UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT

INVESTMENT COMPANIES

| Investment Company Act file number: |

811-23490 |

| |

|

| Exact name of registrant as specified in charter: |

abrdn Global Infrastructure

Income Fund |

| |

|

| Address of principal executive offices: |

1900 Market Street, Suite 200 |

| |

Philadelphia, PA 19103 |

| |

|

| Name and address of agent for service: |

Sharon Ferrari |

| |

abrdn Inc. |

| |

1900 Market Street Suite 200 |

| |

Philadelphia, PA 19103 |

| |

|

| Registrant’s telephone number, including area code: |

1-800-522-5465 |

| |

|

| Date of fiscal year end: |

September 30 |

| |

|

| Date of reporting period: |

March 31, 2024 |

Item 1. Reports to Stockholders.

abrdn Global Infrastructure Income Fund (ASGI)

Semi-Annual Report

March 31, 2024

Distribution Policies (unaudited)

On May 9, 2024, the Fund's annualized

distribution rate on NAV increased from 9% to 12%. In December 2023, the Board of Trustees (the "Board") of abrdn Global Infrastructure Income Fund (the "Fund") approved a managed distribution policy which

will pay monthly distributions at an annual rate, set once a year, that is a percentage of the average daily net asset value ("NAV") for the previous month-end prior to declaration (the "Distribution Policy"). The

Distribution Policy is subject to regular review by the Board. The Distribution Policy seeks to provide investors with a distribution out of current income, supplemented by realized capital gains and, to the extent

necessary, paid-in capital. The Fund previously paid a fixed monthly distribution of $0.12, which was approved by the Board in March 2023.

With each distribution, the Fund will issue

a notice to shareholders and an accompanying press release which will provide detailed information regarding the amount and estimated composition of the distribution and other information required by the Fund’s

exemptive order. The Board may amend or terminate the Managed Distribution Policy at any time without prior notice to shareholders; however, at this time, there are no reasonably foreseeable circumstances that might

cause the termination of the Managed Distribution Policy. You should not draw any conclusions about the Fund’s investment performance from the amount of distributions or from the terms of the Fund's Distribution

Policy.

Distribution Disclosure

Classification (unaudited)

The Fund’s policy is to provide

investors with a stable distribution rate. Each monthly distribution will be paid out of current income, supplemented by realized capital gains and, to the extent necessary, paid-in capital.

The Fund is subject to U.S.

corporate, tax and securities laws. Under U.S. tax rules, the amount applicable to the Fund and character of distributable income for each fiscal period depends on the actual exchange rates during the entire year

between the U.S. Dollar and the currencies in which Fund assets are denominated and on the aggregate gains and losses realized by the Fund during the entire year.

Therefore, the exact amount

of distributable income for each fiscal year can only be determined as of the end of the Fund’s fiscal year, September 30. Under Section 19 of the Investment Company Act of 1940, as amended (the “1940

Act”), the Fund is required to indicate the sources of certain distributions to shareholders. The estimated

distribution composition may vary from month

to month because it may be materially impacted by future income, expenses and realized gains and losses on securities and fluctuations in the value of the currencies in which Fund assets are denominated.

Based on generally accepted

accounting principles, the Fund estimates the distributions for the fiscal year commenced October 1, 2023 through the distributions declared on May 9, 2024 consisted of 20% net investment income, 62% long-term capital

gains and 18% return of capital. The amounts and sources of distributions reported in this report are only estimates and are not being provided for tax reporting purposes.

In January 2025, a Form

1099-DIV will be sent to shareholders, which will state the final amount and composition of distributions and provide information with respect to their appropriate tax treatment for the 2024 calendar year.

abrdn Global Infrastructure Income

Fund

Letter to Shareholders (unaudited)

Dear Shareholder,

We present the Semi-Annual

Report, which covers the activities of abrdn Global Infrastructure Income Fund (the “Fund”), for the six-month period ended March 31, 2024. The Fund’s principal investment objective is to seek

to provide a high level of total return with an emphasis on current income. The Fund seeks to achieve its investment objective by investing in a portfolio of income-producing public and private infrastructure equity

investments from around the world.

Total Investment Return1

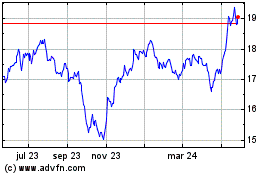

For the six-month period

ended March 31, 2024, the total return to shareholders of the Fund based on the net asset value (“NAV”) and market price of the Fund, respectively, compared to the Fund’s benchmark is as follows:

| NAV2,3

| 13.98%

|

| Market Price2

| 15.59%

|

| S&P Global Infrastructure Index (Net Total Return)4

| 11.95%

|

For more information about

Fund performance, please visit the Fund on the web at www.abrdnasgi.com. Here, you can view quarterly commentary on the Fund's performance, monthly fact sheets, distribution and performance information, and other Fund

literature.

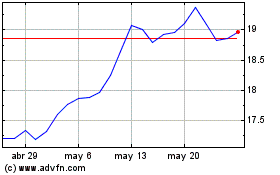

NAV, Market Price and

Premium(+)/Discount(-)

The below table represents

a comparison from current six-month period end to prior fiscal year end of market price to NAV and associated Premium(+) and Discount(-).

|

|

|

|

|

|

| NAV

| Closing

Market

Price

| Premium(+)/

Discount(-)

|

| 3/31/2024

| $20.83

| $17.75

| -14.79%

|

| 9/30/2023

| $19.16

| $16.10

| -15.97%

|

During the six-month period ended March 31,

2024, the Fund’s NAV was within a range of $18.19 to $21.20 and the Fund’s market price traded within a range of $15.02 to $18.27. During the six-month period ended March 31, 2024, the Fund’s shares

traded within a range of a premium(+)/discount(-) of -11.06% to -17.74%.

Distribution Policies

In March 2023, the Board

approved the continuation of a Stable Distribution Plan pursuant to which the Fund would pay a fixed monthly distribution of $0.12, commencing with the distribution paid on April 28, 2023. On December 14, 2023, the

Board approved a managed distribution policy which will pay monthly distributions at an annual rate, set once a year, that is a percentage of the average daily net asset value ("NAV") for the previous month-end

prior to declaration (the "Distribution Policy"). On December 12, 2023, the Board determined the rolling distribution rate to be 9% for the 12-month period commencing with the distribution payable in January 2024. On

May 9, 2024, the Distribution Policy underwent a review by the Board which resulted in an increase in the Fund's annualized distribution rate on NAV from 9% to 12%. This rate increase will commence with the

distribution payable on May 31, 2024, to all shareholders of record as of May 23, 2024 (ex-dividend date May 22, 2024). The Fund intends to maintain the increased Managed Distribution Policy rate for at least

the next 12 months unless there is a significant and unforeseen change in market conditions. The Distribution Policy is subject to regular review by the Board. The Distribution Policy seeks to provide investors with a

distribution out of current income, supplemented by realized capital gains and, to the extent necessary, paid-in capital.

Distributions to common

shareholders for the six-month period ended March 31, 2024 totaled $0.82 per share. Based on the market price of $17.75 on March 31, 2024, the annualized distribution rate was 9.24%. Based on the NAV of $20.59 on

March 31, 2024, the annualized distribution rate was 7.97%.

{foots1}

| 1

| Past performance is no guarantee of future results. Investment returns and principal value will fluctuate and shares, when sold, may be worth more or less than original cost. Current performance may be

lower or higher than the performance quoted. NAV return data include investment management fees, custodial charges and administrative fees (such as Trustee and legal fees) and assumes the reinvestment of all

distributions.

|

{foots1}

| 2

| Assuming the reinvestment of dividends and distributions.

|

{foots1}

| 3

| The Fund’s total return is based on the financial statement NAV, which is updated for financial statement rounding and/or financial statement adjustments, and differs from the reported NAVs on the

six-month period ended March 31, 2024 and the fiscal year ended September 30, 2023. The Fund’s total return for the six-month period ended March 31,2024 based on the reported NAV of $20.58 was: 12.85%.The

Fund’s total return for the fiscal year ended September 30, 2023 based on the reported NAV of $19.12 was: 10.51%.

|

{foots1}

| 4

| The S&P Global Infrastructure Index (Net Total Return) is an unmanaged index considered representative of stock markets of developed and emerging markets. Indexes are unmanaged and have been

provided for comparison purposes only. Indexes are unmanaged and provided for comparison purposes only. No fees or expenses are reflected. You cannot invest directly in an index.

|

| abrdn Global Infrastructure Income Fund

| 1

|

Letter to Shareholders (unaudited) (concluded)

The Fund is covered under exemptive relief

received by the Fund’s investment adviser from the U.S. Securities and Exchange Commission ("SEC") that allows the Fund to distribute long-term capital gains as frequently as monthly in any one taxable year.

Private Investments

The portion of the Fund's

portfolio invested in private placements represented 15.5% of the Fund's assets on March 31, 2024. During the reporting period, some milestones were achieved in the Funds' private placement portfolio that resulted in

an net increase in net asset value of approximately $6 million in the aggregate or $0.25 per share as of March 31, 2024.

Open Market

Repurchase Program

On December 12, 2023, the

Fund's Board approved an open market repurchase and discount management policy (the “Program”). The Program allows the Fund to purchase, in the open market, its outstanding common shares, with the amount

and timing of any repurchase determined at the discretion of the Fund's investment adviser. Such purchases may be made opportunistically at certain discounts to NAV per share in the reasonable judgment of management

based on historical discount levels and current market conditions. The Fund reports repurchase activity on the Fund's website on a monthly basis. For the period ended March 31, 2024, the Fund did not repurchase any

shares through the Program.

Unclaimed Share Accounts

Please be advised that

abandoned or unclaimed property laws for certain states require financial organizations to transfer (escheat) unclaimed property (including Fund shares) to the state. Each state has its own definition of unclaimed

property, and Fund shares could be considered “unclaimed property” due to account inactivity (e.g., no owner-generated activity for a certain period), returned mail (e.g., when mail sent to

a shareholder is returned to the Fund's transfer agent as undeliverable), or a combination of both. If your Fund shares are categorized as unclaimed, your financial advisor or the Fund's transfer agent will

follow the applicable state’s statutory requirements to contact you, but if unsuccessful, laws may require that the shares be escheated to the appropriate state. If this happens, you will have to contact the

state to recover your property, which may involve time and expense. For more information on unclaimed property and how to maintain an active account, please contact your financial adviser or the Fund's transfer

agent.

Portfolio Holdings Disclosure

The Fund's complete schedule

of portfolio holdings for the second and fourth quarters of each fiscal year are included in the Fund's semi-annual and annual reports to shareholders. The Fund files its complete schedule of portfolio holdings with

the SEC for the first and third quarters of each fiscal year as an exhibit to its reports on Form

N-PORT. These reports are available on the

SEC’s website at http://www.sec.gov. The Fund makes the information available to shareholders upon request and without charge by calling Investor Relations toll-free at 1-800-522-5465.

Proxy Voting

A description of the policies

and procedures that the Fund uses to determine how to vote proxies relating to portfolio securities and information regarding how the Fund voted proxies relating to portfolio securities during the most recent 12 month

period ended June 30 is available by August 31 of the relevant year: (1) upon request without charge by calling Investor Relations toll-free at 1-800-522-5465; and (2) on the SEC’s website at

http://www.sec.gov.

Investor Relations Information

As part of abrdn’s

commitment to shareholders, we invite you to visit the Fund on the web at www.abrdnasgi.com. Here, you can view monthly fact sheets, quarterly commentary, distribution and performance information, and other Fund

literature.

Enroll in abrdn’s email

services and be among the first to receive the latest closed-end fund news, announcements, videos, and other information. In addition, you can receive electronic versions of important Fund documents, including annual

reports, semi-annual reports, prospectuses and proxy statements. Sign up today at https://www.abrdn.com/en-us/cefinvestorcenter/contact-us/preferences

Contact Us:

| •

| Visit: https://www.abrdn.com/en-us/cefinvestorcenter

|

| •

| Email: Investor.Relations@abrdn.com; or

|

| •

| Call: 1-800-522-5465 (toll free in the U.S.).

|

Yours sincerely,

/s/ Christian Pittard

Christian Pittard

President

{foots1}

All amounts are U.S.

Dollars unless otherwise stated.

| 2

| abrdn Global Infrastructure Income Fund

|

Total Investment Return (unaudited)

The following table summarizes

the average annual Fund performance compared to the Fund’s benchmark for the six-month (not annualized), 1-year, 3-year and since inception (July 29, 2020) periods ended March 31, 2024.

|

| 6 Months

| 1 Year

| 3 Years

| Since Inception

|

| Net Asset Value (NAV)

| 13.98%

| 6.92%

| 5.73%

| 8.33%

|

| Market Price

| 15.59%

| 7.98%

| 3.80%

| 4.06%

|

| S&P Global Infrastructure Index (Net Total Return)

| 11.95%

| 3.12%

| 4.59%

| 7.68%

|

Performance of a $10,000

Investment (as of March 31, 2024)

This graph shows the change in

value of a hypothetical investment of $10,000 in the Fund for the periods indicated. For comparison, the same investment is shown in the indicated index.

The performance above

reflects fee waivers and/or expense reimbursements made by the Fund’s current investment adviser. Absent such waivers and/or reimbursements, the Fund’s returns would be lower. Additionally, abrdn Inc.

entered into an agreement with the Fund to limit investor relations services fees. This agreement aligns with the term of the advisory agreement and may not be terminated prior to the end of the current term of

the advisory agreement. See Note 3 in the Notes to Financial Statements.

Returns represent past

performance. Total investment return at NAV is based on changes in the NAV of Fund shares and assumes reinvestment of dividends and distributions, if any, at market prices pursuant to the dividend reinvestment program

sponsored by the Fund’s transfer agent. All return data at NAV includes fees charged to the Fund, which are listed in the Fund’s Statement of Operations under “Expenses.” Total investment

return at market value is based on changes in the market price at which the Fund’s shares traded on the NYSE during the period and assumes reinvestment of dividends and distributions, if any, at market prices

pursuant to the dividend reinvestment program sponsored by the Fund’s transfer agent. The Fund’s total investment return is based on the reported NAV as of the financial reporting period end date of March

31, 2024. Because the Fund’s shares trade in the stock market based on investor demand, the Fund may trade at a price higher or lower than its NAV. Therefore, returns are calculated based on both market price

and NAV. Past performance is no guarantee of future results. The performance information provided does not reflect the deduction of taxes that a shareholder would pay on distributions received

from the Fund. The current performance of the Fund may be lower or higher than the figures shown. The Fund’s yield, return, market price and NAV will fluctuate. Performance information current to the most recent

month-end is available at www.abrdnasgi.com or by calling 800-522-5465.

The annualized net operating

expense ratio, excluding fee waivers based on the six-month period ended March 31, 2024 was 2.10%. The annualized net operating expense ratio net of fee waivers based on the six-month period ended March 31, 2024 was

2.05%. The annualized net operating expense ratio, excluding deferred tax expenses based on the fiscal year ended March 31,

2024 was 1.65%.

| abrdn Global Infrastructure Income Fund

| 3

|

Portfolio Summary (as a percentage of net assets) (unaudited)

As of March 31, 2024

The following table summarizes

the sector composition of the Fund’s portfolio, in S&P Global Inc.’s Global Industry Classification Standard (“GICS”) Sectors. Industry allocation is shown below for any sector representing

more than 25% of net assets.

| Sectors

|

|

| Industrials

| 35.6%

|

| Transportation Infrastructure

| 15.4%

|

| Ground Transportation

| 8.8%

|

| Construction & Engineering

| 7.7%

|

| Commercial Services & Supplies

| 3.7%

|

| Utilities

| 33.4%

|

| Electric Utilities

| 11.9%

|

| Multi-Utilities

| 9.9%

|

| Independent Power Producers & Energy Traders

| 9.1%

|

| Unknown G3

| 2.0%

|

| Water Utilities

| 0.5%

|

| Energy

| 15.9%

|

| Communication Services

| 10.0%

|

| Real Estate

| 4.8%

|

| Materials

| 0.8%

|

| Information Technology

| 0.2%

|

| Liabilities in Excess of Other Assets

| (0.7%)

|

|

| 100.0%

|

The

following table summarizes the composition of the Fund’s portfolio by geographic classification.

| Countries

|

|

| United States

| 47.8%

|

| France

| 11.5%

|

| Canada

| 6.7%

|

| Spain

| 6.4%

|

| United Kingdom

| 4.5%

|

| Brazil

| 4.1%

|

| Italy

| 3.1%

|

| Mexico

| 2.9%

|

| Philippines

| 2.1%

|

| Malaysia

| 2.0%

|

| Other, less than 2% each

| 9.6%

|

| Liabilities in Excess of Other Assets

| (0.7%)

|

|

| 100.0%

|

| Top Ten Holdings

|

|

| NextEra Energy, Inc.

| 2.9%

|

| Aena SME SA

| 2.7%

|

| Vinci SA

| 2.7%

|

| Ferrovial SE

| 2.7%

|

| Trinity Gas Holdings, LLC (through abrdn Global Infrastructure Income Fund BL, LLC)

| 2.7%

|

| American Tower Corp., REIT

| 2.6%

|

| Sentinel Midstream Highline JV Holdings LLC (through abrdn Global Infrastructure Income Fund BL, LLC)

| 2.5%

|

| Cellnex Telecom SA

| 2.4%

|

| Engie SA

| 2.4%

|

| Canadian Pacific Kansas City Ltd.

| 2.3%

|

| 4

| abrdn Global Infrastructure Income Fund

|

Consolidated Portfolio of Investments (unaudited)

As of March 31, 2024

|

| Shares

| Value

|

| COMMON STOCKS—85.2%

|

|

| ARGENTINA—1.4%

|

| Industrials—0.6%

|

|

|

|

| Corp. America Airports SA(a)

|

| 190,739

| $ 3,204,415

|

| Materials—0.8%

|

|

|

|

| Loma Negra Cia Industrial Argentina SA, ADR

|

| 600,000

| 4,008,000

|

| Total Argentina

|

| 7,212,415

|

| AUSTRALIA—1.2%

|

| Industrials—1.2%

|

|

|

|

| Aurizon Holdings Ltd.

|

| 2,362,500

| 6,160,107

|

| BRAZIL—4.1%

|

| Industrials—3.0%

|

|

|

|

| CCR SA

|

| 4,115,900

| 11,341,416

|

| Rumo SA

|

| 1,082,800

| 4,805,824

|

|

|

|

| 16,147,240

|

| Utilities—1.1%

|

|

|

|

| Serena Energia SA(a)

|

| 3,031,800

| 5,688,327

|

| Total Brazil

|

| 21,835,567

|

| CANADA—5.5%

|

| Energy—2.1%

|

|

|

|

| Enbridge, Inc.

|

| 299,000

| 10,805,101

|

| Industrials—2.3%

|

|

|

|

| Canadian Pacific Kansas City Ltd.

|

| 138,200

| 12,185,094

|

| Utilities—1.1%

|

|

|

|

| Algonquin Power & Utilities Corp.

|

| 928,700

| 5,868,866

|

| Total Canada

|

| 28,859,061

|

| CHINA—0.2%

|

| Information Technology—0.2%

|

|

|

|

| GDS Holdings Ltd., ADR(a)

|

| 164,000

| 1,090,600

|

| FRANCE—11.5%

|

| Industrials—7.0%

|

|

|

|

| Eiffage SA

|

| 107,200

| 12,166,355

|

| Getlink SE

|

| 602,800

| 10,263,512

|

| Vinci SA

|

| 110,400

| 14,167,474

|

|

|

|

| 36,597,341

|

| Utilities—4.5%

|

|

|

|

| Engie SA

|

| 742,600

| 12,444,002

|

| Veolia Environnement SA

|

| 348,300

| 11,330,832

|

|

|

|

| 23,774,834

|

| Total France

|

| 60,372,175

|

| GERMANY—1.8%

|

| Utilities—1.8%

|

|

|

|

| RWE AG

|

| 282,700

| 9,608,177

|

| HONG KONG—1.1%

|

| Utilities—1.1%

|

|

|

|

| CLP Holdings Ltd.

|

| 699,000

| 5,575,393

|

| INDONESIA—0.6%

|

| Communication Services—0.6%

|

|

|

|

| Sarana Menara Nusantara Tbk. PT

|

| 62,856,400

| 3,409,429

|

| ITALY—3.1%

|

| Communication Services—1.1%

|

|

|

|

| Infrastrutture Wireless Italiane SpA(b)

|

| 522,600

| 5,930,445

|

| Utilities—2.0%

|

|

|

|

| Enel SpA

|

| 1,564,391

| 10,327,320

|

| Total Italy

|

| 16,257,765

|

|

| Shares

| Value

|

|

|

|

| JAPAN—1.0%

|

| Industrials—1.0%

|

|

|

|

| Japan Airport Terminal Co. Ltd.

|

| 131,800

| $ 5,208,222

|

| MALAYSIA—2.0%

|

| Industrials—2.0%

|

|

|

|

| Malaysia Airports Holdings Bhd.

|

| 4,984,200

| 10,433,618

|

| MEXICO—2.9%

|

| Industrials—2.9%

|

|

|

|

| Grupo Aeroportuario del Centro Norte SAB de CV

|

| 875,000

| 8,660,217

|

| Promotora y Operadora de Infraestructura SAB de CV

|

| 605,500

| 6,437,118

|

|

|

|

| 15,097,335

|

| NIGERIA—0.5%

|

| Communication Services—0.5%

|

|

|

|

| IHS Holding Ltd.(a)

|

| 684,400

| 2,415,932

|

| PHILIPPINES—2.1%

|

| Industrials—2.1%

|

|

|

|

| International Container Terminal Services, Inc.

|

| 1,954,200

| 11,054,622

|

| SPAIN—6.4%

|

| Communication Services—2.4%

|

|

|

|

| Cellnex Telecom SA(a)(b)

|

| 359,001

| 12,699,552

|

| Industrials—2.7%

|

|

|

|

| Aena SME SA(b)

|

| 72,300

| 14,239,736

|

| Utilities—1.3%

|

|

|

|

| EDP Renovaveis SA

|

| 476,600

| 6,454,199

|

| Total Spain

|

| 33,393,487

|

| TANZANIA—1.8%

|

| Communication Services—1.8%

|

|

|

|

| Helios Towers PLC(a)

|

| 8,111,990

| 9,663,560

|

| UNITED KINGDOM—4.5%

|

| Communication Services—0.9%

|

|

|

|

| Vodafone Group PLC, ADR

|

| 544,900

| 4,849,610

|

| Industrials—0.8%

|

|

|

|

| Mobico Group PLC

|

| 4,629,600

| 4,066,901

|

| Utilities—2.8%

|

|

|

|

| National Grid PLC

|

| 420,800

| 5,669,858

|

| SSE PLC

|

| 430,636

| 8,977,892

|

|

|

|

| 14,647,750

|

| Total United Kingdom

|

| 23,564,261

|

| UNITED STATES—33.5%

|

| Energy—5.3%

|

|

|

|

| Cheniere Energy, Inc.

|

| 59,900

| 9,660,672

|

| Kinder Morgan, Inc.

|

| 458,799

| 8,414,374

|

| Williams Cos., Inc.

|

| 249,400

| 9,719,118

|

|

|

|

| 27,794,164

|

| Industrials—8.2%

|

|

|

|

| CoreCivic, Inc.(a)

|

| 452,600

| 7,065,086

|

| Ferrovial SE

|

| 356,200

| 14,102,614

|

| GEO Group, Inc.(a)

|

| 222,700

| 3,144,524

|

| Norfolk Southern Corp.

|

| 46,900

| 11,953,403

|

| Union Pacific Corp.

|

| 28,700

| 7,058,191

|

|

|

|

| 43,323,818

|

| abrdn Global Infrastructure Income Fund

| 5

|

Consolidated Portfolio of Investments (unaudited) (concluded)

As of March 31, 2024

|

| Shares

| Value

|

| COMMON STOCKS (continued)

|

|

| UNITED STATES (continued)

|

| Real Estate—4.8%

|

|

|

|

| American Tower Corp., REIT

|

| 69,800

| $ 13,791,782

|

| Crown Castle, Inc., REIT

|

| 108,100

| 11,440,223

|

|

|

|

| 25,232,005

|

| Utilities—15.2%

|

|

|

|

| Altus Power, Inc.(a)

|

| 546,300

| 2,611,314

|

| American Electric Power Co., Inc.

|

| 100,300

| 8,635,830

|

| CenterPoint Energy, Inc.

|

| 249,600

| 7,111,104

|

| Clearway Energy, Inc., Class C

|

| 251,100

| 5,787,855

|

| CMS Energy Corp.

|

| 154,770

| 9,338,822

|

| FirstEnergy Corp.

|

| 130,700

| 5,047,634

|

| NextEra Energy Partners LP

|

| 296,200

| 8,909,696

|

| NextEra Energy, Inc.

|

| 236,211

| 15,096,245

|

| PPL Corp.

|

| 310,168

| 8,538,925

|

| Vistra Corp.

|

| 123,400

| 8,594,810

|

|

|

|

| 79,672,235

|

| Total United States

|

| 176,022,222

|

| Total Common Stocks

|

| 447,233,948

|

| PRIVATE CREDIT(c)—1.2%

|

|

| UNITED STATES—1.2%

|

| Energy—1.2%

|

|

|

|

| OYA Solar CDG LLC(d)(e)

|

| –

| 6,350,215

|

| Total Private Credit

|

| 6,350,215

|

| PRIVATE EQUITY(c)(f)—14.3%

|

|

| CANADA—1.2%

|

| Communication Services—1.2%

|

|

|

|

| NOVA-telMAX HoldCo LLC(a)(g)(h)

|

| –

| 6,143,793

|

| UNITED STATES—13.1%

|

| Communication Services—1.5%

|

|

|

|

| BT Co-Invest Fund, L.P. (through abrdn Global Infrastructure Income Fund BL, LLC)(h)(i)

|

| –

| 7,697,199

|

| Energy—7.3%

|

|

|

|

| Arroyo Trinity Direct Investment I, L.P. (through abrdn Global Infrastructure Income Fund BL, LLC)(h)(i)

|

| –

| 1,858,103

|

| CAI Co-Invest LP (through abrdn Global Infrastructure Income Fund BL, LLC)(a)(h)(i)

|

| –

| 651,538

|

| Cresta Highline Co-Invest Fund I (through abrdn Global Infrastructure Income Fund BL, LLC)(a)(h)(i)

|

| –

| 8,940,727

|

| Sentinel Midstream Highline JV Holdings LLC (through abrdn Global Infrastructure Income Fund BL, LLC)(d)(e)(h)

|

| –

| 12,926,000

|

| Trinity Gas Holdings, LLC (through abrdn Global Infrastructure Income Fund BL, LLC)(a)(h)

|

| –

| 14,033,016

|

|

|

|

| 38,409,384

|

|

| Shares

| Value

|

|

|

|

|

|

| Industrials—1.8%

|

|

|

|

| WR Holdings LLC (through abrdn Global Infrastructure Income Fund BL, LLC)(a)(e)(i)

|

| –

| $ 9,392,407

|

| Utilities—2.5%

|

|

|

|

| Cresta BBR Co-Invest BL LLC(a)(h)(j)

|

| –

| 2,875,495

|

| Zon Holdings II, LLC (through abrdn Global Infrastructure Income Fund BL, LLC)(a)(h)(i)

|

| –

| 2,114,542

|

| Zon Holdings, LLC (through abrdn Global Infrastructure Income Fund BL, LLC)(a)(h)(i)

|

| –

| 8,462,566

|

|

|

|

| 13,452,603

|

| Total United States

|

| 68,951,593

|

| Total Private Equity

|

| 75,095,386

|

Total Investments

(Cost $477,162,629)—100.7%

| 528,679,549

|

| Liabilities in Excess of Other Assets—(0.7%)

| (3,728,268)

|

| Net Assets—100.0%

| $524,951,281

|

| (a)

| Non-income producing security.

|

| (b)

| Denotes a security issued under Regulation S or Rule 144A.

|

| (c)

| Illiquid security.

|

| (d)

| Indicates a security that may be restricted in certain markets.

|

| (e)

| Fair Valued Security. Fair Value is determined pursuant to procedures approved by the Fund’s Board of Directors. Unless otherwise noted, securities are valued by applying

valuation factors to the exchange trade price. See Note 2(a) of the accompanying Notes to Consolidated Financial Statements for inputs used.

|

| (f)

| Private Equity Investments. See Note 6 of the accompanying Notes to Consolidated Financial Statements.

|

| (g)

| NOVA-telMAX HoldCo LLC invests 100% of its capital in Telmax, Inc., in which the Fund's percentage of ownership is approximately 15%.

|

| (h)

| Restricted security, not readily marketable. See Notes to Consolidated Financial Statements.

|

| (i)

| abrdn Global Infrastructure Income Fund BL, LLC invests 100% of its capital in Arroyo Trinity Direct Investment I, BT Co-Invest Fund, L.P., Climate Adaptive Infrastructure (CAI)

Co-Invest Fund LP, Cresta Highline Co-Invest, L.P., Sentinel Midstream Highline JV Holdings LLC, Trinity Gas Holdings, LLC, WR Holdings LLC, Zon Holdings, LLC and Zon Holdings II, LLC in which the Fund's percent of

ownership is approximately 2%, 9%, 8%, 32%, 19%, 18%, 5%, 50% and 50%, respectively.

|

| (j)

| Cresta Blocker invests 100% of its capital in Cresta Fund LP, in which the Fund's percentage of ownership is approximately 18%.

|

| ADR

| American Depositary Receipt

|

| PLC

| Public Limited Company

|

| REIT

| Real Estate Investment Trust

|

See Notes to Consolidated Financial

Statements.

| 6

| abrdn Global Infrastructure Income Fund

|

Consolidated Statement of Assets and

Liabilities (unaudited)

As of March 31, 2024

| Assets

|

|

| Investments, at value (cost $477,162,629)

| $ 528,679,549

|

| Interest and dividends receivable

| 465,185

|

| Tax reclaim receivable

| 500,559

|

| Prepaid expenses

| 5,555

|

| Total assets

| 529,650,848

|

| Liabilities

|

|

| Deferred tax liability (Note 9)

| 2,056,457

|

| Due to custodian

| 1,596,993

|

| Investment management fees payable (Note 3)

| 521,163

|

| Trustee fees payable

| 85,258

|

| Administration fees payable (Note 3)

| 34,754

|

| Investor relations fees payable (Note 3)

| 1,255

|

| Other accrued expenses

| 403,687

|

| Total liabilities

| 4,699,567

|

|

|

| Net Assets

| $524,951,281

|

| Composition of Net Assets

|

|

| Common stock (par value $0.001 per share) (Note 5)

| $ 25,207

|

| Paid-in capital in excess of par

| 478,048,577

|

| Distributable earnings

| 46,877,497

|

| Net Assets

| $524,951,281

|

| Net asset value per share based on 25,206,605 shares issued and outstanding

| $20.83

|

See Notes to Consolidated

Financial Statements.

| abrdn Global Infrastructure Income Fund

| 7

|

Consolidated Statement of Operations (unaudited)

For the Six-Months Ended March 31, 2024

| Net Investment Income

|

|

| Investment Income:

|

|

| Dividends and other income (net of foreign withholding taxes of $327,574)

| $ 6,112,647

|

| Non-cash income (Note 2i)

| 472,735

|

| Total investment income

| 6,585,382

|

| Expenses:

|

|

| Investment management fee (Note 3)

| 3,393,337

|

| Deferred tax expense (Note 9)

| 999,512

|

| Administration fee (Note 3)

| 201,087

|

| Legal fees and expenses

| 188,041

|

| Trustees' fees and expenses

| 185,730

|

| Independent auditors’ fees and tax expenses

| 67,474

|

| Custodian’s fees and expenses

| 66,713

|

| Reports to shareholders and proxy solicitation

| 45,702

|

| Investor relations fees and expenses (Note 3)

| 37,208

|

| Insurance expense

| 23,437

|

| Transfer agent’s fees and expenses

| 8,202

|

| Miscellaneous

| 54,171

|

| Total operating expenses before reimbursed/waived expenses

| 5,270,614

|

| Expenses waived (Note 3)

| (123,691)

|

| Total expenses

| 5,146,923

|

|

|

| Net Investment Income

| 1,438,459

|

| Net Realized/Unrealized Gain/(Loss) from Investments and Foreign Currency Related Transactions:

|

|

| Net realized gain/(loss) from:

|

|

| Investments (Note 2h)

| 6,379,273

|

| Foreign currency transactions

| (458,754)

|

|

| 5,920,519

|

| Net change in unrealized appreciation/(depreciation) on:

|

|

| Investments (Note 2h)

| 55,330,918

|

| Foreign currency translation

| 7,016

|

|

| 55,337,934

|

| Net realized and unrealized gain from investments and foreign currencies

| 61,258,453

|

| Change in Net Assets Resulting from Operations

| $62,696,912

|

See Notes to Consolidated

Financial Statements.

| 8

| abrdn Global Infrastructure Income Fund

|

Consolidated Statements of Changes in Net

Assets

|

| For the

Six-Month

Period Ended

March 31, 2024

(unaudited)

| For the

Year Ended

September 30, 2023

|

| Increase/(Decrease) in Net Assets:

|

|

|

| Operations:

|

|

|

| Net investment income

| $1,438,459

| $5,072,024

|

| Net realized gain from investments and foreign currency transactions

| 5,920,519

| 25,098,416

|

| Net change in unrealized appreciation/(depreciation) on investments and foreign

currency translation

| 55,337,934

| (21,919,388)

|

| Net increase in net assets resulting from operations

| 62,696,912

| 8,251,052

|

| Distributions to Shareholders From:

|

|

|

| Distributable earnings

| (20,669,416)

| (26,486,548)

|

| Net decrease in net assets from distributions

| (20,669,416)

| (26,486,548)

|

| Proceeds from shares issued from the reorganization resulting in the issuance of 0 and

16,351,605 shares of common stock, respectively (Note 10)

| –

| 333,513,983

|

| Change in net assets

| 42,027,496

| 315,278,487

|

| Net Assets:

|

|

|

| Beginning of period

| 482,923,785

| 167,645,298

|

| End of period

| $524,951,281

| $482,923,785

|

Amounts listed as

“–” are $0 or round to $0.

See Notes to Consolidated

Financial Statements.

| abrdn Global Infrastructure Income Fund

| 9

|

Consolidated Statement of Cash Flows (unaudited)

For the Six-Months Ended March 31, 2024

| Cash flows from operating activities:

|

|

| Net increase/(decrease) in net assets resulting from operations

| $ 62,696,912

|

Adjustments to reconcile net increase in net assets resulting

from operations to net cash provided by operating activities:

|

|

| Investments purchased

| (32,315,435)

|

| Investments sold and principal repayments

| 50,075,770

|

| Decrease in short-term investments, excluding foreign government

| 1,755,228

|

| Net payment-in-kind interest income

| (472,735)

|

| Decrease in cash due to adviser

| (231,113)

|

| Increase in interest, dividends and other receivables

| (196,959)

|

| Decrease in prepaid expenses

| 23,438

|

| Increase in accrued investment advisory fees payable

| 44,096

|

| Increase in deferred tax liability

| 999,512

|

| Decrease in other accrued expenses

| (142,785)

|

| Net change in unrealized appreciation of investments

| (55,330,918)

|

| Net change in unrealized appreciation on foreign currency translations

| (7,016)

|

| Net realized gain on investments transactions

| (6,379,273)

|

| Net cash provided by operating activities

| 20,991,457

|

| Cash flows from financing activities:

|

|

| Decrease in payable to custodian

| (322,041)

|

| Distributions paid to shareholders

| (20,669,416)

|

| Net cash used in financing activities

| (20,991,457)

|

| Unrestricted and restricted cash and foreign currency, beginning of period

| –

|

| Unrestricted and restricted cash and foreign currency, end of period

| $–

|

| Supplemental disclosure of cash flow information:

|

|

Amounts listed as

“–” are $0 or round to $0.

See Notes to Consolidated

Financial Statements.

| 10

| abrdn Global Infrastructure Income Fund

|

Consolidated Financial Highlights

|

| For the

Six-Month

Period Ended

March 31,

| For the Fiscal Years Ended September 30,

| For the

Period Ended

September 30,

|

|

| 2024

(unaudited)

| 2023

| 2022

| 2021

| 2020

(a)

|

| PER SHARE OPERATING PERFORMANCE(b):

|

|

|

|

|

|

| Net asset value per common share, beginning of period

| $19.16

| $18.93

| $22.27

| $19.43

| $20.00

|

| Net investment income

| 0.06

| 0.28

| 0.04

| 0.20

| 0.02

|

Net realized and unrealized gains/(losses) on investments and foreign

currency transactions

| 2.43

| 1.39

| (2.01)

| 3.94

| (0.59)

|

| Total from investment operations applicable to common shareholders

| 2.49

| 1.67

| (1.97)

| 4.14

| (0.57)

|

| Distributions to common shareholders from:

|

|

|

|

|

|

| Net investment income

| (0.82)

| (0.68)

| (0.22)

| (1.20)

| –

|

| Net realized gains

| –

| (0.76)

| (1.15)

| (0.10)

| –

|

| Total distributions

| (0.82)

| (1.44)

| (1.37)

| (1.30)

| –

|

| Net asset value per common share, end of period

| $20.83

| $19.16

| $18.93

| $22.27

| $19.43

|

| Market price, end of period

| $17.75

| $16.10

| $15.73

| $19.93

| $17.51

|

| Total Investment Return Based on(c):

|

|

|

|

|

|

| Market price

| 15.59%

| 11.04%

| (15.23%)

| 21.54%

| (12.45%)

|

| Net asset value

| 13.98%(d)

| 9.80%(d)

| (8.70%)(d)

| 22.39%(d)

| (2.85%)

|

| Ratio to Average Net Assets Applicable to Common Shareholders/Supplementary Data:

|

|

|

|

|

|

| Net assets applicable to common shareholders, end of period (000 omitted)

| $524,951

| $482,924

| $167,645

| $197,185

| $172,015

|

| Average net assets applicable to common shareholders (000 omitted)

| $502,717

| $372,392

| $195,544

| $196,015

| $177,052

|

| Net operating expenses, net of fee waivers

| 2.05%(e)

| 1.83%(f)

| 1.99%(f)

| 1.78%

| 2.00%(e)(g)

|

| Net operating expenses, excluding deferred tax expense

| 1.65%(e)

| 1.65%

| 1.79%

| 1.78%

| 2.00%(e)(g)

|

| Net operating expenses, excluding fee waivers

| 2.10%(e)

| 1.85%

| 1.99%

| 1.78%

| 2.00%(e)(g)

|

| Net Investment income

| 0.57%(e)

| 1.36%

| 0.20%

| 0.92%

| 0.55%(e)

|

| Portfolio turnover

| 8%(h)

| 28%(i)

| 25%

| 28%

| –(h)

|

| (a)

| For the period from July 29, 2020 (commencement of operations) through September 30, 2020.

|

| (b)

| Based on average shares outstanding.

|

| (c)

| Total investment return based on market value is calculated assuming that shares of the Fund’s common stock were purchased at the closing market price as of the beginning of the period, dividends,

capital gains and other distributions were reinvested as provided for in the Fund’s dividend reinvestment plan and then sold at the closing market price per share on the last day of the period. The computation

does not reflect any sales commission investors may incur in purchasing or selling shares of the Fund. The total investment return based on the net asset value is similarly computed except that the Fund’s net

asset value is substituted for the closing market value.

|

| (d)

| The total return shown above includes the impact of financial statement rounding of the NAV per share and/or financial statement adjustments.

|

| (e)

| Annualized.

|

| (f)

| The Fund recorded a deferred tax liability primarily associated with its subsidiary’s investments in partnerships of $654,810 and $402,135 for the years ended September 30, 2023 and September

30, 2022, respectively.

|

| (g)

| The expense ratio is higher than the Fund anticipates for a typical fiscal year due to the short fiscal period covered by the report.

|

| (h)

| Not annualized.See Notes to Consolidated Financial Statements.

|

| abrdn Global Infrastructure Income Fund

| 11

|

Consolidated Financial Highlights (concluded)

| (i)

| The portfolio turnover calculation excludes $194,946,484 and $181,919,462 of proceeds received and cost of investments related to rebalancing the portfolio

after the fund reorganization which occurred on March 10, 2023.

|

Amounts listed as

“–” are $0 or round to $0.

See Notes to Consolidated

Financial Statements.

| 12

| abrdn Global Infrastructure Income Fund

|

Notes to Consolidated Financial

Statements (unaudited)

March 31, 2024

1. Organization

abrdn Global Infrastructure

Income Fund (the “Fund”) is a closed-end management investment company. The Fund was organized as a Maryland statutory trust on November 13, 2019 and seeded with an initial capital amount of $100,000 on

June 19, 2020. It commenced operations on July 29, 2020. The Fund is diversified for purposes of 1940 Act. Pursuant to guidance from the Securities and Exchange Commission (the "SEC"), the Fund's classification

changed from a non-diversified fund to a diversified fund. As a result of this classification change, the Fund is limited in the proportion of its assets that may be invested in the securities of a single

issuer. The Fund’s investment objective is to seek to provide a high level of total return with an emphasis on current income. The investment objective is not fundamental and may be changed by the Board

without shareholder approval. There is no assurance that the Fund will achieve its investment objective.

Basis for Consolidation for the

Fund

abrdn Global Infrastructure

Income Fund BL, LLC (the “Subsidiary”), a Delaware limited liability company, was incorporated on September 28, 2020 and is a wholly-owned subsidiary of the Fund. The Subsidiary acts as an investment

vehicle for the Fund in order to effect certain investments on behalf of the Fund consistent with the Fund’s investment objective and policies as described in the Fund’s

prospectus. The Consolidated Schedule of

Portfolio Investments (“CSOI”) includes positions of the Fund and the Subsidiary. The consolidated financial statements include the accounts of the Fund and the Subsidiary. Subsequent references to the

Fund within the Notes to the Consolidated Financial Statements collectively refer to the Fund and the Subsidiary. All significant intercompany balances and transactions have been eliminated in consolidation.

Fund Reorganization

On March 10, 2023, the Fund

acquired the assets and assumed the liabilities of Macquarie Global Infrastructure Total Return Fund Inc. (“MGU”) pursuant to a plan of Reorganization approved by the Board on August 11, 2022

("Reorganization"). In the Reorganization, common shareholders of MGU received an amount of ASGI common shares with a net asset value equal to the aggregate net asset value of their holdings of MGU common shares, as

determined at the close of regular business on March 10, 2023. Any applicable fractional shares were paid as cash-in-lieu to the applicable holder. The Reorganization was structured as a tax-free transaction. The Fund

is considered the tax survivor and accounting survivor of the Reorganization.

The following is a summary of

the net asset value (“NAV”) per share issued as of March 10, 2023.

| Acquired Fund

| Acquiring Fund NAV per

Share ($) 3/10/2023

| Conversion Ratio

| Shares Issued

|

| Macquarie Global Infrastructure Total Return Fund Inc. (“MGU”)

| 20.3964

| 1.329043

| 16,351,605

|

2. Summary of

Significant Accounting Policies

The Fund is an investment company and

accordingly follows the investment company accounting and reporting guidance of the Financial Accounting Standards Board ("FASB") Accounting Standard Codification Topic 946 Financial Services-Investment Companies. The

following is a summary of significant accounting policies followed by the Fund in the preparation of its financial statements. The policies conform to generally accepted accounting principles ("GAAP") in the United

States of America. The preparation of financial statements requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities, disclosure of contingent assets and

liabilities at the date of the financial statements, and the reported amounts of income and expenses for the period. Actual results could differ from those estimates. The accounting records of the Fund are maintained

in U.S. Dollars and the U.S. Dollar is used as both the functional and reporting currency.

a. Security Valuation:

The Fund values its

securities at current market value or fair value, consistent with regulatory requirements. "Fair value" is defined in the Fund's Valuation and Liquidity Procedures as the price that could be

received to sell an asset or paid to

transfer a liability in an orderly transaction between willing market participants without a compulsion to transact at the measurement date. Pursuant to Rule 2a-5 under the 1940 Act, the Board designated abrdn Inc.,

the Fund's Investment Adviser (the "Investment Adviser"), as the valuation designee ("Valuation Designee") for the Fund to perform the fair value determinations relating to Fund investments for which market

quotations are not readily available or deemed unreliable.

In accordance with the

authoritative guidance on fair value measurements and disclosures under U.S. GAAP, the Fund discloses the fair value of its investments using a three-level hierarchy that classifies the inputs to valuation techniques

used to measure the fair value. The hierarchy assigns Level 1, the highest level, measurements to valuations based upon unadjusted quoted prices in active markets for identical assets, Level 2 measurements to

valuations based upon other significant observable inputs, including adjusted quoted prices in active markets for similar assets, and Level 3, the lowest level, measurements to valuations based upon unobservable

inputs that are significant to the valuation. Inputs refer broadly to the assumptions that market participants would use in pricing the asset or liability,

| abrdn Global Infrastructure Income Fund

| 13

|

Notes to Consolidated Financial

Statements (unaudited) (continued)

March 31, 2024

including assumptions about risk, for

example, the risk inherent in a particular valuation technique used to measure fair value including a pricing model and/or the risk inherent in the inputs to the valuation technique. Inputs may be observable or

unobservable. Observable inputs are inputs that reflect the assumptions market participants would use in pricing the asset or liability, which are based on market data obtained from sources independent of the

reporting entity. Unobservable inputs are inputs that reflect the reporting entity’s own assumptions about the assumptions market participants would use in pricing the asset or liability developed based on the

best information available in the circumstances. A financial instrument’s level within the fair value hierarchy is based upon the lowest level of any input that is significant to the fair value measurement.

Open-end mutual funds are

valued at the respective net asset value (“NAV”) as reported by such company. The prospectuses for the registered open-end management investment companies in which the Fund invests explain the

circumstances under which those companies will use fair value pricing and the effects of using fair value pricing. Closed-end funds and exchange-traded funds (“ETFs”) are valued at the market price of

the security at the Valuation Time (defined below). A security using any of these pricing methodologies is generally determined to be a Level 1 investment.

Equity securities that are

traded on an exchange are valued at the last quoted sale price or the official close price on the principal exchange on which the security is traded at the “Valuation Time” subject to application, when

appropriate, of the valuation factors described in the paragraph below. Under normal circumstances, the Valuation Time is as of the close of regular trading on the New York Stock Exchange ("NYSE") (usually 4:00 p.m.

Eastern Time). In the absence of a sale price, the security is valued at the mean of the bid/ask price quoted at the close on the principal exchange on which the security is traded. Securities traded on NASDAQ are

valued at the NASDAQ official closing price.

Foreign equity securities

that are traded on foreign exchanges that close prior to the Valuation Time are valued by applying valuation factors to the last sale price or the mean price as noted above. Valuation factors are provided by an

independent pricing service provider. These valuation factors are used when pricing the Fund's portfolio holdings to estimate market movements between the time foreign markets close and the time the Fund values such

foreign securities. These valuation factors are based on inputs such as depositary receipts, indices, futures, sector indices/ETFs, exchange rates, and local exchange opening and closing prices of each security. When

prices with the application of valuation factors are utilized, the value assigned to the foreign securities may not be the same as quoted or published prices of the securities on their primary markets. A security that

applies a valuation factor is generally determined to be a Level 2 investment because the exchange-traded price has been adjusted. Valuation factors are not utilized if the independent pricing

service provider is unable to provide a

valuation factor or if the valuation factor falls below a predetermined threshold; in such case, the security is determined to be a Level 1 investment.

Short-term investments are

comprised of cash and cash equivalents invested in short-term investment funds which are redeemable daily. The Fund sweeps available cash into the State Street Institutional U.S. Government Money Market Fund,

which has elected to qualify as a “government money market fund” pursuant to Rule 2a-7 under the 1940 Act, and has an objective, which is not guaranteed, to maintain a $1.00 per share NAV. Generally, these

investment types are categorized as Level 1 investments.

In the event that a

security’s market quotations are not readily available or are deemed unreliable (for reasons other than because the foreign exchange on which it trades closes before the Valuation Time), the security is valued

at fair value as determined by the Valuation Designee, taking into account the relevant factors and surrounding circumstances using valuation policies and procedures approved by the Board. A security that has been

fair valued by the Adviser may be classified as Level 2 or Level 3 depending on the nature of the inputs.

The three-level hierarchy of

inputs is summarized below:

Level 1 - quoted prices

(unadjusted) in active markets for identical investments;

Level 2 - other significant observable

inputs (including valuation factors, quoted prices for similar securities, interest rates, prepayment speeds, and credit risk, etc.); or

Level 3 - significant unobservable inputs

(including the Fund’s own assumptions in determining the fair value of investments). Investments that are included in this category are private credit investments and private transaction investments that are not

able to use NAV as practical expedient as detailed below.

Level 3 investments are

valued using significant unobservable inputs. The Fund may also use a discounted cash flow based valuation approach in which the anticipated future cash flows of the investment are used to estimate the current fair

value. The derived value of a Level 3 investment may not represent the value which is received upon disposition and this could impact the results of operations.

Level 3 investments are

valued using significant unobservable inputs. The Fund may also use a discounted cash flow based valuation approach in which the anticipated future cash flows of the investment are used to estimate the current fair

value. The derived value of a Level 3 investment may not represent the value which is received upon disposition and this could impact the results of operations.

The Fund may also invest in

infrastructure investments through private transactions, which represented 15.0% of the net assets of the Fund as of March 31, 2024. For certain of the private equity investments, the Fund values private investment

companies using the

| 14

| abrdn Global Infrastructure Income Fund

|

Notes to Consolidated Financial

Statements (unaudited) (continued)

March 31, 2024

NAVs provided by the underlying private

investment companies as a practical expedient. The Fund determined that the use of the practical expedient was appropriate as the investments in private investment companies did not have readily determinable fair

values. The Fund applies the practical expedient to private investment companies on an investment-by-investment basis, and consistently with the Fund’s entire position in a particular investment, unless it is

probable that the Fund will sell a portion of an investment at an amount different from the NAV of the investment. In such cases, the Fund may make adjustments to the NAV reported by the private investment company

based on market or economic changes, which can include market fluctuations or other economic conditions for which it may be

necessary to adjust a reported NAV. In

addition, the impact of changes in the market environment and other events on the fair values of the Fund’s investments that have no readily available market values may differ from the impact of such changes on

the readily available market values for the Fund’s other investments. The Fund’s net asset value could be adversely affected if the Fund’s determinations regarding the fair value of the Fund’s

investments were materially higher or lower than the values that the Fund ultimately realizes upon the disposal of such investments. These holdings are not considered part of the three-level hierarchy and

therefore are only represented in the total below.

The following is a

summary of the inputs used as of March 31, 2024 in valuing the Fund's investments and other financial instruments at fair value. The inputs or methodology used for valuing securities are not necessarily an indication

of the risk associated with investing in those securities. Please refer to the Consolidated Portfolio of Investments for a detailed breakout of the security types:

| Investments, at Value

| Level 1 – Quoted

Prices

| Level 2 – Other Significant

Observable Inputs

| Level 3 – Significant

Unobservable Inputs

| Total

|

| Assets

|

|

|

| Investments in Securities

|

|

|

|

| Common Stocks

| $246,713,745

| $200,520,203

| $–

| $447,233,948

|

| Private Credit

| –

| –

| 6,350,215

| 6,350,215

|

| Private Equity

| –

| –

| 9,392,407

| 9,392,407

|

| Private Equity

|

|

|

| 65,702,979

|

| Total Investments in Securities

|

|

|

| $528,679,549

|

Amounts listed as

“–” are $0 or round to $0.

Rollforward of Level 3 Fair Value Measurements

For the Six Months Ended March 31, 2024

|

Investments

in Securities

| Balance

as of

September 30,

2023

| Net Realized

Gain (Loss)

and Change

in Unrealized

Appreciation

(Depreciation)

| Net

Purchases

| Net

Sales

| Net

Transfers

in to

(out of)

Level 3

| Balance

as of

March 31,

2024

| Change in

Unrealized

Appreciation

(Depreciation)

from

Investments

Held at

March 31,

2024

|

| Private Credit

|

|

|

|

|

|

|

|

| United States

| $12,896,644

| $(326,104)

| $468,961

| $(975,000)

| $(5,714,286)

| $6,350,215

| $(326,104)

|

| Private Equity

|

|

|

|

|

|

|

|

| United States

| 6,271,360

| 1,934,864

| 1,186,183

| -

| -

| 9,392,407

| 1,934,864

|

| Total

| $19,168,004

| $1,608,760

| $1,655,144

| $(975,000)

| $(5,714,286)

| $15,742,622

| $1,608,760

|

Amounts listed as

“–” are $0 or round to $0.

| abrdn Global Infrastructure Income Fund

| 15

|

Notes to Consolidated Financial

Statements (unaudited) (continued)

March 31, 2024

| Description

| Fair Value at

03/31/24

| Valuation Technique (s)

| Unobservable Inputs

| Range

| Weighted

Average

| Relationship

Between

FairValue

and Input;

if input value

increases then

Fair Value:

|

| Private Credit

| $6,350,215

| Market Approach

| Bid Activity

| N/A

| N/A

| Increase

|

| Private Equity

| $9,392,407

| Market Approach

| EBITDA Multiple

| 6.7x - 9.6x

| 8.2x

| Increase

|

|

| $15,742,622

|

|

|

|

|

|

Amounts listed as

“–” are $0 or round to $0.

The value of Oya Solar CDG

LLC credit investment is not expected to be repaid in full at maturity, but rather repaid from available proceeds following the completion of the sale of the overall Oya business. The valuation is based on an estimate

of the fair value of the collateral pool of assets and equipment backed by active bids for the acquisition of the whole company as part of the current sale process.

b. Restricted

Securities:

Restricted securities are privately-placed

securities whose resale is restricted under U.S. securities laws. The Fund may invest in restricted securities, including unregistered securities eligible for resale without registration pursuant to Rule 144A and

privately-placed securities of U.S. and non-U.S. issuers offered outside the U.S. without registration pursuant to Regulation S under the Securities Act of 1933, as amended. Rule 144A securities may be freely traded

among certain qualified institutional investors, such as the Fund, but resale of such securities in the U.S. is permitted only in limited circumstances.

c. Foreign Currency

Translation:

Foreign securities,

currencies, and other assets and liabilities denominated in foreign currencies are translated into U.S. Dollars at the exchange rate of said currencies against the U.S. Dollar, as of the Valuation Time, as provided by

an independent pricing service approved by the Board.

Foreign currency amounts are

translated into U.S. Dollars on the following basis:

(i) market value of investment

securities, other assets and liabilities – at the current daily rates of exchange at the Valuation Time; and

(ii) purchases and sales of

investment securities, income and expenses – at the relevant rates of exchange prevailing on the respective dates of such transactions.

The Fund does not isolate

that portion of gains and losses on investments in equity securities due to changes in the foreign exchange rates from the portion due to changes in market prices of equity securities. Accordingly, realized and

unrealized foreign currency gains and losses with respect to such securities are included in the reported net realized and unrealized gains and losses on investment transactions balances.

Net unrealized currency gains or losses from

valuing foreign currency denominated assets and liabilities at period end exchange rates are reflected as a component of net unrealized appreciation/depreciation in value of investments, and translation of other

assets and liabilities denominated in foreign currencies.

Net realized foreign exchange

gains or losses represent foreign exchange gains and losses from transactions in foreign currencies and forward foreign currency contracts, exchange gains or losses realized between the trade date and settlement date

on security transactions, and the difference between the amounts of interest and dividends recorded on the Fund’s books and the U.S. Dollar equivalent of the amounts actually received.

Foreign security and currency

transactions may involve certain considerations and risks not typically associated with those of domestic origin, including unanticipated movements in the value of the foreign currency relative to the U.S. Dollar.

Generally, when the U.S. Dollar rises in value against foreign currency, the Fund's investments denominated in that foreign currency will lose value because the foreign currency is worth fewer U.S. Dollars; the

opposite effect occurs if the U.S. Dollar falls in relative value.

d. Rights Issues and

Warrants:

Rights issues give the

right, normally to existing shareholders, to buy a proportional number of additional securities at a given price (generally at a discount) within a fixed period (generally a short-term period) and are offered at the

company’s discretion. Warrants are securities that give the holder the right to buy common stock at a specified price for a specified period of time. Public Rights issues and warrants are speculative and

have no value if they are not exercised before the expiration date. Rights issues and warrants are valued at the last sale price on the exchange on which they are traded.

| 16

| abrdn Global Infrastructure Income Fund

|

Notes to Consolidated Financial

Statements (unaudited) (continued)

March 31, 2024

e. Security Transactions, Investment Income

and Expenses:

Security transactions are

recorded on the trade date. Realized and unrealized gains/(losses) from security and currency transactions are calculated on the identified cost basis. Dividend income and corporate actions are recorded generally on

the ex-date, except for certain dividends and corporate actions which may be recorded after the ex-date, as soon as the Fund acquires information regarding such dividends or corporate actions. Interest income and

expenses are recorded on an accrual basis.

f. Distributions:

The Fund records dividends

and distributions payable to its shareholders on the ex-dividend date. The amount of dividends and distributions from net investment income and net realized capital gains are determined in accordance with

federal income tax regulations, which may differ from GAAP. These book basis/tax basis differences are either considered temporary or permanent in nature. To the extent these differences are permanent in nature, such

amounts are reclassified within the capital accounts based on their federal tax basis treatment; temporary differences do not require reclassification. Dividends and distributions which exceed net investment income

and net realized capital gains for tax purposes are reported as return of capital.

g. Federal Income Taxes:

The Fund intends to

continue to qualify as a “regulated investment company” ("RIC") by complying with the provisions available to certain investment companies, as defined in Subchapter M of the Internal Revenue Code of 1986,

as amended, and to make distributions of net investment income and net realized capital gains sufficient to relieve the Fund from all federal income taxes. Therefore, no federal income tax provision is required.

For tax purposes, the

Subsidiary is not a RIC and is a separate taxable entity not consolidated for tax purposes. As such, it is taxed at normal corporate tax rates based on taxable income and, as a result of its activities, may generate

an income tax provision or benefit. The taxable income or loss of the Subsidiary may differ from its book income or loss due to temporary book and tax timing differences and permanent differences. This income tax

provision, or benefit, if any, and the related tax assets and liabilities are reflected in the consolidated financial statements.

The Fund recognizes the tax

benefits of uncertain tax positions only where the position is “more likely than not” to be sustained assuming examination by tax authorities. Management of the Fund has concluded that there are no

significant uncertain tax positions that would require recognition in the financial statements. Since tax authorities can examine previously filed tax returns, the Fund's U.S. federal and state tax returns for each of

the most recent four fiscal

years up to the most recent fiscal year ended

September 30, 2023 will be subject to such review when available.

Deferred tax assets and

liabilities are recorded for losses or income at the Subsidiary using statutory tax rates. A valuation allowance is provided against deferred tax assets when it is more likely than not that some portion or all of the

deferred tax asset will not be realized.

h. Foreign Withholding

Tax:

Dividend and interest

income from non-U.S. sources received by the Fund are generally subject to non-U.S. withholding taxes and are recorded on the Statement of Operations. The Fund files for tax reclaims for the refund of such

withholding taxes according to tax treaties. Tax reclaims that are deemed collectible are booked as tax reclaim receivable on the Statement of Assets and Liabilities. In addition, the Fund may be subject to

capital gains tax in certain countries in which it invests. The above taxes may be reduced or eliminated under the terms of applicable U.S. income tax treaties with some of these countries. The Fund accrues such taxes

when the related income is earned.

In addition, when the Fund

sells securities within certain countries in which it invests, the capital gains realized may be subject to tax. Based on these market requirements and as required under GAAP, the Fund accrues deferred capital gains

tax on securities currently held that have unrealized appreciation within these countries. The amount of deferred capital gains tax accrued is reported on the Statement of Operations as part of the Net Change in

Unrealized Appreciation/Depreciation on investments.

i. Payment-In-Kind:

The Fund may invest in

securities that pay-in-kind (PIK) the interest due on such debt instruments. The PIK interest, computed at the contractual rate specified, is added to the existing principal balance of the debt when issued bonds have

same terms as the bond or recorded as a separate bond when terms are different from the existing debt, and is recorded as interest income. PIK interest income is reflected as non-cash income on the Statement of

Operations.

3. Agreements and Transactions

with Affiliates

a. Investment Adviser and

Sub-Adviser:

abrdn Inc. and abrdn

Investments Limited serve as the Fund’s Investment Adviser and Sub-Adviser, respectively, pursuant to an investment advisory agreement (the “Advisory Agreement”) and sub-advisory agreement (the

“Sub-Advisory Agreement”) with the Fund. abrdn Inc. and abrdn Investments Limited are wholly-owned indirect subsidiaries of abrdn plc. In rendering advisory services, the Investment Adviser and Sub-Adviser

(together, the "Advisers") may use the resources of investment advisor subsidiaries of abrdn plc. These affiliates have entered into procedures pursuant to which investment

| abrdn Global Infrastructure Income Fund

| 17

|

Notes to Consolidated Financial

Statements (unaudited) (continued)

March 31, 2024

professionals from affiliates may render

portfolio management and research services as associated persons of the Advisers.

As compensation for its

services to the Fund, abrdn Inc. receives an annual investment advisory fee of 1.35% based on the Fund’s average daily Managed Assets, computed daily and payable monthly. “Managed Assets” is defined

as total assets of the Fund, including assets attributable to any form of leverage, minus liabilities (other than debt representing leverage and the aggregate liquidation preference of any preferred stock that may be

outstanding). Under the Sub-Advisory Agreement, abrdn Inc. is responsible for the payment of fees to abrdn Investments Limited. For the six-month period ended March 31, 2024, the Investment Advisor earned $3,393,337

for advisory services.

Effective upon the close of

the Reorganization, the Investment Adviser entered into a written contract with the Fund to limit the total ordinary operating expenses of the Fund (excluding leverage costs, interest, taxes, brokerage commissions,

acquired fund fees and expenses and any non-routine expenses) from exceeding 1.65% of the average daily net assets of the Fund on an annualized basis for twelve months (the "Expense Limitation Agreement"). The Expense

Limitation Agreement may not be terminated before March 10, 2024, without the approval of the Fund's trustees who are not “interested persons” of the Fund (as defined in the 1940 Act). The Adviser

continued to waive expenses voluntarily through the end of the March 31, 2024 reporting period.

During the six-month period

ended March 31, 2024, the Investment Adviser waived $123,691 pursuant to the Expense Limitation Agreement.

The Fund may reimburse the

Investment Adviser for the advisory fees waived or reduced and other payments remitted by the Investment Adviser and other expenses reimbursed as of a date not more than three years after the date when the Investment

Adviser limited the fees or reimbursed the expenses; provided that the following requirements are met: the reimbursements do not cause the Fund to exceed the lesser of the applicable expense limitation in the contract

at the time the fees were limited or expenses are paid or the applicable expense limitation in effect at the time the expenses are being recouped by the Investment Adviser, and the payment of such reimbursement is

approved by the Board on a quarterly basis (the "Reimbursement Requirements").

b. Fund Administration:

abrdn Inc. is the

Fund’s Administrator, pursuant to an agreement under which abrdn Inc. receives a fee paid by the Fund, at an annual fee rate of 0.08% of the Fund’s average daily net assets. Upon the close of the