TIDMBGLF

RNS Number : 3941V

Blackstone / GSO Loan Financing Ltd

02 December 2019

Blackstone / GSO Loan Financing Limited

2 December 2019

Notification of Establishment and Capitalisation of New Manager

Entity

NOT FOR RELEASE, PUBLICATION OR DISTRIBUTION IN WHOLE OR IN

PART, DIRECTLY OR INDIRECTLY, IN OR INTO, THE UNITED STATES OF

AMERICA, CANADA, JAPAN, AUSTRALIA, OR SOUTH AFRICA OR ANY OTHER

JURISDICTION WHERE IT IS UNLAWFUL TO DISTRIBUTE THIS ANNOUNCEMENT

OR ANY COPY OF IT.

This announcement is not an offer of securities for sale or

subscription in the United States of America, Canada, Japan,

Australia, South Africa or any other jurisdiction.

Blackstone / GSO Loan Financing Limited ("BGLF" or the

"Company")

Following the rollback of the U.S. risk retention rules for open

market CLOs in 2018, as explained in the Company's RNS dated 12

February 2018, BGLF, through its investment in Blackstone / GSO

Corporate Funding Designated Activity Company ("BGCF"), has

continued its strategy of seeking to own majority economic equity

positions in U.S. collateralized loan obligation transactions

("U.S. CLOs") by investing directly into U.S. CLOs instead of

making these investments through Blackstone / GSO US Corporate

Funding, Ltd. (the "U.S. MOA"). Blackstone / Debt Funds Management

Europe Limited ("DFME"), as Adviser to BGLF, and GSO / Blackstone

Debt Funds Management LLC ("DFM"; together with DFME, the

"Adviser"), its U.S. affiliate, have informed the Company's board

of the establishment of a new manager entity designed to facilitate

the opportunistic investment by BGCF in certain U.S. CLOs that are

expected to be structured in a manner intended to comply with the

European risk retention regulation.

The Adviser believes that this new manager entity will benefit

the Company and its portfolio of U.S. CLOs. As these CLOs will now

seek to be compliant with the European risk retention regulation,

they will be able to be marketed to a broader investor base,

including European institutional investors, who have expressed

potential demand for U.S. exposure and diversification within their

investment portfolios. This additional demand may potentially

result in lower CLO liability costs, which could help support the

Company's performance through improved net interest margins of its

U.S. CLO investments.

On 13 August 2019, the Board of BGCF approved the establishment

and capitalisation of a new manager entity, Blackstone / GSO CLO

Management LLC (the "NME" or the "New Manager Entity"), in the

amount of up to $428 million. To the extent necessary to comply

with the European risk retention regulation, the NME expects to

serve the multiple functions of acting as collateral manager to the

U.S. CLOs and warehouses, acting as "originator" for a portion of

the U.S. CLO assets at closing, retaining a portion of CLO equity,

and providing funding for U.S. CLO warehouse first loss

positions.

To assist it in fulfilling its contemplated roles as

manager-originator, the NME has entered into a shared services

agreement (the "Shared Services Agreement") with DFM (the "Shared

Services Provider") pursuant to which the Shared Services Provider

has agreed to share certain professionals with the NME, undertake

the credit review of the loans for which it intends to be the

"originator" for purposes of satisfying the European risk retention

regulation and provide certain other related services.

The changes referred to herein are consistent with BGLF's

investment objective and policy, which seeks to gain exposure to

floating rate senior secured loans and bonds directly and

indirectly through companies or entities established from time to

time ("Underlying Companies"). BGLF's investment objective and

policy remains unchanged.

IMPORTANT INFORMATION

This document has been issued by the Company, and should not be

taken as an inducement to engage in any investment activity and is

for the purpose of providing information about the Company. This

document does not constitute or form part of, and should not be

construed as, any offer for sale or subscription of, or

solicitation of any offer to buy or subscribe for, any share in the

Company or securities in any other entity, in any jurisdiction,

including the United States, Canada, Japan or South Africa nor

shall it, or any part of it, or the fact of its distribution, form

the basis of, or be relied on in connection with, any contract or

investment decision whatsoever, in any jurisdiction.

This document, and the information contained therein, is not for

viewing, release, distribution or publication in or into the United

States, Canada, Japan, South Africa or any other jurisdiction where

applicable laws prohibit its release, distribution or publication,

and will not be made available to any national, resident or citizen

of the United States, Canada, Japan or South Africa. The

distribution of this document in other jurisdictions may be

restricted by law and persons into whose possession this document

comes must inform themselves about, and observe, any such

restrictions. Any failure to comply with the restrictions may

constitute a violation of the federal securities law of the United

States and the laws of other jurisdictions.

The shares issued and to be issued by the Company (the "Shares")

have not been and will not be registered under the US Securities

Act of 1933, as amended (the "Securities Act"), or with any

securities regulatory authority of any state or other jurisdiction

of the United States. The Shares may not be offered, sold, resold,

pledged, delivered, distributed or otherwise transferred, directly

or indirectly, into or within the United States, or to, or for the

account or benefit of, US persons (as defined in Regulation S under

the Securities Act). No public offering of the Shares is being made

in the United States.

The Company has not been and will not be registered under the US

Investment Company Act of 1940, as amended (the "Investment Company

Act") and, as such, holders of the Shares will not be entitled to

the benefits of the Investment Company Act. No offer, sale, resale,

pledge, delivery, distribution or transfer of the Shares may be

made except under circumstances that will not result in the Company

being required to register as an investment company under the

Investment Company Act. Neither the U.S. Securities and Exchange

Commission (the "SEC") nor any state securities commission has

approved or disapproved of the Shares or passed upon or endorsed

the merits of the offering of the Shares or the adequacy or

accuracy of the Prospectus. Any representation to the contrary is a

criminal offence in the United States. In addition, the Shares are

subject to restrictions on transferability and resale in certain

jurisdictions and may not be transferred or resold except as

permitted under applicable securities laws and regulations.

Investors may be required to bear the financial risks of their

investment in the Shares for an indefinite period of time. Any

failure to comply with these restrictions may constitute a

violation of the securities laws of any such jurisdictions.

No liability whatsoever (whether in negligence or otherwise)

arising directly or indirectly from the use of this document is

accepted and no representation, warranty or undertaking, express or

implied, is or will be made by the Company, or any of their

respective directors, officers, employees, advisers,

representatives or other agents ("Agents") for any information or

any of the opinions contained herein or for any errors, omissions

or misstatements. None of the Agents makes or has been authorised

to make any representation or warranties (express or implied) in

relation to the Company or as to the truth, accuracy or

completeness of this document, or any other written or oral

statement provided. In particular, no representation or warranty is

given as to the achievement or reasonableness of, and no reliance

should be placed on any projections, targets, estimates or

forecasts contained in this document and nothing in this document

is or should be relied on as a promise or representation as to the

future.

Unless otherwise indicated, the information provided herein is

based on matters as they exist as of the date of preparation and

not as of any future date. Recipients of this document are

encouraged to contact the Company's representatives to discuss the

procedures and methodologies used to make the projections and other

information provided herein.

All investments are subject to risk, including the loss of the

principal amount invested. Past performance is no guarantee of

future returns. All investments to be held by the Company involve a

substantial degree of risk, including the risk of total loss. The

value of shares and the income from them is not guaranteed and can

fall as well as rise due to stock market and currency movements.

When you sell your investment you may get back less than you

originally invested. You should always seek expert legal,

financial, tax and other professional advice before making any

investment decision.

Blackstone / GSO Loan Financing Limited is a self-managed Jersey

registered alternative investment fund, and is regulated by the

Jersey Financial Services Commission. The Jersey Financial Services

Commission does not take any responsibility for the financial

soundness of the Company or for the correctness of any statements

made or expressed in this document.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

END

MSCLLFVRFFLFIIA

(END) Dow Jones Newswires

December 02, 2019 11:36 ET (16:36 GMT)

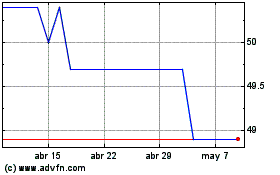

Blackstone Loan Financing (LSE:BGLP)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

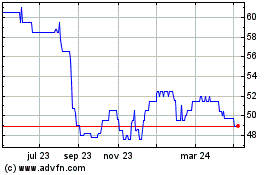

Blackstone Loan Financing (LSE:BGLP)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024