Form 6-K - Report of foreign issuer [Rules 13a-16 and 15d-16]

22 Mayo 2024 - 8:08AM

Edgar (US Regulatory)

FORM

6-K

U.S. SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

REPORT OF

FOREIGN PRIVATE ISSUER

PURSUANT TO RULE 13a-16 OR 15d-16 OF THE

SECURITIES EXCHANGE ACT OF 1934

dated May

22, 2024

Commission

File Number 1-15148

BRF

S.A.

(Exact Name as Specified in its Charter)

N/A

(Translation of Registrant’s

Name)

14401 AV. DAS NACOES UNIDAS 22ND FLOOR

CHAC SANTO ANTONIO 04730 090-São Paulo – SP, Brazil

(Address of principal executive

offices) (Zip code)

Indicate by

check mark whether the registrant files or will file annual reports under cover Form 20-F or Form 40-F.

Form

20-F x

Form 40-F o

Indicate by

check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T

Rule 101(b)(1):

Indicate by

check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T

Rule 101(b)(7):

Indicate by

check mark whether by furnishing the information contained in this Form, the registrant is also thereby furnishing the information

to the Commission pursuant to Rule 12g3-2(b) under the Securities Exchange Act of 1934.

Yes o

No x

If “Yes”

is marked, indicate below the file number assigned to the registrant in connection with Rule 12g3-2(b): Not applicable.

*

* *

This material

includes certain forward-looking statements that are based principally on current expectations and on projections of future events

and financial trends that currently affect or might affect the Company’s business, and are not guarantees of future performance.

These forward-looking statements are based on management’s expectations, which involve a number of known and unknown risks,

uncertainties, assumptions and other important factors, many of which are beyond the Company’s control and any of which could

cause actual financial condition and results of operations to differ materially fom those set out in the Company’s forward-looking

statements. You are cautioned not to put undue reliance on such forward-looking statements. The Company undertakes

no obligation, and expressly disclaims any obligation, to update or revise any forward-looking statements. The risks and

uncertainties relating to the forward-looking statements in this Report on Form 6-K, including Exhibit 1 hereto, include those

described under the captions “Forward-Looking Statements” and “Item 3. Key Information — D. Risk Factors”

in the Company’s annual report on Form 20-F for the year ended December 31, 2012.

SIGNATURES

Pursuant

to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this Report to be signed on its behalf

by the undersigned, thereunto duly authorized.

| Date: May 22, 2024 |

|

| |

|

| |

BRF S.A. |

| |

|

| |

|

| |

By: |

/s/ Fabio Luis Mendes Mariano |

| |

|

Name: |

Fabio Luis Mendes Mariano |

| |

|

Title: |

Chief Financial and Investor Relations Officer

|

EXHIBIT INDEX

BRF S.A.

Publicly Held Company

CNPJ 01.838.723/0001-27

NIRE 42.300.034.240

CVM 16269-2

ANNOUNCEMENT OF RELATED

PARTY TRANSACTION

BRF S.A. (“BRF” or “Company”)

(B3: BRFS3; NYSE: BRFS), in accordance with item XXXII of article 33 of CVM Resolution no. 80/2022, informs its shareholders and the market

in general of the following related party transaction:

|

Related Party Names

|

BRF S.A. and Saudi Agricultural and Livestock Investment Company (“SALIC”). |

| Relationship with the Company |

SALIC is the owner of shares representing 11.03% of the total share capital of BRF. |

| Transaction Date |

May 21, 2024 |

| Purpose and main terms and conditions of the transaction |

The Company and SALIC have entered into a strategic product supply agreement ("Agreement") on this date. The Agreement allows SALIC to acquire up to 200,000 tons of products per year whenever there is a state of food emergency in the Kingdom of Saudi Arabia. The price to be paid will be determined according to market prices offered by the Company to key clients at the time of SALIC's product acquisition. The Company's obligation to sell products to SALIC is conditional, among other factors, on the existence of plants authorized for export to Saudi Arabia, in a manner that does not impair the supply of the Company's products to other clients in that country. |

| Company's management reasoning on the transaction |

The Company's management considers the agreement to be equitable because (i) the price to SALIC will be equivalent to an average of market prices charged by the Company to other clients and (ii) the supply obligation will only exist if the Company has plants authorized for export to the Kingdom of Saudi Arabia with sufficient volume to also meet the needs of its other clients in that country. |

| Any participation by the counterparty, its shareholders, or managers in the Company's decision-making process regarding the transaction or in negotiating the transaction as representatives of the Company, describing such participation |

There was no participation by SALIC or its managers in BRF's decision-making process regarding the execution of the contract. |

São Paulo, May 22, 2024

Fabio Luis Mendes Mariano

Chief Financial and Investor Relations Officer

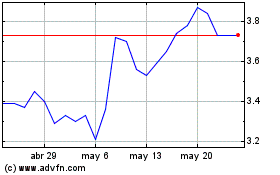

BRF (NYSE:BRFS)

Gráfica de Acción Histórica

De Oct 2024 a Nov 2024

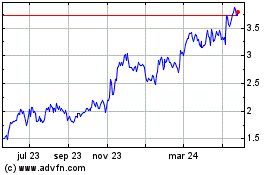

BRF (NYSE:BRFS)

Gráfica de Acción Histórica

De Nov 2023 a Nov 2024