Berkshire's Stock Gets Caught in the Kraft Heinz Swoon

22 Febrero 2019 - 5:13PM

Noticias Dow Jones

By Nicole Friedman

Shares in Berkshire Hathaway Inc. fell nearly 2% Friday, ahead

of the company's fourth-quarter earnings report Saturday morning,

dragged down by the disclosure of a multibillion-dollar write-down

at Kraft Heinz Co.

Warren Buffett's company owns more than a quarter of Kraft

Heinz, which means the write-down will likely affect Berkshire's

profits directly. Barclays, for instance, on Friday slashed its

quarterly operating-earnings forecast for Berkshire to $1,726 from

$3,522 per A share.

The ties between Berkshire and Kraft Heinz go back several

years, and Mr. Buffett has defended the packaged-food company's

strategy in the face of criticism. The write-down, which led

Kraft's stock to tumble 27.5% Friday, represents a rare black eye

for the legendary investor.

Berkshire didn't respond to a request for comment.

Berkshire first teamed up with Brazilian private-equity firm 3G

Capital to buy H.J. Heinz Co. in 2013. The two companies partnered

again to finance Heinz's 2015 merger with Kraft Foods Group

Inc.

Kraft Heinz made a $143 billion offer to buy Unilever PLC in

early 2017, which would have been financed with $15 billion each

from Berkshire and 3G, Mr. Buffett has said, but the approach was

rebuffed. Mr. Buffett has long declined to make hostile bids.

Berkshire valued its 26.7% investment in Kraft Heinz stock at

$17.6 billion at the end of 2017, up from $15.3 billion a year

earlier.

Kraft Heinz contributed $2.9 billion to Berkshire's net earnings

in 2017. Mr. Buffett praised Kraft Heinz at his company's annual

meeting in May.

Mr. Buffett retired from Kraft Heinz's board last year as he

decreased his travel commitments.

Two Berkshire employees remain on Kraft Heinz's board: Greg

Abel, vice chairman for noninsurance business operations and one of

two candidates to succeed Mr. Buffett as chief executive, and Tracy

Britt Cool, CEO of Berkshire subsidiary Pampered Chef and Mr.

Buffett's former financial assistant.

Mr. Buffett has long faced criticism for his association with

3G, which employs aggressive cost-cutting strategies that some

Berkshire shareholders find distasteful. Unlike 3G, Berkshire is

known for letting its companies set their own strategies and rarely

doing big layoffs.

Mr. Buffett has argued that Berkshire buys companies that

already run efficiently, while 3G pursues strategy changes at

inefficient businesses.

"The people at 3G are great, great managers," Mr. Buffett said

at Berkshire's 2018 annual meeting. "We are their partners and

delighted to be their partners."

Write to Nicole Friedman at nicole.friedman@wsj.com

(END) Dow Jones Newswires

February 22, 2019 17:58 ET (22:58 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

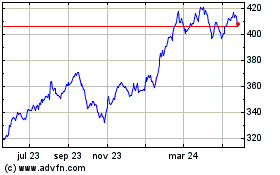

Berkshire Hathaway (NYSE:BRK.B)

Gráfica de Acción Histórica

De Jun 2024 a Jul 2024

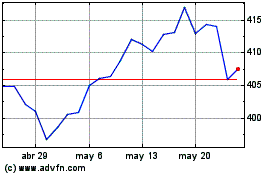

Berkshire Hathaway (NYSE:BRK.B)

Gráfica de Acción Histórica

De Jul 2023 a Jul 2024