - | | |

| - | | |

| 4,001 | |

| Other accounts payable | |

| 47,984 | | |

| - | | |

| 493 | | |

| 161 | | |

| 3,141 | | |

| - | | |

| 457,532 | | |

| - | | |

| 509,311 | |

| Accounts payable to related parties | |

| 7,481 | | |

| - | | |

| 1,226 | | |

| 28,563 | | |

| 23,146 | | |

| - | | |

| 197,485 | | |

| (229,337 | ) | |

| 28,564 | |

| Provisions | |

| 12,366 | | |

| 46,287 | | |

| 10,002 | | |

| 2,228 | | |

| - | | |

| - | | |

| 27,184 | | |

| - | | |

| 98,067 | |

| Deferred tax liability | |

| 58,804 | | |

| 66,415 | | |

| - | | |

| 63,473 | | |

| - | | |

| - | | |

| 2 | | |

| - | | |

| 188,694 | |

| Total non-current liabilities | |

| 138,166 | | |

| 197,691 | | |

| 143,065 | | |

| 698,229 | | |

| 26,410 | | |

| 73,058 | | |

| 829,602 | | |

| (229,519 | ) | |

| 1,876,702 | |

| Total liabilities | |

| 1,692,656 | | |

| 475,930 | | |

| 341,998 | | |

| 860,231 | | |

| 27,764 | | |

| 204,772 | | |

| 1,345,155 | | |

| (501,287 | ) | |

| 4,447,219 | |

| Equity attributable to controlling interest in the Company | |

| 604,039 | | |

| 424,874 | | |

| 146,259 | | |

| 162,680 | | |

| 1,397 | | |

| 289,942 | | |

| 1,369,744 | | |

| (1,736,558 | ) | |

| 1,262,377 | |

| Non-controlling interest | |

| 5,624 | | |

| 31,918 | | |

| 47,551 | | |

| 54,225 | | |

| - | | |

| 84,500 | | |

| 3,033 | | |

| (1,939 | ) | |

| 224,912 | |

| Total liabilities and equity | |

| 2,302,319 | | |

| 932,722 | | |

| 535,808 | | |

| 1,077,136 | | |

| 29,161 | | |

| 579,214 | | |

| 2,717,932 | | |

| (2,239,784 | ) | |

| 5,934,508 | |

AENZA S.A.A. and Subsidiaries

Notes to the Interim Condensed

Consolidated Financial Statements

As of December 31, 2023, and March 31, 2024

| | |

Engineering | | |

| | |

Infrastructure | | |

| | |

Parent | | |

| | |

| |

| In thousands of soles | |

and

construction | | |

Energy | | |

Toll

roads | | |

Transportation | | |

Water

treatment | | |

Real

estate | | |

Company

operations | | |

Eliminations | | |

Consolidated | |

| As of March 31, 2024 | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| |

| Assets | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| |

| Cash and cash equivalents | |

| 213,280 | | |

| 61,997 | | |

| 131,605 | | |

| 124,117 | | |

| 3,004 | | |

| 174,260 | | |

| 147,689 | | |

| - | | |

| 855,952 | |

| Trade accounts receivables, net | |

| 833,326 | | |

| 134,634 | | |

| 36,468 | | |

| 127,497 | | |

| 1,792 | | |

| 3,024 | | |

| 1,620 | | |

| - | | |

| 1,138,361 | |

| Accounts receivable from related parties | |

| 63,932 | | |

| 215 | | |

| 69,661 | | |

| 564 | | |

| 807 | | |

| 7,194 | | |

| 167,501 | | |

| (298,296 | ) | |

| 11,578 | |

| Other accounts receivable, net | |

| 256,593 | | |

| 27,866 | | |

| 17,888 | | |

| 9,249 | | |

| 1 | | |

| 9,740 | | |

| 8,182 | | |

| 4,506 | | |

| 334,025 | |

| Inventories, net | |

| 42,843 | | |

| 47,897 | | |

| 8,200 | | |

| 44,214 | | |

| - | | |

| 211,304 | | |

| - | | |

| 20 | | |

| 354,478 | |

| Prepaid expenses | |

| 13,789 | | |

| 3,356 | | |

| 3,517 | | |

| 1,956 | | |

| 81 | | |

| 101 | | |

| 7,502 | | |

| - | | |

| 30,302 | |

| Total current assets | |

| 1,423,763 | | |

| 275,965 | | |

| 267,339 | | |

| 307,597 | | |

| 5,685 | | |

| 405,623 | | |

| 332,494 | | |

| (293,770 | ) | |

| 2,724,696 | |

| Trade accounts receivable, net | |

| 736 | | |

| - | | |

| 6,197 | | |

| 761,890 | | |

| 1,338 | | |

| 3,095 | | |

| - | | |

| - | | |

| 773,256 | |

| Accounts receivable from related parties | |

| 299,630 | | |

| - | | |

| 17,452 | | |

| 3,064 | | |

| 14,015 | | |

| - | | |

| 417,378 | | |

| (222,207 | ) | |

| 529,332 | |

| Prepaid expenses | |

| - | | |

| 481 | | |

| 7,610 | | |

| 1,577 | | |

| 567 | | |

| - | | |

| - | | |

| (510 | ) | |

| 9,725 | |

| Other accounts receivable, net | |

| 113,660 | | |

| 71,450 | | |

| - | | |

| - | | |

| 7,346 | | |

| 60,096 | | |

| 65,076 | | |

| - | | |

| 317,628 | |

| Inventories, net | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| 70,295 | | |

| - | | |

| - | | |

| 70,295 | |

| Investments in associates and joint ventures | |

| 957 | | |

| 11,344 | | |

| - | | |

| - | | |

| - | | |

| 2,103 | | |

| 1,748,516 | | |

| (1,749,378 | ) | |

| 13,542 | |

| Investment property, net | |

| - | | |

| - | | |

| - | | |

| 1,408 | | |

| - | | |

| 17,798 | | |

| 38,139 | | |

| - | | |

| 57,345 | |

| Property, plant and equipment, net | |

| 81,328 | | |

| 212,307 | | |

| 5,036 | | |

| 1,052 | | |

| 224 | | |

| 5,276 | | |

| 798 | | |

| - | | |

| 306,021 | |

| Intangible assets and goodwill, net | |

| 137,508 | | |

| 361,605 | | |

| 212,703 | | |

| 114 | | |

| - | | |

| 615 | | |

| 12,594 | | |

| - | | |

| 725,139 | |

| Right-of-use assets, net | |

| 3,712 | | |

| 6,460 | | |

| 2,434 | | |

| 14 | | |

| 120 | | |

| 990 | | |

| 26,560 | | |

| (7,613 | ) | |

| 32,677 | |

| Deferred income tax asset | |

| 157,687 | | |

| 5,675 | | |

| 25,980 | | |

| - | | |

| 466 | | |

| 15,666 | | |

| 57,058 | | |

| (16 | ) | |

| 262,516 | |

| Total non-current assets | |

| 795,218 | | |

| 669,322 | | |

| 277,412 | | |

| 769,119 | | |

| 24,076 | | |

| 175,934 | | |

| 2,366,119 | | |

| (1,979,724 | ) | |

| 3,097,476 | |

| Total assets | |

| 2,218,981 | | |

| 945,287 | | |

| 544,751 | | |

| 1,076,716 | | |

| 29,761 | | |

| 581,557 | | |

| 2,698,613 | | |

| (2,273,494 | ) | |

| 5,822,172 | |

| Liabilities | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Borrowings | |

| 22,275 | | |

| 36,758 | | |

| 15,334 | | |

| 15 | | |

| 5 | | |

| 12,771 | | |

| 439,193 | | |

| (8,343 | ) | |

| 518,008 | |

| Bonds | |

| 3,923 | | |

| - | | |

| 49,377 | | |

| 29,046 | | |

| - | | |

| - | | |

| - | | |

| - | | |

| 82,346 | |

| Trade accounts payable | |

| 833,264 | | |

| 91,250 | | |

| 54,443 | | |

| 33,834 | | |

| 113 | | |

| 20,069 | | |

| 13,854 | | |

| - | | |

| 1,046,827 | |

| Accounts payable to related parties | |

| 117,545 | | |

| 81,979 | | |

| 52,592 | | |

| 51,773 | | |

| 13 | | |

| 11,163 | | |

| 14,117 | | |

| (288,526 | ) | |

| 40,656 | |

| Current income tax | |

| 18,228 | | |

| 2,297 | | |

| 1,789 | | |

| 15,909 | | |

| 130 | | |

| 1,086 | | |

| 2,014 | | |

| - | | |

| 41,453 | |

| Other accounts payable | |

| 429,045 | | |

| 39,997 | | |

| 30,266 | | |

| 10,378 | | |

| 1,293 | | |

| 84,485 | | |

| 37,830 | | |

| - | | |

| 633,294 | |

| Provisions | |

| 85,980 | | |

| 20,187 | | |

| 677 | | |

| 1,208 | | |

| - | | |

| 194 | | |

| 9,751 | | |

| - | | |

| 117,997 | |

| Total current liabilities | |

| 1,510,260 | | |

| 272,468 | | |

| 204,478 | | |

| 142,163 | | |

| 1,554 | | |

| 129,768 | | |

| 516,759 | | |

| (296,869 | ) | |

| 2,480,581 | |

| Borrowings | |

| 179 | | |

| 84,080 | | |

| 234 | | |

| - | | |

| 121 | | |

| 71,776 | | |

| 140,728 | | |

| - | | |

| 297,118 | |

| Bonds | |

| 10,857 | | |

| - | | |

| 119,047 | | |

| 598,546 | | |

| - | | |

| - | | |

| - | | |

| - | | |

| 728,450 | |

| Trade accounts payable | |

| - | | |

| - | | |

| - | | |

| 2,295 | | |

| - | | |

| - | | |

| - | | |

| - | | |

| 2,295 | |

| Other accounts payable | |

| 44,773 | | |

| - | | |

| 493 | | |

| 120 | | |

| 3,071 | | |

| - | | |

| 457,848 | | |

| - | | |

| 506,305 | |

| Accounts payable to related parties | |

| 6,698 | | |

| - | | |

| 1,006 | | |

| 28,881 | | |

| 24,543 | | |

| - | | |

| 195,107 | | |

| (227,354 | ) | |

| 28,881 | |

| Other provisions | |

| 13,183 | | |

| 48,063 | | |

| 10,338 | | |

| 2,898 | | |

| - | | |

| - | | |

| 27,366 | | |

| - | | |

| 101,848 | |

| Deferred income tax liability | |

| 56,789 | | |

| 64,910 | | |

| - | | |

| 64,049 | | |

| - | | |

| - | | |

| 1 | | |

| - | | |

| 185,749 | |

| Total non-current liabilities | |

| 132,479 | | |

| 197,053 | | |

| 131,118 | | |

| 696,789 | | |

| 27,735 | | |

| 71,776 | | |

| 821,050 | | |

| (227,354 | ) | |

| 1,850,646 | |

| Total liabilities | |

| 1,642,739 | | |

| 469,521 | | |

| 335,596 | | |

| 838,952 | | |

| 29,289 | | |

| 201,544 | | |

| 1,337,809 | | |

| (524,223 | ) | |

| 4,331,227 | |

| Equity attributable to controlling interest in the Company | |

| 570,818 | | |

| 441,938 | | |

| 157,233 | | |

| 178,325 | | |

| 472 | | |

| 292,140 | | |

| 1,357,783 | | |

| (1,747,327 | ) | |

| 1,251,382 | |

| Non-controlling interest | |

| 5,424 | | |

| 33,828 | | |

| 51,922 | | |

| 59,439 | | |

| - | | |

| 87,873 | | |

| 3,021 | | |

| (1,944 | ) | |

| 239,563 | |

| Total liabilities and equity | |

| 2,218,981 | | |

| 945,287 | | |

| 544,751 | | |

| 1,076,716 | | |

| 29,761 | | |

| 581,557 | | |

| 2,698,613 | | |

| (2,273,494 | ) | |

| 5,822,172 | |

AENZA S.A.A. and Subsidiaries

Notes to the Interim Condensed

Consolidated Financial Statements

As of December 31, 2023, and March 31, 2024

| | |

Engineering | | |

| | |

Infrastructure | | |

| | |

Parent | | |

| | |

| |

| In thousands of soles | |

and

construction | | |

Energy | | |

Toll

roads | | |

Transportation | | |

Water

treatment | | |

Real

estate | | |

Company

operations | | |

Elimination | | |

Consolidated | |

| For the period ended March 31, 2023 | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| |

| Revenue | |

| 498,745 | | |

| 164,876 | | |

| 133,388 | | |

| 102,108 | | |

| 1,263 | | |

| 17,775 | | |

| 25,189 | | |

| (93,206 | ) | |

| 850,138 | |

| Gross profit (loss) | |

| (7,091 | ) | |

| 29,706 | | |

| 16,315 | | |

| 31,417 | | |

| 762 | | |

| 3,650 | | |

| 5,947 | | |

| 216 | | |

| 80,922 | |

| Administrative expenses | |

| (23,225 | ) | |

| (4,412 | ) | |

| (5,156 | ) | |

| (2,797 | ) | |

| (240 | ) | |

| (3,911 | ) | |

| (6,636 | ) | |

| 514 | | |

| (45,863 | ) |

| Other income and expenses, net | |

| (4,529 | ) | |

| 168 | | |

| 373 | | |

| 175 | | |

| - | | |

| 780 | | |

| 3,798 | | |

| (332 | ) | |

| 433 | |

| Operating profit (loss) | |

| (34,845 | ) | |

| 25,462 | | |

| 11,532 | | |

| 28,795 | | |

| 522 | | |

| 519 | | |

| 3,109 | | |

| 398 | | |

| 35,492 | |

| Financial expenses | |

| (11,567 | ) | |

| (5,947 | ) | |

| (6,225 | ) | |

| (1,800 | ) | |

| (108 | ) | |

| (3,235 | ) | |

| (26,608 | ) | |

| 13,678 | | |

| (41,812 | ) |

| Financial income | |

| 4,964 | | |

| 2,122 | | |

| 1,408 | | |

| 1,471 | | |

| 160 | | |

| 1,913 | | |

| 18,334 | | |

| (12,340 | ) | |

| 18,032 | |

| Gain (loss) on present value of financial asset or

financial liability | |

| 1,352 | | |

| 138 | | |

| (1,014 | ) | |

| - | | |

| - | | |

| 1,256 | | |

| 12,074 | | |

| - | | |

| 13,806 | |

| Share of profit or loss in

associates and joint ventures | |

| (1 | ) | |

| 867 | | |

| - | | |

| - | | |

| - | | |

| - | | |

| (2,877 | ) | |

| 2,875 | | |

| 864 | |

| Profit (loss) before income tax | |

| (40,097 | ) | |

| 22,642 | | |

| 5,701 | | |

| 28,466 | | |

| 574 | | |

| 453 | | |

| 4,032 | | |

| 4,611 | | |

| 26,382 | |

| Income tax | |

| (10,207 | ) | |

| (7,203 | ) | |

| (1,355 | ) | |

| (8,682 | ) | |

| (167 | ) | |

| (141 | ) | |

| (4,634 | ) | |

| 8 | | |

| (32,381 | ) |

| Profit (loss) profit for the period | |

| (50,304 | ) | |

| 15,439 | | |

| 4,346 | | |

| 19,784 | | |

| 407 | | |

| 312 | | |

| (602 | ) | |

| 4,619 | | |

| (5,999 | ) |

| Profit (loss) profit from attributable to: | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Owners of the Company | |

| (50,462 | ) | |

| 13,467 | | |

| 1,587 | | |

| 14,838 | | |

| 407 | | |

| (1,084 | ) | |

| (615 | ) | |

| 4,474 | | |

| (17,388 | ) |

| Non-controlling interest | |

| 158 | | |

| 1,972 | | |

| 2,759 | | |

| 4,946 | | |

| - | | |

| 1,396 | | |

| 12 | | |

| 146 | | |

| 11,389 | |

| | |

| (50,304 | ) | |