Angkor Signs USD $4.6 Million Earn-In Agreement on Oyadao License

13 Enero 2020 - 7:00AM

Angkor Resources Corp. (TSXV: ANK and OTC: ANKOF) (“Angkor”

or “the Company”) CEO Stephen Burega is pleased to report

that it has signed an Earn-In Agreement on its Oyadao License with

Canadian development company Hommy Oyadao Inc. (“Hommy”) to earn up

to a 70% interest in Angkor’s Oyadao North License in exchange for

payments totalling USD $4.6 million.

AGREEMENT HIGHLIGHTS

- Hommy 5 Resources Inc. will return

any earned interest in Angkor’s Banlung License in return for Hommy

Oyadao Inc. receiving an initial 10% earn-in interest in Oyadao

(see press release dated Sept. 19, 2018).

- With the end of the previous

agreement with Hommy 5 Resources Inc., the Banlung License returns

to being 100% owned by Angkor.

- Hommy may acquire an additional 20%

interest in Oyadao by making an upfront payment to Angkor of USD

$100,000 for past and future work associated with the property, and

by paying to Angkor as operator on or before May 30, 2020, an

additional USD $500,000 to be spent on exploration of Oyadao

North.

- Following that, Hommy will spend a

minimum of USD$ 100,000 a quarter on Oyadao.

- Once Hommy has either spent an

additional USD $4 million on Oyadao in exploration, development and

related statutory fees relating to the License, or has produced

more than 300 ounces of gold per month for six consecutive months

or an aggregate of 2,000 ounces of gold from the property,

whichever is the sooner, then Hommy will be granted a further 40%

Participating Interest, bringing its total interest in Oyadao North

to 70%.

- Should Hommy fail to meet any of

the above milestones, the property will revert to Angkor with no

interest earned by Hommy.

“We are very pleased to be working again with

Hommy,” said Mike Weeks, Executive Chairman of Angkor. “They were

excellent development partners on Banlung. The proximity of Oyadao

to the development at Mesco’s Phum Syarung mine site (see press

release dated June 25, 2018) is of great interest to us both and we

are excited to pursue this initiative together.”

Dr. Adrian G. Mann, director of, and technical

advisor to, Hommy Oyadao Inc., is optimistic about their immediate

exploration plans for Oyadao: “Mesco's Vertical Shaft is about 400

metres from our first drill target which is based on a strong EM

conductor that coincides with the line of strike of their main

vein. It's a modest but aggressive program on which we can

build.”

The Oyadao License is a 222 km2 area near the

Vietnam border, running north and east of Mesco’s Phum Syarung mine

site, the mineral rights of which were sold separately by Angkor to

Mesco in 2013 and licensed in 2016 for $1.8 million US in cash,

with Angkor retaining a sliding scale Net Smelter Return interest

ranging from 2.0% to 7.5% on any gold production, as well as 7.5%

of the value all other metals produced.

ABOUT THE HOMMY GROUP

Hommy Oyadao Inc. and Hommy 5 Resources Inc. are

private companies based in Alberta, Canada. It is a family fund of

Canadian investors experienced in the resource sector.

ABOUT ANGKOR RESOURCES

CORP.

Angkor Resources Corp. is a public company,

listed on the TSX-Venture Exchange, and is a leading mineral

explorer in Cambodia with a large land package. In 2019 it added

Block VIII, a 7,300 square kilometre oil and gas exploration

license in Cambodia, to its exploration portfolio.

CONTACT:

Stephen Burega, CEOTelephone: +1 (647)

515-3734Email:

sb@angkorgold.caWebsite: http://www.angkorgold.ca or follow us

on Twitter @AngkorGold.

Neither TSX Venture Exchange nor its Regulation

Services Provider (as that term is defined in the policies of the

TSX Venture Exchange) accepts responsibility for the adequacy or

accuracy of this release.

Certain of the statements made and information

contained herein may constitute “forward-looking information.” In

particular references to the private placement and future work

programs or expectations on the quality or results of such work

programs are subject to risks associated with operations on the

property, exploration activity generally, equipment limitations and

availability, as well as other risks that we may not be currently

aware of. Accordingly, readers are advised not to place undue

reliance on forward-looking information. Except as required under

applicable securities legislation, the Company undertakes no

obligation to publicly update or revise forward-looking

information, whether as a result of new information, future events

or otherwise.

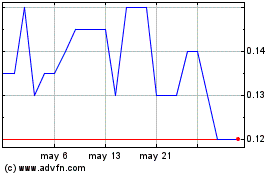

Angkor Resources (TSXV:ANK)

Gráfica de Acción Histórica

De Oct 2024 a Nov 2024

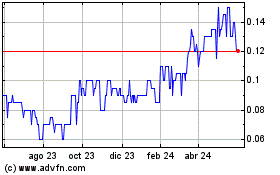

Angkor Resources (TSXV:ANK)

Gráfica de Acción Histórica

De Nov 2023 a Nov 2024