Strong Cash Flow Generation

Quarterly Cash Dividend of $0.147 Per

Share

GeoPark Limited (“GeoPark” or the “Company”) (NYSE: GPRK), a

leading independent Latin American oil and gas explorer, operator,

and consolidator, reports its consolidated financial results for

the three-month period ended September 30, 2024 (“Third Quarter” or

“3Q2024”). A conference call to discuss these financial results

will be held on November 7, 2024, at 10:00am (Eastern Standard

Time).

THIRD QUARTER 2024 FINANCIAL SUMMARY

In 3Q2024, GeoPark delivered solid financial performance with

$99.8 million Adjusted EBITDA,1 a margin of 63% and $25.1 million

net profit, amidst a softer price environment and operational

challenges. Net profit was 1.2% higher than 3Q2023, demonstrating

resilient profitability in the context of lower oil prices.

Adjusted EBITDA for the nine-month period ended September 30, 2024

was higher than the same period in 2023, underscoring the strength

and consistency of our financial results year-to-date.

GeoPark invested $45.9 million in capital expenditures in

3Q2024, focused on: i) facilities upgrades and advancing

development and appraisal activities in the Llanos 34 Block

(GeoPark operated, 45% WI) in Colombia, including an ongoing

water-flooding campaign and facility expansions; ii) drilling two

exploration wells in the CPO-5 Block (GeoPark non-operated, 30% WI)

in Colombia; iii) ongoing delineation and exploration in the

Toritos and Bisbita fields in the Llanos 123 Block (GeoPark

operated, 50% WI) in Colombia; iv) exploration and workover

activities in the Espejo (GeoPark operated, 50% WI) and Perico

(GeoPark non-operated, 50% WI) Blocks in Ecuador; and v)

infrastructure development, with the construction of drilling pads

in the Put-8 Block (GeoPark operated, 50% WI) in Colombia.

Underscoring its ongoing commitment to disciplined financial

management, GeoPark concluded 3Q2024 with a growing cash balance

that reached $123.4 million at end-September, while net leverage

remained low at 0.8x. GeoPark’s debt profile remains resilient,

with no principal maturities scheduled until January 2027.

Each dollar invested in capital expenditures yielded $2.2 in

Adjusted EBITDA, and the return on average capital employed (ROACE)

reached 34%. These financial achievements and discipline allowed

GeoPark to reward its shareholders once again with a quarterly

dividend of $7.5 million ($0.147 per share), representing an

annualized dividend of $30 million and a yield of approximately

7%.

Quarterly average oil and gas production in 3Q2024 was 33,215

boepd,2 down 4% compared to 3Q2023 mainly due to the divestment of

the Chilean business in 1Q2024, suspended operations at the Manati

gas field in Brazil (GeoPark non-operated, 10% WI), production in

the Llanos 34 Block not offsetting the natural base decline, and

continued blockades affecting operations in the Llanos 34 and CPO-5

Blocks. These factors were previously identified as risks, and

their realization has impacted production within the anticipated

1,500-2,500 boepd average range for the year.

GeoPark’s acquisition of four unconventional hydrocarbon blocks

in Vaca Muerta, Argentina became effective on July 1, 2024, with

the transaction expected to close (pending regulatory approvals) by

the end of 2024.3 During 3Q2024, the development wells in the Mata

Mora Norte Block (GeoPark non-operated, 45% WI) achieved a gross

average production of 12,621 boepd, demonstrating the high

productivity of these assets. The operator is now initiating

production from three exploration wells in the Confluencia Norte

Block (GeoPark non-operated, 50% WI), aimed at unlocking and

de-risking the substantial growth potential of this block. The

Group’s Argentine subsidiary, GeoPark Argentina, S.A., has secured

crucial capital markets approvals, including bank credit lines, an

AA+(arg) credit rating from Fitch Ratings’ local Argentine

affiliate FIX, and authorization from Argentina’s securities

regulator (Comisión Nacional de Valores or “CNV”) to issue up to

$500 million in debt securities over the next five years, providing

strategic financial flexibility to support the future development

of these assets.

Looking ahead, GeoPark plans to release its 2025 Work Program

and Investment Guidelines before year-end. This upcoming framework

will outline GeoPark’s strategic initiatives and capital allocation

priorities, setting the stage for sustainable growth and enhanced

value creation across its asset portfolio.

Andrés Ocampo, Chief Executive Officer of GeoPark, said: “In the

third quarter, we continued to build on our strengths, generating

robust cash flow and efficiently advancing our strategic

initiatives with a disciplined $45.9 million investment in capital

expenditures. This investment focused on key development,

appraisal, and exploration activities across our core assets in

Colombia and Ecuador. Our expansion into Vaca Muerta also took an

important step forward with a recent field trip, where alongside

our partner, Phoenix Global Resources, we hosted a group of fixed

income and equity investors. This visit provided an invaluable

opportunity to showcase our growth strategy first hand and

highlight the scalable, efficient growth potential of our

unconventional assets in Vaca Muerta. We remain committed to

disciplined capital allocation and maximizing shareholder value as

we unlock further potential in our core assets and prepare for

sustained, long-term growth in Argentina.”

Supplementary information is available at the following link:

https://ir.geo-park.com/3Q24-SupplementaryRelease

THIRD QUARTER 2024 HIGHLIGHTS

Oil and Gas Production and Operations

- 3Q2024 consolidated average oil and gas production of 33,215

boepd4

- Production decreased 7% in Colombia compared to 2Q2024, due to

continued blockades affecting operations in the Llanos 34 and the

CPO-5 Blocks, and suspended production at the Manati gas field

- Production in the Mata Mora Norte Block in Vaca Muerta averaged

12,621 boepd gross in 3Q2024, peaking at a record of 15,418 boepd

gross during August 2024

- 9 rigs in operation at the end of 3Q2024 (5 drilling rigs and 4

workover rigs), including one drilling rig in Argentina

Revenue, Adjusted EBITDA and Net Profit

- Revenue of $159.5 million, a decrease of 16% from 2Q2024,

reflecting lower realized oil prices and lower deliveries

- Adjusted EBITDA of $99.8 million (63% Adjusted EBITDA

margin)

- Operating profit of $54.7 million (34% operating profit

margin)

- Net profit of $25.1 million

Cost and Capital Efficiency

- Capital expenditures of $45.9 million

- 3Q2024 Adjusted EBITDA to capital expenditures ratio of

2.2x

- ROACE of 34%5

Balance Sheet Reflects Financial Quality

- Cash in hand of $123.4 million, reflecting strong cash-flow

generation

- Net leverage remained healthy (0.8x), with no principal debt

maturities until January 2027

- Current cash position of $140 million (October 31, 2024)

Commitment to Shareholder Return

- Quarterly cash dividend of $0.147 per share payable on December

6, 2024, to shareholders of record at the close of business on

November 21, 2024

- GeoPark expects to return more than $73 million to shareholders

in full-year 2024 through dividends and buybacks, a potential 18%

capital return yield,6 significantly exceeding 2023 payout

_________________________

1 For reconciliations, see “Reconciliation

of Adjusted EBITDA to Profit Before Income Tax” table below.

2 Reported in the 3Q2024 Operational

Update and not including production from Vaca Muerta.

3 The Vaca Muerta acquisition is not yet

consolidated in our Financial Statements.

4 Not including production from Vaca

Muerta.

5 ROACE is defined as last twelve-month

operating profit divided by average total assets minus current

liabilities.

6 Based on GeoPark’s market capitalization

as of October 31, 2024.

CONSOLIDATED OPERATING PERFORMANCE

Key performance indicators:

Key Indicators

3Q2024

2Q2024

3Q2023

9M2024

9M2023

Oil productiona (bopd)

33,091

35,504

32,510

34,279

33,323

Gas production (mcfpd)

747

623

13,610

2,884

15,898

Average net production (boepd)

33,215

35,608

34,778

34,760

35,973

Brent oil price ($ per bbl)

78.5

85.0

86.0

81.8

82.2

Combined realized price ($ per boe)

65.1

72.0

68.3

67.5

62.9

⁻ Oil ($ per bbl)

67.7

74.9

74.6

70.8

68.4

⁻ Gas ($ per mcf)

6.8

8.9

4.4

5.8

4.7

Sale of crude oil ($ million)

157.5

187.2

185.4

506.9

534.3

Sale of purchased crude oil ($

million)

1.5

2.4

2.2

5.7

4.1

Sale of gas ($ million)

0.5

0.6

5.3

4.6

19.1

Commodity risk management contracts ($

million)

—

—

(0.7

)

(0.1

)

(0.7

)

Revenue ($ million)

159.5

190.2

192.1

517.1

556.9

Production & operating costsb ($

million)

(39.8

)

(41.4

)

(58.2

)

(119.8

)

(171.4

)

G&G, G&Ac ($ million)

(15.7

)

(16.0

)

(14.1

)

(44.4

)

(39.9

)

Selling expenses ($ million)

(3.5

)

(4.4

)

(3.8

)

(12.1

)

(8.3

)

Operating profit ($ million)

54.7

90.3

80.5

229.0

226.6

Adjusted EBITDA ($ million)

99.8

127.9

115.2

339.2

334.0

Adjusted EBITDA ($ per boe)

40.7

48.4

41.0

44.3

37.7

Net profit ($ million)

25.1

25.7

24.8

81.0

84.8

Capital expenditures ($ million)

45.9

49.2

44.1

143.9

132.4

Cash and cash equivalents ($ million)

123.4

66.0

106.3

123.4

106.3

Short-term financial debt ($ million)

5.7

12.5

5.7

5.7

5.7

Long-term financial debt ($ million)

491.1

490.2

487.6

491.1

487.6

Net debt ($ million)

373.3

436.7

387.0

373.3

387.0

Dividends paid ($ per share)

0.147

0.147

0.132

0.430

0.392

Shares repurchased (million shares)

—

4.369

0.500

4.369

2.224

Basic shares – at period end (million

shares)

51,193

51,163

56,118

51,193

56,118

Weighted average basic shares (million

shares)

51,178

52,246

56,513

52,911

57,155

_________________________

a)

Includes royalties and other economic

rights paid in kind in Colombia for approximately 6,073 bopd, 6,956

bopd, and 5,045 bopd in 3Q2024, 2Q2024 and 3Q2023, respectively. No

royalties were paid in kind in other countries. Production in

Ecuador is reported before the Government’s production share.

b)

Production and operating costs include

operating costs, royalties and economic rights paid in cash,

share-based payments and purchased crude oil.

c)

G&A and G&G expenses include

non-cash, share-based payments for $1.4 million, $1.3 million, and

$1.7 million in 3Q2024, 2Q2024 and 3Q2023, respectively. These

expenses are excluded from the Adjusted EBITDA calculation.

All figures are expressed in US Dollars and growth comparisons

refer to the same period of the prior year, except when otherwise

specified. Definitions and terms used herein are provided in the

Glossary at the end of this document. This press release and its

supplementary information do not contain all the Company’s

financial information and the Company’s consolidated financial

statements and corresponding notes for the period are available on

the Company’s website.

RECONCILIATION OF ADJUSTED EBITDA TO PROFIT BEFORE INCOME

TAX

9M2024 (In millions of $)

Colombia

Ecuador

Brazil

Chile

Other(a)

Total

Adjusted EBITDA

338.6

11.7

(2.4

)

(0.1

)

(8.5

)

339.2

Depreciation

(89.3

)

(5.6

)

(1.1

)

—

(0.0

)

(96.0

)

Write-off of unsuccessful exploration

efforts

(6.9

)

(7.7

)

—

—

—

(14.6

)

Share based payment

(1.0

)

(0.0

)

(0.0

)

—

(3.8

)

(4.8

)

Lease Accounting - IFRS 16

4.9

0.0

0.7

—

—

5.6

Others

0.8

0.1

(1.1

)

0.0

(0.2

)

(0.3

)

OPERATING PROFIT (LOSS)

247.1

(1.6

)

(3.9

)

(0.1

)

(12.5

)

229.0

Financial costs, net

(27.0

)

Foreign exchange charges, net

7.2

PROFIT BEFORE INCOME TAX

209.2

9M2023 (In millions of $)

Colombia

Ecuador

Brazil

Chile

Other(a)

Total

Adjusted EBITDA

331.2

2.2

4.5

3.6

(7.4

)

334.0

Depreciation

(71.7

)

(5.1

)

(1.7

)

(7.8

)

(0.0

)

(86.4

)

Write-off of unsuccessful exploration

efforts

(21.5

)

—

—

—

—

(21.5

)

Share based payment

(0.9

)

(0.0

)

(0.0

)

(0.1

)

(4.3

)

(5.3

)

Lease Accounting - IFRS 16

6.1

0.0

0.7

0.7

—

7.6

Others

2.2

(0.5

)

(0.2

)

(2.2

)

(1.1

)

(1.9

)

OPERATING PROFIT (LOSS)

245.4

(3.4

)

3.3

(5.9

)

(12.8

)

226.6

Financial costs, net

(29.9

)

Foreign exchange charges, net

(16.9

)

PROFIT BEFORE INCOME TAX

179.7

_________________________

a)

Includes Argentina and Corporate.

CONFERENCE CALL INFORMATION

GeoPark management will host a conference call on Thursday,

November 7, 2024, at 10:00 am (Eastern Standard Time) to discuss

the 3Q2024 financial results.

To listen to the call, participants can access the webcast

located in the Invest with Us section of the Company’s website at

www.geo-park.com, or by clicking below:

https://events.q4inc.com/attendee/332625400

Interested parties may participate in the

conference call by dialing the numbers provided below:

United States Participants: +1 404-975-4839

Global Dial-In Numbers:

https://www.netroadshow.com/conferencing/global-numbers?confId=68476

Passcode: 027838

Please allow extra time prior to the call to visit the website

and download any streaming media software that might be required to

listen to the webcast.

An archive of the webcast replay will be made available in the

Invest with Us section of the Company’s website at www.geo-park.com

after the conclusion of the live call.

GLOSSARY

2027 Notes

5.500% Senior Notes due 2027

Adjusted EBITDA

Adjusted EBITDA is defined as profit for

the period before net finance costs, income tax, depreciation,

amortization, the effect of IFRS 16, certain non-cash items such as

impairments and write-offs of unsuccessful efforts, accrual of

share-based payments, unrealized results on commodity risk

management contracts and other non-recurring events

Adjusted EBITDA per boe

Adjusted EBITDA divided by total boe

deliveries

Operating Netback per boe

Revenue, less production and operating

costs (net of depreciation charges and accrual of stock options and

stock awards, the effect of IFRS 16), selling expenses, and

realized results on commodity risk management contracts, divided by

total boe deliveries. Operating Netback is equivalent to Adjusted

EBITDA net of cash expenses included in Administrative, Geological

and Geophysical and Other operating costs

Bbl

Barrel

Boe

Barrels of oil equivalent

Boepd

Barrels of oil equivalent per day

Bopd

Barrels of oil per day

G&A

Administrative Expenses

G&G

Geological & Geophysical Expenses

Mcfpd

Thousand cubic feet per day

Net Debt

Current and non-current borrowings less

cash and cash equivalents

WI

Working interest

NOTICE

Additional information about GeoPark can be found in the Invest

with Us section of the website at www.geo-park.com.

Rounding amounts and percentages: Certain amounts and

percentages included in this press release and its supplementary

information have been rounded for ease of presentation. Percentage

figures included in this press release and its supplementary

information have not in all cases been calculated on the basis of

such rounded figures, but on the basis of such amounts prior to

rounding. In addition, certain other amounts that appear in this

press release and its supplementary information may not sum due to

rounding.

This press release and its supplementary information contain

certain oil and gas metrics, including information per share,

operating netback, reserve life index and others, which do not have

standardized meanings or standard methods of calculation and

therefore such measures may not be comparable to similar measures

used by other companies. Such metrics have been included herein to

provide readers with additional measures to evaluate the Company’s

performance; however, such measures are not reliable indicators of

the future performance of the Company and future performance may

not compare to the performance in previous periods.

CAUTIONARY STATEMENTS RELEVANT TO

FORWARD-LOOKING INFORMATION

This press release and its supplementary information contain

statements that constitute forward-looking statements. Many of the

forward-looking statements contained in this press release can be

identified by the use of forward-looking words such as

‘‘anticipate,’’ ‘‘believe,’’ ‘‘could,’’ ‘‘expect,’’ ‘‘should,’’

‘‘plan,’’ ‘‘intend,’’ ‘‘will,’’ ‘‘estimate’’ and ‘‘potential,’’

among others.

Forward-looking statements that appear in a number of places in

this press release include, but are not limited to, statements

regarding the intent, belief or current expectations, regarding

various matters, including production, timing for closing of the

acquisition transaction, Work Program and Investment Guidelines,

strategic initiatives, growth and capital allocation.

Forward-looking statements are based on management’s beliefs and

assumptions, and on information currently available to the

management. Such statements are subject to risks and uncertainties,

and actual results may differ materially from those expressed or

implied in the forward-looking statements due to various

factors.

Forward-looking statements speak only as of the date they are

made, and the Company does not undertake any obligation to update

them in light of new information or future developments or to

release publicly any revisions to these statements in order to

reflect later events or circumstances, or to reflect the occurrence

of unanticipated events. For a discussion of the risks facing the

Company which could affect whether these forward-looking statements

are realized, see filings with the U.S. Securities and Exchange

Commission (SEC).

Oil and gas production figures included in this press release

and its supplementary information are stated before the effect of

royalties paid in kind, consumption and losses. Annual production

per day is obtained by dividing total production by 365 days.

Non-GAAP Measures: The Company believes Adjusted EBITDA,

free cash flow and operating netback per boe, which are each

non-GAAP measures, are useful because they allow the Company to

more effectively evaluate its operating performance and compare the

results of its operations from period to period without regard to

its financing methods or capital structure. The Company’s

calculation of Adjusted EBITDA, free cash flow, and operating

netback per boe may not be comparable to other similarly titled

measures of other companies.

Adjusted EBITDA: The Company defines Adjusted EBITDA as

profit for the period before net finance costs, income tax,

depreciation, amortization and certain non-cash items such as

impairments and write-offs of unsuccessful exploration and

evaluation assets, accrual of stock options and stock awards,

unrealized results on commodity risk management contracts and other

non-recurring events. Adjusted EBITDA is not a measure of profit or

cash flow as determined by IFRS. The Company excludes the items

listed above from profit for the period in arriving at Adjusted

EBITDA because these amounts can vary substantially from company to

company within our industry depending upon accounting methods and

book values of assets, capital structures and the method by which

the assets were acquired. Adjusted EBITDA should not be considered

as an alternative to, or more meaningful than, profit for the

period or cash flow from operating activities as determined in

accordance with IFRS or as an indicator of our operating

performance or liquidity. Certain items excluded from Adjusted

EBITDA are significant components in understanding and assessing a

company’s financial performance, such as a company’s cost of

capital and tax structure and significant and/or recurring

write-offs, as well as the historic costs of depreciable assets,

none of which are components of Adjusted EBITDA. For a

reconciliation of Adjusted EBITDA to the IFRS financial measure of

profit, see the accompanying financial tables and the supplementary

information.

Operating Netback per boe: Operating netback per boe

should not be considered as an alternative to, or more meaningful

than, profit for the period or cash flow from operating activities

as determined in accordance with IFRS or as an indicator of the

Company’s operating performance or liquidity. Certain items

excluded from operating netback per boe are significant components

in understanding and assessing a company’s financial performance,

such as a company’s cost of capital and tax structure and

significant and/or recurring write-offs, as well as the historic

costs of depreciable assets, none of which are components of

operating netback per boe. The Company’s calculation of operating

netback per boe may not be comparable to other similarly titled

measures of other companies.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20241106277775/en/

INVESTORS: Maria Catalina Escobar Shareholder Value and

Capital Markets Director mescobar@geo-park.com Miguel Bello

Investor Relations Officer mbello@geo-park.com Maria Alejandra

Velez Investor Relations Leader mvelez@geo-park.com MEDIA:

Communications Department communications@geo-park.com

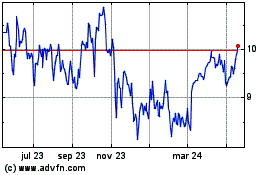

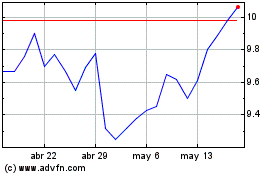

GeoPark (NYSE:GPRK)

Gráfica de Acción Histórica

De Nov 2024 a Dic 2024

GeoPark (NYSE:GPRK)

Gráfica de Acción Histórica

De Dic 2023 a Dic 2024