VAYK Reached Agreement on Terms to Acquire $1 Million Company for Disruptive Airbnb Strategy

02 Diciembre 2024 - 8:00AM

InvestorsHub NewsWire

Atlanta, GA --

December 2, 2024 -- InvestorsHub NewsWire -- Vaycaychella, Inc.

(OTC

Pink: VAYK) ("VAYK") today announces that the company has

reached agreement with the acquiree upon the terms and conditions

to acquire 50% non-managerial ownership of a home engineering

service company based in Atlanta, Georgia.

The acquisition

target reported approximately $1 million revenue for the year 2023,

with a solid margin of operating profit.

Payment in Preferred Shares with a

Conversion Price of $0.005

The two parties

have agreed that VAYK will issue 500,000 Series B preferred stocks

to the owner of the business, in exchange for the 50%

non-managerial ownership. Each Series B preferred share will bear a

face value of $1.00, and will be eligible to convert into 200

common shares after 24 months, effecting a conversion price of

$0.005 per share. This conversion price is more than 700% higher

than the most recent closing price of VAYK's common stocks.

The acquisition

price ($500,000 for 50% ownership) is roughly based on 1x

Value/Revenue multiple, which is lower than the average multiple of

engineering and construction industry, according to the newest

available data published by independent valuation provider Eqvista

(https://eqvista.com/revenue-multiples-by-industry/).

The company also

has a conditional option to acquire the rest 50% ownership and to

completely take over the acquiree. The acquisition price will be

the same plus preformulated adjustments, but the company will have

to pay in cash.

Integrated Part of $100 Million New and

Disruptive Airbnb Business Strategy

This acquisition

will be one of VAYK's moves to carry out a disruptive business

model in the short-term rental (Airbnb etc.) industry.

"Our new business

model will integrate real estate development, financial

engineering, social accountability, and short-term rental

management," declares Stephanie Anderl, Interim CEO of

Vaycaychella. "It will be a revolutionary business model with the

potential to redefine the concept of short-term rental, and disrupt

the whole short-term rental industry. Our near-term goal is to

build a $20 million portfolio and expand it to $100 million with

financing."

Anderl confirms

that the company is working with business partners and prospective

investors to possibly kick off this new business model in the year

2025.

"The acquiree is a

home engineering service company, which specializes in remodeling,

redecorating and renovating residential properties," explains

Anderl. "Not only it has the potential to grow into a $2 million to

$3 million business by itself, but it will also provide an in-house

capability to build residential properties customized for our new

business model."

The company expects

to close the acquisition by the end of this year.

Disclaimer/Safe Harbor: This news

release contains forward-looking statements within the meaning of

the Securities Litigation Reform Act. The statements reflect the

Company's current views with respect to future events that involve

risks and uncertainties. Among others, these risks include the

expectation that any of the companies mentioned herein will achieve

significant sales, the failure to meet schedule or performance

requirements of the companies' contracts, the companies' liquidity

position, the companies' ability to obtain new contracts, the

emergence of competitors with greater financial resources and the

impact of competitive pricing. In the light of these uncertainties,

the forward-looking events referred to in this release might not

occur.

VAYK Contact:

Contact@Vaycaychella.com

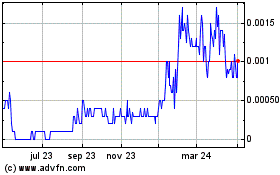

Vaycaychella (PK) (USOTC:VAYK)

Gráfica de Acción Histórica

De Dic 2024 a Ene 2025

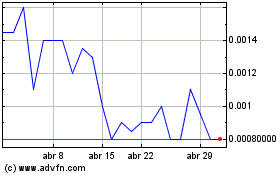

Vaycaychella (PK) (USOTC:VAYK)

Gráfica de Acción Histórica

De Ene 2024 a Ene 2025