TIDMCNKS

RNS Number : 1870L

Cenkos Securities PLC

09 September 2021

9 September 2021

Cenkos Securities plc

Interim Results for the six months ended 30 June 2021

Cenkos Securities plc (the "Company" or "Cenkos" or the "Firm"),

the independent institutional stockbroking firm, today announces

its results for the six months ended 30 June 2021.

Cenkos' shares are admitted to trading on the AIM Market of the

London Stock Exchange ("LSE"). The Company is authorised and

regulated by the Financial Conduct Authority ("FCA") and is a

member of the LSE.

Highlights 30 Jun-21 30-Jun-20

------------------------------ ---------- ----------

GBP18.2 GBP13.3

Revenue m m

Underlying profit (1) GBP2.8 m GBP2.0 m

Profit before tax GBP1.7 m GBP0.8 m

Profit after tax GBP1.5m GBP0.6m

GBP22.4

Cash GBP24.0m m

Net assets GBP25.4m GBP24.6m

Basic earnings per share (2) 3.1p 1.2p

Interim dividend per share 1.25p 1.0p

(1) Underlying profit is profit before restructuring costs and

charges related to the Cenkos incentive plans and tax.

(2) Prior year comparatives have been restated to conform with

current interpretation of IAS 33 such that there is no adjustment

for dividends on shares held in SIP & DBS in arriving at

Earnings for the purpose of basic earnings per share.

Since being admitted to trading on AIM in 2006, the Company has

returned GBP116.4 million of cash to shareholders, equivalent to

180.8p per share, before the payment of the proposed 2021 interim

dividend of 1.25p per share.

Outlook:

Since the end of the period, the completion of 2 IPOs and a

further 8 fundraisings further demonstrate the ongoing strength of

the business and its pipeline. Whilst we cannot always assume

favourable conditions within equity markets, by continuing to lay

the groundwork for growth and through our tenacity and long-term

partnering with clients, we see reasons for optimism for the

remainder of 2021 and beyond.

Julian Morse, Chief Executive Officer commented: " The healthy

performance in the first six months of the year, with a 44%

increase in underlying profits of GBP2.8m, a 37% increase in

revenues to GBP18.2m and a 25% increase in our interim dividend, is

testament to the quality of our clients and the focus and

commitment of our colleagues. Our people are our greatest asset and

I want to thank everyone for their hard work on delivering these

results and setting us up with a strong pipeline. In recognition of

the importance of our people, we are proud to have implemented a

company-wide TSR-based share incentive scheme for the first time to

align all our key stakeholders and ensure everyone at the firm is

able to share in our success. "

Enquiries:

Cenkos Securities plc

Julian Morse - Chief Executive +44 20 7397

Officer 8900

Nominated Adviser

Spark Advisory Partners Limited

Matthew Davis +44 20 3368 3550

Public Relations

The Nisse Consultancy

Jason Nisse +44 7769 688618

Andrew Garfield +44 7974 982337

Chairman's statement

With a new leadership team in place, bringing energy and focus

to delivering our strategic goals and further developing the firm's

collaborative and entrepreneurial culture, I am heartened by our

performance in the first six months of the financial year.

Against the backdrop of the ongoing challenges presented by

Covid-19 and remote working, the leadership team have created a

flexible and inclusive work environment for our employees and these

results show how the firm's values of professionalism and teamwork

are a key part of our recent success.

The Board is committed to building Cenkos to the number one

position in our key markets and to achieve this, we must look

beyond the short-term cyclicality of the markets. Our long-term

strategy requires investment in both people and systems, and I am

delighted to report that we continue to attract and develop the

best talent to achieve this.

With an energised team, a strong balance sheet and a clear focus

on our strategic goals, we are well-positioned to build further

from here, creating value for our entire shareholder base.

Lisa Gordon

Non-Executive Chairman

8 September 2021

Chief Executive Officer's statement

The healthy performance in the first six months of the year,

with a 44% increase in underlying profits of GBP2.8m, a 37%

increase in revenues to GBP18.2m and a 25% increase in our interim

dividend, is testament to the quality of our clients and the focus

and commitment of our colleagues. Our people are our greatest asset

and I want to thank everyone for their hard work on delivering

these results and setting us up with a strong pipeline. In

recognition of the importance of our people, we are proud to have

implemented a company-wide TSR-based share incentive scheme for the

first time to align all our key stakeholders and ensure everyone at

the firm is able to share in our success.

Our drive and ambition helped us win twelve new clients across

the business during the first six months of the year and

successfully secure more than 10% of all funds raised on AIM during

that time, as well as execute significant follow-on placings for a

number of our main list investment company clients. 2 IPOs and a

further 8 fundraisings since the end of the first half further

demonstrate the ongoing strength of the business and its potential

to continue to grow both revenue and market share.

We are seeing the benefits of our strategy begin to emerge.

Maintaining a low-cost base and a strong balance sheet have allowed

us to invest in people, systems and technology, provide high-touch

service levels to our clients and create a resilient platform from

which we can grow.

With 12 new hires in the first half, we continue to deepen our

talent pool across the firm and will look to make further

high-quality hires to deliver our mission of building market

share.

The market for UK equities has been strong during the period,

and while we see no reason for this to change in the near term, we

cannot always assume favourable conditions. That said, a large

proportion of our business is focused on raising money for

corporates trading on AIM, which has seen the aggregate value of

companies on the market double over the last seven years, and those

companies consistently raise funds, with the amount raised each

year on AIM ranging from GBP3.8 billion to GBP6.4 billion. By

continuing to lay the groundwork for growth and through our

tenacity and long-term partnering with innovative clients, we see

reasons for optimism for the remainder of 2021 and beyond.

Performance

I am pleased to report that H1 2021 revenue increased by 37% to

GBP18.2 million (H1 2020: GBP13.3 million) while underlying profit

increased by 44% to GBP2.8 million (H1 2020: GBP2.0 million).

A summary of H1 2021 performance compared to H1 2020 is set out

in the table below:

Six months Six months

ended ended

30 June 30 June

2021 2020

Revenue streams GBP 000's GBP 000's % change

---------------------------------------------- ----------- ----------- ---------

Corporate finance 12,732 9,216 38%

---------------------------------------------- ----------- ----------- ---------

Nomad, broking and research 3,076 3,244 -5%

---------------------------------------------- ----------- ----------- ---------

Execution - net trading gains 2,413 806 199%

Revenue 18,221 13,266 37%

---------------------------------------------- ----------- ----------- ---------

Other operating expense (45) (361) -88%

---------------------------------------------- ----------- ----------- ---------

Staff costs (11,778) (7,392) 59%

---------------------------------------------- ----------- ----------- ---------

Administrative expenses before restructuring

and incentive plans (3,565) (3,539) 1%

----------- ----------- ---------

Underlying profit 2,833 1,974 44%

---------------------------------------------- ----------- ----------- ---------

Restructuring costs and incentive plans (1,066) (1,158) -8%

---------------------------------------------- ----------- ----------- ---------

Operating profit 1,767 816 117%

---------------------------------------------- ----------- ----------- ---------

Investment income - interest income 7 23 -71%

---------------------------------------------- ----------- ----------- ---------

Finance costs (88) (86) 2%

---------------------------------------------- ----------- ----------- ---------

Profit before tax 1,686 753 124%

---------------------------------------------- ----------- ----------- ---------

Tax (183) (163) 12%

---------------------------------------------- ----------- ----------- ---------

Profit after tax 1,503 590 155%

---------------------------------------------- ----------- ----------- ---------

Corporate finance

Corporate finance fees increased by 38% to GBP12.7 million (H1

2020: GBP9.2 million) reflecting an increased level of corporate

activity across the market during the period. Cenkos completed 16

(H1 2020: 11) placing transactions helping its clients raise

GBP0.58 billion in equity finance. Of this, GBP0.40 billion was

raised on the AIM market which equates to just over 10% (H1 2020:

9%) of the GBP3.96 billion (H1 2020: GBP2.89 billion) raised by

Companies during the period to 30 June 2021.

Nomad, broking and research

The number of clients represented by Cenkos increased over the

first half of 2021 from 94 to 100 (June 2020: 97), although for

timing reasons this is not fully reflected in the Nomad, broking

and research fees generated, which decreased by 5% to GBP3.1

million (H1 2020: GBP3.2 million).

Execution

Net trading gains increased by 199% to GBP2.4 million (H1 2020:

GBP0.8 million) against a backdrop of heightened market activity

which had followed on from the final quarter of 2020 and continued

throughout the first half of 2021. During this period, we

maintained a top 5 market share in 90% (H1 2020: 94%) of our

clients' stocks and overall made markets in 219 (H1 2020: 185)

equities and Investment Trusts.

Other operating income

Other operating income includes the fair value gains and losses

on options and warrants, which this year has been shown separately

from execution - net trading gains under the revenue caption as the

Directors believe this provides a clearer view of the performance

of the business by separating out from revenue the gains and losses

on level 3 instruments. To 30 June 2021, this showed a loss of

GBP45k against the prior period loss of GBP361k, reflecting the

fair value movement of the warrants received in lieu of fees and

those acquired during the period.

Administrative expenses

Administrative expenses - staff costs

Staff costs increased by 59% to GBP11.8 million (H1 2020: GBP7.4

million) primarily due to an increase in the accrual for variable

remuneration in line with the significant improvement in

performance, but also as a result of a targeted increase in staff

to 92 employees at 30 June 2021 (June 2020: 89) from 90 at 31

December 2020. This is in-line with Cenkos' aim to recruit ahead of

the curve, so it may continue to provide a premium service to its

clients as the business grows.

Administrative expenses - other

Other administrative expenses remained largely flat at GBP3.6

million (H1 2020: GBP3.5 million) reflecting continued tight

control over the cost base offset by considered investment.

Administrative expenses - restructuring costs and Incentive

Plans (STIP, LTIP & CSOP)

Costs associated with the restructuring and incentive plans

decreased by 8% to GBP1.1 million (H1 2020: GBP1.2 million). In

addition to the charges associated with the STIP ("Short Term

Incentive Plan"), the incentive plan launched in April 2020, this

caption also includes charges associated with the LTIP ("Long Term

Incentive Plan") and CSOP ("Company Share Option Plan"). These

schemes were launched in May 2021, aimed at retaining and

incentivizing staff, with the LTIP focused on senior management and

the CSOP all employees. The charge of GBP0.6 million (H1 2020:

GBP0.5 million) in respect of these plans represents the portion of

the fair value of the schemes allocated to this period.

Profit and earnings per share

Underlying profit increased by 44% to GBP2.8 million (H1 2020:

GBP2.0 million). Underlying profit is disclosed before

restructuring costs and costs associated with the incentive plans

as the Directors believe this provides a clearer view of the

performance of the business.

Statutory profit before tax for the period increased by 124% to

GBP1.7 million (H1 2020: GBP0.8 million). The tax charge for the

period of GBP0.2 million (H1 2020: GBP0.2 million) equates to an

effective tax rate of 11% (H1 2020: 22%). Profit after tax for the

period was GBP1.5 million (H1 2020: GBP0.6 million).

Basic earnings per share for the period was 3.1p (H1 2020

Restated: 1.2p).

Financial position

The statement of financial position shows net assets increased

to GBP25.4 million as at 30 June 2021 (30 June 2021: GBP24.6

million), which reflects the profits generated over the period

being partially offset by the cost of shares acquired by the EBT

and dividends paid.

The decrease in non-current assets relates to the amortization

of the right of use asset recognized in respect of the London and

Edinburgh office leases, which has a corresponding impact on trade

and other payables.

The increase in net trading investments is mainly due to the

increase in asset prices and activity over the period. The increase

in activity and the settlement of share trades is also reflected in

the movements in trade and other receivables and trade and other

payables. Profitable trading during the period has resulted in an

increase in the accrual for variable remuneration and cash and cash

equivalents.

30 June 30 June

2021 2020 Change

Net assets summary GBP 000's GBP 000's GBP 000's

------------------------------------- ---------- ---------- ----------

Non-current assets 4,771 5,171 (400)

------------------------------------- ---------- ---------- ----------

FVOCI financial assets - - -

------------------------------------- ---------- ---------- ----------

Other current financial assets 7,126 4,163 2,963

------------------------------------- ---------- ---------- ----------

Other current financial liabilities (2,678) (681) (1,997)

------------------------------------- ---------- ---------- ----------

Net trading investments 4,448 3,482 965

------------------------------------- ---------- ---------- ----------

Trade and other receivables 15,821 11,737 4,085

------------------------------------- ---------- ---------- ----------

Trade and other payables (23,620) (18,155) (5,465)

------------------------------------- ---------- ---------- ----------

Cash and cash equivalents 23,982 22,352 1,630

25,402 24,587 816

------------------------------------- ---------- ---------- ----------

Capital and Liquidity

The Board continuously assesses the Company's cash and capital

requirements with the intention of maintaining a strong balance

sheet, including a significant surplus over and above its Pillar 1,

Individual Capital Guidance ('ICG') and Combined Capital Buffer

('CCB') requirements and sufficient liquid resources to cover at

least 12 months of fixed overheads.

The new Investment Firms Prudential Regime ('IFPR') is due to

come into force in January 2022. Whilst the legislation is subject

to final approval, Management has conducted a high-level review and

expect there to be little change to Cenkos' capital requirement

under the new IFPR.

At 30 June 2021, Cenkos had a capital resources surplus of

GBP17.0 million (H1 2020: GBP15.8 million) above its Pillar 1

regulatory capital requirement.

The Board

As previously announced, Jim Durkin retired from the Company on

the 12 May 2021. Subsequent to the Annual General Meeting, Julian

Morse took up the position of Chief Executive Officer and Jeremy

Osler took up his role as an Executive Director of the Company,

both positions having received regulatory approval from the

Financial Conduct Authority.

Going concern

The Coronavirus ('COVID-19') continues to have a major impact

worldwide. Many countries still have measures in place restricting

travel, business operations and peoples' activities to contain the

spread of the virus. In the UK, restrictions have been removed

largely due to the success of the vaccination programme resulting

in a fall in the number of new cases and hospitalizations. This is

being closely monitored, as is the emergence of new variants and

their resistance to the vaccines. Cenkos' offices are open and

fully operational, although should restrictions be re-imposed, the

business continuity plan will once again be enacted. Management has

performed an impact analysis as part of its going concern

assessment using information available to the date of issue of

these financial statements. Having performed this analysis,

management believes: (a) regulatory capital requirements will

continue to be met; (b) the Company has sufficient liquidity to

meet its liabilities for the next 12 months; and (c) that the

preparation of the financial statements on a going concern basis

remains appropriate as the Company expects to be able to meet its

obligations as and when they fall due for the foreseeable

future.

Outlook

Since the end of the period, the completion of 2 IPOs and a

further 8 fundraisings further demonstrate the ongoing strength of

the business and its pipeline. Whilst we cannot always assume

favourable conditions within equity markets, by continuing to lay

the groundwork for growth and through our tenacity and long-term

partnering with clients, we see reasons for optimism for the

remainder of 2021 and beyond.

Dividend

The Board recognises the importance of dividends to our

shareholders, and since being admitted to AIM we have returned the

equivalent of 180.8p per share of cash to shareholders. The Board

will continue to look to return significant value to shareholders

while seeking to establish a level of consistency of dividend

payments throughout variable market conditions.

The Board proposes an interim dividend of 1.25p (H1:2020 1.0p)

per share. The dividend will be paid on 4 November 2021 to all

shareholders on the register at 8 October 2021.

Julian Morse

Chief Executive Officer

8 September 2021

Condensed income statement

For the six months ended 30 June 2021

Unaudited Unaudited Audited

Six months Six months

ended ended Year ended

30 June 30 June 31 December

2021 2020 2020

GBP 000's GBP 000's GBP 000's

---------------------------------------------- ----------- ----------- ------------

Continuing operations

---------------------------------------------- ----------- ----------- ------------

Revenue 18,221 13,266 31,654

------------------------------------------------- ----------- ----------- ------------

Other operating income/(expense) (45) (361) 259

Administrative expenses (16,409) (12,089) (29,514)

------------------------------------------------- ----------- ----------- ------------

Operating profit 1,767 816 2,399

------------------------------------------------- ----------- ----------- ------------

Investment income - interest

income 7 23 30

------------------------------------------------- ----------- ----------- ------------

Finance costs - interest

on lease liability (88) (86) (176)

------------------------------------------------- ----------- ----------- ------------

Profit before tax from continuing operations 1,686 753 2,253

------------------------------------------------ ----------- ----------- ------------

Tax (183) (163) (449)

------------------------------------------------- ----------- ----------- ------------

Profit after tax 1,503 590 1,804

------------------------------------------------- ----------- ----------- ------------

Attributable to:

---------------------------------------------- ----------- ----------- ------------

Equity holders of Cenkos Securities plc 1,503 590 1,804

------------------------------------------------ ----------- ----------- ------------

Restated*

-----------

Basic earnings per share 3.1p 1.2p 3.7p

------------------------------------------------- ----------- ----------- ------------

Diluted earnings per share 2.7p 1.1p 3.3p

------------------------------------------------- ----------- ----------- ------------

* Prior year comparatives have been restated to conform with IAS

33 such that there is no longer any adjustment for dividends on

shares held in SIP & DBS in arriving at Earnings for the

purpose of basic earnings per share.

Condensed statement of comprehensive income

For the six months ended 30 June 2021

Unaudited Unaudited Audited

Six months Six months

ended ended Year ended

30 June 30 June 31 December

2021 2020 2020

GBP 000's GBP 000's GBP 000's

------------------------------------------------------- ----------- ----------- ------------

Profit 1,503 590 1,804

---------------------------------------------------------- ----------- ----------- ------------

Amounts that will not be recycled to income statement

in future periods

---------------------------------------------------------- ----------- ----------- ------------

Loss on FVOCI financial

asset - (36) (35)

---------------------------------------------------------- ----------- ----------- ------------

Tax on FVOCI financial

asset - 6 6

---------------------------------------------------------- ----------- ----------- ------------

Other comprehensive losses - (30) (29)

---------------------------------------------------------- ----------- ----------- ------------

Total comprehensive income 1,503 560 1,775

---------------------------------------------------------- ----------- ----------- ------------

Attributable to:

------------------------------------------------------- ----------- ----------- ------------

Equity holders of Cenkos

Securities plc 1,503 560 1,775

---------------------------------------------------------- ----------- ----------- ------------

Condensed statement of financial position

As at 30 June 2021

Unaudited Unaudited Audited

30 June 30 June 31 December

2021 2020 2020

GBP 000's GBP 000's GBP 000's

------------------------------- ---------- ---------- ------------

Non-current assets

------------------------------- ---------- ---------- ------------

Property, plant and equipment 320 434 382

---------------------------------- ---------- ---------- ------------

Right-of-use assets 3,817 4,299 4,059

Intangible asset 16 50 33

Deferred tax asset 617 387 727

Investments in subsidiary

undertakings 1 1 1

---------------------------------- ---------- ---------- ------------

4,771 5,171 5,202

------------------------------- ---------- ---------- ------------

Current assets

------------------------------- ---------- ---------- ------------

Trade and other receivables 15,821 11,737 12,993

---------------------------------- ---------- ---------- ------------

FVOCI financial assets - - -

------------------------------- ---------- ---------- ------------

Other current financial

assets 7,126 4,163 5,312

---------------------------------- ---------- ---------- ------------

Cash and cash equivalents 23,982 22,352 32,735

---------------------------------- ---------- ---------- ------------

46,929 38,252 51,040

------------------------------- ---------- ---------- ------------

Total assets 51,700 43,423 56,242

---------------------------------- ---------- ---------- ------------

Current liabilities

------------------------------- ---------- ---------- ------------

Trade and other payables (18,913) (12,818) (24,520)

---------------------------------- ---------- ---------- ------------

Other current financial

liabilities (2,678) (681) (1,011)

---------------------------------- ---------- ---------- ------------

(21,591) (13,499) (25,531)

------------------------------- ---------- ---------- ------------

Net current assets 25,338 24,753 25,509

---------------------------------- ---------- ---------- ------------

Non-current liabilities

------------------------------- ---------- ---------- ------------

Trade and other payables (4,707) (5,337) (5,086)

---------------------------------- ---------- ---------- ------------

Total liabilities (26,298) (18,836) (30,617)

---------------------------------- ---------- ---------- ------------

Net assets 25,402 24,587 25,625

---------------------------------- ---------- ---------- ------------

Equity

------------------------------- ---------- ---------- ------------

Share capital 567 567 567

---------------------------------- ---------- ---------- ------------

Share premium 3,331 3,331 3,331

---------------------------------- ---------- ---------- ------------

Capital redemption reserve 195 195 195

---------------------------------- ---------- ---------- ------------

Own shares (6,796) (5,579) (6,607)

---------------------------------- ---------- ---------- ------------

FVOCI reserve (170) (171) (170)

---------------------------------- ---------- ---------- ------------

Retained earnings 28,275 26,244 28,309

---------------------------------- ---------- ---------- ------------

Total equity 25,402 24,587 25,625

---------------------------------- ---------- ---------- ------------

Condensed cash flow statement

For the six months ended 30 June 2021

Unaudited Unaudited Audited

Six months Six months

ended ended Year ended

30 June 30 June 31 December

2021 2020 2020

GBP 000's GBP 000's GBP 000's

-------------------------------------------------------- ----------- ----------- ------------

Profit 1,503 590 1,804

----------------------------------------------------------- ----------- ----------- ------------

Adjustments for:

-------------------------------------------------------- ----------- ----------- ------------

Investment income - interest

income (7) (22) (30)

----------------------------------------------------------- ----------- ----------- ------------

Finance costs - interest

on lease liability 88 86 176

----------------------------------------------------------- ----------- ----------- ------------

Tax expense 183 163 449

----------------------------------------------------------- ----------- ----------- ------------

Depreciation of property, plant and equipment,

ROU assets and intangible asset 329 348 691

----------------------------------------------------------- ----------- ----------- ------------

Shares and options received

in lieu of fees (163) (120) (11)

----------------------------------------------------------- ----------- ----------- ------------

Share-based payment expense 1,035 945 2,395

----------------------------------------------------------- ----------- ----------- ------------

Operating cash inflow before movements in working

capital 2,968 1,990 5,474

----------------------------------------------------------- ----------- ----------- ------------

(Increase) / decrease in net trading investments

and FVOCI financial assets 16 3,795 2,867

----------------------------------------------------------- ----------- ----------- ------------

(Increase) / decrease in trade

and other receivables (2,823) 1,756 468

--------------------------------------------------------- ----------- ----------- ------------

(Decrease) / increase in trade

and other payables (5,295) (2,596) 8,301

--------------------------------------------------------- ----------- ----------- ------------

Net cash (outflow) / inflow from operating activities

before interest and tax paid (5,134) 4,945 17,110

----------------------------------------------------------- ----------- ----------- ------------

Tax paid (485) - (99)

----------------------------------------------------------- ----------- ----------- ------------

Net cash (outflow) / inflow from operating activities (5,619) 4,945 17,011

----------------------------------------------------------- ----------- ----------- ------------

Investing activities

-------------------------------------------------------- ----------- ----------- ------------

Interest received - 26 24

----------------------------------------------------------- ----------- ----------- ------------

Purchase of property, plant and

equipment (9) (7) (41)

--------------------------------------------------------- ----------- ----------- ------------

Net cash outflow from investing activities (9) 19 (17)

----------------------------------------------------------- ----------- ----------- ------------

Financing activities

-------------------------------------------------------- ----------- ----------- ------------

Landlord incentive received as part of

lease arrangement - 500 500

---------------------------------------------------------- ----------- ----------- ------------

Rent paid under lease

arrangement (378) (22) (117)

----------------------------------------------------------- ----------- ----------- ------------

Dividends paid (1,280) (515) (1,027)

----------------------------------------------------------- ----------- ----------- ------------

Proceeds from sale of own shares to employees

on dividend reinvestment 14 - 12

----------------------------------------------------------- ----------- ----------- ------------

Acquisition of own shares (1,481) (908) (1,960)

----------------------------------------------------------- ----------- ----------- ------------

Net cash used in financing activities (3,125) (945) (2,592)

----------------------------------------------------------- ----------- ----------- ------------

Net (decrease) / increase in cash and cash equivalents (8,753) 4,019 14,402

----------------------------------------------------------- ----------- ----------- ------------

Cash and cash equivalents at beginning

of period 32,735 18,333 18,333

--------------------------------------------------------- ----------- ----------- ------------

Cash and cash equivalents at

end of period 23,982 22,352 32,735

--------------------------------------------------------- ----------- ----------- ------------

Condensed statement of changes in equity

For the six months ended 30 June 2021

Equity attributable to equity holders

Capital

Share Share redemption Own FVOCI Retained

capital premium reserve shares reserve earnings Total

GBP GBP

000's GBP 000's GBP 000's 000's GBP 000's GBP 000's GBP 000's

----------------------------------- --------- ---------- ------------ -------- ---------- ---------- ----------

Balance at 1 January 2020 567 3,331 195 (5,436) (141) 26,142 24,658

----------------------------------- --------- ---------- ------------ -------- ---------- ---------- ----------

Profit - - - - - 590 590

----------------------------------- --------- ---------- ------------ -------- ---------- ---------- ----------

Loss on FVOCI financial

asset net of tax - - - - (30) - (30)

----------------------------------- --------- ---------- ------------ -------- ---------- ---------- ----------

Total comprehensive income - - - - (30) 590 560

----------------------------------- --------- ---------- ------------ -------- ---------- ---------- ----------

Transfer of shares from

share plans to employees - - - 765 - (765) -

----------------------------------- --------- ---------- ------------ -------- ---------- ---------- ----------

Acquisition of own shares - - - (908) - - (908)

----------------------------------- --------- ---------- ------------ -------- ---------- ---------- ----------

Credit to equity for

equity-settled

share-based payments - - - - - 792 792

----------------------------------- --------- ---------- ------------ -------- ---------- ---------- ----------

Dividends paid - - - - - (515) (515)

----------------------------------- --------- ---------- ------------ -------- ---------- ---------- ----------

Balance at 30 June 2020 567 3,331 195 (5,579) (171) 26,244 24,587

----------------------------------- --------- ---------- ------------ -------- ---------- ---------- ----------

Profit - - - - - 1,214 1,214

----------------------------------- --------- ---------- ------------ -------- ---------- ---------- ----------

Loss on FVOCI financial

assets net of tax - - - - 1 - 1

----------------------------------- --------- ---------- ------------ -------- ---------- ---------- ----------

Total comprehensive income - - - - 1 1,214 1,215

----------------------------------- --------- ---------- ------------ -------- ---------- ---------- ----------

Issue of shares to employees

on dividend reinvestment - - - 13 - - 13

----------------------------------- --------- ---------- ------------ -------- ---------- ---------- ----------

Transfer of shares from

share plans to employees - - - 11 - (11) -

----------------------------------- --------- ---------- ------------ -------- ---------- ---------- ----------

Acquisition of own shares - - - (1,052) - - (1,052)

----------------------------------- --------- ---------- ------------ -------- ---------- ---------- ----------

Credit to equity for

equity-settled

share-based payments - - - - - 1,374 1,374

----------------------------------- --------- ---------- ------------ -------- ---------- ---------- ----------

Dividends paid - - - - - (512) (512)

----------------------------------- --------- ---------- ------------ -------- ---------- ---------- ----------

Balance at 31 December 2020 567 3,331 195 (6,607) (170) 28,309 25,625

----------------------------------- --------- ---------- ------------ -------- ---------- ---------- ----------

Capital

Share Share redemption Own FVOCI Retained

capital premium reserve shares reserve earnings Total

GBP GBP

000's GBP 000's GBP 000's 000's GBP 000's GBP 000's GBP 000's

----------------------------------- --------- ---------- ------------ -------- ---------- ---------- ----------

Balance at 1 January 2021 567 3,331 195 (6,607) (170) 28,309 25,625

----------------------------------- --------- ---------- ------------ -------- ---------- ---------- ----------

Profit - - - - - 1,503 1,503

----------------------------------- --------- ---------- ------------ -------- ---------- ---------- ----------

Total comprehensive income - - - - - 1,503 1,503

----------------------------------- --------- ---------- ------------ -------- ---------- ---------- ----------

Issue of shares to employees

on dividend reinvestment - - - 8 - 6 14

----------------------------------- --------- ---------- ------------ -------- ---------- ---------- ----------

Transfer of shares from

share plans to employees - - - 1,284 - (1,284) -

----------------------------------- --------- ---------- ------------ -------- ---------- ---------- ----------

Acquisition of own shares - - - (1,481) - - (1,481)

----------------------------------- --------- ---------- ------------ -------- ---------- ---------- ----------

Credit to equity for

equity-settled

share-based payments - - - - - 985 985

----------------------------------- --------- ---------- ------------ -------- ---------- ---------- ----------

Deferred tax on share-based

payments - - - - - 36 36

----------------------------------- --------- ---------- ------------ -------- ---------- ---------- ----------

Dividends paid - - - - - (1,280) (1,280)

----------------------------------- --------- ---------- ------------ -------- ---------- ---------- ----------

Balance at 30 June 2021 567 3,331 195 (6,796) (170) 28,275 25,402

----------------------------------- --------- ---------- ------------ -------- ---------- ---------- ----------

Notes to the financial statements

1. Accounting policies

General information

The interim condensed financial statements of Cenkos Securities

plc (the "Company" or "Cenkos") for the six months ended 30 June

2021 are unaudited and were approved by the Board of Directors for

issue on 8 September 2021.

The Company is incorporated in England under the Companies Act

2006 (company registration No. 05210733) and its shares are

publicly traded. The Company's principal activity is as an

institutional stockbroker to UK small and mid- cap companies and

investment funds. These financial statements are presented in

pounds sterling because that is the currency of the primary

economic environment in which the Company operates.

The preparation of financial statements in conformity with

UK-adopted International Accounting Standards requires the use of

estimates and assumptions that affect the reported amounts of

assets and liabilities at the date of the financial statements and

the reported amounts of revenues and expenses during the reporting

period. Although these estimates are based on management's best

knowledge of the amount, event or actions, actual results

ultimately may differ from those of estimates.

Critical accounting policies and key sources of estimation

uncertainty

The judgements and assumptions considered to be the most

important to the portrayal of the Company's financial condition are

those relating to equity-settled share-based payments, valuation of

derivative financial assets, provisions and revenue recognition.

These critical accounting policies and judgements are described on

page 68 of the Cenkos Securities plc's 2020 Annual Report and

Accounts. In addition to this, to the extent that derivative

financial assets are traded, reference is made to recent bargains

in estimating the fair value of these financial assets. The

Directors consider that this reflects fair consideration for the

services provided.

These financial statements have been prepared on the historical

cost basis, except for the revaluation of certain financial

instruments.

Where appropriate prior year figures have been restated to

conform to the current year presentation.

Basis of accounting

On 31 December 2020, IFRS as adopted by the European Union at

that date was brought into UK law and became UK-adopted

International Accounting Standards, with future changes being

subject to endorsement by the UK Endorsement Board. Cenkos

Securities PLC transitioned to UK-adopted International Accounting

Standards in its Financial Statements on 1 January 2021. This

change constitutes a change in accounting framework. However, there

is no impact on recognition, measurement or disclosure in the

period reported as a result of the change in framework.

The interim condensed financial statements for the six months

ended 30 June 2021 have been prepared in accordance with

International Accounting Standard ("IAS") 34 Interim Financial

Reporting. The interim condensed financial statements do not

include all the information and disclosures required in the annual

financial statements and should be read in conjunction with the

Group's annual financial statements for the year ended 31 December

2020.

The accounting policies adopted in the preparation of the

interim condensed financial statements are consistent with those

followed in the preparation of the Group's annual financial

statements for the year ended 31 December 2020 apart from in

relation to derivative financial assets, where to the extent that

they are traded, reference is made to recent bargains in estimating

the fair value of these financial assets.

The financial information contained in these interim condensed

financial statements does not constitute the Company's statutory

accounts within the meaning of section 434 of the Companies Act

2006. The comparative information contained in this report for the

year ended 31 December 2020 does not constitute the statutory

accounts for that financial period. Those accounts have been

reported on by the Company's auditors, BDO LLP and delivered to the

Registrar of Companies. The report of the auditors was unqualified

and did not contain a statement under section 498 (2) or (3) of the

Companies Act 2006.

Going Concern

The Group's business activities, together with the factors

likely to affect its future development and performance, its

principal risks and uncertainties, the financial position of the

Group, its cash flows and liquidity position are set out in the

Strategic Report in the Group's Annual Report for the year ended 31

December 2020.

In light of internal forecasts and the current pipeline of

transactions, the Directors are satisfied that the Group has

sufficient resources to continue in operation for the foreseeable

future, a period of not less than 12 months from the date of this

report. Accordingly, the Directors continue to adopt a going

concern basis in preparing the interim financial statements.

The Coronavirus ('COVID-19') continues to have a major impact

worldwide. Many countries still have measures in place restricting

travel, business operations and peoples' activities to contain the

spread of the virus. In the UK, restrictions have been removed

largely due to the success of the vaccination program resulting in

a fall in the number of new cases and hospitalisations. This is

being closely monitored as is the emergence of new variants and

their resistance to the vaccines. Cenkos offices are open and fully

operational, although should restrictions be re-imposed, the

business continuity plan will once again be enacted.

In its 6th assessment report released in August 2021, the

Intergovernmental Panel on Climate Change ('IPCC') highlights the

catastrophic impact human activity is having on global warming and

its links to recent extreme worldwide weather patterns. This report

is timed to focus the minds of the governments, across 195

countries, ahead of the UN Climate change conference (COP26) in

October this year and encourage multilateral agreement to

significantly reduce greenhouse gas emissions. This potentially

will have a wide-ranging impact on the conduct of business and our

daily lives.

Cenkos has performed well in the first six months of the year

and since the period end, has completed a number of equity

fundraisings for our clients, including two IPOs. This could

suggest the current favourable market conditions are set to

continue. Alternatively, although our current pipeline is

encouraging and we continue to win new clients, we recognize that

our performance is reliant on the success of Government efforts to

stimulate the economy; any commitments made at COP26 resulting in

opportunities for Growth companies rather than having a negative

impact on the economy; and the continued success of the vaccination

program in combatting COVID-19 and any new variants, meaning

further measures to control the spread of the virus such as

lockdowns are not required.

Whilst it is not possible to quantify the overall impact of the

events, as described above, if it were to lead to a period of

inactivity this would most likely lead to a reduction in fees

generated from placing and corporate finance and a decline in fair

values of listed equities, options and warrants. Management

continues to monitor the impact of the COVID-19 pandemic and

Climate Change on the Company and the financial markets.

In order to mitigate the risk associated with fluctuations in

the financial markets, the Company operates a flexible business

model which links risk adjusted variable remuneration to corporate

performance. Fixed costs are kept low and controlled. Cenkos is not

reliant on external borrowings but is funded entirely by share

capital and retained earnings. The business is not capitally

intensive. The trading book is tightly controlled by book limits

and, apart from shares received in lieu of fees, is held for market

making purposes or to facilitate client business. Cenkos has a

positive cash cycle and does not run any liquidity mismatches. Cash

is the largest asset on the statement of financial position and

consequently its exposure to credit risk is largely due to its bank

deposits before risk weighting.

Management has also performed an impact analysis as part of its

going concern assessment using information available to the date of

issue of these financial statements. As part of this analysis, a

number of adverse scenarios have been modelled to assess the

potential impact on the Company's revenue streams, in particular

corporate finance fees, and on asset values, liquidity and capital

adequacy. In addition, a reverse stress test has been modelled to

assess the stresses the balance sheet has to endure before there is

a breach of the relevant regulatory capital requirement or

insufficient cash resources and including an assessment of any

relevant mitigations management has within their control to

implement. Having performed this analysis, management believes

regulatory capital requirements continue to be met and the Company

has sufficient liquidity to meet its liabilities for the next 12

months and that the preparation of the financial statements on a

going concern basis remains appropriate as the Company expects to

be able to meet its obligations as and when they fall due for the

foreseeable future.

2. Dividends

Amounts recognised as distributions to equity holders in the

year:

Six months Six months

ended ended Year ended

30 June 30 June 31 December

2021 2020 2020

GBP 000's GBP 000's GBP 000's

------------------------------------------------- ----------- ----------- ------------

Amounts recognised as distributions to equity

holders in the period:

---------------------------------------------------- ----------- ----------- ------------

Final dividend for the year ended 31 December

2020 of 2.5p (2019: 1.0p) per share 1,280 515 515

---------------------------------------------------- ----------- ----------- ------------

Interim dividend for the period to 30 June 2020

of 1.0p (2019: 2.0p) per share - - 512

1,280 515 1,027

------------------------------------------------- ----------- ----------- ------------

The proposed interim dividend for 30 June 2021 of 1.25p (30 June

2020: 1.0p) per share was approved by the Board on 8 September 2021

and has not been included as a liability as at 30 June 2021. The

dividend will be payable on 4 November 2021 to all shareholders on

the register at 8 October 2021.

3. Events after the reporting period

There were no material events to report on that occurred between

30 June 2021 and the date at which the Directors signed the Annual

Report.

4. Market abuse regulation (MAR) disclosure

This announcement contains certain inside information for the

purposes of Article 7 of the Market Abuse Regulation (EU) 596/2014

as it forms part of UK domestic law by virtue of the European Union

(Withdrawal) Act 2018 ("MAR"), and is disclosed in accordance with

the Company's obligations under Article 17 of MAR.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

IR DKFBKFBKDCCK

(END) Dow Jones Newswires

September 09, 2021 02:00 ET (06:00 GMT)

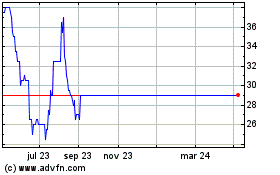

Cenkos Securities (LSE:CNKS)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

Cenkos Securities (LSE:CNKS)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024