TIDMTFW

RNS Number : 9795N

Thorpe(F.W.) PLC

05 October 2021

Results

for the year ended 30 June 2021

FW Thorpe Plc - a group of companies that de sign, manufacture

and supply professional lighting systems - is pleased to announce

its preliminary results for the year ended 30 June 2021.

Key points:

Continuing operations 2021 2020

-------------------------------------- --------- --------- -------------

Revenue GBP117.9m GBP113.3m 4.0% increase

Operating profit (before exceptional GBP19.2m GBP16.3m 17.7%

item) increase

Profit before tax (before exceptional GBP18.6m GBP15.9m 16.5%

item) increase

Profit before tax GBP20.1m GBP15.9m 26.3%

increase

18.5%

Basic earnings per share 13.57p 11.45p increase

-------------------------------------- --------- --------- -------------

-- Total interim and final dividend of 5.80p (2020: 5.66p) - an increase of 2.5%

-- Final dividend of 4.31p (2020: 4.20p) and special dividend of

2.20p (2020: nil) - last paid in 2016

-- Revenue surpassed last year's high - supported by large scale orders and by services

-- Operating profit recovered strongly from prior year, no impact from fire at Lightronics

-- Profit before tax includes exceptional profit due to

insurance claims from the fire of GBP1.6m

-- Net cash generated from operating activities remained strong - GBP21.9m (2020: GBP19.4m)

-- Solid start to 2021/22, operating performance in line with the start of last year

This announcement contains inside information for the purposes

of Article 7 of Regulation (EU) No 596/2014 (MAR) as supplemented

by The Market Abuse (Amendment) (EU Exit) Regulations (SI 2019/310)

("UK MAR").

For further information please contact:

FW Thorpe Plc

Mike Allcock - Chairman, Joint Chief Executive 01527 583200

Craig Muncaster - Joint Chief Executive, Group

Financial Director 01527 583200

Singer Capital Markets - Nominated Adviser

Steve Pearce /James Moat 020 7496 3000

Chairman's Statement

After a year of very difficult trading conditions for many

companies, I would like to start by thanking the management and

workforce across FW Thorpe Plc for their total commitment to Group

operations in the last 12 months. Without their dedication, I would

not be able to report the improved operating results below.

Whilst I am pleased with the improved performance under such

circumstances, there is an element of wondering what could have

been, for a second year running, had the Group not encountered, and

continued to encounter, difficulties associated with the COVID-19

pandemic, the ongoing fallout from Brexit in the UK, and worldwide

supply shortages.

On a positive note, within the Group we have once again started

the new financial year with a very strong order book, exceeding our

expectations in most companies, especially Thorlux Lighting, and we

look forward to more normal trading conditions returning soon.

The Annual Report and Accounts contains a more detailed overview

of the COVID situation and how it is being dealt with across the

Group, together with a closer appraisal of the performance of each

Group company.

Group Results

Year-end revenue grew again in the year, despite various

operational difficulties, culminating in an overall increase of

4.0%, at GBP118m. A high proportion of the growth is attributed to

Thorlux Lighting, but there were notable performances too from TRT

Lighting, exceeding GBP10m revenue for the first time, and Solite

and Portland Lighting, recovering well from reduced levels last

year, and truly solid performances from the Dutch contingent,

especially Lightronics, having to cope with the near-total

destruction of its manufacturing facility early in autumn 2020.

More on this later.

Philip Payne's market, of high-end hospitality venues and

central London offices, was adversely affected the most in the

Group by the pandemic, with no traditional large scale orders

materialising. A solid year of battening down the hatches and

controlling costs resulted in a subdued but profitable year

overall.

Final Group operating profit (before exceptional item) for the

year ended up 17.7% at GBP19m - another creditable result, all

things considered.

The Group's continued robust balance sheet and strong cashflow

performance allows the Board to recommend a final dividend of 4.31p

per share (2020: 4.20p) for the year to 30 June 2021, which gives a

total of 5.80p (2020: 5.66p) and an increase of 2.5%. It has been a

number of years since the Group paid a special dividend, so I am

pleased to recommend a special dividend of 2.20p per share (2020:

nil).

General Overview

All businesses have targeted further growth this year, and early

signs are positive, with order intake overall for the Group at

record levels. The Group has found it particularly hard to forecast

the ongoing stability of orders, given the uncertainty of the

general economic situation. Orders have certainly held up better

than expected; within the Group, we believe that during uncertainty

customers have been less inclined to take chances with lesser known

brands and have stuck with tried and tested and more local

manufacturers. Certain export markets have improved, such as

Germany and Norway, but generally export projects have been harder

to win, reinforcing the point made above. Nevertheless, Group

companies' overall resilience to various adverse trading conditions

has again been proven throughout the financial year.

The Group's use of technology has been good, rolling out new up

to date systems such as Office 365 just before the pandemic. For

sales people, however, there is nothing like a face to face

meeting, and it is only recently that these have restarted on a

gradual basis. This has, for example, made it harder for general

new starters in the sales team, and specifically for a new venture

for Philip Payne attempting to increase, with new recruits, its

sales efforts into end users.

In coming months there are significant challenges to deal with,

especially related to component shortages affecting everyone in the

Group. All companies are dealing with severe shortages and rising

costs for many of the basic components necessary for making Group

luminaires, such as steel, plastics, cardboard, electronic

components and microchips. Although the Group has a strong cash

position and can afford to stock up, the reality is that this has

not been possible and stocks have reduced. Not receiving reliable

delivery dates from suppliers, even for goods planned months in

advance, is making day to day operations tense and frustrating.

Individual companies' service levels have declined - particularly

at Thorlux Lighting, which is now quoting significantly longer lead

times than are normal or desirable.

To add to these difficulties, Brexit has resulted in a number of

workers from Group factories returning home to mainland Europe.

There is a reduced pool of labour in the UK to replace them, which

is not helpful during a period in which the Group is recruiting

heavily to support its requirement to ramp up production output.

Various improvement plans are in place, but there may be some

disruption in output and service levels until later in the autumn.

Brexit also created operational difficulties in the early part of

the calendar year, with finished goods for delivery to the EU

extensively stuck in ports for long periods, and inbound component

supplies hampered in a similar way. Some customers in Germany have

actively moved away from the Group as a result, although within the

Group we have managed to successfully route some orders through

Lightronics to mitigate some of the trading impacts.

I am pleased to report that the Group has successfully completed

the earn-out period with the investors and management team in the

Netherlands. I am also delighted to report that the Group has

successfully secured the ongoing services of the management team. I

take this opportunity to thank all the Group's Dutch colleagues for

their excellent work in recent years - a successful example of just

what can be achieved, working collaboratively, that the Group

aspires to with all its companies and future investments.

As mentioned in my interim statement, Lightronics suffered a

devastating fire in September 2020. It is of credit to the local

management that, on the morning following the fire, new temporary

premises were secured and a recovery plan codenamed Project Restart

commenced. Production output soon recovered and overall,

incredibly, Lightronics managed to achieve similar performance to

that of the prior year, even improving margins slightly through

material cost reductions. Plans for the new building, which will

have around 75% more manufacturing space than the previous unit,

have received planning consent, and construction will commence

shortly. Insurance claims have been recovered, as expected.

Famostar, too, is actively developing its site for future

expansion, with a greater warehouse area planned and plans

generally for a larger operation in the future.

Indeed, all companies have developed individual plans for

growth. For example, Portland Lighting, whose customer base has

been in steady decline for the last few years, has developed new

products into two completely new market sectors to strengthen its

own resilience to market movements in a similar way to the Group as

whole.

On the sustainability front, within the Group we continue to

develop and implement strategies to improve our credentials even

further - an activity first started in earnest with an improvement

programme back in 2010. A few months ago, I visited the Group's

tree planting scheme in Devauden, Monmouthshire, some 10 years on

from when I ceremonially planted the first tree there with the

government minister for the environment and sustainable

development. Currently 149,849 saplings have been planted, with

many well on their way to reaching maturity, with the scheme

winning independent awards in the process. Fewer trees will be

planted in future, as the Group will have less grid supplied energy

to offset, having completed a project during the year to fit solar

PV panels to most Group company factory roofs, with a target of

self-generating around 40 to 50% of the Group's energy. Many Group

directors, me included, have switched to fully electric vehicles;

of course, during the daytime, whilst we are sitting at our desks

working, our cars are charging, pollution free, in front of the

building. Apart from the obvious green benefits, the Group's solar

investments are expected to pay back in as little as five years, so

it is good news for lowering our cost base too.

All Group companies, on the product front, are taking

circularity seriously, further minimising the use of plastics and

environmentally damaging materials, targeting even longer

lifetimes, and making products simpler to upgrade or recycle at the

end of their lifetime. More and more of the Group's customers

demand solutions that are kind to the environment - good news for

local manufacturing wherever possible.

The Group is undergoing a three year improvement programme,

using an external third party assessor, to better measure and

improve its green credentials and certify them to appropriate

standards in an independent and reliable way. The Board feels this

is important, because the credibility of some claims in the market

is generally questionable.

Throughout the pandemic, FW Thorpe has continued its policy of

independence and has not claimed government assistance such as

furlough monies at any stage. Even during periods of layoff and

during COVID-related absences, employees have been paid in full. I

am proud of what has been achieved by everyone concerned - those

working diligently from home, and those arriving daily at the

Group's busy and COVID-secure factories.

Investments in lighting controls technology, and in particular

in the ability of those systems to co-communicate with other

systems, continues at pace. Later in the year, Thorlux will release

the second generation of SmartScan, building on the reliable and

successful SmartScan system first launched in 2016, which won the

2019 Queen's Award for Enterprise in the Innovation category. The

system, now being used extensively by many companies across the

Group, will be faster and smarter, and importantly will provide

more data and analytics for customers to use in new ways to help

streamline their operations, using the Group's luminaires as a

method of collecting and transporting information. Investments this

year in new improved electronics, especially but not limited to

those for outdoor areas, have brought cost downs, enabling

customers to achieve paybacks in shorter times.

Acquisition

I mentioned last year that the Group remained acquisitive but

was waiting until business again stabilised to some extent. I am

pleased to report that, having put acquisition projects on hold

last spring and following further discussions, on 4 October 2021 FW

Thorpe acquired a majority stake in Electrozemper S.A., trading as

Zemper, which has manufactured emergency lighting luminaires in

Ciudad Real, Spain, since 1967.

Zemper has a complete range of emergency lighting, an area of

business well liked by FW Thorpe for being somewhat niche and

specialised. The factory is self-contained, with its own plastic

moulding production, electronic printed circuit board assembly

lines, robotic assembly techniques and end of line testing.

Generally, Zemper operates in markets where the Group currently

only has a very small market share. Zemper's largest revenue is

derived from Spain, France and Belgium. Zemper's annual revenue is

EUR20m, with EBITDA over EUR4m. The deal structure is similar to

that agreed for the Dutch acquisitions, and management is part of

the ongoing project.

The Board sees long term synergies and collaboration

possibilities with other companies in the Group whilst further

penetrating wider geographical markets.

I welcome to FW Thorpe Plc the employees of Zemper and wish them

long and successful careers as part of the team.

Personnel

I would like to thank my whole team for their continued support

and diligence through such challenging times. I hope that some

stability will return in this financial year, and I look forward to

being able more regularly to visit Group operating sites again

soon.

Outlook

Whilst still carrying some increased manufacturing costs, all

companies are capable of producing increased revenue in the coming

year. As mentioned earlier, the Group as a whole commenced the new

year with a good order book, especially at Thorlux Lighting.

There remain some difficulties, though, caused by component

supply shortages, some capacity restraints and ongoing

COVID-related disruption.

Mike Allcock

Chairman and Joint Chief Executive

5 October 2021

Consolidated Results

Consolidated Income Statement

For the year ended 30 June 2021

2021 2020

Notes GBP'000 GBP'000

------------------------------------------------ ----- -------- --------

Continuing operations

Revenue 2 117,875 113,342

Cost of sales (62,484) (63,351)

------------------------------------------------ ----- -------- --------

Gross profit 55,391 49,991

------------------------------------------------ ----- -------- --------

Distribution costs (13,598) (13,434)

Administrative expenses (22,855) (20,489)

Other operating income 289 264

------------------------------------------------ ----- -------- --------

Operating profit (before exceptional item) 19,227 16,332

Exceptional item in respect of Lightronics fire 1,566 -

------------------------------------------------ ----- -------- --------

Operating profit 2 20,793 16,332

Finance income 615 708

Finance expense (1,267) (1,097)

------------------------------------------------ ----- -------- --------

Profit before income tax 20,141 15,943

Income tax expense 3 (4,329) (2,629)

------------------------------------------------ ----- -------- --------

Profit for the year 15,812 13,314

------------------------------------------------ ----- -------- --------

Earnings per share from continuing operations attributable to

the equity holders of the Company during the year (expressed in

pence per share)

2021 2020

Basic and diluted earnings per share Notes pence pence

------------------------------------- ----- ------ ------

- Basic 8 13.57 11.45

- Diluted 8 13.52 11.40

------------------------------------- ----- ------ ------

Consolidated Statement of Comprehensive Income

For the year ended 30 June 2021

2021 2020

GBP'000 GBP'000

----------------------------------------------------- -------- --------

Profit for the year: 15,812 13,314

------------------------------------------------------ -------- --------

Other comprehensive income/(expenses)

Items that may be reclassified to profit or loss

Exchange differences on translation of foreign

operations (688) 229

------------------------------------------------------ -------- --------

(688) 229

Items that will not be reclassified to profit

or loss

Revaluation of financial assets at fair value

through other comprehensive income 135 (834)

Actuarial gain/(loss) on pension scheme 1,758 (2,039)

Movement on unrecognised pension scheme surplus (1,940) 1,869

Taxation (236) 13

------------------------------------------------------ -------- --------

(283) (991)

Other comprehensive expense for the year, net

of tax (971) (762)

------------------------------------------------------ -------- --------

Total comprehensive income for the year attributable

to equity shareholders 14,841 12,552

------------------------------------------------------ -------- --------

Consolidated Statement of Financial Position

As at 30 June 2021

Group

---------------------------------------------------- ----- ------------------

2021 2020

Notes GBP'000 GBP'000

---------------------------------------------------- ----- -------- --------

Assets

Non-current assets

Property, plant and equipment 5 28,251 30,574

Intangible assets 6 19,705 21,032

Investments in subsidiaries - -

Investment property 1,967 1,987

Financial assets at amortised cost 746 1,800

Equity accounted investments and joint arrangements - -

Financial assets at fair value through other

comprehensive income 3,764 3,772

---------------------------------------------------- ----- -------- --------

Total non-current assets 54,433 59,165

---------------------------------------------------- ----- -------- --------

Current assets

Inventories 20,389 25,296

Trade and other receivables 29,310 21,256

Financial assets at amortised cost 1,800 625

Short-term financial assets 7 23,603 18,580

Cash and cash equivalents 52,268 44,422

---------------------------------------------------- ----- -------- --------

Total current assets 127,370 110,179

---------------------------------------------------- ----- -------- --------

Total assets 181,803 169,344

---------------------------------------------------- ----- -------- --------

Liabilities

Current liabilities

Trade and other payables (39,198) (36,185)

Lease liabilities (226) (220)

Current income tax liabilities (1,040) (831)

---------------------------------------------------- ----- -------- --------

Total current liabilities (40,464) (37,236)

---------------------------------------------------- ----- -------- --------

Net current assets 86,906 72,943

---------------------------------------------------- ----- -------- --------

Non-current liabilities

Other payables (78) (67)

Lease liabilities (435) (417)

Provisions for liabilities and charges (2,242) (2,721)

Deferred income tax liabilities (1,591) (601)

---------------------------------------------------- ----- -------- --------

Total non-current liabilities (4,346) (3,806)

---------------------------------------------------- ----- -------- --------

Total liabilities (44,810) (41,042)

---------------------------------------------------- ----- -------- --------

Net assets 136,993 128,302

---------------------------------------------------- ----- -------- --------

Equity

Share capital 1,189 1,189

Share premium account 1,960 1,526

Capital redemption reserve 137 137

Foreign currency translation reserve 2,076 2,764

Retained earnings

---------------------------------------------------- ----- -------- --------

At 1 July 122,686 117,036

Profit for the year attributable to the owners 15,812 13,314

Other changes in retained earnings (6,867) (7,664)

---------------------------------------------------- ----- -------- --------

131,631 122,686

---------------------------------------------------- ----- -------- --------

Total equity 136,993 128,302

---------------------------------------------------- ----- -------- --------

Consolidated Statement of Changes in Equity

For the year ended 30 June 2021

Foreign

Share Capital currency

Share premium redemption translation Retained Total

capital account reserve reserve earnings equity

Notes GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

----------------------------- ----- -------- -------- ----------- ------------ --------- --------

Balance at 1 July

2019 1,189 1,266 137 2,535 117,036 122,163

Adjustments on first

time adoption of IFRS16

(net of tax) - - - - (265) (265)

Restated balance at

1 July 2019 1,189 1,266 137 2,535 116,771 121,898

----------------------------- ----- -------- -------- ----------- ------------ --------- --------

Comprehensive income

Profit for the year

to 30 June 2020 - - - - 13,314 13,314

Actuarial loss on

pension scheme - - - - (2,039) (2,039)

Movement on unrecognised

pension scheme surplus - - - - 1,869 1,869

Revaluation of financial

assets at fair value

through other comprehensive

income - - - - (834) (834)

Movement on associated

deferred tax - - - - 81 81

Impact of deferred

tax rate change - - - - (68) (68)

Exchange differences

on translation of

foreign operations - - - 229 - 229

----------------------------- ----- -------- -------- ----------- ------------ --------- --------

Total comprehensive

income - - - 229 12,323 12,552

Transactions with

owners

Shares issued from

exercised options - 260 - - - 260

Dividends paid to

shareholders 4 - - - - (6,468) (6,468)

Share based payment

charge - - - - 60 60

----------------------------- ----- -------- -------- ----------- ------------ --------- --------

Total transactions

with owners - 260 - - (6,408) (6,148)

----------------------------- ----- -------- -------- ----------- ------------ --------- --------

Balance at 30 June

2020 1,189 1,526 137 2,764 122,686 128,302

----------------------------- ----- -------- -------- ----------- ------------ --------- --------

Comprehensive income

Profit for the year

to 30 June 2021 - - - - 15,812 15,812

Actuarial loss on

pension scheme - - - - 1,758 1,758

Movement on unrecognised

pension scheme surplus - - - - (1,940) (1,940)

Revaluation of financial

assets at fair value

through other comprehensive

income - - - - 135 135

Movement on associated

deferred tax - - - - (59) (59)

Impact of deferred

tax rate change - - - - (177) (177)

Exchange differences

on translation of

foreign operations - - - (688) - (688)

----------------------------- ----- -------- -------- ----------- ------------ --------- --------

Total comprehensive

income - - - (688) 15,529 14,841

Transactions with

owners

Shares issued from

exercised options - 434 - - - 434

Dividends paid to

shareholders 4 - - - - (6,631) (6,631)

Share based payment

charge - - - - 47 47

----------------------------- ----- -------- -------- ----------- ------------ --------- --------

Total transactions

with owners - 434 - - (6,584) (6,150)

----------------------------- ----- -------- -------- ----------- ------------ --------- --------

Balance at 30 June

2021 1,189 1,960 137 2,076 131,631 136,993

----------------------------- ----- -------- -------- ----------- ------------ --------- --------

Consolidated Statement of Cash Flows

For the year ended 30 June 2021

Group

------------------------------------------------- ----- ------------------

2021 2020

Notes GBP'000 GBP'000

------------------------------------------------- ----- -------- --------

Cash flows from operating activities

Cash generated from operations 9 25,726 23,231

Tax paid (3,853) (3,848)

------------------------------------------------- ----- -------- --------

Net cash generated from operating activities 21,873 19,383

------------------------------------------------- ----- -------- --------

Cash flows from investing activities

Purchases of property, plant and equipment (2,932) (6,988)

Proceeds from sale of property, plant and

equipment 290 212

Purchase of intangibles (1,756) (1,719)

Net sale/(purchase) of financial assets at

fair value through Other Comprehensive Income 205 (61)

Insurance proceeds re: property, plant and

equipment lost in fire 3,057 -

Proceeds from sale of other financial assets

at fair value through Profit and Loss account - 387

Property rental and similar income 41 92

Dividend income 186 187

Net (deposit)/withdrawal of short-term financial

assets (5,023) 7,903

Interest received 105 322

Net receipt of loan notes 59 1,156

------------------------------------------------- ----- -------- --------

Net cash (used in)/received from investing

activities (5,768) 1,491

------------------------------------------------- ----- -------- --------

Cash flows from financing activities

Net proceeds from the issuance of ordinary

shares 434 260

Proceeds from loans 365 192

Repayment of borrowings (958) (203)

Settlement of lease liabilities - (1,011)

Payment of lease liabilities (310) (265)

Payment of lease interest (39) (36)

Dividends paid to Company's shareholders 4 (6,631) (6,468)

------------------------------------------------- ----- -------- --------

Net cash used in financing activities (7,139) (7,531)

------------------------------------------------- ----- -------- --------

Effects of exchange rate changes on cash (1,120) 272

------------------------------------------------- ----- -------- --------

Net increase in cash in the year 7,846 13,615

Cash and cash equivalents at beginning of

year 44,422 30,807

------------------------------------------------- ----- -------- --------

Cash and cash equivalents at end of year 52,268 44,422

------------------------------------------------- ----- -------- --------

Notes

1 Basis of preparation

The consolidated and company financial statements of FW Thorpe

Plc have been prepared in accordance with International Accounting

Standards in conformity with the requirements of the Companies Act

2006. The financial statements have been prepared on a going

concern basis, under the historical cost convention except for the

financial instruments measured at fair value either through other

comprehensive income or profit and loss per the provisions of

IFRS9.

There are no other standards that are not yet effective that are

expected to have a material impact on the group in the current or

future reporting periods and on foreseeable future

transactions.

The consolidated financial statements are presented in Pounds

Sterling, which is the Company's functional and presentation

currency, rounded to the nearest thousand.

The preparation of financial information in conformity with the

basis of preparation described above requires the use of certain

critical accounting estimates. It also requires management to

exercise its judgement in the process of applying the Company's and

Group's accounting policies. The areas involving a higher degree of

judgement or complexity, or areas where assumptions and estimates

are significant to the consolidated financial information, are

disclosed in the critical accounting estimates and judgements

section.

The Company has elected to take the exemption under section 408

of the Companies Act 2006 from presenting the Company income

statement.

The directors confirm they are satisfied that the Group and

Company have adequate resources, with GBP52.3m cash and GBP23.6m

short term deposits, to continue in business for the foreseeable

future factoring in the expected impact of Covid-19. They have also

produced an analysis that demonstrates that the Group could cover

its cash commitments even if there was a reduction of 33% in sales

over the following year from approving these accounts. For this

reason, they continue to adopt the going concern basis in preparing

the accounts.

The financial information set out in this document does not

constitute the statutory financial statements of the Group for the

year end 30 June 2021 but is derived from the Annual Report and

Accounts 2021. The auditors have reported on the annual financial

statements and issued an unqualified opinion.

2 Segmental Analysis

(a) Business segments

The segmental analysis is presented on the same basis as that

used for internal reporting purposes. For internal reporting FW

Thorpe is organised into ten operating segments based on the

products and customer base in the lighting market - the largest

business is Thorlux, which manufactures professional lighting

systems for industrial, commercial and controls markets. The

businesses in the Netherlands, Lightronics and Famostar, are

material subsidiaries and disclosed separately as Netherlands

companies.

The seven remaining operating segments have been aggregated into

the "other companies" reportable segment based upon their size,

comprising the entities Philip Payne Limited, Solite Europe

Limited, Portland Lighting Limited, TRT Lighting Limited, Thorlux

Lighting L.L.C., Thorlux Australasia Pty Limited, Thorlux Lighting

GmbH.

FW Thorpe's chief operating decision-maker (CODM) is the Group

Board. The Group Board reviews the Group's internal reporting in

order to monitor and assess performance of the operating segments

for the purpose of making decisions about resources to be

allocated. Performance is evaluated based on a combination of

revenue and operating profit. Assets and liabilities have not been

segmented, which is consistent with the Group's internal

reporting.

Inter- Total

Netherlands Other segment continuing

Thorlux companies companies adjustments operations

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

------------------------------------------- -------- ----------- ---------- ------------ -----------

Year to 30 June 2021

Revenue to external customers 69,969 31,490 16,416 - 117,875

Revenue to other group companies 3,304 290 5,238 (8,832) -

------------------------------------------- -------- ----------- ---------- ------------ -----------

Total revenue 73,273 31,780 21,654 (8,832) 117,875

Operating profit (before exceptional

item) 11,694 5,402 1,722 409 19,227

Exceptional item in respect of Lightronics

fire - 1,566 - - 1,566

------------------------------------------- -------- ----------- ---------- ------------ -----------

Operating profit 11,694 6,968 1,722 409 20,793

------------------------------------------- -------- ----------- ---------- ------------ -----------

Net finance expense (652)

------------------------------------------- -------- ----------- ---------- ------------ -----------

Profit before income tax 20,141

------------------------------------------- -------- ----------- ---------- ------------ -----------

Year to 30 June 2020

Revenue to external customers 65,615 31,340 16,387 - 113,342

Revenue to other group companies 3,164 234 4,021 (7,419) -

------------------------------------------- -------- ----------- ---------- ------------ -----------

Total revenue 68,779 31,574 20,408 (7,419) 113,342

------------------------------------------- -------- ----------- ---------- ------------ -----------

Operating profit 10,150 4,125 1,412 645 16,332

------------------------------------------- -------- ----------- ---------- ------------ -----------

Net finance expense (389)

------------------------------------------- -------- ----------- ---------- ------------ -----------

Profit before income tax 15,943

------------------------------------------- -------- ----------- ---------- ------------ -----------

Inter segment adjustments to operating profit consist of

property rentals on premises owned by FW Thorpe Plc, adjustments to

profit related to stocks held within the Group that were supplied

by another segment and elimination of profit on transfer of assets

between Group companies.

(b) Geographical analysis

The Group's business segments operate in four main areas, the

UK, the Netherlands, the rest of Europe and the rest of the World.

The home country of the company, which is also the main operating

company, is the UK.

2021 2020

GBP'000 GBP'000

------------------ -------- --------

UK 74,363 69,657

Netherlands 28,879 28,748

Rest of Europe 12,499 12,265

Rest of the World 2,134 2,672

------------------ -------- --------

117,875 113,342

------------------ -------- --------

3 Income Tax Expense

Analysis of income tax expense in the year:

2021 2020

GBP'000 GBP'000

-------------------------------------------------- -------- ---------

Current tax

Current tax on profits for the year 4,128 3,691

Adjustments in respect of prior years (564) (981)

-------------------------------------------------- -------- ---------

Total current tax 3,564 2,710

-------------------------------------------------- -------- ---------

Deferred tax

Origination and reversal of temporary differences 765 (81)

-------------------------------------------------- -------- ---------

Total deferred tax 765 (81)

-------------------------------------------------- -------- ---------

Income tax expense 4,329 2,629

-------------------------------------------------- -------- ---------

The tax assessed for the year is higher (2020: lower) than the

standard rate of corporation tax in the UK of 19.00% (2020:

19.00%). The differences are explained below:

2021 2020

GBP'000 GBP'000

--------------------------------------------------------- -------- --------

Profit before income tax 20,141 15,943

--------------------------------------------------------- -------- --------

Profit on ordinary activities multiplied by the standard

rate in the UK of 19% (2020: 19.00%) 3,827 3,029

Effects of:

Expenses not deductible for tax purposes 1,077 854

Accelerated tax allowances and other timing differences 238 17

Adjustments in respect of prior years (564) (981)

Patent box relief (686) (643)

Foreign profit taxed at higher rate 437 353

--------------------------------------------------------- -------- --------

Tax charge 4,329 2,629

--------------------------------------------------------- -------- --------

The effective tax rate was 21.49% (2020: 16.49%). Adjustments in

respect of prior years relates to refunds received for prudent

assumptions on additional investment allowances and patent box

relief in the tax calculations.

The UK corporation tax rate of 19% (effective 1 April 2020) was

substantively enacted on 17 March 2020. The UK corporation tax rate

increase from 19% to 25% from 1 April 2023, was substantively

enacted in May 2021. This has led to an increase in the deferred

tax assets and liabilities at 30 June 2021 as these values have

been calculated based on a rate at which they are expected to

crystalise.

4 Dividends

Dividends paid during the year are outlined in the tables

below:

Dividends paid (pence per share) 2021 2020

--------------------------------- ---- ----

Final dividend 4.20 4.10

Interim dividend 1.49 1.46

--------------------------------- ---- ----

Total 5.69 5.56

--------------------------------- ---- ----

A final dividend in respect of the year ended 30 June 2021 of

4.31p per share, amounting to GBP5,028,000 (2020: GBP4,886,000) and

a special dividend of 2.20p, amounting to GBP2,567,000 (2020: nil)

is to be proposed at the Annual General Meeting on 18 November 2021

and, if approved, will be paid on 25 November 2021 to shareholders

on the register on 29 October 2021. The ex-dividend date is 28

October 2021. These financial statements do not reflect this

dividend payable.

Dividends proposed (pence per share) 2021 2020

------------------------------------- ---- ----

Final dividend 4.31 4.20

------------------------------------- ---- ----

Special dividend 2.20 -

------------------------------------- ---- ----

2021 2020

Dividends paid GBP'000 GBP'000

----------------- -------- --------

Final dividend 4,895 4,770

Interim dividend 1,736 1,698

----------------- -------- --------

Total 6,631 6,468

----------------- -------- --------

2021 2020

Dividends proposed GBP'000 GBP'000

------------------- -------- --------

Final dividend 5,028 4,886

------------------- -------- --------

Special dividend 2,567 -

------------------- -------- --------

5 Property, Plant and Equipment

Group

------------------------- ----------------------------------------------

Right-

Freehold land Plant and of-use

and buildings equipment assets Total

GBP'000 GBP'000 GBP'000 GBP'000

------------------------- -------------- ---------- -------- --------

Cost

At 1 July 2020 23,552 26,933 856 51,341

Additions 133 2,435 364 2,932

Disposals* (1,181) (1,548) (276) (3,005)

Currency translation (410) (158) (49) (617)

------------------------- -------------- ---------- -------- --------

At 30 June 2021 22,094 27,662 895 50,651

------------------------- -------------- ---------- -------- --------

Accumulated depreciation

At 1 July 2020 4,362 15,955 450 20,767

Charge for the year 617 2,487 212 3,316

Disposals* (283) (1,013) (221) (1,517)

Currency translation (58) (84) (24) (166)

------------------------- -------------- ---------- -------- --------

At 30 June 2021 4,638 17,345 417 22,400

------------------------- -------------- ---------- -------- --------

Net book amount

------------------------- -------------- ---------- -------- --------

At 30 June 2021 17,456 10,317 478 28,251

------------------------- -------------- ---------- -------- --------

* Disposals includes the write off of assets as a result of the

Lightronics fire.

Group

------------------------- ----------------------------------------------

Right-

Freehold land Plant and of-use

and buildings equipment assets Total

GBP'000 GBP'000 GBP'000 GBP'000

------------------------- -------------- ---------- -------- --------

Cost

At 1 July 2019 19,720 23,851 - 43,571

Adoption of IFRS16 - - 2,266 2,266

------------------------- -------------- ---------- -------- --------

At 1 July (restated) 19,720 23,851 2,266 45,837

Additions 3,709 4,016 192 7,917

Disposals (31) (1,005) (1,628) (2,664)

Transfers (17) 17 - -

Currency translation 171 54 26 251

------------------------- -------------- ---------- -------- --------

At 30 June 2020 23,552 26,933 856 51,341

------------------------- -------------- ---------- -------- --------

Accumulated depreciation

At 1 July 2019 3,712 14,506 - 18,218

Adoption of IFRS16 - - 908 908

------------------------- -------------- ---------- -------- --------

At 1 July (restated) 3,712 14,506 908 19,126

Charge for the year 662 2,331 228 3,221

Disposals (31) (911) (699) (1,641)

Transfers (2) 2 - -

Currency translation 21 27 13 61

------------------------- -------------- ---------- -------- --------

At 30 June 2020 4,362 15,955 450 20,767

------------------------- -------------- ---------- -------- --------

Net book amount

------------------------- -------------- ---------- -------- --------

At 30 June 2020 19,190 10,978 406 30,574

------------------------- -------------- ---------- -------- --------

6 Intangible Assets

Development Brand Fishing

Goodwill costs Technology name Software Patents rights Total

Group 2021 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

--------------------- -------- ----------- ---------- -------- -------- -------- ------------------- --------

Cost

At 1 July 2020 15,116 7,357 3,000 1,323 2,573 150 182 29,701

Additions - 1,516 - - 240 - - 1,756

Write-offs

and transfers - (964) - - (5) - - (969)

Currency translation (685) (38) (154) (66) 3 - - (940)

--------------------- -------- ----------- ---------- -------- -------- -------- ------------------- --------

At 30 June

2021 14,431 7,871 2,846 1,257 2,811 150 182 29,548

--------------------- -------- ----------- ---------- -------- -------- -------- ------------------- --------

Accumulated

amortisation

At 1 July 2020 248 3,902 1,908 980 1,481 150 - 8,669

Charge for

the year - 1,508 373 74 373 - - 2,328

Write-offs

and transfers - (964) - - (5) - - (969)

Currency translation (7) (31) (102) (48) 3 - - (185)

--------------------- -------- ----------- ---------- -------- -------- -------- ------------------- --------

At 30 June

2021 241 4,415 2,179 1,006 1,852 150 - 9,843

--------------------- -------- ----------- ---------- -------- -------- -------- ------------------- --------

Net book amount

--------------------- -------- ----------- ---------- -------- -------- -------- ------------------- --------

At 30 June

2021 14,190 3,456 667 251 959 - 182 19,705

--------------------- -------- ----------- ---------- -------- -------- -------- ------------------- --------

Write-offs relate to development assets where no further

economic benefits will be obtained.

Development Brand Fishing

Goodwill costs Technology name Software Patents rights Total

Group 2020 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

--------------------- -------- ----------- ---------- -------- -------- -------- -------- --------

Cost

At 1 July 2019 14,921 7,292 2,956 1,304 2,202 150 182 29,007

Additions - 1,322 - - 397 - - 1,719

Write-offs

and transfers - (1,275) - - (26) - - (1,301)

Currency translation 195 18 44 19 - - - 276

--------------------- -------- ----------- ---------- -------- -------- -------- -------- --------

At 30 June

2020 15,116 7,357 3,000 1,323 2,573 150 182 29,701

--------------------- -------- ----------- ---------- -------- -------- -------- -------- --------

Accumulated

amortisation

At 1 July 2019 246 3,441 1,504 801 1,178 150 - 7,320

Charge for

the year - 1,715 371 162 329 - - 2,577

Write-offs

and transfers - (1,275) - - (26) - - (1,301)

Currency translation 2 21 33 17 - - - 73

--------------------- -------- ----------- ---------- -------- -------- -------- -------- --------

At 30 June

2020 248 3,902 1,908 980 1,481 150 - 8,669

--------------------- -------- ----------- ---------- -------- -------- -------- -------- --------

Net book amount

--------------------- -------- ----------- ---------- -------- -------- -------- -------- --------

At 30 June

2020 14,868 3,455 1,092 343 1,092 - 182 21,032

--------------------- -------- ----------- ---------- -------- -------- -------- -------- --------

7 Short-term Financial Assets

2021 2020

Group and Company GBP'000 GBP'000

--------------------------- -------- --------

Beginning of year 18,580 26,483

Net deposits/(withdrawals) 5,023 (7,903)

--------------------------- -------- --------

23,603 18,580

--------------------------- -------- --------

The short-term financial assets consist of term cash deposits in

sterling with an original term in excess of three months.

8 Earnings Per Share

Basic and diluted earnings per share for profit attributable to

equity holders of the Company

Basic earnings per share is calculated by dividing the profit

attributable to equity holders of the Company by the weighted

average number of ordinary shares in issue during the year,

excluding ordinary shares purchased by the Company and held as

treasury shares.

Basic 2021 2020

--------------------------------------------------------------- ------------ -----------

Weighted average number of ordinary shares in issue 116,511,580 116,272,709

--------------------------------------------------------------- ------------ -----------

Profit attributable to equity holders of the Company (GBP'000) 15,812 13,314

--------------------------------------------------------------- ------------ -----------

Basic earnings per share (pence per share) total 13.57 11.45

--------------------------------------------------------------- ------------ -----------

Diluted 2021 2020

--------------------------------------------------------------- ------------ -----------

Weighted average number of ordinary shares in issue (diluted) 116,938,189 116,805,366

--------------------------------------------------------------- ------------ -----------

Profit attributable to equity holders of the Company (GBP'000) 15,812 13,314

--------------------------------------------------------------- ------------ -----------

Diluted earnings per share (pence per share) total 13.52 11.40

--------------------------------------------------------------- ------------ -----------

9 Cash Generated from Operations

Group

------------------------------------------------------ ------------------

2021 2020

Cash generated from continuing operations GBP'000 GBP'000

------------------------------------------------------ -------- --------

Profit before income tax 20,141 15,943

Depreciation charge 3,316 3,221

Depreciation of investment property 20 19

Amortisation of intangibles 2,328 2,577

Profit on disposal of property, plant and equipment (115) (118)

Exceptional item in respect of Lightronics fire (1,566) -

Insurance proceeds re inventory lost in fire 5 -

Insurance proceeds re other costs 318 -

Net finance expense 652 389

Retirement benefit contributions in excess of current

and past service charge (182) (170)

Share based payment charge 1,429 1,211

Research and development expenditure credit (289) (249)

Effects of exchange rate movements 1,114 (219)

Changes in working capital

- Inventories 4,878 238

- Trade and other receivables (7,287) 571

- Payables and provisions 964 (182)

------------------------------------------------------ -------- --------

Total cash generated from operations 25,726 23,231

------------------------------------------------------ -------- --------

10 Events after the Statement of Financial Positions date

On 21 September 2021 the Group completed its commitment to

purchase the outstanding share appreciation rights in the

subsidiaries Lightronics Participaties B.V. and Famostar Emergency

Lighting B.V. The settlement was executed by a cash payment of the

outstanding liability.

On 4 October 2021, the Group acquired 63% of the share capital

of Electrozemper S.A. (Zemper), an emergency lighting specialist in

Spain. The company was acquired by FW Thorpe Plc for initial

consideration of EUR20.3m (GBP17.5m), plus EUR4.2m (GBP3.6m) for

cash, working capital and property adjustments, with an additional

EUR1.1m (GBP1.0m) payable subject to EBITDA performance 2021/22.

The acquisition has been funded from the cash reserves of FW Thorpe

Plc.

For the financial year to June 2021, Zemper achieved revenue of

EUR20.3m (GBP17.4m) and operating profit of EUR3.8m (GBP3.3m). A

fair value exercise will be performed in the next 12 months to

determine the value of goodwill and other intangible assets that

have arisen from this acquisition.

11 Cautionary statement

Sections of this report contain forward looking statements that

are subject to risk factors including the economic and business

circumstances occurring from time to time in countries and markets

in which the Group operates. By their nature, forward looking

statements involve a number of risks, uncertainties and future

assumptions because they relate to events and/or depend on

circumstances that may or may not occur in the future and could

cause actual results and outcomes to differ materially from those

expressed in or implied by the forward looking statements. No

assurance can be given that the forward-looking statements in this

preliminary announcement will be realised. Statements about the

Chairman's expectations, beliefs, hopes, plans, intentions and

strategies are inherently subject to change, and they are based on

expectations and assumptions as to future events, circumstances and

other factors which are in some cases outside the Company's

control. Actual results could differ materially from the Company's

current expectations. It is believed that the expectations set out

in these forward looking statements are reasonable but they may be

affected by a wide range of variables which could cause actual

results or trends to differ materially, including but not limited

to, changes in risks associated with the Company's growth strategy,

fluctuations in product pricing and changes in exchange and

interest rates.

12 Annual report and accounts

The annual report and accounts will be sent to shareholders on

12 October 2021 and will be available, along with this

announcement, on the Group's website (www.fwthorpe.co.uk) from 12

October 2021. The Group will hold its AGM on 18 November 2021.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

FR EAPELEEXFFFA

(END) Dow Jones Newswires

October 05, 2021 02:00 ET (06:00 GMT)

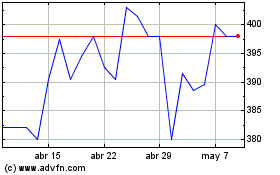

Thorpe (f.w.) (LSE:TFW)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

Thorpe (f.w.) (LSE:TFW)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024