Pebblebrook Hotel Trust Announces Proposed Offering of Senior Notes

23 Septiembre 2024 - 6:54AM

Business Wire

Pebblebrook Hotel Trust (NYSE: PEB) (the “Company”) today

announced that its operating partnership, Pebblebrook Hotel, L.P.

(the “Operating Partnership”), and a wholly owned subsidiary of the

Operating Partnership, PEB Finance Corp.(together with the

Operating Partnership, the “Issuers”), intend to offer, in a

private placement, subject to market conditions and other factors,

$350 million aggregate principal amount of senior notes due 2029

(the “Notes”). The Notes will be senior unsecured obligations of

the Issuers and will initially be fully and unconditionally

guaranteed by the Company and the Operating Partnership’s

subsidiaries that guarantee the existing credit facilities of the

Operating Partnership. The Operating Partnership intends to use the

net proceeds from the offering as follows: (i) with at least $253.0

million, to pay down in whole or in part one or more of the

Operating Partnership’s unsecured term loans and (ii) with the

balance, which may be up to $87.4 million, to pay down part of one

or more of the Operating Partnership’s other unsecured term loans

and/or repurchase a portion of the convertible senior notes of the

Company.

The Notes and the related guarantees have not been and will not

be registered under the Securities Act of 1933, as amended (the

“Securities Act”), any state securities laws or the securities laws

of any other jurisdiction. The Notes may not be offered or sold in

the United States or to U.S. persons absent registration or

pursuant to an exemption from, or in a transaction not subject to,

registration. The Notes will be offered and sold only to persons

reasonably believed to be “qualified institutional buyers” pursuant

to Rule 144A under the Securities Act and to certain non-U.S.

persons in offshore transactions outside the United States pursuant

to Regulation S under the Securities Act. This press release is

neither an offer to sell nor a solicitation of an offer to buy the

Notes or any other securities and shall not constitute an offer to

sell or a solicitation of an offer to buy, or a sale of, the Notes

or any other securities in any jurisdiction in which such offer,

solicitation or sale would be unlawful.

This press release contains certain “forward-looking” statements

within the meaning of the Private Securities Litigation Reform Act

of 1995 and other federal securities laws, including those related

to the offering of Notes, the use of proceeds therefrom and whether

or not the Issuers will consummate the offering. Forward-looking

statements are generally identifiable by use of forward-looking

terminology such as “may,” “will,” “should,” “potential,” “intend,”

“expect,” “seek,” “anticipate,” “estimate,” “approximately,”

“believe,” “could,” “project,” “predict,” “forecast,” “continue,”

“assume,” “plan,” references to “outlook” or other similar words or

expressions. These forward-looking statements are subject to

various risks and uncertainties, many of which are beyond the

Company’s control, which could cause actual results to differ

materially from such statements.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240922918989/en/

Raymond D. Martz, Co-President and Chief Financial Officer,

Pebblebrook Hotel Trust - (240) 507-1330

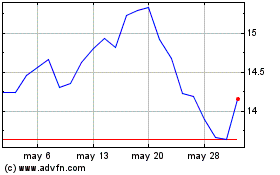

Pebblebrook Hotel (NYSE:PEB)

Gráfica de Acción Histórica

De Mar 2025 a Abr 2025

Pebblebrook Hotel (NYSE:PEB)

Gráfica de Acción Histórica

De Abr 2024 a Abr 2025