THOR

Index Rotation ETF

THIR

SUMMARY

PROSPECTUS

September

1, 2024

Before

you invest, you may want to review the Fund’s Prospectus, which contains more information about the Fund and its risks. The Fund’s

Prospectus and Statement of Additional Information, both dated September 1, 2024, are incorporated by reference into this Summary Prospectus.

You can obtain these documents and other information about the Fund online at www.thorfunds.com. You can also obtain these documents

at no cost by calling 1-800-974- 6964 or by sending an email request to Fulfillment@ultimusfundsolutions.com. Shares of the Fund

are listed and traded on the NYSE (the “Exchange”).

Investment

Objective: The Fund seeks to provide investment results that generally correspond, before fees and expenses, to the performance of

the THOR SDQ Rotation Index (the “Index”).

Fees

and Expenses of the Fund: This table describes the fees and expenses that you may pay if you buy, hold and sell shares of the Fund.

You may pay other fees, such as brokerage commissions and other fees to financial intermediaries, which are not reflected in the tables

and examples below.

| Annual

Fund Operating Expenses |

|

| (expenses

that you pay each year |

|

| as

a percentage of the value of your investment) |

|

| Management

Fees |

0.55% |

| Distribution

and Service (12b-1) Fees |

0.00% |

| Other

Expenses(1) |

0.00% |

| Acquired

Fund Fees and Expenses(1)(2) |

0.15% |

| Total

Annual Fund Operating Expenses(1) |

0.70% |

| (1) | Estimated

for the current fiscal year. |

| (2) | Acquired

Fund Fees and Expenses are the indirect costs of investing in other investment companies.

The operating expenses in this fee table will not correlate to the expense ratio in the Fund’s

financial highlights because the financial statements include only the direct operating expenses

incurred by the Fund. |

Example:

This Example is intended to help you compare the cost of investing in the Fund with the cost of investing in other mutual funds.

The

Example assumes that you invest $10,000 in the Fund for the time periods indicated and then redeem all of your shares at the end of those

periods. The Example also assumes that your investment has a 5% return each year and that the Fund’s operating expenses remain

the same. Although your actual costs may be higher or lower, based upon these assumptions your costs would be:

Portfolio

Turnover: The Fund pays transaction costs, such as commissions, when it buys and sells securities (or “turns over” its

portfolio). A higher portfolio turnover rate may indicate higher transaction costs and may result in higher taxes when Fund shares are

held in a taxable account. These costs, which are not reflected in annual fund operating expenses or in the Example, affect the Fund’s

performance. The Fund has not commenced operations as of the date of this Prospectus.

Principal

Investment Strategies: The Fund seeks to achieve its investment objective by investing its total assets in securities included in

the Index. The rules-based index is comprised of U.S. index exchange traded funds (“ETFs”). The primary goal of the Index

is to gain exposure to U.S. large cap equities while attempting to lower volatility by avoiding indexes and ETFs that are currently in

a down trending cycle, in the view of THOR Analytics, LLC dba THOR Financial Technologies, LLC (the “Adviser”).

The

Index measures the price trends and historic volatility of three U.S. index ETFs (the “Select List”) over the medium term

(three to six months). The Select List includes the S&P 500 Index, Dow Jones Industrial Index, and the NASDAQ 100 Index. The Index

uses a proprietary algorithm weekly to evaluate the Select List to determine whether the security on the Select List is currently “risk

on” (buy) or “risk off” (sell). Only securities with a risk on signal are included in the Index.

| ● | If

all three indexes are risk on, the indexes are equally weighted, and the Index consists of

a 33.3% allocation to each index. |

| ● | If

an index is risk off, the Index is equally weighted to the risk on indexes, with a maximum

allocation of 50% to each index. |

| ● | If

one index is risk on and two indexes are risk off, the Index is allocated 50% to the risk

on index and 50% to cash. |

| ● | The

balance of the Index is allocated to one or more U.S. money market funds, cash alternative,

or other ETFs. |

| ● | The

Index may consist 100% of U.S. money market funds, cash alternatives or other ETFs during

periods of sustained market declines. |

The

Index is owned and was developed by the Adviser. The Adviser has retained Solactive AG (the “Index Calculation Agent”) to

calculate and maintain the Index. The Index follows a weekly reconstitution and rebalancing schedule. The Index’s periodic rebalance

and reconstitution schedule may cause the Fund to experience a higher rate of portfolio turnover. The Adviser will use a replication

strategy to track the Index, rather than a sampling approach, meaning the Fund will generally invest in all of the component securities

of the Index in the same approximate proportions as in the Index.

Principal

Investment Risks: The following describes the risks the Fund bears directly or indirectly through investments in ETFs (“Underlying

Funds”). As with all funds, there is the risk that you could lose money through your investment in the Fund. Many factors affect

the Fund’s net asset value (“NAV”) and performance.

Allocation

Risk. If the Fund’s strategy for allocating assets among different indexes does not work as intended, the Fund may not achieve

its objective or may underperform other funds with the same or similar investment strategy.

Authorized

Participant Risk. Only an Authorized Participant (“AP”) may engage in creation or redemption transactions directly with

the Fund. The Fund has a limited number of institutions that may act as APs on an agency basis (i.e., on behalf of other market participants).

To the extent that APs exit the business or are unable to proceed with creation or redemption orders with respect to the Fund and no

other AP is able to step forward to create or redeem Creation Units, Fund shares may be more likely to trade at a premium or discount

to net asset value and possibly face trading halts or delisting. AP concentration risk may be heightened for ETFs that invest in non-U.S.

securities or other securities or instruments that have lower trading volumes.

Cash

or Cash Equivalents Risk. At any time, the Fund may have significant investments in cash or cash equivalents. When a substantial

portion of a portfolio is held in cash or cash equivalents, there is the risk that the value of the cash account, including interest,

will not keep pace with inflation, thus reducing purchasing power over time.

ETF

Structure Risks. The Fund is structured as an ETF, and as a result, is subject to the special risks, including:

| ○ | Not

Individually Redeemable. Shares of the Fund (“Shares”) are not individually

redeemable and may be redeemed by the Fund at NAV only in large blocks known as “Creation

Units.” You may incur brokerage costs purchasing enough Shares to constitute a Creation

Unit. |

| ○ | Trading

Issues. An active trading market for the Shares may not be developed or maintained. Trading

in Shares on the New York Stock Exchange (“NYSE” or the “Exchange”)

may be halted due to market conditions or for reasons that, in the view of the Exchange,

make trading in Shares inadvisable, such as extraordinary market volatility. |

There

can be no assurance that Shares will continue to meet the listing requirements of the Exchange. If the Shares are traded outside a collateralized

settlement system, the number of financial institutions that can act as APs that can post collateral on an agency basis is limited, which

may limit the market for the Shares.

| ○ | Market

Price Variance Risk. The market prices of Shares will fluctuate in response to changes

in NAV and supply and demand for Shares and will include a “bid-ask spread” charged

by the exchange specialists, market makers or other participants that trade the particular

security. There may be times when the market price and the NAV vary significantly. This means

that Shares may trade at a discount to NAV. |

Index

Calculation Agent Risk. The Fund seeks to achieve returns that generally correspond, before fees and expenses, to the performance

of its Index, as published by its Index Calculation Agent. There is no assurance that the Index Calculation Agent will compile the index

accurately, or that the index will be determined, composed or calculated accurately. While the Adviser gives descriptions of what the

index is designed to achieve, the Index Calculation Agent does not provide any warranty or accept any liability in relation to the quality,

accuracy or completeness of data in the index, and does not guarantee that its index will be in line with its methodology.

Index

Tracking Risk. The Fund’s return may not match or achieve a high degree of correlation with the return of the Index.

Large

Capitalization Stock Risk. The Fund will invest in large capitalization companies. The securities of such companies may underperform

other segments of the market because such companies may be less responsive to competitive challenges and opportunities and may be unable

to attain high growth rates during periods of economic expansion.

Limited

History of Operations Risk. The Fund has a limited history of operations for investors to evaluate.

Market

Risk. The increasing interconnectivity between global economies and financial markets increases the likelihood that events or conditions

in one region or financial market may adversely impact issuers in a different country, region or financial market. Securities in the

Fund’s portfolio may underperform due to inflation (or expectations for inflation), interest rates, global demand for particular

products or resources, natural disasters, climate change and climate-related events, pandemics, epidemics, terrorism, military conflicts,

geopolitical events, regulatory events and governmental or quasi-governmental actions. The occurrence of global events similar to those

in recent years may result in market volatility and may have long term effects on the U.S. financial market.

Models

and Data Risk. The Index relies heavily on a proprietary algorithm as well as data and information supplied by third parties that

are utilized by such model. To the extent the algorithm does not perform as designed or as intended, including accurately measuring historic

price trends and volatility, the Fund’s strategy may not be successfully implemented and the Fund may lose value.

Passive

Investment Risk. The Fund is not actively managed and, therefore, the Fund would not sell a security due to current or projected

underperformance of the security, industry, or sector unless that security is removed from the Index or selling the security is otherwise

required upon a rebalancing of the Index.

Portfolio

Turnover Risk. The Fund may buy and sell investments frequently if the Index constituents change. Such a strategy often involves

higher transaction costs, including brokerage commissions, and may increase the amount of capital gains (in particular, short-term gains)

realized by the Fund. Shareholders may pay tax on such capital gains.

Securities

Market Risk. The value of securities owned by the Fund may go up or down, sometimes rapidly or unpredictably, due to factors affecting

particular companies or the securities markets generally. A general downturn in the securities market may cause multiple asset classes

to decline in value simultaneously.

Smaller

Fund Risk. A smaller fund is subject to the risk that its performance may not represent how the fund is expected to or may perform

in the long-term. There can be no assurance that the Fund will achieve an economically viable size, in which case it could ultimately

liquidate. In a liquidation, shareholders of the Fund will receive an amount equal to the Fund’s NAV, after deducting the costs

of liquidation. Receipt of a liquidation distribution may have negative tax consequences for shareholders.

Underlying

Funds Risk. Underlying Funds in which the Fund invests are subject to investment advisory and other expenses, which will be indirectly

paid by the Fund. As a result, the cost of investing in the Fund is higher than the cost of investing directly in the Underlying Funds

and may be higher than other funds that invest directly in stocks and bonds. Through its investments in Underlying Funds, the Fund is

subject to the risks associated with the Underlying Funds’ investments. The U.S. money market funds in which the Fund invests seek

to maintain a stable NAV, but money market funds are subject to credit, market and other risks, and are not guaranteed.

Performance:

Because the Fund has only recently commenced investment operations, no performance information is presented for the Fund at this

time. In the future, performance information will be presented in this section of this Prospectus. In addition, shareholder reports containing

financial and performance information will be mailed to shareholders semi-annually. Updated performance information is available at no

cost by visiting www.thorfunds.com or by calling 1-800-974-6964.

Investment

Adviser: THOR Financial Technologies, LLC (the “Adviser”)

Portfolio

Managers: Bradley Roth and Cameron Roth have served the Fund as a Portfolio Manager since August 2024.

Purchase

and Sale of Fund Shares: The Fund issues and redeems Shares at NAV only in large blocks of 10,000 Shares (each block of Shares is

called a “Creation Unit”). Creation Units are issued and redeemed for cash and/or in-kind for securities. Individual Shares

may only be purchased and sold in secondary market transactions through brokers. Except when aggregated in Creation Units, the Shares

are not redeemable securities of the Fund.

Shares

of the Fund are listed for trading on the Exchange and trade at market prices rather than NAV. Shares of the Fund may trade at a price

that is greater than, at, or less than NAV.

Tax

Information: The Fund’s distributions generally will be taxable as ordinary income or long-term capital gains. A sale of Shares

may result in capital gain or loss.

Payments

to Broker-Dealers and Other Financial Intermediaries: If you purchase the Fund through a broker-dealer or other financial intermediary

(such as a bank), the Fund and its related companies may pay the intermediary for the sale of Fund shares and related services. These

payments may create a conflict of interest by influencing the broker-dealer or other intermediary and your salesperson to recommend the

Fund over another investment. Ask your salesperson or visit your financial intermediary’s website for more information.

(This

Page Intentionally Left Blank)

(This

Page Intentionally Left Blank)

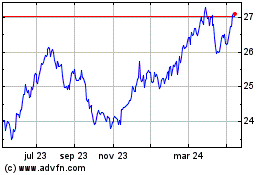

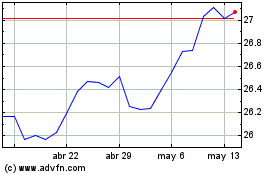

THOR Equal Weight Low Vo... (NYSE:THLV)

Gráfica de Acción Histórica

De Nov 2024 a Dic 2024

THOR Equal Weight Low Vo... (NYSE:THLV)

Gráfica de Acción Histórica

De Dic 2023 a Dic 2024