Arcelormittal Announces The Completion Of Its Share Buyback Programme

19 Febrero 2019 - 3:44AM

Noticias Dow Jones

TIDMMT

Luxembourg, 19 February 2019 - ArcelorMittal announces the completion of

its share buyback programme on 15 February 2019. ArcelorMittal has

repurchased 4 million shares for a total value of approximately

EUR79,577,540 (equivalent $US 89,679,370) at an approximate average

price per share of EUR19.894. All details are available on its website

on:

https://www.globenewswire.com/Tracker?data=WzwnOu9dO3nHzBTyIMPtoyO1aPll_686WcCZmoIflgYwF1V0SgNb3kuNKE-jD2K-3RZoYAXsIQO62noOOxFo2XLzFl_CsKbe-8cO_GApDD2e6Ws49pqatxnmhCeW4AX-qvHL18nypCO4Rk3BVBgowl_3ct3J7fSwTIAIWG75wl6SyEoaLf-KK07Yb6P-AEcw_XAHpS7q3aNkqwh23Fr970S-RIW0v058VOztJ5foJtycaOC7w6Hzuh-pXNzz5zYc

https://corporate.arcelormittal.com/investors/equity-investors/share-buyback-2019.

Ends

About ArcelorMittal

ArcelorMittal is the world's leading steel and mining company, with a

presence in 60 countries and an industrial footprint in 18 countries.

Guided by a philosophy to produce safe, sustainable steel, we are the

leading supplier of quality steel in the major global steel markets

including automotive, construction, household appliances and packaging,

with world-class research and development and outstanding distribution

networks.

Through our core values of sustainability, quality and leadership, we

operate responsibly with respect to the health, safety and wellbeing of

our employees, contractors and the communities in which we operate.

For us, steel is the fabric of life, as it is at the heart of the modern

world from railways to cars and washing machines. We are actively

researching and producing steel-based technologies and solutions that

make many of the products and components people use in their everyday

lives more energy efficient.

We are one of the world's five largest producers of iron ore and

metallurgical coal. With a geographically diversified portfolio of iron

ore and coal assets, we are strategically positioned to serve our

network of steel plants and the external global market. While our steel

operations are important customers, our supply to the external market is

increasing as we grow.

In 2017, ArcelorMittal had revenues of $68.7 billion and crude steel

production of 93.1 million metric tonnes, while own iron ore production

reached 57.4 million metric tonnes.

ArcelorMittal is listed on the stock exchanges of New York (MT),

Amsterdam (MT), Paris (MT), Luxembourg (MT) and on the Spanish stock

exchanges of Barcelona, Bilbao, Madrid and Valencia (MTS).

For more information about ArcelorMittal please visit:

http://corporate.arcelormittal.com/

Contact information ArcelorMittal

Investor Relations

Europe +44 20 7543 1156

Americas +1 312 899 3985

Retail +44 20 7543 1156

SRI +44 207543 1156

Bonds/Credit +33 171 921 026

Contact information ArcelorMittal

Corporate Communications

mailto:press@arcelormittal.com

E-mail: press@arcelormittal.com

--------------------------------

Phone: +442076297988

ArcelorMittal Corporate Communications

Paul Weigh +44 20 3214 2419

(END) Dow Jones Newswires

February 19, 2019 04:29 ET (09:29 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

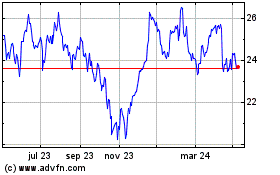

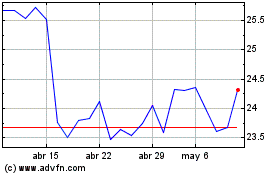

ArcelorMittal (EU:MT)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

ArcelorMittal (EU:MT)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024