TIDMCPC

RNS Number : 6858M

City Pub Group PLC (The)

23 September 2021

The City Pub Group PLC

(the "City Pub Group", the "Company" or the "Group")

INTERIM RESULTS FOR THE 26 WEEK PERIODED 27 JUNE 2021

The City Pub Group, the owner and operator of a predominantly

freehold estate of 50 pubs and development sites, located in some

of the finest cities and market towns in the UK, announces its

unaudited results for the 26 weeks ended 27 June 2021.

Trading since reopening

-- Trading on an upward trajectory with sales since the

reopening of indoor trading on 17 May at above 90% of 2019 levels,

with further improved trade in city centre sites since the

beginning of September as return to work gathers pace

-- 2 new sites acquired signalling confidence in expansion

-- Accommodation performed strongly over the summer benefitting from "staycations"

H1 at EBIDTA break-even (Pre-IFRS16), despite majority of period under COVID-19 restrictions

-- Revenue of GBP8.9 million (H1 2020: GBP12.1 million)

-- Adjusted EBITDA* of GBP(0.0) million (H1 2020: (GBP1.2)

million)

-- Adjusted profit / (loss) before tax** of GBP(2.0) million (H1

2020: GBP(3.5) million)

A better, stronger business

-- Continued focus on cost reduction is improving profitability

-- Identified cost reductions being realised and relentless focus on further efficiencies

o Supply chain streamlined

o Reduced menu complexity

o Central contracts re-negotiated

o Pre-booked business enables better labour scheduling

-- Extensive refurbishments undertaken at six properties,

further works to begin at the Phene, London, Bath Brew House, Bath

and Pontcanna Inn, Cardiff

-- Increased freehold mix

-- Experienced and ambitious management team and a more diverse Board

-- A strong balance sheet with ample liquidity of GBP18m

* Pre-IFRS16 Adjusted earnings before exceptional items, share

option charge, interest, taxation, depreciation and

amortisation.

** Pre-IFRS16 Adjusted profit / (loss) before tax is the profit

/ (loss) before tax, share option charge and exceptional items.

Clive Watson, Executive Chairman of The City Pub Group,

said:

"We have traded well since May and are emerging strongly with a

streamlined and more profitable business. We have continued to

implement a relentless focus on cost control and we are capturing

cost savings identified and negotiated over the last year.

We are emerging from the pandemic in a good shape, well prepared

for the challenges facing our industry.

We have maintained and enhanced a number of our pubs and

benefitted during staycation summer from our estate of more than

200 letting rooms.

With our good trading and strong balance sheet we have begun to

look to expand again recently making two significant acquisitions.

Our ambition is for the estate to be in excess of a 100 pubs.

We have the right team, a business that is in great shape, a

very high quality bespoke largely freehold estate and plenty of

opportunity to grow our business"

23 September 2021

The information contained within this Announcement is deemed by

the Company to constitute inside information as stipulated under

the Market Abuse Regulation (EU) No.596/2014 as amended by The

Market Abuse (Amendment) (EU Exit) Regulations 2019. By the

publication of this Announcement via a Regulatory Information

Service, this inside information is now considered to be in the

public domain.

Enquiries:

City Pub Group Via Instinctif Partners

Clive Watson, Chairman

Tarquin Williams, CFO

Instinctif Partners +44 (0) 20 7457 2020

Matthew Smallwood

William Cammegh

Liberum (Nomad & Joint Broker) +44 (0) 20 3100 2000

Chris Clarke

Edward Thomas

Peel Hunt (Joint Broker) +44 (0)20 31288789

George Sellar

Andrew Clark

Will Bell

CHAIRMAN'S STATEMENT

Since my last statement in May 2021, the business has traded

well as it emerges strongly following the Covid-19 lockdowns. In

April we reopened 22 of our pubs which had large outside trading

areas and in May a further 16 sites were opened when we were able

to welcome customers inside. I believe the Company has dealt with

this extraordinary situation in a very professional fashion and the

business is in much better shape now than prior to the pandemic and

even since we last reported.

In recent months the management team has continued to focus on

cost reduction, improving systems, establishing a central marketing

structure, growing the City Club App, and ensuring the trading

estate is fit for business. Your directors continue to work on

maintaining and enhancing staff morale, helped by improving levels

of communication and supporting staff during the pandemic and

thereafter.

Trading is on an upward trend and since 17 May sales are above

90% of 2019 levels. Since the beginning of September, the return to

work has gathered pace and this has helped increase trade in our

city centre sites.

Trading Estate

The Group currently operates 46 trading sites and a further 4

development sites.

We have undertaken refurbishments at the following pubs/hotels

to maintain and further enhance the quality of the estate:

-- The Hoste, Burnham Market

-- Brighton Beach Club, Brighton

-- Georgian Townhouse, Norwich

-- Cock and Bottle, Notting Hill

-- Inn on the Beach, Hayling Island

-- Lighthouse, Battersea

Further works will be undertaken at the Phene, Chelsea, the Bath

Brew House, Bath and the Pontcanna Inn, Cardiff.

In all cases where we have refurbished/extended our pubs we have

seen a noticeable uplift in trade. The Hoste and the Georgian

Townhouse in Norfolk have seen significant uplifts in trade over

the summer. The Inn on the Beach and Brighton Beach Club have

increased their number of covers which has benefited trade and in

due course, we will carry out similar schemes at other suitable

pubs in our estate to further improve our outside trading areas to

trade longer throughout the year.

I am pleased to say that we have opened the Turks Head in Exeter

City centre, a Brew House benefiting from an outside terrace and 6

letting rooms. We will also be opening our site in Mumbles, Swansea

at the start of 2022, which has 16 letting rooms, a large ground

floor trading area and a first-floor terrace. Our site in Bath,

overlooking the City, has now been granted planning consents and we

anticipate this site being opened by Easter 2022.

Refurbishment work has commenced at the former Tivoli site in

Cambridge. It will trade over 3 floors with a large outside terrace

area for 80 customers. Opening is anticipated around Easter

2022.

The Group's bespoke estate of predominately freehold,

high-quality managed pubs is unique in the sector. Our pubs are

located in some of the finest cities and market towns in England

and Wales. City workers and students are starting to arrive back

which should give a further boost to trade. We now have over 200

letting rooms across the estate and our occupancy levels during the

course of summer were significantly higher than in 2019, partly

helped by "staycations" but also by better marketing which has

improved Revenue per available room. Accommodation revenue now

accounts for more than 10% of overall sales, thereby improving the

quality of the sales mix.

Return to Expansion

As separately announced today, I am pleased to report that we

have acquired the Cliftonville Hotel in Cromer, Norfolk. This

freehold asset has 30 sea facing bedrooms and 3 substantial trading

areas. The hotel is 100m from the beach and 200m from the town. The

Cliftonville Hotel was built in the late Victorian era and has a

history of royal connections dating back to the Edwardian era. It

is a Grade II listed building and an iconic site. The total

consideration was GBP1.7 million of which GBP1.6 million is payable

in cash and GBP100k in shares. The cash element will be funded from

the Group's existing resources.

We have also just acquired a former Café Rouge site in Bury St

Edmunds in the heart of this historic market town. The site

consists of a sizeable ground floor area and a large outside

trading area. We anticipate opening this site in the first quarter

of 2022. These acquisitions demonstrate our desire for trading from

historic building in great locations.

As previously announced, we acquired a 49% stake in Barts Pub

Ltd which owns the iconic KPH site based in Ladbroke Grove. We

operate the pub under management contract and have an option to buy

a freehold at a fixed price next year.

We also acquired the freehold of the Roundhouse, Wandsworth, for

GBP1.15 million which has previously operated on a leasehold basis

in June 2021.

Disposals

We completed disposal of the Punt Yard in Cambridge and Tell

Your Friends in Parsons Green is in the process of being exchanged.

We have also disposed of a freehold investment in the Island,

Kensal Rise, London, to the tenant who had the option to buy the

freehold, and we received GBP2.2 million in cash with an additional

amount of GBP300k payable over 4 years.

We are in negotiations on two further leaseholds to be returned

to the landlord and on other leases we are negotiating to reduce

the annual rental payment.

As a result, we are successfully reshaping the portfolio with

nearly 70% of estate being freehold, reduced rent liabilities and a

significant increase in number of letting rooms across the estate,

thereby increasing the overall quality.

Financial Highlights

Summary for the 26 weeks ended 27 June 2021:

-- Revenue down 27% to GBP8.9 million (2020: GBP12.1

million)

-- Adjusted EBITDA* of GBP(0.0) million (2020: GBP(1.2)

million)

-- Adjusted profit/(loss) before tax** of GBP(2.0) million

(2020: GBP(3.5) million)

-- Reported profit/(loss) of GBP(1.3) million (2020: GBP(3.5)

million)

Key Metrics

------------------------ ---------- --------- ---------- -------- ---------

Post IFRS Pre IFRS Post IFRS Pre IFRS

16 16 16 16

26 weeks 26 weeks 26 weeks 26 weeks

to to to to Change

Pre IFRS

27.06.21 27.06.21 28.06.20 28.06.20 16

GBPm GBPm GBPm GBPm %

------------------------ ---------- --------- ---------- -------- ---------

Revenue 8.9 8.9 12.1 12.1 -27%

Adjusted EBITDA 0.9 (0.0) (0.2) (1.2) N/A

Adjusted Profit/(loss)

before tax (2.2) (2.0) (3.6) (3.5) -41%

------------------------ ---------- --------- ---------- -------- ---------

* Pre-IFRS16 Adjusted earnings before exceptional items, share

option charge, interest, taxation, depreciation and

amortisation.

** Pre-IFRS16 Adjusted profit / (loss) before tax is the profit

/ (loss) before tax, share option charge and exceptional items

.

Bank Facilities

We have a revolving credit facility (RCF) of GBP35m with

Barclays of which we have drawn GBP25m. We also have an additional

GBP5m CLBLS facility which has not been drawn.

The Group is in a strong liquidity position with GBP15m of

unused facilities. We have over GBP11m of cash deposits, resulting

in a net debt position of approximately GBP14m.This gives us

sufficient liquidity to not only maintain stability of the Group,

but also to seek further acquisition opportunities as they present

themselves.

Barclays have waived the RCF's existing financial covenants

through to June 2022. They have been replaced with a Minimum

Liquidity Test (MLT) in the sum of GBP8m and a monthly minimum

EBITDA test. We have significant headroom on both of these

tests.

Retail and Operational Improvements

The Group continues to implement further improvements:

1. Supply chain has been streamlined to reduce complexity and improve operating margin.

2. Food menus continue to evolve and improve whilst at the same

time being simplified thereby reducing the labour cost of the

kitchen staff.

3. City Club App continues to develop and grow with 140k new

users and we are starting to collaborate with reward partners to

make the membership more attractive.

4. We continue the ongoing negotiations of key central contracts including liquor supply deals.

5. Much better management of utility costs to reduce carbon emissions and waste.

6. More focus on pre-booked business helped by improved marketing and bookings teams.

7. Better communication between the head office and the pubs so

decisions made can be swiftly executed.

These improvements have been essential to enhance the way we run

the business but at the same time pubs are still encouraged to be

innovative and run their own local events, their own social media,

and to have regional variations on the liquor and food menus. We

want to retain the entrepreneurial culture which can help us

improve the optimisations of the existing business and be well

placed to expand the number of pubs operated, thus drive the

overall performance.

Board Changes

John Roberts, Co-Founder of the business in 2011 and a

Non-Executive director since that time, has agreed to stand down as

a director of the Company in order to take on executive duties,

particularly in relation to the growing number of brew pubs within

the Group. The Turks Head recently opened in Exeter as a brew pub

and we believe we can expand the range of their activities. While

stepping off the board, John will remain a director of a trading

subsidiary. I would like to thank John for helping us develop the

business from the beginning as a start-up in 2011 through listing

on AIM in 2017 and its development since. The Board is pleased that

John will be continuing his involvement with the Group through his

new role and are confident that our brew pubs will continue to

expand under his experienced stewardship.

ESG

We recently established an ESG committee, chaired by Emma Fox.

We have launched a significant and thorough review to ensure that

we emerge as a more responsible business, primed to play a positive

role in the industry's recovery. We are now implementing procedures

across the pubs which will help reduce our carbon footprint and

waste, engage more with local communities so that they can utilise

our pubs, and promote diversity across the Group. We are taking our

responsibilities seriously and want to get it right as we do

understand that those that succeed in this area will have

competitive advantage.

Dividends

The Board has decided to utilise short-term positive cash flow

generated to either invest in new opportunities or reduce its bank

borrowings. However, when there is a return to normal trading

conditions and the cash position is even stronger, the Group will

consider a resumption of dividend payments. It is important to

stress it will not however resume dividends while it continues to

receive state aid such as business rates relief, VAT reductions and

grants or has access to its CLBLS, a condition of which is that

dividends are not paid.

COVID-19 / Industry Issues

There have been a number of well publicised issues which have

impacted the pub industry. We have not experienced any major supply

issues of goods. However, the lead time in doing pub refurbishments

has extended due to disruptions in supply of equipment, furniture

etc. and we are factoring this in when taking on new acquisitions

which require refurbishment.

There have been staff shortages as a result of many people

during COVID going back to the EU and not returning. There have

also been people who have left the industry. Also, a number of

staff, especially in July and August, have been asked not to go

into work as they've been identified as close contacts by Track and

Trace. Whilst this is very frustrating, we believe that the end of

the furlough scheme in September will increase the pool of labour

able to work in our industry and the returning students should also

help with staffing.

It would seem sensible for, and we call upon the Government to,

introduce a 2-3 year working visa to European nationals so that

people can come to the UK, work, study and return home extolling

the virtues of the British pub. This, we believe, will also

encourage much needed tourism, which is essential in helping our

sector to get back on its feet.

Outlook

The Group is emerging strongly from the pandemic with a better

and more efficient business. We are trading well and have improved

the quality of our estate in terms of its freehold mix and the

quality of the assets. We continue to make operational improvements

at Head Office and upgrade our pubs through well-costed and returns

enhancing refurbishments.

We have retained a core of very loyal employees across Head

Office and at site, with many of our key employees owning share

options to help drive performance and retention.

Trading is on an upward trend and since 17 May sales are above

90% of 2019 levels. Since the beginning of September, the return to

work has gathered pace and this has helped increase trade in our

city centre sites. A number of marketing activities are in place to

ensure that students frequent our pubs.

The increased emphasis on bedrooms has reaped significant reward

over the course of the summer, and whilst the staycation boom will

not last in perpetuity there has definitely been a reintroduction

on a broad scale to the traditional British seaside holiday, which

can only be beneficial to us and offers a great alternative to

carbon-conscious customers opting for a fly-free holiday. Our new

opening programme is very exciting and demonstrates that we are now

back on the expansion trajectory.

We remain ambitious. We seek to grow the number of pubs to more

than 100. We have brought together a very high quality and very

experienced Head Office team to achieve this. We have reduced costs

substantially to improve profitability and our reshaped trading

estate will deliver higher quality earnings.

Each and everyone involved with the Group has played their part

in helping us to emerge strongly and in optimal shape to take

advantage of the opportunities ahead. Our employees have been

brilliant and the Board would like to put on record its thanks. We

have a strong balance sheet, a new pipeline of acquisitions and a

great platform to trade the pubs from. Most importantly we have the

ambition to make sure the City Pub Group is a strong player in the

evolving pub market.

I look forward to updating you with further strong progress in

our January trading update.

Clive Watson

Executive Chairman

23 September 2021

Consolidated Statement of Comprehensive Income

For the 26 weeks ended 27 June 2021

Unaudited Unaudited Audited

26 weeks 26 weeks

ended ended 52 weeks ended

27 June 27 December

2021 28 June 2020 2020

Notes GBP'000 GBP'000 GBP'000

Revenue 8,872 12,142 25,815

Costs of sales (2,228) (3,029) (6,280)

---------- ------------- ---------------

Gross profit 6,644 9,113 19,535

Other operating income 2 4,921 2,931 5,391

Administrative expenses (12,623) (15,636) (31,423)

---------- ------------- ---------------

Operating loss (1,058) (3,592) (6,497)

Reconciliation to adjusted

EBITDA*

Operating loss (1,058) (3,592) (6,497)

7 &

Depreciation 8 2,645 2,775 5,494

Share option charge 304 103 397

Exceptional items 3 (954) 520 1,814

*Adjusted earnings/(loss)

before exceptional items,

share option charge, interest,

taxation and depreciation 937 (194) 1,208

---------------------------------

Finance costs (512) (653) (1,137)

---------- ------------- ---------------

Loss before tax (1,570) (4,245) (7,634)

Tax credit 4 242 760 1,171

Loss for the period and

total comprehensive income (1,328) (3,485) (6,463)

========== ============= ===============

Loss per share

Basic loss per share (p) 5 (1.28) (4.52) (7.15)

========== ============= ===============

Diluted earnings per share 5

(p) n/a n/a n/a

========== ============= ===============

All activities comprise continuing operations. There are no

recognised gains or losses other than those passing through the

statement of comprehensive income.

The accompanying notes are an integral part of these interim

financial statements.

Consolidated Statement of Financial Position

As at 27 June 2021

Unaudited Unaudited Audited

26 weeks

26 weeks ended ended 52 weeks ended

28 June 27 December

27 June 2021 2020 2020

Assets Notes GBP'000 GBP'000 GBP'000

Non-current

Intangible assets 3,282 4,136 3,282

Property, plant and equipment 7 108,770 110,709 108,573

Right-of-use assets 8 18,442 20,233 19,565

Deferred tax assets 745 - 503

Financial assets at fair

value 4,053 - 1,309

Total non-current assets 135,292 135,078 133,232

--------------- ---------- ---------------

Current

Inventories 909 740 703

Trade and other receivables 3,190 2,970 3,064

Cash and cash equivalents 9,775 11,666 12,331

Total current assets 13,874 15,376 16,098

--------------- ---------- ---------------

Total assets 149,166 150,454 149,330

--------------- ---------- ---------------

Liabilities

Current liabilities

Trade and other payables (10,146) (6,419) (8,430)

Financial liabilities -

lease liabilities (2,013) (2,083) (2,103)

Total current liabilities (12,159) (8,502) (10,533)

--------------- ---------- ---------------

Non-current

Borrowings (24,820) (24,829) (24,801)

Financial liabilities -

lease liabilities (16,892) (18,299) (17,750)

Deferred tax liabilities (2,181) (2,018) (2,181)

Total non-current liabilities (43,893) (45,146) (44,732)

--------------- ---------- ---------------

Total liabilities (56,052) (53,648) (55,265)

--------------- ---------- ---------------

Net assets 93,114 96,806 94,065

=============== ========== ===============

Equity

Share capital 9 31,275 31,275 31,275

Share premium 9 59,376 59,360 59,303

Own shares (JSOP) (3,272) (3,272) (3,272)

Other reserve 92 92 92

Share-based payment reserve 1,678 1,080 1,374

Retained earnings 3,965 8,271 5,293

Total equity 93,114 96,806 94,065

=============== ========== ===============

* - see note 7 for explanation of restatement.

The accompanying notes are an integral part of these interim

financial statements.

Consolidated Statement of Changes in Equity

For the 26 weeks ended 27 June 2021

Share-based

Share Share Own shares Other payment Retained

capital premium (JSOP) reserve reserve earnings Total

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

Balance at

29 December

2019 (Audited) 30,812 38,570 (3,272) 92 977 11,756 78,935

Employee share-based

compensation - - - - 103 - 103

Issue of new

shares 463 20,790 - - - - 21,253

Transactions

with owners 463 20,790 - - 103 - 21,356

--------- --------- ----------- --------- ------------ ---------- ---------

Loss for the

period - - - - - (3,485) (3,485)

Total comprehensive

income for

the period - - - - - (3,485) (3,485)

--------- --------- ----------- --------- ------------ ---------- ---------

Balance at

28 June 2020

(Unaudited) 31,275 59,360 (3,272) 92 1,080 8,271 96,806

========= ========= =========== ========= ============ ========== =========

Employee share-based

compensation - - - - 294 - 294

Issue of new

shares - (57) - - - - (57)

Transactions

with owners - (57) - - 294 - 237

--------- --------- ----------- --------- ------------ ---------- ---------

Loss for the

period - - - - - (2,978) (2,978)

Total comprehensive

income for

the period - - - - - (2,978) (2,978)

--------- --------- ----------- --------- ------------ ---------- ---------

Balance at

27 December

2020 (Audited) 31,275 59,303 (3,272) 92 1,374 5,293 94,065

========= ========= =========== ========= ============ ========== =========

Employee share-based

compensation - - - - 304 - 304

Issue of new

shares - 73 - - - - 73

Transactions

with owners - 73 - - 304 - 377

--------- --------- ----------- --------- ------------ ---------- ---------

Loss for the

period - - - - - (1,328) (1,328)

Total comprehensive

income for

the period - - - - - (1,328) (1,328)

--------- --------- ----------- --------- ------------ ---------- ---------

Balance at

27 June 2021

(Unaudited) 31,275 59,376 (3,272) 92 1,678 3,965 93,114

========= ========= =========== ========= ============ ========== =========

The accompanying notes are an integral part of these interim

financial statements.

Consolidated Statement of Cashflows

For the 26 weeks ended 27 June 2021

Unaudited Unaudited Audited

26 weeks

26 weeks ended ended 52 weeks ended

28 June 27 December

27 June 2021 2020 2020

GBP'000 GBP'000 GBP'000

Cash flows from operating activities

Loss for the period (1,328) (3,485) (6,463)

Taxation (242) (760) (1,171)

Finance costs 512 653 1,137

--------------- ---------- ---------------

Operating loss (1,058) (3,592) (6,497)

Adjustments for:

Depreciation 2,645 2,775 5,494

Share-based payment charge 304 103 397

Impairment - - 933

Change in inventories (206) 480 517

Change in trade and other receivables (126) 1,080 1,055

Change in trade and other payables 1,738 (2,287) (258)

--------------- ---------- ---------------

Cash generated from/(used in)

operations 3,297 (1,441) 1,641

Tax paid - (341) (341)

Net cash (used in)/from operating

activities 3,297 (1,782) 1,300

--------------- ---------- ---------------

Cash flows from investing activities

Purchase of property, plant and

equipment (1,980) (1,699) (2,304)

Purchase of investments (2,744) - (1,309)

Proceeds from disposal of property,

plant and equipment - - 821

Net cash used in investing activities (4,724) (1,699) (2,792)

--------------- ---------- ---------------

Cash flows from financing activities

Proceeds from issue of share capital 73 21,252 21,196

Repayment of borrowings - (7,500) (7,544)

Principal elements of lease payments (647) (1,008) (1,347)

Interest paid (555) (366) (1,251)

Net cash from financing activities (1,129) 12,378 11,054

--------------- ---------- ---------------

Net change in cash and cash equivalents (2,556) 8,897 9,562

Cash and cash equivalents at the

start of the period 12,331 2,769 2,769

Cash and cash equivalents at the

end of the period 9,775 11,666 12,331

=============== ========== ===============

The accompanying notes are an integral part of these interim

financial statements.

Notes to the Financial Statements

For the 26 weeks ended 27 June 2021

1 Basis of preparation

This interim report was approved by the board on 22 September

2021. The interim financial statements are unaudited and are not

the Group's statutory accounts as defined in section 434 of the

Companies Act 2006.

The consolidated interim financial statements have been prepared

under IFRS as adopted by the European Union and on the basis of the

accounting policies set out in the statutory accounts of The City

Pub Group plc, for the period ended 27 December 2020. The financial

statements have not been prepared (and are not required to be

prepared) in accordance with IAS 34: 'Interim Financial Reporting'.

They do not include any of the information required for full annual

financial statements and should be read in conjunction with the

consolidated financial statements of the Group for the period ended

27 December 2020.

Statutory accounts for the period ended 27 December 2020 have

been delivered to the Registrar of Companies. These accounts

contain an unqualified audit report under Section 495 of the

Companies Act 2006, which did not make any statements under Section

498 of the Companies Act 2006.

The interim report is presented in Great British Pounds and all

values are rounded to the nearest thousand pounds, except where

otherwise indicated.

This interim report has been prepared in accordance with the AIM

Rules issued by the London Stock Exchange.

2 Other operating income

During the interim period the Group has continued to receive

Government grants, mainly in relation to the Furlough Scheme

provided by the Government in response to COVID-19's impact on

our business. Further analysis of other operating income

is set out below.

Unaudited Unaudited Audited

26 weeks 26 weeks 52 weeks

ended ended ended

27 June 27 December

2021 28 June 2020 2020

GBP'000 GBP'000 GBP'000

Coronavirus Job Retention

Scheme 2,911 2,904 5,141

Other government grants 1,010 27 250

Insurance claim 1,000 - -

4,921 2,931 5,391

========== ============= ============

3 Exceptional items

Unaudited Unaudited Audited

26 weeks 26 weeks 52 weeks

ended ended ended

27 June 27 December

2021 28 June 2020 2020

GBP'000 GBP'000 GBP'000

Pre opening costs 7 5 14

Impairment of a pub site

(note 6) - - 933

Inventory impairments - - 662

Other non recurring items 39 515 205

Insurance claim (1,000) - -

(954) 520 1,814

========== ============= ============

For the purposes of this interim announcement and annual report

and accounts, Exceptional items are highlighted as part of the use

of alternative non-Generally Accepted Accounting Practice

('non-GAAP') financial measures which are not defined within IFRS.

The Directors use these measures in order to assess the underlying

operational performance of the Group and as such, these measures

are important and should be considered alongside the IFRS

measures.

The insurance claim is recognised within other operating income

and all the other exceptional items are recorded within

administrative expenses line in the statement of comprehensive

income.

4 Tax credit on loss on ordinary activities

The taxation credit is calculated by applying the Directors'

best estimate of the annual effective tax rate to the loss for the

period. All items of taxation are reflected through the Statement

of Comprehensive Income.

Unaudited Unaudited Audited

26 weeks 26 weeks 52 weeks

ended ended ended

27 June 28 June 27 December

2021 2020 2020

GBP'000 GBP'000 GBP'000

Current income tax:

Current income tax (credit)/charge - (655) (572)

Adjustments in respect of previous

period - - (154)

Total current income tax (credit)/charge - (655) (726)

---------- ---------- ------------

Deferred tax:

Origination and reversal of

temporary differences (242) (105) (445)

Adjustments in respect of previous - - -

period

Total deferred tax (credit)/charge (242) (105) (445)

---------- ---------- ------------

Total tax (credit)/charge (242) (760) (1,171)

========== ========== ============

5 Loss per share

Unaudited Unaudited Audited

26 weeks ended 26 weeks ended 52 weeks ended

27 December

27 June 2021 28 June 2020 2020

GBP'000 GBP'000 GBP'000

Loss for the period

attributable to Shareholders (1,328) (3,485) (6,463)

=============== =============== ===============

Loss per share:

Basic loss per share

(p) (1.28) (4.52) (7.15)

Diluted earnings per n/a n/a n/a

share (p)

Weighted average number Number of Number of Number of

of shares: shares shares shares

Weighted average shares

for basic EPS 103,764,494 77,145,443 90,451,692

Effect of share options n/a n/a n/a

in issue

Weighted average shares n/a n/a n/a

for diluted earnings

per share

=============== =============== ===============

6 Dividends

The Directors did not propose a dividend in relation to the year

ended 27 December 2020 due to the Coronavirus pandemic (2019:

nil).

7 Property, plant and equipment

Group

Freehold Fixtures,

& leasehold fittings

property and computers Total

Cost GBP'000 GBP'000 GBP'000

At 29 December 2019 (Audited) 97,292 29,357 126,649

Additions 111 1,650 1,761

------------- --------------- --------

At 28 June 2020 (Unaudited) 97,403 31,007 128,410

Additions 200 457 657

Disposals (821) - (821)

At 27 December 2020 (Audited) 96,782 31,464 128,246

------------- --------------- --------

Additions 1,155 869 2,024

Disposals - (20) (20)

------------- --------------- --------

At 27 June 2021 (Unaudited) 97,937 32,313 130,250

------------- --------------- --------

Depreciation

At 29 December 2019 (Audited) 4,627 11,108 15,735

Provided during the period 373 1,593 1,966

At 28 June 2020 (Unaudited) 5,000 12,701 17,701

Provided during the period 374 1,519 1,893

Impairment - 79 79

At 27 December 2020 (Audited) 5,374 14,299 19,673

------------- --------------- --------

Provided during the period 372 1,455 1,827

Disposals - (20) (20)

At 27 June 2021 (Unaudited) 5,746 15,734 21,480

------------- --------------- --------

Net book value

At 27 June 2021 (Unaudited) 92,191 16,579 108,770

============= =============== ========

At 27 December 2020 (Audited) 91,408 17,165 108,573

============= =============== ========

At 28 June 2020 (Unaudited) 92,403 18,306 110,709

============= =============== ========

At 29 December 2019 (Audited) 92,665 18,249 110,914

============= =============== ========

During the period ended 27 December 2020 the group made a

provision for impairment against a number of sites totalling

GBP593,000, however GBP514,000 of this impairment should have been

processed against goodwill rather than fixtures and fittings,

therefore a correction has been processed to the 27 December 2020

figures. This restatement has no impact on the result for the

current year, on earnings per share, on net assets or on the

retained earnings reserve brought forward.

8 Right-of-use assets

Right-of-use

assets

Cost GBP'000

At 29 December 2019 (Audited) -

-------------

On adoption of IFRS 16 21,042

At 28 June 2020 (Unaudited) 21,042

-------------

Additions 158

-------------

At 27 December 2020 (Audited) 21,200

-------------

Disposals (418)

-------------

At 27 June 2021 (Unaudited) 20,782

-------------

Depreciation

At 29 December 2019 (Audited) -

-------------

Provided during the period 809

At 28 June 2020 (Unaudited) 809

-------------

Provided during the period 826

-------------

At 27 December 2020 (Audited) 1,635

-------------

Provided during the period 818

Disposals (113)

-------------

At 27 June 2021 (Unaudited) 2,340

-------------

Net book value

At 27 June 2021 (Unaudited) 18,442

=============

At 27 December 2020 (Audited) 19,565

=============

At 28 June 2020 (Unaudited) 20,233

=============

At 29 December 2019 (Audited) -

=============

The disposal during the period relates to the Roundhouse Pub,

where the Group acquired the Freehold and therefore no ongoing ROU

asset required.

9 Share capital

In May 2021 the Group issued 22,500 GBP0.01 shares at a price of

GBP1.00 per share in relation to the exercise of share options. The

premium on the shares issued was credited to the share premium

account.

10 Events after the reporting period

- Disposal of the Island, Kensal Green during July 2021.

- Disposal of the Punt Yard during August 2021.

- Opening of our new site, the Turks Head in Exeter during September 2021.

- Completed on the acquisition of a freehold 30-bedroom pub / hotel in north Norfolk.

- Completed on a new leasehold site in Bury St Edmunds.

- Exchanged on the disposal of Tell Your Friends, London.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

IR BLLLLFKLLBBX

(END) Dow Jones Newswires

September 23, 2021 02:00 ET (06:00 GMT)

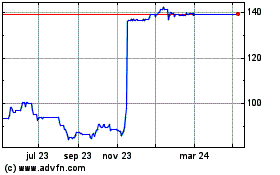

City Pub (LSE:CPC)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

City Pub (LSE:CPC)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024