Reunion Gold Corporation (TSXV: RGD; OTCQB: RGDFF) (the "Company")

is pleased to announce additional drill results from its Oko West

project in Guyana. Results from an additional 38 diamond drill

holes (totalling 14,965 m) include additional diamond drilling

within the Block 4 zone, extending the known extent of

mineralization down dip and along strike, while also demonstrating

the potential for higher grade, structurally controlled shoots

within the broader mineralized system.

Drilling within Block 4 (Figure 1 and Figure 4),

designed to provide a sufficient drill density for a maiden

resource estimate in mid-2023, continues to intersect highly

encouraging intervals as shown in Table 1 below. Highlights include

39.5 m @ 11.04 g/t Au in D-185,

37.0 m @ 4.66 g/t Au in D-182, 107.3m @

2.74 g/t Au in D-187 and 86.0 m @ 2.75 g/t

Au in D-176, all using a 0.3 g/t Au cut-off. Due to the

commencement of deeper drill holes with a more acute angle of

intersection of the drill hole to the plane of mineralization, the

Company is now reporting Estimated True Thickness (ETT) for all

significant intervals within and near Block 4.

Table 1 – Selected significant intervals

from Block 4 resource definition drill holes.

|

Hole ID |

Block |

From(m) |

To(m) |

DownholeInterval(m) |

Au Grade(g/t) |

Grade x Downhole Int.(gm/t) |

ETT*(m) |

Cutoff**(Au g/t) |

|

OKWD22-176 |

4 |

293 |

379 |

86.0 |

2.75 |

237 |

68.6 |

0.3 |

|

inc |

|

335.1 |

358 |

22.9 |

7.36 |

169 |

18.3 |

1.5 |

|

inc |

|

370 |

379 |

9.0 |

4.01 |

36 |

7.2 |

1.5 |

|

OKWD22-182 |

4 |

386 |

430.6 |

44.6 |

0.75 |

33 |

37.4 |

0.3 |

|

and |

|

441 |

478 |

37.0 |

4.66 |

172 |

31.3 |

0.3 |

|

inc |

|

441 |

446.3 |

5.3 |

7.40 |

39 |

4.5 |

1.5 |

|

inc |

|

449 |

478 |

29.0 |

4.51 |

131 |

24.6 |

1.5 |

|

OKWD22-185 |

4 |

243.4 |

316.2 |

72.8 |

1.67 |

121 |

61.8 |

0.3 |

|

and |

|

328.15 |

367.6 |

39.5 |

11.04 |

436 |

34.1 |

0.3 |

|

inc |

|

328.15 |

345.55 |

17.4 |

3.25 |

57 |

15.0 |

1.5 |

|

inc |

|

347.6 |

365.2 |

17.6 |

21.32 |

375 |

15.2 |

1.5 |

|

OKWD22-187 |

4 |

418.56 |

525.82 |

107.3 |

2.74 |

294 |

87.3 |

0.3 |

|

inc |

|

445.71 |

450.6 |

4.9 |

2.67 |

13 |

4.0 |

1.5 |

|

inc |

|

456.84 |

462.44 |

5.6 |

2.11 |

12 |

4.5 |

1.5 |

|

inc |

|

465.19 |

506.16 |

41.0 |

5.71 |

234 |

33.5 |

1.5 |

|

OKWD22-195 |

4 |

405.6 |

437.3 |

31.7 |

0.75 |

24 |

24.1 |

0.3 |

|

and |

|

457 |

524.6 |

67.6 |

2.83 |

191 |

51.7 |

0.3 |

|

inc |

|

475.7 |

485 |

9.3 |

5.23 |

49 |

7.1 |

1.5 |

|

inc |

|

489 |

497 |

8.0 |

3.73 |

30 |

6.1 |

1.5 |

|

inc |

|

501.2 |

509.5 |

8.3 |

5.47 |

45 |

6.3 |

1.5 |

* Estimated True Thickness ("ETT") based on an

average dip / dip direction of -65° / 095° to represent the

orientation of the mineralized zone in Block 4.** Significant

intervals calculated using a 0.3 g/t Au cut-off, 10m minimum length

and 10m maximum consecutive internal waste. Included intervals

calculated using a 1.5 g/t Au cut-off, 3m minimum length and a 2m

maximum consecutive internal waste.

Rick Howes, the Company’s newly appointed

President and CEO, commented, “I am thrilled to be joining the

Reunion team to help advance this very exciting new discovery. We

continue to have success through the drill bit, which is showing

significant growth and continuity of the mineralized envelope. The

intercepts in holes D-185 and D-182 indicate the potential for

higher grade shoots within this mineralized envelope. The two deep

holes, D-200 and D-203, show the potential to extend the

mineralization by over 400 meters to a depth of almost 1 km. This

will be an exciting year for the Company as we continue to expand

the resource, move towards a maiden resource estimate and complete

a PEA study of the Oko West project.”

He added, “In striving to achieve a more

sustainable project, we intend to evaluate new and innovative

approaches. One of the new technologies we are evaluating with

Instream Energy is run-of-river hydro power generation as a

potential green energy source for the project. I look forward to

engaging with all stakeholders on this very exciting journey to

create a project with a positive social and economic impact in an

environmentally and socially responsible way.”

The Company continues to intersect higher grade

intervals within the current Block 4 drill program and believes

these zones relate to potential higher-grade and structurally

controlled shoots. The narrower but higher-grade zones intersected

to date demonstrate the potential to define mineralized volumes at

a significantly higher cut-off, in turn allowing for exploration

upside within deeper portions of Block 4. Intersects from this

release that highlight these zones include 17.6 m @ 21.32

g/t Au in hole D-185, 41.0 m @ 5.71 g/t

Au in hole D-187 and 22.9 m @ 7.36 g/t Au

in hole D-176. The Company believes that such higher-grade zones

may be controlled by the intersection of two local foliations,

resulting in potential steep northerly dipping intersection

lineations.

Two drill holes, D-200 and D-203, (shown

in Figure 1 and Figure 4) targeted the deeper extension of

Block 4 and each encountered broad zones of mineralization,

extending the known down-dip length of mineralization by over 400 m

from the deepest previously reported drilling (to 970 m below

surface). Significant intervals are listed in Table 2 below and

include 20.6 m @ 3.03 g/t Au (13.3 m ETT) in hole

D-203 (shown in cross section in Figure 2).

Table 2 – Significant intervals from

drill holes D-200 and D-203

|

Hole ID |

Block |

From(m) |

To(m) |

Downhole Interval(m) |

Au Grade(g/t) |

Grade x Downhole Int.(gm/t) |

ETT*(m) |

Cutoff*(Au g/t) |

|

OKWD22-200 |

4 |

809 |

813 |

4.0 |

2.92 |

12 |

2.6 |

1.5 |

|

and |

|

828 |

878.45 |

50.5 |

1.08 |

55 |

32.5 |

0.3 |

|

inc |

|

828 |

831.7 |

3.7 |

3.81 |

14 |

2.4 |

1.5 |

|

inc |

|

872.8 |

876.2 |

3.4 |

3.26 |

11 |

2.2 |

1.5 |

|

OKWD22-203 |

4 |

848.85 |

865.15 |

16.3 |

1.05 |

17 |

10.2 |

0.3 |

|

inc |

|

856 |

860.25 |

4.3 |

1.95 |

8 |

2.7 |

1.5 |

|

and |

|

890 |

1011 |

121.0 |

1.32 |

159 |

78.5 |

0.3 |

|

inc |

|

916.65 |

920.8 |

4.1 |

1.89 |

8 |

2.7 |

1.5 |

|

inc |

|

934 |

954.6 |

20.6 |

3.03 |

62 |

13.3 |

1.5 |

|

inc |

|

978 |

984 |

6.0 |

3.20 |

19 |

4.0 |

1.5 |

|

inc |

|

987 |

990 |

3.0 |

3.41 |

10 |

2.0 |

1.5 |

* Estimated True Thickness ("ETT") based on an

average dip / dip direction of -65° / 095° to represent the

orientation of the mineralized zone in Block 4.** Significant

intervals calculated using a 0.3 g/t Au cut-off, 10m minimum length

and 10m maximum consecutive internal waste. Included intervals

calculated using a 1.5 g/t Au cut-off, 3m minimum length and a 2m

maximum consecutive internal waste.

The Company continues to follow up reverse

circulation drill results from Blocks 5 and 6, located along strike

and to the south of Block 4, with diamond drilling. Highlights from

recent drilling include 61.0 m @ 0.93 g/t Au in

D-196 from Block 6, and 42.5 m @ 0.86 g/t Au from

D-206 from Block 5. Additional highlights are reported in Table 3

and Figure 3 below.

Table 3 - Significant intercepts from

Blocks 5 and 6.

|

Hole ID |

Block |

From(m) |

To(m) |

Downhole Interval(m) |

Au Grade(g/t) |

Grade x Downhole Int.(gm/t) |

Cutoff*(Au g/t) |

|

OKWD22-196 |

6 |

94 |

155.03 |

61.0 |

0.93 |

57 |

0.3 |

|

OKWD22-199 |

6 |

153.35 |

183 |

29.7 |

1.30 |

38 |

0.3 |

|

inc |

|

161 |

174 |

13.0 |

1.96 |

26 |

1.5 |

|

OKWD22-206 |

5 |

14.9 |

57.8 |

42.9 |

0.39 |

17 |

0.3 |

|

and |

|

141.5 |

184 |

42.5 |

0.86 |

37 |

0.3 |

|

inc |

|

161 |

166.95 |

5.9 |

3.38 |

20 |

1.5 |

|

and |

|

218.45 |

231 |

12.6 |

2.02 |

25 |

0.3 |

|

OKWD22-210 |

5 |

99.2 |

128.25 |

29.1 |

0.51 |

15 |

0.3 |

* Significant intervals calculated using a 0.3

g/t Au cut-off, 10m minimum length and 10m maximum consecutive

internal waste. Included intervals calculated using a 1.5 g/t Au

cut-off, 3m minimum length and a 2m maximum consecutive internal

waste.

Exploration Priorities for

2023

In 2023, the Company’s exploration efforts will

be focused on two main initiatives. The first is to continue the

step out drilling on the Kairuni zone in support of a maiden

resource estimate in 2023. This includes both ongoing expansion

drilling in Block 4 to approximately 575 m depth and step out

drilling along strike and to depth in Blocks 1, 5 and 6. The

Company will also continue to investigate the potential for higher

grade zones associated with structural intersections, within Block

4 in particular. The second priority is to explore areas that lie

outside of the current resource definition drilling program, but

within the Oko West permit, to identify additional new zones of

gold mineralization.

This latter program will include: 1) Follow up

exploration and drill testing on the Takutu zone to investigate

areas of anomalous gold identified by the initial wide-spaced RC

drilling program. 2) Conduct ground magnetics (mag) surveys over

the area proximal to the main shear zone (Carole Zone), to identify

additional zones that may have a similar mag signature to Blocks 1,

4, 5 and 6. This work includes the area immediately west of the

current definition drilling where narrow gold intersects in earlier

RC drilling indicate the possibility of parallel shears within the

mafic volcanics. 3) The Company will be carrying out approximately

8,000 m of scout RC drilling using a smaller rig designed to drill

30 to 40 m deep holes over the Bryan Zone, to build a more

comprehensive geochemical anomaly map of the west of the permit

where duricrust and alluvial cover prevent the use of shallow soil

surveys. Downstream alluvial working in particular point to the

potential for gold sources in the topographically higher areas

capped by duricrust. Follow up of any generated targets will be

conducted in H2 2023.

Sample collection, assaying and data

management

Significant intervals in this press release have

been calculated using a grade cut-off of 0.3 g/t Au, a minimum

length of ten meters, and up to ten meters maximum length of

consecutive internal waste. Included significant intervals have

been calculated using a grade cut-off of 1.5 g/t Au, a minimum

length of three meters, and up to two meters maximum length of

consecutive internal waste. Gold grades are uncapped. Mineralized

intersection lengths are not necessarily true widths and estimated

true thickness (“ETT”) has been calculated using an assumed plane

of mineralization dipping 65° towards 095°, representative of the

mineralization identified in Block 4. Complete drilling results and

drill hole data are posted on the Company's Website. Diamond drill

(DD) samples consist of half of either HQ or NQ core taken

continuously at regular intervals averaging 1.4 m, bagged, and

labelled at the site core shed. Reverse circulation (RC) drill

samples are obtained from a rotary splitter attached to a Metzke

cyclone, weighed, bagged, and tagged at the drill site. All samples

are shipped to the Actlabs certified laboratory in Georgetown,

Guyana, respecting best-practice chain of custody procedures. At

the laboratory, samples are dried, crushed to 80% passing 2 mm,

riffle split (250 g), and pulverized to 95% passing 105 μm. Coarse

blanks are inserted by the Company, and are used between and

following suspected high-grade intervals. Barren sand flushes are

inserted by the analytical laboratory after each sample is

pulverized to clean the bowl. Gold analysis is carried out through

a 50 g fire assay with an atomic absorption finish. Initial assays

with results above 3.0 g/t Au are re-assayed with a gravimetric

finish. Samples with visible gold are additionally assayed with a

metallic screen method using 1 kg of pulp. Certified reference

materials and blanks are inserted at a rate of 5% of samples

shipped to the laboratories. RC field duplicates and DD umpire pulp

duplicates are also generated at a rate of 5% of samples. Pulp

umpire duplicates are analyzed at the MSALabs certified laboratory

in Georgetown. Assay data is subject to QA/QC prior to accepting

into the company database managed by an independent consultant.

Qualified Person

The technical information in this press release

has been reviewed and approved by Justin van der Toorn, the

Company's VP Exploration. Mr. van der Toorn (CGeol FGS, EurGeol) is

a qualified person under Canadian National Instrument 43-101.

Cautionary Disclaimer Regarding

Forward-Looking Statements

This press release contains forward-looking

statements and forward-looking information within the meaning of

Canadian securities laws (collectively, "forward-looking

statements"). Statements and information that are not historical

facts are forward-looking statements. Forward-looking statements

are frequently, but not always, identified by words such as

"expects", "anticipates", "believes", "intends", "estimates",

"potential", "possible" and similar expressions, or statements that

events, conditions, or results "will", "may", "could" or "should"

occur or be achieved. Forward-looking statements and the

assumptions made in respect thereof involve known and unknown

risks, uncertainties and other factors beyond the Company's

control. Forward-looking statements in this press release include

statements regarding plans to complete drilling and other

exploration programs and studies, potential mineralization,

exploration and drill results, interpretation of such exploration

and drill results, plans to complete a maiden mineral resource, and

statements regarding beliefs, plans, expectations or intentions of

the Company. Mineral exploration is highly speculative,

characterized by several significant risks, which even a

combination of careful evaluation, experience and knowledge may not

eliminate. Refer to the Company's most recent annual management's

discussion and analysis for a description of such risks.

Forward-looking statements in this press release

are made as of the date herein. Although the Company believes that

the assumptions and factors used in preparing the forward-looking

statements in this press release are reasonable, undue reliance

should not be placed on such statements. The Company undertakes no

obligation to update publicly or otherwise revise any

forward-looking statements, whether as a result of new information

or future events or otherwise, except as may be required by

law.

Neither the TSX Venture Exchange nor its

Regulation Services Provider (as that term is defined in the

policies of the TSX Venture Exchange) accept responsibility for the

adequacy or accuracy of this press release.

About Reunion Gold Corporation

Reunion Gold Corporation is a leading gold explorer in the Guiana

Shield, South America. In 2021 the Company made an exciting new

gold discovery at its Oko West project in Guyana, where to date it

has outlined continuous gold mineralization at the Kairuni zone

over 2,000 meters of strike and to a depth of 575 meters. The

mineralization appears to be open-pit amenable with a strong grade

profile and favourable initial metallurgy. In addition to Kairuni

there are several additional priority exploration targets on the

Oko West project area that the Company is exploring. The Company's

common shares are listed on the TSX Venture Exchange under the

symbol 'RGD' and trade on the OTCQB under the symbol 'RGDFF'.

Additional information about the Company

is available on SEDAR

(www.sedar.com) and the Company's

website (www.reuniongold.com

).

For further information, please

contact: REUNION GOLD CORPORATION Rick Howes, President

and CEO, or Doug Flegg, Business Development AdvisorTelephone: +1

450.677.2585Email: info@reuniongold.com

Figure 1 - Inclined long

section showing Block 4 mineralization represented as a grade x

downhole interval plot and including selected significant intervals

reported as part of this press release. Labelled drill holes are

newly released and available significant intervals listed in Table

1, Table 2, and on the Company’s Website. Link

to Figure 1:

https://www.reuniongold.com/230131-pr?lightbox=dataItem-ldkk7r7o1

Figure 2 - Cross section

(Section A in Figure 1) showing hole D-203 in relation to the

significant intervals presented in this press release.

Link to Figure 2:

https://www.reuniongold.com/230131-pr?lightbox=dataItem-ldkk7r7t

Figure 3 - Inclined long section showing

selected significant intervals from Blocks 5 and

6. Link to Figure 3:

https://www.reuniongold.com/230131-pr?lightbox=dataItem-ldkk7r7t2

Figure 4 - Plan map showing all drill traces

(projected to surface) from drilling completed to date, with 0.3

g/t Au cut-off significant interval locations, both previously

reported and from this press release. Link to Figure

4:

https://www.reuniongold.com/230131-pr?lightbox=dataItem-ldkk7r7u

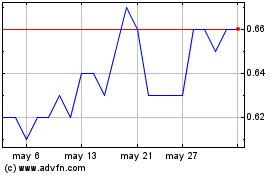

Reunion Gold (TSXV:RGD)

Gráfica de Acción Histórica

De Dic 2024 a Ene 2025

Reunion Gold (TSXV:RGD)

Gráfica de Acción Histórica

De Ene 2024 a Ene 2025