TIDMPSDL

RNS Number : 3502B

Phoenix Spree Deutschland Limited

30 January 2020

30 January 2020

Phoenix Spree Deutschland Limited

(The "Company" or "PSDL")

Investment property valuation as at 31 December 2019

Phoenix Spree Deutschland (LSE: PSDL.LN), the UK listed

investment company specialising in Berlin residential real estate,

announces the valuation for the portfolio of investment properties

held by the Company and its subsidiaries (the "Portfolio") as at 31

December 2019.

Further increase in portfolio value

The total Portfolio was valued at EUR730.2 million by Jones Lang

LaSalle GmbH, the Company's external valuers, an increase of 13.1

per cent over the twelve-month period (31 December 2018: EUR645.7

million). This valuation represents an average value per square

metre of EUR3,741 (31 December 2018: EUR3,527) and a gross

fully-occupied rental yield of 2.9 per cent (31 December 2018: 3.0

per cent).

On a like-for-like basis, after adjusting for the impact of

acquisitions net of disposals, the Portfolio valuation increased by

7.1 per cent in the year to 31 December 2019, and 3.1 per cent in

the second half of the financial year. This reflects the combined

impact of market rental growth and the active management of the

Portfolio.

Based on the Company's year-end Portfolio valuation, it is

expected that the reported EPRA NAV per share as at 31 December

will fall within a range of EUR4.90 - EUR4.96 (GBP4.15 - GBP4.20*)

(31 December 2018: EUR4.58 (GBP4.11)). This represents a Sterling

EPRA NAV per share total return within a range of 2.5 to 3.8 per

cent for the financial year to 31 December 2019.

Update on proposed rent controls

On 26 November 2019, the Berlin Senate (the government of the

federal state of Berlin) passed a draft bill for the Berlin rent

price cap (Mietendeckel). It is expected that this bill will be

adopted by the Berlin House of Representatives (the legislative

chamber of the federal state of Berlin) and come into force in

early February 2020.

The opposition in the Berlin House of Representatives and a

parliamentary faction of the Federal Government have already

announced that they intend to have the proposed legislation

reviewed by Berlin's Regional Constitutional Court and the Federal

Constitutional Court. The Company and its legal advisors remain of

the view that the proposals as currently drafted are

unconstitutional and illegal. In particular, they raise concerns

about whether the state of Berlin is competent to pass local rent

legislation, as the provisions substantially deviate from existing

German federal law.

Given the uncertainty about the legal validity of the proposed

rent controls, it is not yet clear what impact there could be on

future property prices. Jones Lang Lasalle GmbH have, however,

confirmed that, to date, there has been no material adverse effect

on either sale prices or rental levels in the Berlin market. The

portfolio valuation conducted by Jones Lang LaSalle GmbH for year

to 31 December 2019 reflects current Berlin market prices and does

not factor in any additional future impact on property valuations

that may materialise in the event the proposed rent controls are

introduced.

The Company has previously set out how it intends to adapt its

strategy during any period in which the proposed rent controls are

in force to mitigate any short-term impact on the portfolio, while

ensuring it maintains maximum strategic optionality in the event

the proposals are found to be unconstitutional. Good progress has

been made with these plans which include share buybacks,

condominium splitting and sales, as well as selective acquisitions

in areas within Greater Berlin that are not impacted by the rent

control proposals.

Condominium sales at an 18 per cent premium to book value.

During the year to 31 December 2019, a total of 18 apartments

were notarised for sale, with an aggregate value of EUR8.8 million.

The average notarised value per sqm achieved was EUR4,068,

representing a 17.5 per cent premium to book value and an 8.8 per

cent premium to the 31 December 2019 Berlin Portfolio average of

EUR3,741 per sqm. Condominium sales accelerated significantly

during the second half of the financial year, with a total of 14

units notarised with an aggregate value of EUR6.3m, a 23.6 per cent

premium to book value.

Share Buy-backs at an average 24 per cent discount to net asset

value

Following the completion of a new EUR240 million loan facility

on improved terms, the Company announced in September 2019 that it

would consider buying back up to 10 per cent of existing share

capital in issue. The share buy-back programme commenced in

mid-October and, as at 30 January 2019, the Company had purchased a

total of 3.2 million shares (3.2 per cent of the ordinary share

capital) for a total consideration of GBP10.3 million. The average

price paid represented a 23.9 per cent discount to EPRA Net Asset

Value per share as at 30 June 2019.

Acquisitions unaffected by proposed Berlin rent controls

Notwithstanding the uncertain regulatory backdrop in central

Berlin, there remains opportunity to acquire in areas within the

Greater Berlin region that are unaffected by the proposed

Mietendeckel rent controls. In December 2019, the Company completed

the acquisition of an apartment complex in Brandenburg, with a

total asset value of EUR43.5 million, for a net consideration of

EUR24.2 million, excluding acquisition costs. This property meets

the Company's investment criteria and the Board believes there is

significant potential to add value through active asset management

strategies.

Full year results

The Company will publish its full year results in early April

2020.

* Based on Sterling / Euro exchange rate as at 31(st) December

2019 of 1.182

Robert Hingley, Chairman of Phoenix Spree Deutschland

commented:

"I am pleased with the continued performance of the portfolio

and the progress made in mitigating any short-term impact on the

portfolio during the period of uncertainty created by the proposed

rent controls. Supported by our strong balance sheet, we remain

well placed to take advantage of selective acquisition

opportunities and share buy-backs, while maintaining our strategic

optionality in the event the rent control proposals are found to be

unconstitutional."

This announcement contains inside information.

For further information, please contact:

Phoenix Spree Deutschland Limited

Stuart Young +44 (0)20 3937 8760

Numis Securities Limited (Corporate Broker)

David Benda +44 (0)20 3100 2222

Tulchan Communications (Financial PR)

Elizabeth Snow +44 (0)20 7353 4200

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

END

MSCBLMRTMTTTBTM

(END) Dow Jones Newswires

January 30, 2020 02:00 ET (07:00 GMT)

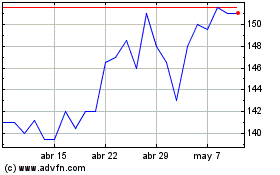

Phoenix Spree Deutschland (LSE:PSDL)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

Phoenix Spree Deutschland (LSE:PSDL)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024