TIDMDPEU

RNS Number : 6154N

Jubilant Foodworks Netherlands B.V.

30 September 2021

NOT FOR RELEASE, PUBLICATION OR DISTRIBUTION, IN WHOLE OR IN

PART, DIRECTLY OR INDIRECTLY, IN, INTO OR FROM ANY JURISDICTION

WHERE TO DO SO WOULD CONSTITUTE A VIOLATION OF THE RELEVANT LAWS OR

REGULATIONS OF SUCH JURISDICTION. THIS ANNOUNCEMENT IS FOR

INFORMATION PURPOSES ONLY AND THE INFORMATION CONTAINED HEREIN DOES

NOT CONSTITUTE AN OFFER TO SELL OR ACQUIRE SECURITIES IN ANY

JURISDICTION

THIS ANNOUNCEMENT CONTAINS INSIDE INFORMATION

30 September 2021

Jubilant Foodworks Netherlands B.V. announces Reverse Bookbuild

to acquire shares in DP Eurasia N.V. at 95 pence per share

Jubilant Foodworks Netherlands B.V. (the "Purchaser"), a wholly

owned subsidiary of Jubilant Foodworks Limited ("Jubilant

Foodworks") announces its intention to purchase up to 24,973,787

ordinary shares of DP Eurasia N.V. (LSE: DPEU, "DP Eurasia" or the

"Company") at a price of 95 pence per share ("Offer Price") via a

reverse bookbuild ("RBB"). On completion of the RBB, the Purchaser

and its direct subsidiary will hold up to 49.99% of the issued

share capital of the Company.

The Offer Price of 95 pence per ordinary share represents a

premium of approximately:

-- 23.4 per cent. to the closing share price of 77 pence per

ordinary share on 29 September 2021 (being the last practical date

prior to the publication of this announcement); and

-- 25.2 per cent. to the volume weighted average price of 75.9

pence per ordinary share over the 3 months to 29 September 2021

(being the last practical date prior to the publication of this

announcement).

Jubilant Foodworks believes that the RBB represents both a

significant premium to the above share price metrics, as well as

offering a significant liquidity event to shareholders entitled to

participate in the RBB. Jubilant Foodworks does not intend to make

any further acquisitions of DP Eurasia ordinary shares by way of a

public offer to all shareholders for the whole of the Company for

at least six months following the completion of the RBB.

The Purchaser's direct subsidiary, Fides Food Systems

Coöperatief U.A. ("Fides"), currently owns 47,697,882 ordinary

shares of DP Eurasia, representing approximately 32.81 per cent. of

DP Eurasia's issued share capital.

Peel Hunt LLP ("Peel Hunt") is acting as financial adviser and

sole bookrunner for the RBB on behalf of the Purchaser.

The opportunity to participate in the RBB will be made available

to certain professional investors. The books for the RBB will be

opened immediately following this announcement. The final number of

ordinary shares to be purchased will be agreed at the close of the

RBB process at the sole discretion of the Purchaser and Peel Hunt,

and the results of the RBB will be announced as soon as practicable

thereafter. To the extent that the RBB is oversubscribed above the

49.99% limit, applications will be scaled back (whether on a pro

rata basis or otherwise) at the sole discretion of the Purchaser

and Peel Hunt.

Enquiries:

Jubilant Foodworks

Ashish Goenka ashish.goenka@jublfood.com

Peel Hunt (Financial Adviser and Bookrunner) +44 (0) 20 7418 8900

Miles Cox

Oliver Jackson

Adrian Trimmings

Sohail Akbar (ECM)

Reasons for the RBB

Jubilant Foodworks is India's largest foodservice company

operating across India, Sri Lanka, Bangladesh and Nepal with the

master franchise rights for Domino's Pizza, Dunkin' Donuts and

Popeyes. It has been a partner of Domino's Pizza in India for more

than 25 years. Jubilant Foodworks completed its indirect

acquisition of 32.81 per cent. of DP Eurasia in March 2021 in order

to add value to DP Eurasia's business and create value for its

shareholders.

Jubilant Foodworks is a very long term and patient investor.

Working closely with DP Eurasia over the past six months has

supported Jubilant Foodworks' views on the long term prospects of

the DP Eurasia business. Consequently, Jubilant Foodworks would

like to increase its indirect shareholding in the Company and in

doing so proposes to increase its indirect stake to 49.99 per cent

of DP Eurasia's issued share capital. At this level, Jubilant

Foodworks would also intend to consolidate its investment in DP

Eurasia into its own accounts, subject to certain approvals and

clearances.

Jubilant Foodworks also believes that DP Eurasia's historical

operational growth and success has had limited impact on its share

price due to the depreciation of the value of the Turkish lira

against major currencies. Despite system sales growth of 82.6%

between December 2017 and December 2020, DP Eurasia's share price

declined 51.3% in 2018, 50.0% in 2019 and a further 14.1% in 2020.

Furthermore, with an average daily volume of 131,014 shares over

the last 12 months, Jubilant Foodworks believes that liquidity in

the shares is likely to be insufficient to allow larger

shareholders to exit their positions without negatively impacting

the share price absent a corporate transaction similar in

anticipated effect to the RBB. Jubilant Foodworks believes that the

RBB should, therefore, offer shareholders who are able to

participate in the RBB the opportunity to reduce or exit their

positions through a significant liquidity event.

Details of the RBB

The RBB will open with immediate effect following the release of

this announcement. Due to the significant number of US shareholders

on DP Eurasia's share register, the RBB will close at 4.30 p.m. on

29 October 2021 (the "Acceptance Period").

The Purchaser is prepared to purchase up to 24,973,787 ordinary

shares of DP Eurasia at a price of 95 pence per ordinary share to

increase its shareholding to up to 49.99% of the issued share

capital of the Company.

The Offer Price of 95 pence per ordinary share represents a

premium of approximately:

-- 23.4 per cent. to the closing share price of 77 pence per

ordinary share on 29 September 2021 (being the last practical date

prior to the publication of this announcement); and

-- 25.2 per cent. to the volume weighted average price of 75.9

pence per ordinary share over the 3 months to 29 September 2021

(being the last practical date prior to the publication of this

announcement).

The final number of DP Eurasia ordinary shares acquired in the

RBB will be agreed by Peel Hunt and the Purchaser at the close of

the Bookbuild and the result will be announced as soon as

practicable thereafter and settlement is expected to be on 3

November 2021. To the extent that the RBB is oversubscribed above

the 49.99% limit, applications will be scaled back (whether on a

pro rata basis or otherwise) at the sole discretion of the

Purchaser and Peel Hunt.

Peel Hunt is acting as financial adviser and sole bookrunner for

the RBB on behalf of the Purchaser. Shareholders who are entitled

and wish to participate in the RBB are requested to contact Peel

Hunt as soon as possible following the release of this

announcement.

Shareholders who do not hold depositary interests in CREST will

need to dematerialise their shares in CREST before they will be

able to participate in the RBB.

Closing of the RBB is subject to a number of terms including

there being: (i) no material adverse change relating to the

Company; (ii) no material adverse change relating to certain market

conditions; and (iii) the Purchaser complying with its obligations

(including that the representations and warranties given by the

Purchaser which are typical for transactions of this nature are

true and accurate) under the agreement that it has entered into

with Peel Hunt.

The RBB is subject to the terms and conditions set out in the

remainder of this announcement.

The Purchaser also intends to apply for retrospective antitrust

clearance from the Turkish Competition Authority and an approval

from the Russian Competition Authority. The RBB is not however

conditional on Turkish or Russian antitrust clearance.

DP Eurasia is not subject to the City Code on Takeovers and

Mergers or the Dutch Takeover Regulations.

Jubilant Foodworks' future intentions for the DP Eurasia

business

Jubilant Foodworks attaches great importance to the skill and

experience of DP Eurasia's management and employees and recognises

that the employees and management of DP Eurasia will be key to its

future success. Jubilant Foodworks is supportive of DP Eurasia's

business plan and looks forward to working with DP Eurasia's

management team.

Fides' relationship agreement with DP Eurasia also remains in

place and subject to its terms continues to govern Jubilant

Foodworks' ongoing relationship with DP Eurasia. Jubilant Foodworks

further confirms that it does not intend to make a public offer to

all shareholders for the whole of the Company for at least the next

six months following the closure of the offer period for the RBB.

Jubilant Foodworks does however reserve the right within such

period to otherwise directly or indirectly acquire further DP

Eurasia ordinary shares and/or, if and following an announcement

being made of an offer for DP Eurasia by or on behalf of a third

party, to directly or indirectly make or participate in an offer or

possible offer for DP Eurasia.

About Jubilant Foodworks

Jubilant Foodworks is part of Jubilant Bhartia group and is

India's largest foodservice company. Its Domino's Pizza franchise

extends across a network of 1,380 restaurants in 298 cities. It has

the exclusive rights to develop and operate Domino's Pizza brand in

India, Sri Lanka, Bangladesh and Nepal. At present, it operates in

India, and through its subsidiary companies in Sri Lanka and

Bangladesh. Jubilant Foodworks also enjoys exclusive rights to

develop and operate Dunkin' Donuts restaurants in India, has 27

restaurants in operation across 8 cities in India. Jubilant

Foodworks has ventured into the Chinese cuisine segment with its

first owned restaurant brand, 'Hong's Kitchen', which now has 11

restaurants across 3 cities. Recently, Jubilant Foodworks has added

Indian cuisine of biryani, kebabs, breads and more to the portfolio

by launching Ekdum! which currently has 7 restaurants across 3

cities. Jubilant Foodworks has exclusive rights to develop and

operate Popeyes(R) restaurants in India, Bangladesh, Nepal and

Bhutan. In accordance with shifting consumer habits, Jubilant

Foodworks has also moved into the ready-to-cook segment with

'ChefBoss'.

Important Notices

This announcement and the information contained herein is not

for release, publication or distribution, in whole or in part,

directly or indirectly, in, into or from any jurisdiction where to

do so would constitute a violation of the relevant laws or

regulations of such jurisdiction. This announcement is for

information purposes only and the information contained herein does

not constitute or form part of an offer to buy, sell, issue,

acquire or subscribe for, or the solicitation of an offer to buy,

sell, issue, acquire or subscribe for, any securities in any

jurisdiction where it would be unlawful to do so. Any failure to

comply with these restrictions may constitute a violation of the

securities laws of such jurisdictions.

The distribution of this announcement may be restricted by law

in certain jurisdictions and persons into whose possession any

document or other information referred to herein comes should

inform themselves about and observe any such restriction.

The RBB is not being directed, directly or indirectly, to DP

Eurasia investors in any jurisdiction where to do so would be

unlawful.

In the EEA and the United Kingdom, this announcement is only

directed at (and is only being distributed to) persons whose

ordinary activities involve them in acquiring, holding, managing

and disposing of investments (as principal or agent) for the

purposes of their business and who have professional experience in

matters relating to investments and are: (a) if in a member state

of the European Economic Area (the "EEA"), persons who are

qualified investors, within the meaning of Article 2(E) of the

Prospectus Regulation (Regulation (EU) 2017/1129 of the European

Parliament and of the Council); or (b) if in the United Kingdom,

'Qualified Investors' within the meaning of Article 2(E) of the UK

Prospectus Regulation (Regulation (EU) (2017/1129) as it forms part

of UK domestic law by virtue of the European Union Withdrawal Act

2018) and who are also: (i) persons who fall within the definition

of "investment professionals" in Article 19(5) of the Financial

Services And Markets Act 2000 (Financial Promotion) Order 2005, as

amended (the "Order"), or (ii) high net worth bodies corporate,

unincorporated associations and partnerships and trustees of high

value trusts as described in Article 49(2) of the order, or (c)

other persons to whom it may otherwise be lawfully communicated,

and in all cases who are capable of being categorised as a

professional client or an eligible counterparty for the purposes of

the FCA conduct of business rules who are permitted to sell or

dispose of securities in the RBB pursuant to applicable legislation

(all such persons referred to in (a), (b) and (c) above together

being referred to as "Relevant Persons").

Any investment or investment activity to which this announcement

relates is available in the EEA or the United Kingdom only to

Relevant Persons and will be engaged in only with Relevant Persons.

This announcement must not be acted on or relied on by persons in

the EEA or the United Kingdom who are not Relevant Persons.

The RBB relates to securities of a non-U.S. company that is

subject to the disclosure requirements, rules and practices

applicable to companies listed in the UK, which differ from those

of the United States in certain material respects. The RBB will be

made in the United States in accordance with other requirements of

Regulation 14E under the US Securities Exchange Act of 1934, as

amended (the "Exchange Act") to the extent applicable. US

shareholders should note that the ordinary shares of DP Eurasia are

not listed on a US securities exchange and DP Eurasia is not

subject to the periodic reporting requirements of the Exchange Act

and is not required to, and does not, file any reports with the US

Securities and Exchange Commission (the "SEC") thereunder.

Neither the SEC nor any US state securities commission has

approved or disapproved of this transaction or passed upon the

merits of fairness of such transaction or passed upon the adequacy

of the information contained in this announcement. Any

representation to the contrary is a criminal offence in the United

States.

The securities in the RBB have not been offered or sold and will

not be offered or sold in Hong Kong, by means of any document,

other than (a) being solicited or purchased from "professional

investors" as defined in the Securities and Futures Ordinance (Cap.

571 of the Laws of Hong Kong) (the "SFO") and any rules made

thereunder; or (b) in other circumstances which do not result in

the document being a "prospectus" as defined in the Companies

(Winding Up and Miscellaneous Provisions) Ordinance (Cap. 32 of the

Laws of Hong Kong) or which do not constitute an offer to the

public within the meaning of that ordinance. No advertisement,

invitation or document relating to the RBB has been or may be

issued or has been or may be in the possession of any person for

the purposes of issue, whether in Hong Kong or elsewhere, which is

directed at, or the contents of which are likely to be accessed or

read by, the public in Hong Kong (except if permitted to do so

under the securities laws of Hong Kong) other than with respect to

the securities in the RBB which are or are intended to be disposed

of only to persons outside Hong Kong or only to "professional

investors" in Hong Kong as defined in the SFO and any rules made

thereunder.

This announcement does not constitute a public offer in the

Cayman Islands by either Jubilant Foodworks or Peel Hunt (on behalf

of Jubilant Foodworks) to purchase the DP Eurasia ordinary shares

and any invitation to participate in the RBB is not being conducted

from a place of business in the Cayman Islands.

No advertisement, invitation or public announcement relating to

the RRB and no offer to purchase, sell, acquire or subscribe for

securities, has been or will be, published or made to the public in

The Bahamas. This advertisement is being circulated for

informational purposes only, to certain accredited investors

incorporated in The Bahamas who are existing shareholders in the

Company and are designated or deemed to be "non-resident" for the

purposes of the Exchange Control Regulations of The Bahamas.

Terms of Participation in the RBB

Peel Hunt and the Purchaser (acting jointly) reserve the

absolute right to determine who may participate in the RBB.

Participating in the RBB shall constitute an irrevocable offer

to sell to the Purchaser the total number of DP Eurasia ordinary

shares accepted for purchase by Peel Hunt on behalf of the

Purchaser. Investors offering DP Eurasia ordinary shares for

purchase in the RBB will be deemed to represent, warrant and

undertake to Peel Hunt and the Purchaser that: (a) the investor is

either (i) the legal and beneficial owner and has full power and

authority to sell, assign or transfer the DP Eurasia ordinary

shares being sold in the RBB (together with all rights attaching

thereto) or (ii) irrevocably and unconditionally entitled on behalf

of the beneficial owner to sell, assign or transfer the DP Eurasia

ordinary shares being sold in the RBB (together with all rights

attaching thereto) and, in each case, when the same are purchased

by the Purchaser, the Purchaser will acquire such DP Eurasia

ordinary shares free and clear of all liens, charges, restrictions,

claims, equitable interests, encumbrances, pre-emption rights and

third party rights and together with all rights attaching thereto

and such representation and warranty will be true in all respects

at the time the Purchaser purchases such DP Eurasia ordinary shares

as if it had been entered into anew at such time and shall not be

extinguished by such purchase; (b) such investor shall do all such

acts and things as shall be necessary or expedient, and execute any

additional documents deemed by Peel Hunt or the Purchaser to be

desirable, to complete the purchase of the DP Eurasia ordinary

shares referred to in this paragraph; (c) such investor has fully

observed any applicable legal requirements (including, where

relevant, obtaining any requisite consents, complying with

applicable formalities and taking or not omitting to take any

action which would otherwise result in Peel Hunt or the Purchaser

acting in breach of any applicable legal requirements) such that

the RBB may be made to him under the laws of all relevant

jurisdictions, and the investor's offer to sell DP Eurasia ordinary

shares to the Purchaser, and any acceptance thereof, shall not be

unlawful under the laws of any jurisdiction. Peel Hunt shall be

under no obligation to purchase any DP Eurasia ordinary shares in

the RBB if its arrangements with the Purchaser terminate.

It is the sole responsibility of any person wishing to

participate in the RBB to satisfy himself or herself as to the full

observance of the terms of participation in the RBB as detailed in

this announcement and as to the full observance of the laws of the

relevant jurisdiction(s) in which the investor is resident,

incorporated or carries on business and any other relevant laws to

which that person is subject, including the obtaining of any

governmental, exchange control or other consents which may be

required, the compliance with other necessary formalities and the

payment of any transfer or other taxes or other requisite payments

due in such jurisdiction.

Any person who participates in the RBB irrevocably and

unconditionally agrees and acknowledges that it will indemnify on

an after-tax basis and hold each of Peel Hunt and the Purchaser and

each of their respective employees, directors, officers, agents,

affiliates and any person acting on their respective behalf

harmless from and against any and all costs, claims, losses,

liabilities and expenses (including legal fees and expenses)

arising out of, directly or indirectly, or in connection with any

breach by that person of any of the representations, warranties,

agreements, confirmations and acknowledgements given or deemed to

have been given by them in these terms of participation in the RBB

or otherwise to Peel Hunt or the Purchaser in connection with the

RBB, and further agrees and acknowledges that such indemnification

will survive completion of the RBB.

No document soliciting intentions to sell securities has been or

will be prepared in connection with any of the transactions

described in this announcement. Any investment decision to sell

securities as part of the RBB must be made solely on the basis of

publicly available information. Such information is not the

responsibility of, and has not been independently verified by, Peel

Hunt, the Purchaser or Jubilant Foodworks or any of their

respective affiliates. This announcement does not constitute a

recommendation concerning any investor's investment decision with

respect to the RBB or any DP Eurasia securities. The contents of

this announcement are not to be construed as legal, business,

financial or tax advice. Each investor or prospective investor

should consult his, her or its own legal adviser, business adviser,

financial adviser or tax adviser for legal, financial, business or

tax advice.

Payment for the shares acquired in the RBB will be made promptly

following expiry of the Acceptance Period.

Peel Hunt LLP, which is authorised and regulated in the United

Kingdom by the FCA, is acting as financial adviser and sole

bookrunner exclusively for Jubilant Foodworks and no one else in

connection with the matters set out in this announcement and will

not regard any other person as its client in relation to the

matters set out in this announcement and will not be responsible to

anyone other than Jubilant Foodworks for providing the protections

afforded to clients of Peel Hunt LLP, nor for providing advice in

relation to the contents of this announcement or any other matter

referred to herein. Neither Peel Hunt LLP nor any of its

subsidiaries, branches or affiliates owes or accepts any duty,

liability or responsibility whatsoever (whether direct or indirect,

whether in contract, in tort, under statute or otherwise) to any

person who is not a client of Peel Hunt LLP in connection with this

announcement, any statement contained herein or otherwise or any

transaction, arrangement or other matter referred to herein

(including, without limitation, the RBB).

Neither Peel Hunt nor any of its affiliates nor any of their

respective directors, officers, employees, advisers or agents

accepts any responsibility or liability whatsoever for, or makes

any representation or warranty, express or implied, as to, the

truth, accuracy or completeness of the information in this

announcement (or whether any information has been omitted from the

announcement) or any other information relating to Jubilant

Foodworks or the Company or any of its or their subsidiaries or

associated companies, whether written, oral or in a visual or

electronic form, and howsoever transmitted or made available or for

any loss howsoever arising from any use of this announcement or its

contents or otherwise arising in connection therewith.

All times referred to are London, UK, time unless otherwise

stated.

Market Abuse Regulation

The information contained within this announcement would have,

prior to its release, constituted inside information as stipulated

under Article 7 of the Market Abuse Regulation (EU) No.596/2014 as

incorporated into UK domestic law by virtue of the European Union

(Withdrawal) Act 2018 (together, "UK MAR"). Upon the publication of

this announcement via a regulatory information service, this inside

information will be considered to be in the public domain. For the

purposes of UK MAR, the person responsible for arranging for the

release of this information on behalf of Jubilant Foodworks is

Ashish Goenka, Chief Financial Officer of Jubilant Foodworks.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

MSCMZGFLKGFGMZM

(END) Dow Jones Newswires

September 30, 2021 11:44 ET (15:44 GMT)

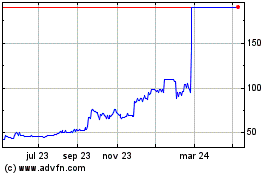

Dp Eurasia N.v (LSE:DPEU)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

Dp Eurasia N.v (LSE:DPEU)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024