Pebblebrook Hotel Trust (NYSE: PEB):

Q2 FINANCIAL

HIGHLIGHTS

- Net income of $32.2 million

- Same-Property Total RevPAR(1) increased by 2.5% vs. Q2 2023,

with urban properties improving 3.4% and resort properties growing

0.6%

- Same-Property EBITDA(1) of $117.2 million, up $9.6 million, or

8.9%, vs. Q2 2023

- Adjusted EBITDAre(1) of $123.5 million, ahead by $7.2 million,

or 6.2%, vs. Q2 2023

- Adjusted FFO(1) per diluted share of $0.69, increasing 11.3%

from Q2 2023

HOTEL OPERATING TRENDS

- Both urban and resort occupancies grew in Q2. Urban

Same-Property Occupancy increased 2.5 percentage points, with gains

driven by San Diego, Chicago, Boston and Washington, D.C. Resort

Same-Property Occupancy rose by 3.5 percentage points, bolstered by

continued improvement in weekday demand from business transient and

groups and weekend occupancy from leisure travelers.

- Focused efforts to achieve operating cost efficiencies, coupled

with reduced expense pressures and better-than-expected progress in

realizing real estate tax reductions, resulted in a 0.1%

year-over-year decline in Same-Property Total Expenses. This helped

to improve Same-Property EBITDA margins by 182 basis points.

PORTFOLIO UPDATES &

CAPITAL REPOSITIONINGS

- Pebblebrook’s multiyear comprehensive redevelopment and

repositioning projects, totaling over $520 million, have been

completed, positioning the Company to achieve significant revenue

gains and cash flow improvements over the next several years.

- LaPlaya Beach Resort & Club (“LaPlaya”) continues to ramp

up its operating performance following its redevelopment and

restoration after Hurricane Ian. In Q2, EBITDA reached $7.0

million. Additionally, $7.3 million of business interruption income

was recorded, exceeding the Company’s Q2 Outlook by $3.3

million.

- Le Méridien Delfina Santa Monica will be converted and

rebranded to Hyatt Centric in mid-September 2024, becoming the

first Hyatt-affiliated franchise in this highly desirable

beachfront destination.

2024

OUTLOOK

- Net loss: ($13.0) to ($4.0) million

- Same-Property RevPAR(1) Growth Rate: +1.25% to +2.25% (midpoint

down 125 bps)

- Adjusted EBITDAre(1): $351.0 to $360.0 million (midpoint

increased $9.0 million)

- Adjusted FFO(1) per diluted share: $1.59 to $1.67 (midpoint

increased $0.08)

(1) See tables later in this press release

for a description of Same-Property information and reconciliations

from net income (loss) to non-GAAP financial measures used in the

table above and elsewhere in this press release.

“Second quarter demand was in line with our expectations, with

healthy business group, transient and leisure boosting the urban

markets, and strong weekday and weekend demand positively affecting

our resort portfolio. Our recently redeveloped and repositioned

properties – Estancia La Jolla Hotel & Spa, Skamania Lodge,

Hilton Gaslamp San Diego Quarter, Margaritaville San Diego Gaslamp

Quarter and Newport Harbor Island Resort – are performing well,

ramping up successfully and gaining market share. Our bottom-line

operating results exceeded our outlook, primarily due to

better-than-expected execution of operating efficiency initiatives,

reduced expense pressures and slightly greater-than-expected

savings from real estate tax reductions. Both our urban hotels and

resorts grew Same-Property EBITDA during the second quarter, which

is very encouraging.

“For the remainder of the year, increasing geopolitical and

economic uncertainties are likely to impact industry performance

and operating results, prompting us to adopt a modestly more

cautious outlook. While we are slightly lowering our revenue growth

outlook for the year, we are raising our 2024 outlook for Hotel

EBITDA, Adjusted EBITDAre, Adjusted FFO and AFFO/share. Although

our overall group and transient pace remains ahead for the balance

of the year compared with 2023, the margin of advantage has been

narrowing. Business group and transient segments remain healthy.

However, leisure consumers have become increasingly

price-conscious, particularly within the lower-priced segments, and

this trend is beginning to impact some higher-end segments. We were

previously expecting overall ADR declines to ease in the second

half of this year, but we now expect continued pressure throughout

the remainder of the year. Despite this, luxury and upscale

travelers have remained resilient, and we are on track for a

successful summer season across our portfolio.”

-Jon E. Bortz, Chairman and Chief Executive Officer of

Pebblebrook Hotel Trust

Second Quarter and Year-to-Date Highlights

Second Quarter

Six Months Ended June

30,

Same-Property and Corporate

Highlights

2024

2023

Var

2024

2023

Var

($ in millions except RevPAR and

per share data)

Net income (loss)

$32.2

$46.2

(30.2%)

$4.7

$24.1

(80.4%)

Same-Property RevPAR(1)

$234

$230

1.7%

$208

$205

1.6%

Same-Property Room Revenues(1)

$244.0

$239.7

1.8%

$435.6

$425.8

2.3%

Same-Property Total Revenues(1)

$372.8

$363.4

2.6%

$667.9

$651.4

2.5%

Same-Property Total Expenses(1)

$255.5

$255.7

(0.1%)

$490.9

$482.6

1.7%

Same-Property EBITDA(1)

$117.2

$107.7

8.9%

$177.0

$168.8

4.8%

Adjusted EBITDAre(1)

$123.5

$116.2

6.2%

$184.3

$177.0

4.1%

Adjusted FFO(1)

$83.8

$75.7

10.7%

$108.8

$98.1

10.9%

Adjusted FFO per diluted share(1)

$0.69

$0.62

11.3%

$0.90

$0.79

13.9%

2024 Monthly Results

Same-Property Portfolio

Highlights(2)

Jan

Feb

Mar

Apr

May

Jun

($ in millions except ADR and

RevPAR data)

Occupancy

51%

63%

70%

73%

76%

81%

ADR

$295

$294

$307

$303

$310

$302

RevPAR

$151

$184

$215

$220

$236

$244

Total Revenues

$84.8

$94.9

$115.4

$115.4

$129.8

$127.5

Total Revenues Growth Rate (’24 vs.

’23)

6%

3%

0%

(1%)

7%

2%

Hotel EBITDA

$8.1

$19.1

$32.5

$31.0

$47.3

$38.9

(1)

See tables later in this press release for

a description of Same-Property information and reconciliations from

net income (loss) to non-GAAP financial measures, including

Earnings Before Interest, Taxes, Depreciation and Amortization

(“EBITDA”), EBITDA for Real Estate (“EBITDAre”), Adjusted EBITDAre,

Funds from Operations (“FFO”), FFO per share, Adjusted FFO and

Adjusted FFO per share.

Adjusted EBITDAre, Adjusted FFO and

Adjusted FFO per share exclude the amortization of share-based

compensation expense. Historical and comparable period results of

such non-GAAP financial measures have been adjusted to reflect the

exclusion.

(2)

Includes information for all the hotels

the Company owned as of June 30, 2024, except for the

following:

- LaPlaya Beach Resort & Club is excluded from Jan – Jun

“Both our urban hotels and resorts demonstrated positive

performance in the second quarter,” noted Mr. Bortz. “Year to date,

our urban properties have improved occupancy by 2.4 percentage

points and increased Same-Property EBITDA by 7.0% over the

prior-year period. Meanwhile, our Resort Same-Property Occupancy

increased by 3.5 percentage points for the quarter and 1.8

percentage points year to date, with Resort Same-Property EBITDA

year to date increasing by 2.0% over last year.

‘We’re also very pleased with the tremendous progress our

property teams and asset managers have made in delivering operating

efficiency improvements across the portfolio. It has been a primary

focus for our teams. Our Same-Property hotel operating expenses

decreased by 0.1% versus Q2 2023, with costs per occupied room

declining by 3.8%. Excluding property taxes and insurance, our

hotel operating expenses rose by only 1.4%, while decreasing by

2.4% on a per occupied room basis. Generally, we have also

experienced reduced operating cost pressures across the portfolio,

which we expect will continue through the remainder of the

year.”

Ramp Up of LaPlaya Beach Resort & Club

Following the post-hurricane reconstruction completion and full

reopening of LaPlaya in Naples, Florida earlier this year, the

luxury resort's operating performance continues to improve rapidly.

Year to date, LaPlaya has achieved $15.3 million in Hotel EBITDA,

as compared to a loss of $3.7 million in the same period last year,

and a positive $23.1 million in the same period of 2022, which was

the resort’s best performing year prior to Hurricane Ian in

September 2022. The property’s underlying performance is expected

to continue to ramp up, and LaPlaya is fully poised to capitalize

on the upcoming high-demand travel season in Naples, starting in

the fourth quarter of 2024. As part of the Company’s increased 2024

outlook, LaPlaya is expected to contribute $24 million of EBITDA

for the entire year, which represents a $2 million improvement from

the Company’s prior expectations.

Regarding insurance claims, the Company expects all operational

and physical disruptions to be covered under its business

interruption (“BI”) and property insurance policies, net of

deductibles. In Q2 2024, a preliminary settlement of $7.3 million

for BI proceeds related to income losses from October 2023 through

February 2024 was recorded, exceeding the Company’s Q2 outlook by

$3.3 million. Year to date, the Company has recorded $11.3 million

in BI income and forecasts an additional $2.7 million for the

remainder of 2024, bringing the total expected BI income for 2024

to $14.0 million. This is $3.0 million more than previously

expected. These projections are now incorporated into the Company’s

2024 Outlook. It is important to note that while business

interruption proceeds will increase Adjusted EBITDAre and Adjusted

FFO, they are not included in Same-Property Hotel EBITDA. As a

reminder, LaPlaya’s operating performance is excluded from all

same-property reporting results for 2024 and 2023.

Le Méridien Delfina Santa Monica to Convert to Hyatt

Centric

The Company recently reached an agreement with Hyatt Hotels

& Resorts (“Hyatt”) to reflag its existing 315-room Le Méridien

Delfina Santa Monica as the Hyatt Centric Delfina Santa Monica in

mid-September 2024. This exciting conversion will include an

approximate $16.0 million property refresh, commencing in the

fourth quarter of this year, with expected completion in the second

quarter of 2025. Hyatt is providing key money, offsetting a

meaningful portion of the property refresh.

“We are thrilled that our lifestyle-oriented Delfina Santa

Monica hotel will become part of Hyatt Centric,” noted Mr. Bortz.

“After evaluating many alternative options, we determined that

converting to Hyatt Centric was the optimal choice for this unique

lifestyle-oriented property. We were already planning a refresh,

and the additional scope to meet Hyatt Centric standards was

relatively minor. This will be the only Hyatt-branded hotel in the

desirable and high barrier-to-entry beachside Santa Monica hotel

market, which should be a tremendous benefit for the property.”

Capital Investments and Strategic Property

Redevelopments

During the second quarter, the Company completed $28.7 million

of capital investments throughout its portfolio, excluding capital

expenditures related to the repair and rebuilding of LaPlaya. These

investments relate to a number of the Company’s last major property

redevelopments, including:

- the $50 million comprehensive redevelopment and transformation

of Newport Harbor Island Resort into a luxury island resort,

which fully launched on Memorial Day weekend;

- the finalization of Estancia La Jolla Hotel & Spa’s

$26 million redevelopment and repositioning, which was completed in

mid-April and included fully renovating public areas and extensive

public area landscaping, adding a lobby bar and patio, outdoor

meeting venues, an outdoor pool bar and grill and new cabanas, and

upgrading the main ballroom and the Mustangs and Burros restaurant;

and

- the May completion of Skamania Lodge's $20 million phase

1 of its much larger master plan to expand and introduce

alternative lodging accommodations, including the recent addition

of two new 2-bedroom cabins, one new 3-bedroom villa, and five

first-of-their-kind luxury glamping units. Other recent resort

additions included a multi-million-dollar outdoor meeting and event

venue adjacent to the resort’s new 18-hole putting course, three

additional treehouses bringing the total number of treehouses to

nine, and road and utility infrastructure for existing and future

alternative accommodations.

With the completion of these investments, virtually all of the

Company's properties have undergone recent major redevelopments or

renovations. This marks a transition to a period of significantly

reduced capital investments planned for the next few years. The

Company continues to expect it will invest a total of $85 to $90

million in the portfolio in 2024, net of key money.

Balance Sheet and Liquidity

As of June 30, 2024, the Company had $111.2 million in cash,

cash equivalents and restricted cash, plus $636.3 million of

undrawn availability on its $650 million senior unsecured revolving

credit facility. The Company’s current $2.2 billion of consolidated

debt and convertible notes is well-structured, with an estimated

effective weighted-average interest rate of 4.4% as of the

beginning of the third quarter. 75% of the combined debt and

convertible notes is fixed at an estimated effective

weighted-average interest rate of 3.4%, while the remaining 25% is

floating at an estimated weighted-average interest rate of 7.3%. In

addition, approximately 91% of the Company’s outstanding debt is

unsecured, and the weighted-average maturity of the Company’s debt

is approximately 2.7 years. The Company has no meaningful debt

maturities until Q4 2025.

Common and Preferred Dividends

On June 14, 2024, the Company declared a quarterly cash dividend

of $0.01 per share on its common shares and a regular quarterly

cash dividend for the following preferred shares of beneficial

interest:

- $0.39844 per 6.375% Series E Cumulative Redeemable Preferred

Share;

- $0.39375 per 6.3% Series F Cumulative Redeemable Preferred

Share;

- $0.39844 per 6.375% Series G Cumulative Redeemable Preferred

Share; and

- $0.35625 per 5.7% Series H Cumulative Redeemable Preferred

Share.

Update on Curator Hotel & Resort Collection

Curator Hotel & Resort Collection (“Curator”) is a curated

collection of experientially focused small brands and independent

lifestyle hotels and resorts worldwide founded by Pebblebrook and

several industry-leading independent lifestyle hotel operators. As

of June 30, 2024, Curator had 97 member hotels and resorts and 117

master service agreements with preferred vendor partners. The

master service agreements provide Curator member hotels with

preferred pricing, enhanced operating terms, and early access to

curated new technologies. Curator's mission is to support lifestyle

hotels and resorts through its best-in-class operating agreements,

services and technology, while helping properties amplify their

independent brands and what makes them unique.

2024 Outlook

The Company's 2024 Outlook, which does not assume any

acquisitions or dispositions, incorporates planned capital

investments and key assumptions, including an estimated $14.0

million in business interruption proceeds and $24.0 million of

Hotel EBITDA related to LaPlaya, which is incorporated into

Adjusted EBITDAre and Adjusted FFO, but does not impact

Same-Property Hotel EBITDA.

This forecast assumes stable travel conditions, unaffected by

pandemics, major weather events, federal shutdowns or deteriorating

macro-economic factors.

2024

Outlook

As of 7/24/24

Variance

to Prior Outlook

Var to 4/23/24

($ in millions, except per share

data)

Low

High

Low

High

Net (loss)

($13.0)

($4.0)

$49.0

$43.0

Adjusted EBITDAre

$351.0

$360.0

$12.0

$6.0

Adjusted FFO

$193.5

$202.5

$13.0

$7.0

Adjusted FFO per diluted share

$1.59

$1.67

$0.10

$0.06

This 2024 Outlook is based, in part, on the following

estimates and assumptions:

2024

Outlook

As of 7/24/24

Variance

to Prior Outlook

Var to 4/23/24

($ in millions)

Low

High

Low

High

US Hotel Industry RevPAR Growth Rate

0.75%

1.75%

0.75%

(0.25%)

Same-Property RevPAR variance vs. 2023

1.25%

2.25%

(0.75%)

(1.75%)

Same-Property Total Revenue variance vs.

2023

2.4%

3.4%

(0.9%)

(1.4%)

Same-Property Total Expense variance vs.

2023

2.9%

3.4%

(1.8%)

(1.9%)

Same-Property Hotel EBITDA

$350.1

$359.1

$6.0

–

Same-Property Hotel EBITDA variance vs.

2023

0.8%

3.4%

1.7%

–

The Company’s Q3 2024 Outlook is as follows:

Q3 2024 Outlook

Low

High

($ in millions, except per share

and RevPAR data)

Net income

$7.5

$12.5

Adjusted EBITDAre

$101.0

$106.0

Adjusted FFO

$59.5

$64.5

Adjusted FFO per diluted share

$0.49

$0.53

This Q3 2024 Outlook is based, in part, on the following

estimates and assumptions:

Same-Property RevPAR

$238

$243

Same-Property RevPAR variance vs. Q3

2023

1.25%

3.25%

Same-Property Total Revenue variance vs.

Q3 2023

1.7%

3.8%

Same-Property Total Expense variance vs.

Q3 2023

3.9%

4.9%

Same-Property Hotel EBITDA

$108.0

$113.0

Same-Property Hotel EBITDA variance vs. Q3

2023

(3.5%)

1.0%

Second Quarter 2024 Earnings Call

The Company will conduct its quarterly analyst and investor

conference call on Thursday, July 25, 2024, at 9:30 AM ET. Please

dial (877) 407-3982 approximately ten minutes before the call

begins to participate. A live webcast of the conference call will

also be available through the Investor Relations section of

www.pebblebrookhotels.com. To access the webcast, click on

https://investor.pebblebrookhotels.com/news-and-events/webcasts/default.aspx

ten minutes before the conference call. A replay of the conference

call webcast will be archived and available online.

About Pebblebrook Hotel Trust

Pebblebrook Hotel Trust (NYSE: PEB) is a publicly traded real

estate investment trust (“REIT”) and the largest owner of urban and

resort lifestyle hotels and resorts in the United States. The

Company owns 46 hotels and resorts, totaling approximately 12,000

guest rooms across 13 urban and resort markets. For more

information, visit www.pebblebrookhotels.com and follow

@PebblebrookPEB.

This press release contains certain “forward-looking statements”

made pursuant to the safe harbor provisions of the Private

Securities Reform Act of 1995. Forward-looking statements are

generally identifiable by the use of forward-looking terminology

such as “may,” “will,” “should,” “potential,” “intend,” “expect,”

“seek,” “anticipate,” “estimate,” “approximately,” “believe,”

“could,” “project,” “predict,” “forecast,” “continue,” “assume,”

“plan,” references to “outlook” or other similar words or

expressions. Forward-looking statements are based on certain

assumptions and can include future expectations, future plans and

strategies, financial and operating projections and forecasts and

other forward-looking information and estimates. Examples of

forward-looking statements include the following: descriptions of

the Company’s plans or objectives for future capital investment

projects, operations or services; forecasts of the Company’s future

economic performance; forecasts of hotel industry performance;

expectations of BI income; and descriptions of assumptions

underlying or relating to any of the foregoing expectations

including assumptions regarding the timing of their occurrence.

These forward-looking statements are subject to various risks and

uncertainties, many of which are beyond the Company’s control,

which could cause actual results to differ materially from such

statements. These risks and uncertainties include, but are not

limited to, the state of the U.S. economy and the supply of hotel

properties, and other factors as are described in greater detail in

the Company’s filings with the SEC, including, without limitation,

the Company’s Annual Report on Form 10-K for the year ended

December 31, 2023. Unless legally required, the Company disclaims

any obligation to update any forward-looking statements, whether as

a result of new information, future events or otherwise.

For further information about the Company’s business and

financial results, please refer to the "Management’s Discussion and

Analysis of Financial Condition and Results of Operations” and

“Risk Factors” sections of the Company’s filings with the U.S.

Securities and Exchange Commission, including, but not limited to,

its Annual Report on Form 10-K and Quarterly Reports on Form 10-Q,

copies of which may be obtained at the Investor Relations section

of the Company’s website at www.pebblebrookhotels.com.

All information in this press release is as of July 24, 2024.

The Company undertakes no duty to update the statements in this

press release to conform the statements to actual results or

changes in the Company’s expectations.

Pebblebrook Hotel Trust Consolidated Balance Sheets

($ in thousands, except share and per-share data) June

30, 2024 December 31, 2023 (Unaudited)

ASSETS Assets: Investment in hotel properties, net

$

5,442,903

$

5,490,776

Cash and cash equivalents

101,689

183,747

Restricted cash

9,489

9,894

Hotel receivables (net of allowance for doubtful accounts of $343

and $689, respectively)

63,555

43,912

Prepaid expenses and other assets

86,716

96,644

Total assets

$

5,704,352

$

5,824,973

LIABILITIES AND EQUITY

Liabilities: Unsecured revolving credit facilities

$

-

$

-

Unsecured term loans, net of unamortized deferred financing costs

1,262,552

1,375,004

Convertible senior notes, net of unamortized debt premium and

discount and deferred financing costs

747,720

747,262

Senior unsecured notes, net of unamortized deferred financing costs

2,396

2,395

Mortgage loans, net of unamortized debt discount and deferred

financing costs

194,533

195,140

Accounts payable, accrued expenses and other liabilities

238,429

238,644

Lease liabilities - operating leases

320,681

320,617

Deferred revenues

85,112

76,874

Accrued interest

6,637

6,830

Distribution payable

11,857

11,862

Total liabilities

2,869,917

2,974,628

Commitments and contingencies

Shareholders' Equity:

Preferred shares of beneficial interest, $0.01 par value

(liquidation preference $690,000 at June 30, 2024 and December 31,

2023), 100,000,000 shares authorized; 27,600,000 shares issued and

outstanding at June 30, 2024 and December 31, 2023

276

276

Common shares of beneficial interest, $0.01 par value, 500,000,000

shares authorized; 120,094,380 shares issued and outstanding at

June 30, 2024 and 120,191,349 shares issued and outstanding at

December 31, 2023

1,201

1,202

Additional paid-in capital

4,077,360

4,078,912

Accumulated other comprehensive income (loss)

29,281

24,374

Distributions in excess of retained earnings

(1,362,359

)

(1,341,264

)

Total shareholders' equity

2,745,759

2,763,500

Non-controlling interests

88,676

86,845

Total equity

2,834,435

2,850,345

Total liabilities and equity

$

5,704,352

$

5,824,973

Pebblebrook Hotel Trust Consolidated

Statements of Operations ($ in thousands, except share and

per-share data) (Unaudited) Three months

endedJune 30, Six months endedJune 30,

2024

2023

2024

2023

Revenues: Room

$

253,778

$

250,934

$

451,878

$

447,308

Food and beverage

101,520

93,748

182,615

169,511

Other operating

41,812

39,661

76,686

73,243

Total revenues

$

397,110

$

384,343

$

711,179

$

690,062

Expenses: Hotel operating expenses: Room

$

65,003

$

64,690

$

120,026

$

121,114

Food and beverage

70,921

68,985

131,935

127,657

Other direct and indirect

111,733

112,354

211,752

211,568

Total hotel operating expenses

247,657

246,029

463,713

460,339

Depreciation and amortization

57,296

57,957

114,505

116,326

Real estate taxes, personal property taxes, property insurance, and

ground rent

25,002

29,571

57,407

58,475

General and administrative

11,946

11,202

24,123

21,190

Gain on sale of hotel properties

-

(23,584

)

-

(30,219

)

Business interruption insurance income

(7,301

)

(14,015

)

(11,281

)

(22,104

)

Other operating expenses

1,539

2,377

3,120

6,047

Total operating expenses

336,139

309,537

651,587

610,054

Operating income (loss)

60,971

74,806

59,592

80,008

Interest expense

(27,939

)

(29,544

)

(54,360

)

(56,974

)

Other

217

952

543

1,135

Income (loss) before income taxes

33,249

46,214

5,775

24,169

Income tax (expense) benefit

(1,010

)

(31

)

(1,056

)

(31

)

Net income (loss)

32,239

46,183

4,719

24,138

Net income (loss) attributable to non-controlling interests

1,303

1,458

2,133

2,341

Net income (loss) attributable to the Company

30,936

44,725

2,586

21,797

Distributions to preferred shareholders

(10,632

)

(10,987

)

(21,263

)

(21,975

)

Net income (loss) attributable to common shareholders

$

20,304

$

33,738

$

(18,677

)

$

(178

)

Net income (loss) per share available to common

shareholders, basic

$

0.17

$

0.27

$

(0.16

)

$

(0.00

)

Net income (loss) per share available to common shareholders,

diluted

$

0.16

$

0.24

$

(0.16

)

$

(0.00

)

Weighted-average number of common shares, basic

120,094,380

121,696,400

120,089,803

123,581,926

Weighted-average number of common shares, diluted

149,744,864

151,238,955

120,089,803

123,581,926

Considerations Regarding Non-GAAP Financial

Measures

This press release includes certain non-GAAP financial measures.

These measures are not in accordance with, or an alternative to,

measures prepared in accordance with GAAP and may be different from

similarly titled non-GAAP financial measures used by other

companies. In addition, these non-GAAP financial measures are not

based on any comprehensive set of accounting rules or principles.

Non-GAAP financial measures have limitations in that they do not

reflect all of the amounts associated with the Company’s results of

operations determined in accordance with GAAP.

Funds from Operations (“FFO”) - FFO represents net income

(computed in accordance with GAAP), excluding gains or losses from

sales of properties, plus real estate-related depreciation and

amortization and after adjustments for unconsolidated partnerships.

The Company considers FFO a useful measure of performance for an

equity REIT because it facilitates an understanding of the

Company's operating performance without giving effect to real

estate depreciation and amortization, which assume that the value

of real estate assets diminishes predictably over time. Since real

estate values have historically risen or fallen with market

conditions, the Company believes that FFO provides a meaningful

indication of its performance. The Company also considers FFO an

appropriate performance measure given its wide use by investors and

analysts. The Company computes FFO in accordance with standards

established by the Board of Governors of Nareit in its March 1995

White Paper (as amended in November 1999 and April 2002), which may

differ from the methodology for calculating FFO utilized by other

equity REITs and, accordingly, may not be comparable to that of

other REITs. Further, FFO does not represent amounts available for

management’s discretionary use because of needed capital

replacement or expansion, debt service obligations or other

commitments and uncertainties, nor is it indicative of funds

available to fund the Company’s cash needs, including its ability

to make distributions. The Company presents FFO per diluted share

calculations that are based on the outstanding dilutive common

shares plus the outstanding Operating Partnership units for the

periods presented.

Earnings before Interest, Taxes, and Depreciation and

Amortization ("EBITDA") - The Company believes that EBITDA provides

investors a useful financial measure to evaluate its operating

performance, excluding the impact of our capital structure

(primarily interest expense) and our asset base (primarily

depreciation and amortization).

Earnings before Interest, Taxes, and Depreciation and

Amortization for Real Estate ("EBITDAre") - The Company believes

that EBITDAre provides investors a useful financial measure to

evaluate its operating performance, and the Company presents

EBITDAre in accordance with Nareit guidelines, as defined in its

September 2017 white paper "Earnings Before Interest, Taxes,

Depreciation and Amortization for Real Estate." EBITDAre adjusts

EBITDA for the following items, which may occur in any period, and

refers to these measures as Adjusted EBITDAre: (1) gains or losses

on the disposition of depreciated property, including gains or

losses on change of control; (2) impairment write-downs of

depreciated property and of investments in unconsolidated

affiliates caused by a decrease in value of depreciated property in

the affiliate; and (3) adjustments to reflect the entity's share of

EBITDAre of unconsolidated affiliates.

The Company also evaluates its performance by reviewing Adjusted

FFO and Adjusted EBITDAre because it believes that adjusting FFO to

exclude certain recurring and non-recurring items described below

provides useful supplemental information regarding the Company's

ongoing operating performance and that the presentation of Adjusted

FFO and Adjusted EBITDAre, when combined with the primary GAAP

presentation of net income (loss), more completely describes the

Company's operating performance. The Company adjusts FFO available

to common share and unit holders for the following items, which may

occur in any period, and refers to this measure as Adjusted FFO and

Adjusted EBITDAre:

- Transaction costs: The Company excludes transaction

costs expensed during the period because it believes that including

these costs in FFO does not reflect the underlying financial

performance of the Company and its hotels.

- Non-cash ground rent: The Company excludes the non-cash

ground rent expense, which is primarily made up of the

straight-line rent impact from a ground lease.

- Management/franchise contract transition costs: The

Company excludes one-time management and/or franchise contract

transition costs expensed during the period because it believes

that including these costs in FFO and Adjusted EBITDAre does not

reflect the underlying financial performance of the Company and its

hotels.

- Interest expense adjustment for acquired liabilities:

The Company excludes interest expense adjustment for acquired

liabilities assumed in connection with acquisitions, because it

believes that including these non-cash adjustments in FFO and

Adjusted EBITDAre does not reflect the underlying financial

performance of the Company.

- Finance lease adjustment: The Company excludes the

effect of non-cash interest expense from finance leases because it

believes that including these non-cash adjustments in FFO and

Adjusted EBITDAre does not reflect the underlying financial

performance of the Company.

- Non-cash amortization of acquired intangibles: The

Company excludes the non-cash amortization of acquired intangibles,

which includes but is not limited to the amortization of favorable

and unfavorable leases or management agreements and above/below

market real estate tax reduction agreements because it believes

that including these non-cash adjustments in FFO and Adjusted

EBITDAre does not reflect the underlying financial performance of

the Company.

- Non-cash interest expense, one-time operation suspension

expenses, early extinguishment of debt, amortization of share-based

compensation expense, issuance costs of redeemed preferred shares,

and hurricane-related repairs costs: The Company excludes these

items because the Company believes that including these adjustments

in FFO does not reflect the underlying financial performance of the

Company and its hotels.

- One-time operation suspension expenses, amortization of

share-based compensation expense, and hurricane-related costs:

The Company excludes these items because it believes that including

these costs in EBITDAre does not reflect the underlying financial

performance of the Company and its hotels.

The Company presents weighted-average number of basic and fully

diluted common shares and units by excluding the dilutive effect of

shares issuable upon conversion of convertible debt.

The Company’s presentation of FFO and Adjusted EBITDAre as

adjusted by the Company, should not be considered as an alternative

to net income (computed in accordance with GAAP) as an indicator of

the Company’s financial performance or to cash flow from operating

activities (computed in accordance with GAAP) as an indicator of

its liquidity. The Company’s presentation of EBITDAre, and as

adjusted by the Company, should not be considered as an alternative

to net income (computed in accordance with GAAP) as an indicator of

the Company’s financial performance or to cash flow from operating

activities (computed in accordance with GAAP) as an indicator of

its liquidity.

Pebblebrook Hotel Trust Reconciliation of

Net Income (Loss) to FFO and Adjusted FFO ($ in thousands,

except share and per-share data) (Unaudited)

Three months endedJune 30, Six months endedJune 30,

2024

2023

2024

2023

Net income (loss)

$

32,239

$

46,183

$

4,719

$

24,138

Adjustments: Real estate depreciation and amortization

57,215

57,871

114,341

116,155

Gain on sale of hotel properties

-

(23,584

)

-

(30,219

)

Impairment loss

-

-

-

-

FFO

$

89,454

$

80,470

$

119,060

$

110,074

Distribution to preferred shareholders and unit holders

(11,796

)

(12,151

)

(23,591

)

(24,303

)

Issuance costs of redeemed preferred shares

-

-

-

-

FFO available to common share and unit holders

$

77,658

$

68,319

$

95,469

$

85,771

Transaction costs

40

257

44

310

Non-cash ground rent

1,872

1,905

3,745

3,811

Management/franchise contract transition costs

-

99

44

211

Interest expense adjustment for acquired liabilities

368

543

631

1,084

Finance lease adjustment

747

736

1,492

1,470

Non-cash amortization of acquired intangibles

(481

)

(482

)

(963

)

(4,531

)

Early extinguishment of debt

-

-

1,534

-

Amortization of share-based compensation expense

3,523

3,032

6,583

5,911

Issuance costs of redeemed preferred shares

-

-

-

-

Hurricane-related costs

33

1,282

183

4,067

Adjusted FFO available to common share and unit holders

$

83,760

$

75,691

$

108,762

$

98,104

FFO per common share - basic

$

0.64

$

0.56

$

0.79

$

0.69

FFO per common share - diluted

$

0.64

$

0.56

$

0.79

$

0.69

Adjusted FFO per common share - basic

$

0.69

$

0.62

$

0.90

$

0.79

Adjusted FFO per common share - diluted

$

0.69

$

0.62

$

0.90

$

0.79

Weighted-average number of basic common shares and units

121,105,508

122,704,780

121,100,931

124,590,306

Weighted-average number of fully diluted common shares and units

121,314,817

122,806,160

121,494,964

124,590,306

See “Considerations Regarding Non-GAAP Financial Measures”

of this press release for important considerations regarding our

use of non-GAAP financial measures. Any differences are a result of

rounding.

Pebblebrook Hotel Trust

Reconciliation of Net Income (Loss) to EBITDA, EBITDAre and

Adjusted EBITDAre ($ in thousands) (Unaudited)

Three months endedJune 30, Six months endedJune

30,

2024

2023

2024

2023

Net income (loss)

$

32,239

$

46,183

$

4,719

$

24,138

Adjustments: Interest expense

27,939

29,544

54,360

56,974

Income tax expense (benefit)

1,010

31

1,056

31

Depreciation and amortization

57,296

57,957

114,505

116,326

EBITDA

$

118,484

$

133,715

$

174,640

$

197,469

Gain on sale of hotel properties

-

(23,584

)

-

(30,219

)

Impairment loss

-

-

-

-

EBITDAre

$

118,484

$

110,131

$

174,640

$

167,250

Transaction costs

40

257

44

310

Non-cash ground rent

1,872

1,905

3,745

3,811

Management/franchise contract transition costs

-

99

44

211

Non-cash amortization of acquired intangibles

(481

)

(482

)

(963

)

(4,531

)

Amortization of share-based compensation expense

3,523

3,032

6,583

5,911

Hurricane-related costs

33

1,282

183

4,067

Adjusted EBITDAre

$

123,471

$

116,224

$

184,276

$

177,029

See “Considerations Regarding Non-GAAP Financial Measures”

of this press release for important considerations regarding our

use of non-GAAP financial measures. Any differences are a result of

rounding.

Pebblebrook Hotel Trust

Reconciliation of Q3 2024 and Full Year 2024 Outlook Net Income

(Loss) to FFO and Adjusted FFO (in millions, except per

share data) (Unaudited) Three months

endingSeptember 30, 2024 Year endingDecember 31, 2024

Low High Low High Net income

(loss)

$

8

$

13

$

(13

)

$

(4

)

Adjustments: Real estate depreciation and amortization

57

57

227

227

Gain on sale of hotel properties

-

-

-

-

Impairment loss

-

-

-

-

FFO

$

65

$

70

$

214

$

223

Distribution to preferred shareholders and unit holders

(12

)

(12

)

(47

)

(47

)

FFO available to common share and unit holders

$

53

$

58

$

167

$

176

Non-cash ground rent

2

2

8

8

Amortization of share-based compensation expense

4

4

14

14

Other

1

1

5

5

Adjusted FFO available to common share and unit holders

$

60

$

65

$

194

$

203

FFO per common share - diluted

$

0.44

$

0.48

$

1.37

$

1.45

Adjusted FFO per common share - diluted

$

0.49

$

0.53

$

1.59

$

1.67

Weighted-average number of fully diluted common shares and

units

121.5

121.5

121.5

121.5

See “Considerations Regarding Non-GAAP Financial Measures”

of this press release for important considerations regarding our

use of non-GAAP financial measures. Any differences are a result of

rounding.

Pebblebrook Hotel Trust Reconciliation

of Q3 2024 and Full Year 2024 Outlook Net Income (Loss) to EBITDA,

EBITDAre and Adjusted EBITDAre ($ in millions)

(Unaudited) Three months endingSeptember 30, 2024

Year endingDecember 31, 2024 Low High

Low High

Net income (loss)

$

8

$

13

$

(13

)

$

(4

)

Adjustments: Interest expense and income tax expense

30

30

115

115

Depreciation and amortization

57

57

227

227

EBITDA

$

95

$

100

$

329

$

338

Gain on sale of hotel properties

-

-

-

-

Impairment loss

-

-

-

-

EBITDAre

$

95

$

100

$

329

$

338

Non-cash ground rent

2

2

8

8

Amortization of share-based compensation expense

4

4

14

14

Other

-

-

-

-

Adjusted EBITDAre

$

101

$

106

$

351

$

360

See “Considerations Regarding Non-GAAP Financial Measures” of this

press release for important considerations regarding our use of

non-GAAP financial measures. Any differences are a result of

rounding.

Pebblebrook Hotel Trust Same-Property

Statistical Data (Unaudited) Three months

endedJune 30, Six months endedJune 30,

2024

2023

2024

2023

Same-Property Occupancy

76.6

%

73.8

%

68.9

%

66.6

%

2024 vs. 2023 Increase/(Decrease)

3.8

%

3.5

%

Same-Property ADR

$304.94

$311.03

$302.45

$307.88

2024 vs. 2023 Increase/(Decrease)

(2.0

%)

(1.8

%)

Same-Property RevPAR

$233.51

$229.56

$208.46

$205.11

2024 vs. 2023 Increase/(Decrease)

1.7

%

1.6

%

Same-Property Total RevPAR

$356.72

$348.04

$319.64

$313.74

2024 vs. 2023 Increase/(Decrease)

2.5

%

1.9

%

Notes:

For the three months ended June 30, 2024

and 2023, the above table of hotel operating statistics includes

information from all hotels owned as of June 30, 2024, except for

the following: • LaPlaya Beach Resort & Club is excluded due to

its closure following Hurricane Ian. • Newport Harbor Island Resort

is excluded due to its redevelopment. For the six months ended June

30, 2024 and 2023, the above table of hotel operating statistics

includes information from all hotels owned as of June 30, 2024,

except for the following: • LaPlaya Beach Resort & Club is

excluded from Q1 and Q2 due to its closure following Hurricane Ian.

• Newport Harbor Island Resort is excluded from Q1 and Q2 due to

its redevelopment. These hotel results for the respective periods

may include information reflecting operational performance prior to

the Company's ownership of the hotels. Any differences are a result

of rounding. The information above has not been audited and is

presented only for comparison purposes.

Pebblebrook Hotel Trust Same-Property

Statistical Data - by Market (Unaudited)

Three months endedJune 30, Six months endedJune

30,

2024

2024

Same-Property RevPAR variance to 2023: Other Resort Markets

14.4

%

2.9

%

San Diego

10.5

%

10.2

%

Boston

5.2

%

5.2

%

Washington DC

4.0

%

5.0

%

Chicago

0.4

%

(1.0

%)

Los Angeles

(3.3

%)

(1.3

%)

San Francisco

(4.1

%)

(0.6

%)

Southern Florida/Georgia

(5.0

%)

(4.6

%)

Portland

(21.8

%)

(24.0

%)

Urban

2.6

%

3.4

%

Resorts

(0.7

%)

(2.6

%)

Notes:

For the three months ended June 30, 2024,

the above table of hotel operating statistics includes information

from all hotels owned as of June 30, 2024, except for the

following: • LaPlaya Beach Resort & Club is excluded due to its

closure following Hurricane Ian. • Newport Harbor Island Resort is

excluded due to its redevelopment. For the six months ended June

30, 2024, the above table of hotel operating statistics includes

information from all hotels owned as of June 30, 2024, except for

the following: • LaPlaya Beach Resort & Club is excluded from

Q1 and Q2 due to its closure following Hurricane Ian. • Newport

Harbor Island Resort is excluded from Q1 and Q2 due to its

redevelopment. Other Resort Markets includes: Columbia River Gorge,

WA and Santa Cruz, CA. These hotel results for the respective

periods may include information reflecting operational performance

prior to the Company's ownership of the hotels. Any differences are

a result of rounding. The information above has not been audited

and is presented only for comparison purposes.

Pebblebrook Hotel Trust Hotel Operational Data

Schedule of Same-Property Results ($ in thousands)

(Unaudited) Three months endedJune 30, Six

months endedJune 30,

2024

2023

2024

2023

Same-Property Revenues: Room

$

244,016

$

239,675

$

435,571

$

425,849

Food and beverage

92,234

88,471

165,383

160,949

Other

36,521

35,230

66,938

64,599

Total hotel revenues

372,771

363,376

667,892

651,397

Same-Property Expenses: Room

$

62,932

$

61,518

$

117,075

$

114,289

Food and beverage

65,102

63,613

121,534

118,417

Other direct

8,058

8,342

15,170

15,846

General and administrative

29,646

29,128

55,960

55,209

Information and telecommunication systems

5,100

5,029

10,119

9,927

Sales and marketing

27,387

26,682

52,121

50,174

Management fees

10,972

10,716

18,831

18,742

Property operations and maintenance

13,113

13,175

25,562

25,436

Energy and utilities

10,451

9,256

20,392

18,997

Property taxes

8,547

13,692

25,856

28,933

Other fixed expenses

14,219

14,561

28,247

26,585

Total hotel expenses

255,527

255,712

490,867

482,555

Same-Property EBITDA

$

117,244

$

107,664

$

177,025

$

168,842

Same-Property EBITDA Margin

31.5

%

29.6

%

26.5

%

25.9

%

Notes: For the three

months ended June 30, 2024 and 2023, the above table of hotel

operating statistics includes information from all hotels owned as

of June 30, 2024, except for the following:• LaPlaya Beach Resort

& Club is excluded due to its closure following Hurricane Ian.•

Newport Harbor Island Resort is excluded due to its

redevelopment.For the six months ended June 30, 2024 and 2023, the

above table of hotel operating statistics includes information from

all hotels owned as of June 30, 2024, except for the following:•

LaPlaya Beach Resort & Club is excluded from Q1 and Q2 due to

its closure following Hurricane Ian.• Newport Harbor Island Resort

is excluded from Q1 and Q2 due to its redevelopment.These hotel

results for the respective periods may include information

reflecting operational performance prior to the Company's ownership

of the hotels. Any differences are a result of rounding.The

information above has not been audited and is presented only for

comparison purposes.

Pebblebrook Hotel Trust Historical

Operating Data ($ in millions except ADR and RevPAR

data) (Unaudited) Historical Operating

Data: First Quarter Second Quarter Third

Quarter Fourth Quarter Full Year

2019

2019

2019

2019

2019

Occupancy

74%

86%

86%

77%

81%

ADR

$251

$275

$272

$250

$263

RevPAR

$186

$236

$234

$192

$212

Hotel Revenues

$294.3

$375.5

$372.5

$318.8

$1,361.0

Hotel EBITDA

$74.2

$132.7

$126.5

$84.9

$418.3

Hotel EBITDA Margin

25.2%

35.3%

34.0%

26.6%

30.7%

First Quarter Second Quarter Third

Quarter Fourth Quarter Full Year

2023

2023

2023

2023

2023

Occupancy

59%

73%

75%

64%

68%

ADR

$303

$312

$312

$296

$306

RevPAR

$177

$229

$235

$188

$208

Hotel Revenues

$290.2

$372.1

$383.0

$320.3

$1,365.7

Hotel EBITDA

$59.1

$110.5

$111.9

$67.7

$349.1

Hotel EBITDA Margin

20.4%

29.7%

29.2%

21.1%

25.6%

First Quarter Second Quarter

2024

2024

Occupancy

60%

76%

ADR

$299

$306

RevPAR

$179

$232

Hotel Revenues

$295.1

$380.5

Hotel EBITDA

$58.4

$118.9

Hotel EBITDA Margin

19.8%

31.2%

Notes: These historical hotel

operating results include information for all of the hotels the

Company owned as of June 30, 2024, as if they were owned as of

January 1, 2019, except for LaPlaya Beach Resort & Club which

is excluded from all time periods due to its closure following

Hurricane Ian. These historical operating results include periods

prior to the Company's ownership of the hotels. The information

above does not reflect the Company's corporate general and

administrative expense, interest expense, property acquisition

costs, depreciation and amortization, taxes and other

expenses.These hotel results for the respective periods may include

information reflecting operational performance prior to the

Company's ownership of the hotels. Any differences are a result of

rounding.The information above has not been audited and is

presented only for comparison purposes.

Pebblebrook Hotel

Trust 2024 Same-Property Inclusion Reference Table

Hotels Q1 Q2 Q3 Q4

LaPlaya Beach Resort & Club Newport Harbor Island Resort X

Notes: A property marked with

an "X" in a specific quarter denotes that the same-property

operating results of that property are included in the

Same-Property Statistical Data and in the Schedule of Same-Property

Results.The Company's estimates and assumptions for 2024

Same-Property RevPAR, RevPAR Growth, Total Revenue Growth, Total

Expense Growth, Hotel EBITDA and Hotel EBITDA growth include all of

the hotels the Company owned as of June 30, 2024, except for the

following:• LaPlaya Beach Resort & Club is excluded from all

quarters due to its closure following Hurricane Ian.• Newport

Harbor Island Resort is excluded from Q1, Q2 and Q4 due to its

redevelopment.Operating statistics and financial results may

include periods prior to the Company's ownership of the hotels.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240724034441/en/

Raymond D. Martz, Co-President and Chief Financial Officer,

Pebblebrook Hotel Trust - (240) 507-1330 For additional information

or to receive press releases via email, please visit

www.pebblebrookhotels.com

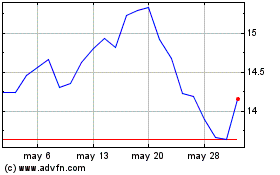

Pebblebrook Hotel (NYSE:PEB)

Gráfica de Acción Histórica

De Oct 2024 a Nov 2024

Pebblebrook Hotel (NYSE:PEB)

Gráfica de Acción Histórica

De Nov 2023 a Nov 2024