The Marcus Corporation Files Universal Shelf Registration Statement

04 Octubre 2024 - 5:31PM

Business Wire

The Marcus Corporation (NYSE: MCS) today announced that it has

filed a new universal shelf registration statement with the

Securities and Exchange Commission to allow The Marcus Corporation

to potentially offer an indeterminate principal amount and number

of securities in the future with a proposed maximum aggregate

offering price of up to $150,000,000. The new shelf registration

statement replaces The Marcus Corporation’s prior universal shelf

registration statement, which was set to expire later this

month.

Under the shelf registration statement, The Marcus Corporation

will have the flexibility to publicly offer and sell from time to

time debt securities, common stock, preferred stock, warrants and

other securities or any combination of such securities. The Marcus

Corporation may periodically offer one or more of these securities

in amounts, at prices and on terms announced if and when the

securities are ever offered. The specifics of any potential future

offerings, along with the use of proceeds of any such securities

offered by The Marcus Corporation, will be described in detail in a

prospectus supplement at the time of any such offering.

Gregory S. Marcus, president, chief executive officer and

chairman of the board of The Marcus Corporation, said, “Like many

public companies who file these types of registration statements,

we consider this filing to be a proactive step to quickly and

efficiently facilitate our future ability to raise public equity or

debt capital to potentially expand existing businesses, fund

potential acquisitions, invest in other growth opportunities, or

repay existing debt.”

This press release shall not constitute an offer to sell or the

solicitation of an offer to buy, nor shall there be any sale of

these securities in any state or jurisdiction in which such offer,

solicitation or sale would be unlawful prior to the registration or

qualification under the securities laws of any such state or

jurisdiction.

About the Marcus

Corporation

Headquartered in Milwaukee, The Marcus Corporation is a leader

in the lodging and entertainment industries, with significant

company-owned real estate assets. The Marcus Corporation’s theatre

division, Marcus Theatres®, is the fourth largest theatre circuit

in the U.S. and currently owns or operates 981 screens at 79

locations in 17 states under the Marcus Theatres, Movie Tavern® by

Marcus and BistroPlex® brands. The company’s lodging division,

Marcus® Hotels & Resorts, owns and/or manages 16 hotels,

resorts and other properties in eight states. For more information,

please visit the company’s website at www.marcuscorp.com.

Certain matters discussed in this press release are “forward

looking statements” intended to qualify for the safe harbors from

liability established by the Private Securities Litigation Reform

Act of 1995. These forward-looking statements may generally be

identified as such because the context of such statements include

words such as we “believe,” “anticipate,” “expect” or words of

similar import. Similarly, statements that describe our future

plans, objectives or goals are also forward-looking statements.

Such forward-looking statements are subject to certain risks and

uncertainties which may cause results to differ materially from

those expected, including, but not limited to, the following: (1)

the adverse effects future pandemics or epidemics may have on our

theatre and hotels and resorts businesses, results of operations,

liquidity, cash flows, financial condition, access to credit

markets and ability to service our existing and future

indebtedness; (2) the availability, in terms of both quantity and

audience appeal, of motion pictures for our theatre division

(including disruptions in the production of films due to events

such as a strike by actors, writers or directors or future

pandemics); (3) the effects of theatre industry dynamics such as

the maintenance of a suitable window between the date such motion

pictures are released in theatres and the date they are released to

other distribution channels; (4) the effects of adverse economic

conditions in our markets; (5) the effects of adverse economic

conditions on our ability to obtain financing on reasonable and

acceptable terms, if at all; (6) the effects on our occupancy and

room rates caused by the relative industry supply of available

rooms at comparable lodging facilities in our markets; (7) the

effects of competitive conditions in our markets; (8) our ability

to achieve expected benefits and performance from our strategic

initiatives and acquisitions; (9) the effects of increasing

depreciation expenses, reduced operating profits during major

property renovations, impairment losses, and preopening and

start-up costs due to the capital intensive nature of our business;

(10) the effects of changes in the availability of and cost of

labor and other supplies essential to the operation of our

business; (11) the effects of weather conditions, particularly

during the winter in the Midwest and in our other markets; (12) our

ability to identify properties to acquire, develop and/or manage

and the continuing availability of funds for such development; (13)

the adverse impact on business and consumer spending on travel,

leisure and entertainment resulting from terrorist attacks in the

United States, other incidents of violence in public venues such as

hotels and movie theatres; and (14) a disruption in our business

and reputational and economic risks associated with civil

securities claims brought by shareholders. These statements are not

guarantees of future performance and are subject to risks,

uncertainties and other factors, some of which are beyond our

control and difficult to predict and could cause actual results to

differ materially from those expressed or forecasted in the

forward-looking statements. Our forward-looking statements are

based upon our assumptions, which are based upon currently

available information. Shareholders, potential investors and other

readers are urged to consider these factors carefully in evaluating

the forward-looking statements and are cautioned not to place undue

reliance on such forward-looking statements. The forward-looking

statements made herein are made only as of the date of this press

release and we undertake no obligation to publicly update such

forward-looking statements to reflect subsequent events or

circumstances.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20241004343232/en/

The Marcus Corporation Chad M. Paris (414) 905-1100

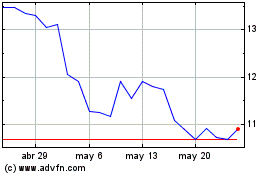

Marcus (NYSE:MCS)

Gráfica de Acción Histórica

De Nov 2024 a Dic 2024

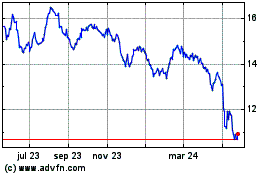

Marcus (NYSE:MCS)

Gráfica de Acción Histórica

De Dic 2023 a Dic 2024