Form 8-K - Current report

12 Noviembre 2024 - 3:35PM

Edgar (US Regulatory)

12/260000062234FALSE00000622342024-11-062024-11-06

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of

the Securities Exchange Act of 1934

| | | | | | | | | | | |

| Date of Report | | |

| (Date of earliest

event reported): | November 6, 2024 | |

(Exact name of registrant as

specified in its charter)

| | | | | | | | | | | | | | |

| Wisconsin | | 1-12604 | | 39-1139844 |

(State or other jurisdiction of incorporation) | | (Commission File Number) | | (IRS Employer Identification No.) |

111 East Kilbourn Avenue, Suite 1200, Milwaukee, Wisconsin 53202-4125

(Address of principal executive offices, including zip code)

(414) 905-1000

(Registrant’s telephone number, including area code)

| | |

| Not Applicable |

| (Former name or former address, if changed since last report) |

|

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| | | | | |

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17-CFR 240.14d-2(b)) |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17-CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | |

| Title of each class | Trading Symbol | Name of each exchange on which registered |

| Common Stock, $1.00 par value | MCS | New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. o

Item 5.03 Amendments to Articles of Incorporation or Bylaws; Change in Fiscal Year.

On November 6, 2024, the Board of Directors of The Marcus Corporation (the “Company”) approved a change in the fiscal year end from a 52-53 week year ending on the last Thursday of December to a calendar year ending on December 31, effective beginning with fiscal year 2025. The Company expects to make the fiscal year change on a prospective basis and will not adjust operating results for prior periods. The change to the Company’s fiscal year will not impact the Company’s results for the year ended December 26, 2024. However, the change will impact the prior year comparability of each of the fiscal quarters and the annual period in 2025 and in future filings. The Company believes this change will provide numerous benefits, including aligning its reporting periods to be more consistent with peer companies.

Since the change in the Company’s year end is from a 52-53 week fiscal year to the last day of the month commencing within seven days of the month end last reported, and the new fiscal year will commence with the end of the old fiscal year, the change is not deemed a change in fiscal year for purposes of reporting subject to Rule 13a-10 or 15d-10; hence, no transition reporting is required.

The reporting periods and applicable Securities and Exchange Commission reports for the remainder of fiscal year 2024 and fiscal year 2025 are expected to be as follows:

| | | | | | | | | | | | | | |

| FISCAL PERIOD | | REPORTING PERIOD | | REPORT TO BE FILED |

| 2024 fiscal year | | December 29, 2023 to December 26, 2024 | | Annual Report on Form 10-K |

| First quarter of fiscal 2025 | | December 27, 2024 to March 31, 2025 | | Quarterly Report on Form 10-Q |

| Second quarter of fiscal 2025 | | April 1, 2025 to June 30, 2025 | | Quarterly Report on Form 10-Q |

| Third quarter of fiscal 2025 | | July 1, 2025 to September 30, 2025 | | Quarterly Report on Form 10-Q |

| Fiscal year 2025 | | December 27, 2024 to December 31, 2025 | | Annual Report on Form 10-K |

Financial Reporting Impact

The change in the Company’s fiscal year end to a calendar year end results in no impact to fiscal 2024, and results in six additional operating days in the 2025 fiscal year as under a 52-53 week fiscal year (52 weeks in fiscal 2025). There will be changes in the number of operating days in the quarterly periods in 2025 as compared to the quarterly periods under a 52-53 week fiscal year which will have an impact on the Company’s quarterly financial results as well as the comparative presentation of period over period information.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | FIRST QUARTER | | SECOND QUARTER | | THIRD QUARTER | | FOURTH QUARTER | | FISCAL YEAR 2025 |

| Impact to Operating Days in Reporting Period: | | | | | | | | | | |

| Number of Operating Days in Calendar Period | | 95 | | 91 | | 92 | | 92 | | 370 |

| Number of Operating Days in 52-53 Week Period | | 91 | | 91 | | 91 | | 91 | | 364 |

| Change in Operating Days | | +4 | | 0 | | +1 | | +1 | | +6 |

Forward-Looking Statements

This report contains forward-looking statements, within the meaning of Section 21E of the Securities Exchange Act of 1934, as amended, which reflect the Company’s current estimates, expectations and projections about the Company’s future results, performance, prospects and opportunities. These forward-looking statements may generally be identified as such because the context of such statements include words such as we “believe,” “anticipate,” “expect” or words of similar import. Similarly, statements that describe our future plans, objectives or

goals are also forward-looking statements. Such forward-looking statements are subject to certain risks and uncertainties which may cause results to differ materially from those expected, including, but not limited to, the following: (1) the adverse effects future pandemics or epidemics may have on the Company’s theatre and hotels and resorts businesses, results of operations, liquidity, cash flows, financial condition, access to credit markets and ability to service the Company’s existing and future indebtedness; (2) the availability, in terms of both quantity and audience appeal, of motion pictures for the Company’s theatre division (including disruptions in the production of films due to events such as a strike by actors, writers or directors or future pandemics); (3) the effects of theatre industry dynamics such as the maintenance of a suitable window between the date such motion pictures are released in theatres and the date they are released to other distribution channels; (4) the effects of adverse economic conditions in the Company’s markets; (5) the effects of adverse economic conditions on the Company’s ability to obtain financing on reasonable and acceptable terms, if at all; (6) the effects on the Company’s occupancy and room rates caused by the relative industry supply of available rooms at comparable lodging facilities in the Company’s markets; (7) the effects of competitive conditions in the Company’s markets; (8) the Company’s ability to achieve expected benefits and performance from the Company’s strategic initiatives and acquisitions; (9) the effects of increasing depreciation expenses, reduced operating profits during major property renovations, impairment losses, and preopening and start-up costs due to the capital intensive nature of the Company’s business; (10) the effects of changes in the availability of and cost of labor and other supplies essential to the operation of the Company’s business; (11) the effects of weather conditions, particularly during the winter in the Midwest and in the Company’s other markets; (12) the Company’s ability to identify properties to acquire, develop and/or manage and the continuing availability of funds for such development; (13) the adverse impact on business and consumer spending on travel, leisure and entertainment resulting from terrorist attacks in the United States, other incidents of violence in public venues such as hotels and movie theatres; and (14) a disruption in the Company’s business and reputational and economic risks associated with civil securities claims brought by shareholders. These statements are not guarantees of future performance and are subject to risks, uncertainties and other factors, some of which are beyond the Company’s control and difficult to predict and could cause actual results to differ materially from those expressed or forecasted in the forward-looking statements. The Company’s forward-looking statements are based upon the Company’s assumptions, which are based upon currently available information. Shareholders, potential investors and other readers are urged to consider these factors carefully in evaluating the forward-looking statements and are cautioned not to place undue reliance on such forward-looking statements. The forward-looking statements made herein are made only as of the date of this Current Report on Form 8-K and we undertake no obligation to publicly update such forward-looking statements to reflect subsequent events or circumstances

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized. | | | | | | | | |

| THE MARCUS CORPORATION |

| | |

| | |

Date: November 12, 2024 | By: | /s/ Chad M. Paris |

| | Chad M. Paris |

| | Chief Financial Officer and Treasurer |

v3.24.3

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionEnd date of current fiscal year in the format --MM-DD.

| Name: |

dei_CurrentFiscalYearEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:gMonthDayItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

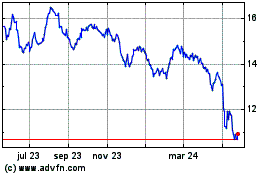

Marcus (NYSE:MCS)

Gráfica de Acción Histórica

De Nov 2024 a Dic 2024

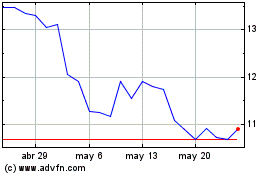

Marcus (NYSE:MCS)

Gráfica de Acción Histórica

De Dic 2023 a Dic 2024