TIDMIMM

RNS Number : 2838N

Immupharma PLC

29 September 2021

RNS: RELEASE | 29 SEPTEMBER 2021

ImmuPharma PLC

("ImmuPharma" or the "Company")

INTERIM RESULTS ANNOUNCEMENT

for the six months ended 30 June 2021

ImmuPharma PLC (LSE:IMM) , (Euronext Growth Brussels: ALIMM)

("ImmuPharma" or the "Company"), the specialist drug discovery and

development company, is pleased to announce its interim results for

the six months ended 30 June 2021 (the "Period").

Key Highlights (including post Period review)

Financials

-- Financial performance in line with expectations over the Period

o Cash balance of GBP4.2m as at 30 June 2021 (31 December 2020:

GBP5.9m)

o Loss for the period of GBP3.7m (30 June 2020: GBP3m)

o Research and development expenses of GBP1.3m (30 June 2020:

GBP0.9m)

o Administrative expenses of GBP1.5m (30 June 2020: GBP1m)

o Derivative financial asset of GBP0.2m as at 30 June 2021 (31

December 2020: GBP1.2m)

o Incanthera financial asset of GBP1.2m (GBP1.8m at 31 December

2020) and warrants financial asset of GBP0.2m (GBP0.6m at 31

December 2020)

o Convertible loan notes of GBP0.7m (GBP0.6m at 31 December

2020)

o Share based expense of GBP0.3m (30 June 2020: GBP1m)

o Basic and diluted loss per share of 1.46p (30 June 2020:

1.69p)

'Autoimmunity': P140

o Lupuzor(TM) (P140) - now entering a pharmacokinetic ("PK")

study prior to the optimized Phase 3 study in lupus in conjunction

with its licensing partner, Avion Pharmaceuticals.

o P140 for Chronic Inflammatory Demyelinating Polyneuropathy

("CIDP") a neurological disorder targeting the body's nerves.

Active preparation for a phase 2/3 clinical study has now been

initiated.

o Potential further clinical applications based on further

preclinical investigation include asthma, Sjogrens syndrome, renal

inflammation in diabetes and periodontitis.

'Anti-infection'

o BioAMB, a novel peptide-based drug that offers a potential

improvement on the limiting side effects of current Amphotericin-B

("AMB") formulations. AMB is one of a last line of agents against

serious and life-threatening fungal infections caused by the

aspergillus family of fungi.

o BioCin, a novel peptide-based drug based on an existing potent

antibacterial used in high medical need cases. BioCin has the

potential to offer improved safety and/or administration

benefits.

Board changes

-- New Board established:

o Tim McCarthy appointed as Chief Executive Officer ("CEO")

o Dr Tim Franklin appointed as Chief Operating Officer

("COO").

o Non Executive Directors ("NED") appointed - Dr Sanjeev Pandya

& Lisa Baderoon.

Commenting on the statement and outlook Tim McCarthy, Chairman

& CEO, said :

"The last few months have seen significant changes in the

leadership of the Company. This has been echoed in the Corporate

Update, which we announced today, reflecting the positive steps

being taken, to move ImmuPharma forward. We have created positive

and constructive changes within the business, with a focus on

delivery of product development, value added milestones and a much

more commercially focussed corporate strategy. The new Board,

together with the excellent team supporting us, are determined to

progress the development and commercialisation of all the key

assets in our portfolio and to build shareholder value.

In closing, the Board would like to take this opportunity to

thank its shareholders for their continued patience and support, as

well as its staff, corporate and scientific advisers and our

partners including, CNRS and Avion"

Market Abuse Regulation (MAR) Disclosure

THIS ANNOUNCEMENT CONTAINS INSIDE INFORMATION AS STIPULATED

UNDER THE UK VERSION OF THE MARKET ABUSE REGULATION NO 596/2014

WHICH IS PART OF UK LAW BY VIRTUE OF THE EUROPEAN UNION

(WITHDRAWAL) ACT 2018, AS AMED. ON PUBLICATION OF THIS ANNOUNCEMENT

VIA A REGULATORY INFORMATION SERVICE, THIS INFORMATION IS

CONSIDERED TO BE IN THE PUBLIC DOMAIN.

For further information please contact:

ImmuPharma PLC (www.immupharma.com) + 44 (0) 207 152 4080

Tim McCarthy, Chairman & CEO

Lisa Baderoon, Head of Investor Relations & NED + 44 (0) 7721 413496

SPARK Advisory Partners Limited (NOMAD)

Neil Baldwin

Stanford Capital Partners (Joint Broker)

Patrick Claridge, John Howes +44 (0) 203 36 8 8974

SI Capital (Joint Broker) +44 (0) 203 815 8880

Nick Emerson +44 (0) 1483 413500

4Reliance (Euronext Growth Listing Sponsor)

Jean-Charles Snoy

Degroof Petercam (Liquidity Provider)

Erik De Clippel +32 (0) 2 747 02 60

Backstage Communication +32 (0) 2 287 95 34

Olivier Duquaine +32 (0) 477 504 784

Gunther De Backer +32 (0) 475 903 909

A copy of the interim report is available on the Company's

website www.immupharma.com and from the Company Secretary at

registered address.

ImmuPharma plc

Chairman's Statement

INTERIM HIGHLIGHTS

The first half of 2021, up to the current date, has seen a

number of key developments for ImmuPharma, including further

progress within our flagship Lupuzor(TM) program in Lupus and

changes in the Board of Directors.

Lupuzor(TM) - Opportunity and next steps

There are an estimated five million people globally suffering

from lupus, with approximately 1.5 million patients in the US,

Europe and Japan (Source: Lupus Foundation of America). Current

'standard of care' treatments, including steroids and

immunosuppressants, can potentially have either serious side

effects for patients or limited efficacy, with over 60 per cent of

patients not adequately treated.

ImmuPharma believes Lupuzor(TM) has the potential to be a novel

specific drug therapy for the treatment of Lupus by specifically

modulating the immune system and halting disease progression in a

substantial proportion of patients.

Lupuzor(TM) has a unique mechanism of action that modulates the

activity of CD4 T-cells which are involved in the cell-mediated

immune response which leads to the lupus disease. Lupuzor(TM),

taken over the long term, as indicated in earlier stage clinical

trials, has the potential to prevent the progression of lupus

rather than just treating its symptoms, with the rest of the immune

system retaining the ability to work normally.

The Board is confident that there are a number of routes to

market for Lupuzor(TM), including corporate collaborations. Such a

collaboration was successfully completed at the end of November

2019, resulting in a signed exclusive Trademark, License and

Development Agreement with Avion Pharmaceuticals LLC ("Avion") in

the US. Positive discussions with a number of potential commercial

partners for Lupuzor(TM) in key territories outside of the US are

continuing.

Lupuzor(TM) and Avion Pharmaceuticals

On 28 November 2019, ImmuPharma and Avion Pharmaceuticals

("Avion") signed an exclusive Trademark, License and Development

Agreement for Lupuzor(TM), with Avion agreeing to fund a new

international Phase 3 trial and commercialising Lupuzor(TM) in the

US. Since then, both companies have been working closely on the

clinical trial design and strategy, bolstered by consultation with

an eminent group of key opinion leaders. This tripartite Phase 3

protocol development approach provided thorough and detailed

support for developing the most relevant clinical trial for

Lupuzor(TM) in systemic lupus erythematosus ("SLE") patients. Data

and results from the first Phase 3 clinical study were analysed and

considered in detail and, as a result, a new optimised

international Phase 3 study protocol has been finalised and

approved on the 22 July 2021 by the US Food and Drug Administration

("FDA") (subject to prior successful completion of PK study).

In the first half of 2021 ImmuPharma provided progress updates

to the market in respect to guidance meetings between the FDA and

Avion.

As part of this feedback and as announced on 9 February 2021,

the FDA requested that Avion and ImmuPharma develop and validate a

bioanalytical assay in order to confirm the unique pharmacokinetic

("PK") profile of Lupuzor(TM).

On 24 June 2021 it was announced that following submission by

Avion of the PK methodology study, the FDA would, by written

response, approve the PK study around the end of July 2021.

On 12 August 2021 ImmuPharma announced that the FDA had approved

the commencement of the PK study.

The PK study is a Phase 1 study to assess the presence of

Lupuzor(TM) in the body after administration of a single dose. The

study will be carried out in a total of up to 24 healthy male

volunteers. Dependent on timing of patient recruitment, we

anticipate that the PK study will take between 8-12 weeks to

complete, from commencement.

Preparations will be made to commence the Phase 3 study,

following completion of the PK study. For the continued late-stage

program development, ImmuPharma and Avion, as part of a joint

steering committee, agreed on a collaborative group consisting of a

Board of Key Opinion Leaders ("KOLs") and a leading medical patient

advocacy group. Collectively, this network, due to its in-depth

knowledge of the lupus disease and their access to lupus patient

groups, will be invaluable to the successful outcome of the Phase 3

trial, which is being fully funded by Avion, estimated to be around

$25 million investment.

ImmuPharma will provide an update on the progress of the PK

study once it has commenced.

Pipeline Overview

Most recently, the Board completed a full review of the R&D

activities across the Group which resulted in the Board having the

following conclusions:

There is a depth of scientific knowledge and innovation within

the R&D team in Bordeaux and with the new scientific leadership

we expect there to be a significant improvement in productivity and

achievement of product development targets in the future. There is

a need for a focus on those product developments (see below) which

offer the highest probability of both scientific and commercial

success. Management will concentrate more of their time on

identifying and concluding commercial collaborations and licensing

deals across the product portfolio.

Having assessed our current portfolio and resources, the focus

will now be on Autoimmunity and Anti-infection and those product

developments which offer near-term and commercially viable

opportunities:

Autoimmunity

The increasing knowledge of P140's mode of action and its

relevance to many autoimmune and inflammatory conditions provides a

depth of disease states for ImmuPharma and its partners to explore

in the near future. The therapeutic potential of P140 goes beyond

just lupus, with Chronic Inflammatory Demyelinating Polyneuropathy

("CIDP") being the next step. This expanding insight is

fundamentally driven by the excellent research partnership between

the Company and Prof. Sylviane Muller, inventor of P140 and

director of CNRS, France.

o Lupuzor(TM) (P140) - now entering a PK study prior to the

optimized Phase 3 study in lupus.

o P140 for CIDP a neurological disorder targeting the body's

nerves. Active preparation for a phase 2/3 clinical study has now

been initiated.

o Further clinical applications based on further preclinical

investigation include asthma, Sjogrens syndrome, renal inflammation

in diabetes and periodontitis.

Anti-Infection

The innovative peptide technology at ImmuPharma Biotech has been

a huge success and very recently has given rise to a number of

novel development programs, out of which we have identified two

core programs, in pre-clinical development; BioAMB and BioCin,

which we believe have the best commercial opportunity and speed to

market.

o BioAMB, a novel peptide-based drug that offers a potential

improvement on the limiting side effects of current Amphotericin-B

("AMB") formulations. AMB is one of a last line of agents against

serious and life-threatening fungal infections caused by the

aspergillus family of fungi.

o BioCin, a novel peptide-based drug based on an existing potent

antibacterial used in high medical need cases. BioCin has the

potential to offer improved safety and/or administration

benefits

Board Changes

In 2021 to date, the Company announced a number of key Board

changes. In June 2021, Dr Robert Zimmer, co-founder of ImmuPharma

and Chief Science Officer, retired to pursue other endeavours after

16 years of service. As a substantial shareholder in ImmuPharma and

to demonstrate his continued support of the Company, Dr Zimmer

entered into a lock-in agreement, to not dispose of shares in which

he has an interest, for a period of three years or, if earlier than

three years, the date of the reporting by the Company of the

preliminary results of the next Phase 3 clinical trial of

Lupuzor(TM).

On 16 July 2021, Dr Tim Franklin, Chief Operating Officer, was

appointed to the Board of Directors. Tim has worked for ImmuPharma

for over three years, initially as a consultant and more recently

appointed as Chief Operating Officer in November 2020. His key

responsibilities include working closely with ImmuPharma's product

development team and scientific advisors, in addition to exploring

business development opportunities with potential partners. These

activities aim to progress the Company's drug development

portfolio, both through in house development and partnering

opportunities.

On 30 July 2021, as part of a Board Changes announcement, it was

confirmed that Dimitri Dimitriou, co-founder and CEO of ImmuPharma,

for over 16 years, had decided to step down from his position, in

order to pursue a number of other external opportunities. Tim

McCarthy, Chairman, has been appointed as CEO. The Company has

initiated a process to identify a suitable person to take over as

Non-Executive Chair of the Company and during this interim period

Tim McCarthy will continue as Chairman.

Further, Dr Franco di Muzio, Senior NED and Dr Stéphane Méry,

NED stepped down from the Board, following 14 and 6 years in these

roles respectively.

In the same announcement, Dr Sanjeev Pandya was appointed as

Senior Independent NED. In addition, Lisa Baderoon has been

appointed to the Board as NED.

Interest in Incanthera Plc

ImmuPharma has a 13.37% interest in Oncology specialist,

Incanthera plc, which trades on Aquis Stock Exchange ("AQSE") under

the ticker (TIDM:INC).

ImmuPharma also has 7,272,740 warrants options in Incanthera at

an exercise price of 9.5p pence, being the price at which new

shares have been issued in the Placing accompanying Incanthera's

listing.

As a major shareholder, ImmuPharma remains supportive of

Incanthera.

Financial Review

ImmuPharma's cash balance at 30 June 2021 was GBP4.2 million

(GBP5.9 million at 31 December 2020, GBP2.7 million at 30 June

2020). Financial asset related to investment in Incanthera plc

amounted to GBP1.2 million (GBP1.8 million at 31 December 2020,

GBP1.2 million at 30 June 2020) and warrants granted has resulted

in amount of GBP0.2 million (GBP0.6 million at 31 December 2020 and

GBP0.5 million at 30 June 2020), recognized under financial asset.

As a result of the Lanstead Sharing Agreements, the Company had a

derivative financial asset of GBP0.2 million at 30 June 2021

(GBP1.2 million at 31 December 2020, GBP2.5 million at 30 June

2020). The convertible loans liability amounted to GBP0.7 million

(GBP0.6 million at 31 December 2020, GBP1.8 million at 30 June

2020). Trade and other payables liability amounted to GBP1.1

million at 30 June 2021 (GBP0.6 million at 31 December 2020, GBP0.2

million at 30 June 2020). The increase was mainly caused by

Directors and Related Party departures. Basic and diluted loss per

share were 1.46p and 1.46p respectively (30 June 2020: 1.69p and

1.69p). In line with the Company's current policy, no interim

dividend is proposed.

Operating loss for the Period was GBP3.1 million (GBP2.9 million

for the six months ended 30 June 2020). Research and development

expenditure in the Period was GBP1.3 million (GBP0.9 million for

the six months ended 30 June 2020). Administrative expenses were

GBP1.5 million during the Period (GBP1.0 million for the six months

ended 30 June 2020), with the increase being largely due to

departure costs regarding Directors and Related Parties in the

period, which were settled post period-end. The share based expense

was GBP0.3 million (GBP1.0 million for the six months ended 30 June

2020). Finance costs for the Period were GBP0.9 million (GBP0.4

million for the six months ended 30 June 2020). This arose largely

due to the calculation of fair value of the derivative financial

asset - "Lanstead Sharing Agreements", which resulted in a finance

loss of GBP0.8 million. Finance income for the Period was GBP0.1

million (GBP0.1 million for the six months ended 30 June 2020). It

primarily arose due to foreign exchange gain in relation to

intercompany receivables.

Given the stage of ImmuPharma's development, the fact that

losses have continued to be made is to be expected since there is

minimal revenue and business activity is concerned with significant

investment in the form of clinical development expenditure, in

addition to maintaining the infrastructure of the Company.

Current Activities and Outlook

The last few months have seen significant changes in the

leadership of the Company. We have created positive and

constructive changes within the business, with a focus on delivery

of product development, value added milestones and a much more

commercially focussed corporate strategy. The new Board, together

with the excellent team supporting us, are determined to progress

the development and commercialisation of all the key assets in our

portfolio and to build shareholder value.

In closing, the Board would like to take this opportunity to

thank its shareholders, new and longstanding, for their patience

and support as well as its staff, corporate and scientific advisers

and our partners including, CNRS and Avion.

Tim McCarthy

Non-Executive Chairman & CEO

ImmuPharma plc

CONSOLIDATED INCOME STATEMENT

FOR THE PERIODED 30 JUNE 2021

Note Unaudited Audited Unaudited

6 months Year ended 6 months

ended 31 December ended

30 June 2020 30 June

2021 2020

GBP GBP GBP

Continuing operations

Revenue 23,531 126,667 62,207

Research and development

expenses (1,319,875) (2,372,834) (924,263)

Administrative expenses (1,495,308) (1,764,897) (1,042,345)

Share based expense (288,826) (1,578,368) (953,034)

Operating loss (3,080,478) (5,589,432) (2,857,435)

Finance costs 4 (904,549) (1,697,832) (391,671)

Finance income 95,225 41,089 142,342

Loss before taxation (3,889,802) (7,246,175) (3,106,764)

Tax 229,919 386,248 147,423

Loss for the period (3,659,883) (6,859,927) (2,959,341)

Attributable to:

Equity holders of the parent

company (3,659,883) (6,859,927) (2,959,341)

Loss per ordinary share

Basic and diluted 2 (1.46)p (3.43)p (1.69)p

ImmuPharma plc

CONSOLIDATED STATEMENT OF COMPREHENSIVE INCOME

FOR THE PERIODED 30 JUNE 2021

Unaudited Audited Unaudited

6 months Year 6 months

ended ended 31 ended

30 June December 30 June

2021 2020 2020

GBP GBP GBP

Loss for the financial period (3,659,883) (6,859,927) (2,959,341)

Other comprehensive income

Items that will not be reclassified

subsequently to profit or loss:

Fair value (loss)/gain on investment (555,633) 851,772 472,728

Fair value (loss)/gain on warrants (395,640) 625,576 481,357

Total items that will not be

reclassified subsequently to

profit or loss (951,273) 1,477,348 954,085

Items that may be reclassified

subsequently to profit or loss:

Exchange differences on translation

of foreign operations (20,357) 42,207 91,651

Total items that may be reclassified

subsequently to profit or loss (20,357) 42,207 91,651

Other comprehensive (loss)/income

for the period (971,630) 1,519,555 1,045,736

Total comprehensive loss for

the period (4,631,513) (5,340,372) (1,913,605)

ImmuPharma plc

CONSOLIDATED STATEMENT OF FINANCIAL POSITION

AS AT 30 JUNE 2021

Note Unaudited Audited Unaudited

6 months Year 6 months

ended ended 31 ended

30 June December 30 June

2021 2020 2020

GBP GBP GBP

Non-current assets

Intangible assets 495,736 484,042 502,062

Property, plant and equipment 369,700 411,606 276,302

Financial asset 1,466,985 2,418,258 1,645,483

Derivative financial asset 4 - 174,488 760,011

Total non-current assets 2,332,421 3,488,394 3,183,858

Current assets

Trade and other receivables 129,850 161,998 162,125

Cash and cash equivalents 4,248,412 5,862,057 2,713,903

Current tax asset 211,180 386,590 147,882

Derivative financial asset 4 160,436 1,016,635 1,774,001

Total current assets 4,749,878 7,427,280 4,797,911

Current liabilities

Financial liabilities -

borrowings (914) (6,939) (30,376)

Trade and other payables (1,113,465) (619,037) (237,541)

Convertible loans (655,811) (634,902) (236,647)

Total current liabilities (1,770,190) (1,260,878) (504,564)

Net current assets 2,979,688 6,166,402 4,293,347

Non-current liabilities

Convertible loans 5 - - (1,598,795)

Net assets 5,312,109 9,654,796 5,878,410

EQUITY

Ordinary shares 25,022,130 25,022,130 18,301,093

Share premium 27,237,329 27,237,329 27,122,305

Merger reserve 106,148 106,148 106,148

Other reserves 3,524,005 3,255,536 2,544,800

Retained earnings (50,577,503) (45,966,347) (42,195,936)

Total equity 5,312,109 9,654,796 5,878,410

ImmuPharma plc

CONSOLIDATED STATEMENT OF CHANGES IN EQUITY

FOR THE PERIODED 30 JUNE 2021

Other Other

Other Other reserves reserves

reserves reserves -Equity -

Merger - - shares Convertible Retained

Share Share reserve Acquisition Translation to be option Earnings Total

capital premium reserve Reserve issued reserve equity

GBP GBP GBP GBP GBP GBP GBP GBP GBP

At 1 January

2020 16,736,093 27,187,316 106,148 (3,541,203) (1,350,687) 6,322,227 - (40,190,680) 5,269,214

Loss for the

financial

period - - - - - - - (2,959,341) (2,959,341)

Exchange

differences

on

translation

of foreign

operations - - - - 91,651 - - - 91,651

Share based

payments - - - - - 953,034 - - 953,034

New issues of

equity

capital 1,565,000 - - - - - - - 1,565,000

Cost of new

issue of

equity

capital - (65,011) - - - - - - (65,011)

Equity

component of

convertible

loan notes - - - - - - 69,778 - 69,778

Fair value

gain on

investments - - - - - - - 472,728 472,728

Fair value

gain on

warrants - - - - - - - 481,357 481,357

------------ ------------ ---------- -------------- --------------------- ----------- -------------- -------------- ------------------------------

At 30 June

2020 18,301,093 27,122,305 106,148 (3,541,203) (1,259,036) 7,275,261 69,778 (42,195,936) 5,878,410

============ ============ ========== ============== ===================== =========== ============== ============== ==============================

At 1 January

2020 16,736,093 27,187,316 106,148 (3,541,203) (1,350,687) 6,322,227 - (40,190,680) 5,269,214

Loss for the

financial

year - - - - - - - (6,859,927) (6,859,927)

Exchange

differences

on

translation

of foreign

operations - - - - 42,207 - - - 42,207

Share based

payments - - - - - 1,751,369 - - 1,751,369

Equity

component of

convertible

loan notes 31,623 - 31,623

New issue of

equity

capital 8,286,037 665,281 - - - - - - 8,951,318

Cost of new

issue of

equity

capital - (615,268) - - - - - (393,088) (1,008,356)

Fair value

gain o n

investments - - - - - - - 851,772 851,772

Fair value

gain on

share

warrants - - - - - - - 625,576 625,576

------------ ------------ ---------- -------------- --------------------- ----------- -------------- -------------- ------------------------------

At 31

December

2020

& 1 January

2021 25,022,130 27,237,329 106,148 (3,541,203) (1,308,480) 8,073,596 31,623 (45,966,347) 9,654,796

============ ============ ========== ============== ===================== =========== ============== ============== ==============================

Loss for the

financial

period - - - - - - - (3,659,883) (3,659,883)

Exchange

differences

on

translation

of foreign

operations - - - - (20,357) - - - (20,357)

Share based

payments - - - - - 288,826 - - 288,826

Fair value

loss on

investments - - - - - - - (555,633) (555,633)

Fair value

loss on

warrants - - - - - - - (395,640) (395,640)

------------ ------------ ---------- -------------- --------------------- ----------- -------------- -------------- ------------------------------

At 30 June

2021 25,022,130 27,237,329 106,148 (3,541,203) (1,328,837) 8,362,422 31,623 (50,577,503) 5,312,109

============ ============ ========== ============== ===================== =========== ============== ============== ==============================

Attributable

to:-

Equity

holders of

the

parent

company 25,022,130 27,237,329 106,148 (3,541,203) (1,328,837) 8,362,422 31,623 (50,577,503) 5,312,109

============ ============ ========== ============== ===================== =========== ============== ============== ==============================

ImmuPharma plc

CONSOLIDATED STATEMENT OF CASHFLOWS

FOR THE PERIODED 30 JUNE 2021

Note Unaudited Audited Unaudited

6 months Year 6 months

ended ended 31 ended

30 June December 30 June

2021 2020 2020

GBP GBP GBP

Cash flows from operating

activities

Cash used in operations 3 (2,068,937) (3,879,936) (2,095,047)

Tax received 390,418 606,157 640,198

Interest paid (1,444) (55,622) (1,373)

Net cash used in operating

activities (1,679,963) (3,329,401) (1,456,222)

Investing activities

Purchase of property,

plant and equipment (48,014) (360,290) (83,239)

Purchase of intangibles (4,756) - -

Interest received 215 41,089 100,825

Purchase of investments - (250,000) -

Net cash (used in)/generated

from investing activities (52,555) (569,201) 17,586

Financing activities

Decrease in bank overdraft 5 (184) (212)

New loans/(loan repayments) (5,751) (21,256) 1,942

Settlements from Sharing

Agreement 261,116 1,292,393 655,065

Gross proceeds from issue

of new share capital - 8,000,000 1,500,000

Share capital issue costs - (702,133) -

Funds deferred per Sharing

Agreement - (1,300,000) (1,300,000)

Gross proceeds from issue

of convertible loan notes - 2,152,252 1,905,220

Convertible loan notes issue - (235,552) -

costs

Convertible loan notes repaid - (815,166) -

Net cash generated from/(used

in) financing activities 255,370 8,370,354 2,762,015

Net increase/(decrease) in

cash and cash equivalents (1,477,148) 4,471,752 1,323,379

Cash and cash equivalents

at start of period 5,862,057 1,364,840 1,364,840

Effects of exchange rates

on cash and

cash equivalents (136,497) 25,465 25,684

Cash and cash equivalents

at end of period 4,248,412 5,862,057 2,713,903

ImmuPharma plc

NOTES TO THE CONSOLIDATED INTERIM ACCOUNTS FOR THE PERIODED 30

JUNE 2021

1 ACCOUNTING POLICIES

Basis of preparation

The interim financial information in this report has been

prepared using accounting policies consistent with IFRS as adopted

by the United Kingdom. IFRS is subject to amendment and

interpretation by the International Accounting Standards Board

(IASB) and the IFRS Interpretations Committee and there is an

ongoing process of review and endorsement by the UK Endorsement

Board. The financial information has been prepared on the basis of

IFRS expected to be adopted by the United Kingdom and applicable as

at 31 December 2021. The Group has chosen not to adopt IAS 34

"Interim Financial Statements" in preparing the interim financial

information.

The accounting policies applied are consistent with those that

were applied to the financial statements for the year ended 31

December 2020.

Non-Statutory accounts

The financial information set out in this interim report does

not constitute the Group's statutory accounts, within the meaning

of Section 434 of the Companies Act 2006. The statutory accounts

for the year ended 31 December 2020 have been filed with Registrar

of Companies. The auditors reported on those accounts; their report

was unqualified, did not contain a statement under either Section

498 (2) or Section 498 (3) of the Companies Act 2006 but did

include emphasis of matter paragraphs relating to the carrying

value of Parent Company's investment in subsidiaries and

receivables due from group undertakings. The financial information

for the 6 months ended 30 June 2021 and 30 June 2020 is

unaudited.

Copies of this statement will be available on the Company's

website - www.immupharma.com.

ImmuPharma plc

NOTES TO THE CONSOLIDATED INTERIM ACCOUNTS FOR THE PERIODED 30

JUNE 2021

(Continued)

2 LOSS PER SHARE

Unaudited Audited Unaudited

6 months Year 6 months

ended ended 31 ended

30 June December 30 June

2021 2020 2020

GBP GBP GBP

Loss

Loss for the purposes of basic

and diluted loss per share

being net loss attributable

to equity shareholders (3,659,883) (6,859,927) (2,272,823)

Number of shares

Weighted average number of

ordinary shares for the purposes

of basic loss per share 250,221,297 200,176,156 174,969,760

Basic loss per share (1.46)p (3.43)p (1.69)p

Diluted loss per share (1.46)p (3.43)p (1.69)p

There is no difference between basic loss per share and diluted

loss per share as the share options and warrants are

anti-dilutive.

ImmuPharma plc

NOTES TO THE CONSOLIDATED INTERIM ACCOUNTS FOR THE PERIODED 30

JUNE 2021

(Continued)

3 CASH USED IN OPERATIONS

Unaudited Audited Unaudited

6 months Year 6 months

ended ended 31 ended

30 June December 30 June

2021 2020 2020

GBP GBP GBP

Operating loss (3,080,478) (5,589,432) (2,857,435)

Depreciation & amortisation 86,639 170,954 43,903

Share based payments 288,826 1,578,368 953,034

Decrease/(increase) in trade

& other receivables 29,964 (8,380) (8,516)

Increase/(decrease) in trade

& other payables 511,100 113,926 (267,550)

Gain/(loss) on foreign

exchange 95,012 (145,372) 41,517

Cash used in operations (2,068,937) (3,897,936) (2,095,047)

ImmuPharma plc

NOTES TO THE CONSOLIDATED INTERIM ACCOUNTS FOR THE PERIODED 30

JUNE 2021

(Continued)

4 Derivative Financial Asset

As part of the placement completed in June 2019, the Company

issued 26,565,200 new ordinary shares to Lanstead Capital

Investors L.P. ("Lanstead") at a price of 10p per share

for an aggregate subscription price of GBP2.66 million before

expenses. In an additional placement completed in March

2020, the Company issued 13,000,000 new ordinary shares

to Lanstead at a price of 10p per share for an aggregate

subscription price of GBP1.3 million before expenses. The

Subscription proceeds were pledged under a Sharing Agreement

under which Lanstead made and will continue to make, subject

to the terms and conditions of that Sharing Agreement, monthly

settlements to the Company that are subject to adjustment

upwards or downwards depending on the Company's share price

performance.

The Company also issued, in aggregate, a further 1,328,290

new ordinary shares in July 2019 and 650,000 new ordinary

shares in March 2020 to Lanstead as value payments in connection

with the Subscription and the Sharing Agreement. Monthly

settlements under the Sharing Agreement will continue in

2021 and 2022, completing in September 2021 and June 2022

respectively.

At the end of the accounting period the amount receivable

has been adjusted to fair value based upon the share price

of the Company at that date. Any change in the fair value

of the derivative financial asset is reflected in the income

statement. As at 30 June 2021, the Company completed a calculation

of fair value of the derivative financial asset that resulted

in a finance loss of GBP769,570 which was recorded in the

income statement. The restatement to fair value will be

calculated at the end of each accounting period during the

course of the Sharing Agreement and will vary according

to the Company's share price performance.

5 Convertible Loan Notes

On 10 June 2020, the Company issued GBP2.4m/$3.0m (face value)

convertible loan notes. The proceeds received equated to

GBP2.2m/$2.7m (before expenses of GBP0.2m/$0.3m).

The value of liability component and the equity conversion

component were determined at the date the instrument was issued.

The fair value of the liability was calculated at the rate of

interest for similar debt without the conversion option of

19.90%.

On initial recognition the value of the equity amounted to

GBP56k and the liability amounted to GBP1,835k. At the period end

the liability had a fair value of GBP656k.

The summary of the key terms of the loan notes is as

follows.

Term 18 months

Conversion price 17.96p, which is equivalent to

120% of the Volume Weighted Average

Price ("VWAP") of the ordinary

shares for 09 June 2020.

On 2 September 2020, (as the

result of additional placing)

the conversion price has been

adjusted downwards to 11p.

---------------------------------------

Conversion by the Company During the maturity period, if

the VWAP on each of at least

20 consecutive trading days shall

be equal to or have exceeded

35.92p (200% of the Conversion

Price).

---------------------------------------

Conversion by the Investors At any time during the maturity

period.

---------------------------------------

Security All amounts failing due under

the Convertible Loan Notes will

be secured by debenture constituting

a first-ranking fixed and floating

charge over all the assets of

the Company (the "Debenture").

---------------------------------------

Coupon & Payment 10% per annum, payable quarterly

in arrears.

---------------------------------------

Redemption The Convertible Loan Notes can

be redeemed:

-in the event of additional funds

receipt by the

Company, Investors have rights

to repurchase any

unconverted securities to the

value of up to 25% of the gross

proceeds of financing, at 105%

of face value;

-upon Nasdaq listing ImmuPharma

can offer to redeem all or part

of the unsecured convertible

notes at 105% of face value plus

accrued interest;

-otherwise, automatically at

the end of the term.

---------------------------------------

Unaudited Audited Unaudited

6 months Year 6 months

ended ended 31 ended

30 June December 30 June

2021 2020 2020

GBP GBP GBP

Balance brought 634,902 - -

forward

Value of loan at

inception - 2,153,824 2,153,824

Issue costs - (232,263) (232,263)

Equity component - (31,623) (69,778)

Value of shares converted - (799,846) -

Repurchased to date - (815,166) -

Exchange differences (63,383) (44,500) (16,341)

Interest expense 84,292 199,190 -

(Gain)/Loss on revaluation - 205,286 -

Balance carried forward 655,811 634,902 1,835,442

6 Subsequent events

On 16 July 2021, Dr Tim Franklin, Chief Operating Officer, was

appointed to the Board of Directors.

On 29 July 2021, Dimitri Dimitriou, co-founder and CEO of

ImmuPharma, for over 16 years, had decided to step down from his

position. Tim McCarthy, Chairman, has been appointed as CEO.

On 29 July 2021, Dr Franco di Muzio, Senior NED and Dr Stéphane

Méry, NED stepped down from the Board, following 14 and 6 years in

these roles respectively.

On the same day, Dr Sanjeev Pandya was appointed as Senior

Independent NED. In addition, Lisa Baderoon has been appointed to

the Board as NED.

, the news service of the London Stock Exchange. RNS is approved by

the Financial Conduct Authority to act as a Primary Information

Provider in the United Kingdom. Terms and conditions relating to

the use and distribution of this information may apply. For further

information, please contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

IR FLFFRAEITFIL

(END) Dow Jones Newswires

September 29, 2021 02:29 ET (06:29 GMT)

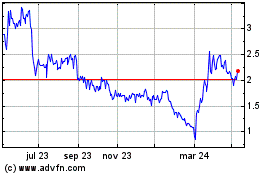

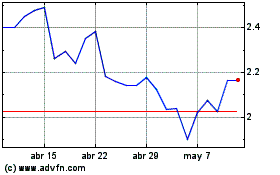

Immupharma (LSE:IMM)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

Immupharma (LSE:IMM)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024