Yu Group PLC Trading Update and Notice of Results (0741B)

28 Enero 2020 - 1:00AM

UK Regulatory

TIDMYU.

RNS Number : 0741B

Yu Group PLC

28 January 2020

28 January 2020

Yü Group PLC

("Yü Group" or the "Group")

Trading Update and Notice of Results

Yü Group PLC, the independent supplier of gas, electricity and

water to the UK business sector, is pleased to provide an update on

trading for the year ended 31 December 2019.

Financial highlights:

-- Revenues for FY 2019 expected to be approx. GBP110m (2018:

GBP80.6m), an increase of c.35% and ahead of market

expectations

-- Adjusted EBITDA for FY 2019 expected to be at least in line with market expectations

o Significant improvement from H1 to H2 as Group's strategic

actions take effect

-- Cash and trading counterparty deposits of GBP12.6m (2018: GBP14.6m)

-- Positive outlook as Group anticipates material improvement to

Adjusted EBITDA for FY 2020, with higher gross margins being

achieved

Operational highlights

-- Entry into GBP13.0m facility with SmartestEnergy to support

the Group's hedging and reduce the Group's working capital

requirements

-- Senior management team strengthened with appointment of Sales

& Marketing Director and Board changed post period end

-- Commercial arrangements finalised for new Leicester office

due to open in 2021 to support the Group's growth

Bookings, representing the annualised value of new or renewed

contracts entered into with customers during FY 2019, averaged

GBP4.2m per month (FY 2018: GBP8.4m). The monthly average bookings

have increased from GBP3.2m in H1 2019 to GBP5.1m in H2 2019, and

this upward momentum is expected to continue in FY 2020.

Bookings were deliberately slowed in early 2019 whilst processes

and systems were redesigned, and certain contracts which had

negative EBITDA contribution (due to low margin or high credit

risk) were not renewed. The sales operating model was also revised,

including the creation of a new Sales & Marketing Director role

and the implementation of new targets and incentivisation metrics.

The Board is pleased with the execution of its strategy to focus on

the quality of revenue it generates.

Contracted revenue for FY 2020 was GBP79.5m at 31 December 2019.

The Board is confident that the revenue now contracted, plus the

future business that it will book, will deliver a higher forward

gross margin and EBITDA contribution than that contracted in 2018

and prior.

Group cash and trading counterparty deposits as at 31 December

2019 were GBP12.6m (2018: GBP14.6m), consisting of GBP2.1m in cash

(2018: GBP14.6m) supplemented by GBP10.5m (2018: GBPnil) of trading

counterparty deposits. The trading cash calls have been made due to

the significant decrease in forward energy commodity markets

experienced in the year.

The new hedging facility ("Facility") arranged with

SmartestEnergy will materially reduce volatility in the Group's

cashflow and cash balances caused by advanced deposits. The

c.GBP13m Facility, which scales with the business, is anticipated

to impact cashflow favourably in H1 2020 as the Group transfers its

trades from its legacy arrangements to SmartestEnergy.

Adjusted EBITDA is currently expected to be at least in line

with market expectations, with H2 2019 losses significantly below

the loss in H1 2019 as the strategic actions implemented through FY

2019 start to produce results. This upward trend is expected to

continue, and the Board looks forward to the future with growing

confidence.

Notice of year end results

The Group intends to publish its full year results on Tuesday 31

March 2020.

Bobby Kalar, Chief Executive of Yü Group, commented:

"Our team's determination over this past year to transform Yu

Group into a disciplined, higher margin business has been momentous

and necessary. Significant controls implemented across the

organisation have now been embedded by the business and are showing

a positive contribution towards areas such as cash collections,

revenue protection and gross margin optimisation. With a new and

evolving Board capable of guiding us in our next phase of growth,

and our new progressive trading arrangement with SmartestEnergy to

enhance and futureproof our cashflow, the focus in the year ahead

is to continue to build on this solid platform and accelerate

manageable growth whilst reducing the cost to serve.

"A core indicator, Adjusted EBITDA, is improving in line with

our plan and we are able to invest in our automated digital

strategy. I'm confident we have weathered the storm and while we

remain cognisant of lessons learned, we are now very much a

forward-facing business. I look forward to a successful year

ahead."

For further information, please contact:

Yü Group PLC

Bobby Kalar

Paul Rawson +44 (0) 115 975 8258

Shore Capital

Advisory

Edward Mansfield

Anita Ghanekar

James Thomas

Broking

Fiona Conroy +44 (0) 20 7408 4090

Alma PR

John Coles

Hilary Buchanan

Helena Bogle +44 (0) 20 3405 0205

Notes to Editors

Information on the Group

Yü Group PLC, trading as Yü Energy, is an independent supplier

of gas, electricity and water focused on servicing the business

sector throughout the UK. It has no involvement in the retail

supply of energy to the domestic sector. The Group was listed on

the AIM market of the London Stock Exchange in March 2016.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

END

TSTPPUQUGUPUGBM

(END) Dow Jones Newswires

January 28, 2020 02:00 ET (07:00 GMT)

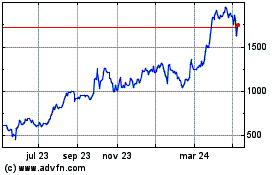

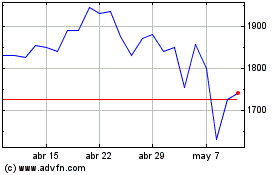

Yu (LSE:YU.)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

Yu (LSE:YU.)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024