Kraft Heinz Was a Classic Bet for Warren Buffet. Then It Soured.

24 Febrero 2019 - 12:38PM

Noticias Dow Jones

By Nicole Friedman

Kraft Heinz Co. was a classic Warren Buffett bet in many ways:

an easy-to-understand company stocked with iconic American

brands.

"This is my kind of transaction," the Omaha, Neb., billionaire

said during the 2015 merger of H.J. Heinz Co. and Kraft Foods Group

Inc., "uniting two world class organizations and delivering

shareholder value."

The abrupt decline of that value demonstrates that even Mr.

Buffett's long-successful investment philosophy is vulnerable to

sudden shifts in consumer taste.

Mr. Buffett's Berkshire Hathaway Inc. said Saturday it swung to

a $25.4 billion loss in the fourth quarter due to an unexpected

write-down last week at Kraft Heinz Co. and unrealized investment

losses. Berkshire owns 27% of Kraft Heinz.

Kraft Heinz's $15.4 billion write-down was an acknowledgment

that the Kraft and Oscar Meyer brands haven't performed as well as

expected. Consumer tastes are shifting toward healthier or

more-natural ingredients and away from processed foods.

Berkshire's fourth-quarter loss dragged down the conglomerate's

net earnings to $4 billion in 2018 from $44.9 billion the prior

year. Berkshire's operating earnings, which exclude impairments and

unrealized investment results, rose to a record $24.8 billion in

2018, up from $14.5 billion the prior year.

Mr. Buffett has long bet that strong consumer brands will help

companies maintain market share and pricing power. Some of his

biggest equity holdings, including Apple Inc. and Coca-Cola Co.,

are household names. Berkshire also owns a number of classic

American companies, including Dairy Queen, Geico, Duracell and

Fruit of the Loom.

"Kraft represented the classic Berkshire company...where you buy

the solid brands that have repeated and dependable cash flow, and

all is great," said Cathy Seifert, equity analyst at CFRA Research.

"It's valid to question what's the go-forward strategy."

Mr. Buffett didn't discuss Kraft Heinz in his annual letter to

shareholders released Saturday, but he acknowledged the challenges

facing the packaged-food business on CNBC in August.

"It's very hard to offer a significant premium for a

packaged-goods company and have it make financial sense," Mr.

Buffett said. "Branded packaged goods are a very, very, very good

business in terms of return on tangible assets. But they're not a

sensational business in terms of where you could be five or 10

years from now."

Mr. Buffett's big bet on the snack business started in 2013,

when Berkshire teamed up with Brazilian private-equity firm 3G

Capital to buy Heinz. Berkshire and 3G helped finance the merger

between Kraft and Heinz in 2015.

As Berkshire has grown, Mr. Buffett has come under increasing

pressure to spend its massive cash pile on acquisitions and

investments. Berkshire hasn't done a major deal in three years, and

Mr. Buffett has struggled to find reasonably priced large companies

to buy.

Berkshire's cash, which is mostly invested in Treasury bills,

grew to almost $112 billion at year-end, marking the sixth straight

quarter above $100 billion.

Mr. Buffett offered no specific guidance in his annual letter on

how he may use his growing pile of cash. He expects to move "much

of our excess liquidity into businesses that Berkshire will

permanently own" but prices are still too high, he wrote. "We

continue, nevertheless, to hope for an elephant-sized

acquisition."

Berkshire repurchased a bit over $400 million of its stock in

the fourth quarter, down from $928 million in buybacks in the third

quarter. Investors were hoping Berkshire would spend a significant

chunk of its cash buying back shares.

Some shareholders have questioned whether Berkshire will buy

more of Kraft Heinz now or acquire the entire thing. Berkshire

could also help finance future acquisitions by Kraft Heinz.

Berkshire valued its Kraft Heinz stake at $13.8 billion in 2018,

down from $17.6 billion the prior year. Berkshire's cost basis for

the investment was $9.8 billion.

Two Berkshire employees sit on Kraft Heinz's board: Greg Abel,

vice chairman for noninsurance business operations and one of two

candidates to succeed Mr. Buffett as chief executive, and Tracy

Britt Cool, CEO of Berkshire subsidiary Pampered Chef and Mr.

Buffett's former financial assistant. Mr. Buffett retired from the

Kraft Heinz board in April as he cut back on travel

commitments.

"I wouldn't want Warren Buffett to be allocating more capital

under the umbrella of Kraft Heinz and 3G," said David Rolfe, chief

investment officer of Wedgewood Partners Inc. in St. Louis, which

holds Berkshire shares. "I would much rather see Warren spend tens

of billions buying back his own stock."

Write to Nicole Friedman at nicole.friedman@wsj.com

(END) Dow Jones Newswires

February 24, 2019 13:23 ET (18:23 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

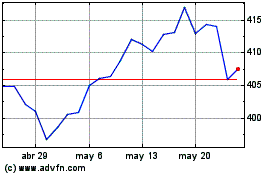

Berkshire Hathaway (NYSE:BRK.B)

Gráfica de Acción Histórica

De Jun 2024 a Jul 2024

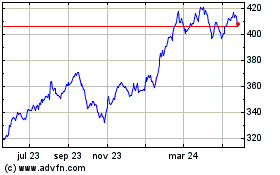

Berkshire Hathaway (NYSE:BRK.B)

Gráfica de Acción Histórica

De Jul 2023 a Jul 2024