Irrigation demand in North America remains

stable while market activity in Brazil declines; infrastructure

results deliver meaningful margin expansion

Lindsay Corporation (NYSE: LNN), a leading global manufacturer

and distributor of irrigation and infrastructure equipment and

technology, today announced results for its second quarter ended on

February 29, 2024.

Key Highlights

- Total revenues decreased 9 percent to $151.5 million on lower

irrigation revenues

- Increased Road Zipper System™ lease revenues support accretive

sales mix shift and improved infrastructure results

- Diluted earnings per share of $1.64 compared to $1.63 in the

prior year quarter

“Demand for irrigation equipment in North America remained

stable during our second quarter and in line with our expectations,

supported by grower investment from the carryover impact of solid

farm profits realized last year," said Randy Wood, President and

Chief Executive Officer. "In Brazil, a significant drop in

commodity prices during the quarter coupled with the anticipated

impact of reduced yields for the current crop has reduced grower

profitability and curtailed near-term capital investment capacity.

In our infrastructure business, we are pleased with the continued

growth of our Road Zipper System™ leasing business, which continues

to represent a greater proportion of our infrastructure segment

revenues with this sales mix accretive to Lindsay's overall margin

profile."

"We continue to invest in our innovation strategy, driving value

creation through our advanced technology platforms. During the

second quarter we successfully launched the next generation of our

industry leading FieldNET™ platform that provides growers with an

intuitive and easy-to-use interface with enhanced capabilities for

precision irrigation management. In January, we announced plans to

invest more than $50 million to expand and modernize our largest

global manufacturing facility located in Lindsay, NE. This includes

implementation of Industry 4.0 technologies, including data

connectivity, analytics, artificial intelligence and additional

automation and robotics. This investment will accelerate our

ability to bring our latest innovations to market, and it aligns

with our capital allocation priorities and commitment to leverage

state-of-the art technology across our global operations."

Second Quarter Summary

Consolidated Financial Summary

Second Quarter

(dollars in millions, except per share

amounts)

FY2024

FY2023

$ Change

% Change

Total revenues

$151.5

$166.2

($14.7)

(9%)

Operating income

$22.1

$27.3

($5.2)

(19%)

Operating margin

14.6%

16.4%

Net earnings

$18.1

$18.1

$0.0

0%

Diluted earnings per share

$1.64

$1.63

$0.01

1%

Revenues for the quarter were $151.5 million, a decrease of

$14.7 million, or 9 percent, compared to revenues of $166.2 million

in the prior year second quarter. The decrease resulted from lower

irrigation segment revenues as infrastructure revenues were

comparable to the prior year second quarter.

Operating income for the quarter was $22.1 million, a decrease

of $5.2 million, or 19 percent, compared to operating income of

$27.3 million in the prior year second quarter. Operating margin

was 14.6 percent of sales, compared to 16.4 percent of sales in the

prior year quarter. The decrease in operating income and operating

margin resulted primarily from lower revenues and the resulting

impact from deleverage of fixed operating expenses as gross margin

was similar to the prior year second quarter.

Net earnings for the quarter were $18.1 million, or $1.64 per

diluted share, compared with net earnings of $18.1 million, or

$1.63 per diluted share, for the prior year second quarter. The

impact of lower operating income was favorably offset by higher

other income and a lower effective tax rate compared to the prior

year second quarter. Other income benefited from increased interest

income and favorable foreign currency translation results compared

to the prior year second quarter. Income tax expense for the

quarter included the realization of a one-time tax benefit of $1.1

million in Brazil.

Second Quarter Segment Results

Irrigation Segment

Second Quarter

(dollars in millions)

FY2024

FY2023

$ Change

% Change

Revenues:

North America

$82.8

$90.4

($7.6)

(8%)

International

$50.2

$57.4

($7.2)

(13%)

Total revenues

$133.0

$147.8

($14.8)

(10%)

Operating income

$25.6

$32.8

($7.2)

(22%)

Operating margin

19.3%

22.2%

Irrigation segment revenues for the quarter were $133.0 million,

a decrease of $14.8 million, or 10 percent, compared to $147.8

million in the prior year second quarter. North America irrigation

revenues of $82.8 million decreased $7.6 million, or 8 percent,

compared to the prior year second quarter. The majority of the

decrease resulted from lower sales of replacement parts, along with

slightly lower average selling prices and the impact of a less

favorable mix of shorter machines compared to the prior year second

quarter. This decrease was partially offset by moderately higher

unit sales volume compared to the prior year second quarter.

International irrigation revenues of $50.2 million decreased

$7.2 million, or 13 percent, compared to the prior year second

quarter. The decrease resulted primarily from lower sales volumes

in Brazil and other Latin America markets compared to the prior

year second quarter while the impact of small increases and

decreases in other markets primarily offset one another. In Brazil,

order activity declined due to a significant drop in local

commodity prices during the quarter which has negatively impacted

the outlook for grower profitability and available liquidity. This

dynamic has also resulted in a more constrained credit environment

which is limiting growers' ability to invest in irrigation

equipment. The decrease in revenues was partially offset by the

favorable effects of foreign currency translation of approximately

$0.9 million compared to the prior year second quarter.

Irrigation segment operating income for the quarter was $25.6

million, a decrease of $7.2 million, or 22 percent, compared to the

prior year second quarter. Operating margin was 19.3 percent of

sales, compared to 22.2 percent of sales in the prior year second

quarter. Lower operating income and operating margin resulted

primarily from lower revenues and the resulting impact from

deleverage of fixed operating expenses.

Infrastructure Segment

Second Quarter

(dollars in millions)

FY2024

FY2023

$ Change

% Change

Total revenues

$18.5

$18.5

$0.0

0%

Operating income

$3.5

$2.0

$1.5

74%

Operating margin

19.0%

10.9%

Infrastructure segment revenues for the quarter of $18.5 million

were comparable to the prior year second quarter. An increase in

Road Zipper System lease revenues was offset by lower Road Zipper

System project sales and lower sales of road safety products

compared to the prior year second quarter.

Infrastructure segment operating income for the quarter was $3.5

million, an increase of $1.5 million, or 74 percent, compared to

the prior year second quarter. Operating margin was 19.0 percent of

sales, compared to 10.9 percent of sales in the prior year second

quarter. Increased operating income and operating margin resulted

from a more favorable margin mix of revenues with higher Road

Zipper System lease revenues compared to the prior year second

quarter.

The backlog of unfilled orders as of February 29, 2024, was

$94.2 million compared with $95.2 million as of February 28, 2023.

Included in these backlogs are amounts of $20.3 million and $5.4

million, respectively, for orders that are not expected to be

fulfilled within the subsequent twelve months.

Outlook

Mr. Wood concluded, “The USDA recently released the initial

projection for 2024 U.S. net farm income which reflects a

substantial decline compared to 2023 levels and was below broader

market expectations. The forecasted decline, if realized, could

negatively affect demand for irrigation equipment during the

remainder of our fiscal 2024. We remain confident in the growth

opportunity in South America end markets and Brazil in particular;

however we expect current market conditions to temper demand for

irrigation equipment at least in the near term."

“In our infrastructure business, we expect continued growth in

our Road Zipper System lease revenues through increased

construction activity supported by growth in U.S. infrastructure

spending. We also continue to execute our Road Zipper System

project sales pipeline, however the timing of implementation

remains challenging to forecast due to the number of variables

involved in executing these projects.”

Second Quarter Conference Call

Lindsay’s fiscal 2024 second quarter investor conference call is

scheduled for 11:00 a.m. Eastern Time today. Interested investors

may participate in the call by dialing (833) 535-2202 in the U.S.,

or (412) 902-6745 internationally, and requesting the Lindsay

Corporation call. Additionally, the conference call will be

simulcast live on the Internet and can be accessed via the investor

relations section of the Company's Web site, www.lindsay.com.

Replays of the conference call will remain on our Web site through

the next quarterly earnings release. The Company will have a slide

presentation available to augment management's formal presentation,

which will also be accessible via the Company's Web site.

About the Company

Lindsay Corporation (NYSE: LNN) is a leading global manufacturer

and distributor of irrigation and infrastructure equipment and

technology. Established in 1955, the company has been at the

forefront of research and development of innovative solutions to

meet the food, fuel, fiber and transportation needs of the world’s

rapidly growing population. The Lindsay family of irrigation brands

includes Zimmatic® center pivot and lateral move agricultural

irrigation systems, FieldNET® and FieldWise® remote irrigation

management, FieldNET Advisor™ irrigation scheduling technology, and

industrial IoT solutions. Also a global leader in the

transportation industry, Lindsay Transportation Solutions

manufactures equipment to improve road safety and keep traffic

moving on the world’s roads, bridges and tunnels, through the

Barrier Systems®, Road Zipper® and Snoline™ brands. For more

information about Lindsay Corporation, visit www.lindsay.com.

Concerning Forward-looking Statements

This release contains forward-looking statements that are

subject to risks and uncertainties, and which reflect management’s

current beliefs and estimates of future economic circumstances,

industry conditions, Company performance and financial results. You

can find a discussion of many of these risks and uncertainties in

the annual, quarterly and current reports that the Company files

with the Securities and Exchange Commission. Forward-looking

statements include information concerning possible or assumed

future results of operations and planned financing of the Company

and those statements preceded by, followed by or including the

words “anticipate,” “estimate,” “believe,” “intend,” "expect,"

"outlook," "could," "may," "should," “will,” or similar

expressions. For these statements, the Company claims the

protection of the safe harbor for forward-looking statements

contained in the Private Securities Litigation Reform Act of 1995.

The Company undertakes no obligation to update any forward-looking

information contained in this press release.

LINDSAY CORPORATION AND

SUBSIDIARIES

CONDENSED CONSOLIDATED

STATEMENTS OF EARNINGS

(Unaudited)

Three months ended

Six months ended

(in thousands, except per share

amounts)

February 29, 2024

February 28, 2023

February 29, 2024

February 28, 2023

Operating revenues

$

151,519

$

166,241

$

312,877

$

342,400

Cost of operating revenues

102,565

111,983

214,018

235,122

Gross profit

48,954

54,258

98,859

107,278

Operating expenses:

Selling expense

9,498

8,733

19,315

18,410

General and administrative expense

13,466

13,739

28,128

28,176

Engineering and research expense

3,892

4,521

8,244

8,829

Total operating expenses

26,856

26,993

55,687

55,415

Operating income

22,098

27,265

43,172

51,863

Other income (expense):

Interest expense

(830

)

(1,038

)

(1,707

)

(1,947

)

Interest income

1,295

490

2,363

865

Other income (expense), net

134

(984

)

(136

)

(1,043

)

Total other income (expense)

599

(1,532

)

520

(2,125

)

Earnings before income taxes

22,697

25,733

43,692

49,738

Income tax expense

4,574

7,681

10,550

13,469

Net earnings

$

18,123

$

18,052

$

33,142

$

36,269

Earnings per share:

Basic

$

1.64

$

1.64

$

3.01

$

3.30

Diluted

$

1.64

$

1.63

$

2.99

$

3.28

Shares used in computing earnings per

share:

Basic

11,033

11,007

11,025

10,998

Diluted

11,074

11,063

11,067

11,068

Cash dividends declared per share

$

0.35

$

0.34

$

0.70

$

0.68

LINDSAY CORPORATION AND

SUBSIDIARIES

SUMMARY OPERATING

RESULTS

(Unaudited)

Three months ended

Six months ended

(in thousands)

February 29, 2024

February 28, 2023

February 29, 2024

February 28, 2023

Operating revenues:

Irrigation:

North America

$

82,845

$

90,354

$

172,222

$

174,288

International

50,173

57,422

100,964

125,571

Irrigation segment

133,018

147,776

273,186

299,859

Infrastructure segment

18,501

18,465

39,691

42,541

Total operating revenues

$

151,519

$

166,241

$

312,877

$

342,400

Operating income:

Irrigation segment

$

25,649

$

32,820

$

50,956

$

61,461

Infrastructure segment

3,506

2,019

7,125

5,391

Corporate

(7,057

)

(7,574

)

(14,909

)

(14,989

)

Total operating income

$

22,098

$

27,265

$

43,172

$

51,863

The Company manages its business activities in two reportable

segments as follows:

Irrigation – This reporting segment includes the manufacture and

marketing of center pivot, lateral move, and hose reel irrigation

systems, as well as various innovative technology solutions such as

GPS positioning and guidance, variable rate irrigation, remote

irrigation management and scheduling technology, irrigation

consulting and design and industrial IoT solutions.

Infrastructure – This reporting segment includes the manufacture

and marketing of movable barriers, specialty barriers, crash

cushions and end terminals, and road marking and road safety

equipment.

LINDSAY CORPORATION AND

SUBSIDIARIES

CONDENSED CONSOLIDATED BALANCE

SHEETS

(Unaudited)

(in thousands)

February 29, 2024

February 28, 2023

August 31, 2023

ASSETS

Current assets:

Cash and cash equivalents

$

133,415

$

97,675

$

160,755

Marketable securities

17,219

8,763

5,556

Receivables, net

153,624

167,007

144,774

Inventories, net

167,334

178,703

155,932

Other current assets

29,121

27,973

20,467

Total current assets

500,713

480,121

487,484

Property, plant, and equipment, net

110,691

93,838

99,681

Intangibles, net

26,277

17,329

27,719

Goodwill

84,099

67,409

83,121

Operating lease right-of-use assets

16,755

17,984

17,036

Deferred income tax assets

9,203

9,518

10,885

Other noncurrent assets

17,542

22,881

19,734

Total assets

$

765,280

$

709,080

$

745,660

LIABILITIES AND SHAREHOLDERS' EQUITY

Current liabilities:

Accounts payable

$

47,903

$

52,998

$

44,278

Current portion of long-term debt

228

224

226

Other current liabilities

81,147

79,566

91,604

Total current liabilities

129,278

132,788

136,108

Pension benefits liabilities

4,234

4,733

4,382

Long-term debt

115,075

115,253

115,164

Operating lease liabilities

16,936

18,659

17,689

Deferred income tax liabilities

677

702

689

Other noncurrent liabilities

16,046

14,673

15,977

Total liabilities

282,246

286,808

290,009

Shareholders' equity:

Preferred stock

—

—

—

Common stock

19,122

19,091

19,094

Capital in excess of stated value

101,060

94,834

98,508

Retained earnings

661,715

607,784

636,297

Less treasury stock - at cost

(277,238

)

(277,238

)

(277,238

)

Accumulated other comprehensive loss,

net

(21,625

)

(22,199

)

(21,010

)

Total shareholders' equity

483,034

422,272

455,651

Total liabilities and shareholders'

equity

$

765,280

$

709,080

$

745,660

LINDSAY CORPORATION AND

SUBSIDIARIES

CONDENSED CONSOLIDATED

STATEMENTS OF CASH FLOWS

(Unaudited)

Six months ended

(in thousands)

February 29, 2024

February 28, 2023

CASH FLOWS FROM OPERATING ACTIVITIES:

Net earnings

$

33,142

$

36,269

Adjustments to reconcile net earnings to

net cash provided by operating activities:

Depreciation and amortization

10,574

9,695

Provision for uncollectible accounts

receivable

249

834

Deferred income taxes

1,488

(185

)

Share-based compensation expense

3,335

3,089

Unrealized foreign currency transaction

(gain) loss

(94

)

878

Other, net

150

354

Changes in assets and liabilities:

Receivables

(9,349

)

(28,707

)

Inventories

(12,003

)

14,014

Other current assets

(7,009

)

1,635

Accounts payable

3,792

(6,178

)

Other current liabilities

(15,186

)

(25,553

)

Other noncurrent assets and

liabilities

3,047

1,742

Net cash provided by operating

activities

12,136

7,887

CASH FLOWS FROM INVESTING ACTIVITIES:

Purchases of property, plant, and

equipment

(18,773

)

(7,222

)

Purchases of marketable securities

(15,042

)

—

Proceeds from maturities of marketable

securities

3,525

2,725

Other investing activities, net

(540

)

(1,214

)

Net cash used in investing activities

(30,830

)

(5,711

)

CASH FLOWS FROM FINANCING ACTIVITIES:

Proceeds from exercise of stock

options

479

—

Dividends paid

(7,724

)

(7,485

)

Common stock withheld for payroll tax

obligations

(1,575

)

(2,471

)

Other financing activities, net

229

128

Net cash used in financing activities

(8,591

)

(9,828

)

Effect of exchange rate changes on cash

and cash equivalents

(55

)

279

Net change in cash and cash

equivalents

(27,340

)

(7,373

)

Cash and cash equivalents, beginning of

period

160,755

105,048

Cash and cash equivalents, end of

period

$

133,415

$

97,675

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240404581249/en/

For further information: LINDSAY CORPORATION:

Alicia Pfeifer Vice President, Investor Relations & Treasury

402-933-6429 Alicia.Pfeifer@lindsay.com

Alpha IR: Joe Caminiti or Stephen Poe 312-445-2870

LNN@alpha-ir.com

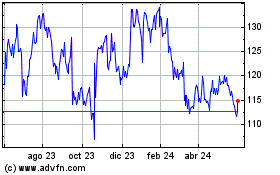

Lindsay (NYSE:LNN)

Gráfica de Acción Histórica

De Ene 2025 a Feb 2025

Lindsay (NYSE:LNN)

Gráfica de Acción Histórica

De Feb 2024 a Feb 2025