GeoPark Argentina Obtains AA+(arg) Credit Rating and Approval From Argentine Regulator to Issue up to $500 Million in Debt Securities

22 Octubre 2024 - 6:33AM

Business Wire

GeoPark Limited (“GeoPark” or the “Company”) (NYSE: GPRK), a

leading independent Latin American oil and gas explorer, operator

and consolidator, announces that its wholly owned subsidiary

GeoPark Argentina S.A. (“GeoPark Argentina”) has received approval

from the Argentinian securities regulator (Comisión Nacional de

Valores or “CNV” by its Spanish acronym) to issue up to $500

million in debt securities over the next five years, and has

obtained an “AA+(arg)” credit rating from Fitch Ratings’ local

Argentine affiliate, FIX.

Following the acquisition of four unconventional blocks in Vaca

Muerta earlier this year1, the key factors contributing to the

strong rating assigned to GeoPark Argentina by FIX include its

existing reserves, production and cash flow generation, alongside a

robust production plan in the Mata Mora Norte Block. Additional

competitive advantages include low operational costs, conservative

leverage, and strong backing from GeoPark.

The Mata Mora Norte Block is currently producing more than

12,500 boepd gross and is expected to generate $90-100 million in

Adjusted EBITDA2 for GeoPark in full-year 2024 on a proforma basis.

By 2028-2030, the block is projected to reach plateau production of

around 40,000 boepd gross, contributing approximately $300 million

net per year for GeoPark in Adjusted EBITDA (based on a Brent price

of $70 per barrel). This does not include the exploratory potential

from the Mata Mora Sur, Confluencia Norte and Confluencia Sur

blocks.

To support the expected production growth, GeoPark Argentina

plans to fund its capital expenditures through ongoing cash flow

generation from the Mata Mora Norte Block and debt raised in the

domestic capital market, where attractive rates and terms are

currently available.

As of the date of this release, GeoPark Argentina has also

secured over $100 million in local credit lines in Argentina and no

amount has been drawn on such credit lines.

______________________ 1 The acquisition of the Vaca Muerta

unconventional blocks in Argentina is expected to close in 4Q2024,

pending customary regulatory approvals. 2 The Company is unable to

present a quantitative reconciliation of GeoPark Argentina’s

full-year 2024 Adjusted EBITDA which is a forward-looking non-GAAP

measure, because the Company cannot reliably predict certain of the

necessary components, such as write-off of unsuccessful exploration

efforts or impairment loss on non-financial assets, etc.

NOTICE

Additional information about GeoPark can be found in the “Invest

with Us” section on the website at www.geo-park.com.

Rounding amounts: Certain amounts included in this press release

have been rounded for ease of presentation.

CAUTIONARY STATEMENTS RELEVANT TO FORWARD-LOOKING

INFORMATION

This press release contains statements that constitute

forward-looking statements. Many of the forward-looking statements

contained in this press release can be identified by the use of

forward-looking words such as ‘‘anticipate,’’ ‘‘believe,’’

‘‘could,’’ ‘‘expect,’’ ‘‘should,’’ ‘‘plan,’’ ‘‘intend,’’ ‘‘will,’’

‘‘estimate’’ and ‘‘potential,’’ among others.

Forward-looking statements that appear in a number of places in

this press release include, but are not limited to, statements

regarding the intent, belief or current expectations, regarding

various matters, including, expected production, expected Adjusted

EBITDA, capital expenditures and timing for the closing of the

acquisition. Forward-looking statements are based on management’s

beliefs and assumptions, and on information currently available to

the management. Such statements are subject to risks and

uncertainties, and actual results may differ materially from those

expressed or implied in the forward-looking statements due to

various factors.

Forward-looking statements speak only as of the date they are

made, and the Company does not undertake any obligation to update

them in light of new information or future developments or to

release publicly any revisions to these statements in order to

reflect later events or circumstances, or to reflect the occurrence

of unanticipated events. For a discussion of the risks facing the

Company which could affect whether these forward-looking statements

are realized, see filings with the U.S. Securities and Exchange

Commission (SEC).

Oil and gas production figures included in this release are

stated before the effect of royalties paid in kind, consumption and

losses.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20241021165352/en/

For further information, please contact:

INVESTORS: Maria Catalina Escobar,

mescobar@geo-park.com Shareholder Value and Capital Markets

Director Miguel Bello, mbello@geo-park.com Investor

Relations Officer Maria Alejandra Velez, mvelez@geo-park.com

Investor Relations Leader

MEDIA: Communications Department,

communications@geo-park.com

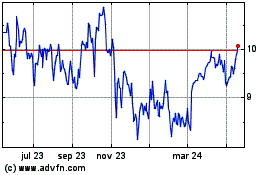

GeoPark (NYSE:GPRK)

Gráfica de Acción Histórica

De Nov 2024 a Dic 2024

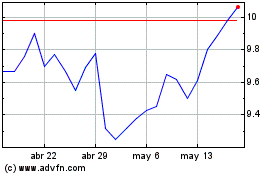

GeoPark (NYSE:GPRK)

Gráfica de Acción Histórica

De Dic 2023 a Dic 2024