Pebblebrook Hotel Trust Announces Closing of Private Placement of $400 Million of 6.375% Senior Notes Due 2029

03 Octubre 2024 - 3:15PM

Business Wire

Pebblebrook Hotel Trust (NYSE: PEB) (the “Company”) today

announced that its operating partnership, Pebblebrook Hotel, L.P.

(the “Operating Partnership”), and a wholly owned subsidiary of the

Operating Partnership, PEB Finance Corp. (together with the

Operating Partnership, the “Issuers”), closed on the private

placement (the “Private Placement”) of $400 million aggregate

principal amount of their 6.375% Senior Notes due 2029 (the

“Notes”). The Notes are senior unsecured obligations of the Issuers

and are initially fully and unconditionally guaranteed by the

Company and the Operating Partnership’s subsidiaries that guarantee

the existing credit facilities of the Operating Partnership.

The Operating Partnership used approximately $353.3 million of

the net proceeds from the offering to pay down three of the

Operating Partnership’s unsecured term loans. As a result of the

repayments, the remaining outstanding principal amounts of the

Operating Partnership’s term loans maturing in October 2024,

October 2025 and October 2027 are $0, $200.0 million and $360.0

million, respectively. Following the repayments, the Company has no

meaningful debt maturities until December 2026.

The Notes and the related guarantees have not been and will not

be registered under the Securities Act of 1933, as amended (the

“Securities Act”), any state securities laws or the securities laws

of any other jurisdiction. The Notes were not offered or sold in

the United States or to U.S. persons absent an exemption from, or

in a transaction not subject to, the registration requirements of

the Securities Act. The Notes were offered and sold only to persons

reasonably believed to be “qualified institutional buyers” pursuant

to Rule 144A under the Securities Act and to certain non-U.S.

persons in offshore transactions outside the United States pursuant

to Regulation S under the Securities Act. This press release is

neither an offer to sell nor a solicitation of an offer to buy the

Notes or any other securities and shall not constitute an offer to

sell or a solicitation of an offer to buy, or a sale of, the Notes

or any other securities in any jurisdiction in which such offer,

solicitation or sale would be unlawful.

About Pebblebrook Hotel

Trust

Pebblebrook Hotel Trust (NYSE: PEB) is a publicly traded real

estate investment trust (“REIT”) and the largest owner of urban and

resort lifestyle hotels in the United States. The Company owns 46

hotels, totaling approximately 12,000 guest rooms across 13 urban

and resort markets. For more information, visit

www.pebblebrookhotels.com and follow @PebblebrookPEB.

For additional information or to receive press

releases via email, please visit www.pebblebrookhotels.com

View source

version on businesswire.com: https://www.businesswire.com/news/home/20241003174652/en/

Raymond D. Martz, Co-President and Chief Financial Officer,

Pebblebrook Hotel Trust - (240) 507-1330

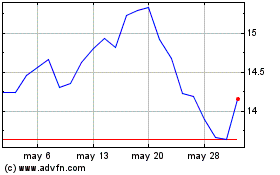

Pebblebrook Hotel (NYSE:PEB)

Gráfica de Acción Histórica

De Oct 2024 a Nov 2024

Pebblebrook Hotel (NYSE:PEB)

Gráfica de Acción Histórica

De Nov 2023 a Nov 2024