Dorian LPG Ltd. (NYSE: LPG) (the “Company,” “Dorian LPG,” “we,”

“us,” and “our”), a leading owner and operator of modern very large

gas carriers (“VLGCs”), today reported its financial results for

the three months ended June 30, 2024.

Key Recent Development

- Declared an irregular dividend totaling $42.6 million to be

paid on or about August 21, 2024 to shareholders of record as of

August 8, 2024.

Highlights for the First Quarter Fiscal Year 2025

- Revenues of $114.4 million.

- Time Charter Equivalent (“TCE”)(1) rate per operating day for

our fleet of $55,228.

- Net income of $51.3 million, or $1.25 earnings per diluted

share (“EPS”), and adjusted net income(1) of $51.7 million, or

$1.26 adjusted earnings per diluted share (“adjusted EPS”).(1)

- Adjusted EBITDA(1) of $78.0 million.

- Declared and paid an irregular cash dividend totaling $40.6

million in May 2024.

- Issued 2,000,000 common shares at a price of $44.50 per share

less underwriting discounts and commissions of $2.225 per

share.

(1)

TCE, adjusted net income, adjusted EPS and

adjusted EBITDA are non-U.S. GAAP measures. Refer to the

reconciliation of revenues to TCE, net income to adjusted net

income, EPS to adjusted EPS and net income to adjusted EBITDA

included in this press release under the heading “Financial

Information.”

John C. Hadjipateras, Chairman, President and Chief Executive

Officer of the Company, commented, “During the quarter, we paid a

dividend to our shareholders based on strong earnings and cash flow

generation, and completed a significant strategic objective with a

successful equity offering that positions us well for future fleet

growth and renewal. Demand for LPG remains strong, as its

availability, cost effectiveness, and environmental footprint make

it a fuel of choice for many applications. As always, I acknowledge

our dedicated seafarers and shoreside staff, whose hard work and

dedication make our results possible.”

First Quarter Fiscal Year 2025 Results Summary

Net income amounted to $51.3 million, or $1.25 per diluted

share, for the three months ended June 30, 2024, compared to $51.7

million, or $1.28 per diluted share, for the three months ended

June 30, 2023.

Adjusted net income amounted to $51.7 million, or $1.26 per

diluted share, for the three months ended June 30, 2024, compared

to adjusted net income of $48.9 million, or $1.21 per diluted

share, for the three months ended June 30, 2023. Adjusted net

income for the three months ended June 30, 2024 is calculated by

adjusting net income for the same period to exclude an unrealized

loss on derivative instruments of $0.4 million. Please refer to the

reconciliation of net income to adjusted net income, which appears

later in this press release.

The $2.8 million increase in adjusted net income for the three

months ended June 30, 2024, compared to the three months ended June

30, 2023, is primarily attributable to (i) increases of $2.8

million in revenues and $2.0 million in interest income and (ii) a

reduction of $0.9 million in interest and finance costs; partially

offset by increases of $1.2 million in general and administrative

expenses, $0.7 million in vessel operating expenses, $0.5 million

in depreciation and amortization, and $0.5 million in voyage

expenses.

The TCE rate per operating day for our fleet was $55,228 for the

three months ended June 30, 2024, an 8.0% increase from $51,156 for

the same period in the prior year. Please see footnote 7 to the

table in “Financial Information” below for information related to

how we calculate TCE. Total fleet utilization (including the

utilization of our vessels deployed in the Helios Pool) decreased

from 98.0% during the three months ended June 30, 2023 to 90.4%

during the three months ended June 30, 2024.

Vessel operating expenses per vessel per calendar day increased

to $10,717 for the three months ended June 30, 2024 compared to

$10,383 in the same period in the prior year. Please see “Vessel

Operating Expenses” below for more information.

Revenues

Revenues, which represent net pool revenues—related party, time

charters and other revenues, net, were $114.4 million for the three

months ended June 30, 2024, an increase of $2.8 million, or 2.5%,

from $111.6 million for the three months ended June 30, 2023

primarily due to an increase in fleet size, partially offset by a

reduction of fleet utilization. Our available days increased from

2,219 for the three months ended June 30, 2023 to 2,275 for the

three months ended June 30, 2024. Our fleet utilization decreased

from 98.0% during the three months ended June 30, 2023 to 90.4%

during the three months ended June 30, 2024. Average TCE rates

increased by $4,072 per operating day from $51,156 for the three

months ended June 30, 2023 to $55,228 for the three months ended

June 30, 2024, but was relatively flat when comparing TCE rates per

available day with a slight decrease from $50,164 for the three

months ended June 30, 2023 to $49,911 for the three months ended

June 30, 2024.

Vessel Operating Expenses

Vessel operating expenses were $20.5 million during the three

months ended June 30, 2024, or $10,717 per vessel per calendar day,

which is calculated by dividing vessel operating expenses by

calendar days for the relevant time-period for the

technically-managed vessels that were in our fleet and increased by

$0.7 million, or 3.2% from $19.8 million for the three months ended

June 30, 2023. The increase of $334 per vessel per calendar day,

from $10,383 for the three months ended June 30, 2023 to $10,717

per vessel per calendar day for the three months ended June 30,

2024 was primarily the result of increases of $159 per vessel per

calendar day for spares and stores and $102 per vessel per calendar

day for crew wages and related costs. Excluding non-capitalizable

drydock-related operating expenses, daily operating expenses

increased by $523 from $10.094 for the three months ended June 30,

2023 to $10.617 for the three months ended June 30, 2024.

General and Administrative Expenses

General and administrative expenses were $10.4 million for the

three months ended June 30, 2024, an increase of $1.2 million, or

13.1%, from $9.2 million for the three months ended June 30, 2023

and was driven by increases of $0.5 million in stock-based

compensation, $0.5 million in cash bonuses, and $0.2 million in

other general and administrative expenses.

Interest and Finance Costs

Interest and finance costs amounted to $9.5 million for the

three months ended June 30, 2024, a decrease of $0.9 million, or

8.5%, from $10.4 million for the three months ended June 30, 2023.

The decrease of $0.9 million during this period was mainly due to a

decrease of $0.9 million in loan interest on our long-term debt,

which was driven by a decrease in average indebtedness, excluding

deferred financing fees, from $658.2 million for the three months

ended June 30, 2023 to $606.6 million for the three months ended

June 30, 2024.

Interest Income

Interest income amounted to $3.7 million for the three months

ended June 30, 2024, compared to $1.7 million for the three months

ended June 30, 2023. The increase of $2.0 million is mainly

attributable to (i) higher average cash balances for the three

months ended June 30, 2024 when compared to the three months ended

June 30, 2023, and (ii) an increase in interest rates over the

periods presented.

Unrealized Gain/(Loss) on Derivatives

Unrealized loss on derivatives amounted to $0.4 million for the

three months ended June 30, 2024, compared to a gain of $2.9

million for the three months ended June 30, 2023. The $3.3 million

unfavorable change is primarily attributable to changes in forward

SOFR yield curves and reduced notional amounts.

Fleet

The following table sets forth certain information regarding our

fleet as of July 25, 2024.

Scrubber

Time

Capacity

ECO

Equipped

Charter-Out

(Cbm)

Shipyard

Year Built

Vessel(1)

or Dual-Fuel

Employment

Expiration(2)

Dorian VLGCs

Captain John NP

82,000

Hyundai

2007

—

—

Pool(4)

—

Comet

84,000

Hyundai

2014

X

S

Pool(4)

—

Corsair(3)

84,000

Hyundai

2014

X

S

Time Charter(6)

Q4 2024

Corvette

84,000

Hyundai

2015

X

S

Pool(4)

—

Cougar(3)

84,000

Hyundai

2015

X

—

Pool-TCO(5)

Q2 2025

Concorde

84,000

Hyundai

2015

X

S

Pool(4)

—

Cobra

84,000

Hyundai

2015

X

—

Pool(4)

—

Continental

84,000

Hyundai

2015

X

—

Pool(4)

—

Constitution

84,000

Hyundai

2015

X

S

Pool(4)

—

Commodore

84,000

Hyundai

2015

X

—

Pool-TCO(5)

Q2 2027

Cresques(3)

84,000

Daewoo

2015

X

S

Pool-TCO(5)

Q2 2025

Constellation

84,000

Hyundai

2015

X

S

Pool(4)

—

Cheyenne

84,000

Hyundai

2015

X

S

Pool(4)

—

Clermont

84,000

Hyundai

2015

X

S

Pool(4)

—

Cratis(3)

84,000

Daewoo

2015

X

S

Pool(4)

—

Chaparral(3)

84,000

Hyundai

2015

X

—

Pool-TCO(5)

Q2 2025

Copernicus(3)

84,000

Daewoo

2015

X

S

Pool(4)

—

Commander

84,000

Hyundai

2015

X

S

Pool(4)

—

Challenger

84,000

Hyundai

2015

X

S

Pool-TCO(5)

Q3 2026

Caravelle(3)

84,000

Hyundai

2016

X

S

Pool(4)

—

Captain Markos(3)

84,000

Kawasaki

2023

X

DF

Pool(4)

—

Total

1,762,000

Time chartered-in VLGCs

Future Diamond(7)

80,876

Hyundai

2020

X

S

Pool(4)

—

HLS Citrine(8)

86,090

Hyundai

2023

X

DF

Pool(4)

—

HLS Diamond(9)

86,090

Hyundai

2023

X

DF

Pool(4)

—

Cristobal(10)

86,980

Hyundai

2023

X

DF

Pool(4)

—

___________________________

(1)

Represents vessels with very low

revolutions per minute, long-stroke, electronically controlled

engines, larger propellers, advanced hull design, and low friction

paint.

(2)

Represents calendar year quarters.

(3)

Operated pursuant to a bareboat chartering

agreement.

(4)

“Pool” indicates that the vessel operates

in the Helios Pool on a voyage charter with a third party and we

receive a portion of the pool profits calculated according to a

formula based on the vessel’s pro rata performance in the pool.

(5)

“Pool-TCO” indicates that the vessel is

operated in the Helios Pool on a time charter out to a third party

and we receive a portion of the pool profits calculated according

to a formula based on the vessel’s pro rata performance in the

pool.

(6)

Currently on a time charter with an oil

major that began in November 2019.

(7)

Currently time chartered-in to our fleet

with an expiration during the first calendar quarter of 2025.

(8)

Vessel has a Panamax beam and is currently

time chartered-in to our fleet with an expiration during the first

calendar quarter of 2030 and purchase options beginning in year

seven.

(9)

Vessel has a Panamax beam and is currently

time chartered-in to our fleet with an expiration during the first

calendar quarter of 2030 and purchase options beginning in year

seven.

(10)

Vessel has a Panamax beam and shaft

generator and is currently time chartered-in to our fleet with an

expiration during the third calendar quarter of 2030 and purchase

options beginning in year seven.

Market Outlook & Update

Following the end of the Northern Hemisphere winter, U.S.

propane prices fell below 40% of West Texas Intermediate (“WTI”)

prices, averaging 39% in the second calendar quarter of 2024 (“Q2

2024”), down from 46% in the first calendar quarter of 2024 (“Q1

2024”). U.S. exports increased by 250,000 metric tons, totaling

over 16 million metric tons (“MM MT”) in Q2 2024, with June alone

exceeding 5.5 MM MT

In Asia, demand remained focused on petrochemical consumption,

particularly in China where four new PDH plants began operations,

according to NGLStrategy’s analysis. Following measures announced

in China in early May to revive the property market, improved

sentiment and prices for olefins and polyolefins in the East

improved somewhat, with propane demand for PDH operations in China

increasing from around 3.1 MM MT in Q1 2024 to 4.4 MM MT in Q2

2024. This gain was somewhat offset by less propylene output from

steam crackers in Q2 2024, with several facilities undergoing

maintenance. Downstream demand for olefins and polyolefins remains

sluggish despite the property market stimulus, with overcapacity

remaining for ethylene and propylene in the East. As a result, PDH

margins continue to be under pressure averaging around $17 per

metric ton in Q2 2024 compared to $26 per metric ton in Q1 2024

(based on variable margins).

Steam cracking margins for naphtha remained negative in the

East, however, propane continued to outperform naphtha averaging

$66 per metric ton in Q2 2024, compared to over $120 per metric ton

in Q1 2024. Naphtha margins in NW Europe for the production of

ethylene via steam crackers remained positive through April and May

2024, but in June 2024 saw a severe deterioration as ethylene

prices and other co-product prices fell at the same time naphtha

prices increased. The propane-naphtha spread remained favorable at

an average of ($153) per metric ton in Q2 2024 in NW Europe.

In the Middle East, OPEC+ met to discuss crude oil production

levels for the remainder of 2024 and 2025. The additional voluntary

production cuts announced in April 2023 and November 2023 are to be

extended to the end of September 2024. LPG exports as a result

remained subdued from countries such as Saudi Arabia where LPG

exports totaled 1.6 MM MT in Q2 2024, 1 MM MT less than levels seen

for the same time period in 2023. The additional measures by some

of the OPEC+ oil producing countries helped maintain an average

Brent price of $86 per barrel in Q2 2024 which was in line with the

level seen in Q1 2024.

Freight rates started Q2 2024 on a softening note averaging

around $64 per metric ton in April 2024. However, May 2024 saw

levels rise to over $80 per metric ton before falling to $74 per

metric ton on average in June 2024. The VLGC supply/demand balance

was seen to improve/tighten in May/June 2024 primarily on the

additional ton-mile demand and supportive arbitrage levels between

the U.S. Gulf Coast and the Far East.

A further six new VLGCs were added to the global fleet during Q2

2024. An additional 41 VLGCs equivalent to roughly 3.6 million cbm

of carrying capacity and 49 VLACs are expected to be added by

calendar year 2027. The average age of the global fleet is now

approximately 10.6 years old. Currently the VLGC orderbook stands

at approximately 10.5% of the global fleet, excluding the very

large ammonia carriers (approximately 21%, including the VLACs) and

very large ethane carriers orderbook.

The above market outlook update is based on information, data

and estimates derived from industry sources available as of the

date of this release, and there can be no assurances that such

trends will continue or that anticipated developments in freight

rates, export volumes, the VLGC orderbook or other market

indicators will materialize. This information, data and estimates

involve a number of assumptions and limitations, are subject to

risks and uncertainties, and are subject to change based on various

factors. You are cautioned not to give undue weight to such

information, data and estimates. We have not independently verified

any third-party information, verified that more recent information

is not available and undertake no obligation to update this

information unless legally obligated.

Seasonality

Liquefied gases are primarily used for industrial and domestic

heating, as chemical and refinery feedstock, as transportation fuel

and in agriculture. The LPG shipping market historically has been

stronger in the spring and summer months in anticipation of

increased consumption of propane and butane for heating during the

winter months. In addition, unpredictable weather patterns in these

months tend to disrupt vessel scheduling and the supply of certain

commodities. Demand for our vessels therefore may be stronger in

our quarters ending June 30 and September 30 and relatively weaker

during our quarters ending December 31 and March 31, although

12-month time charter rates tend to smooth out these short-term

fluctuations and recent LPG shipping market activity has not

yielded the typical seasonal results. The increase in petrochemical

industry buying has contributed to less marked seasonality than in

the past, but there can no guarantee that this trend will continue.

To the extent any of our time charters expire during the typically

weaker fiscal quarters ending December 31 and March 31, it may not

be possible to re-charter our vessels at similar rates. As a

result, we may have to accept lower rates or experience off-hire

time for our vessels, which may adversely impact our business,

financial condition and operating results.

Financial Information

The following table presents our selected financial data and

other information for the periods presented:

Three months ended

(in U.S. dollars, except fleet

data)

June 30, 2024

June 30, 2023

Statement of Operations Data

Revenues

$

114,353,042

$

111,562,907

Expenses

Voyage expenses

804,985

298,383

Charter hire expenses

10,645,140

10,546,810

Vessel operating expenses

20,480,279

19,842,386

Depreciation and amortization

17,170,986

16,655,317

General and administrative expenses

10,424,070

9,218,137

Total expenses

59,525,460

56,561,033

Other income—related parties

645,943

620,433

Operating income

55,473,525

55,622,307

Other income/(expenses)

Interest and finance costs

(9,518,430

)

(10,403,849

)

Interest income

3,728,507

1,690,220

Unrealized gain/(loss) on derivatives

(421,627

)

2,859,274

Realized gain on derivatives

1,717,249

1,847,764

Other gain/(loss), net

308,916

105,421

Total other income/(expenses), net

(4,185,385

)

(3,901,170

)

Net income

$

51,288,140

$

51,721,137

Earnings per common share—basic

1.25

1.29

Earnings per common share—diluted

$

1.25

$

1.28

Financial Data

Adjusted EBITDA(1)

$

77,957,393

$

74,849,872

Fleet Data

Calendar days(2)

1,911

1,911

Time chartered-in days(3)

364

364

Available days(4)

2,275

2,219

Operating days(5)(8)

2,056

2,175

Fleet utilization(6)(8)

90.4

%

98.0

%

Average Daily Results

Time charter equivalent rate(7)(8)

$

55,228

$

51,156

Daily vessel operating expenses(9)

$

10,717

$

10,383

____________________

(1)

Adjusted EBITDA is an unaudited non-U.S.

GAAP measure and represents net income/(loss) before interest and

finance costs, unrealized (gain)/loss on derivatives, realized

(gain)/loss on interest rate swaps, stock-based compensation

expense, impairment, and depreciation and amortization and is used

as a supplemental financial measure by management to assess our

financial and operating performance. We believe that adjusted

EBITDA assists our management and investors by increasing the

comparability of our performance from period to period and

management makes business and resource-allocation decisions based

on such comparisons. This increased comparability is achieved by

excluding the potentially disparate effects between periods of

derivatives, interest and finance costs, stock-based compensation

expense, impairment, and depreciation and amortization expense,

which items are affected by various and possibly changing financing

methods, capital structure and historical cost basis and which

items may significantly affect net income/(loss) between periods.

We believe that including adjusted EBITDA as a financial and

operating measure benefits investors in selecting between investing

in us and other investment alternatives.

Adjusted EBITDA has certain limitations in

use and should not be considered an alternative to net

income/(loss), operating income, cash flow from operating

activities or any other measure of financial performance presented

in accordance with U.S. GAAP. Adjusted EBITDA excludes some, but

not all, items that affect net income/(loss). Adjusted EBITDA as

presented below may not be computed consistently with similarly

titled measures of other companies and, therefore, might not be

comparable with other companies.

The following table sets forth a

reconciliation of net income to Adjusted EBITDA (unaudited) for the

periods presented:

Three months ended

(in U.S. dollars)

June 30, 2024

June 30, 2023

Net income

$

51,288,140

$

51,721,137

Interest and finance costs

9,518,430

10,403,849

Unrealized (gain)/loss on derivatives

421,627

(2,859,274

)

Realized gain on interest rate swaps

(1,717,249

)

(1,847,764

)

Stock-based compensation expense

1,275,459

776,607

Depreciation and amortization

17,170,986

16,655,317

Adjusted EBITDA

$

77,957,393

$

74,849,872

(2)

We define calendar days as the total

number of days in a period during which each vessel in our fleet

was owned or operated pursuant to a bareboat charter. Calendar days

are an indicator of the size of the fleet over a period and affect

both the amount of revenues and the amount of expenses that are

recorded during that period.

(3)

We define time chartered-in days as the

aggregate number of days in a period during which we time

chartered-in vessels from third parties. Time chartered-in days are

an indicator of the size of the fleet over a period and affect both

the amount of revenues and the amount of charter hire expenses that

are recorded during that period.

(4)

We define available days as the sum of

calendar days and time chartered-in days (collectively representing

our commercially-managed vessels) less aggregate off hire days

associated with scheduled maintenance, which include major repairs,

drydockings, vessel upgrades or special or intermediate surveys. We

use available days to measure the aggregate number of days in a

period that our vessels should be capable of generating

revenues.

(5)

We define operating days as available days

less the aggregate number of days that the commercially-managed

vessels in our fleet are off‑hire for any reason other than

scheduled maintenance (e.g., commercial waiting, repositioning

following drydocking, etc.). We use operating days to measure the

number of days in a period that our operating vessels are on hire

(refer to 8 below).

(6)

We calculate fleet utilization by dividing

the number of operating days during a period by the number of

available days during that period. An increase in non-scheduled off

hire days would reduce our operating days, and, therefore, our

fleet utilization. We use fleet utilization to measure our ability

to efficiently find suitable employment for our vessels.

(7)

Time charter equivalent rate, or TCE rate,

is a non-U.S. GAAP measure of the average daily revenue performance

of a vessel. TCE rate is a shipping industry performance measure

used primarily to compare period‑to‑period changes in a shipping

company’s performance despite changes in the mix of charter types

(such as time charters, voyage charters) under which the vessels

may be employed between the periods and is a factor in management’s

business decisions and is useful to investors in understanding our

underlying performance and business trends. Our method of

calculating TCE rate is to divide revenue net of voyage expenses by

operating days for the relevant time period, which may not be

calculated the same by other companies. Note that our calculation

of TCE includes our portion of the net profit of the Helios Pool,

which may also cause our calculation to differ from that of

companies which do not account for pooling arrangements as we

do.

The following table sets forth a

reconciliation of revenues to TCE rate (unaudited) for the periods

presented:

Three months ended

(in U.S. dollars, except operating

days)

June 30, 2024

June 30, 2023

Numerator:

Revenues

$

114,353,042

$

111,562,907

Voyage expenses

(804,985

)

(298,383

)

Time charter equivalent

$

113,548,057

$

111,264,524

Pool adjustment*

(2,050

)

895,272

Time charter equivalent excluding pool

adjustment*

$

113,546,007

$

112,159,796

Denominator:

Operating days

2,056

2,175

TCE rate:

Time charter equivalent rate

$

55,228

$

51,156

TCE rate excluding pool adjustment*

$

55,227

$

51,568

* Adjusted for the effects of

reallocations of pool profits in accordance with the pool

participation agreements primarily resulting from the actual speed

and consumption performance of the vessels operating in the Helios

Pool exceeding the originally estimated speed and consumption

levels.

(8)

We determine operating days for each

vessel based on the underlying vessel employment, including our

vessels in the Helios Pool, or the Company Methodology. If we were

to calculate operating days for each vessel within the Helios Pool

as a variable rate time charter, or the Alternate Methodology, our

operating days and fleet utilization would be increased with a

corresponding reduction to our TCE rate. Operating data using both

methodologies is as follows:

Three months ended

June 30, 2024

June 30, 2023

Company Methodology:

Operating Days

2,056

2,175

Fleet Utilization

90.4

%

98.0

%

Time charter equivalent rate

$

55,228

$

51,156

Alternate Methodology:

Operating Days

2,275

2,218

Fleet Utilization

100.0

%

100.0

%

Time charter equivalent rate

$

49,911

$

50,164

We believe that the Company Methodology

using the underlying vessel employment provides more meaningful

insight into market conditions and the performance of our

vessels.

(9)

Daily vessel operating expenses are

calculated by dividing vessel operating expenses by calendar days

for the relevant time period.

In addition to the results of operations presented in accordance

with U.S. GAAP, we provide adjusted net income and adjusted EPS. We

believe that adjusted net income and adjusted EPS are useful to

investors in understanding our underlying performance and business

trends. Adjusted net income and adjusted EPS are not a measurement

of financial performance or liquidity under U.S. GAAP; therefore,

these non-U.S. GAAP measures should not be considered as an

alternative or substitute for U.S. GAAP. The following table

reconciles net income and EPS to adjusted net income and adjusted

EPS, respectively, for the periods presented:

Three months ended

(in U.S. dollars, except share

data)

June 30, 2024

June 30, 2023

Net income

$

51,288,140

$

51,721,137

Unrealized (gain)/loss on derivatives

421,627

(2,859,274

)

Adjusted net income

$

51,709,767

$

48,861,863

Earnings per common share—diluted

$

1.25

$

1.28

Unrealized (gain)/loss on derivatives

0.01

(0.07

)

Adjusted earnings per common

share—diluted

$

1.26

$

1.21

The following table presents our unaudited balance sheets as of

the dates presented:

As of

As of

June 30, 2024

March 31, 2024

Assets

Current assets

Cash and cash equivalents

$

353,286,506

$

282,507,971

Trade receivables, net and accrued

revenues

728,063

659,567

Due from related parties

79,242,331

52,352,942

Inventories

2,375,025

2,393,379

Available-for-sale debt securities

11,624,497

11,530,939

Derivative instruments

3,872,696

5,139,056

Prepaid expenses and other current

assets

14,417,578

14,297,917

Total current assets

465,546,696

368,881,771

Fixed assets

Vessels, net

1,193,276,988

1,208,588,213

Vessel under construction

24,589,655

23,829,678

Total fixed assets

1,217,866,643

1,232,417,891

Other non-current assets

Deferred charges, net

11,633,800

12,544,098

Derivative instruments

4,989,886

4,145,153

Due from related parties—non-current

25,300,000

25,300,000

Restricted cash—non-current

75,319

75,798

Operating lease right-of-use assets

183,794,058

191,700,338

Other non-current assets

2,584,495

2,585,116

Total assets

$

1,911,790,897

$

1,837,650,165

Liabilities and shareholders’

equity

Current liabilities

Trade accounts payable

$

7,993,668

$

10,185,962

Accrued expenses

4,537,580

3,948,420

Due to related parties

7,266

7,283

Deferred income

556,427

486,868

Current portion of long-term operating

lease liabilities

33,075,348

32,491,122

Current portion of long-term debt

53,654,384

53,543,315

Dividends payable

1,406,175

1,149,665

Total current liabilities

101,230,848

101,812,635

Long-term liabilities

Long-term debt—net of current portion and

deferred financing fees

538,411,109

551,549,215

Long-term operating lease liabilities

150,735,999

159,226,326

Other long-term liabilities

1,548,006

1,528,906

Total long-term liabilities

690,695,114

712,304,447

Total liabilities

791,925,962

814,117,082

Commitments and contingencies

—

—

Shareholders’ equity

Preferred stock, $0.01 par value,

50,000,000 shares authorized, none issued nor outstanding

—

—

Common stock, $0.01 par value, 450,000,000

shares authorized, 53,995,027 and 51,995,027 shares issued,

42,619,448 and 40,619,448 shares outstanding (net of treasury

stock), as of June 30, 2024 and March 31, 2024, respectively

539,950

519,950

Additional paid-in-capital

858,357,646

772,714,486

Treasury stock, at cost; 11,375,579 and

11,375,579 shares as of June 30, 2024 and March 31, 2024,

respectively

(126,837,239

)

(126,837,239

)

Retained earnings

387,804,578

377,135,886

Total shareholders’ equity

1,119,864,935

1,023,533,083

Total liabilities and shareholders’

equity

$

1,911,790,897

$

1,837,650,165

Conference Call

A conference call to discuss the results will be held on

Thursday, August 1, 2024 at 10:00 a.m. ET. The conference call can

be accessed live by dialing 1-800-343-4849, or for international

callers, 1-203-518-9848, and requesting to be joined into the

Dorian LPG call. A replay will be available at 1:00 p.m. ET the

same day and can be accessed by dialing 1-844-512-2921, or for

international callers, 1-412-317-6671. The passcode for the replay

is 11156632. The replay will be available until August 8, 2024, at

11:59 p.m. ET.

A live webcast of the conference call will also be available

under the investor relations section at www.dorianlpg.com. The

information on our website does not form a part of and is not

incorporated by reference into this release.

About Dorian LPG Ltd.

Dorian LPG is a leading owner and operator of modern VLGCs that

transport liquefied petroleum gas globally. Our fleet currently

consists of twenty-five modern VLGCs, including twenty ECO VLGCs

and four dual-fuel ECO VLGCs. Dorian LPG has offices in Stamford,

Connecticut, USA; Copenhagen, Denmark; and Athens, Greece.

Forward-Looking and Other Cautionary Statements

The cash dividends referenced in this release are irregular

dividends. All declarations of dividends are subject to the

determination and discretion of our Board of Directors based on its

consideration of various factors, including the Company’s results

of operations, financial condition, level of indebtedness,

anticipated capital requirements, contractual restrictions,

restrictions in its debt agreements, restrictions under applicable

law, its business prospects and other factors that our Board of

Directors may deem relevant.

This press release contains "forward-looking statements."

Statements that are predictive in nature, that depend upon or refer

to future events or conditions, or that include words such as

"expects," "anticipates," "intends," "plans," "believes,"

"estimates," "projects," "forecasts," "may," "will," "should" and

similar expressions are forward-looking statements. These

statements are not historical facts but instead represent only the

Company's current expectations and observations regarding future

results, many of which, by their nature are inherently uncertain

and outside of the Company's control. Where the Company expresses

an expectation or belief as to future events or results, such

expectation or belief is expressed in good faith and believed to

have a reasonable basis. However, the Company’s forward-looking

statements are subject to risks, uncertainties, and other factors,

which could cause actual results to differ materially from future

results expressed, projected, or implied by those forward-looking

statements. The Company’s actual results may differ, possibly

materially, from those anticipated in these forward-looking

statements as a result of certain factors, including changes in the

Company’s financial resources and operational capabilities and as a

result of certain other factors listed from time to time in the

Company's filings with the U.S. Securities and Exchange Commission.

For more information about risks and uncertainties associated with

Dorian LPG’s business, please refer to the “Management’s Discussion

and Analysis of Financial Condition and Results of Operations” and

“Risk Factors” sections of Dorian LPG’s SEC filings, including, but

not limited to, its annual report on Form 10-K and quarterly

reports on Form 10-Q. The Company does not assume any obligation to

update the information contained in this press release.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240801698950/en/

Ted Young Chief Financial Officer +1 (203) 674-9900

IR@dorianlpg.com

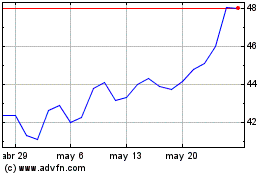

Dorian LPG (NYSE:LPG)

Gráfica de Acción Histórica

De Jul 2024 a Ago 2024

Dorian LPG (NYSE:LPG)

Gráfica de Acción Histórica

De Ago 2023 a Ago 2024