TIDMSVE

RNS Number : 8747Z

Starvest PLC

26 May 2021

26 May 2021

Half-year report - six months ended 31 March 2021

Chairman's statement

Over the six months to 30 March 2021, we continued to experience

the economic effects of COVID-19 but thankfully natural resources

were very resilient compared to other investment sectors. However,

we did note a change in global sentiment from early January 2021 as

several commodities, including precious metals, declined in price,

which had a marked impact on the near-record-high share price

achieved toward the end of 2020. The natural resources sector

managed to navigate the situation, and post period end we've

continued to see gains.

Starvest's focus on precious metals has meant that it has

weathered the period reasonably well and while the Net Asset Value

reduced from GBP17.95m as at 30 September 2020 to GBP16.72m to 30

March 2021, it has increased more than 250% over the 12 months from

30 March 2020 (NAV GBP4.66m). This annual increase is mainly due to

the performance of our holdings in investee company Greatland Gold

plc and, to a lesser extent, Ariana Resources plc. Post period end

we have continued to see gains in the Net Asset Value, which was

GBP19.09m as at 30 April 2021.

Net Assets, as presented in the Statement of Financial Position

in this Half Yearly report, (which differ from the Net Asset Values

stated above as Net Assets include provision for deferred taxation

and current liabilities) declined from GBP15.88m as at 30 September

2020 to GBP14.66m as at 30 March 2021, but increased more than 220%

over the 12 months from 30 March 2020 (Net Assets GBP4.56m).

While many sectors have not yet recovered to pre-pandemic

levels, the mining sector has made significant gains and is

forecast to continue to do so with economic recovery and

climate-focused projects at the forefront of government

infrastructure spending plans, which we expect will benefit the

base and precious metals sectors. Quantitative easing remains a

tool of choice for larger global economies and this provides a firm

foundation to support the price of precious metals going

forward.

Continuing to advance its Paterson project, Greatland Gold

(LON:GGP) has commenced a box cut to establish a decline at the

Havieron gold-copper deposit which continues to yield many exciting

drill results. Growth drilling by operating partners Newcrest

Mining is underway which has the potential to significantly

increase the resource base at the project. A Pre-Feasibility Study

is expected to be delivered in H2 2021. Greatland Gold have also

been conducting their own exploration with new programmes

commencing recently on the Paterson Juri JV area. In addition, last

season's Scallywag drilling has shown strong indications of

mineralisation in the area. We look forward to further encouraging

news from Greatland Gold, which is well-funded and has an

experienced team in place.

Ariana Resources (LON:AAU) reported robust silver-gold

production figures from its Kiziltepe Mine, exceeding guidance for

2020 and making plans to expand its processing plant. Its recent

deal with Ozaltin has provided the company with good working

capital as well as offering the possibility of future dividends to

shareholders following a capital restructure.

Cora Gold (LON:CORA) has recently released exciting results from

its latest drill programme at its flagship Sanankoro gold project.

This is the start of its largest drill programme to date with up to

35,000m of drilling planned for completion by late July 2021 and

the expected announcement of an updated resource statement.

Kefi Minerals (LON:KEFI) continue with construction of the Tulu

Kapi gold mine in Ethiopia and remain on target to start full

production in 2022. Kefi has also made significant advances in its

exploration of the Hawiah project in Saudi Arabia and has commenced

a Pre-Feasibility study of the deposit.

Other investee companies continue their efforts as well. Oracle

Power (LON:ORCP) has expanded its remit and taken up gold

exploration in Western Australia. Sunrise Resources (LON:SRES) is

advancing its pozzolan-perlite project in Nevada USA towards mine

permitting, while Alba (LON:ALBA) is focusing on development of

Welsh gold deposits.

Overall, throughout the past year to 30 March 2021, our strategy

to focus on precious metal investments has been successful and

resulted in significant increase in value for our overall

portfolio. We continue to focus on seeking out value-adding

opportunities in the precious metals sector and believe a robust

gold price going forward will support current and future

strategies.

Callum N Baxter

Chairman & Chief Executive

26 May 2021

Statement of Comprehensive Income

6 months 6 months Year ended

to 31 March to 31 March 30 September

2021 2020 2020

Unaudited Unaudited Audited

GBP GBP GBP

Administrative expenses (147,689) (150,337) (303,259)

Gain on disposal of financial

assets 19,313 22,209 59,146

Amounts written off against

financial assets (1,088,092) (86,103) (104,116)

Movement in fair value of financial

assets through profit and loss - 2,747,065 16,097,296

--------------- ------------- --------------

Operating profit (1,216,468) 2,532,834 15,749,067

Interest receivable - 20 38

--------------- ------------- --------------

Profit on ordinary activities

before tax (1,216,468) 2,532,854 15,749,105

Tax on profit on ordinary activities - - (2,003,618)

--------------- ------------- --------------

(Loss)/profit attributable to

equity holders of the parent (1,216,468) 2,532,854 13,745,487

=============== ============= ==============

Earnings per share - see note

3 (2.11) pence 4.53 pence 24.22 pence

Basic (2.11) pence 4.53 pence 24.22 pence

Diluted

Statement of Financial Position

6 months 6 months Year ended

ended 31 ended 31 30 September

March 2021 March 2020 2020

Unaudited Unaudited Audited

GBP GBP GBP

Fixed assets

Financial assets through

profit and loss 16,596,261 4,537,810 17,825,053

------------- ------------ --------------

Total fixed assets 16,596,261 4,537,810 17,825,053

------------- ------------ --------------

Current assets

Trade and other receivables 29,893 22,738 31,047

Cash and cash equivalents 125,344 118,078 120,365

------------- ------------ --------------

Total current assets 155,237 140,816 151,412

------------- ------------ --------------

Current liabilities

Trade and other payables (84,716) (120,672) (93,215)

------------- ------------ --------------

Total current liabilities (84,716) (120,672) (93,215)

------------- ------------ --------------

Non-current liabilities

Provision for deferred tax (2,003,618) - (2,003,618)

------------- ------------ --------------

Total non-current liabilities (2,003,618) - (2,003,618)

------------- ------------ --------------

Net assets 14,663,164 4,557,954 15,879,632

============= ============ ==============

Capital and reserves

Called up share capital 575,740 559,279 575,740

Share premium account 1,779,414 1,686,829 1,779,414

Retained earnings 12,308,010 2,311,846 13,524,478

------------- ------------ --------------

Total equity shareholders'

funds 14,663,164 4,557,954 15,879,632

============= ============ ==============

Statement of Cash Flows

6 months 6 months Year ended

ended 31 ended 31 30 September

March 2021 March 2020 2020

Unaudited Unaudited Audited

GBP GBP GBP

Cash flows from operating activities

Operating (loss)/profit (1,216,468) 2,532,834 15,749,066

Net interest receivable - 20 38

Shares issued in lieu of fees - - 109,046

Increase in investment provisions 1,088,092 86,103 104,116

Movement in fair value of investments - (2,747,065) (16,097,296)

Profit on sale of current asset

investments (19,313) (22,354) (59,290)

Decrease/(increase) in debtors 1,154 91,800 83,491

(Decrease)/increase in creditors (8,499) 54,669 27,212

------------ ------------ --------------

Net cash used in operating activities (155,034) (3,993) (83,617)

------------ ------------ --------------

Cash flows from investing activities

Purchase of current asset investments - - -

Sale of current asset investments 160,013 61,904 143,815

Net cash generated from investing

activities 160,013 61,904 143,815

------------ ------------ --------------

Cash flows from financing activities

Proceeds from issue of shares - - -

Transaction costs of issue of - - -

shares

Net cash flows from financing - - -

activities

------------ ------------ --------------

Net increase in cash and cash

equivalents 4,979 57,911 60,198

Cash and cash equivalents at

beginning of period 120,365 60,167 60,167

------------ ------------ --------------

Cash and cash equivalents at

end of period 125,344 118,078 120,365

============ ============ ==============

Statement of Changes in Equity

Total Equity attributable to

Share capital Share premium Retained earnings shareholders

GBP GBP GBP GBP

At 30 September 2019 559,279 1,686,829 (221,009) 2,025,099

============= ============= ================= ================================

Profit for the period - - 2,532,854 2,532,854

------------- ------------- ----------------- --------------------------------

Total recognised income and

expenses for the period - - 2,532,854 2,532,854

Shares issued - - - -

Total contribution by and

distributions to owners - - - -

At 31 March 2020 559,279 1,686,829 2,311,845 4,557,953

============= ============= ================= ================================

Profit for the period - - 11,212,633 11,212,633

------------- ------------- ----------------- --------------------------------

Total recognised income and

expenses for the period - - 11,212,633 11,212,633

Shares issued 16,461 92,585 - 109,046

Total contribution by and

distributions to owners 16,461 92,585 - 109,046

At 30 September 2020 575,740 1,779,414 13,524,478 15,879,632

============= ============= ================= ================================

Loss for the period - - (1,216,468) (1,216,468)

Total recognised income and

expenses for the period - - (1,216,468) (1,216,468)

Shares issued - - - -

Total contributions by and - - - -

distributions to owners

At 31 March 2021 575,740 1,779,414 12,308,010 14,663,164

============= ============= ================= ================================

Interim report notes

1. Interim report

The information relating to the six month periods to 31 March

2021 and 31 March 2020 is unaudited.

The information relating to the year ended 30 September 2020 is

extracted from the audited accounts of the Company which have been

filed at Companies House and on which the auditors issued an

unqualified audit report.

2. Basis of preparation

This report has been prepared in accordance with applicable

United Kingdom accounting standards, including Financial Reporting

Standard 102 - 'The Financial Reporting Standard applicable in the

United Kingdom and Republic of Ireland' ('FRS102'), and with the

Companies Act 2006. Although the information included herein does

not constitute statutory accounts within the meaning of section 435

of the Companies Act 2006, the accounting policies that have been

applied are consistent with those adopted for the statutory

accounts for the year ended 30 September 2020.

The Company will report again for the full year to 30 September

2021.

The Company's investments at 31 March 2021 are stated at the

lower of cost and net realisable value or the valuation adopted at

30 September 2020 or the current market value based on market

quoted prices at the close of business. The Chairman's statement

includes a valuation based on market quoted prices at 31 March

2021.

3. Earnings per share

6 months 6 months Year ended

ended 31 ended 31 30 September

March 2021 March 2020 2020

Unaudited Unaudited Audited

GBP GBP GBP

(Loss)/profit for the year: (1,216,468) 2,532,854 13,745,487

--------------- ------------- --------------

Weighted average number of

Ordinary shares of GBP0.01

in issue 57,573,986 55,927,832 56,742,071

--------------- ------------- --------------

Earnings per share - basic (2.11) pence 4.53 pence 24.22 pence

and diluted

=============== ============= ==============

Investment portfolio

Starvest now holds trade investments in the companies listed

below; of these the following companies comprised 99% of the

portfolio value as at 31 March 2021:

Exploration for oil in England,

* Alba Mineral Resources plc lead-zinc in Ireland, uranium in

Mauritania and graphite in Greenland

www.albamineralresources.com

Gold-silver production and exploration

* Ariana Resources plc in Turkey

www.arianaresources.com

Gold exploration in West Africa

* Cora Gold Limited www.coragold.com

Gold exploration and development

* Greatland Gold plc in Australia

www.greatlandgold.com

Gold and copper exploration and

* Kefi Minerals plc development in Ethiopia and Saudi

Arabia

www.kefi-minerals.com

Coal development in Pakistan and

* Oracle Power plc gold exploration in Australia

www.oraclecoalfields.com

Other investments

The remaining non-core investments are available for sale when

the conditions are deemed to be right:

Oil and gas exploration in Bulgaria

* Block Energy plc (formerly Goldcrest Resources plc) www.goldcrestresourcesplc.com

Gold exploration in South America

* Minera IRL Limited www.minera-irl.com

Exploration for industrial minerals

* Sunrise Resources plc in United States, Finland, Australia

and Ireland

www.sunriseresourcesplc.com

Other investee companies are listed in the Company's 2020 annual

report available on request or from the Company web site -

www.starvest.co.uk

Copies of this interim report are available free of charge by

application in writing to the Company Secretary at the Company's

registered office, Salisbury House, London Wall, London EC2M 5PS,

by email to info@starvest.co.uk or from the Company's website -

www.starvest.co.uk

Enquiries to:

Starvest PLC

Callum Baxter or Gemma Cryan 02077 696 876 or

info@starvest.co.uk

Grant Thornton UK LLP (Nomad)

Colin Aaronson, Harrison Clarke or Lukas Girzadas 02073 835

100

SI Capital Ltd (Broker)

Nick Emerson or Alan Gunn 01483 413 500

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

IR PPURPAUPGURQ

(END) Dow Jones Newswires

May 26, 2021 04:31 ET (08:31 GMT)

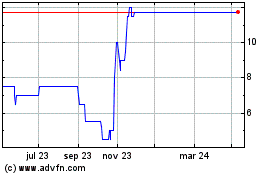

Starvest (LSE:SVE)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

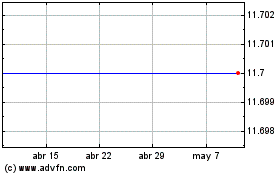

Starvest (LSE:SVE)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024