P&G Raises Outlook After Another Quarter of Strong Sales--Update

23 Enero 2019 - 7:12AM

Noticias Dow Jones

By Aisha Al-Muslim

Procter & Gamble Co. reported strong quarterly sales growth,

continuing a streak of robust gains that prompted the

consumer-products giant to raise its outlook for the year.

The maker of Tide detergent and Gillette razors said organic

sales -- a closely watched metric that strips out currency moves,

acquisitions and divestitures -- rose 4% in the fiscal second

quarter. Organic sales were boosted by 1% due to higher

pricing.

Beauty products fueled the gains, with organic sales rising 8%,

but the company reported growth across a number of categories

including health care, and fabric and home care. The growth came

from higher consumption and pricing.

The Cincinnati-based company has struggled to boost sales in an

industry facing more competition, a consumer shift toward smaller

brands, changing tastes and higher costs of raw materials and

transportation.

After trying to combat weak demand by lowering prices, P&G

changed course late last year, saying it would increase prices for

products including its Pampers, Bounty, Charmin and Puffs brands.

Other consumer-goods makers have followed P&G's lead on raising

prices amid commodity-price increases, foreign-currency

fluctuations and a stronger U.S. dollar.

P&G said prices were 1% higher during the quarter. Overall,

the price increases appeared to not have had a negative impact on

consumption. Shipment volumes rose 2% from a year ago.

P&G said profit rose 28% to $3.19 billion, or $1.22 cents a

share, in the second quarter, which ended Dec. 31, 2018. Core

earnings were $1.25 a share, beating the $1.21 a share analysts

polled by Refinitiv were looking for. Core earnings strip out

currency moves, acquisitions and divestitures.

Net sales were $17.44 billion, unchanged from the previous year,

but unfavorable foreign-exchange fluctuations hurt sales by 4%.

Analysts were expecting net sales to fall slightly to $17.15

billion.

Investors cheered the results in premarket trading on Wednesday,

sending P&G shares up 3.1%. Shares are up 1.6% in the past 12

months.

P&G increased the high end of its full-year forecast for

organic sales to rise 2% to 4%, compared with its prior estimates

of 2% to 3%.

The company now estimates overall sales to be down 1% to up 1%

for the full year, including foreign-exchange headwinds, compared

with the previous outlook of down 2%.

The company maintained its expectation for core

earnings-per-share growth of 3% to 8% for fiscal 2019. The outlook

includes an estimated $1.4 billion headwind from foreign exchange

and higher commodity costs as well as higher transportation

costs.

Write to Aisha Al-Muslim at aisha.al-muslim@wsj.com

(END) Dow Jones Newswires

January 23, 2019 07:57 ET (12:57 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

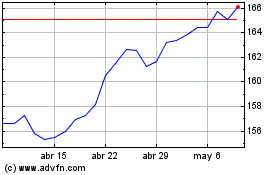

Procter and Gamble (NYSE:PG)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

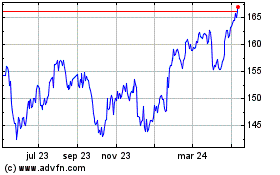

Procter and Gamble (NYSE:PG)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024