Intermap Technologies (TSX: IMP; OTCQB: ITMSF) (“Intermap” or the

“Company”), a global leader in 3D geospatial products and

intelligence solutions, announces a second amendment to the terms

of its offering of Class "A" common shares of the Company (“Common

Shares”), previously announced on July 3, 2024 and initially

amended on July 19, 2024, as a result of high demand (as further

amended as described herein, the “Offering”). Intermap closed the

second tranche of the Offering on July 26, 2024, which included the

issuance of 2,085,000 Common Shares at a price of CAD$0.45 per

Common Share for aggregate gross proceeds of CAD$938,250.

The previously announced closing of the first

tranche of the Offering included the issuance of 2,770,000 Common

Shares at a price of CAD$0.45 per Common Share for aggregate gross

proceeds of CAD$1,246,500. To date, the Company has issued an

aggregate of 4,855,000 Shares under the Offering for aggregate

gross proceeds of CAD$2,184,750. Due to high demand, the Company is

increasing the total maximum number of Common Shares to be offered

by 482,778 additional Common Shares, for an aggregate maximum under

the Offering of up to 7,149,444 Common Shares when combined with

the Common Shares issued under the first and second tranches. The

additional Common Shares are being offered at the same price of

CAD$0.45 per Common Share, for maximum gross proceeds under the

Offering of up to approximately CAD$3,217,250. Upon issuance, all

of the Common Shares issued under the Offering will rank pari passu

in all respects with the Company’s existing issued Common

Shares.

The Company intends to close the oversubscribed

third and final tranche of the Offering before August 9, 2024. The

closing of each tranche of the Offering, including the third

tranche, is subject to certain conditions including, but not

limited to, the receipt of all necessary regulatory and other

approvals.

In connection with this Offering, Intermap has

engaged a third-party finder (the “Finder”) to conduct a best

efforts private placement of the Common Shares. The Finder will

receive the same fee of: (i) an aggregate cash fee equal to 1% of

the gross proceeds of the Offering; and (ii) an issuance of Common

Shares equal to 6% of the Common Shares placed by the Finder under

Offering.

The Company intends to use the aggregate net

proceeds of the Offering for the execution of contracts and for

working capital. Primarily, the capital will be used to execute on

its contract with the government of Indonesia to map the island of

Sulawesi, representing 10% of Indonesia land mass, as well as on a

renewed and expanded contract with the U.S. Air Force. The net

proceeds of the Offering may also be used in connection with other

Southeast Asian contract awards as well as a major renewal and

expansion of a global insurance client agreement. Further details

on the use of proceeds are set forth in the Second Amended Offering

Document (as defined herein).

“Our $20 million contract with the Indonesian government is the

first phase of creating a digital basemap to help the country

secure its social, environmental and economic future,” said Patrick

A. Blott, Intermap Chairman and CEO. “We have deployed to Indonesia

to begin work on this first phase and expect to be awarded

additional contracts to map the remaining 90% of Indonesia’s land

over the next few years. Part of the use of proceeds from this

offering will help us execute against phase one as well as other

projects in our sales and deployment pipelines. On behalf of the

Company, I’d like to thank new and existing shareholders for their

support.”

Subject to compliance with applicable regulatory

requirements, the Common Shares will be offered for sale to

purchasers resident in Canada (except Quebec) pursuant to the

listed issuer financing exemption under Part 5A of National

Instrument 45-106 – Prospectus Exemptions (the “Listed Issuer

Financing Exemption”) and to purchasers resident in the United

States by way of private placement pursuant to an exemption from

the registration requirements under the United States Securities

Act of 1933, as amended (the “1933 Act”). Because the Offering is

being completed pursuant to the Listed Issuer Financing Exemption,

the securities issued in Canada under the Offering will not be

subject to a hold period in Canada pursuant to applicable Canadian

securities laws.

There is an amended offering document related to

this Offering (the “Second Amended Offering Document”) that can be

accessed under the Company’s profile at www.sedarplus.ca and on

Intermap’s website at www.intermap.com. Prospective investors

should read this Second Amended Offering Document before making an

investment decision.

The securities described herein have not been,

and will not be, registered under the 1933 Act, or any state

securities laws, and accordingly, may not be offered or sold within

the United States except in compliance with the registration

requirements of the 1933 Act and applicable state securities

requirements or pursuant to exemptions therefrom. This news release

shall not constitute an offer to sell or the solicitation of an

offer to buy nor shall there be any sale of the securities in the

United States or in any other jurisdiction in which such offer,

solicitation or sale would be unlawful.

Intermap Reader

Advisory Certain information provided in this news

release, including reference to the availability of proceeds from

the Offering, the Company’s ability to raise up to the maximum

proceeds of the Offering, the use of proceeds of the Offering, the

expectation that the Offering will close and the anticipated timing

thereof, the award of new contracts and contract renewals and the

use of proceeds in the Offering in connection therewith, successful

execution of the Company’s existing contracts and the Company’s

expectations with respect to receiving contracts to map the

remaining 90% of Indonesia’s land mass, constitutes forward-looking

statements. The words “will”, “may”, “intends”, “expected to”,

“anticipate”, “subject to”, “phase” and similar expressions are

intended to identify such forward-looking statements. Although

Intermap believes that these statements are based on information

and assumptions which are current, reasonable and complete, these

statements are necessarily subject to a variety of known and

unknown risks and uncertainties. Intermap’s forward-looking

statements are subject to risks and uncertainties pertaining to,

among other things, cash available to fund operations, availability

of capital, revenue fluctuations, the nature of government

contracts, including changing political circumstances in the

relevant jurisdictions, economic conditions, loss of key customers,

retention and availability of executive talent, competing

technologies, common share price volatility, loss of proprietary

information, software functionality, internet and system

infrastructure functionality, information technology security,

breakdown of strategic alliances, and international and political

considerations, as well as those risks and uncertainties discussed

Intermap’s Annual Information Form for the year ended December 31,

2023 and other securities filings. While the Company makes these

forward-looking statements in good faith, should one or more of

these risks or uncertainties materialize, or should underlying

assumptions prove incorrect, actual results may vary significantly

from those expected. Accordingly, no assurances can be given that

any of the events anticipated by the forward-looking statements

will transpire or occur, or if any of them do so, what benefits

that the Company will derive therefrom. All subsequent

forward-looking statements, whether written or oral, attributable

to Intermap or persons acting on its behalf are expressly qualified

in their entirety by these cautionary statements. The

forward-looking statements contained in this news release are made

as at the date of this news release and the Company does not

undertake any obligation to update publicly or to revise any of the

forward-looking statements made herein, whether as a result of new

information, future events or otherwise, except as may be required

by applicable securities law.

About Intermap

TechnologiesFounded in 1997 and headquartered in Denver,

Colorado, Intermap (TSX: IMP; OTCQB: ITMSF) is a global leader in

geospatial intelligence solutions, focusing on the creation and

analysis of 3D terrain data to produce high-resolution thematic

models. Through scientific analysis of geospatial information and

patented sensors and processing technology, the Company provisions

diverse, complementary, multi-source datasets to enable customers

to seamlessly integrate geospatial intelligence into their

workflows. Intermap’s 3D elevation data and software analytic

capabilities enable global geospatial analysis through artificial

intelligence and machine learning, providing customers with

critical information to understand their terrain environment. By

leveraging its proprietary archive of the world’s largest

collection of multi-sensor global elevation data, the Company’s

collection and processing capabilities provide multi-source 3D

datasets and analytics at mission speed, enabling governments and

companies to build and integrate geospatial foundation data with

actionable insights. Applications for Intermap’s products and

solutions include defense, aviation and UAV flight planning, flood

and wildfire insurance, disaster mitigation, base mapping,

environmental and renewable energy planning, telecommunications,

engineering, critical infrastructure monitoring, hydrology, land

management, oil and gas and transportation.

For more information, please

visit www.intermap.com or

contact:Patrick A. BlottChairman and CEOCEO@intermap.com

+1 (303) 708-0955

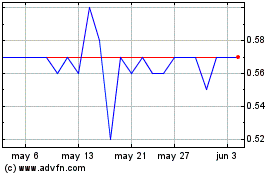

Intermap Technologies (TSX:IMP)

Gráfica de Acción Histórica

De Ene 2025 a Feb 2025

Intermap Technologies (TSX:IMP)

Gráfica de Acción Histórica

De Feb 2024 a Feb 2025